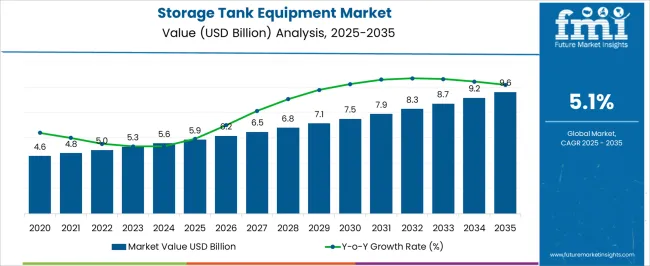

The storage tank equipment market is set to grow from USD 5.9 billion in 2025 to USD 9.6 billion by 2035, with a CAGR of 5.1%. A market growth curve shape analysis reveals a gradual and steady upward trajectory with a slight acceleration as the forecast period progresses. Between 2025 and 2030, the market grows from USD 5.9 billion to USD 7.5 billion, adding USD 1.6 billion in value. This phase shows a CAGR of 5.2%, driven by increasing demand for storage tank equipment in industries such as oil and gas, chemicals, and water treatment. As regulations around storage safety and environmental impact become stricter, the market sees consistent growth. From 2030 to 2035, the market continues its upward trend, moving from USD 7.5 billion to USD 9.6 billion, adding USD 2.1 billion in growth. The CAGR of 4.9% during this period indicates a slight deceleration in growth as the market matures and infrastructure investments reach a point of steady demand. The overall growth curve suggests a stable and predictable expansion in the first half of the forecast, followed by a more moderate increase as the market stabilizes and enters a phase of ongoing technological improvements and infrastructure optimization.

| Metric | Value |

|---|---|

| Storage Tank Equipment Market Estimated Value in (2025 E) | USD 5.9 billion |

| Storage Tank Equipment Market Forecast Value in (2035 F) | USD 9.6 billion |

| Forecast CAGR (2025 to 2035) | 5.1% |

The storage tank equipment market is witnessing consistent growth, underpinned by rising investments in oil & gas infrastructure, water treatment facilities, and chemical manufacturing. Increasing emphasis on regulatory compliance, environmental safety, and asset durability is prompting demand for technologically advanced fittings, monitoring systems, and protective solutions integrated with storage tanks.

Governments and private stakeholders are reinforcing equipment standards to mitigate risks related to corrosion, leakage, and over-pressurization. As industries expand their bulk storage capacities, the requirement for efficient equipment that extends tank lifespan and ensures operational safety is gaining importance.

The transition toward automation, real-time monitoring, and predictive maintenance in storage tank ecosystems is opening up new avenues for precision-engineered components and accessories. Sustainability goals are further influencing material preferences and retrofitting activities across sectors, driving long-term momentum for the market.

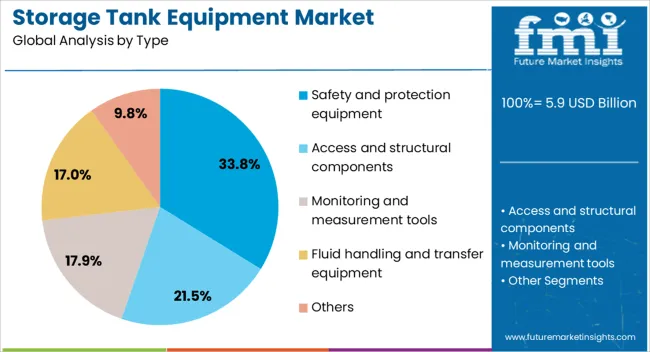

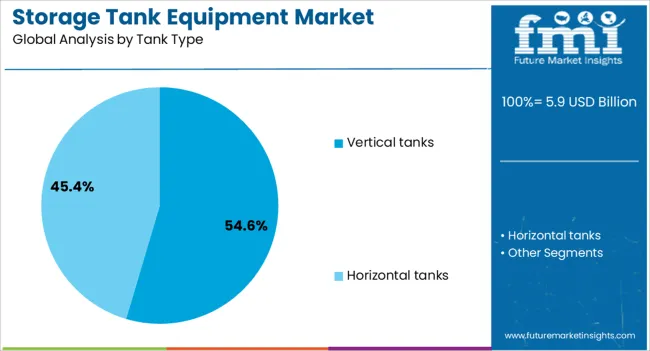

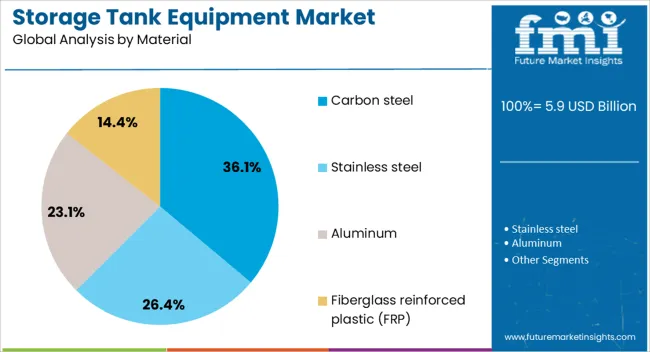

The storage tank equipment market is segmented by type, tank type, material, capacity, application, distribution channel, and region. By type, the market is divided into safety and protection equipment, access and structural components, monitoring and measurement tools, fluid handling and transfer equipment, and others. Based on tank type, it is classified into vertical tanks and horizontal tanks. By material, the market is segmented into carbon steel, stainless steel, aluminum, and fiberglass-reinforced plastic (FRP). In terms of capacity, the market is categorized as small (less than 1,000 m³), medium (1,000–10,000 m³), and large (over 10,000 m³). By application, the market covers oil & gas, chemicals, water & wastewater, petrochemicals, agriculture, power generation, and others. By distribution channel, it is divided into direct sales and indirect sales. Regionally, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Safety and protection equipment is expected to hold a 33.80% revenue share in 2025, making it the leading product type segment within the storage tank equipment market. Its dominance is being driven by rising industry focus on hazard mitigation, worker safety, and asset protection amid stringent regulatory norms.

Equipment such as pressure relief valves, flame arrestors, and overflow alarms are being widely installed to comply with industrial safety mandates and reduce the likelihood of catastrophic failures. The adoption of smart monitoring systems that integrate safety features with data analytics platforms is also contributing to increased demand.

As storage tank capacities grow and operational complexities rise, the deployment of robust safety infrastructure is being prioritized to safeguard both personnel and critical infrastructure.

Vertical tanks are projected to account for 54.60% of the total market revenue in 2025, establishing them as the leading tank type segment. This prominence is being influenced by space optimization benefits, efficient fluid dynamics, and ease of maintenance offered by vertical tank designs.

Industries handling fuels, chemicals, and potable water are increasingly opting for vertical configurations to accommodate larger volumes within limited footprints. The structural efficiency of vertical tanks enables better stratification, thermal management, and installation of internal monitoring devices.

Moreover, their compatibility with automated cleaning systems and retrofitting components is making them preferable for both new installations and capacity upgrades. As industries focus on maximizing land use and ensuring safer containment, vertical tanks remain the design of choice for both above-ground and underground applications.

Carbon steel is forecast to hold a 36.10% revenue share in the market by 2025, positioning it as the most widely used material in storage tank equipment. Its dominance stems from high mechanical strength, ease of fabrication, and cost efficiency across both pressurized and atmospheric storage applications.

Carbon steel's ability to withstand extreme temperatures and pressure fluctuations makes it suitable for harsh industrial environments, particularly in oil & gas and chemical processing sectors. Enhanced corrosion resistance through linings, coatings, and galvanization has further extended its service life and application range.

Additionally, the recyclability of carbon steel aligns with environmental compliance and lifecycle optimization goals. With a well-established supply chain and compatibility with various welding and fabrication techniques, carbon steel continues to be the preferred material for long-term structural reliability and operational safety.

The storage tank equipment market is witnessing growth due to increasing demand across industries such as oil and gas, chemicals, and food and beverage. Storage tanks are essential for the safe containment of liquids and gases, providing security and stability in various applications. The need for better storage solutions driven by rising production volumes and the focus on safety and regulatory compliance is propelling market growth. Despite challenges such as high installation and maintenance costs, there are opportunities in emerging economies and the adoption of advanced storage technologies.

The storage tank equipment market is being driven by the increasing demand for secure and efficient storage solutions across industries. The oil and gas sector, in particular, requires large-scale storage tanks for the safe containment of crude oil, refined products, and chemicals. Similarly, the food and beverage industry relies on storage tanks to maintain the quality and safety of liquids such as dairy, juices, and alcohol. As production volumes rise and the need for safe and regulated storage increases, industries are investing in advanced tank equipment to meet growing demand while ensuring compliance with environmental and safety standards. These factors are driving the adoption of new storage technologies and infrastructure upgrades.

A significant challenge for the storage tank equipment market is the high initial cost of installation and ongoing maintenance. Constructing and installing large storage tanks requires substantial investment in materials, labor, and infrastructure, particularly for specialized tanks designed for hazardous materials. The complexity of meeting regulatory and safety standards adds to the cost burden. Maintenance costs can also be high, as tanks must be regularly inspected, cleaned, and repaired to ensure they meet industry safety and operational requirements. This can be particularly challenging for smaller companies operating in price-sensitive markets, limiting their ability to invest in new storage infrastructure. Long lead times for tank construction and regulatory approvals can further delay project timelines.

Emerging economies present significant opportunities for growth in the storage tank equipment market as industries in these regions continue to expand. Increased industrialization and rising demand for oil, gas, chemicals, and food products are driving the need for more storage solutions. Additionally, the adoption of advanced technologies, such as automated monitoring systems and smart tanks that provide real-time data on storage conditions, offers significant growth potential. As industries focus on improving operational efficiency and safety, innovative storage tank solutions that optimize storage capacity, reduce leakage, and ensure environmental compliance will continue to gain popularity. The development of environmentally-friendly materials and energy-efficient technologies is expected to further boost market growth.

A key trend in the storage tank equipment market is the increasing adoption of smart storage solutions. Technological advancements are enabling tanks to be integrated with sensors, real-time monitoring systems, and automated controls. These features allow operators to track and optimize storage conditions, reducing risks and improving efficiency. The growing focus on sustainability is driving demand for eco-friendly storage tank solutions. Manufacturers are investing in the development of tanks made from recyclable and energy-efficient materials to align with environmental regulations. These trends, along with a focus on safety, are transforming the storage tank equipment market by making storage systems more intelligent, reliable, and environmentally conscious.

The utility scale high voltage power transformer market is projected to grow at a CAGR of 6.1% from 2025 to 2035, driven by grid reliability improvements, renewable energy integration, and cross-border transmission projects. BRICS nations lead growth, with China at 8.2% fueled by ultra-high voltage projects and offshore wind integration, and India at 7.6% supported by grid expansion and renewable capacity targets. Among OECD markets, France posts 6.4%, while the United Kingdom records 5.8% and the United States 5.2%, focusing on substation upgrades and digital-ready transformer adoption. The analysis includes over 40 countries, with the top five detailed below.

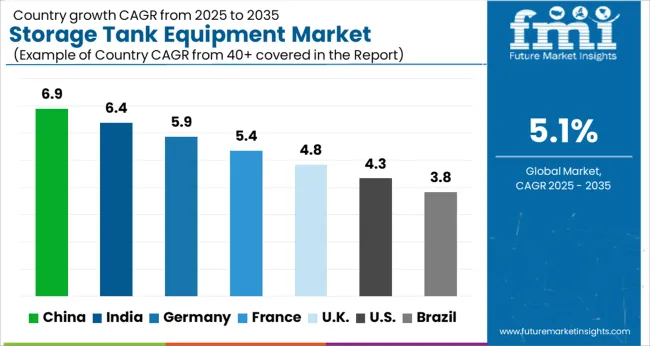

China is expected to grow at a CAGR of 6.9% through 2035, largely driven by the rapid industrialization and growth of sectors such as chemicals, petroleum, and food processing. The country’s vast infrastructure expansion, coupled with its focus on strengthening its chemical, energy, and manufacturing sectors, continues to push the demand for advanced storage tank equipment. With the growing adoption of industrial storage solutions across different applications, China is expected to remain a major global market for storage tanks. China’s strong investments in infrastructure projects and energy storage systems will further drive market growth in the coming years.

India is projected to grow at a CAGR of 6.4% through 2035, driven by the rapid expansion of its industrial base and increasing demand for storage solutions in the chemical, food, and oil sectors. The country’s fast-growing industrial sector is pushing the demand for large-scale storage tanks for chemicals, petroleum products, and agricultural goods. The rise in infrastructure projects and the country’s growing reliance on renewable energy contribute to the need for advanced storage equipment. India’s government initiatives to support industrial growth and manufacturing will further boost the adoption of storage tank solutions in the country.

France is projected to grow at a CAGR of 5.4% through 2035, with demand for storage tank equipment increasing in industries like chemicals, pharmaceuticals, and food processing. France's strong industrial base, particularly in chemical and automotive manufacturing, continues to drive the need for storage tanks to manage raw materials, chemicals, and waste. The rise in environmental regulations promoting energy efficiency and safety standards increases the adoption of advanced storage solutions. The growing demand for efficient storage systems, coupled with France’s robust infrastructure, will continue to fuel market growth.

The United Kingdom is projected to grow at a CAGR of 4.8% through 2035, supported by increasing demand for storage tanks in the oil, gas, and chemical sectors. The country’s ongoing push toward infrastructure development, coupled with the rising need for fuel storage solutions and sustainable materials, accelerates the adoption of storage tank systems. The UK’s focus on developing smart cities and advancing waste and water treatment systems creates a growing demand for advanced storage equipment. As industries seek reliable and safe solutions, the UK market for storage tanks will continue to experience steady growth.

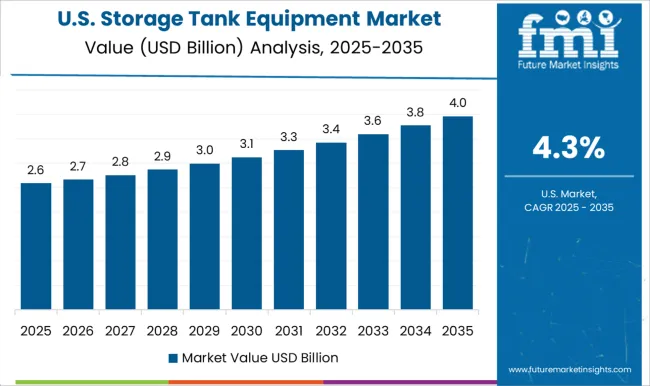

The United States is projected to grow at a CAGR of 4.3% through 2035, with demand primarily driven by industrial needs in the chemical, oil, and water treatment sectors. The USA manufacturing sector’s reliance on bulk storage systems to manage raw materials, chemicals, and finished goods continues to fuel demand for storage tank equipment. The increasing investments in renewable energy and infrastructure projects like water treatment plants contribute to the growing need for storage tanks. The country’s advanced industrial infrastructure and technological innovations in storage tank design further enhance market growth.

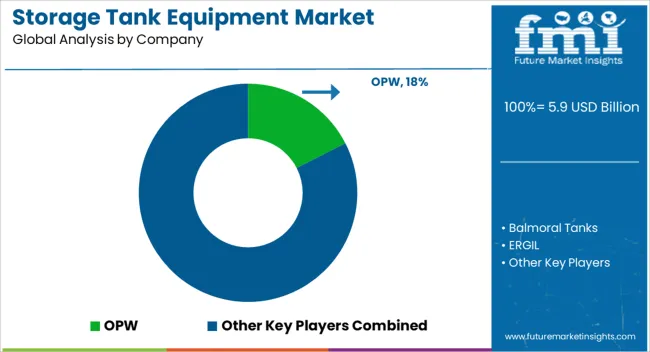

The storage tank equipment market is driven by key players specializing in the design, manufacturing, and installation of tanks for the storage of liquids, chemicals, and gases. OPW is a market leader, offering comprehensive storage tank equipment solutions, including tank monitoring and safety equipment, catering to industries such as oil & gas, chemicals, and food & beverage. Balmoral Tanks and ERGIL provide a wide range of storage tank solutions, focusing on custom-designed tanks for industrial applications, with a strong emphasis on safety, reliability, and environmental compliance. Franklin Electric and Hansa Engineering focus on providing pumps, tank accessories, and tank level management systems, improving operational efficiency and safety for liquid storage operations. Kay Tank and Mass Tank Corp are recognized for their high-quality, durable tanks used in a variety of industries, from agriculture to water treatment.

NOV and Potential Engineering focus on offering specialized solutions for bulk storage and chemical containment, ensuring that storage tanks meet industry standards for structural integrity and operational performance. PROTEGO and Ramén Valves offer safety equipment, including pressure relief valves and other tank protection solutions, ensuring optimal performance and preventing accidents in volatile environments. Rainwater Equipment LLC and TEC Container Solutions specialize in custom water storage and rainwater harvesting systems, while TCEM and Water Storage Tanks, Inc. provide large-scale tanks for municipal and industrial water storage solutions. Competitive differentiation is driven by tank design, durability, safety features, and compliance with regulatory standards. Barriers to entry include high capital investment in tank manufacturing, specialized engineering expertise, and regulatory approvals. Strategic priorities include the development of eco-friendly and energy-efficient storage solutions, expansion into emerging markets, and enhancing the integration of smart monitoring technologies for real-time data analysis and tank management.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Type | Safety and protection equipment, Access and structural components, Monitoring and measurement tools, Fluid handling and transfer equipment, and Others |

| Tank Type | Vertical tanks and Horizontal tanks |

| Material | Carbon steel, Stainless steel, Aluminum, and Fiberglass reinforced plastic (FRP) |

| Capacity | Medium (1,000–10,000 m³), Small (Less than 1,000 m³), and Large (Over 10,000 m³) |

| Application | Oil & gas, Chemical, Water & wastewater, Petrochemical, Agriculture, Power generation, and Others |

| Distribution channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | OPW, Balmoral Tanks, ERGIL, Franklin Electric, Hansa Engineering, Kay Tank, Mass Tank Corp, Nov, Potential Engineering, PROTEGO, Ramén Valves, Rainwater Equipment LLC, TEC Container Solutions, TCEM, and Water Storage Tanks, Inc. |

| Additional Attributes | Dollar sales by equipment type (tank monitoring systems, pressure relief valves, pumps) and end-use segments (oil & gas, chemicals, water treatment). Demand dynamics are driven by increasing industrialization, regulatory compliance, and the need for safe, efficient storage solutions. Regional growth is strongest in North America, Europe, and Asia-Pacific. Innovation focuses on smart monitoring, energy efficiency, and eco-friendly materials. |

The global storage tank equipment market is estimated to be valued at USD 5.9 billion in 2025.

The market size for the storage tank equipment market is projected to reach USD 9.6 billion by 2035.

The storage tank equipment market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in storage tank equipment market are safety and protection equipment, access and structural components, monitoring and measurement tools, fluid handling and transfer equipment and others.

In terms of tank type, vertical tanks segment to command 54.6% share in the storage tank equipment market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

LNG Storage Tank Market Growth - Trends & Forecast 2025 to 2035

Fuel Storage Tank Market Size and Share Forecast Outlook 2025 to 2035

Cold Storage Equipment Market Size and Share Forecast Outlook 2025 to 2035

Storage And Handling Equipment Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tank And Transportation Market Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks and Transportation Market Size and Share Forecast Outlook 2025 to 2035

Hydrogen Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Aboveground Storage Tanks Market Size and Share Forecast Outlook 2025 to 2035

Underground Storage Tanks Market

Storage Water Heater Market Size and Share Forecast Outlook 2025 to 2035

Equipment Management Software Market Size and Share Forecast Outlook 2025 to 2035

Equipment cases market Size and Share Forecast Outlook 2025 to 2035

Tanker Truck Market Size and Share Forecast Outlook 2025 to 2035

Storage Area Network (SAN) Market Analysis by Component, SAN Type, Technology, Vertical, and Region through 2035

Tank Insulation Market Growth – Trends & Forecast 2024-2034

Storage as a Service Market Trends – Growth & Forecast 2020-2030

Storage Virtualization Market

LNG Tank Containers Market Size and Share Forecast Outlook 2025 to 2035

Oil Storage Market Size and Share Forecast Outlook 2025 to 2035

CNG Tanks Cylinders Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA