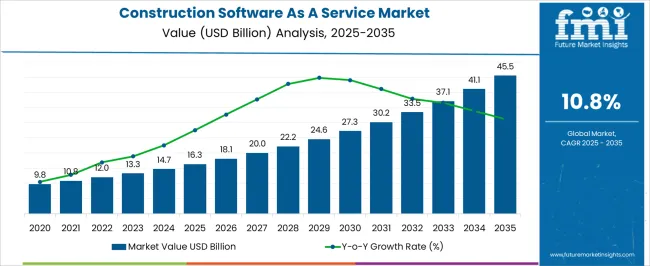

The construction software as a service market is estimated to be valued at USD 16.3 billion in 2025 and is projected to reach USD 45.5 billion by 2035, registering a compound annual growth rate (CAGR) of 10.8% over the forecast period. The 10-year growth comparison of the construction software as a service (SaaS) market indicates a strong upward trajectory, with market value projected to rise from USD 16.3 billion in 2025 to USD 45.5 billion by 2035, reflecting a compound annual growth rate (CAGR) of 10.8%.

This trend reflects the growing adoption of cloud-based construction management platforms, where project efficiency, collaboration, and real-time data access are increasingly driving decision-making and operational planning across contractors and developers. By 2035, the construction SaaS market is projected to reach USD 45.5 billion, underscoring the critical role of digital solutions in streamlining workflows, managing resources, and optimizing project delivery.

The steady growth pattern highlights that industry stakeholders are relying on software solutions that enhance transparency, reduce errors, and support large-scale project execution. The market outlook indicates that construction SaaS will continue to be a central component of operational strategies, providing long-term value to firms focused on efficiency, accountability, and performance.

The construction software as a service (SaaS) market is a specialized segment within the broader construction management software market, where it currently holds approximately 5-6% share, driven by the increasing demand for cloud-based solutions that streamline project planning, scheduling, and collaboration. Within the overall software as a service market, construction-focused SaaS solutions represent around 2-3% share, reflecting their niche application but high value in enabling real-time data access, reporting, and scalability for construction firms.

In the building information modeling (BIM) market, construction SaaS captures roughly 4-5% share, as cloud-based BIM solutions facilitate seamless coordination across design, engineering, and construction teams while improving project efficiency and reducing errors. Within the enterprise software market, its share is about 3-4%, driven by integration with other business systems such as accounting, procurement, and human resources for streamlined operations. Meanwhile, in the project management software market, construction SaaS accounts for approximately 4-5% share, as it offers specialized tools tailored to construction-specific workflows, resource allocation, and milestone tracking.

Collectively, these parent markets highlight the growing significance of construction software as a service in enhancing productivity, collaboration, and project visibility. With rising adoption of cloud technologies, digitalization in construction, and the need for efficient project execution, the market is expected to expand steadily, increasing its share and penetration across these parent sectors over the coming decade.

| Metric | Value |

|---|---|

| Construction Software As A Service Market Estimated Value in (2025 E) | USD 16.3 billion |

| Construction Software As A Service Market Forecast Value in (2035 F) | USD 45.5 billion |

| Forecast CAGR (2025 to 2035) | 10.8% |

SaaS-based solutions offer scalability, centralized data access, and faster implementation timelines, making them ideal for construction firms of all sizes. Regulatory emphasis on documentation transparency and risk mitigation has further accelerated the adoption of digital platforms.

With growing investment in commercial and public infrastructure, particularly in emerging economies, the demand for cloud-first construction software continues to intensify. The market is poised to benefit from integration with BIM, AI-based analytics, and IoT-enabled asset monitoring, reshaping productivity benchmarks across the sector.

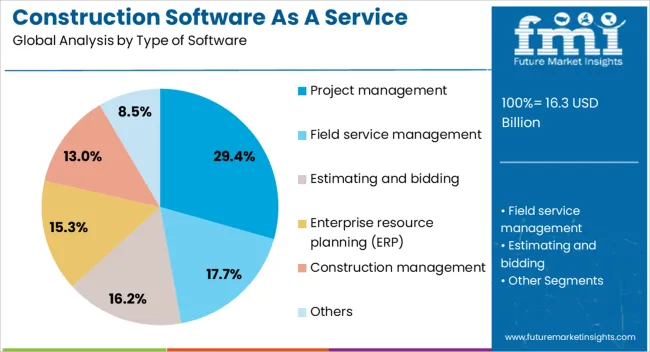

The construction software as a service market is segmented by type of software, deployment model, application, end-user, and geographic regions. By type of software, construction software as a service market is divided into Project management, Field service management, Estimating and bidding, Enterprise resource planning (ERP), Construction management, and Others.

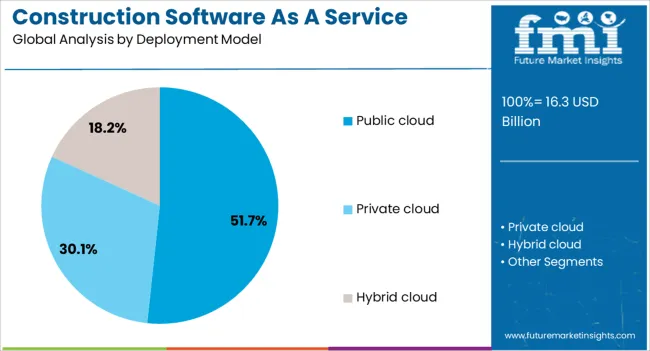

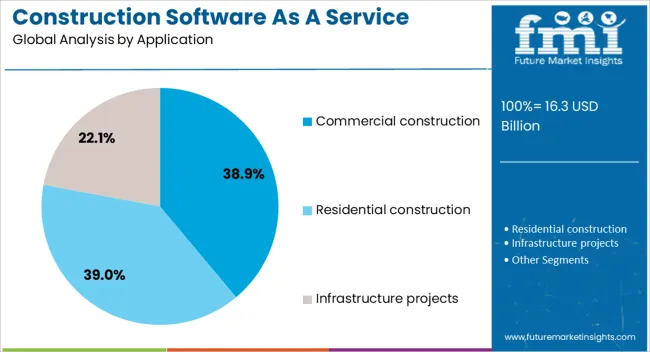

In terms of deployment model, construction software as a service market is classified into Public cloud, Private cloud, and Hybrid cloud. Based on application, construction software as a service market is segmented into Commercial construction, Residential construction, and Infrastructure projects. By end-user, construction software as a service market is segmented into General contractors, Subcontractors, Engineers and architects, and Builders & developers. Regionally, the construction software as a service industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Project management software is projected to lead the construction SaaS landscape with a 29.40% market share in 2025. This dominance is fueled by growing demand for end-to-end control over project lifecycles spanning planning, scheduling, budgeting, and resource management.

Real-time dashboards, automated reporting, and issue-tracking tools are helping firms reduce delays and manage subcontractors more effectively. Increased complexity in commercial and infrastructure projects has made project visibility essential, boosting reliance on centralized platforms.

Additionally, enhanced mobile access and role-based permissions have improved on-site coordination, further propelling this segment's relevance.

The public cloud model is forecast to account for 51.70% of the market share by 2025, making it the dominant deployment choice. Its scalability, lower upfront costs, and rapid implementation are highly attractive to construction firms seeking operational efficiency.

Public cloud platforms enable seamless access to updates, backups, and analytics, reducing IT overhead. Moreover, security enhancements and compliance certifications offered by major cloud providers are resolving earlier adoption hesitations.

As firms pursue digital maturity and distributed team coordination, the flexibility and cost efficiency of public cloud deployment continue to drive market preference.

Commercial construction is expected to hold a 38.90% market share by 2025, emerging as the leading application area. The segment’s leadership stems from heightened construction activity in office spaces, retail complexes, and urban infrastructure across developing economies.

Firms are turning to SaaS tools to streamline tendering, subcontractor management, and client reporting in complex multi-stakeholder environments. Additionally, the commercial sector's higher project value and compliance burden create strong incentives for automation and digital oversight.

As investors and developers demand faster project delivery and transparency, SaaS tools are increasingly embedded in commercial project execution workflows.

The construction software as a service market is expanding due to increasing digitalization and demand for efficient project management. Opportunities lie in IoT and BIM integration, while trends highlight AI-enabled analytics and mobile collaboration. Challenges include data security concerns and platform compatibility. Overall, market growth is supported by the need for real-time, cloud-based solutions that enhance efficiency, transparency, and operational effectiveness across construction projects globally.

The construction software as a service (SaaS) market is being driven by increasing adoption of digital tools in construction planning, project management, and operational workflows. Contractors, developers, and engineering firms are leveraging SaaS platforms to streamline scheduling, cost tracking, and resource management. Cloud-based solutions offer real-time collaboration among stakeholders, improve decision-making, and reduce project delays. Growing emphasis on operational efficiency, transparency, and compliance is accelerating demand for construction SaaS solutions across residential, commercial, and infrastructure projects worldwide.

Significant opportunities are arising from the integration of SaaS platforms with IoT sensors and Building Information Modeling (BIM) technologies. Real-time data from construction sites can enhance predictive maintenance, equipment utilization, and safety monitoring. SaaS solutions that support digital twins, resource optimization, and analytics offer value-added insights to improve project outcomes. Expansion in smart cities and large-scale infrastructure projects creates further potential for scalable, cloud-based construction software, enabling stakeholders to optimize costs, timelines, and operational efficiency.

A notable trend is the adoption of AI-driven analytics and mobile-enabled collaboration in construction SaaS platforms. Predictive scheduling, risk assessment, and automated reporting enhance project performance. Mobile applications allow field personnel and managers to access project data remotely, facilitating real-time updates and decision-making. Platforms offering integrated dashboards, visualization tools, and AI-based insights are increasingly preferred by construction firms seeking efficiency and cost control. These trends reflect the shift toward data-driven, connected, and intelligent construction project management solutions.

The market faces challenges due to concerns over data security, cloud infrastructure vulnerabilities, and compliance with regional data protection regulations. Integration with existing enterprise systems and legacy software can be complex, requiring customization and technical expertise. Resistance to digital adoption among smaller contractors and workforce training gaps also hinder rapid deployment.

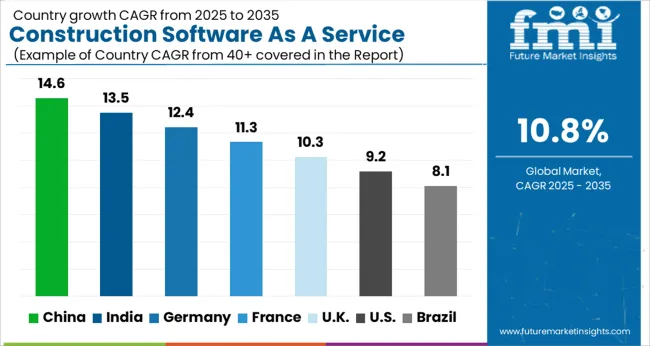

| Country | CAGR |

|---|---|

| China | 14.6% |

| India | 13.5% |

| Germany | 12.4% |

| France | 11.3% |

| UK | 10.3% |

| USA | 9.2% |

| Brazil | 8.1% |

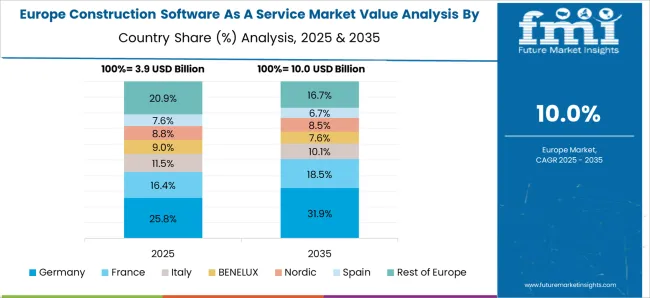

The global construction software as a service market is projected to grow at a CAGR of 10.8% from 2025 to 2035. China leads with a growth rate of 14.6%, followed by India at 13.5% and France at 11.3%. The United Kingdom records a growth rate of 10.3%, while the United States shows the slowest growth at 9.2%. Expansion is supported by increasing adoption of cloud-based construction management platforms, demand for project efficiency, and growing digitalization in the construction sector. Emerging markets like China and India benefit from rapid urbanization, large-scale infrastructure projects, and government-backed smart city initiatives, while developed countries such as the USA, UK, and France focus on upgrading legacy systems, integrating collaboration tools, and optimizing project workflows. This report includes insights on 40+ countries; the top markets are shown here for reference.

The construction software as a service market in China is growing at 14.6% CAGR, the highest among leading nations. Adoption is driven by large-scale infrastructure projects, increasing urban development, and government-backed smart city initiatives. Construction firms are implementing cloud-based project management, collaboration, and scheduling tools to improve efficiency and reduce delays. Integration with mobile platforms and IoT-enabled monitoring solutions further supports market growth. Demand is rising for software that enables remote project tracking, resource optimization, and real-time reporting.

The construction software as a service market in India is advancing at 13.5% CAGR, fueled by expanding urban infrastructure, industrial projects, and government smart city programs. Cloud-based construction management platforms are increasingly adopted for project planning, scheduling, budgeting, and reporting. Firms are focusing on digital collaboration tools to optimize workflows and reduce operational inefficiencies. Rising awareness of project efficiency and cost control further supports steady market growth.

The construction software as a service market in France is growing at 11.3% CAGR, supported by adoption of cloud-based project management and collaborative construction tools. Construction firms are implementing solutions for scheduling, resource allocation, budgeting, and compliance monitoring. Emphasis on efficient project delivery and real-time reporting contributes to market growth. Retrofit and modernization projects in urban areas further enhance SaaS adoption.

The construction software as a service market in the United Kingdom is expanding at 10.3% CAGR, influenced by digitalization of project management, smart building initiatives, and adoption of cloud collaboration tools. SaaS platforms are increasingly deployed for resource management, cost control, and project tracking. Demand for real-time reporting, remote monitoring, and integrated workflow solutions supports market growth. Construction firms are prioritizing software that improves efficiency and reduces project delays.

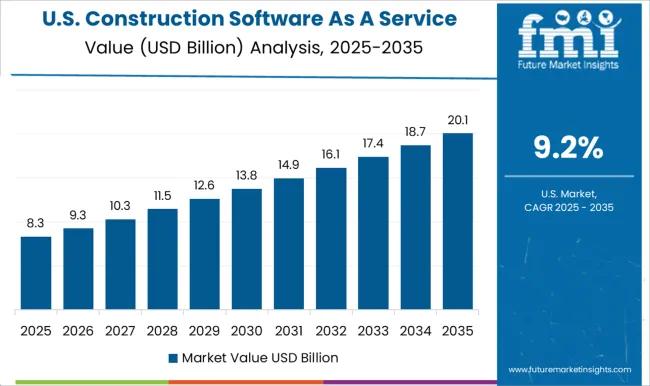

The construction software as a service market in the United States is growing at 9.2% CAGR, the slowest among leading nations. Adoption is driven by demand for cloud-based project management, collaboration tools, and workflow optimization. Firms are increasingly leveraging SaaS for scheduling, budgeting, and real-time project monitoring. Integration with mobile and IoT-enabled platforms supports efficiency improvements. Legacy system upgrades and digital transformation initiatives reinforce market expansion in residential, commercial, and industrial construction sectors.

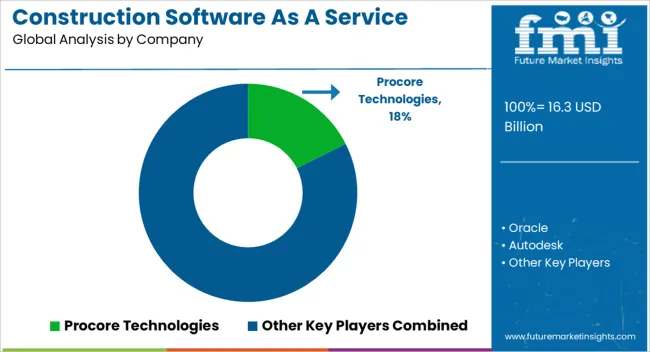

Leading suppliers in the construction software as a service market, such as Procore Technologies, Oracle, and Autodesk, are competing by offering cloud-based platforms that streamline project management, collaboration, and data analytics for construction firms. Procore emphasizes integrated project workflows and real-time reporting, with brochures highlighting improved team coordination, cost control, and reduced project delays. Oracle focuses on enterprise-grade construction management solutions, promoting scalability, advanced analytics, and seamless integration with ERP systems. Autodesk markets design and building information modeling (BIM) platforms delivered via cloud, emphasizing efficiency, collaboration, and reduced rework.

Other notable players, including Sage Group, Trimble, and Bentley Systems, differentiate through specialized modules for scheduling, asset management, and field operations. Buildertrend and Jonas Construction Software target small to mid-sized contractors, presenting user-friendly platforms with mobile accessibility. HCSS and Newforma emphasize data management and document control for large-scale infrastructure projects. Product brochures consistently focus on workflow optimization, real-time insights, and ease of integration with existing systems. Market competition is driven by how effectively companies communicate platform capabilities, flexibility, and ROI potential, positioning SaaS solutions as essential tools for efficient, transparent, and digitally connected construction operations.

| Item | Value |

|---|---|

| Quantitative Units | USD 16.3 Billion |

| Type of Software | Project management, Field service management, Estimating and bidding, Enterprise resource planning (ERP), Construction management, and Others |

| Deployment Model | Public cloud, Private cloud, and Hybrid cloud |

| Application | Commercial construction, Residential construction, and Infrastructure projects |

| End-User | General contractors, Subcontractors, Engineers and architects, and Builders & developers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Procore Technologies, Oracle, Autodesk, Sage Group, Trimble, Bentley Systems, Jonas Construction Software, Buildertrend, Heavy Construction Systems Specialists (HCSS), and Newforma |

| Additional Attributes | Dollar sales by software type (project management, design, estimating, scheduling) and deployment model (cloud-based, hybrid) are key metrics. Trends include growing demand for real-time collaboration, integration with BIM and IoT, and adoption in residential and commercial construction. Regional adoption, technological advancements, and efficiency-driven strategies are driving market growth. |

The global construction software as a service market is estimated to be valued at USD 16.3 billion in 2025.

The market size for the construction software as a service market is projected to reach USD 45.5 billion by 2035.

The construction software as a service market is expected to grow at a 10.8% CAGR between 2025 and 2035.

The key product types in construction software as a service market are project management, field service management, estimating and bidding, enterprise resource planning (ERP), construction management and others.

In terms of deployment model, public cloud segment to command 51.7% share in the construction software as a service market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom - Size, Share, and Forecast 2025 to 2035

Construction Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Construction Aggregates Market Trends - Growth, Demand & Forecast 2025 to 2035

Construction Anchor Market Growth – Trends & Forecast 2024-2034

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Material Testing Equipment Market Growth – Trends & Forecast 2024-2034

Construction Fabric Market Growth – Trends & Forecast 2024-2034

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Sealants Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Construction 4.0 Market Size and Share Forecast Outlook 2025 to 2035

Construction Bots Market Analysis Size and Share Forecast Outlook 2025 to 2035

Construction Pump Market Size and Share Forecast Outlook 2025 to 2035

Construction Chemical Industry Analysis in India - Size, Share, and Forecast 2025 to 2035

Construction Tech Market Analysis - Size, Demand & Trends 2025 to 2035

Construction Chemical Market Growth – Trends & Forecast 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA