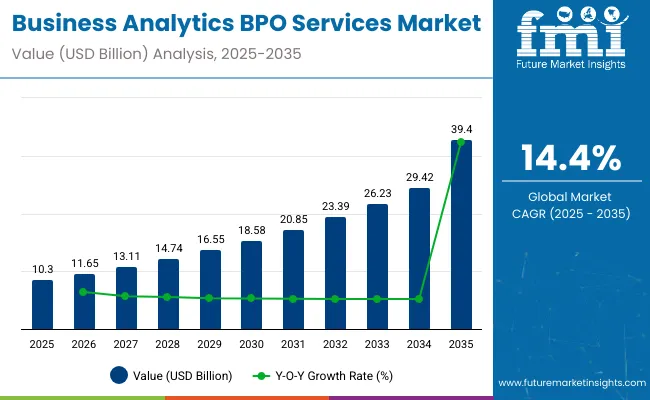

The global business analytics BPO services market is projected to witness remarkable growth over the forecast period, reaching USD 10.3 billion in 2025 and is projected to be valued at USD 39.4 billion by 2035.

This substantial growth reflects a CAGR of 14.4%, underlining the growing importance of outsourced analytics solutions among organizations striving to leverage data-driven decision-making without incurring the high costs of developing in-house capabilities. Business analytics BPO services play a vital role in helping companies analyze vast volumes of data to improve strategic planning, customer engagement, and operational performance.

By outsourcing these services, companies can focus on core competencies while benefiting from the expertise of specialized third-party providers, resulting in optimized business operations and enhanced competitiveness in the market.

The market's upward trajectory is primarily fueled by the increasing need for real-time data interpretation and decision-making across industries such as BFSI, healthcare, retail, telecom, and manufacturing. Organizations worldwide are generating unprecedented volumes of data, and managing this deluge efficiently requires advanced analytics tools that many companies find costly or challenging to maintain internally.

Business analytics BPO service providers offer an economical alternative by delivering services such as predictive analytics, data processing, market intelligence, and risk assessment. Additionally, the growing adoption of cloud-based analytics platforms has made these services more scalable, secure, and accessible to businesses of all sizes, particularly in regions like Asia Pacific and the Middle East, where digital transformation efforts are intensifying.

A key driving factor behind this market’s expansion is the integration of artificial intelligence (AI) and machine learning (ML) technologies into BPO services. These innovations enable advanced pattern recognition, automated reporting, and improved forecasting accuracy, empowering clients with deeper and more actionable insights.

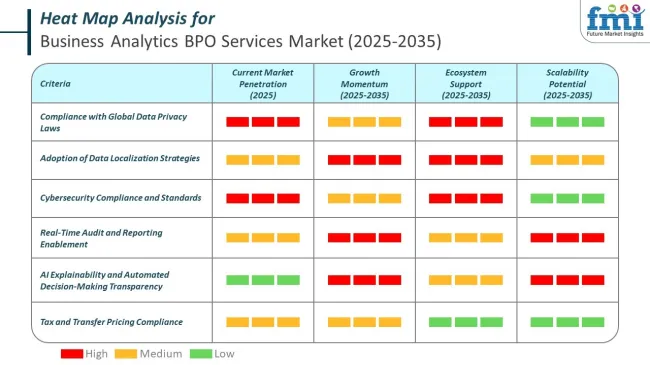

Moreover, heightened awareness regarding data privacy, regulatory compliance, and security protocols has reinforced the trust of organizations in BPO partners that adhere to stringent data governance standards.

The continual advancement in automation and intelligent analytics tools, alongside a rising demand for cost-efficient yet high-quality data solutions, will likely sustain market growth over the coming decade, especially as more industries realize the strategic value of outsourcing their analytics functions to expert vendors.

Stricter global data protection frameworks are reshaping business analytics BPO operations. Rising client concerns over data handling, confidentiality, and jurisdiction-specific laws have made regulatory compliance a key value proposition for service providers. With increasing cross-border data flows and rising demand from highly regulated industries such as banking, healthcare, and insurance, service providers must align with evolving legal obligations.

Business analytics BPO firms are rapidly evolving into real-time insight enablers by embedding artificial intelligence, self-service business intelligence (BI), and cloud-native infrastructure into their service stacks. This transformation is driven by client demand for actionable insights in minutes, not days. Providers are focusing on agility, automation, and vertical-specific intelligence layers.

The below table presents the expected CAGR for the global Business Analytics BPO Services market over several semi-annual periods spanning from 2025 to 2035. This assessment outlines changes in the Business Analytics BPO Services industry and identify revenue trends, offering key decision makers an understanding about market performance throughout the year.

H1 represents first half of the year from January to June, H2 spans from July to December, which is the second half. In the first half H1 of the year from 2024 to 2034, the business is predicted to surge at a CAGR of 13.9%, followed by a slightly higher growth rate of 14.6% in the second half H2 of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 13.9% |

| H2 (2024 to 2034) | 14.6% |

| H1 (2025 to 2035) | 13.6% |

| H2 (2025 to 2035) | 14.8% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 13.6% in the first half and remain higher at 14.8% in the second half. In the first half H1 the market witnessed a decrease of 30 BPS while in the second half H2, the market witnessed an increase of 20 BPS.

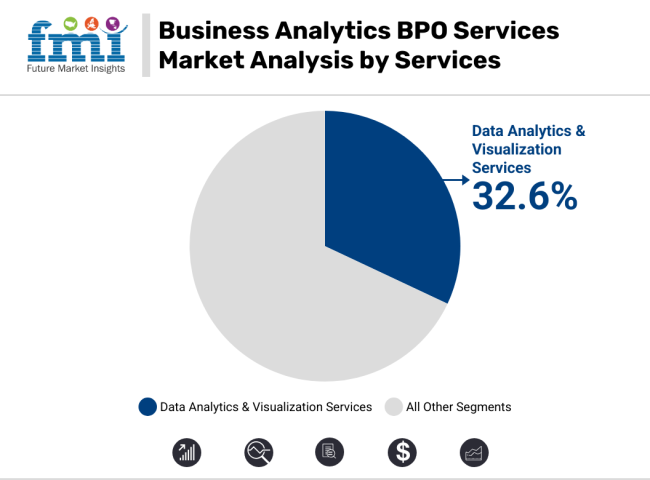

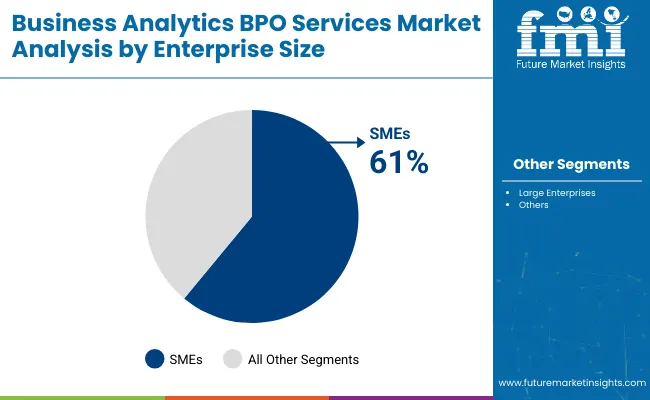

The business analytics BPO services market is comprehensively segmented based on services, enterprise size, industry, and region. By services, the market includes data analytics & visualization services, risk analytics services, marketing & sales analytics services, supply chain analytics services, financial analytics services, and others (human resource (HR) analytics, operational analytics, customer service analytics, and compliance analytics).

In terms of enterprise size, the market is classified into SMEs and large enterprises. Based on industry, the market covers BFSI, manufacturing, retail, IT & telecom, government, healthcare, travel & hospitality, and others (education, energy, logistics, and real estate). Regionally, the market is analyzed across North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, the Middle East, and Africa.

The data analytics & visualization services segment is projected to dominate the business analytics BPO services market, accounting for the largest revenue share of 32.6% in 2025. The demand for this service is being propelled by the growing need among enterprises to transform complex datasets into meaningful, easy-to-understand insights.

With businesses increasingly focusing on interactive dashboards, real-time reporting, and user-friendly visualization tools, this segment continues to serve as a critical enabler for informed decision-making across various industries, including BFSI, healthcare, and retail.

The risk analytics services segment is growing as rising concerns related to cyber threats, data breaches, and financial risks are pushing organizations to adopt sophisticated risk assessment tools offered by BPO service providers. The marketing & sales analytics services segment is supported by the increasing emphasis on customer behavior analysis, personalized marketing campaigns, and performance tracking of sales processes.

Furthermore, the supply chain analytics services segment is driven by the need for supply chain optimization, real-time inventory management, and demand forecasting, especially among manufacturing and retail enterprises.

The financial analytics services segment is growing as companies seek insights into budgeting, financial forecasting, and investment decisions to remain competitive in a volatile market landscape. The other segment, which includes HR analytics and operational analytics, is fueled by the increasing adoption of business analytics tools in non-core business areas to improve organizational efficiency and resource utilization.

On the basis of enterprise size, the SMEs segment registers 61% share. Business analytics BPO services are popular among small and medium-sized enterprises (SMEs) because they provide access to advanced data analysis and insights without the need for heavy investment in in-house expertise or infrastructure.

These services help SMEs make informed decisions, improve operational efficiency, and identify growth opportunities by turning raw data into actionable intelligence. Outsourcing analytics also allows SMEs to focus on core business functions while benefiting from the expertise of specialized providers.

Additionally, as competition increases and data-driven strategies become essential, BPO analytics services offer a cost-effective way for SMEs to stay competitive and agile in their respective markets.

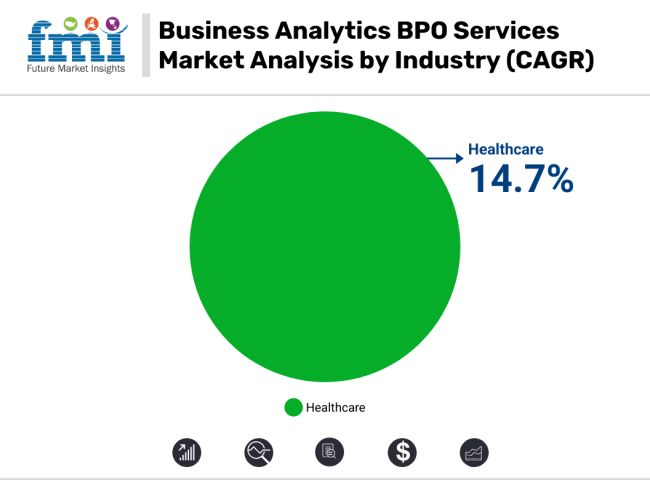

The healthcare segment is poised to emerge as the fastest-growing sector in the global market, projected to expand at a significant CAGR of 14.7% during the period 2025 to 2035. This rapid growth can be attributed to the increasing demand for predictive analytics, patient data management, and cost optimization solutions among healthcare institutions such as hospitals, clinics, and diagnostic centers.

As healthcare organizations are faced with mounting pressure to improve patient outcomes, reduce operational costs, and comply with stringent data protection regulations like HIPAA, they are increasingly turning to outsourced analytics services. These services enable healthcare providers to analyze electronic health records (EHR), optimize resource allocation, forecast disease outbreaks, and improve diagnostic accuracy.

In contrast, the BFSI (banking, financial services, and insurance) sector is expected to retain a substantial market share owing to its critical dependency on analytics for fraud detection, credit risk assessment, customer segmentation, and compliance monitoring. The need to process high volumes of transactional and customer data securely and efficiently has made these services indispensable to BFSI companies aiming to minimize risk and improve client services.

The manufacturing sector continues to benefit from analytics BPO services for applications such as supply chain optimization, inventory management, production forecasting, and predictive maintenance, which are crucial for maintaining operational efficiency and reducing downtime. Retail and IT & telecom sectors are leveraging analytics for customer behavior analysis, personalized marketing campaigns, and network optimization to enhance customer satisfaction and service quality.

Government organizations are increasingly outsourcing their analytics functions to improve public service delivery, optimize resource allocation, and make evidence-based policy decisions. The travel & hospitality industry utilizes these services to predict demand patterns, tailor guest experiences, and optimize pricing strategies.

The other segment, which includes education and energy industries, is gradually adopting analytics-driven approaches to enhance decision-making, operational processes, and service offerings in response to evolving market demands.

The demand for data-driven decision-making is propelling a significant increase in Data Analytics & Visualization services. Vendors are focused on increasingly rely on accurate data for enhancing strategies, streamline operations and help to improve customer engagement. The services are converting raw data into actionable insights helping organizations to understand their performance and customer behavior more clearly.

In 2023, To foster data-driven governance in sectors such as healthcare and infrastructure the government of USA allocated USD 1.2 billion program for the critical role of analytics. A government report specifies 85% of federal agencies implemented advanced data analytics to boost operational transparency and efficiency.

The rise in cybersecurity threats, organizations are focused on risk analytics services and it is designed for digital protection for safeguarding their assets. As the cyber-attacks become more sophisticated, businesses are in need for advanced tools to identify vulnerabilities and proactive measures. The risk analytics services are provided by BPO companies to allow real-time monitoring and analysis of data and it is enabling firms to detect emerging threats before they escalate.

In 2022, the government of UK launched National Cyber Security Strategy and investment around USD 2.5 billion for risk management and cyber defense technologies. The initiative encouraged private companies for enhancing their cybersecurity efforts and the reports showing 65% of British businesses are focused on investment for outsourced risk analytics services. The growing demand is focused on boosting the business analytics BPO services market as organizations are prioritizing digital security.

The integration of social media and digital channels with advanced analytics tools is focused on marketing and sales analytics services. As the customers interacting with brands across different platforms the businesses are analyzing extensive data from engagements to create personalized marketing strategies and help to enhance sales performance.

By outsourcing marketing analytics services the vendors are gaining access to tools that help to track social media trends, digital engagement and consumer behavior and it will help for enabling data-driven decisions that will improve customer satisfaction and propel the revenue growth.

In 2024, to promote digital marketing analytics in the tourism sector the government of India partnered with technology firms and allocated USD 594.7 million. The initiative helps to increase tourism revenue by leveraging advanced analytics for understanding international visitor preferences better to optimize marketing efforts.

Also, 45% of Indian companies are utilizing outsourced analytics services for boosting their marketing strategies, the Business Analytics BPO services market is experiencing significant growth, especially in e-commerce and retail sectors where digital channels are very essential for customer acquisition.

The demand for business analytics BPO services is delayed by a shortage of skilled professionals in data analysis, interpretation and visualization. The business need experts which will effectively use advanced analytics tools, but the limited talent pool makes for challenging to find or train qualified individuals. The scarcity not only raises hiring costs but also poses a barrier for smaller vendors that will struggle to offer competitive salaries to attract top talent.

The organizations will hesitate for investing in outsourcing analytics functions, fearing that service providers will lack the necessary expertise. The gap in skills and availability will slow down the adoption of business analytics BPO services and it is impacting a company ability for leveraging data for informed decision-making. Vendors are helping to navigate challenges to fully utilize the potential of analytics services for enhancing their operations.

Tier 1 vendors such as IBM, Accenture and Deloitte are dominating the market as these organizations offer high-quality analytics solutions that help to cater large enterprises across different industries. They have extensive experience, global presence and investment in advanced technologies helping to enable for providing innovative services and making them preferred partners for businesses looking to outsource analytics functions.

Tier 2 vendors such as Capgemini, Wipro and Cognizant are focused on offerings analytics services with a specific industries or regions. Tier 3 vendors providing tailored solutions that help to meet the unique needs of mid-sized and large organizations. This vendor has ability to combine domain expertise with analytics capabilities enhances their appeal in the market.

Tier 3 vendors contains smaller and niche players such as Fractal Analytics, Mu Sigma and Genpact focus on specialized analytics services or specific geographic regions and allowing them to carve out their niche in the competitive landscape. Tier 3 vendors lack of extensive resources of Tier 1 and Tier 2 vendors, this vendor provide innovative and agile solutions that appeal to small and medium enterprises for cost-effective analytics options.

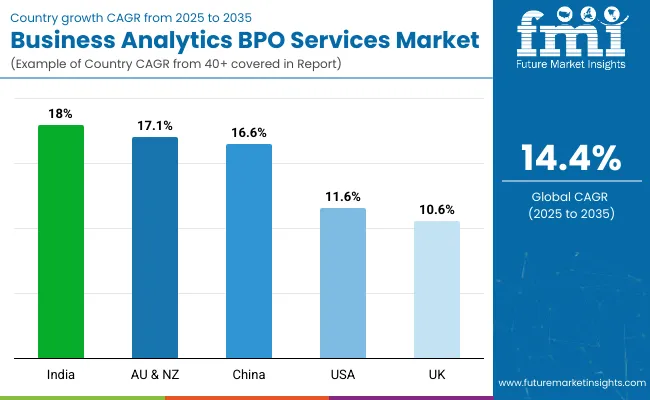

The section highlights the CAGRs of countries experiencing growth in the Business Analytics BPO Services market, along with the latest advancements contributing to overall market development. Based on current estimates, India, China and USA are expected to see steady growth during the forecast period.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| India | 18.0% |

| China | 16.6% |

| United Kingdom | 10.6% |

| Australia & New Zealand | 17.1% |

| United States | 11.6% |

The business analytics BPO services help vendors to increase efficiency, cut costs and help to improve decision-making using advanced data insights. The booming e-commerce market and China vast manufacturing base is focused to boost the need for real-time analytics to streamline supply chains.

According to government of China and their initiative such as China Made in China 2025 help to promotes smart manufacturing and supply chain innovation. In 2023, the government is focused on increasing the funding for digital infrastructure and this will help to enhance supply chain management across different industries.

The shift towards online shopping, retailers are focused on analytics to optimize operations and help to improve customer experience. The business analytics services help retailers to analyze customer behavior, predict preferences and help to streamline inventory and this will help for enhancing personalized services and supply chain efficiency. In 2023, Acording to Government of India there vendors are focused on investament in tech innovations to propell the retail sector the governament are focused on such initiative such as Digital India.

The wealth management firms are focused on leveraging data analytics to predict market trends, assess portfolios and offer personalized financial advice. The predictive analytics helps for optimizing investment strategies, anticipate client needs and helping to reduce risks, enhancing decision-making and client relationships. According to government of USA and their act such as Financial Services Innovation Act help for encouraging financial institutions to adopt data-driven solutions.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 10.3 billion |

| Projected Market Size (2035) | USD 39.4 billion |

| CAGR (2025 to 2035) | 14.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Report Parameter | Revenue in USD billion / volume in million units by service, enterprise size, and industry |

| Services Analyzed | Data Analytics & Visualization, Risk Analytics, Marketing & Sales Analytics, Supply Chain, Financial, Others |

| Enterprise Sizes Analyzed | SMEs, Large Enterprises |

| Industries Analyzed | BFSI, Manufacturing, Retail, IT & Telecom, Government, Healthcare, Travel & Hospitality, Others |

| Regions Covered | North America, Latin America, Asia Pacific, Middle East and Africa (MEA), and Europe |

| Countries Covered | United States, Canada, Germany, France, United Kingdom, Italy, Spain, China, India, Japan, South Korea, Australia, Brazil, Mexico, South Africa |

| Key Players | Accenture, Cognizant, Infosys, TCS, IBM, Deloitte, Wipro, Genpact, Capgemini, Fractal Analytics, Mu Sigma |

| Additional Attributes | Dollar sales by value, market share analysis by region, country-wise analysis |

| Customization and Pricing | Available upon request |

In terms of services, the segment is divided into Data Analytics & Visualization Services, Risk Analytics Services, Marketing & Sales Analytics Services, Supply Chain Analytics Services, Financial Analytics Services and Others.

In terms of enterprise size, the segment is segregated into SMEs and Large Enterprises.

In terms of industry, the industry is segregated into urban BFSI, Manufacturing, Retail , IT & Telecom, Government, Healthcare ¸Travel & Hospitability and Others

A regional analysis has been carried out in key countries of North America, Latin America, Asia Pacific, Middle East and Africa (MEA), and Europe.

The Global Business Analytics BPO Services industry is projected to witness CAGR of 14.4% between 2025 and 2035.

The Global Business Analytics BPO Services industry is anticipated to reach USD 39.4 billion by 2035 end.

South Asia & Pacific is set to record the highest CAGR of 19.2% in the assessment period.

The key players operating in the Global Business Analytics BPO Services industry Accenture, Cognizant, Infosys, Tata Consultancy Services (TCS), IBM, Deloitte and Wipro.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Competitive Overview of Business Analytics BPO Services Companies

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Business Jet Market Size and Share Forecast Outlook 2025 to 2035

Business Storage Units Market Size and Share Forecast Outlook 2025 to 2035

Business as a Service Market Size and Share Forecast Outlook 2025 to 2035

Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Business Process Automation (BPA) Market Size and Share Forecast Outlook 2025 to 2035

Business Value Dashboard Market Size and Share Forecast Outlook 2025 to 2035

Business Email Market Analysis by Channel, Deployment, and Region Through 2035

Business Process as a Service (BPaaS) Market Analysis by Process and Region Through 2035

Business Card Holder Market from 2024 to 2034

Business Cloud VoIP & UC Services Market Size and Share Forecast Outlook 2025 to 2035

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Cloud Business Email Market Report – Trends & Forecast 2017-2027

Fixed Business Voice Platforms And Services Market Size and Share Forecast Outlook 2025 to 2035

Social Business Intelligence Market Growth – Trends & Forecast 2024-2034

Embedded Business Intelligence Market Growth – Trends & Forecast 2023-2033

IBC Rental Business Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA