The Construction Sealants Market is estimated to be valued at USD 8.7 billion in 2025 and is projected to reach USD 17.9 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period. From 2025 to 2030, the market is expected to increase from USD 8.7 billion to USD 12.5 billion, driven by rising demand for high-performance sealing solutions in residential, commercial, and infrastructure projects. Year-on-year analysis shows consistent growth, with values reaching USD 9.4 billion in 2026 and USD 10.1 billion in 2027, supported by increasing construction activities and stringent requirements for energy-efficient building envelopes. By 2028, the market is projected to reach USD 10.8 billion, advancing to USD 11.6 billion in 2029 and USD 12.5 billion by 2030. Growth is likely to be reinforced by the development of hybrid and silicone-based sealants with superior adhesion, durability, and weather resistance. Expanding applications in green building certifications and retrofitting projects will further accelerate adoption. These dynamics position construction sealants as a critical component for structural integrity and performance, enabling manufacturers to capitalize on innovations in low-VOC formulations and advanced application technologies to meet evolving market demands.

| Metric | Value |

|---|---|

| Construction Sealants Market Estimated Value in (2025 E) | USD 8.7 billion |

| Construction Sealants Market Forecast Value in (2035 F) | USD 17.9 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The construction sealants market secures a notable position within several related sectors. In the Adhesives and Sealants Market, it accounts for nearly 25%, as construction applications dominate demand alongside industrial uses. Within the Building and Construction Materials Market, its share is approximately 4%, given the prevalence of cement, concrete, and aggregates in this broader category. For the Waterproofing Solutions Market, it represents about 10%, as sealants are essential for preventing moisture ingress in structures. In the Infrastructure Development Materials Market, the share is close to 3%, considering the scale of steel, cement, and composites in large projects. Within the Facade and Glazing Systems Market, its contribution is roughly 15%, owing to its critical role in ensuring structural integrity and weather resistance of curtain walls and glass installations. Growth is fueled by rising demand for energy-efficient buildings, increased urban infrastructure projects, and regulatory focus on safety and performance. Technological advancements in hybrid polymers, silicone, and polyurethane-based sealants are improving adhesion, flexibility, and durability, even under extreme conditions. The emphasis on green building certifications and low-VOC formulations further boosts adoption. These factors reinforce the market’s strategic role in modern construction practices, ensuring long-term structural reliability and environmental compliance across residential and commercial segments.

The construction sealants market is undergoing steady expansion, driven by increased infrastructure investments, stringent energy efficiency regulations, and the growing emphasis on long-term structural durability. Rising global construction activity, particularly in urban and residential developments, has increased the need for advanced sealing solutions that offer weather resistance, thermal insulation, and adhesion to various substrates.

Technological advancements in formulation have led to longer-lasting, low-VOC sealants that comply with environmental standards. Government-backed sustainability mandates and green building certifications are also promoting the adoption of high-performance sealants.

As retrofitting and renovation projects gain momentum across developed and developing economies, demand is expected to remain resilient across residential, commercial, and industrial segments.

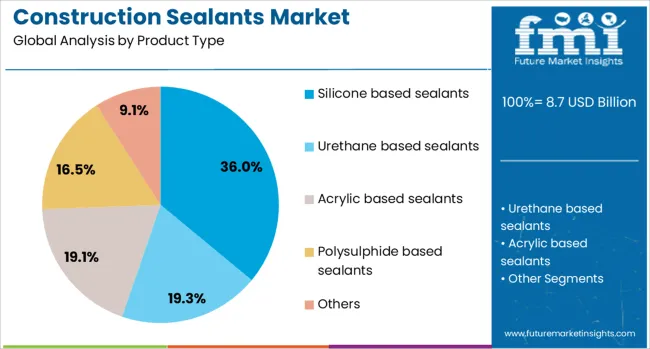

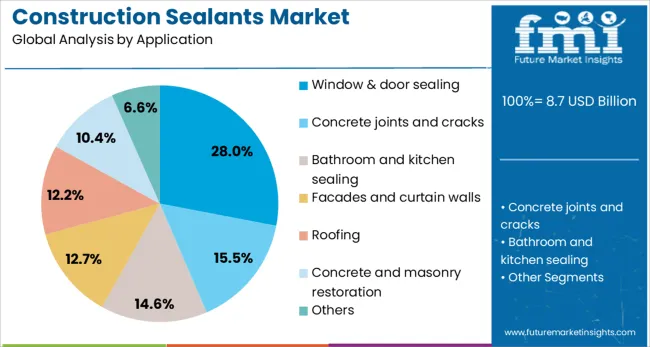

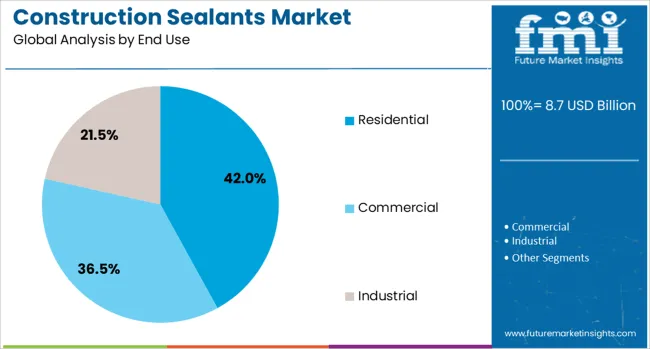

The construction sealants market is segmented by product type, application, end use, and distribution channel and geographic regions. By product type of the construction sealants market is divided into Silicone based sealants, Urethane based sealants, Acrylic based sealants, Polysulphide based sealants, and Others. In terms of application of the construction sealants market is classified into Window & door sealing, Concrete joints and cracks, Bathroom and kitchen sealing, Facades and curtain walls, Roofing, Concrete and masonry restoration, and Others. Based on end use of the construction sealants market is segmented into Residential, Commercial, and Industrial. By distribution channel of the construction sealants market is segmented into Indirect sales and Direct sales. Regionally, the construction sealants industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Silicone-based sealants are projected to account for 36.0% of the market revenue in 2025, making them the leading product type in the construction sealants landscape. Their dominance can be attributed to superior flexibility, UV resistance, and long-term performance under extreme environmental conditions.

These sealants exhibit exceptional adhesion to glass, aluminum, and concrete materials commonly used in modern construction—making them ideal for both interior and exterior applications. The ability of silicone formulations to retain elasticity over time and resist chemical degradation supports their extensive use in structural glazing and expansion joints.

Additionally, their compatibility with green building initiatives and reduced maintenance requirements has further solidified their position as the preferred product in high-specification projects.

The window and door sealing segment is anticipated to hold 28.0% of the total application-based market share in 2025. This leadership stems from the rising global emphasis on energy efficiency and airtight construction standards.

Effective sealing around windows and doors is critical to reducing energy loss, improving acoustic insulation, and ensuring weather resistance. Construction norms across regions such as North America and Europe increasingly mandate enhanced sealing performance, prompting the use of advanced formulations in residential and commercial projects.

The renovation of older buildings and the proliferation of high-rise residential towers have further expanded the application of specialized sealants in fenestration systems. The drive toward net-zero buildings is expected to maintain consistent demand for high-performance sealant solutions in this segment.

The residential sector is expected to lead the market by contributing 42.0% of the revenue share in 2025. Increased urbanization, rising disposable income, and a surge in smart city initiatives have driven the construction of residential complexes globally.

Within this end-use segment, sealants are essential for moisture protection, air sealing, and joint durability, especially in regions prone to temperature fluctuations and heavy rainfall. Homeowners and developers alike are prioritizing materials that deliver lifecycle cost benefits and comply with environmental standards, favoring premium sealing solutions.

Furthermore, DIY home improvement trends and government incentives for energy-efficient buildings have boosted demand in residential remodeling projects. As housing demand grows across emerging economies, the residential sector is poised to remain a key driver of market expansion.

The construction sealants market is expanding due to increasing demand in residential, commercial, and infrastructure projects worldwide. Growth in 2024 and 2025 was fueled by applications in flooring, curtain walls, and expansion joints requiring flexible and durable sealing materials. Opportunities are emerging in high-performance hybrid sealants, pre-fabrication applications, and eco-aligned product formulations. Key trends include automation in sealant application, rising preference for multi-purpose products, and digital procurement solutions. However, volatility in raw material costs, strict environmental compliance requirements, and performance failures under extreme conditions remain significant restraints impacting market growth globally.

The primary growth driver is the increase in large-scale infrastructure and commercial projects across major economies. In 2024 and 2025, sealants were widely adopted in bridge joints, high-rise façades, and industrial flooring to ensure structural integrity and weatherproofing. Curtain wall glazing and expansion joints became major application segments as architects focused on long-term durability. Demand for polyurethane and silicone-based products rose significantly due to their adhesive strength and flexibility under dynamic loads. These developments highlight that rising construction activity and performance-driven material choices remain critical to sustaining market growth.

Significant opportunities exist in the development of advanced hybrid sealants for versatile applications. In 2025, silyl-modified polymer-based sealants gained traction for their superior adhesion and paintability, addressing both functional and aesthetic needs. Modular construction and prefabricated building systems created new demand for factory-applied sealant solutions, reducing on-site labor requirements. Specialized formulations for high-humidity areas such as bathrooms and kitchens opened additional market niches. These factors indicate that manufacturers prioritizing innovative chemistries and supporting modular building trends are well-positioned to capture expanding opportunities in global construction markets.

Emerging trends include the automation of sealant application and the rising preference for multi-purpose products. In 2024, automated dispensing systems were introduced in large construction projects to improve efficiency and reduce material waste. Multi-functional sealants combining adhesion, thermal insulation, and acoustic dampening capabilities became popular for modern building envelopes. Digital procurement platforms also gained traction, allowing contractors to optimize inventory and supply chain processes. These patterns demonstrate a strong shift toward convenience, cost efficiency, and performance integration, reshaping the competitive landscape for construction sealant manufacturers worldwide.

Market restraints are influenced by raw material price volatility, complex regulatory compliance, and technical limitations in extreme environments. In 2024 and 2025, fluctuations in petrochemical-derived inputs such as silicone and polyurethane elevated production costs, squeezing profit margins for suppliers. Stringent VOC emission limits imposed by regulatory bodies increased formulation complexity, further raising costs. Failures in adhesion and elasticity under severe weather conditions also posed reliability issues for some projects. These challenges underline the need for cost optimization, compliance-oriented R&D, and material innovation to maintain competitiveness and ensure long-term market growth.

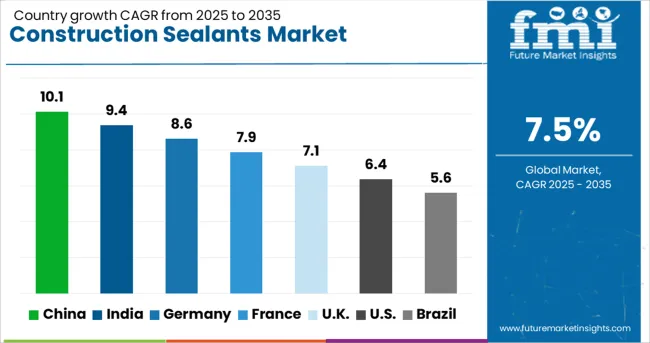

| Country | CAGR |

|---|---|

| China | 10.1% |

| India | 9.4% |

| Germany | 8.6% |

| France | 7.9% |

| UK | 7.1% |

| USA | 6.4% |

| Brazil | 5.6% |

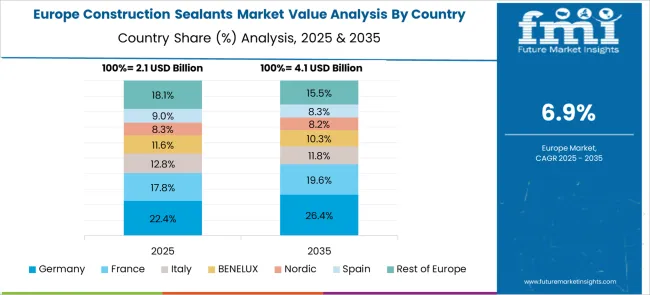

The global construction sealants market is projected to grow at 7.5% CAGR during 2025–2035. China leads with 10.1% CAGR, driven by mega-infrastructure projects and rising adoption of high-performance sealing solutions. India follows at 9.4%, supported by rapid urban development and demand for weather-resistant sealants. Germany posts 8.6% CAGR, focusing on eco-compliant products for green buildings and energy-efficient construction. The United Kingdom grows at 7.1%, while the United States records 6.4%, reflecting stable demand in mature markets emphasizing advanced sealants for renovation and smart building projects. Asia-Pacific dominates due to extensive construction activities, while Europe and North America prioritize sustainable formulations and advanced bonding technologies.

The construction sealants market in China is expected to grow at 10.1% CAGR, fueled by large-scale infrastructure projects, urban redevelopment, and growing demand for smart construction materials. Silicone and polyurethane-based sealants dominate, owing to superior weather resistance and bonding capabilities. Mega projects, such as high-speed rail networks and airport expansions, drive the adoption of sealants for joints and glazing applications. Domestic manufacturers expand production of eco-friendly formulations, while global brands introduce high-performance products for façade engineering and modular construction.

The construction sealants market in India is forecasted to grow at 9.4% CAGR, driven by urban infrastructure development, highway expansion, and residential housing projects. Sealants with high flexibility and temperature resistance see strong demand in diverse climatic zones. Government initiatives such as Smart Cities Mission and Bharatmala strengthen procurement for sealant products in roads, bridges, and metro projects. Local producers emphasize cost-effective silicone and hybrid sealants, while global players introduce premium-grade solutions with superior bonding and low VOC properties.

The construction sealants market in Germany is projected to grow at 8.6% CAGR, driven by stringent EU building efficiency standards and a strong focus on sustainable construction materials. Silicone-based sealants dominate glazing and façade systems for commercial buildings, while polyurethane products are widely used in flooring and structural bonding. Increasing adoption of low-emission and recyclable sealant materials aligns with Germany’s green building initiatives. Automation in application technologies, combined with advanced adhesive properties, supports efficiency in high-rise and prefabricated building projects.

The construction sealants market in the United Kingdom is expected to grow at 7.1% CAGR, driven by increased investments in residential renovation and large-scale infrastructure renewal. Adoption of sealants with thermal insulation and acoustic dampening properties grows in smart housing projects. Manufacturers develop hybrid polymer sealants that combine flexibility, high adhesion, and sustainability for long-term durability. Post-Brexit trade adjustments encourage localized production of sealant products to ensure consistent supply for public and private sector projects.

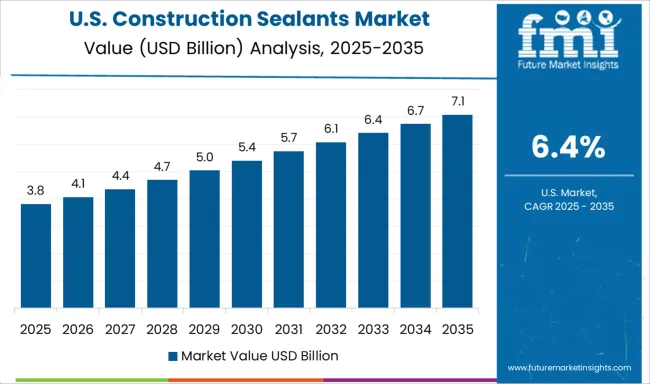

The construction sealants market in the United States is projected to grow at 6.4% CAGR, reflecting steady demand in commercial renovation, residential upgrades, and green building projects. Silicone and silyl-modified polymer (SMP) sealants lead adoption in curtain walls, flooring, and weatherproofing applications. Energy-efficient construction practices and LEED certification requirements accelerate demand for low-VOC, high-durability products. Automation in sealant application and robotic dispensing systems gain traction in large-scale building projects to improve precision and reduce labor costs.

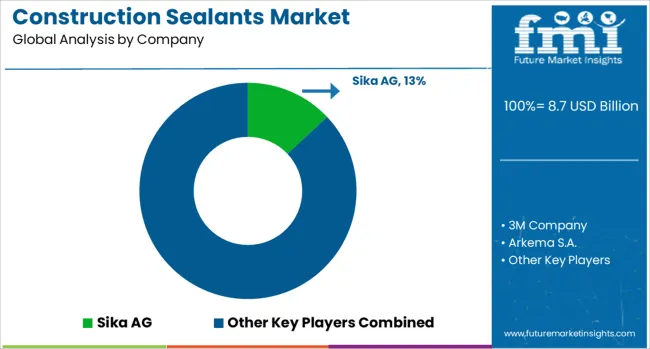

The construction sealants market is dominated by Sika AG, which secures its leadership through a wide portfolio of high-performance sealant solutions designed for structural glazing, joint sealing, and weatherproofing applications. Sika reinforces its dominant position with strong R&D capabilities, global manufacturing presence, and expertise in providing products that ensure durability, adhesion, and flexibility across commercial and residential construction projects. Key players such as Henkel AG & Co. KGaA, Dow Inc., BASF SE, 3M Company, and H.B. Fuller Company maintain significant shares by offering advanced silicone, polyurethane, and hybrid sealants tailored to withstand extreme environmental conditions while meeting stringent building standards. These companies focus on compatibility with modern building materials and improving application efficiency for large-scale projects. Emerging players including Arkema S.A. and its subsidiary Bostik, Avery Dennison Corporation, Huntsman Corporation, MAPEI S.p.A., RPM International Inc., Wacker Chemie AG, ITW Polymers Sealants, and Momentive Performance Materials Inc. are expanding their market footprint by introducing specialized sealant solutions for energy-efficient buildings and infrastructure repairs. Strategies among these suppliers involve developing low-VOC formulations, improving UV resistance, and leveraging regional distribution networks to capture demand in emerging economies. Market growth is driven by increased investment in construction projects, growing demand for energy-efficient structures, and stringent building codes that prioritize durability and safety. Continuous innovation in eco-friendly sealant technologies and enhanced performance characteristics is expected to influence competitive dynamics globally.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.7 Billion |

| Product Type | Silicone based sealants, Urethane based sealants, Acrylic based sealants, Polysulphide based sealants, and Others |

| Application | Window & door sealing, Concrete joints and cracks, Bathroom and kitchen sealing, Facades and curtain walls, Roofing, Concrete and masonry restoration, and Others |

| End Use | Residential, Commercial, and Industrial |

| Distribution Channel | Indirect sales and Direct sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sika AG, 3M Company, Arkema S.A., Avery Dennison Corporation, BASF SE, Bostik (an Arkema subsidiary), Dow Inc., H.B. Fuller Company, Henkel AG & Co. KGaA, Huntsman Corporation, ITW Polymers Sealants, MAPEI S.p.A., Momentive Performance Materials Inc., RPM International Inc., and Wacker Chemie AG |

| Additional Attributes | Dollar sales segmented by sealant type (silicone, polyurethane, acrylic, polysulfide) and applications (façade, glazing, joints, flooring). Regional adoption led by Asia-Pacific with strong demand in commercial construction; North America focuses on low-VOC compliance. Innovations include hybrid chemistries, thermal-insulating sealants, and certified sustainable formulations. OEM collaborations target energy-efficient building envelopes and integrated façade systems. |

The global construction sealants market is estimated to be valued at USD 8.7 billion in 2025.

The market size for the construction sealants market is projected to reach USD 17.9 billion by 2035.

The construction sealants market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in construction sealants market are silicone based sealants, urethane based sealants, acrylic based sealants, polysulphide based sealants and others.

In terms of application, window & door sealing segment to command 28.0% share in the construction sealants market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA