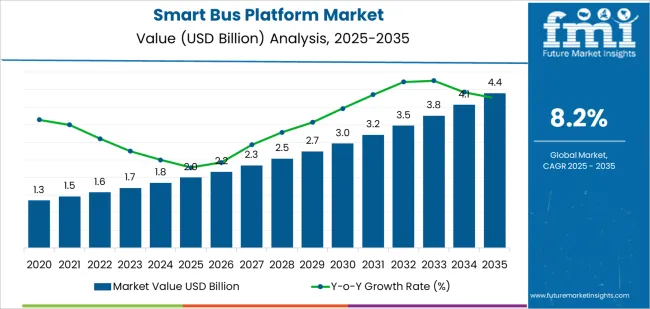

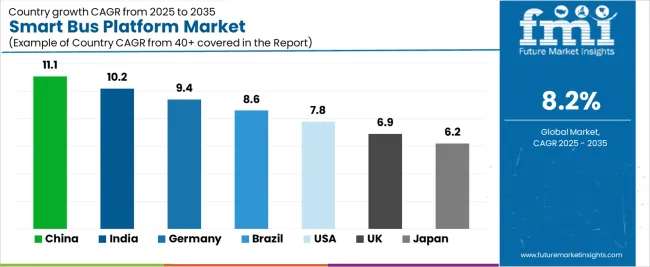

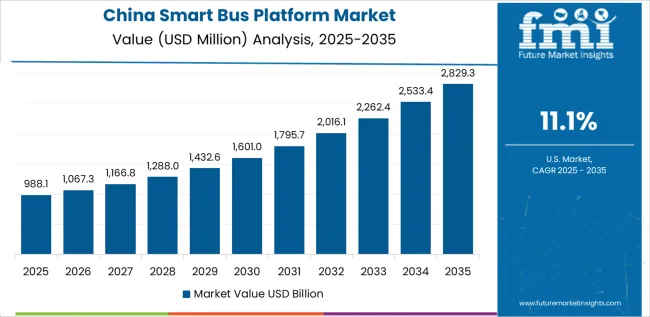

The global smart bus platform market is forecast to grow from USD 1.99 billion in 2025 to approximately USD 4.4 billion by 2035, recording an absolute increase of USD 2.4 billion over the forecast period. This represents a total growth of 119.9%, with the market expected to expand at a CAGR of 8.2% between 2025 and 2035. China leads at 11.1% CAGR, followed by India at 10.2%, and Germany at 9.4%, while Brazil grows at 8.6%, the United States at 7.8%, the United Kingdom at 6.9%, and Japan at 6.2%. These growth rates translate into a premium of +2.9% for China, +2.0% for India, and +1.2% for Germany compared with the global baseline, indicating faster modernization cycles in Asia.

China’s large-scale smart city and 5G deployments have positioned it as the technology anchor for connected transit systems. India’s rapid urban infrastructure expansion and cost-efficient fleet digitization continue to attract government funding and private system integrators. Germany’s progress is being shaped by multimodal transport integration and data protection compliance, which sustain platform sophistication and interoperability standards. Mature markets such as the United States and United Kingdom exhibit more measured growth due to established transit infrastructure and longer procurement cycles, focusing on operational upgrades and cybersecurity assurance. Brazil benefits from transit modernization and contactless fare integration, while Japan emphasizes precision, certification, and reliability, maintaining high technical thresholds. Across all regions, the adoption of 5G-MEC architecture, predictive maintenance analytics, and real-time passenger systems defines the competitive landscape. Vendors demonstrating interoperability, localized support, and AI-driven optimization are expected to capture the next phase of platform consolidation and service-based revenue expansion by 2035.

Regulatory mandates for vehicle tracking, passenger safety monitoring, and emissions reporting are creating sustained demand for comprehensive platform solutions that consolidate multiple functions into unified systems. The market is characterized by the convergence of communication technologies, data analytics, and cloud infrastructure, with platform providers developing modular architectures that support scalability and interoperability across diverse fleet configurations and operational requirements.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 2.0 billion |

| Market Forecast Value (2035) | USD 4.4 billion |

| Forecast CAGR (2025 to 2035) | 8.2% |

| URBANIZATION & TRANSIT MODERNIZATION | TECHNOLOGY INFRASTRUCTURE ADVANCEMENT | REGULATORY & OPERATIONAL REQUIREMENTS |

|---|---|---|

|

|

|

| Category | Segments Covered |

|---|---|

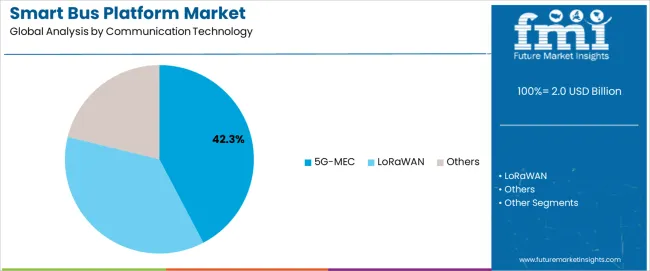

| By Communication Technology | 5G-MEC, LoRaWAN, Others |

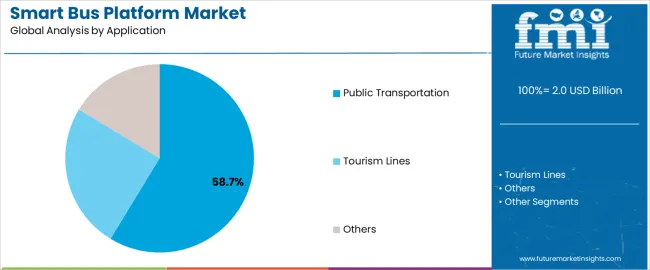

| By Application | Public Transportation, Tourism Lines, Others |

| By Region | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Segment | 2025 to 2035 Outlook |

|---|---|

| 5G-MEC |

|

| LoRaWAN |

|

| Others |

|

| Segment | 2025 to 2035 Outlook |

|---|---|

| Public Transportation |

|

| Tourism Lines |

|

| Others |

|

| DRIVERS | RESTRAINTS | KEY TRENDS |

|---|---|---|

|

|

|

| Region | Market Value 2025 (USD Million) | Market Value 2035 (USD Million) | CAGR (2025 to 2035) |

|---|---|---|---|

| China | 728.6 | 1,448.4 | 11.1% |

| India | 58.9 | 91.3 | 10.2% |

| Germany | 1,338.7 | 2,720.9 | 9.4% |

| Brazil | 1,567.2 | 3,446.7 | 8.6% |

| United States | 1,695.7 | 3,729.3 | 7.8% |

| United Kingdom | 1,834.8 | 4,035.1 | 6.9% |

| Japan | 2,148.0 | 4,366.0 | 6.2% |

Revenue from smart bus platforms in China is projected to grow at 11.1% CAGR by 2035, driven by extensive smart city development programs and comprehensive public transportation modernization initiatives. The country’s established manufacturing capabilities and expanding 5G infrastructure are creating significant demand for integrated platform solutions that support real-time monitoring, passenger information systems, and operational optimization. Major technology companies and transportation authorities are implementing comprehensive smart platform deployments to support large-scale operations and meet growing demand for efficient transit solutions.

Revenue from smart bus platforms in India is expanding at a CAGR of 10.2%, supported by rapid urbanization and government initiatives for public transportation development, creating sustained demand for cost-effective platform solutions across metropolitan transit systems and state transportation corporations. The country’s large urban population and growing middle class are driving investments in public transit infrastructure, with smart platforms viewed as essential for managing fleet expansion and improving service reliability.

Demand for smart bus platforms in Germany is projected to grow at a 9.4% CAGR by 2035, supported by the country’s leadership in automotive technology and advanced public transportation systems requiring sophisticated platform solutions for operational excellence and passenger experience enhancement. German transit operators are implementing high-specification platforms that support integration with multimodal transportation networks, real-time journey planning, and seamless ticketing across operators.

Revenue from smart bus platforms in Brazil is projected to grow at an 8.6% CAGR by 2035, driven by urban transportation modernization programs and increasing adoption of intelligent fleet management systems across metropolitan regions. The country’s extensive bus rapid transit networks and large transit operators are creating demand for platforms that support high-frequency operations, real-time passenger information, and integration with fare collection systems.

Revenue from smart bus platforms in the United States is projected to grow at 7.8% CAGR by 2035, supported by transit agency modernization initiatives and federal funding programs for intelligent transportation systems. The country’s mature transit market and emphasis on operational efficiency are driving adoption of comprehensive platform solutions that integrate fleet management, passenger information, maintenance scheduling, and performance analytics.

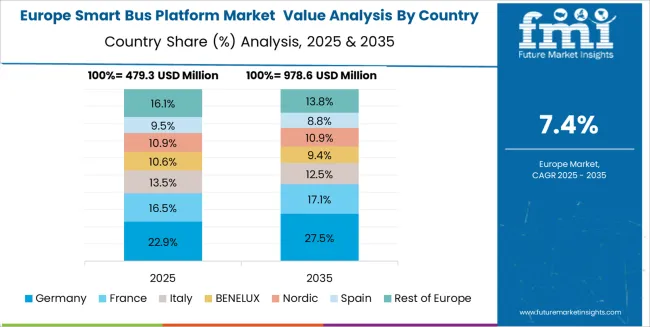

The smart bus platform market in Europe is projected to grow from USD 1,334.7 million in 2025 to USD 2,944.2 million by 2035, registering a CAGR of 8.2% over the forecast period. Germany is expected to maintain its leadership position with a 28.4% market share in 2025, projected to reach 29.1% by 2035, supported by its advanced public transportation infrastructure and comprehensive smart city initiatives across major metropolitan regions including Berlin, Hamburg, and Munich. France follows with a 22.6% share in 2025, anticipated to expand to 23.3% by 2035, driven by transit modernization programs in Paris, Lyon, and other urban centers.

The United Kingdom holds a 19.8% share in 2025, expected to stabilize at 19.5% by 2035 despite post-Brexit adjustments, with continued investments in London and regional bus networks. Italy commands a 14.7% share, while Spain accounts for 11.2% in 2025. The Rest of Europe region is projected to maintain its collective share at approximately 3.3% through 2035, with Nordic countries and Eastern European cities implementing smart platform solutions as part of broader transportation digitalization programs.

Japanese smart bus platform operations reflect the country's emphasis on operational precision and advanced technology integration. Major transit operators including Tokyo Metropolitan Bureau of Transportation and regional bus companies maintain rigorous platform specifications that often exceed international standards, requiring comprehensive testing protocols, extensive documentation, and facility certifications that can extend implementation timelines to 18-24 months.

This creates high barriers for platform vendors but ensures system reliability that supports Japan's reputation for transportation excellence. The Japanese market demonstrates unique requirements for platform integration with existing transportation infrastructure, including seamless coordination with rail networks, automated fare collection systems, and real-time passenger information displays at bus stops. Platform providers must support specific data formats and communication protocols mandated by the Ministry of Land, Infrastructure, Transport and Tourism.

Regulatory oversight emphasizes comprehensive safety management and disaster preparedness capabilities, requiring platforms to support emergency communication protocols, evacuation coordination features, and integration with national alert systems. The focus on passenger experience drives demand for features including precise arrival predictions, detailed service information, and multilingual support for international visitors. Transit operators typically maintain long-term relationships with technology vendors, with contract renewals emphasizing system stability and incremental capability enhancement over disruptive technology transitions.

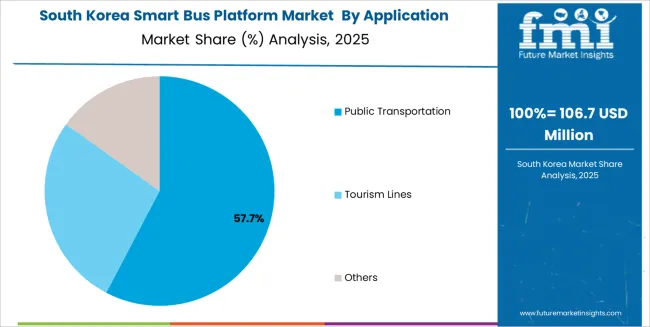

South Korean smart bus platform operations reflect the country's advanced technology sector and government-led smart city initiatives. Major metropolitan areas including Seoul, Busan, and Incheon have implemented comprehensive intelligent transportation systems where smart bus platforms serve as integrated components of broader traffic management and public service delivery networks. Transit authorities maintain sophisticated procurement requirements emphasizing platform capabilities for real-time data integration, analytics-driven operational optimization, and passenger service enhancement.

The Korean market demonstrates particular strength in implementing cutting-edge communication technologies, with early adoption of 5G-enabled platforms supporting advanced applications including HD video surveillance, real-time crowding information, and dynamic route optimization based on traffic conditions.

Regulatory frameworks emphasize data integration and interoperability, with Ministry of Land, Infrastructure and Transport standards requiring platforms to support standardized data exchanges with national transportation information systems. This creates advantages for vendors with experience navigating Korean regulatory requirements and technical specifications.

Transit operators increasingly pursue integrated procurement approaches, seeking vendors who can provide comprehensive solutions spanning hardware, software, communication infrastructure, and ongoing technical support. The market faces ongoing evolution as autonomous vehicle trials expand, with platform providers expected to demonstrate roadmaps for supporting future autonomous bus operations while maintaining compatibility with conventional fleets during transition periods.

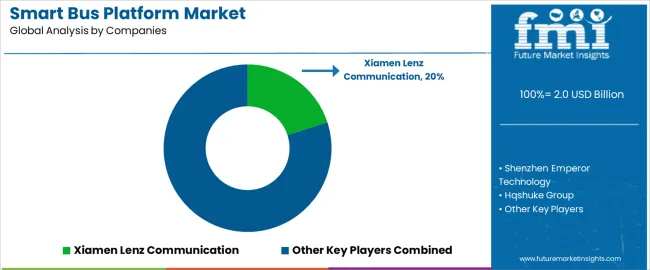

The smart bus platform market demonstrates consolidation patterns around integrated technology providers and specialized platform vendors. Profit concentration occurs in comprehensive solution delivery where vendors combine hardware, software, communication infrastructure, and ongoing support services into unified offerings.

Value migration favors vendors with proven deployment experience, established operator relationships, and capabilities for customization to meet specific regulatory and operational requirements. Several competitive archetypes shape market dynamics: established transportation technology providers leveraging existing fleet management portfolios and operator relationships; pure-play platform specialists focusing on software innovation and cloud-based architectures; communication infrastructure vendors extending into application layers; and regional integrators with localized expertise and government procurement access.

Switching costs remain significant, with platform replacements requiring vehicle hardware updates, driver training, control center reconfigurations, and operational process adjustments that stabilize incumbent positions. However, technology evolution and feature gaps create opportunities for new entrants offering superior passenger experience capabilities, advanced analytics, or specialized functionality for emerging applications including electric vehicle management and autonomous operations preparation.

Market consolidation continues through acquisitions of specialized technology companies by larger transportation and automotive technology firms seeking to expand platform capabilities and geographic reach. Procurement increasingly emphasizes total cost of ownership over initial capital costs, favoring vendors demonstrating operational efficiency gains, maintenance cost reductions, and revenue enhancement through improved service reliability. Digital procurement platforms remain limited, with complex requirements and customization needs maintaining relationship-driven sales processes and multi-year implementation partnerships.

| Items | Values |

|---|---|

| Quantitative Units | USD 2.0 billion |

| Communication Technology | 5G-MEC, LoRaWAN, Others |

| Application | Public Transportation, Tourism Lines, Others |

| Regions Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Countries Covered | China, India, Germany, Brazil, United States, United Kingdom, Japan |

| Key Companies Profiled | Xiamen Lenz Communication, Shenzhen Emperor Technology, Hqshuke Group, Suzhou Huaqi Intelligent Technology, Xiamen GNSS Development, SenseTime, Cloudwalk Technology, Shenyang Xiasun, Zhejiang Hirige, Huawei, Traffipax |

| Additional Attributes | Dollar sales by communication technology and application, regional demand across key markets, competitive landscape, technology adoption patterns, fleet management integration, and IoT infrastructure development driving operational efficiency, passenger experience enhancement, and sustainable urban mobility |

The global smart bus platform market is estimated to be valued at USD 2.0 billion in 2025.

The market size for the smart bus platform market is projected to reach USD 4.4 billion by 2035.

The smart bus platform market is expected to grow at a 8.2% CAGR between 2025 and 2035.

The key product types in smart bus platform market are 5g-mec, lorawan and others.

In terms of application, public transportation segment to command 58.7% share in the smart bus platform market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Smart School Bus Platform Market Size and Share Forecast Outlook 2025 to 2035

Smart Home Wireless Smoke Detector Market Size and Share Forecast Outlook 2025 to 2035

Smart Vision Processing Chips Market Size and Share Forecast Outlook 2025 to 2035

Smart Touch Screen Scale Market Size and Share Forecast Outlook 2025 to 2035

Smart Magnetic Drive Conveyor System Market Size and Share Forecast Outlook 2025 to 2035

Smart Wheelchair market Size and Share Forecast Outlook 2025 to 2035

Smart Mining Technologies Market Size and Share Forecast Outlook 2025 to 2035

Smart Parking Market Size and Share Forecast Outlook 2025 to 2035

Smart Digital Valve Positioner Market Forecast and Outlook 2025 to 2035

Smart Card IC Market Size and Share Forecast Outlook 2025 to 2035

Smart-Tag Inlay Inserters Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Smart TV Market Forecast and Outlook 2025 to 2035

Smart/AI Toy Market Size and Share Forecast Outlook 2025 to 2035

Smart Locks Market Size and Share Forecast Outlook 2025 to 2035

Smart Sprinkler Controller Market Size and Share Forecast Outlook 2025 to 2035

Smart Indoor Gardening System Market Size and Share Forecast Outlook 2025 to 2035

Smart Building Delivery Robot Market Size and Share Forecast Outlook 2025 to 2035

Smart Watch Market Size and Share Forecast Outlook 2025 to 2035

Smart Label Market Size and Share Forecast Outlook 2025 to 2035

Smart Mat Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA