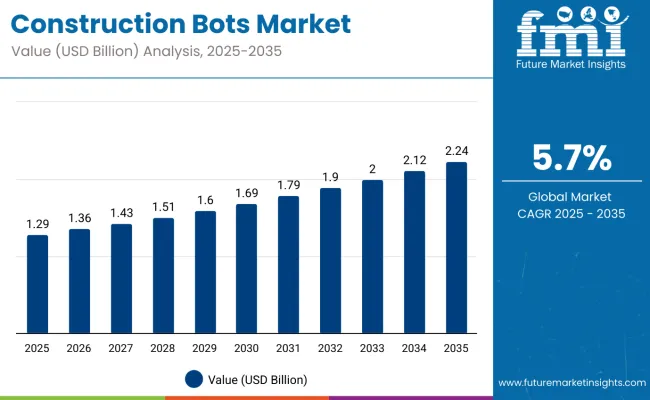

The global construction bots market is projected to be valued at USD 1.29 billion in 2025 and is forecast to reach approximately USD 2.24 billion by 2035. This reflects an absolute increase of USD 950 million, representing a 73.6% growth in value over the forecast period. The market is expected to expand at a compound annual growth rate (CAGR) of 5.7%, with overall market size projected to grow by nearly 1.74X by the end of the decade.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.29 billion |

| Industry Size (2035F) | USD 2.24 billion |

| CAGR (2025-2035) | 5.7% |

Between 2025 and 2030, the construction bots market is projected to grow from USD 1.29 billion to USD 1.69 billion, recording a value addition of USD 0.40 billion. This phase is expected to be driven by early-stage adoption of autonomous and semi-autonomous robots for bricklaying, site inspection, demolition, and 3D printing.

High labor shortages in developed economies and rising infrastructure investment in emerging markets are prompting contractors to explore robotics for repetitive, hazardous, and precision-driven tasks. Pilot programs and government-backed innovation hubs are reinforcing R&D around construction automation, while hardware costs continue to decline across robotic arms, sensors, and AI vision systems.

From 2030 to 2035, the market is expected to increase from USD 1.69 billion to USD 2.24 billion, adding another USD 0.55 billion in value. Growth during this phase is projected to be led by broader deployment of mobile bots for site logistics, drone-based surveillance, and collaborative robotic systems (cobots) on large-scale urban and industrial projects.

Integration with digital twin platforms, cloud-based fleet management, and predictive maintenance frameworks will become common. Regulatory frameworks for autonomous operations in construction zones are also expected to mature, enabling greater investment by large EPCs and government infrastructure programs in robotic construction technologies.

Between 2020 and 2025, the construction bots market expanded from USD 1.01 billion to USD 1.29 billion, supported by rising experimentation with automation in labor-intensive tasks such as concrete pouring, rebar tying, and structural assembly. Growth during this period was influenced by increasing interest from construction firms in mitigating workforce shortages, improving on-site safety.

Market development was largely concentrated in high-income countries such as the United States, Japan, and parts of Western Europe, where cost pressures and stringent safety regulations prompted the adoption of early robotic systems. Collaborative robots for repetitive assembly tasks and remote-controlled bots for inspection and demolition gained traction in both new construction and renovation projects. Partnerships between robotics startups and construction equipment OEMs further accelerated technological development, while modular design and AI integration began to reshape expectations around autonomous jobsite operations.

The growth of the construction bots market is being propelled by a convergence of labor shortages, rising safety compliance needs, and a shift toward digitized project execution. Globally, the construction industry continues to face skilled labor constraints, particularly in tasks that are repetitive, hazardous, or require high precision. This has accelerated demand for automated systems that can operate consistently and reduce jobsite accidents.

Investments in smart infrastructure, high-rise urban developments, and greenfield industrial zones are also driving adoption of bots that support faster build cycles and reduce manual errors. Use cases such as robotic bricklaying, autonomous earthmoving, and 3D-printed structures are moving from pilot to commercial deployment, especially in high-cost regions.

The rise of Industry 4.0 in construction, including the integration of AI, machine learning, and digital twin platforms, is enabling advanced data-driven operations for construction bots. Government support through funding initiatives, robotics testbeds, and regulatory sandboxes is further catalyzing R&D and deployment at scale. As the industry embraces automation to meet future productivity targets, construction bots are expected to play a central role in reshaping site operations, project management, and lifecycle maintenance.

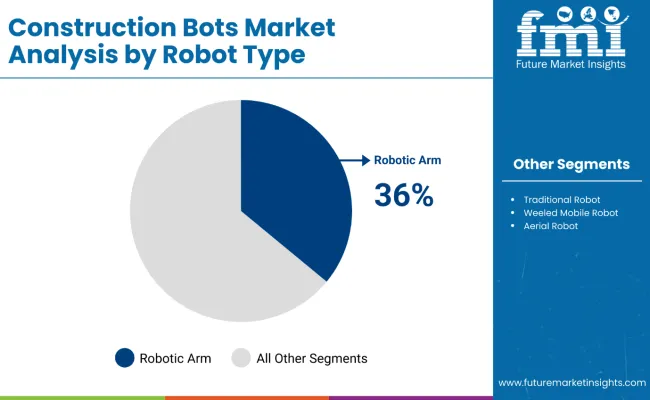

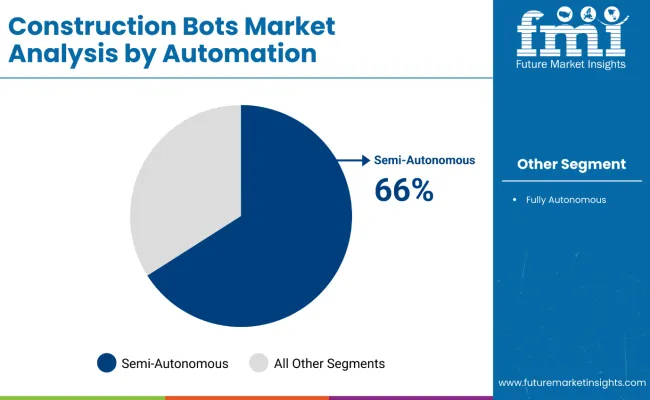

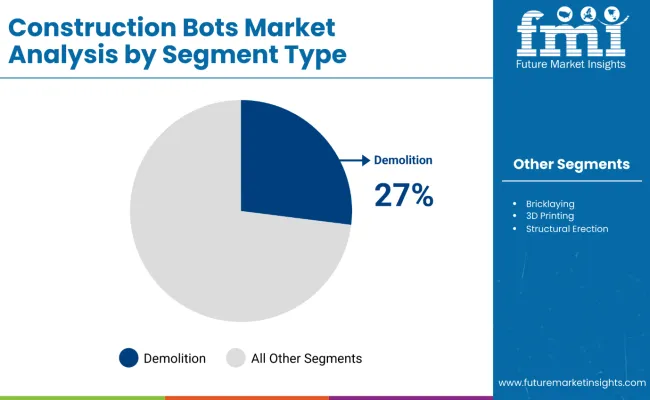

The market is segmented by robot type into traditional robots, robotic arms, wheeled mobile robots, and aerial robots, each suited to different construction tasks based on mobility and functional precision. Automation levels include fully autonomous and semi-autonomous bots, offering varying degrees of control and decision-making capabilities. By segment type, construction bots are used in demolition, bricklaying, 3D printing, structural erection, and installations, reflecting their diverse utility across stages of construction.

Applications span commercial and residential projects, public infrastructure, and other specialized use cases, allowing for adaptation in both private-sector development and large-scale government initiatives. Regional demand is analyzed across North America, Latin America, Europe, East Asia, South Asia & Pacific, and the Middle East & Africa to track adoption patterns and investment trends.

Robotic arms are estimated to contribute 36% of the global construction bots market in 2025, supported by a forecast CAGR of 7.9% from 2025 to 2035. Their popularity has been shaped by widespread integration into tasks requiring precision and repeatability, including welding, bricklaying, and material handling. Their modularity and compatibility with on-site control systems have allowed operators to scale productivity without compromising safety.

Adoption has been accelerated by advancements in torque control, reach flexibility, and the ability to operate in confined spaces. These features have made robotic arms a cost-effective replacement for repetitive manual labor in high-volume urban residential and infrastructure development projects.

Semi-autonomous bots are projected to account for 66% of the market in 2025, with growth estimated at a CAGR of 6.8% through 2035. These systems have been favored due to their operational flexibility, allowing human oversight in complex environments while automating high-risk or labor-intensive tasks. Their use has become prevalent in applications where human-in-the-loop systems are required for navigation or real-time decision-making, particularly during demolition, drilling, or uneven terrain operations. Equipment suppliers have emphasized modular upgrades to enhance autonomy levels, helping contractors gradually adopt automation without full replacement of existing workflows. This trend has reinforced semi-autonomous systems as a transitional and scalable choice for varied construction settings.

Demolition applications are anticipated to contribute 27% of the market by 2025, expanding at a CAGR of 7.2% through 2035. The segment’s leadership stems from the high safety risk and labor intensity involved in building teardown, surface stripping, and controlled deconstruction. Robotic systems have increasingly been employed to minimize manual intervention in hazardous areas while improving dust control and efficiency. Equipment manufacturers have introduced compact, remote-controlled bots capable of operating in confined demolition zones, including high-rise interiors and structurally unstable sites. Increased adoption in urban redevelopment and brownfield regeneration projects has further reinforced demand for robotic demolition units.

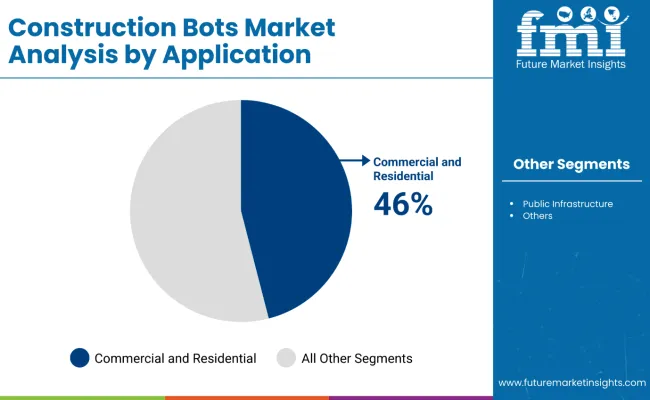

The commercial and residential construction segment is projected to hold 46% of market share in 2025, growing at a CAGR of 6.5% through 2035. The rise in mixed-use buildings, high-density housing, and large-scale urban infrastructure has driven demand for construction automation. Robotics are being integrated into foundation work, façade assembly, concrete pouring, and modular wall placement to reduce project timelines and improve safety.

Developers and contractors have increasingly prioritized automated systems in design-build workflows to meet productivity targets in competitive real estate markets. Cost savings from reduced labor dependency and enhanced precision continue to justify investment in robotic technologies across building construction.

The construction bots market is advancing steadily, driven by ongoing labor shortages, rising demand for consistent build quality, and growing interest in jobsite automation. Adoption remains somewhat constrained by high upfront costs, inconsistent regulatory environments, and the complexity of integrating bots into traditional construction workflows. Technological maturity, safety validation, and return-on-investment clarity continue to shape procurement decisions across regions.

Labor Shortages and Safety Mandates Accelerate Robotic Adoption

The shortage of skilled construction workers is one of the most pressing issues globally, particularly in high-income markets. Construction bots offer a viable solution by automating repetitive, labor-intensive, and high-risk tasks. Demolition bots, rebar tying robots, and robotic arms for tiling and bricklaying are being deployed to reduce worker fatigue and jobsite injuries. Increasing emphasis on worker safety and compliance with OSHA and EU construction regulations is also prompting adoption of bots in tasks involving height, dust exposure, and repetitive strain risks.

Digital Construction Ecosystems Fuel Integrated Bot Deployment

The integration of robotics with BIM (Building Information Modeling), digital twin platforms, and IoT-based project tracking systems is enabling more precise, real-time coordination of tasks. This synergy allows bots to be scheduled alongside human labor, tools, and materials for optimized workflows. Companies are increasingly investing in modular robotic platforms that can switch tools or roles based on project stage, reducing operational downtime and improving ROI. The rise of construction robotics-as-a-service (RaaS) models is also lowering entry barriers for small and mid-size contractors.

| Countries | 2025 |

|---|---|

| Germany | 27% |

| France | 16% |

| UK | 18% |

| Italy | 9% |

| Spain | 8% |

| BENELUX | 7% |

| Russia | 4% |

| Rest of Europe | 11% |

| Countries | 2035 |

|---|---|

| Germany | 25% |

| France | 17% |

| UK | 17% |

| Italy | 10% |

| Spain | 8% |

| BENELUX | 9% |

| Russia | 3% |

| Rest of Europe | 11% |

The construction bots market in Europe is projected to grow from USD 257.7 million in 2025 to USD 506.9 million by 2035, recording a CAGR of 7.0% over the forecast period. While Germany continues to lead the regional landscape, several other countries are gaining share due to focused investments in automation, urban infrastructure modernization, and government-backed robotics programs.

Germany’s share is expected to decline slightly from 27% to 25% by 2035, as more countries expand their deployment of bots beyond pilot initiatives. France’s market share is projected to rise from 16% to 17%, supported by large-scale infrastructure projects and integration of robotics in public housing schemes. The UK maintains a strong position with 18% in 2025, declining modestly to 17% as competition intensifies.

Italy is expected to grow its share from 9% to 10% by focusing on automation in heritage restoration and seismic retrofit programs. BENELUX countries are forecast to see significant gains, rising from 7% to 9%, owing to smart city initiatives and public-private partnerships. Spain remains steady at 8%, while Russia’s share contracts from 4% to 3% due to slower innovation cycles and regulatory headwinds.

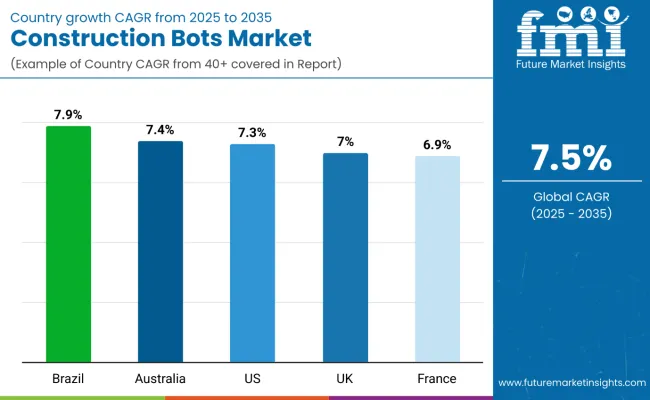

The Brazilian construction bots market is projected to expand the fastest among major economies. Strong public infrastructure push, smart city projects in São Paulo and Rio de Janeiro, and growing automation in highway and commercial construction are accelerating adoption. Labor shortages and high injury rates are prompting demand for robotic bricklayers, concrete drones, and 3D printing bots.

Australia continues to adopt bots for high-rise structures and remote-area projects where labor is costlier. The country's relatively small but technologically advanced construction sector is leveraging autonomous demolition, inspection, and welding bots. Government funding supports AI-based site automation.

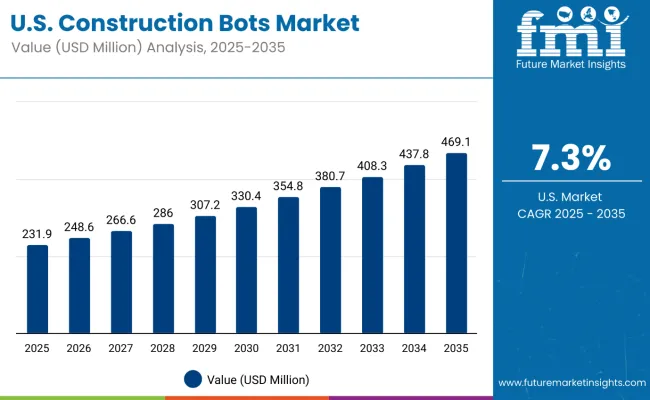

Construction bots in the USA are gaining ground in commercial and industrial real estate projects. Robotics are being deployed for drywall installation, rebar tying, and interior painting. Adoption is driven by union labor shortages, cost overruns, and higher client demand for sustainable construction timelines.

In the UK, the construction bots market is shaped by retrofit demand and productivity improvement mandates. Robotics is being adopted in housing schemes, tunnel projects, and airport expansions. Workforce aging and Brexit-related labor constraints are increasing automation appeal.

France is seeing stable growth in construction bot usage across public housing, road maintenance, and industrial upgrades. The government’s climate goals are driving investment in precision-built infrastructure, supported by robotic welding and concrete laying systems.

Robotic arms account for the largest share (40%) of construction bots in Japan, driven by demand for precise, repetitive tasks in high-rise and modular housing projects. These systems are being adopted for welding, tiling, and material handling in urban builds. Wheeled mobile robots hold 30% share and are used for site inspection, debris clearing, and last-mile delivery of materials within constrained spaces. Traditional robots contribute 20%, largely in factory-based prefabrication units, while aerial robots, holding a 10% share, are employed for structural surveys and real-time visual documentation in infrastructure projects.

Half of South Korea’s construction bot deployments are concentrated in commercial and residential projects, where automation supports reduced cycle times and improved safety. Robotic systems are being utilized in high-rise apartment builds, smart homes, and mixed-use developments. Public infrastructure accounts for 35% of deployments, with use in subway expansion, road paving, and airport maintenance. The remaining 15% falls under others, including industrial park development and special-purpose construction.

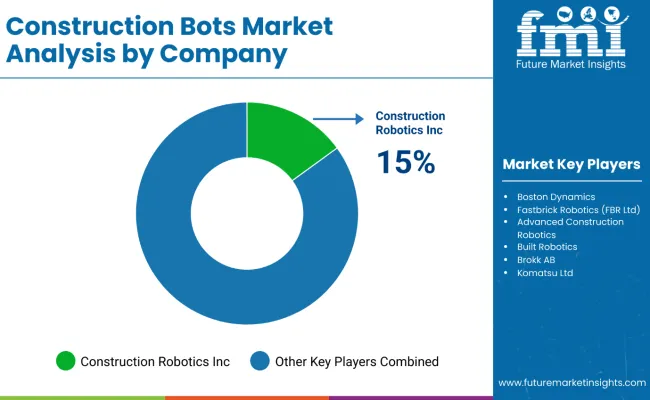

Competition in the construction bots market is intensifying as players focus on multifunctional and AI-powered solutions. Robots are being developed with capabilities spanning 3D printing, drilling, milling, facade treatment, excavation, lifting, and structural placement, enabling on-site automation and multi-purpose task execution. Advanced features like autonomous planning, adaptive path correction, machine learning for terrain assessment, and fleet coordination are being integrated to enhance precision and operational efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.29 Billion (2025) |

| Robot Type | Traditional Robot, Robotic Arm, Wheeled Mobile Robots, Aerial Robots |

| Automation | Fully Autonomous, Semi-Autonomous |

| Segment Type | Demolition, Bricklaying, 3D Printing, Structural Erection, Installation, Other Types |

| Application | Commercial and Residential, Public Infrastructure, Others |

| Regions Covered | North America, Latin America, Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, United Kingdom, France, Japan, South Korea, China, Brazil, Australia |

| Key Companies Profiled | Brokk AB, Built Robotics Inc., Construction Robotics, Fastbrick Robotics Ltd., Husqvarna Group, Advanced Construction Robotics, Ekso Bionics Holdings Inc., Conjet AB, Komatsu Ltd., Apis Cor |

The global construction bots market is projected to be valued at USD 1.29 billion in 2025.

By 2035, the market is expected to reach USD 2.24 billion.

Robotic arms are projected to lead the market due to their growing use in repetitive tasks like bricklaying and structural assembly.

Brazil is expected to exhibit the highest growth, supported by rising adoption of automation in large-scale construction projects.

In South Korea, the commercial and residential segment leads with 50% share, driven by smart city infrastructure and urban redevelopment projects.

Semi-autonomous bots dominate current deployments, but fully autonomous models are gaining traction due to advancements in AI and vision systems.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA