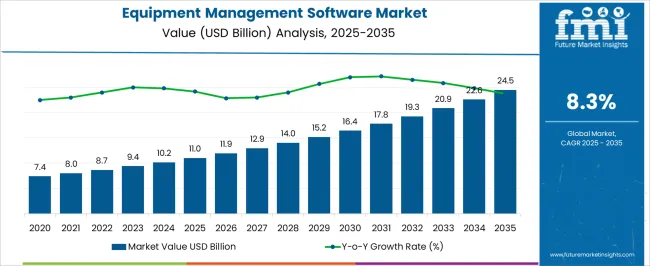

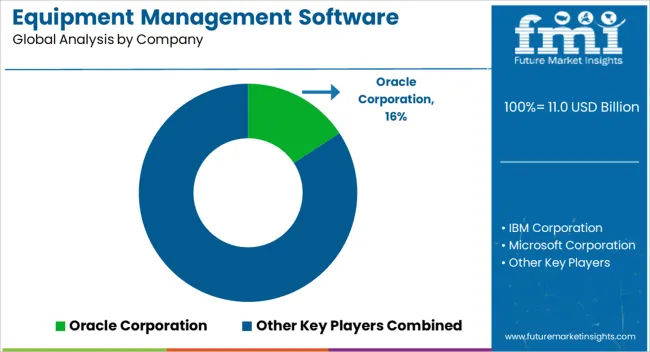

The equipment management software market is estimated to be valued at USD 11.0 billion in 2025 and is projected to reach USD 24.5 billion by 2035, registering a compound annual growth rate (CAGR) of 8.3% over the forecast period.

The market experiences rapid expansion driven by industrial digitalization initiatives, predictive maintenance adoption, and asset optimization strategies that reduce operational downtime while extending equipment lifecycles across manufacturing, construction, and utility operations. Facility managers implement comprehensive software platforms that integrate equipment tracking, maintenance scheduling, and performance monitoring capabilities within unified systems that provide real-time visibility into asset utilization and condition status. The technology's evolution toward cloud-based architectures enables remote monitoring capabilities and mobile workforce management that supports distributed operations and field service organizations.

Manufacturing facilities demonstrate increasing adoption of equipment management systems that coordinate preventive maintenance programs, spare parts inventory optimization, and regulatory compliance documentation across complex production environments containing thousands of critical assets. Plant maintenance teams utilize software platforms that automatically generate work orders, track technician activities, and analyze failure patterns to identify equipment reliability trends and optimization opportunities. Quality assurance protocols benefit from integrated documentation systems that maintain equipment calibration records, performance histories, and compliance audit trails necessary for regulated industries including pharmaceuticals, food processing, and aerospace manufacturing.

Construction industry applications create specialized market segments requiring mobile-compatible software solutions that track equipment location, utilization rates, and maintenance requirements across multiple job sites and equipment rental operations. Project managers utilize real-time equipment tracking capabilities that optimize asset allocation, reduce idle time, and prevent equipment conflicts that could delay project schedules. Fleet management integration enables comprehensive cost tracking including fuel consumption, operator productivity, and maintenance expenses that inform equipment purchasing and replacement decisions throughout project lifecycles.

Supply chain considerations impact software deployment strategies as organizations balance cloud-based solutions against on-premises installations based on data security requirements, internet connectivity reliability, and system integration complexity. Cybersecurity protocols become increasingly important as equipment management systems contain sensitive operational data and provide access to critical infrastructure control systems. Vendor relationships emphasize ongoing support capabilities including software updates, training programs, and technical assistance that ensure successful system implementation and user adoption across diverse organizational structures.

Mobile workforce enablement drives demand for software platforms that provide field technicians with real-time access to equipment manuals, maintenance procedures, and parts ordering capabilities through smartphone and tablet applications. Augmented reality integration enables remote expert assistance and visual maintenance guidance that improves first-time fix rates while reducing technician training requirements. Offline capability ensures field operations continue during network connectivity interruptions while synchronizing data when communications restore.

| Metric | Value |

|---|---|

| Equipment Management Software Market Estimated Value in (2025 E) | USD 11.0 billion |

| Equipment Management Software Market Forecast Value in (2035 F) | USD 24.5 billion |

| Forecast CAGR (2025 to 2035) | 8.3% |

The equipment management software market is experiencing robust growth as industries increasingly prioritize asset optimization, predictive maintenance, and compliance tracking. The transition from traditional spreadsheet-based tracking to intelligent, centralized platforms has been accelerated by the rise of IoT-enabled equipment monitoring and real-time data analytics.

Software providers are incorporating AI-driven predictive insights, automated scheduling, and digital twin capabilities to enhance decision-making and reduce downtime. Regulatory compliance and safety standards are further encouraging organizations to adopt software solutions that can streamline inspection workflows, generate audit-ready reports, and ensure preventive maintenance schedules are adhered to.

The growing preference for subscription-based SaaS models has lowered adoption barriers, making advanced solutions accessible to a broader range of enterprises As industries move toward digital-first operations, the market is expected to witness sustained adoption across manufacturing, construction, healthcare, and logistics, with future growth driven by integration with augmented reality tools, enhanced mobile accessibility, and interoperability with enterprise resource planning systems.

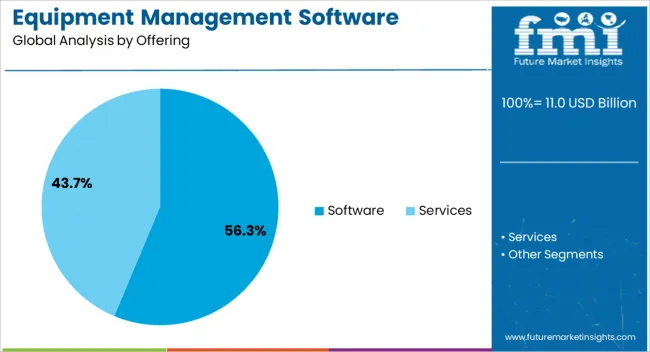

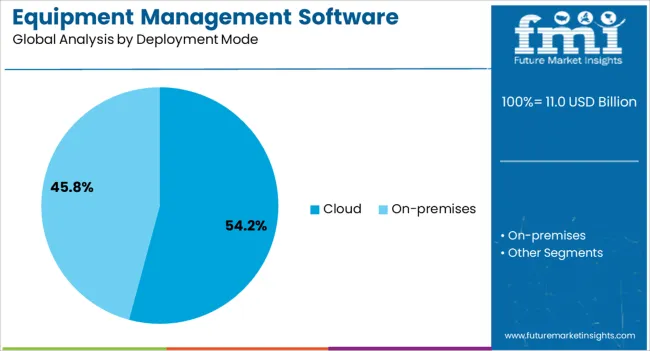

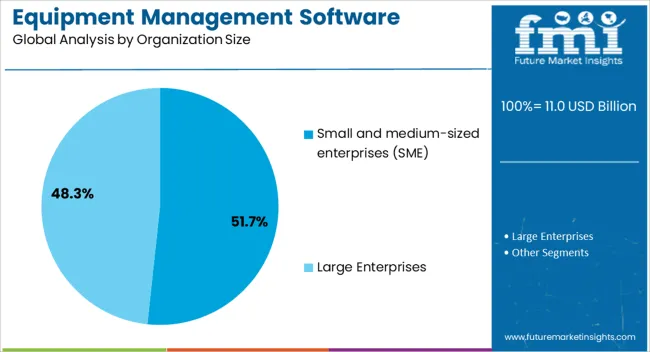

The equipment management software market is segmented by offering, deployment mode, organization size, industry vertical, and geographic regions. By offering, equipment management software market is divided into Software and Services. In terms of deployment mode, equipment management software market is classified into Cloud and On-premises. Based on organization size, equipment management software market is segmented into Small and medium-sized enterprises (SME) and Large Enterprises. By industry vertical, equipment management software market is segmented into Construction, Manufacturing, Healthcare, Oil & gas, Utilities, Transportation & logistics, and Others. Regionally, the equipment management software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software segment is projected to account for 56.3% of the total revenue share in the equipment management software market in 2025, reflecting its role as the core enabler of digital asset lifecycle management. This dominance has been supported by the shift toward automation, centralized data repositories, and AI-powered analytics that enhance decision-making processes. Software solutions provide a unified platform for equipment tracking, maintenance scheduling, and performance monitoring, significantly reducing manual errors and operational inefficiencies.

The ability to customize modules based on industry-specific needs has increased adoption in sectors ranging from construction to manufacturing. Seamless integration with IoT sensors, mobile applications, and enterprise systems has further enhanced the value proposition.

Additionally, regular feature enhancements through updates have enabled businesses to maintain technological relevance without extensive hardware investments The growing emphasis on remote operations and real-time reporting has reinforced software as the preferred offering for organizations seeking to maximize asset utilization and ensure compliance.

The cloud deployment mode segment is expected to hold 54.2% of the overall revenue share in the equipment management software market in 2025, driven by its scalability, flexibility, and cost-effectiveness. Organizations are increasingly opting for cloud-based platforms to enable anytime, anywhere access to critical asset data without the need for extensive on-premises infrastructure. The lower upfront capital expenditure, coupled with predictable subscription-based pricing, has made cloud solutions attractive for both large enterprises and SMEs.

Enhanced cybersecurity protocols, automated backups, and seamless integration with other cloud-native business tools have strengthened adoption. Cloud-based deployment also facilitates real-time collaboration among geographically dispersed teams, ensuring timely decision-making and operational continuity.

The ability to scale resources dynamically based on workload demands has further contributed to its market leadership As businesses continue to embrace hybrid work environments and digital transformation initiatives, cloud deployment is expected to remain the preferred choice for equipment management software implementation.

The small and medium-sized enterprises segment is projected to represent 51.7% of the total revenue share in the equipment management software market in 2025, underscoring the growing adoption among businesses seeking cost-efficient yet powerful solutions. SMEs are increasingly leveraging equipment management software to reduce downtime, extend asset lifespan, and improve operational transparency without incurring significant overhead costs.

The availability of cloud-based, subscription-driven models has removed traditional barriers to entry, enabling SMEs to access advanced features such as predictive maintenance, inventory tracking, and compliance management. The growing focus on digital transformation in smaller organizations has also fueled adoption, with mobile-enabled platforms allowing seamless management of assets in the field.

Integration capabilities with accounting, procurement, and ERP systems have further enhanced efficiency Additionally, competitive market dynamics have led vendors to offer flexible pricing and modular feature sets tailored to SME needs, solidifying this segment’s position as a key driver of overall market growth.

The equipment management software market is being shaped by adoption in asset-heavy industries, demand for predictive maintenance, cloud-based integration, and evolving competitive strategies. Together, these dynamics reinforce its long-term growth trajectory.

Equipment management software has become central in industries such as construction and manufacturing, where equipment downtime directly impacts project costs and delivery timelines. Companies are increasingly relying on digital solutions to track machine usage, fuel consumption, and maintenance schedules. The software helps streamline asset allocation and ensures that tools and machinery are utilized optimally across sites. Rising demand for large-scale infrastructure and manufacturing projects has intensified the need for accurate equipment monitoring to avoid unnecessary capital expenses. The software also assists contractors in managing rental assets, reducing disputes, and ensuring compliance with safety standards. These factors are positioning equipment management solutions as indispensable in improving operational efficiency.

Predictive maintenance has become one of the strongest drivers for equipment management software adoption. By leveraging real-time monitoring and scheduling systems, businesses can identify early warning signals and prevent unplanned equipment failures. This capability not only reduces downtime but also lowers maintenance expenses, which are a major cost factor in asset-heavy industries. Equipment management systems now allow automated reminders for servicing, calibration, and compliance checks, which minimizes risks in critical environments. Industries such as utilities, mining, and transport have been at the forefront of adoption, recognizing the cost savings and reliability gains. Predictive insights therefore remain a crucial growth driver for software providers

The integration of equipment management software with cloud and mobile platforms is transforming accessibility and collaboration. Field teams can now update data in real time, track assets across multiple locations, and ensure synchronization with central systems. Cloud deployment reduces upfront infrastructure costs and enables scalable solutions for small and large enterprises alike. Mobile accessibility also allows managers to monitor performance, track maintenance records, and approve equipment allocation on the go, which improves decision-making speed. This flexibility has encouraged adoption across global supply chains where assets are distributed across vast geographies. Integration with ERP and IoT solutions further enhances operational control and visibility.

The competitive landscape of equipment management software is characterized by strong innovation pipelines, frequent product upgrades, and expanding vendor portfolios. Established players are focusing on integrating analytics, real-time reporting, and compliance features to appeal to large enterprises. Meanwhile, smaller vendors are targeting niche applications such as rental fleet management or specific industrial segments. Partnerships between software providers and equipment manufacturers are creating bundled solutions, improving adoption rates across industries. Mergers and acquisitions are also driving consolidation in the market, as companies aim to expand their geographical reach and diversify capabilities. These dynamics are ensuring a steady pace of evolution in equipment management software.

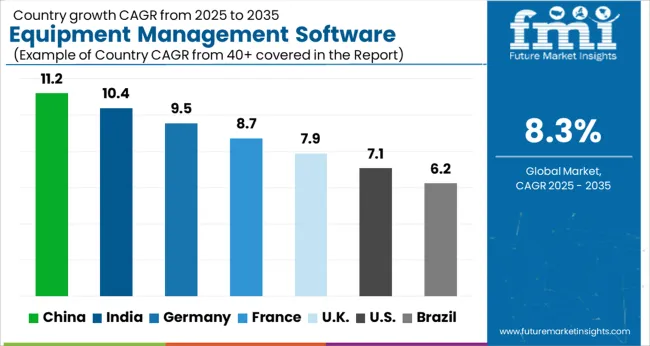

| Country | CAGR |

|---|---|

| China | 11.2% |

| India | 10.4% |

| Germany | 9.5% |

| France | 8.7% |

| UK | 7.9% |

| USA | 7.1% |

| Brazil | 6.2% |

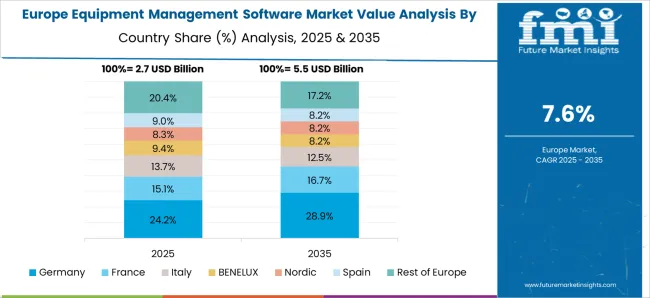

The equipment management software market is projected to grow globally at a CAGR of 8.3% from 2025 to 2035, supported by digital adoption, predictive maintenance demand, and cloud-based deployment models across industries. China leads with a CAGR of 11.2%, driven by large-scale infrastructure projects, manufacturing expansion, and strong investment in digital asset monitoring. India follows at 10.4%, supported by rising construction activities, growth in rental equipment markets, and government-backed digitization initiatives. France records 8.7% growth, benefiting from adoption in industrial manufacturing, logistics hubs, and compliance-focused asset management systems. The United Kingdom posts 7.9%, reflecting steady integration in construction, utilities, and transport projects with emphasis on cost control and efficiency. The United States achieves 7.1%, shaped by demand in manufacturing, mining, and large-scale infrastructure sectors, though its growth remains below global averages due to market maturity. The analysis spans over 40 countries, with these markets serving as key benchmarks for cloud adoption strategies, predictive maintenance integration, and competitive positioning in the global equipment management software industry.

China is projected to post a CAGR of 11.2% during 2025–2035, significantly above the global average of 8.3%. Between 2020–2024, CAGR stood close to 9.6%, reflecting steady adoption as construction, logistics, and large-scale manufacturing facilities began integrating digital monitoring tools. The uplift in the next decade is being driven by aggressive infrastructure spending, rapid cloud adoption, and expanding predictive maintenance integration in state-led industrial projects. Local vendors are expanding SaaS platforms tailored to domestic firms, while global players are collaborating with Chinese contractors to provide scalable asset management solutions. China is expected to remain the most influential growth anchor in global adoption.

India is expected to grow at a CAGR of 10.4% during 2025–2035, outperforming the global 8.3%. During 2020–2024, CAGR averaged around 8.7%, shaped by moderate adoption across construction contractors and early-stage digitization by equipment rental firms. The increase in the next decade is supported by government-backed digital initiatives, growing adoption of predictive analytics, and expansion of infrastructure projects. Local startups are collaborating with OEMs to provide industry-specific solutions, while international vendors are targeting large-scale enterprises with cloud-based offerings. India’s transition toward high-capacity industrial clusters and smart manufacturing parks will fuel consistent software demand in asset-heavy environments.

France is forecasted to record a CAGR of 8.7% during 2025–2035, just above the global 8.3% level. Between 2020–2024, CAGR was close to 7.5%, reflecting stable but selective adoption across industrial facilities, logistics hubs, and construction contractors. The improvement is tied to rising regulatory compliance requirements, adoption of cloud-based platforms in SMEs, and greater focus on predictive maintenance in automotive and aerospace industries. Local vendors are enhancing integration features for ERP systems, while global suppliers are leveraging partnerships with French manufacturers for end-to-end asset tracking. The market continues to benefit from Europe’s emphasis on operational efficiency and risk mitigation.

The United Kingdom is projected to post a CAGR of 7.9% during 2025–2035, below the global 8.3% pace yet higher than its earlier trajectory. During 2020–2024, CAGR was around 7.1%, reflecting limited investment in construction digitization and cautious adoption in industrial verticals. The rise in the coming decade is supported by upgrades in utilities, transportation projects, and wider adoption in aerospace and defense manufacturing. Vendors are focusing on cost-efficient subscription models, while predictive maintenance and integration with IoT-enabled sensors are becoming common. The UK market is expected to see consistent expansion through modernization of legacy systems and gradual uptake across asset-intensive sectors.

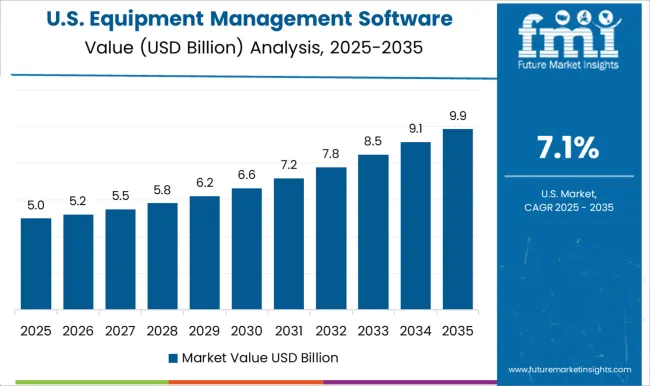

The United States is projected to grow at a CAGR of 7.1% during 2025–2035, trailing the global average of 8.3%. Between 2020–2024, CAGR stood near 6.6%, shaped by reliance on mature IT systems and steady replacement cycles rather than new adoption. The growth in the upcoming decade is fueled by rising demand from data centers, mining, and industrial manufacturing. Predictive maintenance integration is expanding, and adoption of cloud platforms is helping streamline equipment tracking across large geographies. However, higher operational costs and slower adoption in SMEs keep overall growth moderate compared to Asia.

The equipment management software market is driven by global enterprise technology leaders offering advanced platforms for asset lifecycle monitoring, predictive maintenance, and operational efficiency. Oracle Corporation leads with its integrated Enterprise Asset Management (EAM) solutions within the Oracle Cloud ERP ecosystem, delivering real-time visibility, cost tracking, and utilization analytics across diverse equipment portfolios. IBM Corporation provides its Maximo Application Suite, leveraging AI, IoT, and analytics for predictive maintenance, reliability engineering, and connected asset management in manufacturing, utilities, and infrastructure sectors. Microsoft Corporation integrates equipment management within Dynamics 365, enabling digital maintenance workflows, field service optimization, and real-time data synchronization across enterprise networks.

SAP SE delivers robust asset intelligence through its Asset Management suite, incorporating predictive analytics, compliance monitoring, and digital twin technology for industrial and enterprise-scale applications. Siemens AG strengthens its position with MindSphere and other industrial software tools that offer equipment connectivity, performance analytics, and maintenance optimization for energy, transportation, and manufacturing industries. IFS AB provides modular enterprise asset and service management solutions for complex, project-based industries such as aerospace, defense, and utilities, emphasizing mobility and end-to-end equipment lifecycle visibility.

Infor offers a flexible EAM platform widely adopted across manufacturing, healthcare, and government sectors, focusing on cost control and operational uptime. Accruent LLC specializes in asset and facility lifecycle management software for telecom, education, and retail organizations, emphasizing regulatory compliance and workflow automation. Trimble Inc. contributes with asset monitoring and tracking solutions for construction and fleet-based operations, integrating GPS and IoT capabilities. Cisco Systems Inc. supports this ecosystem through IoT-enabled connectivity and cybersecurity solutions that ensure secure, real-time equipment data transmission.

| Item | Value |

|---|---|

| Quantitative Units | USD 11 Billion |

| Offering | Software and Services |

| Deployment Mode | Cloud and On-premises |

| Organization Size | Small and medium-sized enterprises (SME) and Large Enterprises |

| Industry Vertical | Construction, Manufacturing, Healthcare, Oil & gas, Utilities, Transportation & logistics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled |

Oracle Corporation, IBM Corporation, Microsoft Corporation, SAP SE, Siemens AG, IFS AB, Infor, Accruent LLC, Trimble Inc., and Cisco Systems Inc. |

| Additional Attributes | Dollar sales, share, CAGR, adoption across construction and manufacturing, SaaS vs on-premise trends, predictive maintenance demand, regional opportunities, pricing benchmarks, competitor positioning, integration with IoT and ERP. |

The global equipment management software market is estimated to be valued at USD 11.0 billion in 2025.

The market size for the equipment management software market is projected to reach USD 24.5 billion by 2035.

The equipment management software market is expected to grow at a 8.3% CAGR between 2025 and 2035.

The key product types in equipment management software market are software, _asset tracking, _maintenance management, _inventory management, _calibration management, _inspection management, services, _consulting, _implementation & integration and _support & maintenance.

In terms of deployment mode, cloud segment to command 54.2% share in the equipment management software market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Software License Management (SLM) Market Size and Share Forecast Outlook 2025 to 2035

Fuel Management Software Market Size and Share Forecast Outlook 2025 to 2035

Case Management Software (CMS) Market Size and Share Forecast Outlook 2025 to 2035

Farm Management Software Market Size and Share Forecast Outlook 2025 to 2035

Exam Management Software Market

Quote Management Software Market Size and Share Forecast Outlook 2025 to 2035

Trade Management Software Market Size and Share Forecast Outlook (2025 to 2035)

Event Management Software Market Analysis - Size, Share, and Forecast 2025 to 2035

Grant Management Software Market - Trends, Size & Forecast 2025 to 2035

Video Management Software Market

Server Management Software Market Size and Share Forecast Outlook 2025 to 2035

Skills Management Software Market Size and Share Forecast Outlook 2025 to 2035

Change Management Software Market Size and Share Forecast Outlook 2025 to 2035

SBOM Management and Software Supply Chain Compliance Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Church Management Software Market Size and Share Forecast Outlook 2025 to 2035

Cattle Management Software Market Size and Share Forecast Outlook 2025 to 2035

Output Management Software Market Insights – Growth & Forecast through 2035

Travel Management Software Market

Talent Management Software Market Report – Trends & Forecast 2023-2033

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA