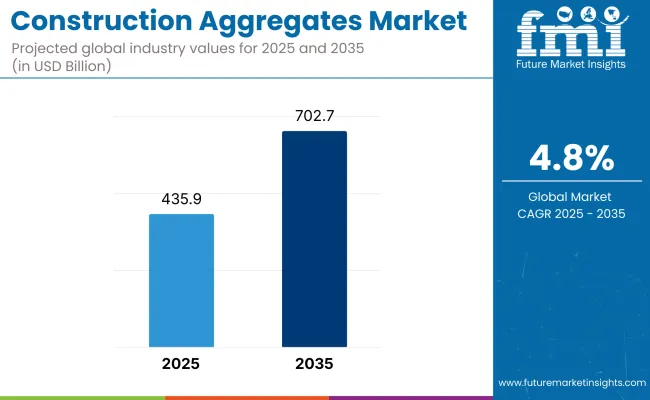

The construction aggregates market is set to grow from USD 435.9 billion in 2025 to USD 702.7 billion by 2035 at a CAGR of 4.86%. Construction aggregates such as crushed stone, sand, and gravel are the pillars of the construction and infrastructure industries, providing the basic building materials for roads, bridges, buildings, and many other public and private sector projects.

The rising demand for residential, commercial, and industrial infrastructure is a key industry growth driver. Urbanization at a rapid pace, especially among emerging industries, is generating increasing demand for dwelling houses, road and transport infrastructures, and commercial complexes that have intensive demand for aggregates. Besides that, government expenditure on mega-size infrastructure projects such as highways, railway lines, airports, and solar power plants is raising consumption levels globally.

Crushed stone, the largest of the aggregates industry's segments, is a staple in road base construction, cement manufacturing, and structural fill. Sand plays a vital role in the production of concrete and mortar, and gravel is used widely in drainage uses and road surfacing. Balancing natural resource extraction with sustainable production is increasingly critical, and innovations in recycled aggregates and green mining technology are called for.

Regionally, Asia Pacific will continue to lead the industry with large-scale infrastructure development, urban growth, and industrialization in China, India, and Southeast Asian nations. North America and Europe, however, are driven by demand for leading firms by infrastructure rehabilitation and renewal, sustainability, and green building.

The governments in these regions are investing in the rehabilitation and renewal of existing public infrastructure and encouraging circular construction practices, further driving the industry. Concurrently, the industry is shifting towards automation, digital tracking, and data-based quarrying in a bid to enhance productivity, reduce waste, and cut down environmental impact. Recycling aggregates are already in practice as an environmental initiative and cleaner construction practices.

Firms are investing more in R&D operations to produce improved quality and performing substitute products, thus widening the industry. There are some concerns, mostly in regulatory concerns in terms of environmental components, land use, and mining licenses. Further, the price volatility of raw materials and transport schemes can affect profit margins and supply chain efficiency. However, as there is a growing focus on green infrastructure and smart cities, the long-term future of the industry appears bright.

The industry in 2025 to 2035 will witness steady growth due to increasing global infrastructure demands, production and recycling technology trends, and a changing movement towards sustainable building practices. With investment continuing to flow into urbanization and infrastructure modernization, aggregate use will remain at the center of shaping the built future.

Market Metrics (2025 to 2035)

| Metrics | Values |

|---|---|

| Industry Size (2025E) | USD 435.9 billion |

| Industry Value (2035F) | USD 702.7 billion |

| CAGR (2025 to 2035) | 4.86% |

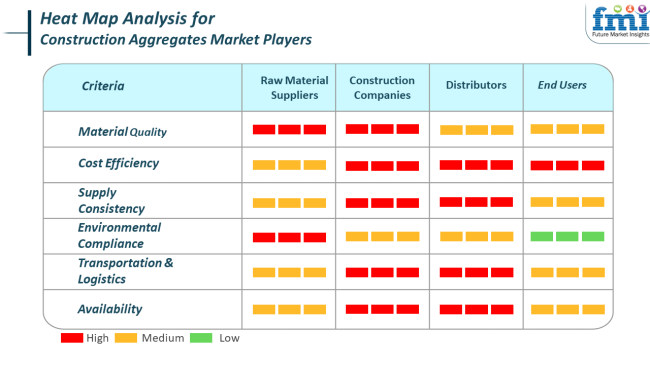

The aggregates industry in construction is an important segment of the overall construction industry, and different players place different levels of importance on supply chain attributes. Trade vendors concentrate on material quality and environmental acceptability, making sure raw aggregates are compliant to the industry while sustainable in intent.

Construction firms concentrate on cost reductions, supply stability, and logistics reliability, since they impact the budgets and schedules of projects immediately. Distribution providers focus heavily on transportation, price, and availability, making a concerted effort to deliver smooth running in the face of volatility of demand. Final users-construction contractors and property developers largely-are interested in affordable, available materials meeting project specifications, and not so much about upstream compliance.

Aggregate demand for construction services, supported by infrastructure expenditure that is increasing in the GCC, maintains strength in the industry. However, balance between control of the environment and high-volume, low-cost supply must be achieved so that growth is supported and stakeholders' satisfaction assured. Strategic sourcing and logistics efficiency will be critical for long-term industry competitiveness.

During 2020 to 2024, the industry experienced firm growth due to an acceleration in infrastructure development, urbanization, and road construction projects in emerging industries. Public-private partnerships and government stimulus packages for refurbishing infrastructure triggered demand for crushed rock, gravel, sand, and recycled aggregates. However, supply chain issues caused by the pandemic and increasing environmental concern over quarrying posed challenges. Solutions such as recycled aggregates were picking up speed but were not yet mainstream.

Between 2025 and 2035, construction aggregate demand will witness a shift towards circular, technology-based, and sustainable solutions. Implementation of green building codes, carbon-neutral infrastructure codes, and regulated land use codes will be the major drivers of the penetration of manufactured and recycled aggregates.

Sophisticated washing, crushing, and sorting technologies combined with automation and artificial intelligence will optimize aggregate quality and reduce waste. Modular fabrication and 3D printing of infrastructure will change material use and reduce dependence on traditional bulk aggregates. Low-impact extraction, smart cities, and climate-resilient infrastructure will revolutionize the industry. Quarries will be recycled and logistics of supply chain will be digitized to facilitate traceability, affordability, and environmental stewardship.

Comparative Market Shift Analysis (2020 to 2024 vs. 2025 to 2035)

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Infrastructure boom, road construction, urban residential growth. | Climate-resilient infrastructures, smart cities, and green building requirements. |

| Heavy reliance on natural aggregates: sand, gravel, and crushed stone. | Transition to recycled, lightweight, and manufactured aggregates to minimize environmental effects. |

| Increased demand for recycled aggregates; adoption still limited. | Circular economy practice dominates; high recycling rates and zero-waste building goals. |

| Old-fashioned crushing, screening, and batching with limited automation. | AI-boosted processing, computerized sorting, and automated quality control systems. |

| Fuel-hungry localized supply chains with limited digitization. | Digitally linked logistics networks with traceability and carbon-footprint monitoring. |

| Quarrying and transport emissions high; reclamation practices limited. | Environmentally friendly extraction, land rehabilitation, and low-emission operations as a norm. |

| Compliance centered on noise, dust suppression, and minimum mining safety standards. | Stringent ESG (Environmental, Social, Governance) regulations and carbon disclosure. |

| Bridges, apartment towers, industrial estates. | Intelligent highways, zero-carbon buildings, prefabricated metropolises, coastal protection measures. |

| Negligible R&D expenditure in new aggregate sources or performance-enhancing additives. | Development of bio-based binder, geopolymer -activated aggregates, and self-healing material blends. |

| Open-cast and riverbed mining by conventional machinery. | Regulated mining, subsurface mining, and robot-excavation of quarrying for land disturbance reduction. |

The growth of the industry is driven largely by fast urbanization, massive infrastructure development, and increasing construction activity in the developed and developing world. Government spending on transport infrastructure, housing real estate, and commercial building keeps driving demand for sand, gravel, crushed stone, and other aggregates.

But there are some risks that can ruin this growth trend. Economic uncertainty is one of them. Construction aggregates are highly related to infrastructure expenditure, which in turn follows the overall macroeconomic climate. Interest rates, inflation, and foreign financial industry risk aversion can limit construction or reduce the rate of intended development, thereby affecting aggregate demand. Volatility in raw materials and energy prices can also tighten profit margins of producers.

Supply chain disruptions are also a big risk. The industry depends upon affordable and on-time delivery of the materials, and disruptions-whether due to geopolitical tensions, workers' strikes, or natural disasters-can delay construction schedules by a considerable margin. Sometimes the shortage of good quality aggregates nearby can force the builders to import materials from farther away, increasing transportation cost and environmental impact.

Manpower shortages are another problem that is of an immediate nature. Construction globally is faced with a lack of skilled personnel, leading to wage inflation, as well as project time overruns. Given its labor-oriented nature, even a steady shortfall in the availability of manpower impacts profitability and productivity directly. Demand for trained site personnel, drivers, and machine operators is particularly huge.

Additionally, the industry is faced with increasing regulatory and environmental pressures. Increased building codes and environmental regulations are driving companies towards more sustainable operations, including the use of recycled aggregates. Although this change presents new opportunities, it also requires investments in compliance and processing technology. Non-compliance can lead to reputational harm and legal liabilities.

To steer through these threats, business players in the construction aggregates industry need to follow a multidimensional approach. This involves diversifying sources of supply, investing in the development of employees, negotiating fixed-cost contracts to mitigate price fluctuations, and focusing on sustainability. Companies that are innovative and regulatorially prepared will more likely ride out this changing wave.

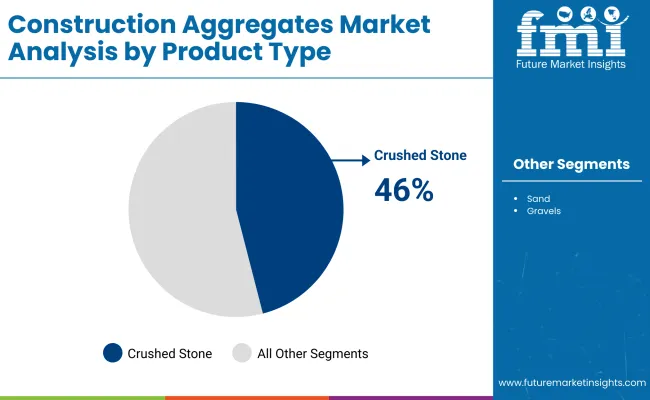

The industry will be majorly driven in 2025 by crushed stone and sand, which together arguably hold about 74% of the entire industry. While crushed stone is expected to enjoy the maximum, with a commanding lead at 46% share, and enjoys the following at 28% share.

The crushed stone, which acts under demand-pull factors in its application to many construction applications, namely infrastructure and non-residential construction, is primarily held fast as the pulling current of demand. Concrete mixes, road bases, airport runways, and railway ballast: Crushed stones are preferred as they impart strength, load-bearing capacity, and weathering resistance to these applications.

With upgraded infrastructure being the focal point globally, the demand for crushed stone is soaring. Countries like China and India are the major consumers of crushed stone, driven by urbanization, infrastructure, industrial corridors, and megacity development.

Key players in this segment include Vulcan Materials Company (USA), Martin Marietta Materials (USA), LafargeHolcim (Switzerland), and Heidelberg Materials (Germany). These players maintain large operational quarry sites and partnered processing plants that guarantee a steady supply that is in accordance with local and cross-border infrastructure demand.

Sand contributes 28% of the industry and is equally important in concrete production, asphalt paving, bricklaying, and mortar formulation. However, environmental challenges in riverbed sand mining and the depletion of natural sources have led to stricter regulations and the promotion of manufactured sand (M-sand). The M-sand provides a consistent particle size, fewer impurities, and greater compressive strength of concrete, making it the most preferred alternative in high-performance construction.

The increasing production capacity for M-sand is being supported by companies like CRH plc (Ireland) and UltraTech Cement (India) to meet the need for sustainable construction.

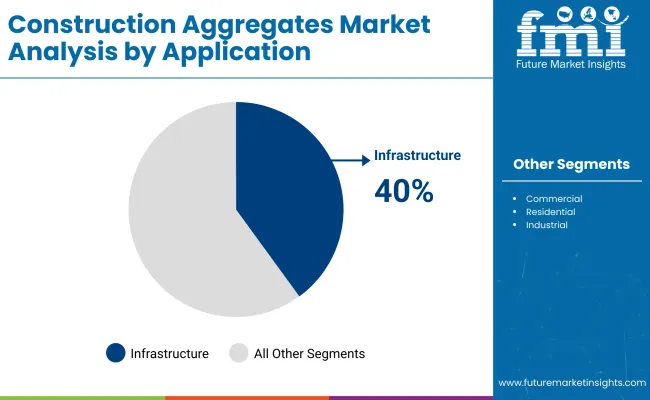

The industry is forecast to be heavily driven by infrastructure and residential development, which together account for almost 68% of the global demand. Infrastructure is expected to take a share of 40%, while residential construction occupies the remaining 28%.

Infrastructure development is the largest and fastest-growing application segment, with strategic investments underway in roads, bridges, airports, railways, and energy facilities. Governments across emerging industries are supporting public-private partnerships (PPPs) and putting in place large-scale construction funds.

Governments across emerging industries are boosting public-private partnerships (PPPs) and committing funds to large-scale construction. The National Infrastructure Pipeline (NIP) of India, for example, lays out an investment of about USD 1.4 trillion to be spent through 2025 in sectors related to transportation and energy, thereby increasing demand for aggregates like crushed stone and sand.

Another driver affecting aggregate consumption on a massive scale is the Belt and Road Initiative of China, which covers more than 60 countries. Very recently, large players like Heidelberg Materials, LafargeHolcim, and China National Building Material Group (CNBM) have been setting up such production hubs near key corridors of infrastructure for the smooth implementation of such megaprojects.

The residential construction industry, accounting for 28%, is seeing considerable growth due to the rising global population, migration to urban areas, and housing affordability programs. According to UN projects, more than 68% of the global population will be residing in urban centers by 2050, thus requiring a large amount of residential infrastructure. Quite strong demand continues in the USA due to low mortgage rates and population increases in suburban areas, whereas Brazil, Indonesia, and South Africa are launching programs for affordable housing.

Companies like Martin Marietta Materials and CRH plc are adding to their aggregate supply networks and establishing strategic distribution centers in urban areas with high growth potential to service the residential construction sector. They also maintain a strong focus on sustainability in sourcing, with investments in recycling technology and alternative materials to help protect the environment and comply with ESG requirements.

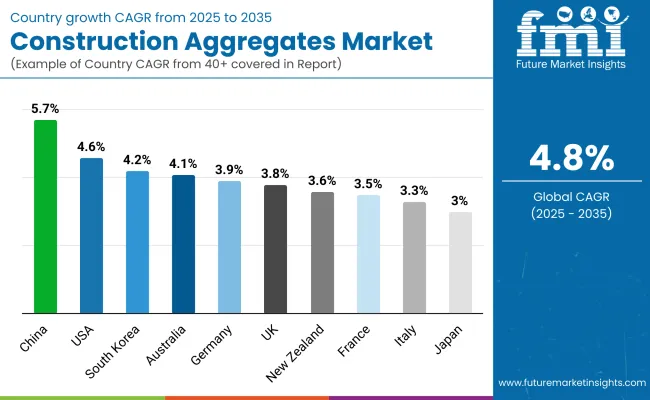

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 4.6% |

| UK | 3.8% |

| France | 3.5% |

| Germany | 3.9% |

| Italy | 3.3% |

| South Korea | 4.2% |

| Japan | 3% |

| China | 5.7% |

| Australia | 4.1% |

| New Zealand | 3.6% |

The USA industry is expected to post a strong CAGR of 4.6% during 2025 to 2035, spurred by an uptick in infrastructure renewal work and continuous urbanization in cities. Growth will be spurred by federal spending on bridge refurbishment, highway expansion, and green transport infrastructure. Unrelenting demand for sand, gravel, and crushed stone in residential and commercial settings is fuelling a stable supply-demand ecosystem.

Large players in the industry, like Vulcan Materials Company, Martin Marietta Materials, and LafargeHolcim, are amassing strength by way of takeovers and local production initiatives. Aggregate recycling technologies are gaining broader approval as well, meeting sustainability objectives and reducing environmental pressure. In-place regional supply and connected logistics infrastructures also guarantee industry strength and operating efficiency throughout the nation.

The UK industry is likely to advance at 3.8% CAGR during 2025 to 2035, reflecting gradual but stable growth due to investment in green building methods and construction of houses. Decarbonizing infrastructure and government retrofitting of existing buildings are driving demand for recycled and light aggregates.

Key industry players such as Tarmac, Breedon Group, and Aggregate Industries are concentrating on digitalizing the supply chain and meeting environmental regulations. Stricter regulatory frameworks on raw materials extraction and transport are impacting procurement as well as pricing policy. Transport infrastructure investment and the growth of commuter rail networks in city centers are also supporting demand.

France is also expected to reach a CAGR of 3.5% for the industry between 2025 and 2035, driven by government-directed projects such as social housing development and city redevelopment. Strategic urban planning and smart city projects are fostering the adoption of sustainable aggregates, most notably road sub-base and drainage uses.

Major companies like Lafarge (Holcim Group), CEMEX, and Vicat are exploiting circular economy principles and pushing the use of secondary aggregates from demolition material. Low-carbon footprint reduction is driving production practices and logistical efficiency. Public-private partnerships would have a good chance of defining long-term growth patterns, particularly in high-density development areas.

Germany's industry is forecast to grow at a CAGR of 3.9% between 2025 and 2035, driven by strong industrial construction work and official encouragement of green infrastructure. The addition of aggregates in strategic highway and rail network development schemes is expected to propel volume growth, particularly in the southern and eastern areas.

Key players like Heidelberg Materials, Holcim, and STRABAG SE are investing in cutting-edge processing facilities and efficiency-saving extraction. Increased demand for aggregates that are customized for precast concrete applications is driving product diversification. Circular construction and digital site management software will increase overall industry efficiency.

The Italian industry is anticipated to witness a CAGR of 3.3% during the period 2025 to 2035, primarily because of urban renewal projects and structural rehabilitation initiatives. Reconstruction in seismically active areas is also generating additional demand for high-durability concrete-compatible specialized aggregates.

Industry players such as Italcementi, Unical AG, and Holcim Italia are seeking performance-improved materials and increasing quality control initiatives. Increased application of ready-mix concrete in big city centers is driving sourcing policy. The implementation of EU-friendly green directives is revolutionizing material consumption patterns and encouraging the utilization of recycled aggregates in public infrastructure.

South Korea is forecast to have a CAGR of 4.2% for the industry during the period 2025 to 2035, driven by sustained urban regeneration and integration into smart cities. Port investment, logistics corridors, and transit-oriented developments as strategic infrastructure are serving as major growth drivers.

Industry drivers like Hanil Cement, Sampyo Group, and Asia Cement are making investments in expansion with high-end automation and precision grading technology. National green building standards are promoting the application of eco-certified aggregates. Further, increased emphasis on seismic-resistant infrastructure is driving the adoption of high-strength aggregates, especially in high-rise and mixed-use complexes.

Japan's industry is projected to expand at a moderate CAGR of 3.0% from 2025 to 2035. Population trends and an emphasis on disaster-resistant infrastructure appropriate to natural disaster mitigation drive the industry. Aging transportation infrastructure and urbanization in the Tokyo metropolitan area continue to provide stable demand.

Major players like Taiheiyo Cement, Sumitomo Osaka Cement, and Ube Industries are setting innovation agendas for low-carbon aggregates and automated quarrying systems. Precast concrete works and tunnel works are driving uniform aggregate demand. Conservation of the environment and rigorous land use policies are directing operating practices and site rehabilitation work.

China will be leading construction aggregates growth at a forecasted CAGR of 5.7% between 2025 and 2035 on account of colossal infrastructure rehabilitation under national development strategies. Mega projects, including high-speed rail, intercity expressways, and coastal city extensions, dominate demand.

Industry leaders such as China National Building Material Group, Anhui Conch, and CRH China are growing aggregate production capacity with end-to-end resource management and smart quarry systems. Massive up-takes of prefabricated building processes are fuelling aggregate demand. The need for sustainability is forcing the adoption of recycled aggregates, mainly in vertically growing cities.

The Australian industry is expected to register a CAGR of 4.1% in the forecast period 2025 to 2035, driven by infrastructure resilience projects and supported residential development around peri-urban and suburban regions. Growth in energy infrastructure and transport corridor expansion and growth in renewable projects is phenomenal.

Companies such as Boral Limited, Hanson Australia, and Holcim Australia are embracing computerized material handling and modular crushing systems to enhance production and consistency. Environmental performance indicators are also shaping public sector procurement policy and contributing to demand for low-emission aggregates. The transition to sustainable building products will accelerate over the next ten years.

New Zealand is anticipated to develop at a CAGR of 3.6% during the 2025 to 2035 period of the industry through seismic resilience activities and increasing public housing projects. Infrastructure growth in transportation, health, and education is leading the trend in the consumption of aggregates in the long term.

Leading suppliers Fulton Hogan, Winstone Aggregates, and Holcim New Zealand are prioritizing sustainable extraction methods and community-focused quarry operations. Government priority on climate-resilient construction is leading to the greater application of recycled aggregates and permeable uses of concrete. Investments in inter-regional links will be expected to guarantee enduring demand over 2035.

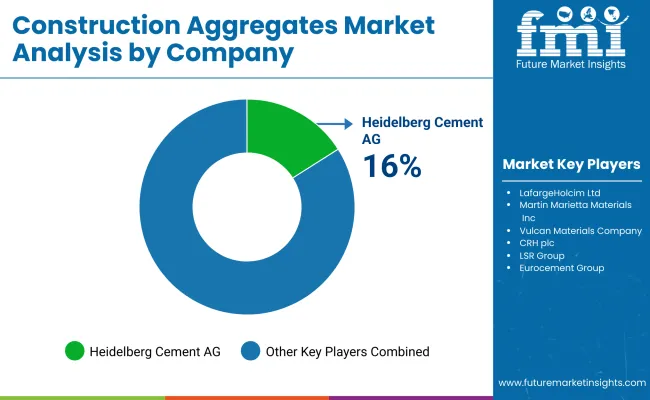

The industry is controlled by a few multinationals with vertically integrated operations, large networks of quarries, and sophisticated material processing capabilities. Heidelberg Cement AG, LafargeHolcim Ltd., and Vulcan Materials Company have a strong regional presence based on acquisitions, efficient supply chains, and modern mining techniques.

The regional players, such as LSR Group and Eurocement Group, carry out cost-effective production and distribution to somehow compete against these multinationals. As industry consolidation, larger companies continue to expand into quarry reserves and customer bases by buying out smaller aggregate producers.

Core competencies include sustainability, with developments in carbon-neutral aggregate production, utilization of recycled materials, and resource efficiency shaping competitive approaches. Heidelberg Cement and LafargeHolcim are frontrunners in alternative aggregate development, using recycled construction materials and advanced crushing techniques.

Following changes in environmental regulations, companies are adopting methods such as dust control systems, water recycling, and energy-efficient mining equipment. The increased need for recycled aggregates from construction-and-demolition (C&D) waste has impacted production strategies and partnerships with waste management companies, influencing their choice in terms of production strategies as well.

Automated quarrying, predictive maintenance, and technologically advanced smart logistics improve operational efficiency. Martin Marietta and CRH plc are applying AI-based tracking systems for materials, IoT-enabled management for fleets, and digitalized supply chains for their cost control and stock management.

Quarry automation, real-time feedback on production, and robotic sorting technologies are essential for increased outputs with less labor and operating costs. Equipped with this technology, companies can do much easier potential manipulation of their operational activities of extraction, processing, and transportation.

Additionally, diversification in the regional and product arenas fortifies competitive positioning. Vulcan Materials and CRH plc are enhancing their positions on the industry with investments in new quarry locations and venture into specialized aggregates. Local pricing strategies and longer-term contracts with construction companies and governmental infrastructure work stabilize the industry. Companies with extensive distribution networks, multimodal transport access, and vertical integrations have a strong advantage over competitors that operate in limited geographic areas.

Market Share Analysis by Company

| Company Name | Market Share (%) |

|---|---|

| Heidelberg Cement AG | 16-20% |

| LafargeHolcim Ltd. | 14-18% |

| Martin Marietta Materials Inc | 10-14% |

| Vulcan Materials Company | 8-12% |

| CRH plc | 6-10% |

| Combined Others | 30-40% |

| Company Name | Key Offerings and Activities |

|---|---|

| Heidelberg Cement AG | Pioneering low-carbon and recycled aggregates, integrating AI-driven quarry automation as well as sustainable material processing. |

| LafargeHolcim Ltd. | Leading supplier of eco-friendly aggregates, emphasizing circular economy solutions and alternative materials in construction. |

| Martin Marietta Materials Inc | Specializes in premium-quality crushed stone, sand, and gravel for residential and infrastructure projects. |

| Vulcan Materials Company | Focuses on automated quarrying, smart logistics, and innovative aggregate supply chain solutions. |

| CRH plc | Invests in sustainable aggregates, leveraging digital tools to optimize material production and delivery. |

Key Company Insights

Heidelberg Cement AG (16-20%)

Enhancing low-carbon and recycled aggregates, using AI in quarry automation together with sustainable techniques to maximize mining efficiency and minimize environmental impact.

LafargeHolcim Ltd (14-18%)

Pioneered the production of alternative construction materials across infrastructure and commercial sectors, as well as aggregate carbon-neutral output under circular economy principles.

Martin Marietta Materials Inc (10-14%)

Smart inventory management and AI-based logistics could further optimize distribution as well as the availability of materials within the supply chain.

Vulcan Materials Company (8-12%)

Fleet tracking AI and digitalized processing methods for materials could provide unprecedented efficiencies and cost savings to improve quarry operations.

CRH plc (6-10%)

Utilizing IoT-enabled real-time monitoring and automated sorting systems to enhance production quality and operational control across all quarry sites.

Other Key Players

By product type, the industry is segmented into crushed stone, sand, and gravels.

By application type, the industry is segmented into commercial, residential, industrial, and infrastructure.

By region, the industry is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa.

The industry is estimated to be USD 435.9 billion in 2025.

By 2035, the industry is projected to reach approximately USD 702.7 billion.

China is expected to register a 5.7% CAGR, backed by extensive government investments in infrastructure and real estate development.

Crushed stone and sand are the dominant product types, due to their essential role in concrete and road construction.

Leading companies include Heidelberg Cement AG, LafargeHolcim Ltd., Martin Marietta Materials Inc., Vulcan Materials Company, CRH plc, LSR Group, Eurocement Group, Adelaide Brighton Ltd., ROGERS GROUP INC., and Cemex SAB de CV ADR

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 4: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 5: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: North America Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 7: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 9: Latin America Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 10: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 11: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 12: Western Europe Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 13: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 15: Eastern Europe Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 16: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 17: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 18: South Asia and Pacific Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 19: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 21: East Asia Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Table 22: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 23: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 24: Middle East and Africa Market Value (US$ Million) Forecast by Application Type, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 6: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 13: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 14: Global Market Attractiveness by Application Type, 2023 to 2033

Figure 15: Global Market Attractiveness by Region, 2023 to 2033

Figure 16: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 17: North America Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 18: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 19: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 20: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 21: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 23: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 24: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 25: North America Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 26: North America Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 27: North America Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 28: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 29: North America Market Attractiveness by Application Type, 2023 to 2033

Figure 30: North America Market Attractiveness by Country, 2023 to 2033

Figure 31: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 32: Latin America Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 33: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 34: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 35: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 36: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 38: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 39: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 41: Latin America Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 42: Latin America Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 43: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 44: Latin America Market Attractiveness by Application Type, 2023 to 2033

Figure 45: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 46: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 47: Western Europe Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 48: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 49: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 50: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 51: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 52: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 53: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 54: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 56: Western Europe Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 57: Western Europe Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 58: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 59: Western Europe Market Attractiveness by Application Type, 2023 to 2033

Figure 60: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 61: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 62: Eastern Europe Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 63: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 64: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 65: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 66: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 67: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 68: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 69: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 70: Eastern Europe Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 71: Eastern Europe Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 72: Eastern Europe Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 73: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Attractiveness by Application Type, 2023 to 2033

Figure 75: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 76: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 77: South Asia and Pacific Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 78: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 81: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 82: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 83: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 84: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 85: South Asia and Pacific Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 86: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 87: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 88: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 89: South Asia and Pacific Market Attractiveness by Application Type, 2023 to 2033

Figure 90: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: East Asia Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 93: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 96: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 97: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 98: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 99: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 100: East Asia Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 101: East Asia Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 102: East Asia Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 103: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 104: East Asia Market Attractiveness by Application Type, 2023 to 2033

Figure 105: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 106: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 107: Middle East and Africa Market Value (US$ Million) by Application Type, 2023 to 2033

Figure 108: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 109: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 110: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 111: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 112: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 113: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 114: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 115: Middle East and Africa Market Value (US$ Million) Analysis by Application Type, 2018 to 2033

Figure 116: Middle East and Africa Market Value Share (%) and BPS Analysis by Application Type, 2023 to 2033

Figure 117: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application Type, 2023 to 2033

Figure 118: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 119: Middle East and Africa Market Attractiveness by Application Type, 2023 to 2033

Figure 120: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA