The Business Analytics BPO Services market is experiencing significant growth as enterprises increasingly outsource data analytics functions to enhance decision-making, optimize operations, and mitigate risks. Organizations are leveraging external expertise to drive business intelligence, predictive analytics, and AI-powered insights. The top 3 vendors Accenture, IBM, and Genpact control 48% of the market, providing advanced analytics capabilities, cloud-based insights, and AI-driven automation tools. The next two largest players, Cognizant and Wipro, collectively hold 22%, focusing on integrated data analytics platforms and industry-specific solutions. Emerging players like EXL Service, TCS, and Capgemini capture 20%, excelling in financial analytics, supply chain optimization, and AI-driven marketing analytics. Niche providers such as Infosys BPM, DXC Technology, and HCL Technologies hold the remaining 10%, addressing specialized needs in customer analytics, fraud detection, and regulatory compliance.

| Category | Industry Share (%) |

|---|---|

| Top 3 (Accenture, IBM, Genpact) | 48% |

| Rest of Top 5 (Cognizant, Wipro) | 22% |

| Emerging Players (EXL Service, TCS, Capgemini) | 20% |

| Niche Providers (Infosys BPM, DXC Technology, HCL Technologies) | 10% |

The Business Analytics BPO Services Market is moderately consolidated, where top players control 40-60% of the market. Companies like Accenture and Genpact dominate, but mid-sized vendors innovate in SMEs landscape.

Data Analytics & Visualization Services hold 30% of the market share, with increasing demand for real-time insights and predictive modeling. Accenture and Genpact have cornered this market due to their advanced visualization tool offerings and AI-driven analytics solutions. Risk Analytics Services make up 20% of the market share, with BFSI and healthcare firms outsourcing risk assessments for fraud detection and regulatory compliance. EXL Service and Wipro provide AI-powered risk models that will help organizations reduce their financial and operational risks. Marketing & Sales Analytics Services account for 15% of the services offered, focus on customer segmentation, personalized marketing, and performance tracking. TCS and Cognizant lead with AI-driven customer insights and automated campaign analytics.

Enterprise size contributes to 70% in large enterprises that are actively investing in AI automation and regulatory compliance. IBM, Accenture, and WNS provide company-wide analytics solutions that boost data processing and decision-making within the companies. SMEs contribute to 30% of market share by adopting cloud-based, cost-efficient analytics solutions. Companies such as EXL, Mu Sigma, and Fractal Analytics help SMEs rationalize operations, enhance forecast precision, and accordingly make better decisions by providing AI-driven platforms.

Cloud Adoption: Organizations are heading towards cloud-based BPO services to avail benefits of agility and flexibility and more cost efficiency advantage. Businesses adapted to cloud analytics solutions that bring operations access in real-time at any possible place without the infrastructure costs of having on-premises. This is making Small and Medium businesses trendsetters in adopting Cloud-based analytics against larger players so that they have insights powered through clouds to conduct their business operation and engage themselves better with their customers.

Industry-specific demand: Companies in the BFSI, healthcare, retail, and telecommunications sectors are outsourcing business analytics to enhance operations. Banks and financial institutions are using analytics BPO services for risk evaluation, fraud detection, and customer segmentation. Medical providers collect analysis of patient data to deliver better care and create efficient hospital management systems. Retailers rely upon outsourced analytics to supply chain, consumer behavior tracking, and personalized marketing efforts.

Regional Growth Trends: Companies of North America lead in the adoption of Business Analytics BPO due to early on integration of technology coupled with a relatively mature outsourcing market. However, businesses in Asia-Pacific are accelerating rapidly in terms of analytics capabilities. India and the Philippines are now added alongside China as a leader in the outsourcing arena along with cost advantages, having an extremely professional workforce and more significant IT capabilities. These regions' governments also support digital transformation initiatives, accelerating the growth of the market further.

Generative AI Impact: Companies are adopting generative AI to enhance productivity in IT and BPO. Analysts perceive that AI automation will have more than 50% efficiency in BPO service within the next five years.

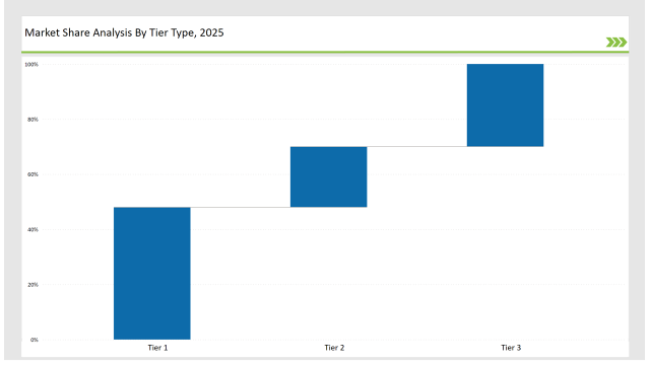

Tier-Wise Company Classification (2025)

| Tier | Tier 1 |

|---|---|

| Vendors | Accenture, IBM, Genpact |

| Consolidated Market Share (%) | 48% |

| Tier | Tier 2 |

|---|---|

| Vendors | Cognizant, Wipro |

| Consolidated Market Share (%) | 22% |

| Tier | Tier 3 |

|---|---|

| Vendors | EXL Service, TCS, Capgemini, Infosys BPM, DXC Technology, HCL Technologies |

| Consolidated Market Share (%) | 30% |

Key Company Initiatives

| Vendor | Key Focus |

|---|---|

| Accenture | Advances AI-driven predictive business intelligence |

| IBM | Strengthens risk analytics and regulatory compliance tools |

| Genpact | Expands fraud detection analytics for BFSI clients |

| Cognizant | Enhances AI-powered marketing and sales analytics |

| Wipro | Develops cloud-based supply chain optimization solutions |

Business analytics BPO vendors must refine AI algorithms, automate supplier risk assessments, and invest in blockchain-enabled transparency to enhance decision intelligence. As competition intensifies, cloud-based business intelligence platforms and industry-specific analytics solutions will define market leadership.

Leading vendors Accenture, IBM, and Genpact hold 48% of the market.

Emerging players EXL Service, TCS, and Capgemini hold 20% of the market.

Niche providers Infosys BPM, DXC Technology, and HCL Technologies hold 10% of the market.

The top 5 vendors (Accenture, IBM, Genpact, Cognizant, and Wipro) control 70% of the market.

Market concentration in 2025 is categorized as medium, with the top 10 players controlling 60-70% of the market.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Business Jet Market Size and Share Forecast Outlook 2025 to 2035

Business Storage Units Market Size and Share Forecast Outlook 2025 to 2035

Business as a Service Market Size and Share Forecast Outlook 2025 to 2035

Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Business Process Automation (BPA) Market Size and Share Forecast Outlook 2025 to 2035

Business Value Dashboard Market Size and Share Forecast Outlook 2025 to 2035

Business Email Market Analysis by Channel, Deployment, and Region Through 2035

Business Process as a Service (BPaaS) Market Analysis by Process and Region Through 2035

Business Card Holder Market from 2024 to 2034

Business Cloud VoIP & UC Services Market Size and Share Forecast Outlook 2025 to 2035

Business Analytics BPO Services Market Analysis – Size, Share & Forecast 2025 to 2035

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Cloud Business Email Market Report – Trends & Forecast 2017-2027

Fixed Business Voice Platforms And Services Market Size and Share Forecast Outlook 2025 to 2035

Social Business Intelligence Market Growth – Trends & Forecast 2024-2034

Embedded Business Intelligence Market Growth – Trends & Forecast 2023-2033

IBC Rental Business Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA