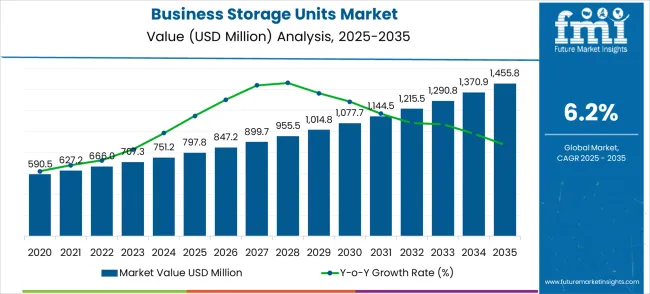

The business storage units market is expected to rise from USD 797.8 million in 2025 to USD 1,455.8 million by 2035, advancing at a CAGR of 6.2%. The growth curve follows a steady upward trajectory, reflecting consistent demand across commercial sectors seeking secure and scalable storage solutions. In the early phase, 2025 to 2028, the curve shows a sharp incline as businesses adopt storage units to manage overflow inventory, equipment, and documents more efficiently. Rising demand from small and medium enterprises further accelerates adoption, contributing to a distinct early growth spurt.

From 2028 to 2032, the curve begins to flatten slightly as early adopters stabilize demand and new growth stems from mid-sized companies and specialized industries requiring tailored solutions. Innovations in security, digital access control, and climate-regulated storage add incremental value during this phase. By 2032 to 2035, the curve is expected to maintain its upward momentum, supported by expansion into emerging regions where commercial activity and infrastructure development are increasing. This shape suggests a market characterized by an initial burst of activity, followed by steady and predictable expansion.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 797.8 million |

| Forecast Value in (2035F) | USD 1,455.8 million |

| Forecast CAGR (2025 to 2035) | 6.2% |

The business storage units market is segmented into small and medium enterprises at 41%, large corporations at 26%, e-commerce and retail businesses at 17%, logistics and distribution firms at 10%, and specialty users such as archives and document storage providers at 6%. Small and medium enterprises drive usage, relying on storage units for inventory overflow, seasonal stock, and equipment. Large corporations utilize them to manage surplus office assets and maintain flexibility in operations. E-commerce and retail businesses adopt storage for last-mile inventory handling and faster customer response. Logistics and distribution firms benefit from temporary warehousing solutions, while specialty users such as healthcare providers and law firms rely on secure facilities for sensitive records. Market trends include digital booking platforms, climate-controlled environments, and enhanced security measures such as biometric access and CCTV monitoring. Operators are expanding flexible leasing and on-demand services to address diverse business requirements. Rising e-commerce activity, hybrid workplace models, and the need for secure, scalable solutions continue to drive adoption. Focus on convenience, accessibility, and value-added services is shaping global market expansion.

The business storage units market presents compelling growth trajectories as enterprises increasingly prioritize operational flexibility, cost optimization, and scalable infrastructure solutions. With the market expanding from USD 797.8 million in 2025 to USD 1,455.8 million by 2035 at a 6.2% CAGR, businesses across all segments are recognizing storage outsourcing as a strategic enabler rather than a cost center.

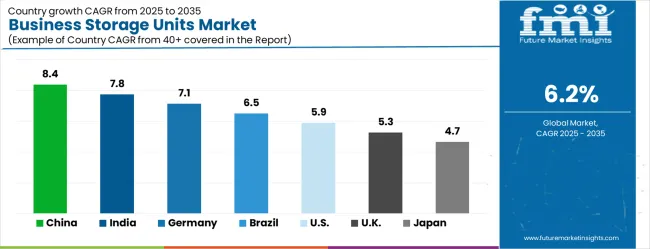

The surge in SME formation, urbanization pressures limiting commercial real estate availability, and the shift toward lean operational models create structural demand drivers. Simultaneously, evolving business models-from e-commerce fulfillment to document digitization-require specialized storage environments that traditional facilities cannot economically provide. Geographic expansion opportunities in high-growth markets like China (8.4% CAGR) and India (7.8% CAGR) offer significant volume capture potential, while technology integration and premium service differentiation promise margin expansion in mature markets.

Pathway A - SME-Focused Flexible Storage Solutions. Small and medium enterprises demand cost-effective, scalable storage that adapts to business cycles without long-term commitments. Providers offering modular pricing, seasonal flexibility, and business-specific amenities (loading docks, extended access, invoice management) can capture this dominant segment. Expected revenue pool: USD 400-600 million.

Pathway B - Technology-Enhanced Storage Management. Integration of IoT sensors, digital inventory tracking, automated access control, and cloud-based management platforms transforms basic storage into an intelligent business infrastructure. Smart storage solutions enabling real-time inventory monitoring and automated billing create premium value propositions. Opportunity: USD 300-450 million.

Pathway C - Specialized Industry Storage Solutions. Developing sector-specific offerings-climate-controlled pharmaceutical storage, secure document retention for legal/financial services, or e-commerce fulfillment-ready facilities-commands higher rates through specialized expertise. Revenue uplift: USD 250-400 million.

Pathway D - Geographic Expansion in Emerging Markets. High-growth regions experiencing rapid SME development and urbanization offer substantial volume opportunities. Local partnerships, culturally adapted service models, and proximity to business districts enable market penetration in China, India, Brazil, and emerging European markets. Pool: USD 500-750 million.

Pathway E - Integrated Logistics and Value-Added Services. Beyond basic storage, offering inventory management, order fulfillment, document scanning/digitization, and last-mile delivery coordination transforms providers into comprehensive business partners. This service expansion captures a larger wallet share from existing customers. Expected upside: USD 300-500 million.

Pathway F - Premium Security and Compliance Solutions. Businesses handling sensitive materials, regulated documents, or high-value inventory require enhanced security features-biometric access, 24/7 surveillance, climate control, and fire suppression. Compliance-certified storage for industries like healthcare and finance enables significant premium pricing. USD 200-350 million.

Pathway G - Corporate Account and Enterprise Partnerships. Large enterprises seeking to optimize real estate portfolios and reduce fixed costs represent high-value, long-term contracts. Corporate storage programs, multi-location management, and enterprise-grade service levels create stable revenue streams with strong margins. Pool: USD 350-500 million.

Market expansion is being supported by the exponential growth of small and medium enterprises and the corresponding demand for flexible storage solutions that can help business operations, inventory management, and document storage requirements. Modern businesses are increasingly focused on cost-effective storage alternatives that provide professional storage services without the capital investment of dedicated storage facilities. Business storage units' proven ability to deliver flexibility, security, and cost-effectiveness makes them essential solutions for operational efficiency and space optimization initiatives.

The growing focus on business agility and lean operational models is driving demand for storage solutions that can support dynamic business requirements and scalable storage needs. Business preference for storage services that combine accessibility with professional management and security features is creating opportunities for innovative business storage implementations. The rising influence of e-commerce businesses and inventory-based operations is also contributing to increased adoption of business storage units that can provide specialized storage environments and logistics support capabilities.

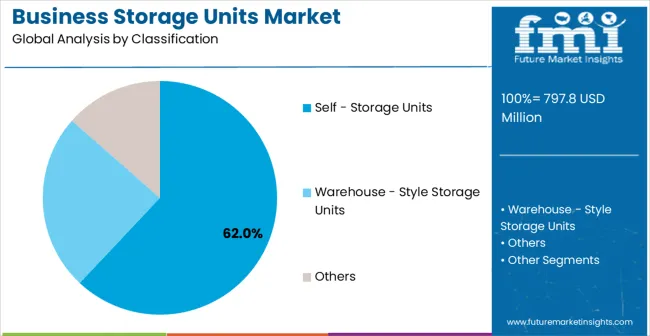

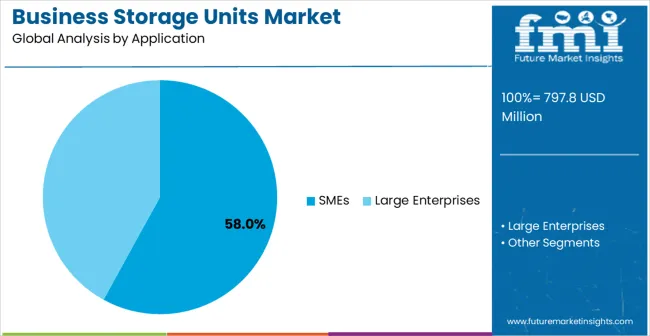

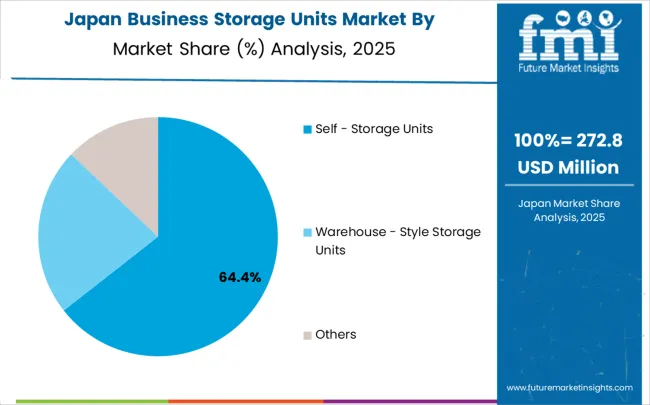

The business storage units market is gaining momentum with enterprises seeking flexible and cost-effective storage options. Self-storage units dominate the storage unit type segment with approximately 62% of the market share, preferred for their affordability, scalability, and accessibility. By application, SMEs lead with about 58% of the market, as small and medium businesses increasingly rely on off-site storage to manage inventory, equipment, and documents. Demand is reinforced by the expansion of e-commerce, seasonal inventory fluctuations, and the need for secure, short- and long-term storage facilities that support business continuity and efficiency.

Self-storage units hold around 62% of the storage unit type market, making them the most widely adopted option among enterprises. These units typically range from 25 to 200 square feet, offering flexibility for businesses of various scales. Providers such as Public Storage, Extra Space Storage, CubeSmart, and U-Haul dominate the market with advanced facilities featuring 24/7 access, climate control, and enhanced security systems. Self-storage units are particularly valued for their month-to-month lease models, reducing long-term commitments while supporting operational agility.

SMEs represent about 58% of the application segment, reflecting their growing reliance on business storage solutions. These units are widely used for inventory overflow, seasonal goods, office furniture, and archival records. Providers such as Public Storage, Extra Space Storage, CubeSmart, and U-Haul cater to SMEs by offering scalable solutions that reduce warehousing costs while improving efficiency. Segment growth is supported by the rising number of SMEs globally, particularly in e-commerce and retail, where off-site storage ensures better inventory management and business continuity.

The business storage units market is advancing steadily due to changing business operational models and increasing demand for flexible, cost-effective storage solutions that support business growth and operational efficiency. The market faces challenges, including economic uncertainties affecting business spending, competition from in-house storage solutions, and concerns about data security and asset protection in shared storage facilities. Innovation in storage technology and service offerings continues to influence market development and expansion patterns.

The expanding small and medium enterprise sector and adoption of flexible business operational models are enabling business storage units to support natural business requirements where traditional storage infrastructure is cost-prohibitive or operationally inefficient. Flexible business models provide enhanced market opportunities while allowing more cost-effective storage solutions across various business types and operational requirements. Organizations are increasingly recognizing the competitive advantages of outsourced storage solutions for operational agility and cost optimization.

Modern business storage providers are incorporating advanced security systems and technology integration to enhance service appeal and address business concerns about asset protection and storage management. These technological enhancements improve service value while enabling new business segments, including technology companies and data-sensitive businesses requiring enhanced security protocols. Advanced technology integration also allows storage providers to differentiate from basic storage solutions while supporting business-grade security and management requirements.

| Country | CAGR (2025-2035) |

|---|---|

| China | 8.4% |

| India | 7.8% |

| Germany | 7.1% |

| Brazil | 6.5% |

| USA | 5.9% |

| UK | 5.3% |

| Japan | 4.7% |

The business storage units market is experiencing solid growth globally, with China leading at an 8.4% CAGR through 2035, driven by rapid SME sector expansion, increasing urbanization, and growing adoption of professional storage services among businesses. India follows closely at 7.8%, supported by the expanding service sector, growing e-commerce businesses, and increasing recognition of storage outsourcing benefits. Germany shows strong growth at 7.1%, prioritizing industrial storage solutions and business service integration. Brazil records 6.5%, focusing on emerging market opportunities and business sector development. The United States shows 5.9% growth, prioritizing market maturity and service innovation. The United Kingdom demonstrates 5.3% growth, supported by business storage adoption and service sector expansion. Japan shows 4.7% growth, prioritizing quality storage solutions and technology integration. The report covers detailed analysis of 40+ countries, with the top countries shared as a reference.

Revenue from business storage units in China is projected to exhibit exceptional growth with a CAGR of 8.4% through 2035, driven by rapid small and medium enterprise sector development and advancing urbanization trends requiring professional storage solutions. The country's leadership in manufacturing and e-commerce sectors and strong business formation rates are creating significant demand for scalable storage solutions. Major domestic and international storage providers are establishing comprehensive business storage capabilities to serve both domestic enterprises and export-oriented businesses.

Revenue from business storage units in India is expanding at a CAGR of 7.8%, supported by the rapidly developing service sector, expanding urban business environment, and increasing adoption of professional storage services among growing enterprises. The country's strong entrepreneurial culture and growing business formation rates are driving demand for flexible storage solutions. International storage companies and domestic providers are establishing comprehensive development and distribution capabilities to address the growing demand for business storage services.

Revenue from business storage units in Germany is projected to grow at a CAGR of 7.1% through 2035, prioritizing industrial storage solutions and business service integration within Europe's largest economy. The country's advanced manufacturing sector and established Mittelstand companies are driving sophisticated storage requirements. German businesses consistently demand high-quality storage facilities that meet stringent industrial standards and provide superior integration capabilities with existing business operations.

Revenue from business storage units in Brazil is expanding at a CAGR of 6.5% through 2035, focusing on emerging market opportunities and business sector development across Latin America's largest economy. Brazilian organizations value cost-effective storage solutions, operational flexibility, and proven business infrastructure, positioning business storage units as essential services for growing companies. The country's expanding service sector and increasing business formalization are creating sustained demand for professional storage facilities.

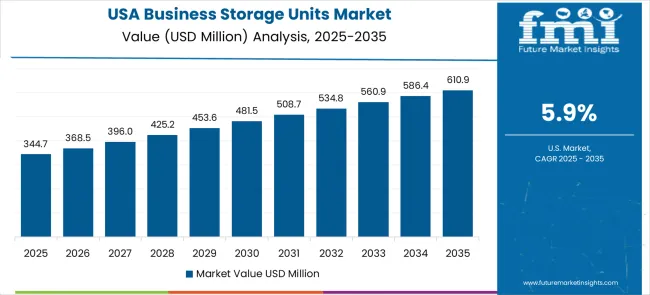

Revenue from business storage units in the United States is projected to grow at a CAGR of 5.9% through 2035, driven by market maturity, service innovation, and advanced storage technology adoption across diverse business sectors. American companies prioritize operational efficiency, regulatory compliance, and technological advancement, making business storage units a preferred choice for enterprise storage applications. The market benefits from established infrastructure and sophisticated customer requirements.

Revenue from business storage units in the United Kingdom is expanding at a CAGR of 5.3% through 2035, supported by strong service sector development, established business infrastructure, and growing adoption of professional storage services across commercial enterprises. British businesses value operational reliability, regulatory compliance, and service quality, positioning business storage facilities as essential infrastructure for modern business operations.

Revenue from business storage units in Japan is projected to grow at a CAGR of 4.7% through 2035, prioritizing on quality storage solutions, technology integration, and precision service delivery aligned with Japanese business standards. Japanese organizations prioritize service excellence, technological sophistication, and long-term reliability, making business storage units a strategic choice for enterprise applications. The market is supported by advanced urban infrastructure and sophisticated business requirements.

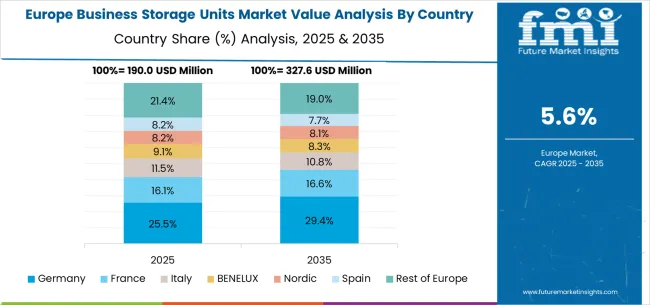

The business storage units market in Europe is projected to grow from USD 145.2 million in 2025 to USD 248.7 million by 2035, registering a CAGR of 5.5% over the forecast period. Germany is expected to maintain its leadership position with a 28.4% market share in 2025, projected to reach 29.1% by 2035, supported by its strong industrial base and comprehensive business service infrastructure, including major commercial centers in Berlin, Munich, and Hamburg.

The United Kingdom follows with a 22.6% share in 2025, projected to reach 23.2% by 2035, driven by expanding service sector adoption and comprehensive business storage facility development in London and other major commercial centers. France holds an 18.7% share in 2025, expected to reach 19.0% by 2035 due to the growing SME sector and business service modernization programs. Italy commands a 12.8% share, while Spain accounts for 9.2% in 2025. The Rest of Europe region is anticipated to gain momentum, expanding its collective share from 8.3% to 9.1% by 2035, attributed to increasing business storage adoption in Nordic countries and emerging Eastern European markets implementing business infrastructure development programs.

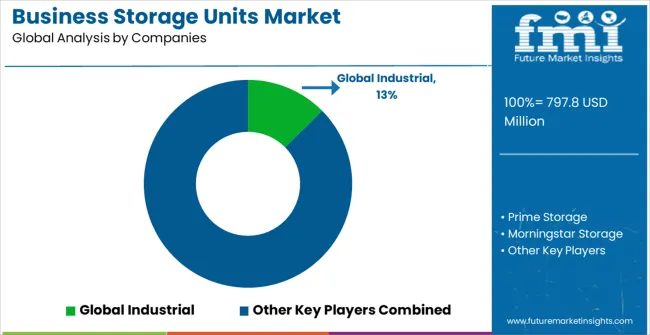

The business storage units market is characterized by competition among established storage facility operators, specialized business storage providers, and emerging technology-enabled storage companies. Companies are investing in facility expansion, security technology development, customer service enhancement, and comprehensive business-focused storage solutions to deliver convenient, secure, and cost-effective storage experiences. Innovation in facility design, access control systems, and customer management technology is central to strengthening market position and customer retention.

Public Storage leads the market with significant market presence, offering comprehensive business storage solutions with a focus on facility quality standards and extensive geographic coverage. U-Haul provides integrated storage and logistics solutions with prioritizing on business mobility and comprehensive service offerings. iStorage delivers premium storage solutions with a focus on security features and business-grade service levels. CubeSmart focuses on technology-enabled storage solutions and customer experience optimization.

Prime Storage provides specialized business storage facilities with a focus on security and accessibility. Morningstar Storage offers regional storage solutions with a focus on business customer service. National Storage specializes in large-format storage solutions for business applications. Gateway Storage Center focuses on commercial storage services with business-specific features. Mobile Storage Solutions provides portable storage alternatives for business applications. Christofferson Moving & Storage offers integrated storage and logistics services with a business focus.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 797.8 million |

| Storage Unit Type | Self-Storage Units, Warehouse-Style Storage Units, Others |

| Application | SMEs, Large Enterprises |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia and 40+ countries |

| Key Companies Profiled | Public Storage, U-Haul, iStorage, CubeSmart, Prime Storage, Morningstar Storage, National Storage, Gateway Storage Center, Mobile Storage Solutions, Christofferson Moving & Storage |

| Additional Attributes | Dollar sales by Storage Unit Type and application, regional demand trends, competitive landscape, business preferences for flexible versus traditional storage solutions, integration with security and technology systems, innovations in facility design and access control for diverse business applications |

The global business storage units market is estimated to be valued at USD 797.8 million in 2025.

The market size for the business storage units market is projected to reach USD 1,455.8 million by 2035.

The business storage units market is expected to grow at a 6.2% CAGR between 2025 and 2035.

The key product types in business storage units market are self - storage units, warehouse - style storage units and others.

In terms of application, smes segment to command 58.0% share in the business storage units market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Business Jet Market Size and Share Forecast Outlook 2025 to 2035

Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Business as a Service Market Size and Share Forecast Outlook 2025 to 2035

Business Cloud VoIP & UC Services Market Size and Share Forecast Outlook 2025 to 2035

Business Intelligence Market Size and Share Forecast Outlook 2025 to 2035

Business Process Automation (BPA) Market Size and Share Forecast Outlook 2025 to 2035

Storage Tank Equipment Market Size and Share Forecast Outlook 2025 to 2035

Storage And Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Business Analytics BPO Services Market Analysis – Size, Share & Forecast 2025 to 2035

Business Value Dashboard Market Size and Share Forecast Outlook 2025 to 2035

Storage Area Network (SAN) Market Analysis by Component, SAN Type, Technology, Vertical, and Region through 2035

Business Email Market Analysis by Channel, Deployment, and Region Through 2035

Business Process as a Service (BPaaS) Market Analysis by Process and Region Through 2035

Competitive Overview of Business Analytics BPO Services Companies

Business Card Holder Market from 2024 to 2034

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Business Analytics BPO Services Market Growth – Trends & Forecast 2023-2033

Storage as a Service Market Trends – Growth & Forecast 2020-2030

Storage Virtualization Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA