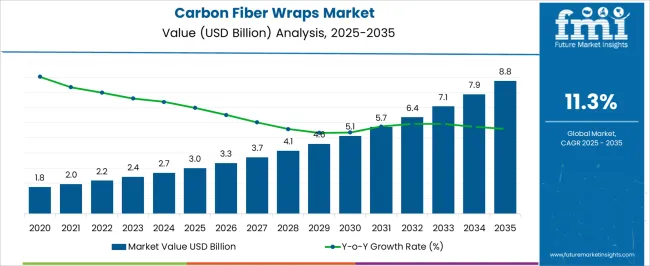

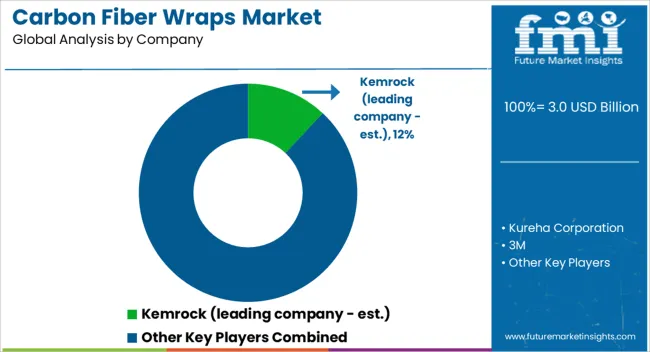

The carbon fiber wraps market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 8.8 billion by 2035, registering a compound annual growth rate (CAGR) of 11.3% over the forecast period.

This expansion is being shaped by growing adoption in automotive, aerospace, and sports equipment sectors, where carbon fiber wraps are valued for their lightweight properties and superior strength. Demand is also being driven by the need for high-performance materials that enhance structural integrity while providing aesthetic appeal. These characteristics have made carbon fiber wraps a preferred choice for industries aiming to balance durability and design flexibility. From 2030 to 2035, the market is projected to expand further from USD 5.1 billion to USD 8.8 billion, reinforcing a strong upward curve in demand.

This second growth block will be influenced by increasing penetration in industrial and consumer applications, where performance efficiency and advanced material usage are prioritized. The market trajectory suggests rising interest from manufacturers and end users seeking materials that can deliver both functionality and premium visual appeal. Expanding applications in vehicle customization, aerospace reinforcement, and protective gear are expected to create new opportunities. The shape of this growth curve indicates a healthy long-term outlook, with the market likely to continue attracting attention as industries look toward advanced composites for next-generation designs.

| Metric | Value |

|---|---|

| Carbon Fiber Wraps Market Estimated Value in (2025 E) | USD 3.0 billion |

| Carbon Fiber Wraps Market Forecast Value in (2035 F) | USD 8.8 billion |

| Forecast CAGR (2025 to 2035) | 11.3% |

The carbon fiber wraps market constitutes a notable slice within several broader industries, with varying penetration rates depending on context. In the composite reinforcement materials sector, carbon fiber wraps represent around 12%, underscoring their importance in reinforcing structures with minimal weight gain. Within the construction and infrastructure strengthening market, their share is somewhat higher at about 15%, driven by growing use in seismic retrofitting and aging structure rehabilitation. In the automotive lightweighting and aesthetic enhancement market, carbon fiber wraps account for roughly 10%, reflecting dual demand for performance improvement and visual customization. The marine and corrosion-protection materials market includes carbon fiber wraps at nearly 9%, as they offer effective hull reinforcement and saltwater resilience.

Finally, in the specialty sports and consumer equipment components market, their presence rises to approximately 14%, benefiting from demand in high-performance sports gear like bicycles, racquets, and ski equipment. These percentages illustrate that carbon fiber wraps, while specialized, have achieved meaningful market shares within sectors that value strength, weight reduction, and durability. Their relatively stronger presence in construction and sports reflects practical needs and performance-driven adoption, whereas slightly lower penetration in automotive and marine markets signals competitive alternatives. Nevertheless, across all parent markets, carbon fiber wraps hold a growing and technically driven niche position with significant crossover appeal where high-performance composite solutions are prioritized.

The market is gaining strong momentum as industries increasingly adopt high-performance composite materials for structural reinforcement and durability enhancement. Demand has been supported by the superior strength-to-weight ratio of carbon fiber, combined with its corrosion resistance and long service life, making it an attractive choice for infrastructure, aerospace, automotive, and marine applications.

Advancements in resin formulations and manufacturing processes have improved adhesion, flexibility, and environmental resistance, further broadening the scope of use. Growing investment in infrastructure rehabilitation and retrofitting projects is creating substantial opportunities for carbon fiber wraps, particularly in regions with aging bridges, buildings, and industrial structures.

Environmental benefits, including lower maintenance requirements and reduced lifecycle costs, are also driving adoption With ongoing innovation in fiber weaving, resin compatibility, and application techniques, the market is expected to expand steadily, supported by both private and public sector projects aimed at enhancing safety, performance, and sustainability across a wide range of end-use industries.

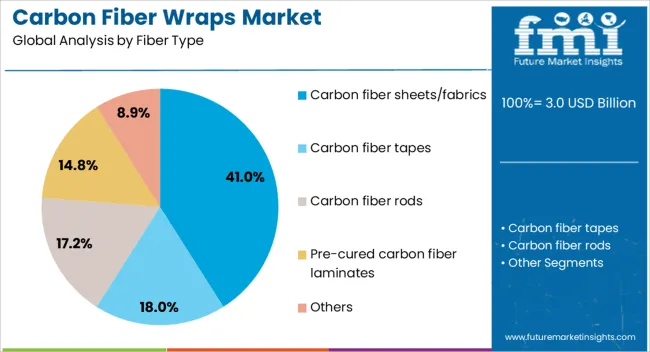

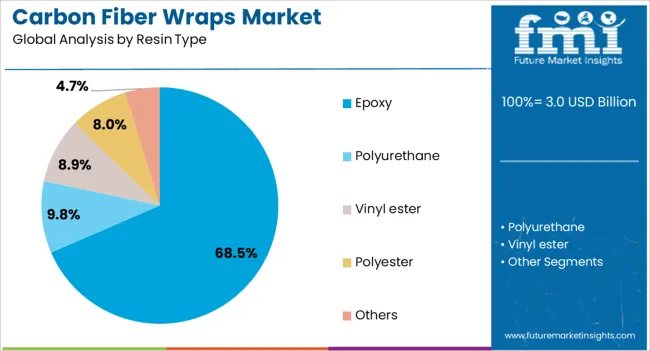

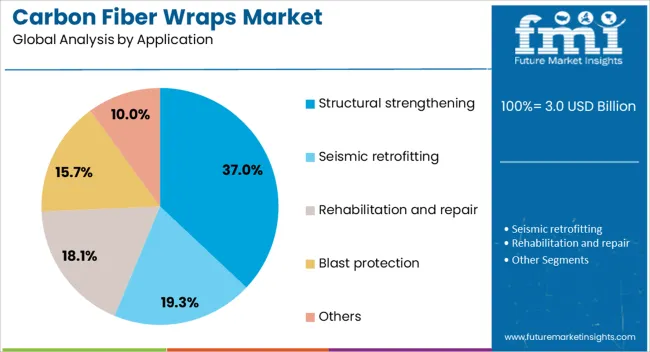

The carbon fiber wraps market is segmented by fiber type, resin type, application, structure type, end use, and geographic regions. By fiber type, carbon fiber wraps market is divided into carbon fiber sheets/fabrics, carbon fiber tapes, carbon fiber rods, pre-cured carbon fiber laminates, and others. In terms of resin type, carbon fiber wraps market is classified into epoxy, polyurethane, vinyl ester, polyester, and others. Based on application, carbon fiber wraps market is segmented into structural strengthening, seismic retrofitting, rehabilitation and repair, blast protection, and others. By structure type, carbon fiber wraps market is segmented into concrete structures, masonry structures, steel structures, timber structures, and others. By end use, carbon fiber wraps market is segmented into bridges and highways, buildings and structures, commercial buildings, residential buildings, industrial buildings, water and wastewater infrastructure, marine structures, historical and heritage structures, and others. Regionally, the carbon fiber wraps industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The carbon fiber sheets and fabrics segment is projected to hold 41% of the carbon fiber wraps market revenue share in 2025, making it the leading fiber type. This dominance has been attributed to the versatility and high tensile strength of woven and unidirectional sheets, which enable precise application across diverse structural configurations. These materials provide superior conformability to surfaces, ensuring strong adhesion and effective load distribution in reinforcement projects.

Their lightweight nature allows for easy handling and installation, reducing labor costs and downtime. The segment has also benefited from continuous improvements in fiber architecture, which enhance mechanical performance and compatibility with various resin systems.

The ability to tailor sheet thickness, weave patterns, and fiber orientation to meet specific project requirements has strengthened their role in civil engineering and industrial applications As demand for advanced composite solutions continues to rise, carbon fiber sheets and fabrics are expected to maintain a strong position due to their proven reliability and adaptability.

The epoxy segment is expected to account for 68.50% of the market revenue share in 2025, emerging as the leading resin type. Its dominance is driven by the excellent bonding properties, chemical resistance, and durability that epoxy offers when combined with carbon fiber. The segment has gained traction due to its superior mechanical performance and compatibility with various surface conditions, making it suitable for demanding structural strengthening applications.

Epoxy resins provide exceptional adhesion to concrete, steel, and other substrates, ensuring long-term stability and load-bearing capacity. Their ability to cure at ambient temperatures while maintaining dimensional stability has facilitated use in both indoor and outdoor projects.

Additionally, advancements in low-viscosity and high-strength epoxy formulations have improved ease of application and reduced curing time These benefits, combined with proven performance in challenging environments, have established epoxy as the preferred resin for high-reliability carbon fiber wrap installations.

The structural strengthening segment is projected to hold 37% of the market revenue share in 2025, positioning it as the leading application. This growth is being driven by the rising demand for cost-effective solutions to repair, retrofit, and enhance the load-bearing capacity of aging infrastructure. The use of carbon fiber wraps in structural strengthening offers minimal disruption to operations while delivering long-lasting performance, making it attractive for bridges, buildings, industrial facilities, and marine structures.

The ability to apply wraps externally without altering the original structure has enabled their adoption in projects where traditional reinforcement methods are not feasible. Growing regulatory emphasis on infrastructure safety and seismic resilience has further accelerated adoption.

Technological advancements in application tools, surface preparation techniques, and inspection methods have improved efficiency and quality assurance These factors have reinforced the leading position of structural strengthening in the overall carbon fiber wraps market.

The carbon fiber wraps market is expanding as industries adopt lightweight, durable, and high-strength reinforcement solutions for infrastructure, automotive, and aerospace applications. Opportunities are rising in retrofitting and repair projects, while trends highlight hybrid composites and aesthetic uses across consumer products. Challenges include high raw material costs, skilled labor needs, and competition from substitutes. In my opinion, long-term success will belong to companies that balance cost efficiency with innovation, delivering carbon fiber wraps that address both structural performance and design-driven applications in global markets.

Demand for carbon fiber wraps has been reinforced by their ability to deliver lightweight reinforcement with high tensile strength for infrastructure, automotive, and aerospace sectors. Construction firms are using these wraps in structural rehabilitation of bridges, buildings, and pipelines to extend service life without adding significant weight. Automotive and marine industries are integrating wraps for performance enhancement and fuel efficiency improvements. In my opinion, demand will continue to expand as industries adopt carbon fiber wraps as practical alternatives to heavy metallic reinforcements in applications requiring durability and precision.

Opportunities are visible in retrofitting, repair, and maintenance, where carbon fiber wraps provide cost-effective solutions for strengthening aging infrastructure. They are being increasingly adopted in earthquake-prone regions for seismic reinforcement and in industrial facilities for corrosion resistance. Aerospace and defense industries are also finding new opportunities in repairing high-value components without full replacements. I believe companies offering customized solutions for specific structural challenges and demonstrating proven field performance will capture premium opportunities, particularly as global infrastructure ages and the demand for reliable repair solutions grows steadily.

Trends in the carbon fiber wraps market show a growing focus on hybrid composites and aesthetic applications. Manufacturers are blending carbon fibers with other materials to enhance fire resistance, thermal performance, and flexibility. At the same time, carbon fiber wraps are being used in consumer markets for decorative finishes in electronics, vehicles, and sporting goods, valued for their sleek appearance. In my opinion, this dual-use trend highlights that carbon fiber wraps are no longer confined to structural uses but are becoming integral to both functional and aesthetic innovation across industries.

Challenges in this market are centered around high costs of raw carbon fibers and the skilled labor required for proper installation. Adoption is restricted among small contractors due to the technical expertise needed to ensure effective application. Cost pressures from cheaper substitutes such as steel and aluminum reinforcements also limit broader penetration. Supply chain volatility in carbon fiber production adds another layer of uncertainty. In my assessment, addressing these challenges will require simplified installation processes, cost reduction strategies, and wider training initiatives to enable mainstream adoption of carbon fiber wraps.

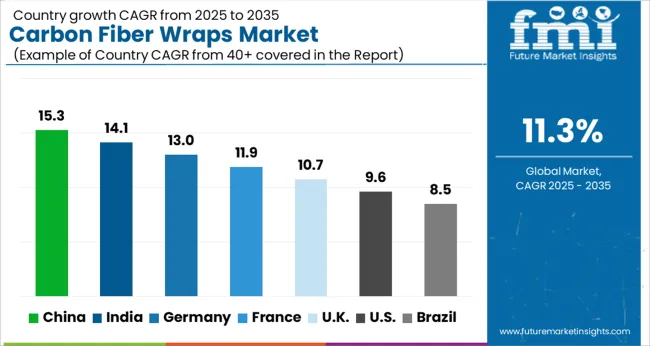

| Country | CAGR |

|---|---|

| China | 15.3% |

| India | 14.1% |

| Germany | 13.0% |

| France | 11.9% |

| UK | 10.7% |

| USA | 9.6% |

| Brazil | 8.5% |

The global carbon fiber wraps market is projected to grow at a CAGR of 11.3% from 2025 to 2035. China leads with a growth rate of 15.3%, followed by India at 14.1%, and Germany at 13%. The United Kingdom records a growth rate of 10.7%, while the United States shows the slowest growth at 9.6%. Growth is fueled by rising demand in automotive, aerospace, construction, and sports equipment industries due to the lightweight, high-strength, and corrosion-resistant properties of carbon fiber wraps. Emerging economies such as China and India benefit from expanding manufacturing and infrastructure projects, while mature markets like Germany, the UK, and the USA focus on innovation, advanced applications, and premium composite solutions.

The carbon fiber wraps market in China is projected to grow at a CAGR of 15.3%. Expanding automotive and aerospace industries are primary growth drivers, with lightweight composites being adopted to improve fuel efficiency and performance. Infrastructure modernization and construction activities also contribute to higher demand. Government support for advanced materials manufacturing and the establishment of domestic carbon fiber production facilities further strengthen China’s position. Increasing exports and partnerships with global players ensure the country’s leading role in the market.

The carbon fiber wraps market in India is expected to grow at a CAGR of 14.1%. The growing automotive sector, supported by rising demand for lightweight and fuel-efficient vehicles, is a major driver. Expanding aerospace and defense applications further enhance adoption. In addition, construction and sports equipment industries are increasingly adopting carbon fiber wraps for durability and performance. Government initiatives to promote advanced materials manufacturing and collaborations with global suppliers are strengthening the domestic ecosystem. This creates long-term opportunities for growth across multiple sectors.

The carbon fiber wraps market in Germany is projected to grow at a CAGR of 13%. Germany’s strong automotive and aerospace industries drive demand for high-performance composites. The country is also a hub for R&D in advanced materials, with innovation focused on lightweight and eco-friendly solutions. The construction sector is adopting carbon fiber wraps for retrofitting and strengthening infrastructure. High consumer preference for premium sports equipment further adds to demand. With a robust regulatory framework promoting sustainable materials, Germany continues to expand its footprint in the global carbon fiber wraps market.

The carbon fiber wraps market in the UK is projected to grow at a CAGR of 10.7%. The aerospace and defense sectors remain key drivers, with carbon fiber wraps being adopted for durability and weight reduction. The automotive industry, especially luxury and performance vehicle segments, also contributes significantly to demand. Additionally, sports and consumer goods industries are adopting carbon fiber wraps for high-performance applications. Growing investment in research collaborations between universities and manufacturers ensures steady innovation in advanced composites.

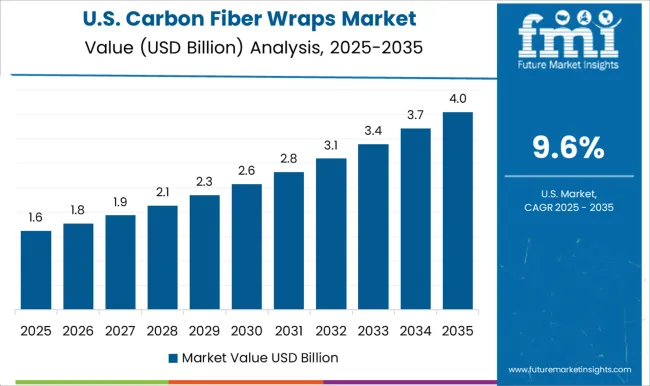

The carbon fiber wraps market in the USA is projected to grow at a CAGR of 9.6%. While slower than emerging economies, growth is driven by steady demand from aerospace, automotive, and defense industries. Carbon fiber wraps are widely used in structural strengthening and retrofitting applications across infrastructure projects. The sports and recreation industry also contributes to adoption, with demand for lightweight, high-performance equipment. Continuous innovation in nanocomposites and advanced resin systems enhances product performance. Strong regulatory support for lightweight materials and sustainability trends further encourage adoption across sectors.

Competition in the carbon fiber wraps market has been influenced by a mix of established chemical producers and composite specialists, each using different strategies to secure dominance. Kemrock has been recognized for its role as an early regional producer, where its emphasis on carbon composite materials and reinforced wraps created an important foundation for structural applications. Kureha Corporation has been steering its approach with deep expertise in specialty polymers and advanced carbon-based products, where its manufacturing consistency has strengthened its authority in aerospace and industrial end-uses. 3M has been leveraging its global presence and diversified product portfolio, where carbon fiber wraps have been marketed as part of a broader suite of repair, reinforcement, and surface protection solutions.

SGL Group has been regarded as a global leader in carbon and graphite materials, where carbon fiber wraps have been integrated into high-performance composites for automotive, wind energy, and construction reinforcement. Formosa Plastics Corporation has been applying its vast chemical production scale to strengthen the availability of carbon fiber intermediates, ensuring reliable supply of wraps for industrial and infrastructure projects. Cytec, now part of Solvay, has been positioned as a research-driven supplier, where innovation in resin systems and high-strength fibers has created differentiation in premium applications.

Strategic positioning among these companies has been shaped by production capacity, material quality, and application-specific expertise. SGL Group and Solvay have been driving innovation at the premium end of the market, developing high-strength and lightweight wraps for demanding industries such as aerospace and automotive. 3M has been focusing on versatility, offering wraps that combine ease of use with durability, appealing strongly to construction and maintenance users. Kureha and Formosa Plastics have been concentrating on scale and consistency, ensuring that supply reliability meets the requirements of industrial buyers. Kemrock has been retaining its regional strength, providing solutions where cost efficiency and accessibility are prioritized. Competition has therefore been defined by how effectively each player addresses structural reinforcement, weight reduction, and reliability, with preference granted to suppliers who combine technical expertise with strong distribution networks.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.0 billion |

| Fiber Type | Carbon fiber sheets/fabrics, Carbon fiber tapes, Carbon fiber rods, Pre-cured carbon fiber laminates, and Others |

| Resin Type | Epoxy, Polyurethane, Vinyl ester, Polyester, and Others |

| Application | Structural strengthening, Seismic retrofitting, Rehabilitation and repair, Blast protection, and Others |

| Structure Type | Concrete structures, Masonry structures, Steel structures, Timber structures, and Others |

| End Use | Bridges and highways, Buildings and structures, Commercial buildings, Residential buildings, Industrial buildings, Water and wastewater infrastructure, Marine structures, Historical and heritage structures, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Kemrock (leading company - est.), Kureha Corporation, 3M, SGL Group, Formosa Plastics Corporation, Solvay |

| Additional Attributes | Dollar sales by product type (fabric wraps vs prepreg wraps), Dollar sales by application (automotive, aerospace, construction, sports equipment), Trends in lightweight reinforcement and structural strengthening, Use in vehicle body panels and aircraft components, Growth in demand for repair and retrofitting solutions, Regional adoption patterns across North America, Europe, and Asia-Pacific. |

The global carbon fiber wraps market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the carbon fiber wraps market is projected to reach USD 8.8 billion by 2035.

The carbon fiber wraps market is expected to grow at a 11.3% CAGR between 2025 and 2035.

The key product types in carbon fiber wraps market are carbon fiber sheets/fabrics, carbon fiber tapes, carbon fiber rods, pre-cured carbon fiber laminates and others.

In terms of resin type, epoxy segment to command 68.5% share in the carbon fiber wraps market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tapes Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Free Waste Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Carbon Labeled Packaged Meal Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Lasers Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Packaging Market Size and Share Forecast Outlook 2025 to 2035

Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Dioxide Synthesis Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Neutral Skincare Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Carbon Textile Reinforced Concrete Market Size and Share Forecast Outlook 2025 to 2035

Carbon And Graphite Felt Market Size and Share Forecast Outlook 2025 to 2035

Carbon Black Content Tester Market Size and Share Forecast Outlook 2025 to 2035

Carbon Free Hose Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Carbon Disulfide Market - Trends & Analysis 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA