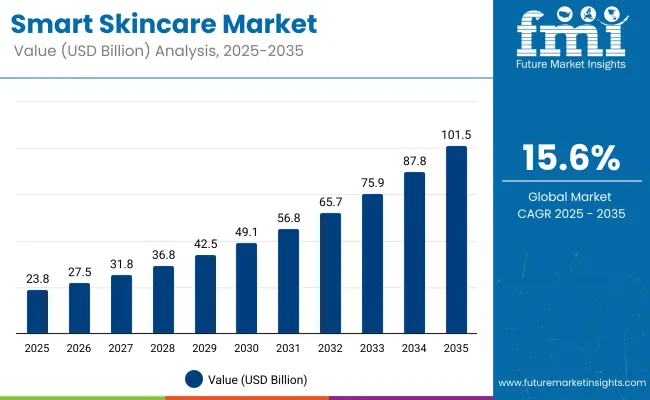

The Global Smart Skincare Market is expected to record a valuation of USD 23.8 billion in 2025 and USD 101.5 billion in 2035, with an increase of USD 77.7 billion over the decade. The overall expansion represents a CAGR of 15.6% and a 4.3X increase in market size.

Global Smart Skincare Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value in (2025E) | USD 23.8 billion |

| Market Forecast Value in (2035F) | USD 101.5 billion |

| Forecast CAGR (2025 to 2035) | 15.6% |

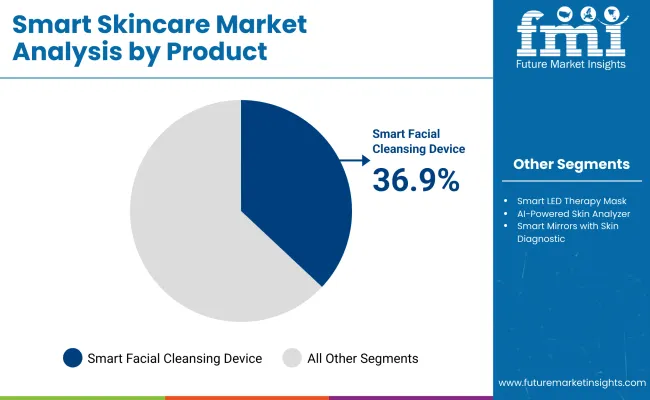

During the first five-year period from 2025 to 2030, the market increases from USD 23.8 billion to USD 49.1 billion, adding USD 25.3 billion, which accounts for 32.6% of the total decade growth. This phase records steady adoption in at-home facial care tools, connected cleansing brushes, and app-enabled diagnostics, driven by the need for convenience, personalization, and anti-aging solutions. Smart facial cleansing devices dominate this period as they cater to over 36.9% of consumer use-cases requiring real-time feedback and visible skincare benefits.

The second half from 2030 to 2035 contributes USD 52.4 billion, equal to 67.4% of total growth, as the market jumps from USD 49.1 billion to USD 101.5 billion. This acceleration is powered by widespread deployment of IoT-integrated skincare routines, wearable skin monitoring patches, and subscription-based personalization models. AI-driven analytics and cloud-connected diagnostics add recurring revenue, increasing the software and services share beyond device-led value creation.

From 2020 to 2024, the Global Smart Skincare Market grew significantly, driven by device-centric adoption. During this period, the competitive landscape was dominated by consumer device manufacturers controlling nearly 70-75% of revenue, with leaders such as FOREO, Neutrogena, and L'Oréal focusing on AI-enhanced cleansing and diagnostic solutions for the home skincare segment.

Competitive differentiation relied on real-time sensing, customization algorithms, and app integration, while software was commonly offered as a value-added companion tool rather than a standalone revenue generator. Service-based personalization models had minimal traction, contributing less than 10% of total market value. Demand for smart skincare will expand to USD 23.8 billion in 2025, and the revenue mix will shift as software and service-based models grow to over 30% share.

Traditional device leaders face rising competition from digital-first brands offering AI-based skin evaluations, cloud-integrated skincare planning, and precision ingredient dispensing. Major device vendors are pivoting toward hybrid ecosystems that integrate skin analysis, live consultation interfaces, and smart home synchronization. Emerging entrants specializing in app-driven personalization, virtual skin coaches, and AR/VR-assisted regimens are gaining share. The competitive advantage is shifting from device innovation alone to the strength of personalization engines, subscription value, and end-to-end digital engagement platforms.

Advancements in skincare device technology have significantly improved the precision and personalization of home-based beauty routines, enabling real-time skin analysis and targeted product application. Smart facial cleansing devices have gained traction due to their affordability, convenience, and ability to deliver consistent cleansing, exfoliation, and stimulation tailored to individual skin types. The rise of AI-powered diagnostic systems has enhanced the accuracy of skin condition detection, supporting more informed skincare decisions. The growing integration of IoT and sensor-based systemssuch as hydration trackers, UV monitors, and pH analyzershas enabled continuous, app-synced skin health monitoring.

This has expanded the relevance of smart skincare across diverse consumer groups, including those concerned with aging, acne, sensitivity, and hyperpigmentation. The increasing availability of mobile-connected tools and cloud-based platforms is also fueling demand for personalized routines, remote skincare consultations, and automated formulation dispensers. Segment growth is expected to be led by AI and IoT-based technologies, smart cleansing tools in the product type category, and diagnostic software platforms due to their scalability, user engagement capabilities, and interoperability with broader digital wellness ecosystems.

The market is segmented by product type, technology, application, distribution channel, consumer demographics, end user, and region. Product types include smart facial cleansing devices, smart LED therapy masks, AI-powered skin analyzers, smart mirrors with skin diagnostics, connected skincare dispensers, wearable skincare monitors, smart exfoliators and massagers, app-based skin analysis tools, and customized skincare capsules or dispensers. Technology segmentation includes AI and machine learning technologies, IoT and sensor-based systems, AR/VR and imaging technologies, and cloud and data analytics platforms.

Application areas cover anti-aging and wrinkle reduction, acne and blemish treatment, daily cleansing and maintenance, hydration and moisture monitoring, brightening and skin tone correction, UV monitoring and sun damage prevention, texture, pores and elasticity care, and sensitivity and skin reaction assessment. Distribution channels are categorized into online retailincluding e-commerce platforms and brand websitesand offline retail, which includes specialty beauty stores, pharmacies and drugstores, department stores, and dermatology clinics and aesthetic spas.

| Product Segment | Market Value Share, 2025 |

|---|---|

| Smart Facial Cleansing Devices | 36.9% |

| Others | 63.1% |

The Smart Facial Cleansing Devices segment is projected to contribute 36.9% of the Smart Skincare Market revenue in 2025, maintaining its position as the dominant product category. This leadership is driven by increasing consumer preference for app-connected cleansing tools that offer real-time feedback, enhanced hygiene, and tailored routines for different skin types. These devices appeal to a wide demographic due to their affordability, portability, and proven results in daily cleansing and exfoliation. Continuous upgrades in vibration technology, silicone brush design, and app-based performance tracking are enhancing user engagement and satisfaction.

As the demand for personalized skincare regimens grows, smart cleansing devices are increasingly bundled with diagnostic features and integrated with AI platforms. The segment’s expansion is further supported by DTC channel penetration and influencer-driven brand engagement. Smart facial cleansing devices are expected to remain the cornerstone of product-based revenue in the smart skincare ecosystem through 2035.

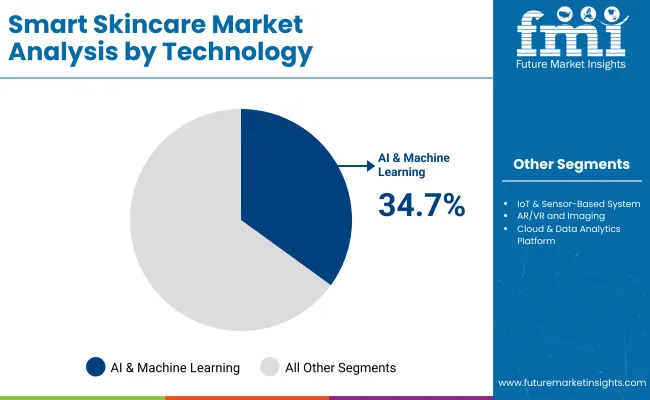

| Technology Segment | Market Value Share, 2025 |

|---|---|

| AI & Machine Learning Technologies | 34.7% |

| Others | 65.3% |

The AI & Machine Learning Technologiessegment is projected to contribute 34.7% of the global smart skincare market revenue in 2025, establishing itself as the leading technology category. This dominance is driven by the rapid adoption of AI-enabled skin analyzers, personalized diagnostics, and algorithm-driven product recommendations. AI technologies empower brands to offer data-backed skincare solutions tailored to an individual’s skin type, condition, and external environment.

These platforms are widely integrated into apps, smart mirrors, and virtual consultationsenhancing user trust and engagement. The segment’s growth is further accelerated by improvements in computer vision, real-time feedback loops, and continuous learning models. As AI integration becomes essential for competitive personalization, this technology is expected to remain the innovation hub of the smart skincare ecosystem.

| Application Segment | Market Value Share, 2025 |

|---|---|

| Daily Cleansing & Maintenance | 26.3% |

| Others | 73.7% |

The Daily Cleansing & Maintenance segment is projected to account for 26.3% of the global smart skincare market value in 2025, marking it as the top application area. This is primarily driven by the consistent, high-frequency use of smart facial cleansing devices and routines designed for everyday skin hygiene. Consumers prioritize cleansing as the foundation of skincare, and smart tools that enhance this step with real-time feedback, sensor-based adjustments, and customizable regimens have witnessed high adoption rates.

Daily maintenance routines benefit from mass appeal, especially across younger demographics and first-time tech beauty users. As smart cleansing solutions become more accessible via e-commerce and influencer-backed brands, this segment is expected to maintain its leadership in usage frequency and revenue contribution.

Drivers

Integration of AI & Machine Learning in Device Ecosystems

With AI & Machine Learning capturing 34.7% of the technology segment share in 2025, the market is moving away from static, one-size-fits-all device functionalities toward adaptive skincare systems. These solutions use real-time data from embedded sensors to analyze hydration, oil levels, and pigmentation changes, then refine skincare routines automatically.

The predictive capability of these algorithms such as identifying early signs of wrinkles or UV damage fosters recurring revenue streams via subscription upgrades, cloud storage for skin health history, and AI-powered consultations. This is particularly influential in markets like the USA and Japan, where mature consumers seek measurable and trackable skincare outcomes.

Rise of Premiumization in Daily Cleansing & Maintenance Segment

Holding 26.3% market share in 2025, the Daily Cleansing & Maintenance category is shifting from basic electronic cleansing brushes to multi-functional, sensor-equipped devices. These premium tools offer real-time feedback on skin conditions while delivering visible improvements, catering to consumers’ desire for both convenience and efficacy.

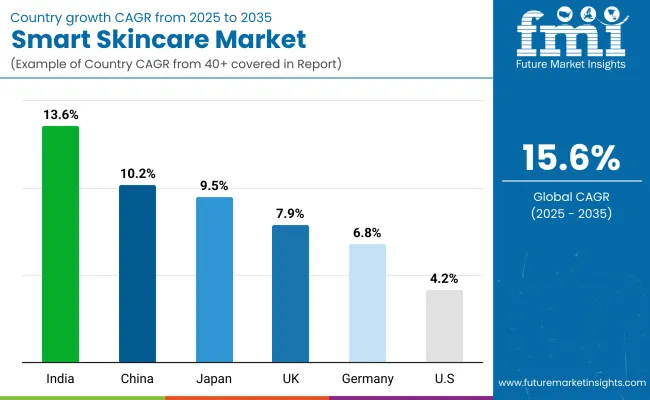

High-end devices with IoT connectivity enable sync with skincare apps, personalized product recommendations, and integration into wider beauty ecosystems. This “premium performance” positioning justifies higher price points and drives repeat purchases, especially in Asia-Pacific where aspirational beauty spending is rising alongside CAGR growth in India (13.6%) and China (10.2%).

Restraints

Device-Sensor Calibration Challenges in Diverse Climates

Emerging high-growth markets such as India and China present unique climatic and environmental conditions humidity swings, heat variations, and high particulate pollution that can reduce the accuracy of optical and bio-impedance sensors in smart skincare devices. Miscalibrated sensors may misinterpret hydration levels or skin barrier conditions, leading to inaccurate recommendations and potential consumer distrust. Brands face increased R&D costs for region-specific calibration and testing, which can slow product rollouts in these lucrative but technically challenging markets.

High Replacement Costs for Hybrid Device-Software Models

As market leaders pivot toward subscription-linked devices and cloud-based personalization services, consumers often face steep replacement costs when hardware becomes obsolete or incompatible with newer software updates. In emerging markets, where affordability remains a key factor, these high upgrade costs can curb adoption rates despite the overall market CAGR of 15.6%. Without modular, upgradable designs, brands risk losing price-sensitive consumers to lower-cost, semi-smart alternatives that sacrifice sophistication for affordability.

Key Trends

Shift from Device-Led to Software-First Revenue Models

The initial market surge was driven by hardware sales, particularly cleansing devices, but the revenue balance is tilting toward software-driven personalization projected to exceed 30% of market value share by 2035. Brands are leveraging AI-skin analysis apps, AR/VR try-on tools, and cloud-linked skin progress tracking to lock users into long-term ecosystems. This transition aligns with recurring revenue models and strengthens brand-consumer engagement, reducing churn compared to one-time device sales.

Localized Skin Diagnostics for Market Penetration in Asia-Pacific

In high-growth regions such as India and China, brands are building localized AI skin models that factor in melanin levels, common regional skin concerns (e.g., pigmentation, pollution-related dryness), and climate-specific hydration needs. These models improve diagnostic accuracy compared to Western-trained algorithms, boosting user satisfaction and trust. This localization strategy not only enhances market penetration in Asia-Pacific but also supports the region’s role as a key growth driver, with India’s 13.6% CAGR and China’s 10.2% CAGR far outpacing global averages.

| Countries | CAGR (2025 to 2035) |

|---|---|

| China | 10.2% |

| India | 13.6% |

| Germany | 6.8% |

| USA | 4.2% |

| UK | 7.9% |

| Japan | 9.5% |

The global Smart Skincare Market exhibits a distinct regional divergence in growth momentum, shaped by digital consumer behavior, wellness tech penetration, and investment in AI-powered personal care ecosystems. Asia-Pacific remains the fastest-growing region, led by India at 13.6% CAGR and China at 10.2% CAGR. China’s strong trajectory is driven by its booming D2C beauty-tech ecosystem, high smartphone penetration, and aggressive rollout of AI-integrated skincare tools across tier-1 and tier-2 cities.

State-supported innovation clusters in digital health and beauty technology, particularly in Shanghai and Shenzhen, have catalyzed domestic manufacturing and R&D in smart skincare devices. India’s expansion reflects steady adoption among Gen Z and millennial consumers, rising disposable incomes, and the growth of local brands offering affordable smart facial tools and app-based skincare platforms. Startups and mobile-first brands are leveraging influencer-driven commerce and vernacular content integration, accelerating market penetration beyond urban centers.

Europe maintains a stable yet high-value growth profile, with Germany growing at 6.8% CAGR and the UK at 7.9% CAGR, supported by mature consumer wellness markets, a regulatory focus on skin health products, and consistent innovation from heritage beauty brands. Germany’s strength lies in its dermo-cosmetic innovation hubs, while the UK benefits from a vibrant beauty-tech startup scene and strong digital adoption of AI-led skincare regimens.

North America continues to expand steadily, with the USA expected to grow at 4.2% CAGR, reflecting a blend of device maturity, personalized skincare demand, and integrated service ecosystems. The USA remains a hub for innovation in AI diagnostics, AR-assisted consultations, and subscription-based smart skincare kits, with growth increasingly driven by software engagement and service models over pure hardware sales. Japan, at 9.5% CAGR, reflects a balance between premium market maturity and conservative innovation cycles.

While the market is dominated by large players such as Shiseido and Panasonic, Japan’s adoption curve is increasingly shaped by personalized wellness trends, aging population needs, and emerging demand for smart patches and non-invasive skin analyzers.

| Year | USA Smart Skincare Market (USD Million) |

|---|---|

| 2025 | 5569.43 |

| 2026 | 6381.44 |

| 2027 | 7311.82 |

| 2028 | 8377.86 |

| 2029 | 9599.32 |

| 2030 | 10998.86 |

| 2031 | 12602.45 |

| 2032 | 14439.83 |

| 2033 | 16545.10 |

| 2034 | 18957.31 |

| 2035 | 21721.21 |

The Smart Skincare Market in the United States is projected to grow at a 4.2% CAGR, maintaining the highest global market share at 23.4% in 2025 and 21.4% in 2035. The market is evolving from product-only purchases to hybrid ecosystems that integrate diagnostics, personalization, and device-linked skincare routines.

The Smart Skincare Market in the United Kingdom is projected to grow at a 7.9% CAGR, with market share rising from 8.7% in 2025 to 9.2% in 2035. British brands are leveraging diagnostic skin tech to drive DTC subscription adoption and refill-based product models.

India’s Smart Skincare Market is forecast to grow at a 13.6% CAGR, with global market share increasing from 4.9% in 2025 to 5.7% in 2035. Smart facial cleansers and LED therapy tools are gaining traction in Tier II & III cities.

| Countries | 2025 |

|---|---|

| China | 13.4% |

| India | 4.9% |

| Germany | 13.4% |

| USA | 23.4% |

| UK | 8.7% |

| Japan | 7.4% |

| Countries | 2035 |

|---|---|

| China | 11.9% |

| India | 5.7% |

| Germany | 12.9% |

| USA | 21.4% |

| UK | 9.2% |

| Japan | 8.1% |

China is expected to grow at a 10.2% CAGR, with market share declining slightly from 13.4% in 2025 to 11.9% in 2035 as competition from emerging markets intensifies. Smart facial cleansing devices and diagnostic mirrors lead in 2025 value contribution.

| Product Segment | Market Value Share, 2025 |

|---|---|

| Smart Facial Cleansing Devices | 36.1% |

| Others | 63.9% |

The USA Smart Skincare Market is valued at USD 5,569.43 million in 2025, with Smart Facial Cleansing Devices leading at 36.1%. This leadership reflects strong consumer trust in connected cleansing devices, driven by advanced sensor integration, waterproof designs, and compatibility with app-based skin diagnostics. The preference for these devices is reinforced by USA consumers’ willingness to invest in premium, results-driven skincare tools that combine convenience and personalization.

The “Others” segmentcomprising LED therapy tools, AI-enabled skin analyzers, and connected masksremains dominant in overall value due to growing adoption in at-home spa treatments and tele-dermatology service bundles. As AI-powered skincare analytics mature, hybrid ecosystems that combine devices with subscription-based skincare regimens are expected to expand. Retail growth is supported by omnichannel strategies, with brands leveraging both specialty beauty retail and direct-to-consumer (DTC) e-commerce platforms.

| Application Segment | Market Value Share, 2025 |

|---|---|

| Anti-Aging & Wrinkle Reduction | 46.7% |

| Others | 53.3% |

The China Smart Skincare Market is valued at USD 3,189.33 million in 2025, with Anti-Aging & Wrinkle Reduction application leading at 46.7%. This dominance is tied to China’s aging population dynamics, the rising popularity of preventative skincare among younger demographics, and the cultural emphasis on maintaining youthful skin. Local beauty-tech firms are rapidly scaling AI-powered diagnostic mirrors, IoT-enabled facial massagers, and customizable anti-aging regimens, making these technologies accessible to a mass-market audience.

The “Others” segment, which includes acne care, skin tone correction, and hydration optimization, remains critical for younger consumer groups, particularly in urban centers. Mass adoption is accelerated by D2C platforms, influencer-led product launches, and government-backed innovation hubs in Shanghai, Shenzhen, and Hangzhou. As e-commerce platforms integrate live shopping with AI skincare consultations, China’s smart skincare penetration is set to outpace many mature markets.

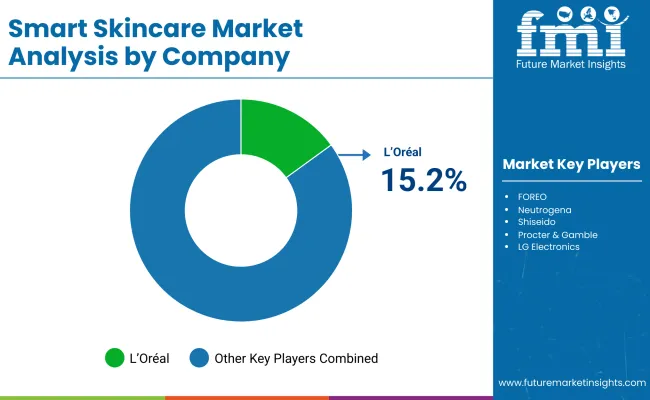

The Smart Skincare Market is moderately fragmented, with a blend of global cosmetics giants, AI-driven startups, and sensor hardware specialists competing across interconnected application areas. Dominant multinational beauty brands such as L’Oréal, FOREO, and Neutrogena hold a significant portion of market value through integrated offerings that combine smart hardware, AI analytics, and personalized product delivery. Their leadership is backed by strong omnichannel presence, dermatological credibility, and continuous investment in wearable skincare and app-based diagnostics.

L’Oréal leads the market with its 15.2% share, driven by solutions like Perso and Skin Genius, offering real-time personalized formulation and smartphone-based AI diagnostics. Its acquisition of ModiFace has further strengthened its AR/AI capabilities across digital retail and virtual skincare consultations. Mid-sized players such as Shiseido, Amorepacific, and Beiersdorf are innovating in localized personalization, sensor-driven devices, and skin data platforms for Asian and European consumers.

These firms focus on leveraging regional skin profiles and dermatology-backed R&D to strengthen loyalty in key geographies. Tech-driven solution providers like HiMirror, Revieve, and Perfect Corp. are building cloud-based diagnostics, mobile scanning, and virtual try-on ecosystems. While not traditional beauty manufacturers, their AI-as-a-service models make them valuable collaborators or challengers depending on the retail channel.

Competitive differentiation is rapidly moving away from standalone hardware specifications toward end-to-end platforms that combine smart diagnostics, cloud analytics, and customized skincare delivery. Players with control over both consumer data and product customization pipelines are expected to retain a long-term strategic edge.

Key Developments in Global Smart Skincare Market

| Item | Value |

|---|---|

| Quantitative Units | USD 23.8 Billion |

| Product Type | Smart Facial Cleansing Devices, Smart LED Therapy Masks, AI-Powered Skin Analyzers, Smart Mirrors with Skin Diagnostics, Connected Skincare Dispensers, Wearable Skincare Monitors, Smart Exfoliators & Massagers, App-Based Skin Analysis Tools, Customized Skincare Capsules/Dispensers |

| Application | Daily Cleansing & Maintenance, Anti-Aging & Wrinkle Reduction, Acne & Blemish Treatment, Hydration & Moisture Monitoring, Skin Tone Correction, UV Monitoring, Texture & Elasticity, Sensitivity & Skin Reaction Assessment |

| Technology | AI & Machine Learning, IoT & Sensor-Based Systems, AR/VR and Imaging Technologies, Cloud & Data Analytics Platforms |

| Distribution Channel | Online Retail (E-commerce Platforms, Brand Websites), Offline Retail (Specialty Beauty Stores, Pharmacies, Department Stores, Dermatology Clinics & Aesthetic Spas) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | L'Oréal, FOREO, Neutrogena, Shiseido, Procter & Gamble, LG Electronics, Panasonic, Revieve, HiMirror, La Roche- Posay, Lululab, Skin Inc, Opte, Perfect Corp, MiLi |

| Additional Attributes | Dollar sales by product type, technology, and application; rapid growth in AI diagnostics and wearable skincare tools; market transition toward hybrid device-software ecosystems; expansion of subscription-based skincare models; regional tech adoption differences; investment in personalization engines; integration of AR/VR in virtual skin consultations; SaaS-based skin analysis platforms gaining momentum. |

The global Smart Skincare Market is estimated to be valued at USD 23.8 billion in 2025.

The market size for the Smart Skincare Market is projected to reach USD 101.5 billion by 2035.

The Smart Skincare Market is expected to grow at a 15.6% CAGR between 2025 and 2035.

The key product types in the Smart Skincare Market include Smart Facial Cleansing Devices, Smart LED Therapy Masks, AI-Powered Skin Analyzers, Smart Mirrors, Connected Skincare Dispensers, Wearable Skincare Monitors, and App-Based Analysis Tools.

In terms of product type, Smart Facial Cleansing Devices are expected to lead with a 36.9% share of the Smart Skincare Market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA