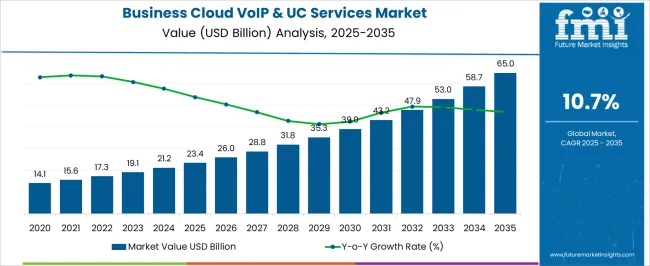

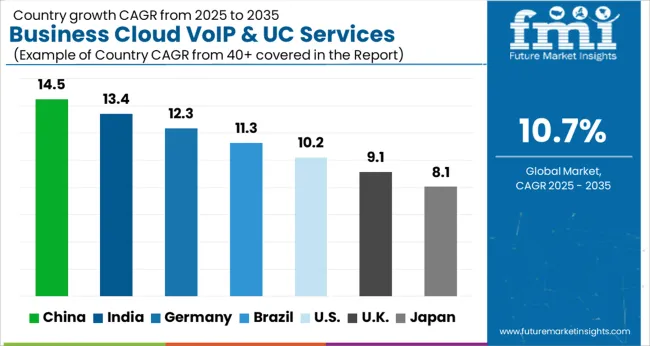

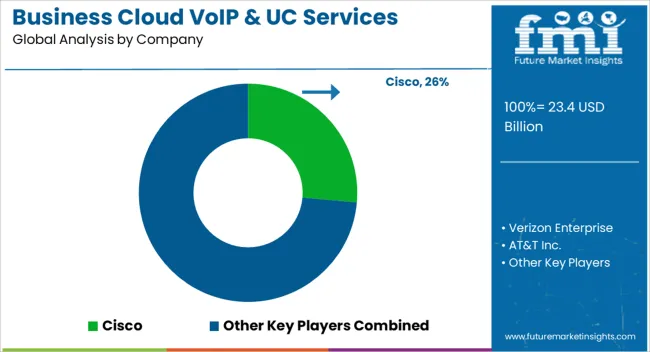

The Business Cloud VoIP & UC Services Market is estimated to be valued at USD 23.4 billion in 2025 and is projected to reach USD 65.0 billion by 2035, registering a compound annual growth rate (CAGR) of 10.7% over the forecast period.

| Metric | Value |

|---|---|

| Business Cloud VoIP & UC Services Market Estimated Value in (2025 E) | USD 23.4 billion |

| Business Cloud VoIP & UC Services Market Forecast Value in (2035 F) | USD 65.0 billion |

| Forecast CAGR (2025 to 2035) | 10.7% |

The Business Cloud VoIP and UC Services market is being driven by the accelerated adoption of cloud-based communication solutions across enterprises seeking cost-efficient and scalable collaboration tools. The current landscape reflects a transition from traditional telephony systems to integrated voice and unified communication platforms that support remote working, hybrid office environments, and global connectivity. Cloud infrastructure investments, increasing internet penetration, and the demand for seamless communication workflows are being seen as key factors shaping market expansion.

The future outlook is expected to be influenced by enhanced service delivery models, API-based integrations, and data-driven communication analytics that allow businesses to optimize performance and reduce operational costs. Small and medium enterprises are actively adopting these solutions to maintain business continuity and improve team collaboration without heavy capital investments.

Additionally, industries such as financial services, healthcare, and retail are increasingly utilizing cloud communication platforms to address customer engagement needs, compliance requirements, and cybersecurity challenges These factors collectively are paving the way for steady growth and sustained demand for cloud-based voice and unified communication services.

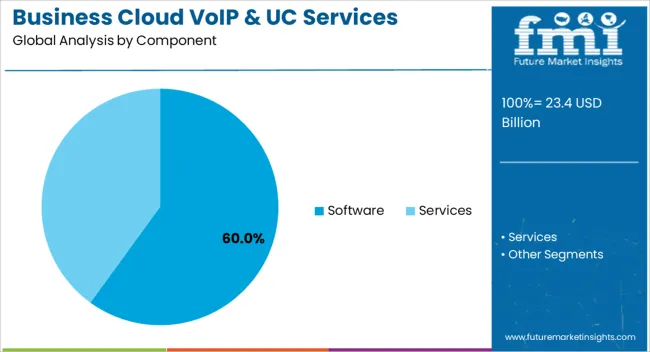

The software component segment is expected to hold 60.00% of the revenue share in the Business Cloud VoIP and UC Services market in 2025, making it the leading contributor. This prominence is being attributed to the demand for scalable, flexible, and easily deployable communication platforms that can be customized according to business requirements. The software offerings are being integrated with artificial intelligence, analytics, and automation tools, enabling organizations to enhance customer service, monitor communication performance, and streamline workflows.

The growing adoption of subscription-based pricing models and cloud-hosted solutions has further supported software’s dominance by offering predictable costs and faster deployment. Software-driven communication tools also allow organizations to integrate across multiple devices and platforms, providing seamless collaboration irrespective of geographical location.

Additionally, enterprises are increasingly prioritizing security, compliance, and data encryption features, all of which are being embedded into software solutions As organizations seek to upgrade legacy systems and invest in future-proof communication infrastructure, the software component segment is positioned to maintain a leading share in the market.

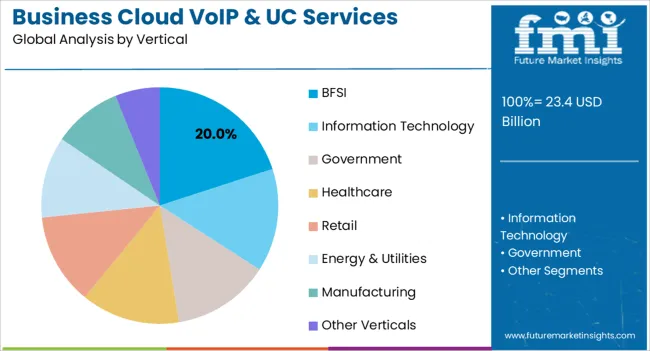

The BFSI vertical is projected to account for 20.00% of the revenue share in the Business Cloud VoIP and UC Services market in 2025, establishing itself as a key industry adopter. This segment’s growth has been supported by the increasing demand for secure, compliant, and efficient communication tools that address regulatory requirements and customer engagement needs.

Financial institutions are adopting cloud communication platforms to enhance customer support, enable remote banking services, and maintain real-time communication across branches and digital channels. The need for secure data exchange, audit trails, and risk management frameworks has accelerated the deployment of unified communication services tailored for finance-related operations.

Furthermore, the adoption of cloud-based voice services is being seen as a way to reduce infrastructure costs and improve scalability as customer interactions shift toward digital platforms The emphasis on customer satisfaction and streamlined workflows has reinforced the adoption of integrated voice and communication solutions within the BFSI sector, which is expected to remain a significant contributor to market growth.

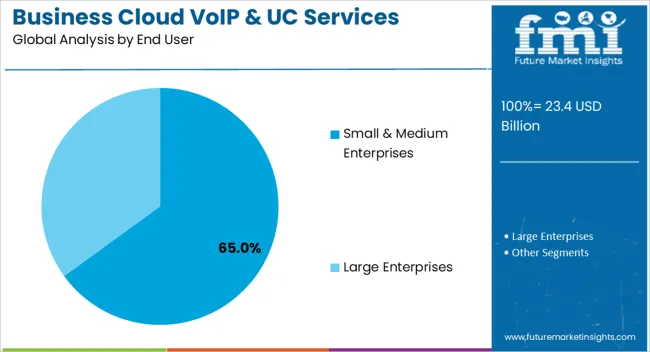

The small and medium enterprises end user segment is expected to hold 65.00% of the market revenue share in 2025, making it the largest user group in the Business Cloud VoIP and UC Services market. This dominance is being driven by the increasing need for cost-effective and easily deployable communication solutions that enable growth without large infrastructure investments. Small and medium enterprises are leveraging cloud-based services to support remote workforces, improve internal collaboration, and enhance customer engagement while maintaining affordability.

Subscription-based pricing models and minimal upfront investments have been seen as key enablers for adoption, allowing businesses to scale as needed without long-term commitments. Additionally, the rise in digital transformation initiatives among SMEs is further fueling the need for cloud communication tools that integrate voice, video, messaging, and collaboration in a single platform.

Enhanced security features, simplified management interfaces, and seamless integrations with existing workflows are making these solutions highly attractive The segment’s preference for agility and flexibility in communication is expected to sustain its leadership as organizations increasingly adopt cloud-driven communication platforms to stay competitive and customer-focused.

SMEs and Large Enterprises to Play a Major Role in Strengthening the Market

SMEs that have employees ranging from 1 to 999 are showing a significant inclination toward business cloud VoIP & UC services. Such business setups move from traditional on-premises communication solutions to modern, user-centric business communications-as-a-service offerings.

As per a survey performed in 2020, 68% of large enterprises and 46% of small enterprises planned to adopt some form of UC in the coming two years. SMEs are looking to streamline expenses and lessen complications wherever possible, as they have budget constraints for dedicated telecommunication and IT service providers.

The business cloud VoIP & UC growth is projected to be strengthened by organizations increasing operations in emerging and frontier markets. Moreover, the need to maintain a presence in developing markets to compete with players, startups and smaller companies are taking initiatives to implement such technologies, which will augment the market size in the coming time.

Increasing Adoption of IoT to Offer Various Opportunities for Expansion

Business VoIP & UC service provides real-time communications to assure the smooth collaboration of people. IoT has a notable impact on the development of UC. IoT can be used to send messages to people with an automated system. These messages are sent through data gathered from real-time activities.

Lately, IoT in a particular healthcare application has gained notable traction. For this purpose, IoT is used in a heart monitor device wherein the nurse or related attendee would be notified of any critical or distressful condition of the heart through an automated medium. The deployment of IoT in a heart monitor can help study the condition of a patient's heart by amassing crucial data and running it through a pre-processed algorithm.

Concerns Associated with Data Security to Hinder the Market Growth

Despite various advantages, the market is expected to suffer in the coming time due to growing concerns regarding data security. Further, interoperability issues with existing assets are another factor that can impact the market negatively in the coming time. However, the increasing popularity of Cloud VoIP and UC services is expected to counter the hampering factors and boost market growth in the coming period.

Increasing Number of Cross-Functional Teams to Encourage Uptake across Large Enterprises

By end user, the large enterprise sector is expected to have accounted for the largest revenue share of 58.2% in 2025. Factors like growing business operations and rising cross-functional teams and remote workers have encouraged corporations to deploy unified communication solutions at the enterprise level to ensure seamless communication practices.

The need to engage in quick meetings and update co-workers about vital strategies has led to the higher acceptance of unified communication solutions. In addition, features like video conferencing, broadcasting and webinars, VoIP calling, and screen & file sharing assist to boost business operations and save time.

Rising SIP Trunk Infrastructure to Boost the Market in North America

As per the analysis, the global business cloud VoIP & UC services market is anticipated to dominate North America during the forecast period. 2025 the region is expected to secure 30.4% of global revenue.

This growth can be attributed to the rising SIP trunk infrastructure and the high priority given to business activities that depend on communications. In North America, UCaaS accounted for 43% of VoIP service revenue in CY21, while SIP trunking and managing IP PBX and UC accounted for 31% and 27%, respectively. This growth is a result of VoIP's many benefits.

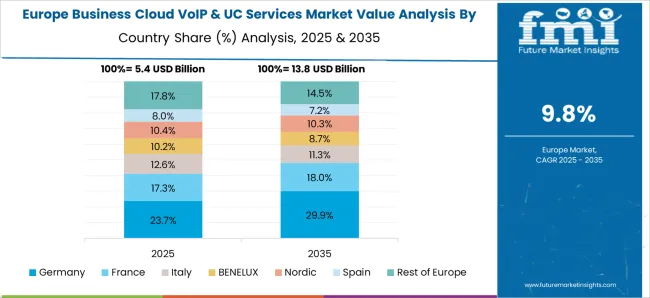

Rapid Globalization across the Region, especially in Germany, to Boost the Regional Market

By 2025, Europe is likely to secure approximately 21.5% of the global market share. Europe is predicted to be the second-largest market during the forecast period. One of the major factors boosting the growth of the Business VoIP & UC services market in Europe is the UCaaS (Unified Communication AS-A-Service) market there.

Further, rapid globalization in Germany has offered various opportunities. In July 2024, it was reported that European distribution sales of Unified Communications (UC) products surged by 76% in Q1 2024, with Germany being a substantial region for industry expansion.

Government Initiatives Taken to Encourage Digital Infrastructure in the Region to Favor the Market

Asia Pacific is anticipated to be the most lucrative market during the forecast period. The growth in this market is driven by the increasing adoption of cloud and mobility trends in developing countries, such as China, Australia and New Zealand, India, and Japan.

Government initiatives to encourage digital infrastructure are also increasing the adoption of UCC solutions in the region. The rapid adoption of UCC solutions in the Asia Pacific has made it highly remunerative and one of the fastest-growing markets globally.

Dialpad (USA), Simpplr (USA), Agora (China), Weave (USA), LogMeIn (USA), Skype (Luxembourg), and Fuze (USA), among others, are some of the new players garnering attention in the market. Players are adopting novel technologies to earn a competitive edge in the market.

Key players in the global business cloud VoIP and UC Services market include Cisco, Verizon Enterprise, AT&T Inc., EarthLink, Inc., XO Communications, LLC, Evolve IP, LLC, Momentum Telecom, West Unified Communications Services Inc., New Horizon Communications, 8x8, Inc., and BroadSoft.

Recent Development in the Industry Include:

| Report Attributes | Details |

|---|---|

| Growth Rate | 10.7% CAGR from 2025 to 2035 |

| Market Value in 2025 | USD 23.4 billion |

| Market Value in 2035 | USD 65.0 billion |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD million for Value |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Component, Vertical, End User, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East & Africa |

| Key Countries Profiled | United States of America, Canada, Mexico, Brazil, Germany, Italy, France, United Kingdom, Spain, China, Japan, South Korea, GCC Countries, South Africa, Israel |

| Key Companies Profiled | Cisco; Verizon Enterprise; AT&T Inc.; Thrive Capital; Kyndryl; Torchsec Technologies LLC; Evolve IP LLC; Momentum Telecom; West Unified Communications Services Inc.; New Horizon Communications; 8x8 Inc.; BroadSoft |

| Customization Scope | Available upon Request |

The global business cloud VoIP & UC services market is estimated to be valued at USD 23.4 billion in 2025.

The market size for the business cloud VoIP & UC services market is projected to reach USD 65.0 billion by 2035.

The business cloud VoIP & UC services market is expected to grow at a 10.7% CAGR between 2025 and 2035.

The key product types in business cloud VoIP & UC services market are software and services.

In terms of vertical, bfsi segment to command 20.0% share in the business cloud VoIP & UC services market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Business Jet Market Size and Share Forecast Outlook 2025 to 2035

Business Storage Units Market Size and Share Forecast Outlook 2025 to 2035

Business as a Service Market Size and Share Forecast Outlook 2025 to 2035

Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Business Process Automation (BPA) Market Size and Share Forecast Outlook 2025 to 2035

Business Value Dashboard Market Size and Share Forecast Outlook 2025 to 2035

Business Email Market Analysis by Channel, Deployment, and Region Through 2035

Business Process as a Service (BPaaS) Market Analysis by Process and Region Through 2035

Business Card Holder Market from 2024 to 2034

Business Analytics BPO Services Market Analysis – Size, Share & Forecast 2025 to 2035

Competitive Overview of Business Analytics BPO Services Companies

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Fixed Business Voice Platforms And Services Market Size and Share Forecast Outlook 2025 to 2035

Cloud Business Email Market Report – Trends & Forecast 2017-2027

Social Business Intelligence Market Growth – Trends & Forecast 2024-2034

Embedded Business Intelligence Market Growth – Trends & Forecast 2023-2033

IBC Rental Business Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA