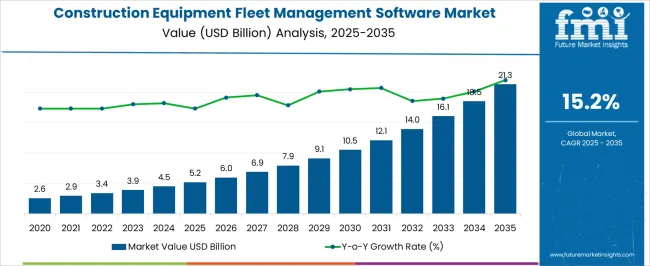

The construction equipment fleet management software market is estimated to be valued at USD 5.2 billion in 2025 and is projected to reach USD 21.3 billion by 2035, registering a compound annual growth rate (CAGR) of 15.2% over the forecast period. Investment in cloud infrastructure, data storage, and real-time analytics constitutes a significant portion of capital allocation, while expenditures on cybersecurity, user interface design, and integration with construction machinery drive incremental operational costs. As the market scales toward USD 10.5 billion by 2030, recurring revenue from subscription-based models and maintenance contracts becomes a central component of the value chain.

Companies increasingly invest in AI-powered predictive analytics, IoT sensor integration, and mobile platform compatibility, which enhance fleet monitoring efficiency and improve operational transparency. Third-party service providers contribute to deployment, training, and support, representing a substantial cost in overall project budgets. By 2035, as the market reaches USD 21.3 billion, revenue diversification across cloud services, analytics modules, and fleet optimization consulting is projected to redefine the cost structure. Margins are expected to improve due to economies of scale, automation of monitoring services, and reduced per-unit software deployment costs. The evolving value chain emphasizes end-to-end fleet management, combining hardware integration, software intelligence, and service support to maximize efficiency and return on investment.

| Metric | Value |

|---|---|

| Construction Equipment Fleet Management Software Market Estimated Value in (2025 E) | USD 5.2 billion |

| Construction Equipment Fleet Management Software Market Forecast Value in (2035 F) | USD 21.3 billion |

| Forecast CAGR (2025 to 2035) | 15.2% |

The construction equipment fleet management software market represents a specialized segment of digital construction technologies, supporting efficiency, cost control, and asset tracking. Within the broader construction software solutions industry, it accounts for nearly 3.8%, underlining its role in enhancing equipment utilization. In the telematics and fleet management sector, it holds about 4.5%, driven by demand for predictive maintenance and real-time monitoring.

Across the heavy machinery management space, it contributes around 3.2%, where contractors prioritize lifecycle optimization. In the digital asset management market, its share stands close to 2.9%, supported by integration with cloud-based platforms. Within the overall construction technology ecosystem, it secures nearly 2.6%, reflecting the shift toward data-driven decision-making in large-scale projects. Recent developments in this market highlight advances in telematics, cloud connectivity, and automation-driven insights. Software providers are focusing on AI-powered predictive analytics to reduce downtime and extend machine life. Integration with IoT sensors is enabling real-time tracking of performance metrics such as fuel consumption, idle time, and operator efficiency. Mobile application compatibility has improved, allowing contractors and project managers to access dashboards remotely. Partnerships between software developers and OEMs are increasing, ensuring seamless hardware-software integration. Sustainability trends are shaping solutions, with carbon emission monitoring features being introduced. The machine learning algorithms are enhancing forecasting models, helping companies optimize equipment allocation across multiple job sites.

The construction equipment fleet management software market is experiencing steady growth due to the increasing need for operational efficiency, cost control, and predictive maintenance across large-scale construction operations. Rising labor costs, tight project timelines, and the growing complexity of equipment logistics are pushing contractors and construction firms to adopt advanced digital fleet management solutions. These platforms enable real-time tracking, remote diagnostics, and data-driven decision-making, thereby reducing downtime and improving asset utilization.

The growing trend of digitization in construction, coupled with the integration of telematics and IoT-based systems, is expanding the scope and capabilities of fleet management platforms. Regulatory requirements related to emissions, safety compliance, and asset tracking are further contributing to market expansion.

As construction companies continue to scale operations across multiple geographies, centralized software tools are gaining favor for streamlining logistics, reducing fuel consumption, and improving workforce coordination. With rapid infrastructure development in emerging economies and increasing investment in automation, the demand for intelligent, software-driven fleet management tools is expected to remain strong in the years ahead.

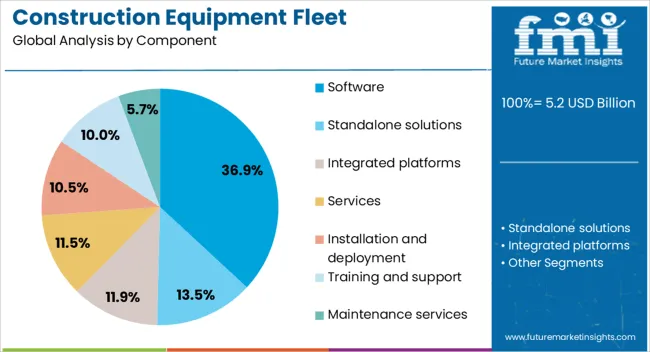

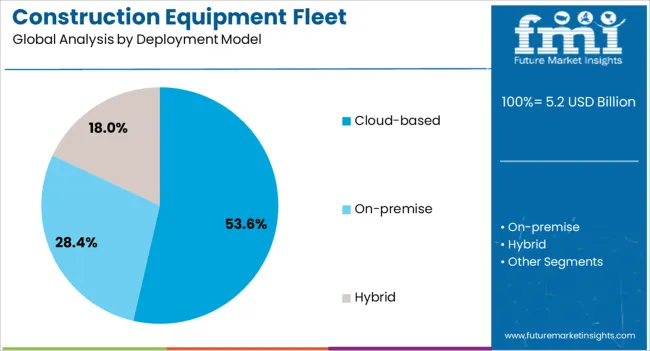

The construction equipment fleet management software market is segmented by component, deployment model, functionality, end user, and geographic regions. By component, construction equipment fleet management software market is divided into Software, Standalone solutions, Integrated platforms, Services, Installation and deployment, Training and support, and Maintenance services. In terms of deployment model, construction equipment fleet management software market is classified into Cloud-based, On-premise, and Hybrid. Based on functionality, construction equipment fleet management software market is segmented into Equipment tracking and monitoring, Maintenance and repair management, Fuel management, Compliance management, and Performance analysis and reporting. By functionality, construction equipment fleet management software market is segmented into Equipment tracking and monitoring, Maintenance and repair management, Fuel management, Compliance management, and Performance analysis and reporting. By end user, construction equipment fleet management software market is segmented into Construction contractors, Equipment rental companies, and Infrastructure development firms. Regionally, the construction equipment fleet management software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software component segment is projected to hold 36.9% of the construction equipment fleet management software market revenue share in 2025, making it the leading component. This dominance is being driven by the central role software plays in enabling core functionalities such as real-time tracking, asset performance analysis, predictive maintenance scheduling, and compliance reporting. Construction firms are increasingly investing in digital solutions to manage growing equipment inventories and optimize fleet operations across diverse project sites.

Software platforms offer configurable dashboards, automated alerts, and integration with GPS, fuel sensors, and engine diagnostics, which enhance operational visibility and control. The ability to generate actionable insights from historical and real-time data enables faster decision-making and minimizes equipment downtime.

Vendors are also offering modular platforms that allow construction firms to scale capabilities as operational needs evolve. As the industry moves toward digital-first operations, the reliance on software as the backbone of fleet intelligence is expected to intensify, reinforcing the segment’s leadership in the market.

The cloud-based deployment model segment is expected to account for 53.6% of the construction equipment fleet management software market revenue share in 2025, establishing it as the leading deployment model. This dominance is attributed to the flexibility, scalability, and cost-efficiency offered by cloud-based platforms, which are increasingly preferred by both large and mid-sized construction firms. These solutions eliminate the need for on-premise infrastructure, allowing for faster implementation and easier access across geographically dispersed job sites.

Cloud-based platforms enable real-time data synchronization, mobile accessibility, and remote updates, supporting seamless coordination across operations. Additionally, enhanced data security protocols, automated backups, and vendor-managed updates are reducing IT overhead and improving reliability.

Construction companies are recognizing the value of cloud systems in managing multi-location fleets and responding quickly to field conditions. As demand grows for always-connected, scalable, and collaborative software environments, the cloud-based model is expected to maintain its lead, driven by widespread adoption and continuous vendor innovation.

The equipment tracking and monitoring functionality segment is anticipated to capture 29.6% of the construction equipment fleet management software market revenue share in 2025, positioning it as the leading functionality. Its dominance is being driven by the critical need to monitor equipment usage, location, engine hours, and performance metrics in real time to improve productivity and reduce losses from theft or misuse. This functionality is essential for maintaining control over costly assets, especially in large-scale or multi-site construction operations.

The ability to receive live updates on idle time, fuel consumption, maintenance needs, and geofence breaches enhances both operational efficiency and cost savings. Construction firms are increasingly deploying GPS-based solutions and IoT-enabled sensors that transmit data to centralized software platforms for actionable insights.

As competitive pressure mounts to reduce project delays and operating expenses, the value of real-time equipment visibility and control is becoming a core component of modern fleet management strategies. The continued focus on data-driven operations and return on investment is expected to keep this functionality at the forefront of market demand.

The market is driven by the increasing demand for real-time monitoring and digitalization in heavy equipment operations. Contractors and rental companies are prioritizing cost efficiency, asset utilization, and operational transparency, which enhances reliance on advanced fleet management platforms. These solutions offer data-driven insights to optimize equipment scheduling, fuel consumption, predictive maintenance, and regulatory compliance. Integration with telematics and IoT devices has further strengthened functionality, enabling accurate tracking and automated reporting. Market growth is reinforced by rising infrastructure investments worldwide, which generate the need for effective equipment allocation and downtime reduction.

Telematics integration is a major driver for fleet management software in construction equipment operations. Through GPS tracking, sensor monitoring, and telematics units, real-time information is gathered on equipment performance, fuel usage, and location data. This data is analyzed using advanced software platforms to improve operational efficiency and extend equipment life cycles. Predictive maintenance powered by analytics helps reduce unexpected breakdowns, lowering repair costs and downtime. Contractors gain visibility into fleet operations, ensuring that resources are utilized effectively across different projects. Data-driven decision-making, supported by telematics-enabled software, has become a standard requirement for companies seeking to stay competitive. The emphasis on analytics-driven fleet optimization continues to push adoption globally, particularly in large-scale infrastructure projects.

Construction companies increasingly focus on reducing ownership and operational costs for heavy machinery, making fleet management software crucial for long-term profitability. Preventive and predictive maintenance functions enable proactive scheduling, reducing repair expenses and extending equipment service life. Fuel management tools integrated into software platforms help monitor consumption patterns and detect inefficiencies, allowing savings in large fleets. Cost control is further supported by detailed reporting and insights into idle time, operator efficiency, and asset allocation. By reducing unnecessary downtime and unplanned repairs, businesses achieve consistent productivity gains. The shift toward software-based fleet optimization is reinforced by contractors seeking to protect margins in competitive infrastructure and construction markets, making maintenance-focused digital solutions essential.

The adoption of cloud-based fleet management software solutions has grown as construction companies require scalability, remote access, and integration with existing IT systems. Mobile applications provide field operators and managers with instant access to fleet data, enabling real-time decision-making at project sites. Cloud platforms lower upfront investment costs, making them accessible to small and mid-sized businesses in the construction industry. Updates and security features are seamlessly deployed, ensuring compliance with data protection standards. Mobile-based functionalities such as instant alerts, digital logs, and operator scheduling enhance productivity on construction sites. The ease of cloud and mobile deployment supports broader adoption globally, as businesses seek flexible and cost-effective solutions tailored to their operational needs.

Regional growth patterns reflect differences in construction activity and digital adoption rates. North America and Europe lead with early adoption of advanced telematics-enabled fleet solutions, driven by regulatory standards and emphasis on cost efficiency. Asia Pacific shows rapid expansion due to ongoing urban infrastructure projects and increasing awareness of fleet digitalization benefits. Market competition is characterized by technology partnerships, software customization, and integration with OEM systems. Companies are investing in artificial intelligence and machine learning to enhance predictive capabilities. Customer support and aftersales services also play a critical role in vendor differentiation. With continuous infrastructure development and rising pressure on equipment productivity, the market is expected to evolve with stronger regional adoption and technological innovation.

| Country | CAGR |

|---|---|

| China | 20.5% |

| India | 19.0% |

| Germany | 17.5% |

| France | 16.0% |

| UK | 14.4% |

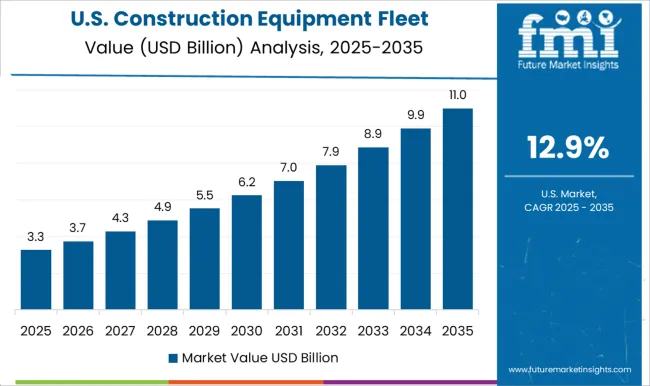

| USA | 12.9% |

| Brazil | 11.4% |

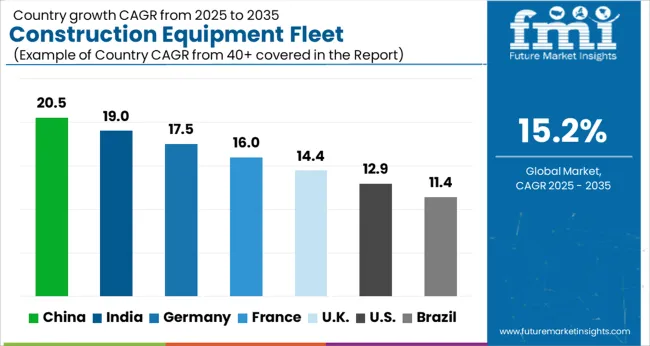

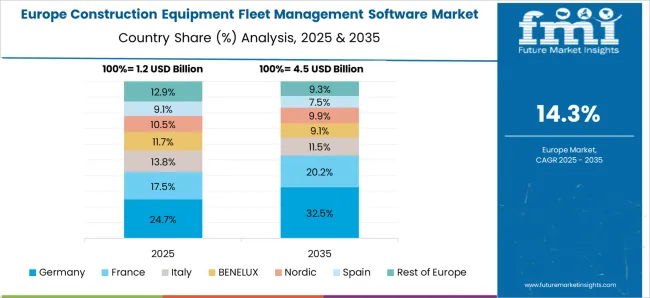

The market is forecast to register a CAGR of 15.2% from 2025 to 2035. India stood at 19.0%, supported by the adoption of digital fleet optimization tools and telematics in large-scale infrastructure projects. China led the market at 20.5%, driven by rapid construction activities and demand for predictive maintenance systems. Germany recorded 17.5%, where integration of IoT solutions has strengthened fleet tracking and utilization. The United Kingdom posted 14.4%, reflecting increased investment in cloud-based platforms for construction equipment monitoring. The United States accounted for 12.9%, where enhanced safety compliance and productivity tracking have reinforced adoption. These markets are advancing through deployment, scaling, and innovation in fleet management technologies. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is anticipated to grow at a CAGR of 20.5%, supported by rapid digitalization of construction operations and integration of telematics in heavy machinery. Government-backed infrastructure projects, smart city initiatives, and large-scale road and rail developments are driving software adoption. Domestic software providers are focusing on analytics-driven solutions, while international players are partnering with equipment manufacturers to enhance fleet performance. The push for reducing downtime and improving machine utilization has accelerated demand across public and private construction firms.

India is expected to record a CAGR of 19.0%, driven by ongoing infrastructure expansion, metro rail projects, and increasing mechanization in construction. Contractors and equipment rental companies are shifting toward centralized fleet monitoring to reduce operational costs. Cloud-based solutions are gaining prominence, enabling small and mid-sized enterprises to access advanced features at affordable rates. Compliance requirements on emissions and safety standards also strengthen the role of fleet monitoring software in project efficiency.

Germany, projected to grow at a CAGR of 17.5%, showcases strong adoption due to emphasis on precision, efficiency, and regulatory compliance in construction projects. German contractors prioritize advanced analytics, automated reporting, and integration with enterprise resource planning systems. Sustainability-driven regulations are encouraging digital solutions that reduce idle time and fuel usage. Established technology players are collaborating with machinery manufacturers to create highly customized fleet solutions.

The United Kingdom is forecast to expand at a CAGR of 14.4%, influenced by urban redevelopment, housing projects, and government-funded infrastructure upgrades. Adoption is shaped by rising emphasis on cost control, compliance, and sustainability. Fleet management platforms are being used to track equipment health, improve scheduling, and ensure compliance with evolving environmental standards. Cloud-driven solutions and mobile accessibility are becoming increasingly vital for mid-tier construction firms.

The United States, growing at a CAGR of 12.9%, benefits from strong demand in large-scale infrastructure, mining, and commercial projects. Rising focus on predictive maintenance, compliance reporting, and downtime reduction has enhanced the role of fleet software. Contractors emphasize real-time monitoring to optimize utilization of expensive machinery. Domestic software vendors are prioritizing integration with telematics hardware and cloud solutions, while partnerships with OEMs ensure seamless adoption across equipment categories.

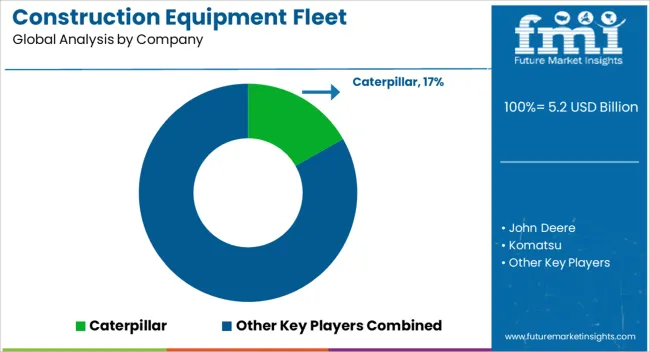

The market is highly competitive, dominated by a blend of global construction equipment manufacturers and specialized software providers, each focusing on operational efficiency, safety, and connectivity. Caterpillar, John Deere, Komatsu, Hitachi Construction Machinery, and Volvo Construction Equipment leverage their heavy equipment expertise and telematics integration capabilities, offering proprietary fleet management solutions tightly coupled with their machinery. These OEM-linked platforms benefit from seamless hardware-software interoperability, predictive maintenance features, and real-time performance analytics, making them preferred choices for large-scale construction operations. Software-focused companies such as Trimble, Topcon Positioning Systems, Teletrac Navman, Samsara, and Zebra Technologies emphasize versatility, cloud-based monitoring, and cross-brand fleet compatibility. These providers differentiate themselves through advanced analytics, GPS tracking, fuel consumption optimization, and IoT-enabled reporting systems, enabling construction firms to manage heterogeneous fleets efficiently.

Trimble and Topcon also integrate positioning and geospatial technologies, enhancing project planning and asset utilization insights. Competitive strategies across the market focus on automation, predictive maintenance, and cost reduction. OEMs aim to strengthen customer loyalty through equipment-software ecosystems, while independent providers prioritize interoperability and advanced data analytics. Increasing adoption of telematics, AI-driven decision-making, and regulatory compliance solutions is expected to drive differentiation, encouraging vendors to continuously enhance platform capabilities to capture market share in an increasingly digital construction landscape.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.2 Billion |

| Component | Software, Standalone solutions, Integrated platforms, Services, Installation and deployment, Training and support, and Maintenance services |

| Deployment Model | Cloud-based, On-premise, and Hybrid |

| Functionality | Equipment tracking and monitoring, Maintenance and repair management, Fuel management, Compliance management, and Performance analysis and reporting |

| Functionality | Equipment tracking and monitoring, Maintenance and repair management, Fuel management, Compliance management, and Performance analysis and reporting |

| End User | Construction contractors, Equipment rental companies, and Infrastructure development firms |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar, John Deere, Komatsu, Trimble, Hitachi Construction Machinery, Volvo Construction Equipment, Samsara, Topcon Positioning Systems, Teletrac Navman, and Zebra Technologies |

| Additional Attributes | Dollar sales by software type and application, demand dynamics across construction, mining, and infrastructure projects, regional trends in digital fleet management adoption, innovation in telematics, predictive maintenance, and cloud integration, environmental impact of fuel optimization and reduced equipment downtime, and emerging use cases in real-time tracking, cost control, and automated compliance management. |

The global construction equipment fleet management software market is estimated to be valued at USD 5.2 billion in 2025.

The market size for the construction equipment fleet management software market is projected to reach USD 21.3 billion by 2035.

The construction equipment fleet management software market is expected to grow at a 15.2% CAGR between 2025 and 2035.

The key product types in construction equipment fleet management software market are software, standalone solutions, integrated platforms, services, installation and deployment, training and support and maintenance services.

In terms of deployment model, cloud-based segment to command 53.6% share in the construction equipment fleet management software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Construction Films Market Size and Share Forecast Outlook 2025 to 2035

Construction Flooring Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Construction Sealants Market Size and Share Forecast Outlook 2025 to 2035

Construction Bots Market Analysis Size and Share Forecast Outlook 2025 to 2035

Construction Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA