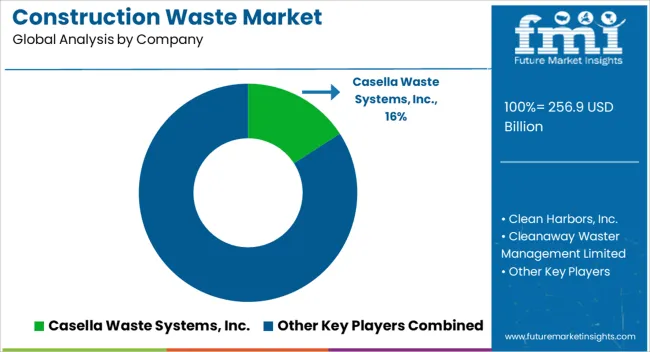

The construction waste market is estimated to be valued at USD 256.9 billion in 2025 and is projected to reach USD 426.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.2% over the forecast period.

The construction waste market is projected to reach 256.8 USD billion in 2025 and expand to 426.4 USD billion by 2035, representing a CAGR of 5.2%. Market share dynamics are expected to shift as new regulations, recycling technologies, and material recovery strategies influence stakeholder behavior. Traditional waste disposal services may experience erosion in regions adopting circular construction practices, while companies providing advanced sorting, recycling, and repurposing solutions are anticipated to gain prominence.

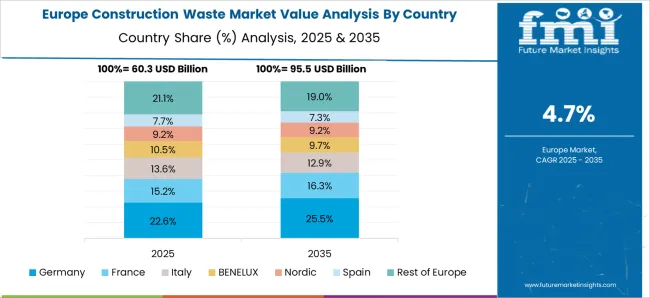

Regional differences in regulatory enforcement, infrastructure, and construction activity will further shape market share distribution. Asia-Pacific is likely to capture incremental share due to rapid urban development, large-scale residential projects, and government-led waste management initiatives. Europe and North America are projected to maintain steady growth driven by stringent landfill diversion policies, industrial retrofitting, and demand for recycled construction materials.

Emerging players offering modular construction, on-site waste segregation, and material recovery technologies are expected to challenge established providers, creating opportunities for portfolio diversification. Strategic partnerships, mergers, and acquisitions could further consolidate market positions for technology-driven waste management companies, while legacy operators may face pressure to modernize. Overall, the market is anticipated to witness dynamic share movements, with innovative waste handling solutions and regulatory compliance serving as key differentiators across global regions.

| Metric | Value |

|---|---|

| Construction Waste Market Estimated Value in (2025 E) | USD 256.9 billion |

| Construction Waste Market Forecast Value in (2035 F) | USD 426.4 billion |

| Forecast CAGR (2025 to 2035) | 5.2% |

The construction waste market is shaped by interconnected parent markets, each contributing differently to overall demand and growth. The residential and commercial construction market holds the largest share at 40%, as new building projects, renovations, and infrastructure expansions generate significant volumes of debris, including concrete, wood, metal, and mixed materials. The demolition and remodeling sector contributes 25%, with large-scale urban redevelopment, building retrofits, and industrial deconstruction producing substantial waste streams that require specialized handling and recycling solutions.

The industrial and infrastructure projects market accounts for 15%, driven by highways, bridges, ports, and large manufacturing facilities, where efficient waste segregation and recovery are prioritized to meet environmental regulations and cost management goals. The recycling and material recovery services market holds 12%, as contractors and municipalities increasingly rely on advanced sorting, processing, and reuse technologies to divert waste from landfills.

Finally, government and regulatory initiatives represent 8%, providing guidelines, incentives, and compliance frameworks that influence construction practices, waste disposal, and recycling adoption. Collectively, the residential, demolition, and industrial segments account for 80% of overall demand, highlighting that building activity, urban redevelopment, and infrastructure expansion remain the primary drivers, while recycling services and regulatory influence support incremental growth and sustainable management of construction debris globally.

The construction waste market is expanding steadily due to rising urbanization, infrastructure development, and stricter environmental regulations aimed at reducing landfill use. Increasing awareness of sustainable construction practices and the economic benefits of recycling have prompted stakeholders to invest in advanced waste sorting, recovery, and recycling technologies.

Government policies mandating proper disposal and recycling of construction debris have further accelerated adoption of organized waste management systems. Technological innovations, such as automated material recovery facilities and on-site waste processing solutions, are improving operational efficiency and reducing environmental impact.

As construction activity continues to grow globally, the focus on circular economy models and resource recovery is expected to strengthen the market’s long-term outlook.

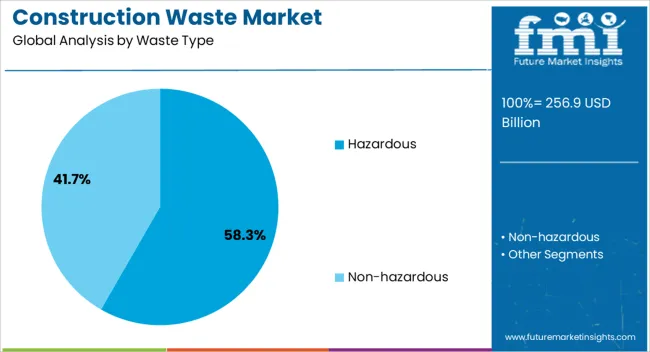

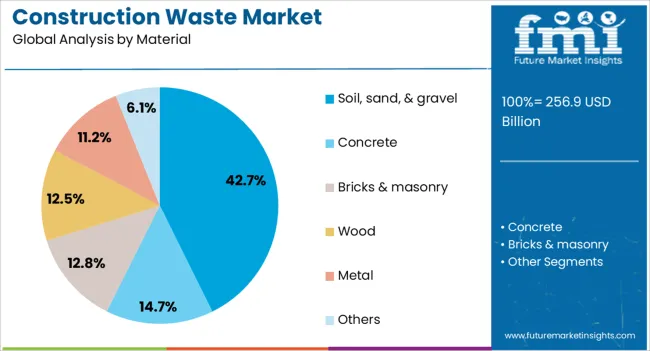

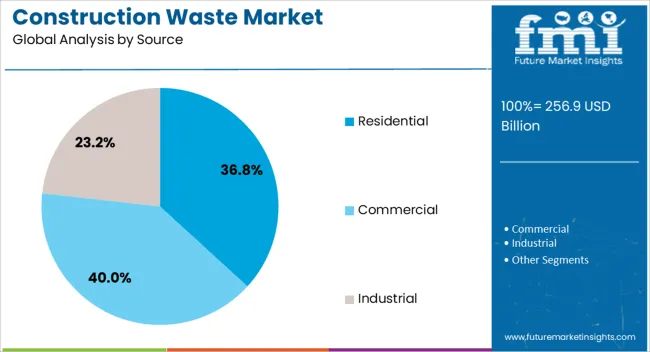

The construction waste market is segmented by waste type, material, source, service, and geographic regions. By waste type, construction waste market is divided into hazardous and non-hazardous. In terms of material, construction waste market is classified into soil, sand, & gravel, concrete, bricks & masonry, wood, metal, and others. Based on source, construction waste market is segmented into residential, commercial, and industrial. By service, construction waste market is segmented into collection, transportation, and disposal. Regionally, the construction waste industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hazardous waste type segment is projected to account for 58.3% of the total market revenue by 2025, making it the largest segment. This growth is driven by the rising volume of hazardous materials generated during demolition, renovation, and construction projects, including paints, solvents, asbestos, and chemical-based building materials.

Regulatory requirements for safe handling, transportation, and disposal of such waste have increased demand for specialized waste management solutions.

The heightened environmental and health risks associated with improper disposal have led to greater investment in hazardous waste treatment facilities and compliance monitoring, thereby reinforcing this segment’s dominance.

The soil, sand, and gravel material segment is expected to contribute 42.7% of the market revenue by 2025, positioning it as the leading material category. This is attributed to the significant quantities of excavation and earthwork materials generated during site preparation and foundation work.

The increasing reuse of these materials in backfilling, land reclamation, and road construction has strengthened their role in sustainable construction practices.

Efficient recovery and repurposing not only reduce environmental impact but also lower procurement costs for construction projects, making this segment a major contributor to market growth.

The commercial source segment is anticipated to hold 40.0% of the total market revenue by 2025, establishing itself as the dominant source category. This is primarily driven by the expansion of office spaces, retail outlets, hospitality projects, and large-scale infrastructure developments.

The diverse range of waste generated, including metals, glass, plastics, packaging materials, and mixed construction debris, has created the need for advanced waste management and recycling practices.

Heightened corporate sustainability goals, stricter environmental compliance requirements, and the rising adoption of green building certifications have further accelerated the growth of this segment, cementing its position as the leading contributor in the construction waste market.

Construction activity, regulatory enforcement, and material recovery are key growth drivers. Service-based solutions and recycling initiatives support incremental expansion across global regions.

The construction waste market is propelled by the rising volume of residential, commercial, and infrastructure projects globally. Large-scale building initiatives, renovations, and industrial developments generate significant debris, including concrete, metals, wood, and mixed materials. The growth of e-commerce warehouses, office complexes, and multifamily housing contributes further to waste streams.

Contractors and developers are increasingly seeking efficient waste handling and disposal solutions to manage high material throughput and comply with local regulations. Seasonal construction cycles and project timelines influence the amount and type of waste generated. As construction activity continues across developed and emerging regions, demand for organized collection, temporary storage, and transport of construction debris is expected to remain strong, creating opportunities for specialized service providers.

Material recovery and recycling have emerged as crucial drivers for the construction waste market. Companies offering automated sorting systems, on-site segregation, and advanced recycling technologies are gaining market share. Concrete crushing, metal separation, and wood repurposing allow for higher material recovery rates and cost savings for contractors.

Manufacturers of processing equipment are responding with scalable solutions for small and large projects alike. Integration of modular collection bins, mobile crushing units, and temporary storage solutions enhances operational efficiency. Demand for recycled aggregates and secondary raw materials is increasing among construction firms seeking cost-effective and reliable inputs. These factors are anticipated to drive investments in recycling infrastructure, partnerships, and service diversification within the market.

Regulatory frameworks significantly shape the construction waste market by mandating proper disposal, segregation, and material recovery. Governments in Europe, North America, and Asia-Pacific have established waste diversion targets, landfill restrictions, and reporting requirements for construction and demolition debris. Compliance drives contractors to adopt organized collection, processing, and recycling practices to avoid penalties and maintain operational licenses.

Public sector projects increasingly require certified waste management plans, influencing procurement and project bidding. Incentives for reuse of materials and resource-efficient practices encourage adoption of innovative waste handling services. Regulatory oversight ensures that environmental standards are met while creating opportunities for waste management companies to provide value-added compliance services.

The construction waste market is seeing growing opportunities in aftermarket services, including temporary waste collection, rental of storage bins, transport services, and on-site processing. Service providers offering flexible, project-specific solutions are capturing incremental market share. Large-scale contractors rely on specialized companies for debris handling, minimizing operational downtime.

Partnerships with construction firms, industrial developers, and municipalities enable consistent service delivery. Regional differences in waste composition and construction practices create demand for tailored solutions. In addition, the sale of recycled materials and secondary products, such as crushed aggregates, metal scrap, and timber, generates revenue streams for service providers. These factors collectively expand the scope of service-oriented offerings within the market.

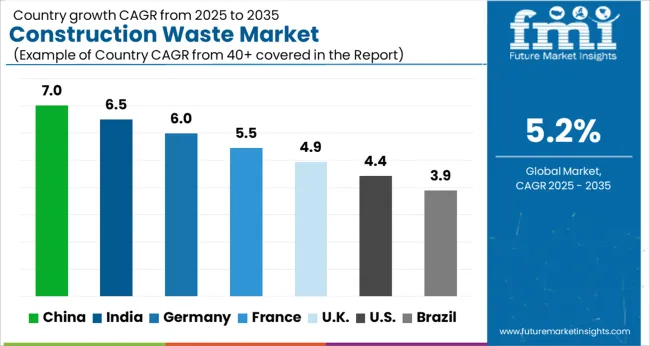

| Country | CAGR |

|---|---|

| China | 7.0% |

| India | 6.5% |

| Germany | 6.0% |

| France | 5.5% |

| UK | 4.9% |

| USA | 4.4% |

| Brazil | 3.9% |

The global construction waste market is projected to grow at a CAGR of 5.2% from 2025 to 2035. China leads at 7.0%, followed by India at 6.5%, Germany at 6.0%, the UK at 4.9%, and the USA at 4.4%. Growth is driven by rising construction activity, large-scale infrastructure projects, and increasing adoption of material recovery and recycling practices. Evolving regulations, landfill restrictions, and government-mandated waste management standards accelerate organized collection, sorting, and disposal initiatives. Asia, particularly China and India, demonstrates rapid expansion due to urban development and industrial projects, whereas Europe and North America focus on compliance, recycling efficiency, and reuse of construction materials. The analysis spans over 40+ countries, with the leading markets shown above.

The construction waste market in China is projected to grow at a CAGR of 7.0% from 2025 to 2035, driven by extensive residential, commercial, and infrastructure development projects. Rapid urban development and large-scale industrial construction are generating substantial volumes of debris, including concrete, metal, timber, and mixed materials, increasing the demand for organized collection, sorting, and recycling solutions.

Companies offering on-site segregation, material recovery, and automated processing are gaining prominence. Government regulations and landfill diversion policies are further encouraging recycling and reuse of construction materials. Partnerships with local and international service providers facilitate advanced waste handling practices, while technological solutions in material recovery optimize operational efficiency. Urban redevelopment, smart city projects, and public infrastructure expansion continue to drive market adoption across China.

The construction waste market in India is expected to expand at a CAGR of 6.5% from 2025 to 2035, supported by rapid urban construction, highway projects, and industrial facility expansion. Large-scale residential and commercial developments contribute significant debris, while demolition and remodeling projects generate consistent waste streams. Domestic service providers are increasingly offering collection, sorting, and recycling solutions to manage high material volumes efficiently.

Evolving regulations on construction and demolition waste disposal encourage material recovery and reuse, creating opportunities for specialized companies. Industrial parks, metro rail projects, and infrastructure modernization contribute to incremental market growth. Strategic collaborations with international waste management companies enhance technological access and process efficiency, further strengthening India’s construction waste management market.

The construction waste market in Germany is projected to grow at a CAGR of 6.0% from 2025 to 2035, fueled by renovations, infrastructure upgrades, and industrial construction projects. Compliance with strict environmental regulations and waste diversion policies drives adoption of structured collection, sorting, and recycling practices. Companies focus on recovery of concrete, metal, and wood for reuse in new projects, while modular and automated processing solutions enhance efficiency.

Premium residential, commercial, and public infrastructure projects contribute high volumes of debris that require specialized handling. Collaboration between waste management providers and construction firms ensures optimized logistics, cost efficiency, and adherence to sustainability standards. Replacement of legacy waste practices with modern recovery solutions further supports market growth.

The construction waste market in the UK is expected to grow at a CAGR of 4.9% from 2025 to 2035, driven by residential redevelopment, infrastructure projects, and commercial construction activities. Government-led policies on landfill reduction, material recovery, and recycling provide strong incentives for construction companies to adopt organized waste management services. Service providers offering on-site segregation, temporary storage, and material recovery solutions are capturing increasing market share.

Demand for recycled aggregates, metals, and timber as secondary raw materials supports circular construction practices. Urban redevelopment and public infrastructure initiatives, including transportation and housing projects, continue to generate steady volumes of debris. Partnerships between contractors, municipalities, and waste management firms enable efficient logistics and process optimization.

The construction waste market in the USA is projected to grow at a CAGR of 4.4% from 2025 to 2035, supported by residential, commercial, and industrial construction growth. Regulations enforcing waste diversion and recycling drive the adoption of organized collection and material recovery systems. Companies specializing in debris handling, on-site sorting, and recycled material production are gaining prominence.

Large-scale infrastructure projects, including highways, commercial complexes, and industrial parks, contribute consistent volumes of construction waste, requiring efficient logistics and processing. Adoption of recycled aggregates, metals, and wood reduces dependency on virgin materials while lowering disposal costs. Collaborations between contractors, municipalities, and service providers further optimize operations and enhance market reach, enabling steady growth across regions.

Competition in the construction waste market is defined by service breadth, regulatory compliance, and technological efficiency. Veolia Environment S.A. and Republic Services lead with comprehensive waste collection, sorting, and recycling solutions across residential, commercial, and industrial sectors, emphasizing material recovery and compliance with environmental regulations. Casella Waste Systems, Inc. and Clean Harbors, Inc. compete by offering specialized services in hazardous and non-hazardous construction debris management, including on-site processing and temporary storage solutions.

Remondis and Renewi plc focus on European markets, providing modular sorting systems, recycling facilities, and consultancy services for waste optimization. Cleanaway Waste Management Limited, FCC Environment Limited, and GFL Environmental Inc. differentiate through regional coverage, municipal contracts, and integrated logistics networks. Kiverco and Metso Corporation specialize in construction and demolition material processing equipment, offering crushing, screening, and automated sorting solutions to improve recycling efficiency. Daiseki Co., Ltd. targets industrial and infrastructure projects in Asia with advanced waste handling systems.

Windsor Waste and Waste Connections provide cost-effective solutions for regional construction and renovation projects, focusing on entry-level to mid-capacity service offerings. WM Intellectual Property Holdings, LLC emphasizes technology licensing, modular equipment, and innovative handling solutions for construction debris. Strategies across the market focus on regulatory compliance, operational efficiency, and circular material recovery. Companies highlight on-site sorting, modular collection bins, temporary storage, and automated processing to reduce landfill dependence and optimize material reuse.

Partnerships with contractors, municipalities, and industrial developers enable tailored solutions and scalable service delivery. Product portfolios include collection services, transport logistics, recycling facilities, and secondary material sales, ensuring comprehensive coverage of construction waste management needs. Brand differentiation is achieved through service reliability, compliance certification, geographic reach, and technology-enabled solutions that enhance material recovery and cost efficiency.

| Item | Value |

|---|---|

| Quantitative Units | USD 256.9 billion |

| Waste Type | Hazardous and Non-hazardous |

| Material | Soil, sand, & gravel, Concrete, Bricks & masonry, Wood, Metal, and Others |

| Source | Residential, Commercial, and Industrial |

| Service | Collection, Transportation, and Disposal |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Casella Waste Systems, Inc., Clean Harbors, Inc., Cleanaway Waster Management Limited, Daiseki Co., Ltd., FCC Environment Limited, GFL Environmental Inc., Kiverco, Metso Corporation, Remondis, Renewi plc, Republic Services, Veolia Environment S.A., Waste Connections, Windsor Waste, and WM Intellectual Property Holdings, LLC |

| Additional Attributes | Dollar sales, market share, CAGR, regional demand, regulatory impact, recycling adoption, service segment growth, competitive landscape, material recovery trends, aftermarket and industrial opportunities, and technology adoption. |

The global construction waste market is estimated to be valued at USD 256.9 billion in 2025.

The market size for the construction waste market is projected to reach USD 426.4 billion by 2035.

The construction waste market is expected to grow at a 5.2% CAGR between 2025 and 2035.

The key product types in construction waste market are hazardous and non-hazardous.

In terms of material, soil, sand, & gravel segment to command 42.7% share in the construction waste market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA