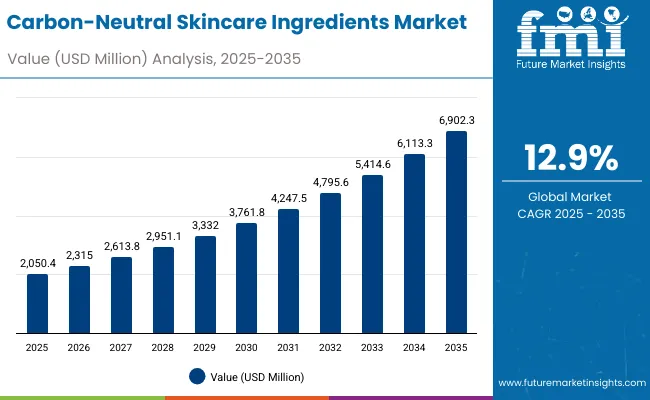

The Carbon-Neutral Skincare Ingredients Market is expected to record a valuation of USD 2,050.4 million in 2025 and USD 6,902.3 million in 2035, with an increase of USD 4,851.9 million, which equals a growth of more than 193% over the decade. The overall expansion represents a CAGR of 12.9% and a 3X increase in market size.

Carbon-Neutral Skincare Ingredients Market Key Takeaways

| Metric | Value |

|---|---|

| Carbon-Neutral Skincare Ingredients Market Estimated Value in (2025E) | USD 2,050.4 million |

| Carbon-Neutral Skincare Ingredients Market Forecast Value in (2035F) | USD 6,902.3 million |

| Forecast CAGR (2025 to 2035) | 12.9% |

During the first five-year period from 2025 to 2030, the market increases from USD 2,050.4 million to USD 3,761.8 million, adding USD 1,711.4 million, which accounts for over 35% of the total decade growth. This phase records steady adoption of carbon-neutral formulations across hydration-focused products, sun care, and creams/lotions, driven by demand from consumers aligning beauty purchases with sustainability pledges. E-commerce dominates in this period as it caters to over 48% of global distribution, becoming the most important channel for eco-conscious beauty.

The second half from 2030 to 2035 contributes USD 3,140.5 million, equal to 65% of total growth, as the market jumps from USD 3,761.8 million to USD 6,902.3 million. This acceleration is powered by widespread certification adoption, rapid innovation in fermentation-derived actives, and the scaling of upcycled byproduct extracts in premium formulations. China and India spearhead global demand, with CAGRs of 19.8% and 23.6% respectively, making Asia the fastest-growing regional cluster. Premium retail and natural/organic beauty stores gain share in this phase, but e-commerce retains leadership due to its global reach.

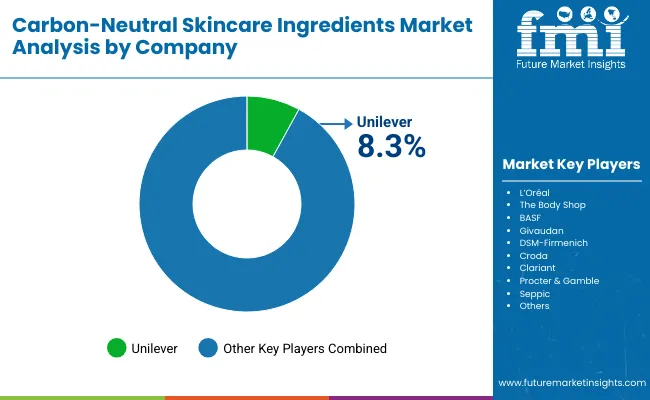

From 2020 to 2024, the Carbon-Neutral Skincare Ingredients Market grew steadily as eco-conscious beauty shifted from niche to mainstream. During this period, the competitive landscape was dominated by multinational consumer goods leaders, with Unilever and L’Oréal driving sustainability narratives and certification programs. Competitive differentiation relied heavily on carbon accounting, traceable sourcing, and low-impact production of skincare actives. Carbon-neutral certification moved from a marketing label to a core purchase driver, supported by the rise of digital marketplaces where eco-labels strongly influenced consumer choices.

Demand is expected to expand to USD 2,050.4 million in 2025, with the revenue mix increasingly tilted toward certified formulations, which account for more than half of the market. Traditional leaders face mounting competition from ingredient manufacturers like BASF, Croda, and DSM-Firmenich, who are embedding circularity and biotechnology at the supply chain level. Emerging entrants, including eco-conscious start-ups leveraging upcycled ingredients and fermentation technologies, are gaining visibility. The competitive advantage is shifting from scale alone to credibility in carbon reporting, certification partnerships, and the ability to integrate sustainability into both mass-market and premium product lines.

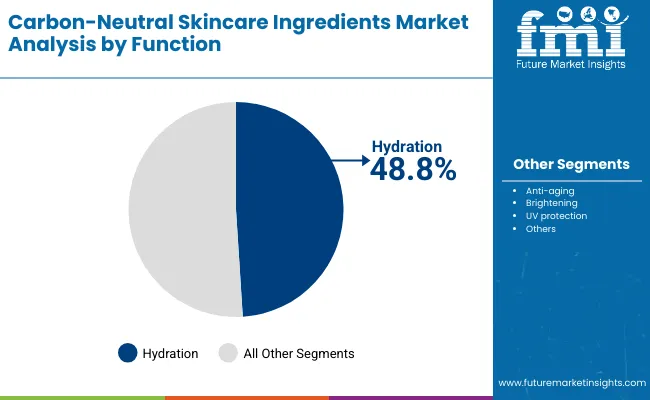

Advances in sustainable ingredient innovation have improved both performance and environmental impact, allowing for more efficient formulation of eco-conscious skincare products. Hydration-focused actives have gained popularity due to their broad suitability across skin types and climates, accounting for 48.8% of global market share in 2025 (USD 993.9 million). The rise of fermentation-derived actives and mineral-based UV protectants has contributed to enhanced efficacy and stability, while also lowering the carbon footprint of production. Industries such as premium beauty, personal care, and pharmaceutical skincare are driving demand for carbon-neutral solutions that integrate seamlessly with existing consumer preferences for high-performance and natural formulations.

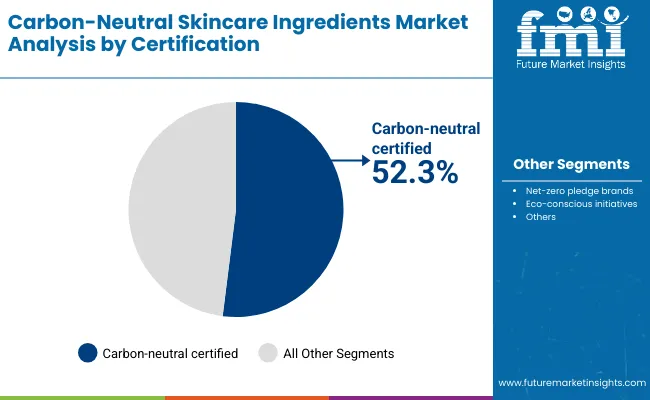

Expansion of carbon-neutral certification and eco-conscious initiatives has fueled market growth, with certified products already contributing 52.3% of value in 2025 (USD 1,076.8 million). Innovations in upcycled byproduct extracts and plant oils are expected to open new application areas, particularly in masks and sun care. Segment growth is expected to be led by carbon-neutral certified formulations, hydration-focused functions, and e-commerce channels, due to their precision targeting of eco-conscious buyers and adaptability to digital-first retail environments. By 2035, the market will be strongly defined by Asia-Pacific leadership, as countries such as India (CAGR 23.6%) and China (CAGR 19.8%) accelerate adoption through scalable, cost-effective innovations.

The market is segmented by ingredient type, function, certification, product type, channel, and region. Ingredient types include plant oils & butters, fermentation-derived actives, mineral-based UV protectants, and upcycled byproduct extracts, highlighting the sustainable raw materials driving adoption. Functional categories cover anti-aging, hydration, brightening, and UV protection, designed to address diverse consumer skincare needs. Based on certification, the segmentation includes carbon-neutral certified, net-zero pledge brands, and eco-conscious initiatives, reflecting varying levels of climate accountability and sustainability commitments.

In terms of product type, the market spans serums, creams/lotions, masks, and sun care, which represent the leading commercial formats for carbon-neutral ingredients. Distribution channels include e-commerce, natural/organic beauty retail, pharmacies, and premium retail, each playing a critical role in shaping access and consumer trust. Regionally, the scope spans North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa. At the country level, coverage includes the United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, and South Africa.

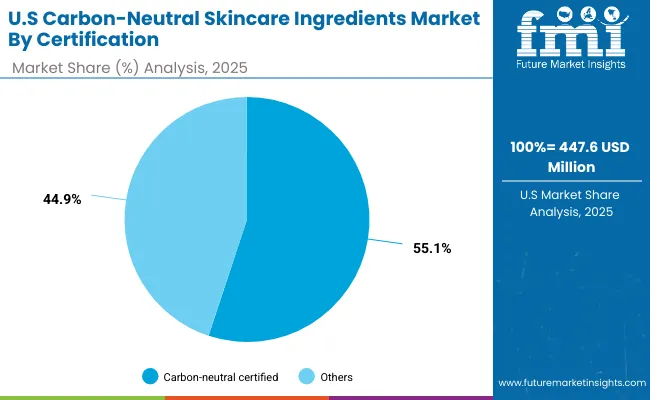

| Certification | Value Share% 2025 |

|---|---|

| Carbon-neutral certified | 52.3% |

| Others | 47.7% |

Carbon-neutral certified products account for over half of global value in 2025. This dominance reflects the rising importance of third-party validation in consumer decision-making. Brands leveraging certification are not only targeting environmentally conscious buyers but also using it as a trust-building mechanism in premium and mass-market lines.

| Function | Value Share% 2025 |

|---|---|

| Hydration | 48.8% |

| Others | 51.2% |

Hydration is the most sought-after function in carbon-neutral skincare. This dominance stems from increasing awareness of skin health, hydration-barrier repair, and climate-adaptive beauty products. The use of fermentation-derived actives and plant oils aligns with both efficacy and sustainability, reinforcing hydration as the leading functional demand driver.

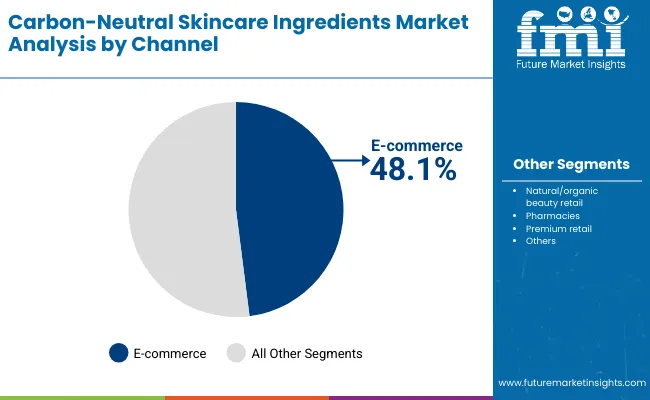

| Channel | Value Share% 2025 |

|---|---|

| E-commerce | 48.1% |

| Others | 51.9% |

E-commerce leads as the top distribution channel, reflecting digital-native beauty consumption patterns and the importance of online platforms in showcasing sustainability metrics. With consumers increasingly checking carbon-neutral claims online, platforms serve as both sales and education channels.

Rising Share of Carbon-Neutral Certification

The market is being driven by the rapid uptake of carbon-neutral certified products, which already account for more than USD 1,076.8 million in 2025. This certification is no longer a symbolic label but a competitive necessity for brands aiming to establish credibility in eco-conscious beauty. Players such as Unilever and L’Oréal are accelerating their investment in third-party certifications and carbon footprint audits to capture premium positioning.

Certification resonates most strongly in North America and Europe, where regulatory scrutiny and consumer activism push brands to validate sustainability claims. In Asia-Pacific, especially in China and Japan, carbon-neutral labeling is emerging as a differentiator for premium skincare, where rising disposable incomes align with ethical purchasing. This creates a double-layered growth driver: consumer willingness to pay more for verified carbon-neutral products, and multinational companies investing aggressively to meet this demand.

Fermentation-Derived Actives and Upcycled Ingredients Driving Functional Innovation

Fermentation-derived actives and upcycled byproduct extracts are rapidly scaling as ingredient categories because they directly address both sustainability and efficacy. Fermentation processes allow the production of potent anti-aging and brightening actives with reduced carbon footprints, while upcycled extracts enable brands to create “zero-waste” formulations that appeal to eco-conscious buyers. These innovations particularly support hydration products, which hold a 48.8% share in 2025 (USD 993.9 million), as well as anti-aging products in mature markets like the USA, Japan, and Germany.

Brands like DSM-Firmenich and Givaudan are investing in biotech fermentation platforms, while Croda and Seppic are leveraging food and beverage byproducts for skincare actives. This functional-ingredient innovation cycle is a structural growth driver because it links environmental responsibility with tangible product performance something consumers increasingly demand.

High Cost of Certification and Low Adoption Among Emerging Brands

Despite the dominance of certified products, the costs associated with achieving carbon-neutral certification remain a barrier for emerging brands and smaller players. Certification involves extensive auditing, supply chain transparency, and recurring compliance costs. As a result, eco-conscious initiatives without official certification still account for 47.7% of the market (USD 979.0 million in 2025), reflecting cost-driven avoidance by many players. This limits the inclusivity of certification-driven growth and slows adoption in price-sensitive markets like India and Latin America, where affordability is a key consumer concern.

Regional Disparities in Growth and Carbon Accounting Standards

The market’s growth is uneven across geographies. While India and China post strong CAGRs of 23.6% and 19.8% respectively, mature markets like the USA (9.1%) and Germany (10.1%) show slower momentum. This divergence is exacerbated by inconsistent carbon accounting frameworks across regions. For example, Europe requires stringent proof of emission offsets, while some Asian markets allow self-declared eco-conscious initiatives. This regulatory disparity creates confusion for global brands trying to harmonize claims and slows the scaling of standardized product lines across multiple geographies.

Hydration as the Leading Gateway for Carbon-Neutral Skincare

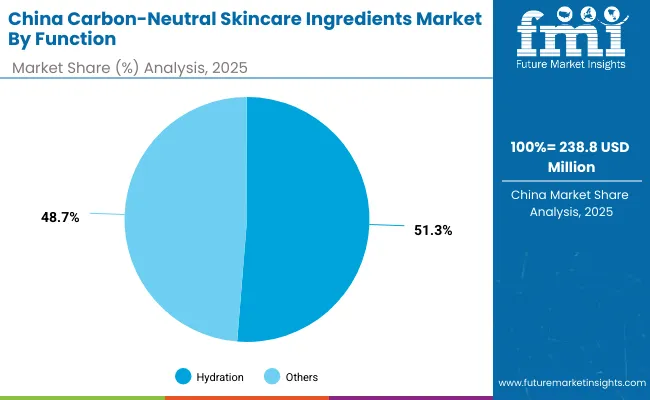

Hydration dominates global demand with 48.8% share in 2025 (USD 993.9 million), making it the key entry point for carbon-neutral skincare. Unlike anti-aging or UV protection, hydration appeals universally across age groups and climates. In China, hydration accounts for over 51.3% of the functional demand, showing its cultural centrality. Brands are layering sustainability messaging onto hydration claims, positioning products as both skin-barrier supporting and environmentally safe. This trend is expected to sustain leadership into 2035, reinforcing hydration as the foundational category for eco-conscious adoption.

E-Commerce as the Leading Carbon-Neutral Storytelling Channel

With 48.1% share in 2025 (USD 993.9 million), e-commerce is more than a sales platform it is the primary channel for sustainability storytelling. Online beauty retailers and DTC brands are now highlighting carbon footprint reductions, certification badges, and eco-score labeling in product pages. This trend is particularly impactful in Asia, where platforms like Tmall, Lazada, and Rakuten are integrating carbon-neutral categories as premium product clusters. By 2035, e-commerce is expected to remain the dominant channel, supported by algorithm-driven product recommendations that highlight sustainability claims.

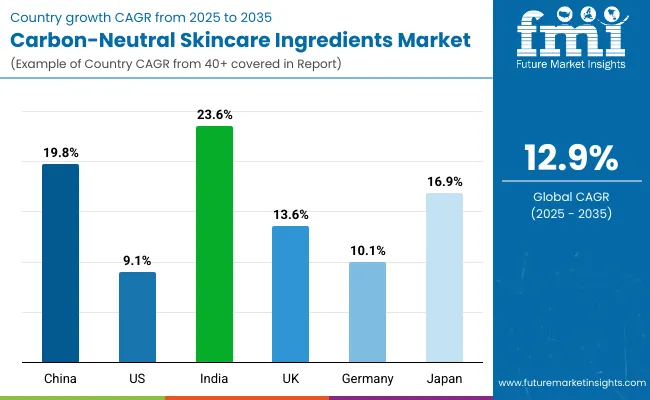

| Countries | Estimated CAGR (2025 to 2035) |

|---|---|

| China | 19.8% |

| USA | 9.1% |

| India | 23.6% |

| UK | 13.6% |

| Germany | 10.1% |

| Japan | 16.9% |

The Carbon-Neutral Skincare Ingredients Market shows sharp contrasts in growth dynamics across key countries. India emerges as the fastest-growing market with a projected CAGR of 23.6%, supported by rising disposable incomes, the rapid adoption of natural and eco-conscious beauty among younger consumers, and government-backed sustainability programs encouraging local sourcing of plant-based and upcycled ingredients.

China follows with a robust 19.8% CAGR, fueled by its massive consumer base, accelerated certification adoption, and e-commerce platforms actively promoting carbon-neutral categories as premium offerings. Japan, with a CAGR of 16.9%, reflects a strong alignment between cultural values of minimalism and biotech innovation, particularly fermentation-derived actives and mineral-based UV protectants, making it a highly influential trend-setting market in Asia-Pacific.

In contrast, mature Western markets demonstrate slower but stable growth trajectories. The USA posts a CAGR of 9.1%, indicating market maturity, where carbon-neutral products are already mainstream but face competitive pressures from established multinational brands. Germany, with a 10.1% CAGR, remains Europe’s anchor market, driven by regulatory rigor and consumer insistence on verified certifications.

The UK, posting 13.6% CAGR, balances innovation and retail-driven adoption, benefiting from the country’s strong natural/organic beauty retail landscape and consumer affinity for certified eco-conscious products. Collectively, these figures underline a global shift in growth leadership toward Asia-Pacific, while Europe and North America maintain market share through certification credibility and established sustainability practices.

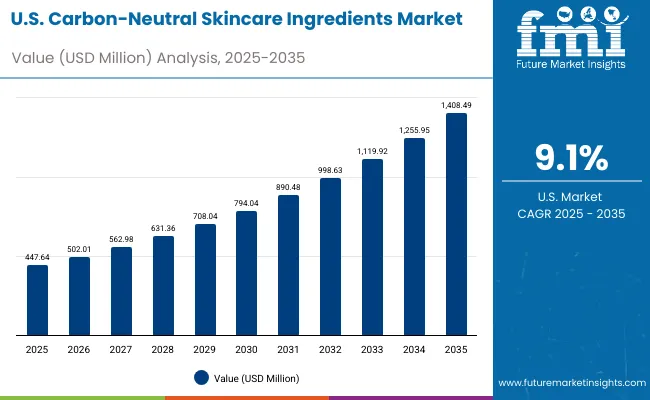

| Year | USA Carbon-Neutral Skincare Ingredients Market (USD Million) |

|---|---|

| 2025 | 447.64 |

| 2026 | 502.01 |

| 2027 | 562.98 |

| 2028 | 631.36 |

| 2029 | 708.04 |

| 2030 | 794.04 |

| 2031 | 890.48 |

| 2032 | 998.63 |

| 2033 | 1,119.92 |

| 2034 | 1,255.95 |

| 2035 | 1,408.49 |

The Carbon-Neutral Skincare Ingredients Market in the United States is projected to grow at a CAGR of 9.1%, led by the strong demand for certified carbon-neutral formulations. With carbon-neutral certified products already accounting for 55.1% of market share in 2025 (USD 246.7 million), the USA consumer base is demonstrating clear preference for products with third-party validation. Growth is being driven by premium skincare categories such as serums and creams/lotions, where eco-labeling strongly influences purchase decisions.

Hydration and anti-aging functions dominate, while e-commerce and pharmacies are the most prominent channels for adoption. Multinational players including Unilever, L’Oréal, and Procter & Gamble are expanding their climate-neutral roadmaps in the USA, investing heavily in ingredient traceability and upcycled formulations.

The Carbon-Neutral Skincare Ingredients Market in the United Kingdom is expected to grow at a CAGR of 13.6%, supported by consumer affinity for sustainability certifications and a mature natural/organic beauty retail landscape. Premium retail outlets and eco-focused specialty stores have integrated carbon impact labels, reinforcing the demand for certified ingredients. UK consumers show strong adoption of hydration and brightening functions, supported by fermentation-derived actives and mineral-based UV protectants. Government-backed sustainability initiatives and academic collaboration with biotech labs continue to strengthen the innovation pipeline.

India is witnessing the fastest growth in the Carbon-Neutral Skincare Ingredients Market, forecast to expand at a CAGR of 23.6% through 2035. A surge in demand from urban millennials and Gen Z consumers is driving rapid adoption, particularly for hydration and brightening products. Tier-2 and Tier-3 cities are emerging as growth hubs, supported by cost-effective launches of eco-certified skincare lines. Local brands are increasingly adopting upcycled byproduct extracts to lower production costs and appeal to eco-conscious younger buyers. Educational campaigns and rising e-commerce penetration further amplify awareness.

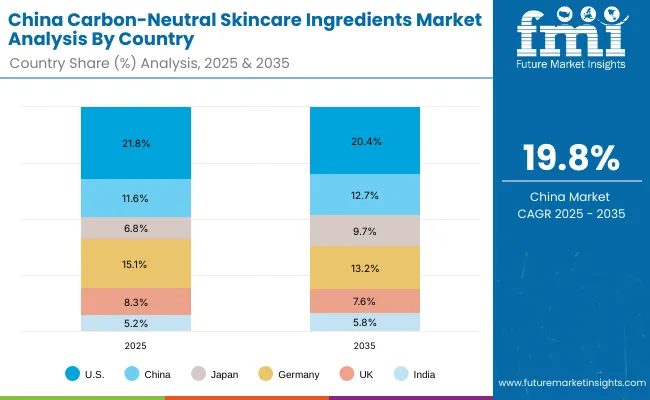

| Countries | 2025 Share (%) |

|---|---|

| USA | 21.8% |

| China | 11.6% |

| Japan | 6.8% |

| Germany | 15.1% |

| UK | 8.3% |

| India | 5.2% |

| Countries | 2035 Share (%) |

|---|---|

| USA | 20.4% |

| China | 12.7% |

| Japan | 9.7% |

| Germany | 13.2% |

| UK | 7.6% |

| India | 5.8% |

The Carbon-Neutral Skincare Ingredients Market in China is expected to grow at a CAGR of 19.8%, among the highest worldwide. This momentum is driven by the integration of carbon-neutral labels on hydration products, which already account for 51.3% share in 2025 (USD 122.6 million). E-commerce platforms such as Tmall and JD.com are amplifying certified beauty categories, often positioning them as premium offerings. Urban consumers are showing strong preference for fermentation-derived actives and mineral-based UV protectants, while government policies encourage climate-aligned product innovations. Local ingredient suppliers are also developing affordable, carbon-conscious alternatives that enable mass-market adoption.

| USA by Certification | Value Share% 2025 |

|---|---|

| Carbon-neutral certified | 55.1% |

| Others | 44.9% |

The Carbon-Neutral Skincare Ingredients Market in the United States is projected at USD 447.6 million in 2025, growing to USD 1,408.5 million by 2035 at a CAGR of 9.1%. Carbon-neutral certified formulations contribute 55.1% (USD 246.7 million), while non-certified eco-conscious initiatives hold the remaining 44.9% (USD 200.9 million). This indicates a strong consumer preference for verifiable certification rather than unverified claims. Certification adoption is particularly high in premium skincare lines such as serums and creams/lotions, where third-party validation drives brand trust and willingness to pay.

The shift toward certification is reinforced by regulatory scrutiny and consumer watchdog groups demanding transparent carbon accounting. USA buyers increasingly prioritize hydration and anti-aging functions, aligning with demographic demand for skin health and longevity. E-commerce remains the leading channel, supported by pharmacies expanding their eco-certified assortments. As multinational corporations scale traceable sourcing and carbon accounting, the USA market is expected to consolidate around brands that combine efficacy, certification, and sustainability narratives.

| China by Function | Value Share% 2025 |

|---|---|

| Hydration | 51.3% |

| Others | 48.7% |

The Carbon-Neutral Skincare Ingredients Market in China is projected at USD 238.8 million in 2025, with a CAGR of 19.8%, one of the highest globally. Hydration dominates with a 51.3% share (USD 122.6 million), reflecting strong consumer preference for functional, barrier-supportive formulations in an urbanizing and pollution-sensitive environment. Brightening and UV protection functions also gain traction, but hydration is central to mass adoption.

China’s leadership in digital-first retail is accelerating this momentum. Platforms like Tmall and JD.com actively highlight carbon-neutral categories, treating them as premium offerings and embedding sustainability scores in product recommendations. Domestic ingredient suppliers are increasingly offering affordable fermentation-derived actives and upcycled extracts, making sustainable formulations accessible to middle-income consumers. Government policies promoting low-carbon product innovation further reinforce this growth trajectory.

The Carbon-Neutral Skincare Ingredients Market is moderately fragmented, with multinational consumer goods leaders, ingredient suppliers, and niche-focused eco-innovators competing across diverse functions and regions. Unilever holds 8.3% of global market value in 2025, making it the single largest player, while the remaining 91.7% is distributed among other leading corporations and emerging challengers.

Consumer goods giants such as Unilever, L’Oréal, Procter & Gamble, and The Body Shop dominate mass adoption through large-scale certified product lines, strong e-commerce penetration, and visible sustainability pledges. Ingredient innovators like BASF, DSM-Firmenich, Croda, Givaudan, Clariant, and Seppic hold competitive strength by embedding biotech fermentation, upcycled actives, and carbon-neutral production at the supply chain level. Their role is increasingly critical as brands demand certified, low-carbon inputs to differentiate product portfolios.

Smaller eco-conscious brands and start-ups are carving space with specialized innovations in upcycled byproduct extracts, localized ingredient sourcing, and subscription-based distribution models. These players excel at storytelling and consumer engagement, particularly in Asia-Pacific and Europe. Competitive differentiation is moving away from price and formulation alone toward a complete ecosystem approach: carbon-neutral certification, traceable supply chains, and digital-first retail partnerships. By 2035, players with robust carbon reporting and integration of AI-driven life-cycle analysis will likely lead global market share growth.

Key Developments in Carbon-Neutral Skincare Ingredients Market

| Item | Value |

|---|---|

| Quantitative Units | USD 2,050.4 Million |

| Ingredient Type | Plant oils & butters, Fermentation-derived actives, Mineral-based UV protectants, Upcycled byproduct extracts |

| Function | Anti-aging, Hydration, Brightening, UV protection |

| Certification | Carbon-neutral certified, Net-zero pledge brands, Eco-conscious initiatives |

| Product Type | Serums, Creams/lotions, Masks, Sun care |

| Channel | E-commerce, Natural/organic beauty retail, Pharmacies, Premium retail |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Unilever, L’Oréal, The Body Shop, BASF, Givaudan, DSM- Firmenich, Croda, Clariant, Procter & Gamble, Seppic |

| Additional Attributes | Dollar sales by certification, function, and channel; rapid adoption of hydration-focused formulations; growing use of fermentation-derived actives and upcycled byproduct extracts; increasing role of carbon-neutral certification in premium and mass-market skincare; expansion of e-commerce sustainability labeling; regional leadership from Asia-Pacific (China, India, Japan) alongside steady North American and European demand; and ongoing innovations in mineral-based UV protectants a nd biotechnology-driven actives. |

The Carbon-Neutral Skincare Ingredients Market is estimated to be valued at USD 2,050.4 million in 2025.

The market size for the Carbon-Neutral Skincare Ingredients Market is projected to reach USD 6,902.3 million by 2035.

The Carbon-Neutral Skincare Ingredients Market is expected to grow at a 12.9% CAGR between 2025 and 2035.

The key product types in the Carbon-Neutral Skincare Ingredients Market are serums, creams/lotions, masks, and sun care.

In terms of function, the hydration segment is expected to command 48.8% share in the Carbon-Neutral Skincare Ingredients Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Skincare Supplement Market Size and Share Forecast Outlook 2025 to 2035

Skincare Oil Market Size and Share Forecast Outlook 2025 to 2035

Skincare Nutritional Serum Market Size and Share Forecast Outlook 2025 to 2035

Skincare Products Market Size and Share Forecast Outlook 2025 to 2035

Skincare Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Skincare Packaging Market Size, Share & Forecast 2025 to 2035

Skincare Industry in India – Trends & Growth Forecast 2024-2034

Global Skincare Treatment Market Analysis – Size, Share & Forecast 2024-2034

Global PDRN Skincare Market Size and Share Forecast Outlook 2025 to 2035

Men’s Skincare Products Market Size, Growth, and Forecast for 2025 to 2035

Global Smart Skincare Market Size and Share Forecast Outlook 2025 to 2035

Cooling Skincare Gels Market Size and Share Forecast Outlook 2025 to 2035

Natural Skincare Preservatives Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Ormedic Skincare Market Demand & Insights 2024-2034

Ceramide Skincare Market Size and Share Forecast Outlook 2025 to 2035

BPA-Free Skincare Market Trends – Demand & Forecast 2024-2034

Camellia Skincare & Cosmetics Market

Buffering Skincare Products Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Menopause Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA