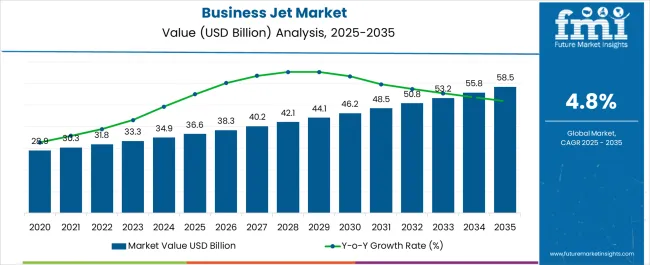

The Business Jet Market is estimated to be valued at USD 36.6 billion in 2025 and is projected to reach USD 58.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4.8% over the forecast period.

| Metric | Value |

|---|---|

| Business Jet Market Estimated Value in (2025 E) | USD 36.6 billion |

| Business Jet Market Forecast Value in (2035 F) | USD 58.5 billion |

| Forecast CAGR (2025 to 2035) | 4.8% |

The Business Jet market is experiencing steady growth, supported by rising demand for efficient and flexible air travel solutions among corporate leaders, entrepreneurs, and high-net-worth individuals. Increasing globalization of businesses, coupled with the need for time-sensitive travel, has positioned business jets as essential for executives seeking to maximize productivity. Advances in aviation technology, including improved fuel efficiency, connectivity features, and cabin comfort, are enhancing customer appeal.

In addition, the integration of digital solutions such as real-time flight planning, in-flight connectivity, and enhanced avionics systems is contributing to operational reliability and convenience. Rising demand from emerging economies, particularly in Asia and the Middle East, is further fueling expansion as regional companies and wealthy individuals increasingly prioritize private aviation.

The COVID-19 pandemic accelerated a shift toward private air travel due to safety and flexibility concerns, and this preference continues to support growth Moreover, fleet modernization programs, sustainable aviation initiatives, and increasing investments in long-range models are reshaping market dynamics, ensuring long-term opportunities for both manufacturers and operators.

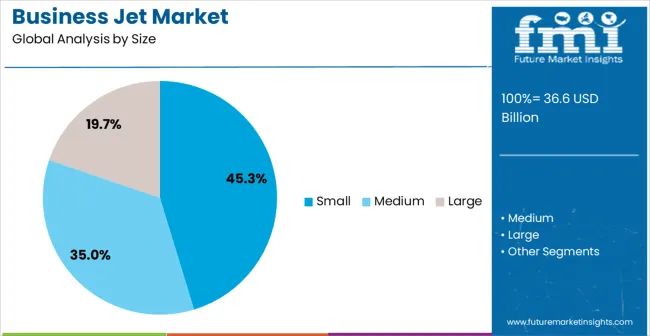

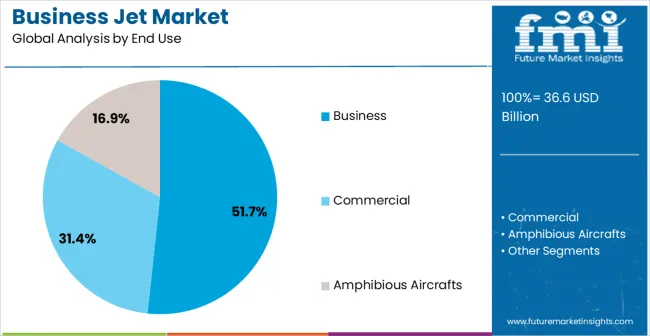

The business jet market is segmented by size, end use, and geographic regions. By size, business jet market is divided into Small, Medium, and Large. In terms of end use, business jet market is classified into Business, Commercial, and Amphibious Aircrafts. Regionally, the business jet industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The small size segment is projected to account for 45.3% of the Business Jet market revenue in 2025, making it the leading category. Growth in this segment is being driven by its affordability, versatility, and suitability for short to mid-range travel, which aligns with the needs of small businesses, entrepreneurs, and regional operators. Small jets are valued for their lower operating costs, easier maintenance, and ability to access smaller airports, providing greater flexibility for time-sensitive travel.

Their relatively lower acquisition cost compared to medium and large jets has expanded accessibility to a broader customer base. In addition, advancements in cabin design, in-flight connectivity, and fuel-efficient engines are increasing operational performance and customer comfort.

Charter operators are also leveraging small jets to expand on-demand travel services, meeting growing demand for personalized and flexible mobility With rising adoption among first-time buyers and businesses seeking efficient regional travel, small size jets are expected to retain their leadership, supported by continuous improvements in performance, efficiency, and customer-focused features.

The business end use segment is anticipated to hold 51.7% of the market revenue in 2025, positioning it as the leading application area. Its dominance is being reinforced by the growing demand for corporate air travel solutions that prioritize efficiency, confidentiality, and productivity. Business jets are widely adopted by multinational companies, financial institutions, and professional service providers that require flexible schedules and direct access to key business hubs.

The ability to conduct meetings, maintain confidentiality, and maximize travel time productivity enhances their appeal in corporate environments. In addition, companies are increasingly using business jets to strengthen relationships with clients and expand into global markets, making them integral to business operations. The continued rise of high-net-worth individuals and executives in emerging economies is further expanding demand.

Enhanced cabin technologies, digital connectivity, and sustainable aviation initiatives are aligning with corporate sustainability goals, further boosting adoption As organizations continue to prioritize efficient, secure, and flexible mobility, the business segment is expected to remain the largest revenue contributor in the Business Jet market.

Business jet is a jet aircraft generally used for private purposes, parcel deliveries, transportation of small group of people by government officers, public bodies and armed forces. Increase of disposable income in developed and developing countries enabled more people to owe their personal jets.

Light and over light jets are expected to dominate the global market over the estimated period. Global jet market forecasts promising growth over the estimated time. Business jets provide the consumer with the facilities of on demand flight scheduling, to conduct business during the flight, reduces travel time, safe and cost effective mode of travel.

Costumers are driven by the value effective schemes offered by the global market players and this is boosting the growth of global business jet market. Globalization of business and trading resulted in the integration of global partner and connected economies and this is estimated to propel the demand of business jet in the global market.

Time saving capability increase the productivity including the tracking of business essentials, optimizing time, faster business track and this increases the overall efficiency profit and revenue growth. Business jet gives decision making power in the consumer hand. Prominent key benefit derived from business jet is improvised organizational efficiency and value of knowledge integration.

Technological advancement has resulted in the introduction of new models in the business jet global market that will provide the consumer with several alternatives and this will trigger the global business jet. Easy financing at low interest rates is further boosting the business jet global market. Market of business jet is mainly divided into two segments that are fractional ownership and branded charter which include air taxi. There is a prominent growth in business jet association and on demand air travel over the estimated period.

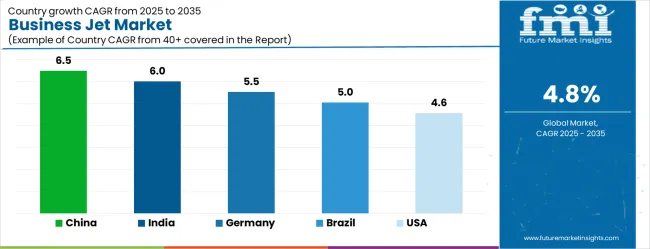

| Country | CAGR |

|---|---|

| China | 6.5% |

| India | 6.0% |

| Germany | 5.5% |

| Brazil | 5.0% |

| USA | 4.6% |

| UK | 4.1% |

| Japan | 3.6% |

The Business Jet Market is expected to register a CAGR of 4.8% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 6.5%, followed by India at 6.0%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Japan posts the lowest CAGR at 3.6%, yet still underscores a broadly positive trajectory for the global Business Jet Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 5.5%. The USA Business Jet Market is estimated to be valued at USD 12.5 billion in 2025 and is anticipated to reach a valuation of USD 12.5 billion by 2035. Sales are projected to rise at a CAGR of 0.0% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 1.8 billion and USD 1.1 billion respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 36.6 Billion |

| Size | Small, Medium, and Large |

| End Use | Business, Commercial, and Amphibious Aircrafts |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

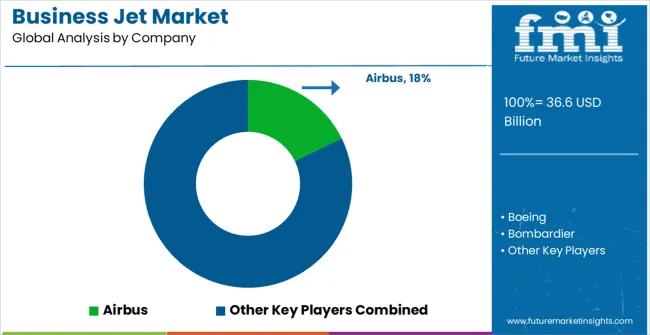

| Key Companies Profiled | Airbus, Boeing, Bombardier, Dassault Aviation, Eclipse Aerospace, Embraer, General Dynamics (Gulfstream Aerospace), Honda Aircraft, Pilatus Aircraft, Piper Aircraft, and Textron |

The global business jet market is estimated to be valued at USD 36.6 billion in 2025.

The market size for the business jet market is projected to reach USD 58.5 billion by 2035.

The business jet market is expected to grow at a 4.8% CAGR between 2025 and 2035.

The key product types in business jet market are small, medium and large.

In terms of end use, business segment to command 51.7% share in the business jet market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Jet Needle-free Injectors Market Size and Share Forecast Outlook 2025 to 2035

Business Storage Units Market Size and Share Forecast Outlook 2025 to 2035

Business as a Service Market Size and Share Forecast Outlook 2025 to 2035

Business Cloud VoIP & UC Services Market Size and Share Forecast Outlook 2025 to 2035

Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Business Process Automation (BPA) Market Size and Share Forecast Outlook 2025 to 2035

Jet Mill Market Size and Share Forecast Outlook 2025 to 2035

Business Analytics BPO Services Market Analysis – Size, Share & Forecast 2025 to 2035

Business Value Dashboard Market Size and Share Forecast Outlook 2025 to 2035

Business Email Market Analysis by Channel, Deployment, and Region Through 2035

Business Process as a Service (BPaaS) Market Analysis by Process and Region Through 2035

Competitive Overview of Business Analytics BPO Services Companies

Business Card Holder Market from 2024 to 2034

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Jetting Pumps Market

Inkjet Printers Market Size and Share Forecast Outlook 2025 to 2035

Inkjet Printer Market in Korea – Growth & Demand Forecast through 2035

Inkjet Coders Market Growth - Trends & Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA