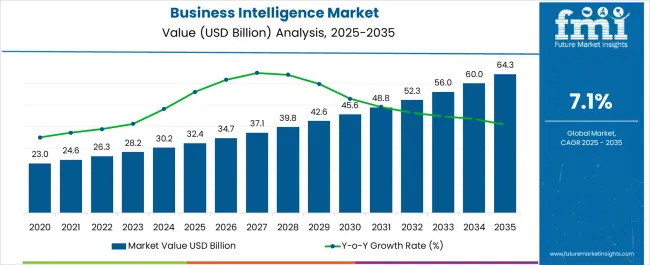

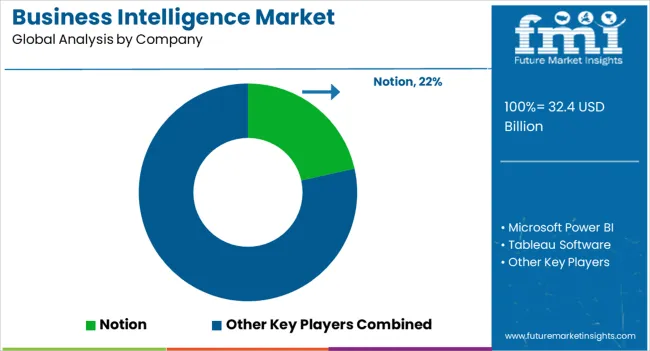

The Business Intelligence Market is estimated to be valued at USD 32.4 billion in 2025 and is projected to reach USD 64.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.1% over the forecast period.

| Metric | Value |

|---|---|

| Business Intelligence Market Estimated Value in (2025 E) | USD 32.4 billion |

| Business Intelligence Market Forecast Value in (2035 F) | USD 64.3 billion |

| Forecast CAGR (2025 to 2035) | 7.1% |

The business intelligence market is experiencing strong growth as organizations prioritize data driven strategies to enhance decision making, operational efficiency, and customer engagement. Rising volumes of structured and unstructured data across industries are accelerating adoption of advanced analytics platforms.

Cloud integration, artificial intelligence, and natural language processing are further expanding the scope of business intelligence solutions, enabling real time insights and predictive modeling. Enterprises are increasingly leveraging BI to align with digital transformation goals, optimize supply chains, and improve workforce productivity.

Regulatory requirements for data governance and compliance are also encouraging investments in secure and scalable BI platforms. The outlook remains positive as organizations of all sizes continue to embed analytics into their core business processes, making BI an indispensable tool for sustainable growth and competitive advantage.

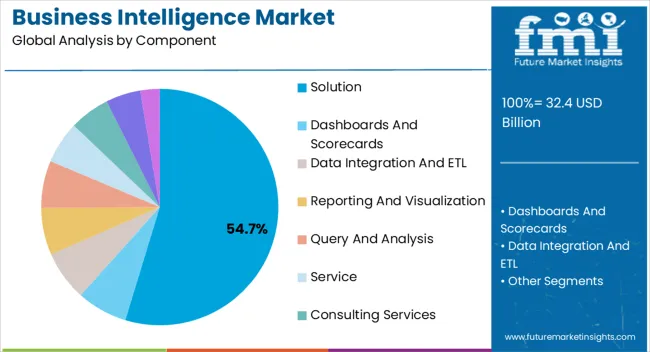

The solution segment is projected to account for 54.70% of market revenue by 2025, establishing it as the leading component category. This dominance is attributed to the ability of BI solutions to integrate diverse data sources, generate actionable dashboards, and enhance enterprise wide decision support.

Organizations have increasingly adopted comprehensive solutions over standalone services to ensure scalability, security, and flexibility in data management. The demand for predictive and prescriptive analytics is further reinforcing reliance on BI solutions, particularly in highly competitive markets where timely insights determine profitability.

Continuous innovation in visualization, automation, and self service capabilities has positioned solutions as the cornerstone of the BI ecosystem.

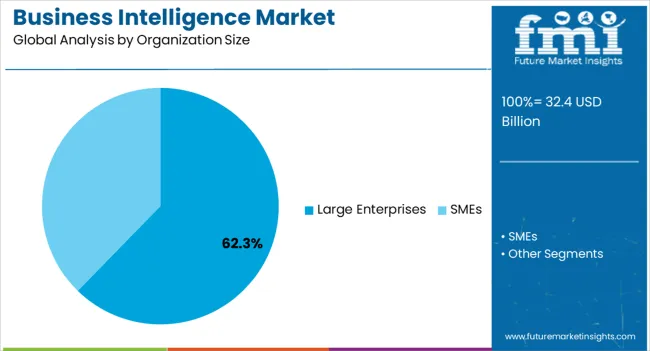

Large enterprises are expected to capture 62.30% of total revenue by 2025 within the organization size category, making them the leading segment. Their dominance is driven by the scale and complexity of data generated across multiple business units, necessitating robust BI adoption.

Significant financial capacity allows large organizations to invest in advanced analytics infrastructure, cloud migration, and integrated data governance frameworks. Strategic goals such as global expansion, digital transformation, and regulatory compliance have accelerated BI adoption in this category.

Furthermore, large enterprises rely heavily on BI to optimize performance monitoring and identify growth opportunities, ensuring their continued leadership in this segment.

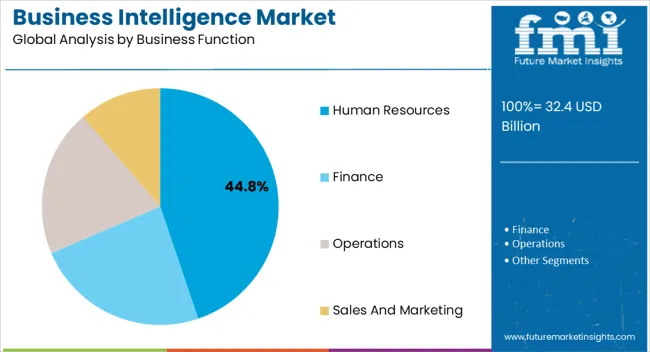

The human resources segment is projected to hold 44.80% of market revenue by 2025 within the business function category, positioning it as the leading segment. This leadership is due to the increasing use of BI tools for workforce analytics, talent acquisition, and employee performance management.

Human resource departments are utilizing BI to gain real time insights into employee engagement, retention trends, and skill gap analysis. The integration of predictive analytics is supporting data driven recruitment and succession planning strategies.

Additionally, compliance monitoring and diversity reporting have become essential use cases driving adoption. By enabling HR leaders to align workforce planning with business objectives, BI has solidified its role as a critical function in enterprise success.

The business intelligence market size expanded globally at a CAGR of 5.0% from 2020 to 2025. In the year 2020, the business intelligence market size stood globally at USD 21,962.1 million. In the following years, the BI (business intelligence) market has experienced worldwide significant growth, accounting for USD 26,745.8 million in 2025.

The spread of the digital technologies, Vendors in the business intelligence market are producing and gathering massive amounts of data from several sources such as social media, supply chains, transactions of sales, and other databases.

The gaining and managing valued insights from the data is difficult due to the complexity of the data, which is growing. To assist enterprises to make sense of complicated data and get insightful knowledge, business intelligence technologies offer the required skills to collect, clean, and analyse huge datasets.

With the ongoing trends in businesses and frequently rising competition, the role of business intelligence platforms is increasing. As it provides a perspective that companies use in navigating multiple channels is increasing.

The prominent factors driving the sales of business intelligence systems are the growing demand for integrated business models. Along with advanced technology such as machine learning, the Internet of Things (IoT), artificial intelligence, and predictive decision-making. The advanced analytics and better statistical support provided by the business intelligence system are also helping the market grow.

Machine learning, along with business intelligence systems, helps the corporate spaces in problem-solving tactics and predicting possible conclusions. This also helps in optimizing internal business processes, increasing revenue growth, and integrating systems. To enhance processing, providing a competitive edge to the companies over other brands.

The data visualization dashboard provides quantitative data analysis and competitive analysis. These integrated features help the companies in hitting their KPIs that push their score in the market rankings. Businesses like healthcare, education, and IT hold high expectations from business intelligence platforms with new features like perspective building, salesforce research, and surveys.

Business intelligence platforms have provided great help to businesses in looking at their operations, revenue generation, and sales in past years. It provided an estimated idea or forecast of a company’s performance with the help of data visualization. This data helped multiple companies in countering the impact of the pandemic and provided a silver lining to a lot of businesses.

The metric collection is done with the help of survey tools in order to provide a segmented outlook of multiple dimensions of a business. It is another process that business intelligence platforms help the corporates with, integrating with new generation technology.

Apart from the benefits that business intelligence platforms provide, high capital investment and unjustified ROI are some challenges that the business intelligence industry faces. This involves the implementation, maintenance, and training costs that don’t justify the return on investment. Another restraint that the market of business intelligence faces is the incubation phase of the market.

This doesn’t allow the market to function properly as there are frequent advancements. Integration of business intelligence platforms in any space is another crucial factor that challenges the growth of the market. As it involves complex implementation processes like cloud deployments that are disturbed by the unavailability of certain components and other security issues.

The market is categorized by component, deployment mode, organization size, business function, and vertical. These categories are further divided into small segments that expand their channels in multiple market spaces. These segments perform differently in multiple markets as they have a stronghold in multiple regions.

The component category is segmented into solutions and services, while deployment mode is segmented into on-premise and cloud. The organization size divides the segments into large enterprises, SMEs, and verticals are segmented into retail, manufacturing, government & public services, media & entertainment, transportation & logistics, BFSI, Telecom & IT, healthcare & life sciences, and tourism & hospitality.

In the component segment, the solutions sub segment holds the prominent portion during the forecasted period. The solutions segment is growing at the promising CAGR of 6.9%. In 2025, the solutions segment holds the dominant market share of 68.9%. The solutions segment is further sub- segmented into dashboards and scorecards, data integration and ETL, reporting and visualization, and query & analysis. The growth of this segment is attributed to easy implementation and fewer maintenance charges for these systems.

By deployment, the cloud segment is the dominant segment of the deployment category and is likely to hold a prominent portion of the market. This segment is recording a moderate CAGR of 6.4% and expanding the market in new regions. The factors behind the growth of this segment are safe and secure deployment, enhanced storage, and better maintenance. Another segment that is on-premise is also growing with the personalized use of business intelligence systems.

In the vertical segment, the BFSI sector is leading segment in the business intelligence market and is expected to hold a prominent share in the forecast period. The growth of this segment is due to the rapid expansion of the banking sector in different countries and technological advancements in banking and financial services. The healthcare and life sciences segment is expected to record the maximum CAGR in the forecast period

The sales and marketing segment in the business function segment is excepted to the grow rapidly during the forecast period. The sales and marketing segment carries the 42.3% share in the worldwide business intelligence market.

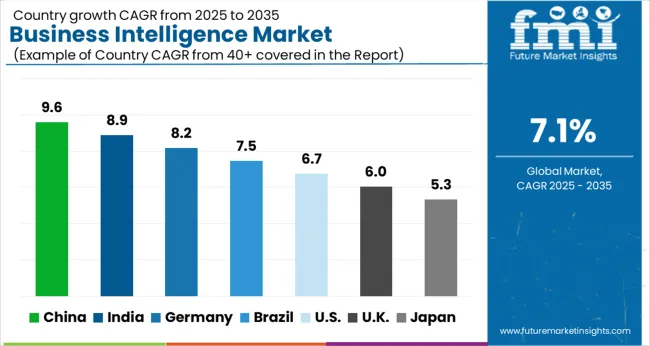

The global business intelligence market is bifurcated into following regions, North America, Latin America, Asia Pacific, Europe and Middle East and Africa (MEA). The North America region is holds dominant market share in the global BI Market. In the NORTH AMERICA region, the USA, which is growing at a pace of the 7.0% (CAGR) between 2025 to 2035 period. The country is expected to holds the market size of USD 64.3 million by the end of 2035.

IT spaces, and expanding banking and finance sector are generating the demand for upgrades in their business structure, including their management and analytics. Another reason behind the high growth of the business intelligence platform market in this region is high competition and new private players in the sector.

Besides this, the China in the APAC region is the second most growing market in business intelligence after the USA. The Chinese BI market size will be reached to USD 3.8 million by the end of 2035 as it thrives on a CAGR of 6.5% between 2025 to 2035.

The UK is growing along with China with the forecasted value of USD 32.4 million at a CAGR of 6.2% between 2025 to 2035.

The United States holds the dominant portion of the market. The United States is also the highest-growing market in the North American region the maximum-growing region. While China is the second-maximum-growing market with a CAGR of 6.3% between (2025 to 2035). Technological advancements, growing market competition, and frequently growing business intelligence industries in developed countries are pushing the demand for business intelligence solutions and services.

| Countries | CAGR Share in Global Market (2025) |

|---|---|

| United States | 19.4% |

| United Kingdom | 6.7% |

| China | 8.3% |

| Japan | 6.7% |

How is the Competition in the Market?

The competitive landscape of business intelligence is diversified and makes the market more exclusive for new players. The competitors focus on adopting advanced technology to enhance corporate workings. Business intelligence vendors focus on creating new business-specific platforms that help new types of businesses. Companies also work in the direction of making their platform more flexible so that it integrates with new-age tools like machine learning and artificial intelligence.

Recent Developments Observed by FMI:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | USD million for Value |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; The Middle East & Africa (MEA) |

| Key Countries Covered | United States, Canada, Germany, United Kingdom, Nordic, Russia, BENELUX, Poland, France, Spain, Italy, Czech Republic, Hungary, Rest of EMEAI, Brazil, Peru, Argentina, Mexico, South Africa, Northern Africa, GCC Countries, China, Japan, South Korea, India, ASEAN, Thailand, Malaysia, Indonesia, Australia, New Zealand, Others |

| Key Segments Covered | Component, Organization Size, Business Function, Vertical, Deployment, Region |

| Report Coverage | Market Forecast, Company Share Analysis, Competition Intelligence, Trend Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

The global business intelligence market is estimated to be valued at USD 32.4 billion in 2025.

The market size for the business intelligence market is projected to reach USD 64.3 billion by 2035.

The business intelligence market is expected to grow at a 7.1% CAGR between 2025 and 2035.

The key product types in business intelligence market are solution, dashboards and scorecards, data integration and etl, reporting and visualization, query and analysis, service, consulting services, deployment and integration services and support and maintenance services.

In terms of organization size, large enterprises segment to command 62.3% share in the business intelligence market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Social Business Intelligence Market Growth – Trends & Forecast 2024-2034

Embedded Business Intelligence Market Growth – Trends & Forecast 2023-2033

Healthcare Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Business Jet Market Size and Share Forecast Outlook 2025 to 2035

Business Storage Units Market Size and Share Forecast Outlook 2025 to 2035

Business as a Service Market Size and Share Forecast Outlook 2025 to 2035

Intelligence Surveillance Reconnaissance (ISR) Market Size and Share Forecast Outlook 2025 to 2035

Business Cloud VoIP & UC Services Market Size and Share Forecast Outlook 2025 to 2035

Business Process Automation (BPA) Market Size and Share Forecast Outlook 2025 to 2035

Business Analytics BPO Services Market Analysis – Size, Share & Forecast 2025 to 2035

Business Value Dashboard Market Size and Share Forecast Outlook 2025 to 2035

Business Email Market Analysis by Channel, Deployment, and Region Through 2035

Business Process as a Service (BPaaS) Market Analysis by Process and Region Through 2035

Competitive Overview of Business Analytics BPO Services Companies

Business Card Holder Market from 2024 to 2034

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Data Business in Oil & Gas Market Size and Share Forecast Outlook 2025 to 2035

Lead Intelligence Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA