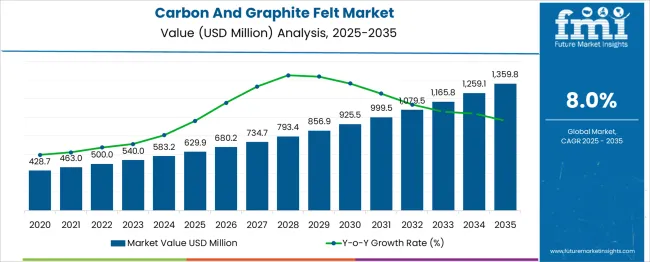

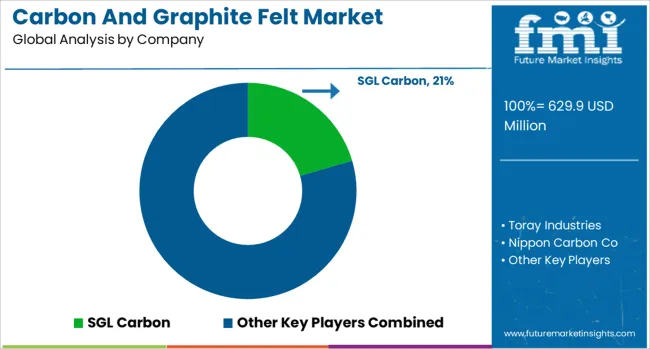

The Carbon And Graphite Felt Market is estimated to be valued at USD 629.9 million in 2025 and is projected to reach USD 1359.8 million by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

| Metric | Value |

|---|---|

| Carbon And Graphite Felt Market Estimated Value in (2025 E) | USD 629.9 million |

| Carbon And Graphite Felt Market Forecast Value in (2035 F) | USD 1359.8 million |

| Forecast CAGR (2025 to 2035) | 8.0% |

The carbon and graphite felt market is driven by rising demand across high-temperature industrial processes and energy storage applications. These materials are widely used for their exceptional thermal resistance, chemical stability, and electrical conductivity, making them critical components in sectors such as metallurgy, semiconductors, and battery manufacturing.

Technological advancements in manufacturing processes and the development of high-performance variants have improved product quality and performance efficiency. Increasing adoption in thermal insulation applications, particularly in vacuum and inert gas furnaces, continues to support the market trajectory.

The growing push for energy-efficient operations and high-purity industrial environments is expected to sustain future demand. As industries pursue decarbonization and enhanced process control, carbon and graphite felt products are positioned as essential solutions in high-precision, high-temperature operating environments.

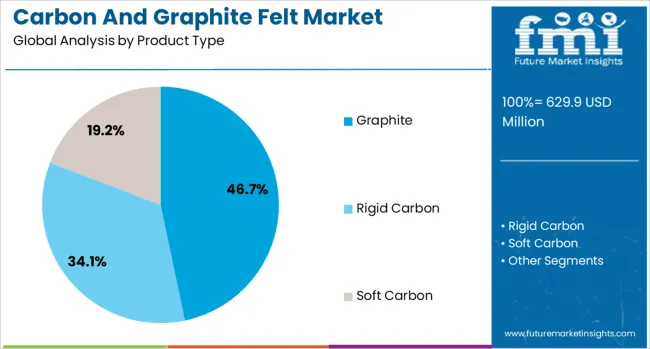

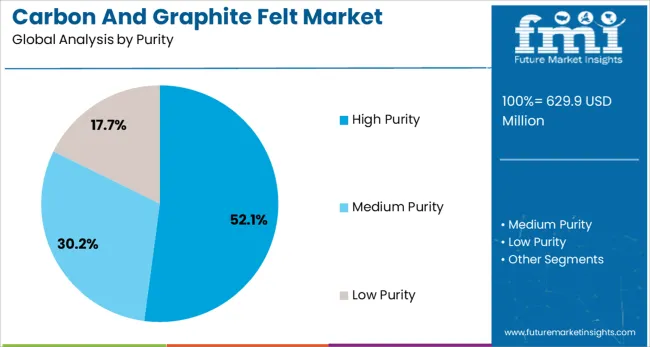

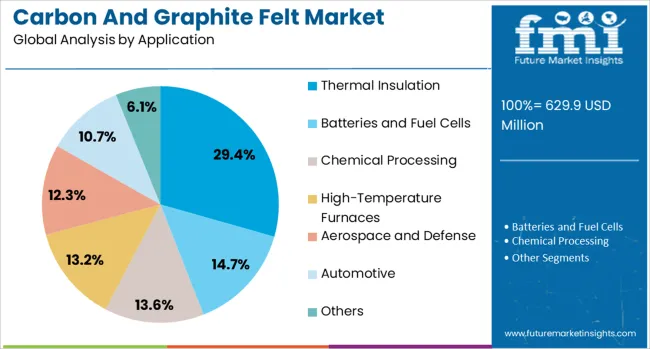

The carbon and graphite felt market is segmented by product type, purity, and application and geographic regions. The carbon and graphite felt market is divided by product type into Graphite, Rigid Carbon, and Soft Carbon. In terms of purity of the carbon and graphite felt, the market is classified into High Purity, Medium Purity, and Low Purity. Based on the application of the carbon and graphite felt market, it is segmented into Thermal Insulation, Batteries and Fuel Cells, Chemical Processing, High-Temperature Furnaces, Aerospace and Defense, Automotive, and Others. Regionally, the carbon and graphite felt industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The graphite segment leads the product type category with a 46.7% market share, supported by its superior thermal conductivity, chemical inertness, and dimensional stability under extreme temperatures. It is particularly favored in applications requiring long-term exposure to high heat, such as industrial furnaces and high-temperature reactors.

Manufacturers are leveraging advancements in carbonization and graphitization techniques to enhance material strength and performance in demanding conditions. The segment has also gained momentum in energy-related applications, including battery components and thermal insulation in power systems.

Increasing preference for lightweight and durable thermal management materials across industries has further reinforced graphite felt’s appeal. As industries place greater emphasis on operational efficiency and thermal reliability, the graphite segment is expected to remain dominant, offering performance advantages that align with modern industrial standards.

High purity carbon and graphite felt commands a 52.1% share in the purity category, driven by its critical role in ultra-clean and controlled processing environments. Industries such as semiconductors, photovoltaics, and aerospace require materials with minimal impurities to prevent contamination and ensure precise outcomes.

High purity variants are engineered to withstand elevated temperatures while maintaining structural integrity and purity levels, making them indispensable in high-value manufacturing and scientific research. The growing use of high-purity has further strengthened demand felts in energy storage systems, including vanadium redox flow batteries and fuel cells.

As production standards become increasingly stringent and the need for ultra-clean materials intensifies, this segment is positioned to experience sustained growth, particularly in advanced technology and clean energy sectors.

The thermal insulation application segment accounts for 29.4% of the carbon and graphite felt market, underpinned by widespread use in industrial furnaces, kilns, and reactors operating under high temperatures. These felts offer low thermal conductivity, excellent heat resistance, and dimensional stability, making them ideal for energy-intensive environments requiring efficient thermal control.

Their ability to improve energy efficiency and reduce operational costs has made them a preferred choice across metallurgy, aerospace, and chemical processing industries. As sustainability goals push industries to enhance thermal management and minimize heat loss, demand for advanced insulation materials continues to rise.

The segment is also benefiting from innovations that enhance felts' mechanical strength and environmental resistance. Ongoing infrastructure modernization and investment in high-efficiency industrial systems are expected to reinforce the dominance of thermal insulation as a core application area.

Carbon and graphite felts are gaining traction as essential materials for high-temperature industrial processes. In 2024, steel and foundry operations incorporated these felts for insulation in furnaces and boilers to improve energy efficiency. In 2025, semiconductor and glass manufacturing expanded their use for heat shielding and filtration applications. Opportunities are developing in engineered felt modules tailored for gas purification systems and composite structures. Manufacturers delivering custom-grade felts with uniform density, thermal stability, and precise dimensional control are positioned to capture a leading role in this specialized materials sector.

Use of carbon and graphite felts in intense heating environments has been identified as a key driver of market growth. In 2024, steelmaking plants began lining heat treatment furnaces with graphite felts to improve thermal efficiency and reduce energy loss. In 2025, glass manufacturing operations increased installation of carbon felt filters to capture particulates at high temperatures. These changes indicate that industrial facilities are prioritizing performance under extreme conditions rather than cost as the driver for felt selection. Manufacturers offering felts with verified thermal resilience and purity consistency are therefore best positioned to win in high-heat process industries.

In 2024, pilot systems were implemented in gas filtration units using graphite felt inserts to capture fine particulates in flue gas streams. In 2025, power generation facilities adopted custom felt modules for mercury removal and gas purification prior to emission outlets. These implementations illustrate that carbon and graphite felts can serve both thermal and filtration needs. Suppliers offering engineered filtration modules with performance calibration for specific industrial gas profiles are being positioned to capture new value in air quality management and process purification markets.

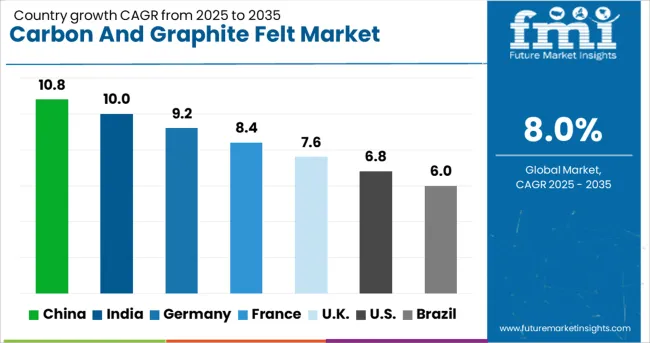

| Country | CAGR |

|---|---|

| China | 10.8% |

| India | 10.0% |

| Germany | 9.2% |

| France | 8.4% |

| UK | 7.6% |

| USA | 6.8% |

| Brazil | 6.0% |

The global carbon and graphite felt market is projected to grow at a CAGR of 8% from 2025 to 2035. China leads at 10.8%, followed by India at 10% and Germany at 9.2%. France records 8.4%, while the United Kingdom posts 7.6%. Growth is driven by demand in high-temperature insulation, energy storage, and semiconductor manufacturing. China and India dominate due to large-scale battery and industrial furnace applications, while Germany focuses on advanced composites for fuel cells. France and the UK emphasize thermal management solutions in aerospace and renewable energy sectors.

China is projected to grow at 10.8%, driven by rapid expansion in energy storage and steel manufacturing sectors. Carbon felt is widely used as an electrode material in flow batteries, while graphite felt dominates in high-temperature furnaces. Local firms invest in purification processes to produce low-sulfur grades for electronics and semiconductor industries. Government initiatives promoting renewable energy boost demand for high-performance insulation materials.

India is expected to grow at 10%, supported by strong demand from electric vehicle battery projects and industrial heat treatment applications. Manufacturers focus on cost-effective felts for insulation in furnaces and energy storage systems. Growth in solar thermal power plants further increases demand for graphite-based thermal management materials. Strategic partnerships with global players enhance local production capabilities.

Germany is forecast to grow at 9.2%, driven by stringent EU energy efficiency regulations and expansion in fuel cell technology. Graphite felt serves as a critical component in PEM fuel cells, while carbon felt supports advanced insulation systems. Manufacturers develop ultra-lightweight felts for aerospace and automotive thermal protection. Increasing use in hydrogen economy projects enhances market potential.

France is projected to grow at 8.4%, supported by renewable energy initiatives and nuclear industry applications. Demand for graphite felt in high-temperature environments is rising in aerospace and power generation sectors. Local manufacturers emphasize felts with improved thermal conductivity for advanced energy systems. Government-backed clean energy projects accelerate demand for specialty felts in turbine and reactor insulation.

The UK is forecast to grow at 7.6%, driven by the adoption of energy storage technologies and advanced manufacturing applications. Demand for felts in molten metal handling and high-performance insulation systems is rising. Manufacturers prioritize felts designed for compatibility with hybrid and electric vehicle battery systems. Research programs in thermal energy storage accelerate development of next-generation felts.

The carbon and graphite felt market is moderately consolidated, led by SGL Carbon with a significant market share. The company holds a dominant position through its high-temperature insulation solutions, global manufacturing capacity, and long-standing presence in industrial and energy applications. Dominant player status is held exclusively by SGL Carbon. Key players include Toray Industries, Nippon Carbon Co., CFC Carbon Co., and Kureha Corporation, each providing advanced carbon and graphite felts engineered for thermal insulation, energy storage, and metallurgical processing with a focus on material performance and process efficiency. Emerging players remain limited in this market due to complex manufacturing requirements, significant R&D costs, and the dominance of established brands with specialized production technologies. Market demand is driven by the expansion of energy storage systems, increasing use in high-temperature industrial processes, and the growing need for durable and lightweight insulation materials in advanced manufacturing.

| Item | Value |

|---|---|

| Quantitative Units | USD 629.9 Million |

| Product Type | Graphite, Rigid Carbon, and Soft Carbon |

| Purity | High Purity, Medium Purity, and Low Purity |

| Application | Thermal Insulation, Batteries and Fuel Cells, Chemical Processing, High-Temperature Furnaces, Aerospace and Defense, Automotive, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | SGL Carbon, Toray Industries, Nippon Carbon Co, CFC Carbon Co, and Kureha Corporation |

| Additional Attributes | Dollar sales by felt type (carbon, graphite, hybrid), regional demand trends, competitive landscape, buyer preferences for porosity and superior thermal stability, integration in high-temperature insulation, furnace linings, and heat shields, innovations in lightweight flexible composites, enhanced oxidation resistance, and improved thermal conductivity for aerospace, energy storage, and industrial applications. |

The global carbon and graphite felt market is estimated to be valued at USD 629.9 million in 2025.

The market size for the carbon and graphite felt market is projected to reach USD 1,359.8 million by 2035.

The carbon and graphite felt market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types in carbon and graphite felt market are graphite, rigid carbon and soft carbon.

In terms of purity, high purity segment to command 52.1% share in the carbon and graphite felt market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tapes Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Free Waste Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Carbon Labeled Packaged Meal Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Bike Wheelset Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Lasers Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Packaging Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Construction Repair Market Size and Share Forecast Outlook 2025 to 2035

Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Dioxide Synthesis Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Neutral Skincare Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Reinforced Plastic Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Wraps Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA