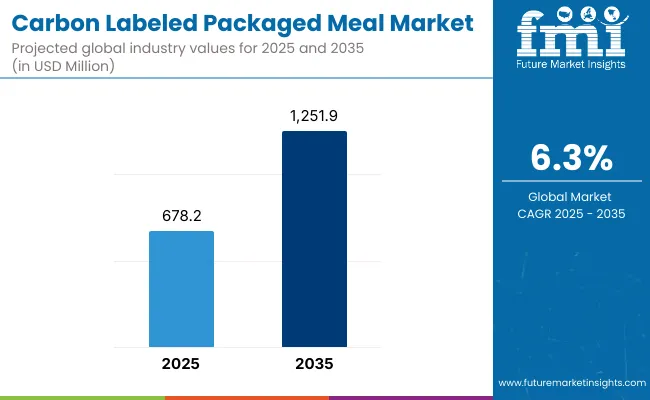

A valuation of USD 678.2 Million has been projected for the carbon-labeled packaged meal market in 2025, and by 2035 the size is anticipated to reach USD 1,251.9 Million. The overall expansion represents a 6.3%, translating into a near-doubling of value over the decade. This trajectory highlights how verified climate transparency in food choices is moving from niche adoption toward mainstream demand.

Carbon Labeled Packaged Meal Market Key Takeaways

| Metric | Value |

|---|---|

| Carbon Labeled Packaged Meal Market Estimated Value in (2025E) | USD 678.2 Million |

| Carbon Labeled Packaged Meal Market Forecast Value in (2035F) | USD 1,251.9 Million |

| Forecast CAGR (2025 to 2035) | 6.3% |

From 2025 to 2030, the market is expected to expand from USD 678.2 Million to USD 905.1 Million, contributing approximately USD 226.9 Million in new revenue, which equals more than one-third of total decade growth. This phase is likely to be characterized by steady consumer adoption, primarily in North America and Europe, where regulations and retailer commitments are reinforcing the uptake of certified labels. Third-party verification is projected to dominate, holding about 40% share, with consumer trust acting as the central growth lever.

In the second half, 2030 to 2035, an additional USD 346.8 Million is forecast to be generated as the market advances from USD 905.1Millionto USD 1,251.9 Million, representing the stronger growth phase of the decade. This acceleration is expected to be powered by South Asia & Pacific and broader European markets, where institutional buyers and policy support are stimulating penetration. By composition, plant-based meals are anticipated to lead with 30% share and 7.5% CAGR, shaping the category’s premium tier. Verified carbon labeling combined with sustainable packaging solutions is projected to become the decisive differentiator, anchoring long-term trust and consumer preference.

From 2020 to 2024, the Carbon-Labeled Packaged Meal Market expanded steadily, with early growth driven by niche adoption among climate-conscious consumers and pilot initiatives by leading retailers. During this period, the competitive landscape was shaped by plant-based meal innovators and sustainability-driven brands, while traditional food majors began experimenting with carbon footprint disclosures. Differentiation relied on credibility of certification and packaging sustainability, while self-declared labels were often treated as supplementary signals rather than primary purchase drivers. Institutional demand contributed minimally, Carbon Labeled Packaged Meal Market accounting for less than 10% of market value as procurement standards were still in transition.

Demand for carbon-labeled packaged meals is projected to reach USD 678.2 Million in 2025, advancing toward USD 1,251.9 Million by 2035 at a 6.3% CAGR. The revenue mix is expected to shift as third-party verified certifications secure ~40% share, supported by growing policy alignment and rising consumer trust. Traditional food players are anticipated to face intensifying competition from digital-first sustainability platforms and plant-based challengers offering transparent, audit-backed climate disclosures.

Established brands are projected to pivot toward hybrid models, integrating verified labeling, eco-packaging, and digital traceability to maintain relevance. Emerging entrants specializing in data-driven carbon analytics, QR-linked transparency tools, and premium plant-based offerings are gaining traction. Competitive advantage is expected to transition away from brand scale alone toward trustworthiness, verifiability, and alignment with consumer sustainability values, enabling long-term differentiation.

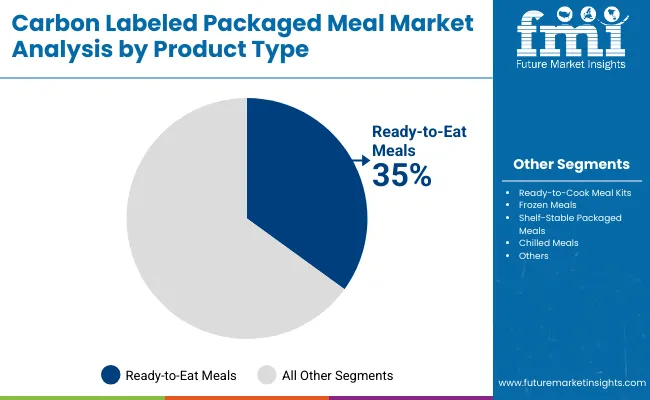

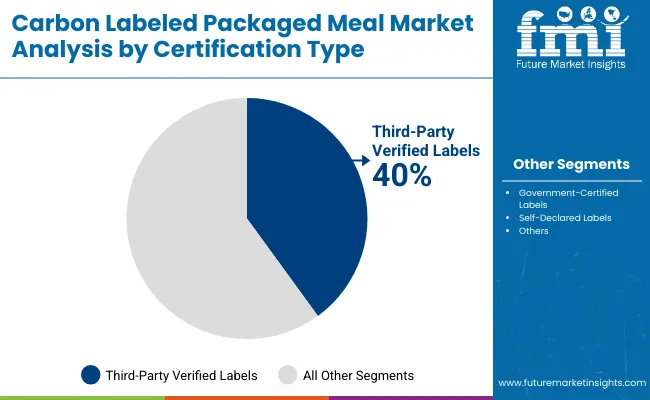

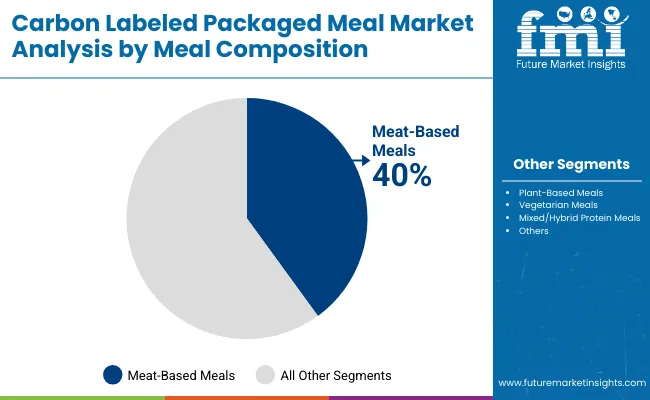

The market is segmented by product type, certification, meal composition, sales channel, packaging, consumer group, and region. Product categories include ready-to-eat, ready-to-cook, frozen, shelf-stable, and chilled formats, reflecting diverse consumer needs. Certification is divided into government-certified, third-party verified, and self-declared labels, highlighting varying levels of trust and transparency. Meal composition spans plant-based, vegetarian, meat-based, and hybrid protein formats, capturing both traditional and emerging dietary preferences.

Sales channels encompass retail, online platforms, subscriptions, and institutional procurement, expanding accessibility. Packaging segmentation covers compostable, recyclable, reusable, and single-use solutions, aligning with sustainability commitments. Consumer groups include climate-conscious buyers, flexitarians, millennials, Gen Z, and health-focused segments. Regionally, the scope extends across North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa.

| Product Type | Share% |

|---|---|

| Ready-to-Eat Meals | 35% |

| Ready-to-Cook Meal Kits | 25% |

| Frozen Meals | 20% |

| Shelf-Stable Packaged Meals | 10% |

| Chilled Meals | 10% |

The product type segment is projected to be dominated by ready-to-eat meals, which are forecasted to hold 35% market share in 2025. Growth in this category is being reinforced by the convenience-driven lifestyles of urban consumers, who are increasingly seeking sustainable and transparent food options. Ready-to-cook meal kits are expected to follow closely, expanding at the fastest CAGR of 7.0%, as households shift toward flexible home dining formats with traceable carbon footprints. Frozen and chilled meals are forecasted to record steady mid-single-digit growth, supported by longer shelf life and premium positioning. Shelf-stable packaged meals are expected to remain the smallest category due to limited freshness perception, although demand may be maintained in developing markets and institutional channels.

| Certification Type | Share% |

|---|---|

| Third-Party Verified Labels | 40% |

| Government-Certified Labels | 30% |

| Self-Declared Labels | 30% |

The certification type segment is expected to be led by third-party verified labels, which are projected to secure around 40% of the total market in 2025. Growth in this category is being powered by consumer trust in independent audits and retailer demand for credible sustainability disclosures. Government-certified programs are forecasted to gain strength in highly regulated markets, particularly in Europe and the UK, where carbon disclosure legislation is advancing. In contrast, self-declared labels are projected to retain a significant presence but at a lower CAGR of 5.8%, as consumers increasingly scrutinize brand claims for credibility. Over the decade, the shift toward transparent, third-party verification is expected to position trust as the defining driver of long-term competitiveness.

| Segment | Share% |

|---|---|

| Meat-Based Meals | 40% |

| Plant-Based Meals | 30% |

| Vegetarian Meals | 15% |

| Mixed/Hybrid Protein Meals | 15% |

The meal composition segment is anticipated to remain led by meat-based meals, which are projected to capture 40% share in 2025. However, expansion is forecasted to be strongest in the plant-based segment, advancing at a CAGR of 7.5%, outpacing all other categories. Rising adoption of flexitarian diets, coupled with sustainability commitments from retailers and foodservice operators, is expected to sustain plant-based growth across both developed and emerging markets. Vegetarian meals and hybrid protein formats are projected to record healthy mid-single-digit growth, supported by consumer interest in balance between taste, nutrition, and sustainability. While meat-based meals will maintain scale through 2035, their relative share is likely to soften as carbon-conscious consumers increasingly prioritize lower-impact meal options.

Adoption of carbon-labeled packaged meals is being accelerated by shifting regulatory frameworks and heightened consumer scrutiny, even as cost pressures and methodological inconsistencies create hurdles. Strategic advantage is expected to hinge on verified disclosures, sustainable packaging, and integration into institutional procurement policies.

Institutionalization of Carbon Disclosure in Food Procurement

Growth is being propelled by the institutional embedding of carbon disclosures within corporate and public procurement frameworks. Schools, hospitals, and corporate canteens are increasingly required to demonstrate Scope 3 reductions, positioning carbon-labeled meals as compliant and credible solutions. The incorporation of verified meal options into large-scale contracts is expected to create stable demand flows beyond retail channels. This institutionalization not only reduces dependence on individual consumer sentiment but also accelerates standardization of verification protocols, strengthening credibility. Over time, institutional adoption is projected to act as a flywheel, reinforcing brand legitimacy, improving data availability, and enabling more precise carbon footprint calculations across the value chain.

Variability in Methodology and Consumer Trust Risk

A major restraint is being presented by methodological variability in footprint measurement, which undermines comparability and risks consumer fatigue. Inconsistent boundaries whether farm-to-fork or cradle-to-retail create divergent results, complicating the establishment of a unified benchmark. This opacity leaves consumers uncertain and regulators cautious, limiting willingness to scale adoption.

Moreover, the proliferation of self-declared claims has heightened the risk of greenwashing, eroding trust among early adopters. If methodological clarity and standard verification frameworks are not advanced, competitive differentiation may collapse into pricing battles, stalling premiumization. To counter this, consensus-driven protocols and digital transparency tools are expected to be critical in rebuilding confidence and sustaining long-term growth trajectories.

Independent third-party verification is projected to remain the cornerstone of credibility, ensuring that consumers, retailers, and policymakers can rely on consistent and transparent carbon-labeling standards.

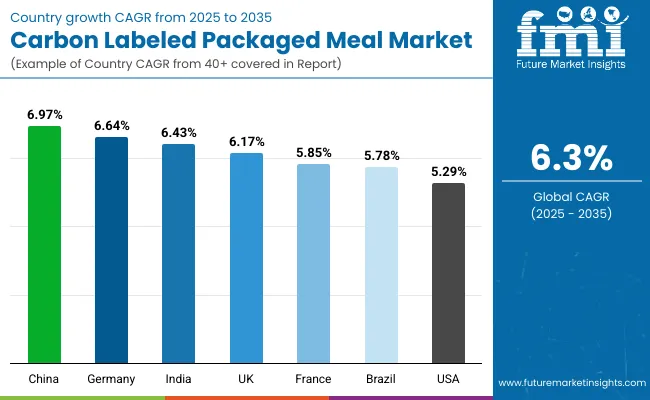

| Country | CAGR |

|---|---|

| China | 6.97% |

| India | 6.43% |

| Germany | 6.64% |

| France | 5.85% |

| UK | 6.17% |

| USA | 5.29% |

| Brazil | 5.78% |

The global carbon-labeled packaged meal market reveals clear disparities in adoption speed, shaped by regulatory frameworks, consumer engagement, and the maturity of retail ecosystems. Asia-Pacific is projected to emerge as the most dynamic growth cluster, anchored by China at 6.97% CAGR and India at 6.43% CAGR. Expansion is expected to be fueled by policy-led sustainability agendas, rapid digitization of food retail, and urban demand for climate-conscious consumption. In China, pilot regulations on carbon disclosure are anticipated to accelerate label adoption, while in India, momentum is expected from institutional procurement and rising penetration of organized retail.

Europe is projected to maintain a robust growth trajectory, led by Germany at 6.64% CAGR, the UK at 6.17%, and France at 5.85%. Progress in the region is expected to be underpinned by EU climate policies, retailer transparency commitments, and expanding demand from flexitarian and millennial consumers. The Rest of Europe is forecasted to expand its share, signaling diffusion beyond core Western markets.

North America is expected to post more moderate expansion, with the USA at 5.29% CAGR, reflecting maturity in packaged foods and a fragmented regulatory stance. Growth is anticipated to be supported primarily by private-label programs, subscription meal services, and institutional food procurement embedding carbon labeling as a compliance requirement.

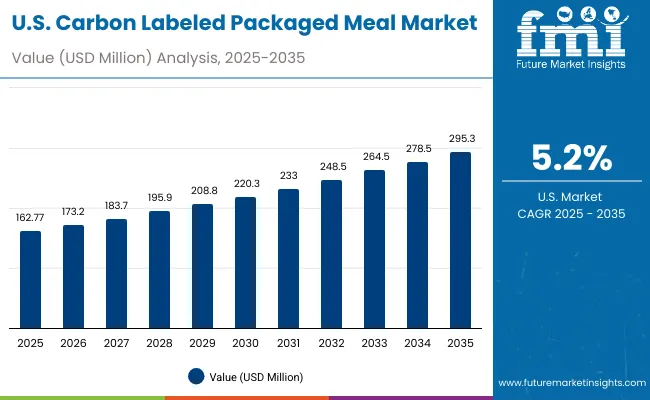

| Year | USA Carbon Labeled Packaged Meal Market (USD Million) |

|---|---|

| 2025 | 162.77 |

| 2026 | 173.2 |

| 2027 | 183.7 |

| 2028 | 195.9 |

| 2029 | 208.8 |

| 2030 | 220.3 |

| 2031 | 233.0 |

| 2032 | 248.5 |

| 2033 | 264.5 |

| 2034 | 278.5 |

| 2035 | 295.3 |

The carbon-labeled packaged meal market in the United States is projected to expand from USD 162.8 Million in 2025 to USD 295.3 Million by 2035, reflecting a steady 6.1% CAGR. Growth is expected to be underpinned by institutional procurement in schools, hospitals, and corporate canteens, where carbon transparency is being embedded into compliance frameworks. Private-label initiatives by major retailers are forecasted to drive wider affordability, while subscription meal platforms are likely to reinforce premium positioning through digital transparency tools.

Year-on-year growth patterns indicate peak expansion around 2028-2033, with annual rates exceeding 6.4%, signaling stronger consumer uptake as third-party verified certifications gain traction. Packaging innovation, particularly recyclable and compostable solutions, is anticipated to add further credibility to USA offerings. Although regulatory adoption is more fragmented than in Europe, competitive differentiation is expected to shift toward verified claims, institutional partnerships, and integration with digital disclosure platforms.

The carbon-labeled packaged meal market in the United Kingdom is forecasted to expand at a CAGR of 6.17% between 2025 and 2035. Market share is projected to soften slightly from 20.8% in 2025 to 20.1% in 2035, yet the UK will remain a European leader. The shift is expected to reflect stronger growth in Rest of Europe while the UK consolidates its base through regulatory and retailer-driven programs.

Expansion will be supported by supermarket mandates for verified carbon labels, government-backed climate disclosure frameworks, and millennial/Gen Z consumer alignment with transparency in food purchasing. Institutional buyers, including universities and healthcare providers, are expected to play a decisive role in embedding labeled meals into public procurement. Premium growth is anticipated from plant-based and hybrid protein categories, which align with evolving flexitarian preferences and resonate with the UK’s broader climate-conscious food culture.

The carbon-labeled packaged meal market in India is projected to grow at a CAGR of 6.43% from 2025 to 2035, positioning the country among the fastest-expanding globally. Growth is expected to be anchored in urban centers where organized retail and e-commerce platforms are enabling access to transparent, labeled offerings. Institutional procurement, particularly in corporate canteens and educational settings, is expected to accelerate adoption as sustainability metrics are introduced into compliance frameworks.

Affordability of labeled meals remains a critical lever, with private-label and D2C subscription platforms likely to capture early momentum. Expansion in plant-based and vegetarian options is forecasted to resonate strongly with dietary patterns in India, ensuring faster acceptance compared to heavily meat-oriented regions. Packaging innovations, particularly compostable and recyclable formats, are anticipated to gain traction as consumers align sustainability with affordability.

The carbon-labeled packaged meal market in China is forecasted to achieve the fastest CAGR globally, at 6.97% between 2025 and 2035. Expansion is expected to be powered by strong urban consumer demand, regulatory encouragement of climate transparency, and rapid digitalization of grocery platforms. The country’s leadership in sustainability reporting and large-scale pilot programs for carbon disclosure is anticipated to create significant momentum in verified labeling.

Growth is likely to be concentrated in metropolitan hubs where climate-conscious younger demographics are driving premium consumption patterns. E-commerce channels are expected to play a defining role, integrating carbon labeling visibility directly into purchase filters and product comparisons. Challenges remain around methodology standardization, but wider adoption of government-supported frameworks is expected to mitigate consumer skepticism. Institutional buyers and large retailers are projected to institutionalize verified carbon labels across food portfolios, sustaining growth beyond retail shelves.

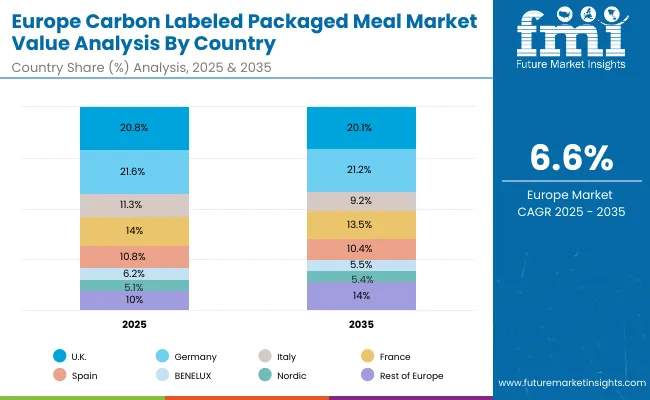

| Country | 2025 |

|---|---|

| UK | 20.80% |

| Germany | 21.65% |

| Italy | 11.37% |

| France | 14.09% |

| Spain | 10.84% |

| BENELUX | 6.24% |

| Nordic | 5.17% |

| Rest of Europe | 10% |

| Country | 2035 |

|---|---|

| UK | 20.14% |

| Germany | 21.26% |

| Italy | 9.24% |

| France | 13.57% |

| Spain | 10.43% |

| BENELUX | 5.50% |

| Nordic | 5.47% |

| Rest of Europe | 14% |

The carbon-labeled packaged meal market in Germany is expected to expand at a CAGR of 6.64% between 2025 and 2035, consolidating its role as the largest European market. Market share is forecasted to remain high, at 21.6% in 2025 and only marginally easing to 21.3% by 2035. The country’s leadership will be sustained by EU-driven sustainability regulation, national climate targets, and retailer commitments to third-party verification. Strong flexitarian and vegetarian consumption patterns are expected to amplify demand for plant-based carbon-labeled meals, which align with consumer values and health priorities.

Institutional procurement is projected to be a central lever, as German schools, hospitals, and corporates integrate climate footprint disclosures into food purchasing. Packaging alignment with recyclability and biodegradability mandates is likely to reinforce consumer trust. Premium differentiation will continue to be anchored in verified labeling, ensuring Germany’s role as a European benchmark for carbon-labeled packaged meals.

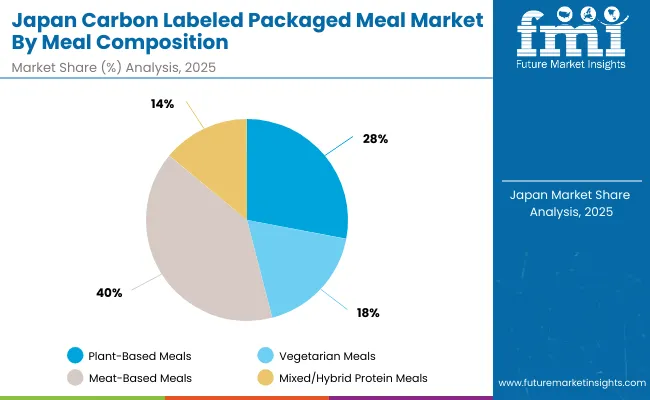

| Japan Meal Composition | 2025 Share |

|---|---|

| Plant-Based Meals | 28% |

| Vegetarian Meals | 18% |

| Meat-Based Meals | 40% |

| Mixed/Hybrid Protein Meals | 14% |

| Japan Meal Composition | CAGR |

|---|---|

| Plant-Based Meals | 7.00% |

| Vegetarian Meals | 6.50% |

| Meat-Based Meals | 5.90% |

| Mixed/Hybrid Protein Meals | 6.20% |

The Carbon-Labeled Packaged Meal Market in Japan is projected to be shaped strongly by meal composition preferences in 2025, with meat-based meals holding the largest share at 40%, followed by plant-based meals at 28%. However, growth momentum is expected to shift toward plant-based meals, which are forecasted to expand at the highest CAGR of 7.0%, reflecting consumer demand for sustainable, low-carbon protein alternatives. Vegetarian meals are anticipated to follow with a CAGR of 6.5%, driven by health-conscious urban demographics.

The gradual expansion of hybrid protein meals (6.2% CAGR) highlights Japan’s transition toward flexible diets that balance traditional meat consumption with plant proteins. While meat-based meals retain dominance, their CAGR of 5.9% indicates a relative slowdown, suggesting a reallocation of consumer expenditure toward more eco-friendly meal options. With regulatory pressure on carbon transparency and growing consumer awareness of climate impact, the Japanese market is expected to pivot steadily toward plant-forward dietary solutions.

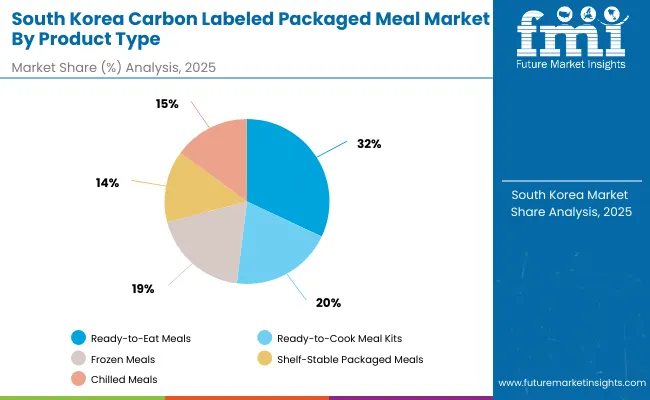

| South Korea Product Type | 2025 Share |

|---|---|

| Ready-to-Eat Meals | 32% |

| Ready-to-Cook Meal Kits | 20% |

| Frozen Meals | 19% |

| Shelf-Stable Packaged Meals | 14% |

| Chilled Meals | 15% |

| South Korea Product Type | CAGR |

|---|---|

| Ready-to-Eat Meals | 6.80% |

| Ready-to-Cook Meal Kits | 7.20% |

| Frozen Meals | 6.50% |

| Shelf-Stable Packaged Meals | 6.00% |

| Chilled Meals | 6.60% |

The Carbon-Labeled Packaged Meal Market in South Korea is expected to be led by ready-to-eat meals, which account for the largest share of 32% in 2025, reflecting strong consumer preference for convenience and time efficiency. However, the fastest growth trajectory is forecasted for ready-to-cook meal kits, with a CAGR of 7.2%, supported by rising household experimentation, premiumization, and sustainability-driven packaging innovations.

Frozen meals represent a 19% share in 2025 and are projected to expand at 6.5% CAGR, fueled by demand for extended shelf life and energy-efficient cold storage solutions. Meanwhile, chilled meals (15% share, 6.6% CAGR) highlight the shift toward freshness and localized food sourcing, with carbon labeling reinforcing transparency for health-conscious buyers. Shelf-stable packaged meals, although smaller in share (14%) and slower in growth (6.0% CAGR), remain relevant for rural distribution and disaster-resilient food supply chains.

Growing consumer emphasis on eco-friendly packaging, digital traceability, and balanced nutrition is expected to redefine South Korea’s competitive landscape, with hybrid models blending convenience and sustainability gaining greater traction.

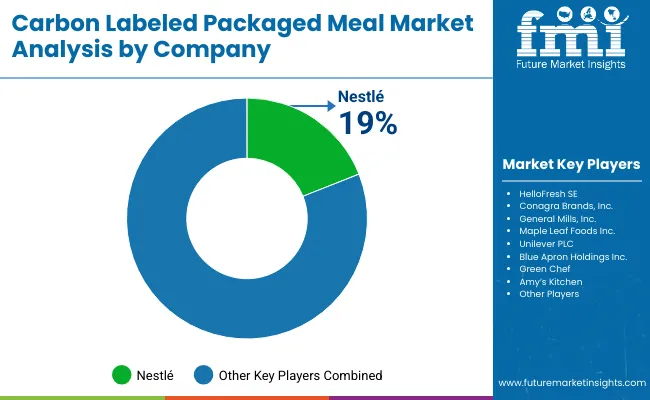

The Carbon-Labeled Packaged Meal Market is moderately fragmented, with global leaders, regional innovators, and niche-focused sustainability specialists competing across diverse consumer segments. Global food companies such as Nestlé, Unilever, and Danone hold significant market share, driven by their expansive distribution networks, portfolio diversity, and early adoption of carbon footprint transparency. Their strategies are being shaped by growing consumer preference for low-impact meals, with emphasis placed on carbon labeling as a brand-differentiation tool aligned with corporate ESG commitments.

Established mid-sized players, including Oatly, Amy’s Kitchen, and Quorn Foods, are leveraging plant-based and vegetarian offerings to strengthen their market positions. Their growth is being accelerated by partnerships with retailers, digital-first distribution channels, and consumer demand for measurable sustainability credentials. These players are increasingly integrating carbon-label certifications as a competitive necessity rather than an optional attribute.

Specialized providers, such as regional organic meal brands and sustainability-driven startups, focus on carbon-labeled ready-to-eat and hybrid protein meals that appeal to eco-conscious urban populations. Their strength lies in agility, localized sourcing, and transparent storytelling, which resonate strongly with younger demographics.

Competitive differentiation is shifting away from scale alone toward credibility in carbon disclosure, lifecycle impact reduction, and integration with digital platforms that allow consumers to track climate footprints in real time.

Key Developments in Carbon Labeled Packaged Meal Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1,251.9 Million |

| Component | Ready-to-Eat Meals, Ready-to-Cook Kits, Frozen Meals, Shelf-Stable Meals, Chilled Meals |

| Certification Type | Government-Certified Labels, Third-Party Verified Labels, Self-Declared Labels |

| Meal Composition | Plant-Based Meals, Vegetarian Meals, Meat-Based Meals, Mixed/Hybrid Protein Meals |

| End-use Industry | Retail Chains & Supermarkets, Online Meal Delivery Platforms, Foodservice Operators, Healthcare Nutrition Providers, Corporate & Institutional Catering |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Korea |

| Key Companies Profiled | Nestlé S.A., HelloFresh SE, Conagra Brands, Inc., General Mills, Inc., Maple Leaf Foods Inc., Unilever PLC, Blue Apron Holdings Inc., Green Chef, Amy’s Kitchen |

| Additional Attributes | Dollar sales by meal type, certification type, and end-use industry; increasing adoption of digital carbon labels; eco-conscious purchasing behavior shaping innovation; plant-based and hybrid meals gaining prominence; competitive advantage linked to transparent labeling, QR-based traceability, and sustainability-driven reformulations |

The global Carbon Labeled Packaged Meal Market is projected to be valued at approximately USD 678.2 Million in 2025.

The market size for the Carbon Labeled Packaged Meal Market is projected to reach USD 1,251.9 Million by 2035.

The Carbon Labeled Packaged Meal Market is expected to expand at a CAGR of 6.3% between 2025 and 2035.

The key product types in the Carbon Labeled Packaged Meal Market are Ready-to-Eat Meals, Ready-to-Cook Meal Kits, Frozen Meals, Shelf-Stable Packaged Meals, and Chilled Meals.

In 2025, Meat-Based Meals are projected to hold the largest share at around 40%, while Plant-Based Meals are anticipated to expand the fastest at 7.5% CAGR, highlighting shifting consumer preference toward sustainable options.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Carbon Capture and Sequestration Market Forecast Outlook 2025 to 2035

Carbon Dioxide Incubators Market Size and Share Forecast Outlook 2025 to 2035

Carbon Enhanced Lead Acid Battery Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Cement Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tetrabromide Market Size and Share Forecast Outlook 2025 to 2035

Carbon Steel Market Size and Share Forecast Outlook 2025 to 2035

Carbon Brush Market Size and Share Forecast Outlook 2025 to 2035

Carbon Offset Platform Market Size and Share Forecast Outlook 2025 to 2035

Carbon Tapes Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Free Waste Gas Abatement System Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Bike Wheelset Market Size and Share Forecast Outlook 2025 to 2035

Carbon Dioxide Lasers Market Size and Share Forecast Outlook 2025 to 2035

Carbon-negative Packaging Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Construction Repair Market Size and Share Forecast Outlook 2025 to 2035

Carbon Credit Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Dioxide Synthesis Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Carbon-Neutral Skincare Ingredients Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Carbonate Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Reinforced Plastic Market Size and Share Forecast Outlook 2025 to 2035

Carbon Fiber Wraps Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA