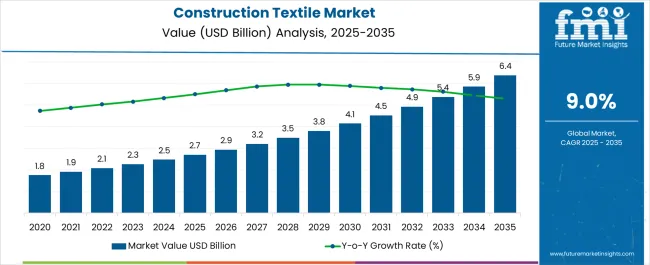

The Construction Textile Market is estimated to be valued at USD 2.7 billion in 2025 and is projected to reach USD 6.4 billion by 2035, registering a compound annual growth rate (CAGR) of 9.0% over the forecast period.

| Metric | Value |

|---|---|

| Construction Textile Market Estimated Value in (2025 E) | USD 2.7 billion |

| Construction Textile Market Forecast Value in (2035 F) | USD 6.4 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The construction textile market is experiencing consistent growth, driven by rising investments in sustainable infrastructure and innovative building solutions. The increasing emphasis on energy-efficient materials and lightweight structures is boosting the adoption of advanced textiles in construction projects worldwide. Growing urbanization and the demand for durable, flexible, and cost-effective building materials are reshaping construction practices.

Modern construction textiles are being developed with enhanced performance features such as UV resistance, fire retardancy, and improved tensile strength, making them suitable for long-term applications in both commercial and residential sectors. Architectural innovations, including tensile structures, green buildings, and modular construction, are further supporting the use of textiles as reliable alternatives to traditional building materials. Manufacturers are also focusing on recyclability and environmental compliance to align with global sustainability targets.

As regulations promoting energy efficiency and eco-friendly construction become stricter, the adoption of construction textiles is expected to accelerate, positioning them as a critical component in next-generation infrastructure development The market outlook remains positive, with increasing technological advancements and evolving application areas paving the path for long-term expansion.

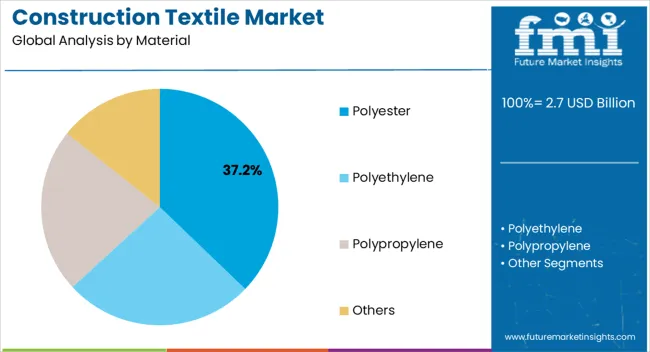

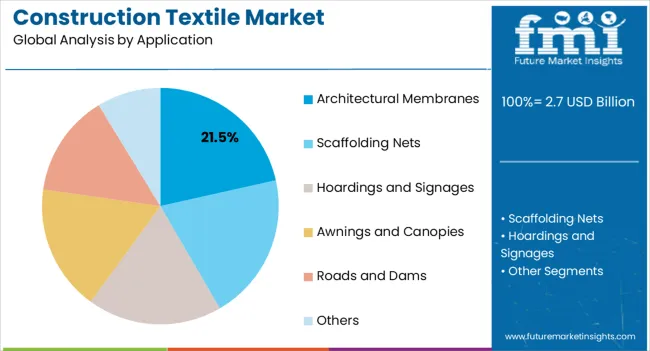

The construction textile market is segmented by material, application, and geographic regions. By material, construction textile market is divided into Polyester, Polyethylene, Polypropylene, and Others. In terms of application, construction textile market is classified into Architectural Membranes, Scaffolding Nets, Hoardings and Signages, Awnings and Canopies, Roads and Dams, and Others. Regionally, the construction textile industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polyester material segment is projected to hold 37.2% of the construction textile market revenue share in 2025, making it the leading material category. Its dominance is attributed to high strength-to-weight ratio, durability, and cost-effectiveness compared to alternative materials. Polyester offers excellent resistance to environmental factors such as moisture, UV radiation, and temperature fluctuations, ensuring long service life in outdoor applications.

The material is widely used in construction projects where performance consistency and low maintenance are critical, including roofing membranes, shading systems, and protective coverings. Advances in textile engineering have enabled polyester to be produced with enhanced fire resistance and recyclability, aligning with sustainability goals in the construction industry.

The affordability of polyester, coupled with its versatility in design and ease of installation, has made it the material of choice in large-scale and modular construction projects Its widespread availability and compatibility with modern architectural requirements are further solidifying its leadership position in the market, ensuring continued growth over the forecast period.

The architectural membranes application segment is expected to account for 21.5% of the construction textile market revenue share in 2025, making it the leading application segment. Growth in this segment is being driven by the increasing demand for lightweight, durable, and aesthetically versatile building materials. Architectural membranes are widely adopted in tensile structures, stadiums, airports, and commercial facilities due to their ability to provide large-span coverage without heavy structural support.

Their superior properties, including weather resistance, UV stability, and flexibility, make them suitable for both temporary and permanent structures. The growing focus on energy-efficient designs is further promoting the use of membranes that allow natural light penetration while maintaining insulation performance. Advances in coatings and lamination technologies are improving durability and extending the lifecycle of these materials.

The cost-effectiveness of architectural membranes, combined with their ability to meet modern design requirements, has reinforced their preference among architects and developers With increasing investments in innovative urban infrastructure and iconic architectural projects, this segment is anticipated to maintain its leadership position in the coming years.

Green Construction Materials to Fuel Demand

With growing environmental awareness, there's an increasing demand for sustainable construction textiles made from recycled materials or renewable sources. Manufacturers are developing eco-friendly options to meet this demand, such as textiles made from recycled plastics or natural fibers like bamboo or hemp.

Future Prospects and Technological Advancements in the Construction Textile Market

Construction textiles are becoming more advanced, offering improved durability, strength, and performance. Innovations in weaving techniques, coatings, and additives are enhancing the properties of textiles used in applications such as geotextiles, roofing membranes, and reinforcement materials.

Growing Demand for Synthetic Fibers to Surge Sales

Integration of smart technologies into construction textiles is gaining traction. These textiles can monitor structural integrity, provide insulation, or even generate energy. Examples include textiles embedded with sensors for structural health monitoring or phase-change materials for temperature regulation.

High Initial Cost to Impede Growth

The initial cost of construction textiles, especially those incorporating advanced technologies or eco-friendly materials, can be higher compared to traditional alternatives. This cost barrier may deter some construction projects from adopting these textiles, particularly in regions with tight budgets or cost-sensitive markets.

China's Belt and Road Initiative (BRI) is promoting infrastructure development and connectivity across Asia, Africa, and Europe, creating opportunities for construction textile manufacturers. Geotextiles and geomembranes are essential components of BRI projects. Digitalization and automation are transforming manufacturing processes and supply chains in China, with advanced techniques like computerized knitting, laser cutting, and robotics enhancing productivity, quality control, and customization capabilities.

In China, advanced manufacturing techniques like 3D weaving, additive manufacturing, and digital fabrication are enabling the production of complex construction textiles with customized properties and designs. The construction textile market is experiencing consolidation among manufacturers and strategic partnerships to enhance product offerings and market reach. Collaborations between textile manufacturers, construction firms, and technology providers drive innovation and competitiveness.

The United States construction industry is focusing on sustainability, with a growing demand for environmentally friendly materials like recycled materials and renewable sources. This aligns with initiatives to reduce carbon footprint and promote green building practices. Construction textiles are also crucial for resilience and disaster mitigation, providing waterproofing solutions, reinforcement materials, and disaster-resistant barriers.

Smart technologies are being integrated into construction textiles for applications like structural health monitoring, energy efficiency, and occupant comfort. These textiles are embedded with sensors, actuators, and communication systems to monitor structural integrity, regulate temperature, and optimize energy consumption. The industry's strict regulations and safety codes significantly influence the use of construction textiles, with compliance with fire safety, building codes, and environmental standards shaping their design and specification.

Japan's infrastructure development plans, urbanization, and high-rise construction demand for construction textiles are driving significant demand. Geotextiles, erosion control mats, and other textiles are needed for soil stabilization, drainage, and reinforcement in large-scale projects.

Japan's urbanization rate is also increasing, leading to increased demand for waterproofing, insulation, and fire protection in high-rise buildings and residential developments. Green building initiatives are promoting eco-friendly materials made from recycled materials or renewable sources, as well as energy-saving and thermal insulation properties. Japan's stringent quality and safety standards govern the construction industry, ensuring durability and performance in fire resistance, waterproofing, and environmental protection.

Architectural membranes are undergoing significant advancements with the introduction of advanced materials like PTFE, ETFE, and PVC-coated fabrics. These materials offer superior durability, weather resistance, and translucency, enabling innovative designs and energy-efficient solutions.

Sustainable design and green building are also gaining traction, with membranes made from recyclable materials and energy-saving technologies like photovoltaic membranes. Transparent membranes, particularly ETFE foils, are being used to maximize natural daylighting and provide thermal insulation, and UV protection.

Architectural membranes offer design flexibility and customization options, with digital fabrication technologies enabling precise shaping and patterning for complex geometries and intricate architectural forms. They are also being integrated with building systems to enhance performance and functionality, incorporating elements like lighting, HVAC, sound systems, and environmental monitoring sensors, creating dynamic and responsive building environments.

Polyester is a cost-effective construction textile material that offers excellent strength, durability, and versatility. It can withstand harsh environmental conditions like UV exposure, moisture, and abrasion, ensuring long-term performance and structural integrity.

Polyester fibers can be engineered to meet specific performance requirements, offering versatility in various fabrics and membranes. They are lightweight, reducing labor costs and construction time. They exhibit chemical resistance to chemicals, acids, and alkalis, making them suitable for applications where exposure to corrosive substances is a concern.

Polyester textiles are low maintenance, requiring minimal upkeep over their lifecycle. They can be recycled and reused, contributing to sustainability efforts in the construction industry. They offer design flexibility, allowing architects and designers to achieve various aesthetic and functional requirements. They can be dyed in a wide range of colors, printed with patterns or logos, and customized in terms of texture and appearance to enhance visual appeal and brand identity.

The construction textile industry is collaborating with small-scale companies to develop innovative fabrics. Leading companies are establishing advanced manufacturing facilities in developing nations to cater to niche markets and comply with strict sustainability regulations by launching eco-friendly fabrics.

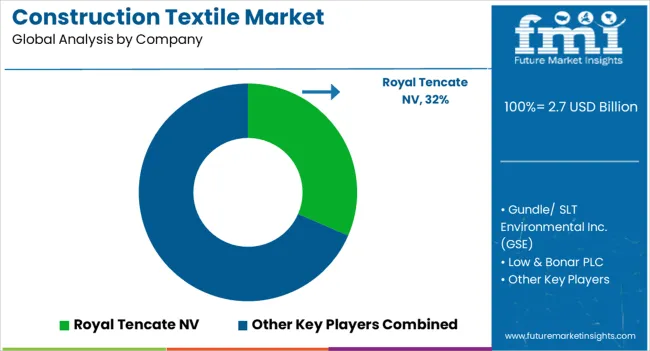

The textile market is experiencing a significant growth trend due to strategies like geographical expansion and mergers and acquisitions. Companies are leveraging government trade agreements and partnerships with e-commerce portals like Amazon, Flipkart, and eBay to boost sales. Royal Tencate NV, Gundle/ SLT Environmental Inc. (GSE), Low & Bonar PLC, and Fibertex Nonwoven A/S are the key players in the construction textile industry.

Industry Updates

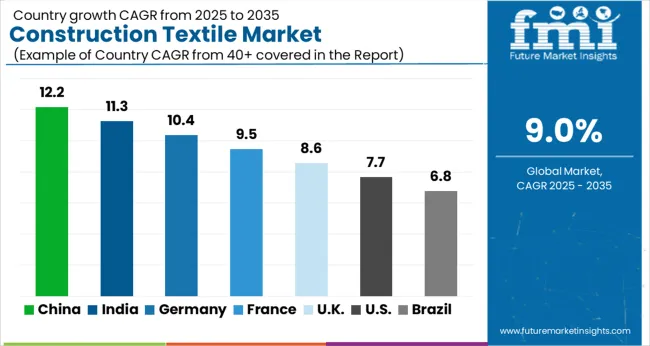

| Country | CAGR |

|---|---|

| China | 12.2% |

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK | 8.6% |

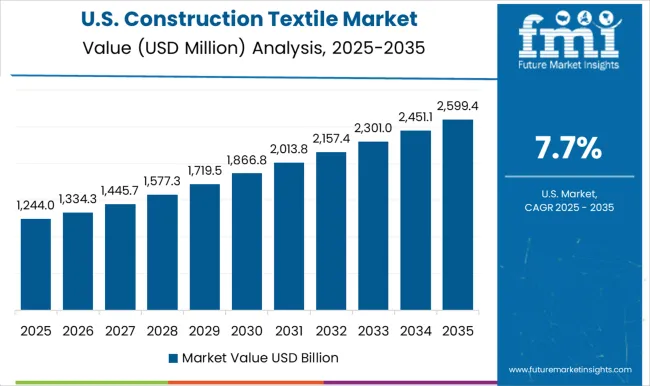

| USA | 7.7% |

| Brazil | 6.8% |

The Construction Textile Market is expected to register a CAGR of 9.0% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 12.2%, followed by India at 11.3%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 6.8%, yet still underscores a broadly positive trajectory for the global Construction Textile Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 10.4%. The USA Construction Textile Market is estimated to be valued at USD 986.4 million in 2025 and is anticipated to reach a valuation of USD 2.1 billion by 2035. Sales are projected to rise at a CAGR of 7.7% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 144.4 million and USD 92.0 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.7 Billion |

| Material | Polyester, Polyethylene, Polypropylene, and Others |

| Application | Architectural Membranes, Scaffolding Nets, Hoardings and Signages, Awnings and Canopies, Roads and Dams, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Royal Tencate NV, Gundle/ SLT Environmental Inc. (GSE), Low & Bonar PLC, and Fibertex Nonwoven A/S |

The global construction textile market is estimated to be valued at USD 2.7 billion in 2025.

The market size for the construction textile market is projected to reach USD 6.4 billion by 2035.

The construction textile market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in construction textile market are polyester, polyethylene, polypropylene and others.

In terms of application, architectural membranes segment to command 21.5% share in the construction textile market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA