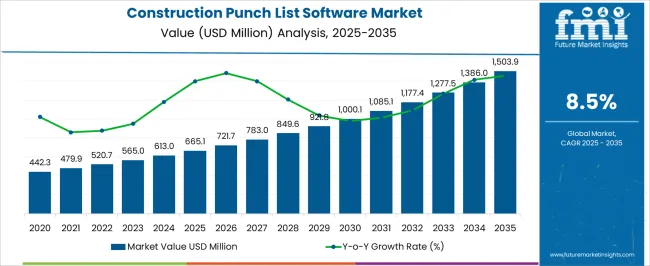

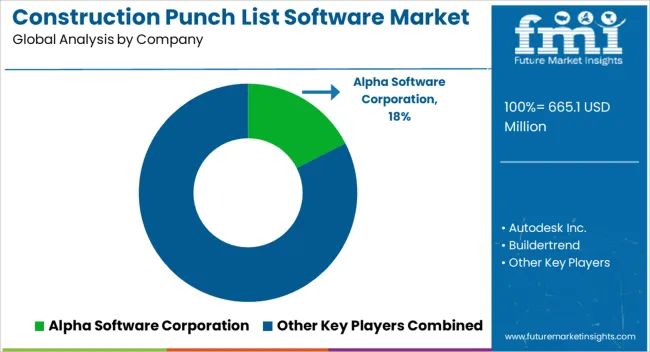

The construction punch list software category is projected to rise from USD 665.1 million in 2025 to USD 1,503.9 million by 2035 at a CAGR of 8.5%. The value accumulation curve appears in interim steps of 721.7, 783.0, 849.6, 921.8, and 1,000.1 by 2030. Adoption is being propelled by defect management, mobile snagging, photo markups, and real time synchronization across trades. Standardized templates, QA QC audit trails, and geo-tagged evidence are used to strengthen accountability. Integration with schedules and cost control is used to compress closeout cycles and reduce rework. The software is viewed as a field management anchor.

From 2031 onward, values are expected at 1,085.1, 1,177.4, 1,277.5, and 1,386.0, culminating at 1,503.9 in 2035. The curve is read as a steady steepening, as portfolio wide rollouts are mandated by owners, EPCs, and general contractors for transparent handover and warranty readiness. Preference is being shown for open APIs, role based permissions, offline sync, timestamped signatures, and secure photo evidence. Compatibility with BIM models and common data environments is required. Superior defect density tracking, faster commissioning, fewer change orders, and lower dispute risk are expected, which is set to lock this category into capital plans and operating budgets.

| Metric | Value |

|---|---|

| Construction Punch List Software Market Estimated Value in (2025 E) | USD 665.1 million |

| Construction Punch List Software Market Forecast Value in (2035 F) | USD 1503.9 million |

| Forecast CAGR (2025 to 2035) | 8.5% |

The construction punch list software segment is estimated to account for 17% of the construction management software market, 28% of the field management and site inspection software market, 32% of the quality management and defect tracking software market, 14% of the project collaboration and document control software market, and 9% of the BIM enabled construction software market. In aggregate, these proportions total 100% across the listed parent categories. This footprint is viewed as decisive because punch list workflows govern closeout, QA QC, deficiency tracking, and site handover on capital projects. Value is delivered through standardized checklists, issue tagging, geo tagged photos, offline capture, and role based routing that shortens rework cycles and raises subcontractor accountability.

Procurement choices are shaped by mobile stability, sync reliability, issue aging dashboards, permission controls, and integrations with CDE, scheduling, and cost systems, which favor platforms with strong field usability. Defect density, cycle time to closure, and cost of quality are measured more transparently, and owners gain confidence during commissioning and pay applications. In this assessment, punch list software acts as the practical control tower for finishing works, bridging general contractors, trades, and consultants with auditable records. Adoption has been reinforced by repeatable templates across healthcare, education, hospitality, and residential towers where handover friction must be minimized. As checklists, photo evidence, and BIM context are fused inside a single source of truth, punch list tools are expected to retain meaningful weight within these parent markets and to guide specification on future AEC programs.

The construction punch list software market is experiencing significant growth, supported by the increasing need for streamlined project management, improved communication, and enhanced quality control in construction projects. The shift toward digital solutions is being accelerated by the growing complexity of modern construction, where multiple stakeholders must coordinate tasks in real time. Cloud-based and web-based platforms are enabling seamless access to project data, ensuring transparency and accountability across teams.

Advancements in mobile integration and user-friendly interfaces are expanding adoption among contractors, project managers, and field teams. The growing emphasis on minimizing delays, reducing rework, and ensuring compliance with project specifications is further driving market demand. As infrastructure development accelerates globally and construction firms seek to optimize operations, punch list software is becoming an essential tool in project delivery.

The integration of analytics and reporting features is enhancing decision-making capabilities, while subscription-based pricing models are improving accessibility for firms of varying sizes These trends collectively position the market for sustained expansion in the years ahead.

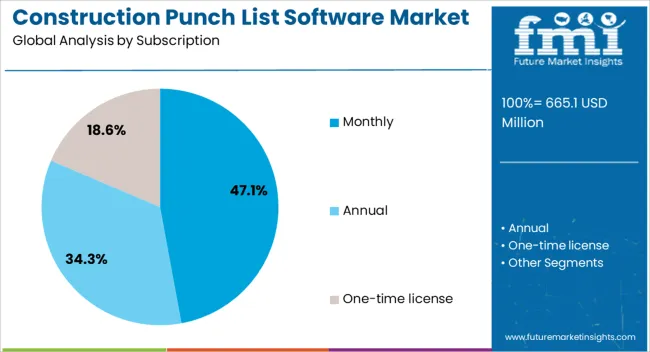

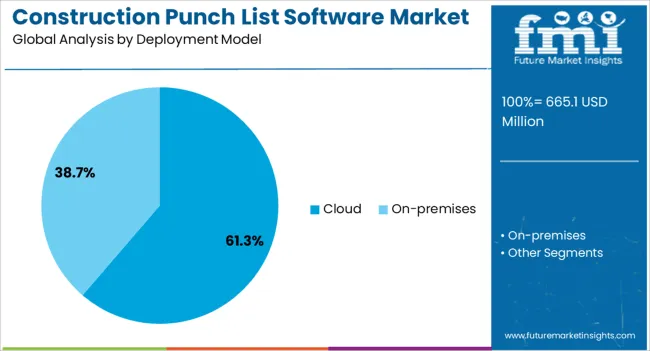

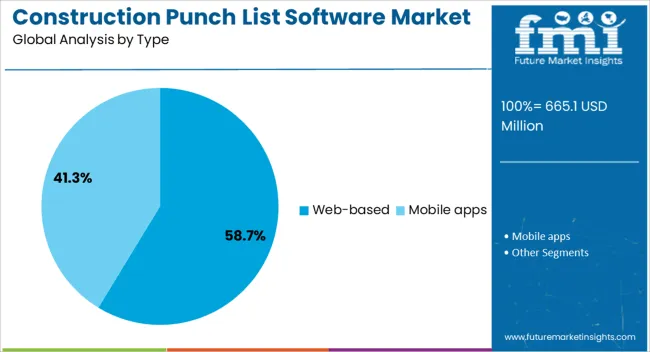

The construction punch list software market is segmented by subscription, deployment model, type, project size, end-user, and geographic regions. By subscription, construction punch list software market is divided into Monthly, Annual, and One-time license. In terms of deployment model, construction punch list software market is classified into Cloud and On-premises. Based on type, construction punch list software market is segmented into Web-based and Mobile apps.

By project size, construction punch list software market is segmented into Large-scale projects and Small & Medium-sized projects. By end-user, the construction punch list software market is segmented into General contractors, subcontractors, Plant engineering contractors, Architects & engineers, and Building owners. Regionally, the construction punch list software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The monthly subscription segment is projected to hold 47.1% of the construction punch list software market revenue share in 2025, making it the leading subscription model. This dominance is being supported by the flexibility it offers to construction companies, enabling them to scale software usage according to project timelines and budgets. Monthly billing allows smaller contractors and mid-sized firms to access advanced features without committing to large upfront costs, promoting broader adoption.

The model’s adaptability is particularly beneficial for firms managing seasonal workloads or short-term projects, where long-term contracts may not be viable. Additionally, monthly subscriptions encourage frequent upgrades and feature enhancements, ensuring users have access to the latest functionalities without disruption.

The ability to quickly onboard and offboard users as projects start or end adds operational efficiency As competition in the software market increases, providers are enhancing their value propositions with monthly plans that combine cost-effectiveness, flexibility, and continual product innovation, reinforcing the segment’s market leadership.

The cloud deployment model segment is expected to account for 61.3% of the construction punch list software market revenue share in 2025, establishing itself as the dominant deployment preference. Its leadership is being driven by the ability to provide real-time access to project data from any location, enabling seamless collaboration between office and field teams. Cloud-based platforms eliminate the need for costly on-premises infrastructure, reducing capital expenditure and enabling faster implementation.

The scalability of cloud solutions allows firms to adjust resources as project demands change, while robust security measures ensure data integrity and compliance. Automatic software updates in cloud environments ensure that users consistently benefit from the latest features and performance improvements without manual intervention.

The growing adoption of remote work practices in the construction industry is further reinforcing demand for cloud deployment. As construction firms increasingly prioritize agility, data accessibility, and cost-efficiency, the cloud model is expected to remain the preferred choice for delivering and managing punch list software solutions.

The web-based type segment is anticipated to represent 58.7% of the construction punch list software market revenue share in 2025, making it the leading type. This dominance is being reinforced by the ability to access software directly through internet browsers without requiring installation, ensuring ease of use and compatibility across devices. Web-based platforms enable rapid deployment and reduce the need for specialized IT support, making them appealing to construction firms of all sizes.

The segment is benefiting from advancements in responsive design, which ensure that interfaces function effectively on both desktop and mobile devices, enhancing usability for field teams. Real-time synchronization of data between project sites and central offices improves collaboration and decision-making.

Additionally, web-based solutions facilitate seamless integration with other project management and documentation tools, further improving operational efficiency. The reduced maintenance burden, combined with the ability to operate in diverse network environments, positions web-based platforms as a preferred choice for delivering flexible and cost-effective punch list management capabilities.

The construction punch list software market is expected to grow steadily as defect tracking, site documentation, and digital closeout are prioritized by contractors and owners. Adoption is being reinforced by the need to reduce rework, shorten handover, and standardize QA QC workflows across multi-trade projects. Opportunities are opening through integrations with project management suites, configurable templates, and service bundles that include onboarding and data migration. Trends point to mobile-first apps, photo markups, and BIM-linked issue coordination. Challenges remain around user training, pricing clarity, legacy integrations, and uneven field connectivity.

Demand has been reinforced by general contractors, specialty trades, architects, and owner reps seeking consistent defect management and faster practical completion. Digital punch lists have been favored over spreadsheets as real-time syncing, photo evidence, and geotagged tasks reduce disputes and rework. Standardized QA QC checklists, commissioning records, and warranty logs have been required on hospitals, education campuses, data centers, and hospitality builds where compliance audits are frequent. Mobile apps with offline capture have been adopted to create snag items, tag responsible subcontractors, and timestamp resolutions, improving accountability during walkthroughs. In an opinionated view, measurable ROI has been realized when punch workflows were connected to RFIs, change orders, and daily reports, placing accountability on schedule-critical trades. As-built documentation and owner handover packs have been accelerated by auto-generated reports, while dashboard metrics have been used by project executives to track closure rates and aging items.

Opportunities have been created by deep integrations with scheduling, document control, and cost platforms so that issues can be linked to activities, submittals, and budget impacts. Prebuilt templates for verticals such as healthcare, retail rollout, and fit-out have been offered to reduce setup time and embed code requirements. Service bundles that include data migration, role-based training, and on-site go-live support have been positioned to lift adoption across multi-office contractors. Mid-market builders have been targeted with tiered pricing and unlimited-project models, while enterprise accounts have preferred multi-year agreements that bundle API access and dedicated customer success. It is argued that the strongest growth will be captured where punch list tools are sold with photo standards, approval matrices, and audit-ready report packs for owner representatives. Channel partnerships with hardware resellers, field camera vendors, and drone providers have opened cross-sell routes for visual verification and progress evidence.

Trends have centered on mobile-first field capture with offline sync, annotated photos, and 360 imagery so that defects are located precisely and context is preserved. BIM-linked coordination has been adopted, allowing issues to be pinned to model elements and federated views during coordination meetings. QR codes and NFC tags at rooms or equipment have been used to pull location-specific checklists and history. Role-based dashboards with cycle-time analytics, heat maps, and trade performance scores have been preferred by project directors seeking predictable closeout. Secure share links for owners and inspectors have been requested to streamline signoff. From an opinionated stance, the decisive shift is toward end-to-end traceability, where every snag item carries photos, assignee, due date, and signoff trail that flows directly into turnover manuals and facility management exports, reducing friction between construction teams and operations staff.

Challenges have been observed in change management as crews accustomed to paper forms resist new mobile routines, resulting in partial use and data gaps. Per-seat pricing and add-on fees for storage or integrations have created budget pushback, especially on longer projects with rotating subcontractors. Legacy systems without modern APIs have complicated bidirectional syncing for RFIs, drawings, and as-builts. Inconsistent owner specifications for report formats and signoff criteria have forced custom work, stretching implementations. Connectivity at remote sites has limited real-time updates, while device policies and security reviews have delayed approvals. It is believed that many setbacks can be avoided through clear field training, offline-first workflows, transparent accuracy of timestamps and user logs, and published integration playbooks. Without these, teams default to emails and spreadsheets, undermining the very cycle-time gains that justify punch list software investments.

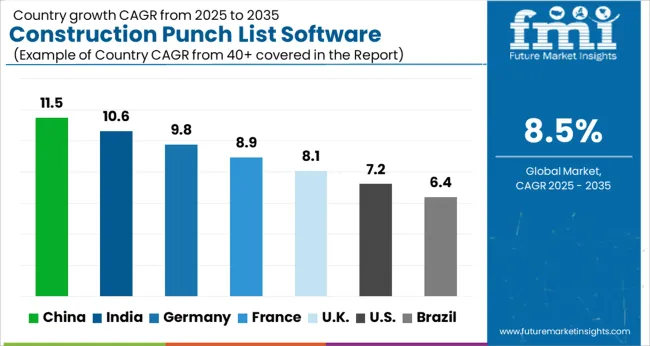

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

| USA | 7.2% |

| Brazil | 6.4% |

The global construction punch list software market is projected to grow at 8.5% from 2025 to 2035. China leads at 11.5%, followed by India 10.6% and Germany 9.8%; the United Kingdom 8.1% and United States 7.2% follow. Growth is being propelled by site-to-office sync needs, defect tracking at scale, and structured closeout requirements. Mobile-first snagging, photo markup, GPS tagging, and role-based approvals are being adopted to cut rework and compress handover timelines. BIM-linked issue management, API connectors to ERP and CDE platforms, and standardized checklists for quality assurance are being prioritized. Asia is set to outpace on volume rollouts and localized feature sets, Europe on compliance and documentation rigor, and the USA on steady upgrades across established GC and specialty contractor networks. This report includes insights on 40+ countries; the top markets are shown here for reference.

The construction punch list software market in China is expected to expand at a CAGR of 11.5%. Adoption is being driven by large public works, mixed-use megaprojects, and prefabrication programs where defect capture and trade coordination must be handled at speed. Mobile apps with offline sync, image annotations, and bulk assignment are being preferred on dense high-rise sites. Procurement is being steered toward cloud deployments hosted within national regions, with Chinese language templates and code-aligned checklists requested at bid. Closeout packs, eSignature, and warranty tracking are being required by owners to avoid delayed handovers. Vendor shortlists are being influenced by QR-tag workflows for rooms, equipment, and façades, while dashboard KPIs are being used to rank subcontractor performance. With scale and standardized methods, sustained double-digit growth appears justified.

The construction punch list software market in India is projected to grow at 10.6%. Demand is being shaped by transport corridors, data centers, institutional campuses, and high-density residential where structured snagging reduces rework costs. Contractors are requesting multilingual interfaces, WhatsApp share links for trades, and GPS-anchored items for large footprints. Cloud subscriptions with flexible seat models are being favored by EPCs managing dispersed packages. Owners are insisting on standardized defect taxonomies and timestamped evidence to support milestone payments. Integration with RFIs, submittals, and commissioning checklists is being adopted so that closeout binders can be generated with fewer manual steps. With organized procurement frameworks and maturing site practices, consistent uptake across tier-1 metros and fast-growing tier-2 cities is being recorded.

The construction punch list software market in Germany is forecast to increase at 9.8%. Uptake is being guided by strict documentation standards, defect liability periods, and precise trade interfaces on industrial plants and public buildings. BIM coordination models are being connected to issue logs so that clashes and field defects share identifiers, improving traceability from model to site. On-prem and EU-region cloud hosting are being specified, with audit trails and DIN-aligned templates required by clients. Photo evidence with measurement overlays, revision histories, and controlled distribution lists are being favored to protect warranty positions. Structured commissioning and room-by-room acceptance are being executed with tablet checklists to reduce paper handling. Given Germany’s emphasis on process control and certified records, strong mid-to-high single-digit growth is being sustained.

The construction punch list software market in the UK is anticipated to rise at 8.1%. Refurb programs, education estates, healthcare builds, and build-to-rent schemes are requiring consistent snag capture and transparent closeout. Contractors are leaning on mobile snagging with offline modes for basement and tunnel areas, while clients request standardized room data sheets tied to punch items. CDE alignment with common naming conventions and issue status mapping is being requested to stay in step with information-management standards. Evidence packs with photo sequences, timestamps, and acceptance sign-offs are being used to support practical completion and defects-liability workflows. With structured procurement and strong use of frameworks, steady adoption across main contractors and specialist trades is being observed.

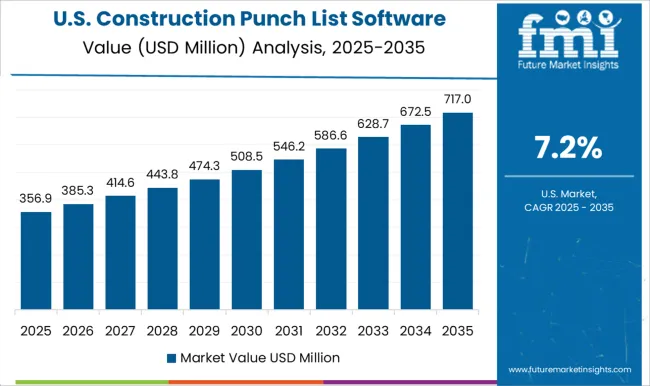

The construction punch list software market in the United States is expected to grow at 7.2%. Uptake is being supported by healthcare, life-science labs, logistics hubs, and corporate interiors where closeout documentation and safety compliance are closely audited. GC and CM firms are standardizing mobile field tools for photo markup, voice-to-item capture, and batch assignments. API connectors into project management suites and financial systems are being valued to link unresolved items with cost exposure. Owners are favoring dashboards that surface aging defects and trade performance, while warranty and O&M handover packets are being packaged as client-facing deliverables. With mature dealer networks and strong retrofit activity, stable growth grounded in workflow rigor is being indicated.

Competition in construction punch list software has been shaped by field usability, closeout control, and how clearly brochures codify workflows. Autodesk Build centralizes issue capture with mobile punch lists and real-time tracking to drive faster resolution. Procore positions a dedicated Punch List tool that assigns ownership, due dates, and status within field creation. Oracle Aconex emphasizes configurable forms so dthat efects, snags, and punch lists flow through standardized inspections. Fieldwire leans on quick tasking, photos, and report generation from the jobsite. BuilderTrend promotes template-driven To Do workflows that function as punch lists for residential teams. Alpha Software targets mobile inspectors with offline capture, geotags, photos, and audio notes in a prebuilt app. Trimble Viewpoint anchors punch lists inside Vista and Field View for handover and snagging. Deltek ArchiSnapper presents paperless inspections and automated reports to cut site admin time. Strategy has been executed through clarity, not slogans. UDA Technologies uses ConstructionOnline to track priority, status, and percentage complete, with client portals to view or edit items.

Procore and Autodesk push closeout speed with mobile capture, standardized fields, and shareable reports that keep owners aligned. Oracle Aconex and Trimble Viewpoint stress configurable forms and offline jobsite use to keep inspections continuous. Fieldwire and Buildertrend highlight punch list reporting and pitfalls guidance to reduce rework. Alpha Software underlines fast inspections with structured projects, action items, and notes for auditable closeout. Differentiation is won when brochures show concrete proof points. Offline resilience, role-based assignments, photo evidence, and templated reports. Clear ownership trails and client-facing access. Buyers compare these artifacts line by line, then select platforms that shorten handover, document accountability, and compress site to office loops with minimal retraining.

| Item | Value |

|---|---|

| Quantitative Units | USD 665.1 Million |

| Subscription | Monthly, Annual, and One-time license |

| Deployment Model | Cloud and On-premises |

| Type | Web-based and Mobile apps |

| Project Size | Large-scale projects and Small & Medium-sized projects |

| End-User | General contractor, Sub-contractor, Plant engineering contractor, Architects & engineers, and Building owners |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Alpha Software Corporation, Autodesk Inc., Buildertrend, Deltek Inc., Fieldwire, Oracle Corporation, Procore Technologies Inc., Strata Systems, Trimble (Viewpoint Inc.), and UDA Technologies Inc. |

| Additional Attributes | Dollar sales by deployment (cloud, on premise), Dollar sales by user type (general contractors, subcontractors, owners), Trends in mobile field capture, photo markups, offline sync, Role in QA QC, closeout, compliance handover, Growth via BIM integrations and e signature workflows, Regional demand across North America, Europe, Asia Pacific. |

The global construction punch list software market is estimated to be valued at USD 665.1 million in 2025.

The market size for the construction punch list software market is projected to reach USD 1,503.9 million by 2035.

The construction punch list software market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in construction punch list software market are monthly, annual and one-time license.

In terms of deployment model, cloud segment to command 61.3% share in the construction punch list software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Telematics Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Construction Films Market Size and Share Forecast Outlook 2025 to 2035

Construction Flooring Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Construction Sealants Market Size and Share Forecast Outlook 2025 to 2035

Construction Bots Market Analysis Size and Share Forecast Outlook 2025 to 2035

Construction Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Generators Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA