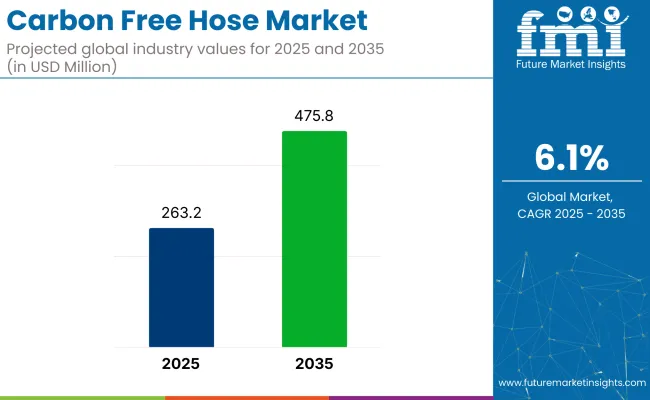

The carbon free hose market is projected to grow from USD 263.2 million in 2025 to USD 475.8 million by 2035, registering a CAGR of 6.1% during the forecast period.

Growth is driven by the increasing demand for non-conductive hoses across industries such as automotive, construction, and industrial manufacturing. The hoses are being increasingly adopted due to their low leakage current and non-toxic materials, providing safer alternatives to traditional hoses used in electrical and chemical applications.

The carbon free hose market holds a specialized share within its parent markets. Within the rubber and plastic hose market, it accounts for approximately 2-3%, as carbon free hoses are a niche product designed for specific applications. In the automotive parts and components market, its share is around 1-2%, as these hoses are used primarily in high-performance automotive applications where contamination risks are critical.

Within the industrial equipment market, the share is approximately 3-4%, driven by the need for durable, non-contaminating hoses in various machinery and systems. In the hydraulic equipment market, carbon free hoses contribute around 2-3%, especially in hydraulic systems that require high standards of cleanliness and performance. In the construction and infrastructure market, its share is about 1-2%, used mainly in specialized applications to prevent contamination.

In April 2025, Continental commissioned a new production line for hydrogen hoses at its location in Korbach, expanding the company’s ability to provide safe and efficient solutions along the entire hydrogen value chain.

This facility, an investment of around €3 million, will offer products for hydrogen production, transportation, storage, distribution, and use in fuel cells and refueling applications for cars, trucks, ships, and aircraft. This move aligns with Continental's commitment to supporting the growing hydrogen economy by providing solutions for industries transitioning to clean energy.

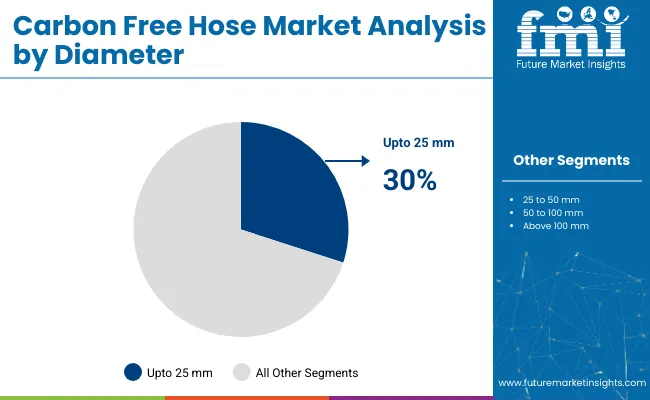

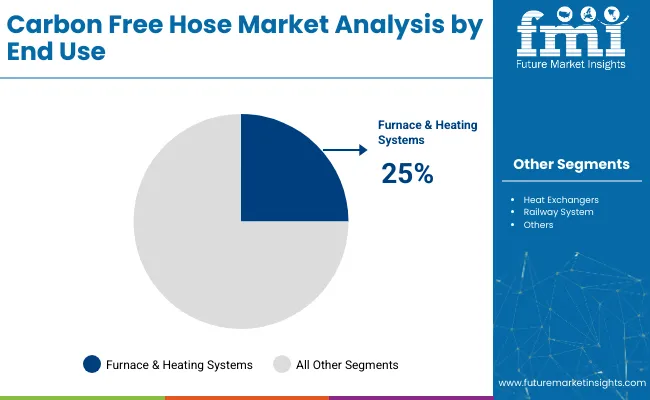

The industry is expected to grow steadily, with standard-duty hoses capturing 40% of the industry share in 2025. Hoses with diameters up to 25 mm are projected to hold 30%, while furnace & heating systems are expected to account for 25% of the end-use segment.

The standard-duty segment is anticipated to hold 40% of the industry share in 2025. Standard-duty hoses are widely used due to their versatility and suitability for a wide range of applications, particularly in industries requiring moderate pressure handling.

These hoses provide an effective balance between cost and performance, making them ideal for general-purpose applications in sectors such as manufacturing, construction, and automotive. The demand for standard-duty hoses is driven by their ability to withstand everyday pressure conditions without sacrificing durability or performance, particularly in environments with moderate fluid or gas pressures.

Hoses with diameters up to 25 mm are projected to account for 30% of the industry in 2025. Smaller-diameter hoses are preferred for applications where compact and flexible hoses are necessary for ease of installation and handling. These hoses are commonly used in environments with space constraints, such as in laboratory equipment, medical devices, and various industrial machinery.

Their ability to efficiently transfer fluids and gases while maintaining structural integrity under low to moderate pressure makes them ideal for numerous industries, including pharmaceuticals and automotive. The demand for smaller diameter hoses continues to rise due to their ease of use and compact design.

Furnace and heating systems are expected to dominate the end-use segment of the industry, capturing 25% of the share in 2025. These hoses are used in furnace and heating systems to transport high-temperature gases and fluids safely. The rise in demand for efficient and durable hoses in industrial heating applications drives the need for the hoses that can withstand elevated temperatures and harsh environments.

The growth in the construction of new industrial heating plants and the replacement of old systems further contributes to the demand for the hoses in this segment.

The industry is growing due to increasing demand for eco-friendly products and stricter environmental regulations. However, high production costs and limited consumer awareness are hindering widespread adoption, especially among small and medium-sized businesses.

Rising Demand for Eco-Friendly Materials and Environmental Regulations Are Driving Industry Growth

The industry is expanding due to increased demand for environmentally friendly products and stricter environmental regulations. Industries are under growing pressure to reduce their environmental impact, and the hoses are increasingly preferred for their reduced ecological footprint.

Sectors like automotive, food processing, and pharmaceuticals are adopting these hoses to comply with green standards. Advancements in material technology have further improved the performance, durability, and cost-effectiveness of the hoses, broadening their application across industries.

High Production Costs and Limited Consumer Awareness Are Hindering Broader Adoption

Despite the growing interest, challenges such as high production costs and limited consumer awareness remain barriers to wider adoption. Carbon-free materials typically come at a higher price compared to traditional options, which makes it difficult for small and medium-sized businesses to invest in these eco-friendly solutions. Additionally, the lack of widespread understanding regarding the long-term cost savings and environmental benefits of the hoses contributes to reluctance among companies to switch from conventional hoses.

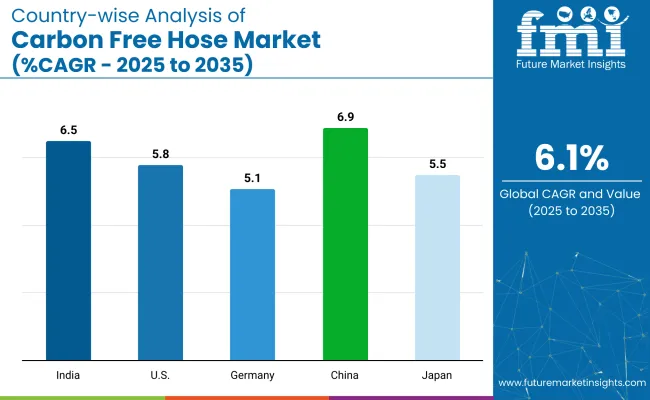

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 5.8% |

| China | 6.9% |

| Germany | 5.1% |

| India | 6.5% |

| Japan | 5.5% |

The global carbon free hose market is projected to grow at a CAGR of 6.1% from 2025 to 2035. The United States, with a CAGR of 5.8%, shows steady growth, driven by increasing demand in industries such as automotive, manufacturing, and construction. China, at 6.9%, demonstrates stronger growth, supported by its expanding industrial base, large manufacturing sector, and growing adoption of eco-friendly products.

Germany, with a CAGR of 5.1%, reflects moderate growth, benefiting from strong demand in the European industrial market, although at a slightly slower pace. India, at 6.5%, sees solid growth due to rapid industrialization, infrastructure development, and increasing environmental awareness.

Japan, with a CAGR of 5.5%, experiences steady growth, driven by the demand for high-quality, environmentally-friendly products in industrial applications. While OECD countries show moderate growth, China and India are the fastest-growing industries, indicating the rising role of emerging economies in shaping the future of the industry.

The report covers in-depth analysis of 40+ countries; five top-performing OECD and BRICS countries are highlighted below.

The sales in the United States are set to record a CAGR of 5.8% through 2035. Growth has been supported by innovation-driven upgrades in industrial fluid systems and evolving OEM procurement standards. Major players such as Gates, Eaton, and Parker Hannifin have invested in performance-grade carbon-free variants tailored for aerospace, manufacturing, and auto components.

Environmental compliance protocols from agencies like the EPA have reinforced the shift away from conventional rubber hoses containing carbon black. Enhanced durability and chemical resistance have made these hoses preferable in high-temperature and heavy-duty settings. The USA remains a leading contributor to the hose production and application development.

Demand for the hoses in China is estimated to grow at a CAGR of 6.9% through 2035. Rapid industrial diversification and environmental enforcement across key sectors are accelerating the transition to non-carbon components in hydraulic and pneumatic systems. Domestic manufacturers such as Zhejiang Tianyao and Hebei Qianli Rubber Products are expanding multi-layer hose production using halogen-free materials.

Large-scale government investments in emission-compliant production under the “Made in China 2025” initiative have boosted R&D for polymer blends. Supply-chain resilience, especially in the construction and mining sectors, is being built around safer and recyclable hose formats.

The industry in Germany is projected to grow at a CAGR of 5.1% through 2035. The country’s mature industrial ecosystem and environmental enforcement have created a high-barrier, quality-focused industry for hose systems. Continental AG and Manuli Hydraulics continue to lead innovations in low-emission hose materials tailored for Tier 1 automotive suppliers and precision tooling factories.

Germany’s technical standard DIN 73379 and EU RoHS directives have eliminated carbon black from multiple hose lines. Increased demand for noise-reduction, chemical resistance, and thermal stability has redefined performance benchmarks across OEMs.

The industry in India is set to record a CAGR of 6.5% through 2035. Expansion has been led by growing industrial output, upgrades in fluid engineering systems, and public-sector green manufacturing programs. Local firms along with multinationals like Parker Hannifin have diversified offerings into agriculture and construction-grade hoses using EPDM and silicon blends.

Bureau of Indian Standards (BIS) certification updates have phased out low-grade rubber compounds, favoring eco-compliant variants. National missions in clean transportation and smart infrastructure have increased institutional procurement of hoses with higher abrasion resistance and minimal emissions.

Sales of the hoses in Japan are forecasted to grow at a CAGR of 5.5% through 2035. Regulatory pressures, alongside industrial robotics adoption, have sustained Japan’s demand for low-soot, high-resilience hose systems. Sumitomo Riko, Bridgestone, and Toyox have developed multilayered, lightweight hose models with advanced thermal shielding.

Compliance with Japan Industrial Standards (JIS) and global ISO frameworks has made these hoses essential in automated production lines. High-end automotive, mechatronics, and heavy equipment sectors have shifted toward carbon-free specifications, driven by OEM mandates and supplier scoring programs.

The carbon free hose market is characterized by dominant players, key players, and emerging firms. Gates Corporation is a dominant player, known for its high-performance Gates® Carbon Free Hose Series, designed to prevent static electricity buildup and eliminate carbon black content.

Key players in the industry include Parker Hannifin Corporation, which offers a comprehensive range of industrial hoses meeting stringent safety and performance standards; Continental AG, a global leader in rubber and plastic technology, providing durable hoses for various industrial applications; and Eaton Corporation, known for its reliable industrial hoses.

Emerging players such as Dantec, a UK-based manufacturer specializing in composite hoses, and SGL Carbon, which focuses on carbon-free solutions and material advancements, are expanding their industry presence.

Recent Carbon Free Hose Industry News

| Report Attributes | Details |

|---|---|

| Industry Size (2025) | USD 263.2 million |

| Projected Industry Size (2035) | USD 475.8 million |

| CAGR (2025 to 2035) | 6.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million meters for volume |

| Pressure Ratings Analyzed (Segment 1) | Standard Duty, Medium Duty, Heavy Duty |

| Diameters Analyzed (Segment 2) | Up to 25 mm, 25 to 50 mm, 50 to 100 mm, Above 100 mm |

| End Uses Analyzed (Segment 3) | Furnace & Heating Systems, Automotive & Transportation, Heat Exchangers, Electrical & Heavy Appliances, Railway System, Others |

| Regions Covered | North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players influencing the Industry | Gates Corporation, Parker Hannifin, JYM Hose, Kwik-Flex Industries, Indomaksson, Polyhose, JK Fenner Ltd |

| Additional Attributes | Dollar sales, share by pressure rating and diameter, increasing demand in automotive and industrial sectors, innovations in heavy-duty hose applications, regional industry penetration trends |

The industry is segmented into standard duty, medium duty, and heavy duty.

The industry includes hoses with diameters up to 25 mm, 25 to 50 mm, 50 to 100 mm, and above 100 mm.

The industry covers furnace & heating systems, automotive & transportation, heat exchangers, electrical & heavy appliances, railway systems, and others.

The industry spans North America, Latin America, Eastern Europe, Western Europe, South Asia & Pacific, East Asia, and Middle East & Africa.

The industry is expected to reach USD 475.8 million by 2035.

The industry is projected to be USD 263.2 million in 2025.

The industry is expected to grow at a CAGR of 6.1%.

The "Up to 25 mm" segment is expected to lead with a 22% industry share.

Asia Pacific, particularly China, is expected to grow at a 6.9% CAGR.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carbon-Free Waste Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Free Fonts with Commercial Use Market Size and Share Forecast Outlook 2025 to 2035

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Freezer Label Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Freezer Liner Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tapes Market Size and Share Forecast Outlook 2025 to 2035

Freeze Neutralising Kit Market Size and Share Forecast Outlook 2025 to 2035

Carbon Labeled Packaged Meal Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Bike Wheelset Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Lasers Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Packaging Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Construction Repair Market Size and Share Forecast Outlook 2025 to 2035

Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA