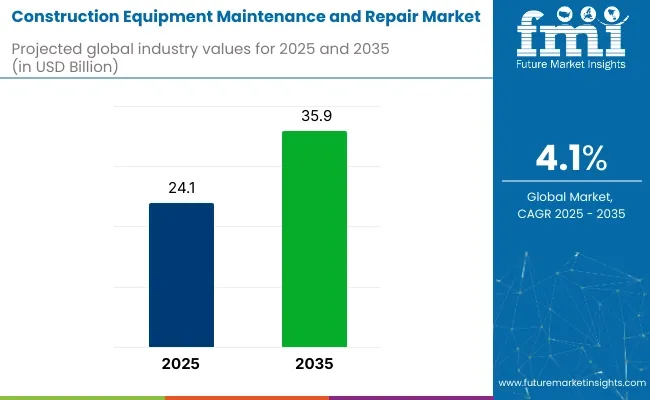

The global construction equipment maintenance and repair market was valued at USD 24.1 billion in 2025 and is projected to reach USD 35.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% during the forecast period. Market expansion is being driven by infrastructure investments, rising equipment utilization rates, and the adoption of asset management platforms to reduce unplanned downtime.

According to Fleetio, equipment maintenance programs are being increasingly standardized to include preventive and predictive protocols. In 2024, Fleetio reported that construction companies implementing data-driven service schedules recorded higher equipment availability and lower per-hour maintenance costs. These programs are being structured around scheduled inspections, fluid analysis, and component lifecycle tracking to ensure optimal equipment performance.

RPM Machinery highlighted in a 2024 release that a structured maintenance plan can reduce lifecycle equipment costs by minimizing emergency repairs and extending machine operating life. Their guidance emphasized that planned maintenance intervals allow for better resource allocation and technician scheduling. RPM also noted that original equipment manufacturers (OEMs) have started providing digital service records and remote diagnostics to improve service consistency across distributed job sites.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 24.1 billion |

| Market Value (2035F) | USD 35.9 billion |

| CAGR (2025 to 2035) | 4.1% |

Increased focus has also been placed on asset tracking and uptime analytics. A 2024 report by Tenna explained how GPS-enabled telematics and software platforms are being adopted to log operating hours, geofencing violations, and maintenance compliance. These systems are allowing fleet managers to monitor mechanical alerts and schedule services before failures occur. As Tenna noted, "Integrating telematics with maintenance planning reduces repair costs and limits revenue loss from equipment downtime".

The rise in equipment-as-a-service models and shared fleet ownership is also contributing to service contract demand. Contractors and rental operators are requiring high equipment uptime for multi-phase infrastructure projects and are investing in long-term service plans to ensure performance consistency.

As telematics, remote diagnostics, and predictive analytics become central to fleet operations, the construction equipment maintenance and repair market is expected to experience steady growth through 2035, supported by digital service optimization and increased equipment lifecycle management practices.

Loaders accounted for 31% of the global market share by vehicle type in 2025 and are projected to grow at a CAGR of 4.3% through 2035. Their extensive usage in construction, mining, and material handling applications contributed to frequent servicing requirements, particularly for hydraulic, engine, and drivetrain systems.

In 2025, high machine uptime expectations across quarrying and bulk material movement projects drove demand for timely maintenance and part replacements. Loaders operated in rugged environments, resulting in accelerated wear and necessitating routine inspection cycles.

OEMs and component suppliers expanded service programs for loaders with predictive maintenance tools, telematics integration, and scheduled overhaul packages. The prevalence of both compact and heavy-duty loader variants across global rental and contractor fleets ensured consistent volume demand in the aftermarket service ecosystem.

Authorized service centers represented 44% of the global market share in 2025 and are expected to grow at a CAGR of 4.2% through 2035. These centers were favored by equipment owners for warranty-compliant repairs, genuine parts access, and technician certification standards.

In 2025, OEM-backed service networks were strengthened through mobile units, regional depots, and annual maintenance contracts covering high-value equipment such as graders, backhoe loaders, and compactors. Fleet operators and infrastructure firms opted for authorized services to maintain residual value, ensure audit traceability, and comply with machine safety protocols.

Manufacturers invested in technician upskilling, diagnostic tool upgrades, and remote service capabilities to support machines operating in remote or high-utilization zones. The segment was particularly active in North America, Western Europe, and select parts of Southeast Asia where equipment financing agreements included bundled service coverage.

High Costs and Downtime Issues

High maintenance cost and unplanned breakdowns are one of the major challenges in constructing equipment maintenance and repair market. Construction machinery is used in hostile environments and often, which makes maintenance an expensive line item for companies.

Non-essential breakdowns delay projects and affect profit margins more than preventable maintenance plans. Companies have to implement both IOT-based monitoring systems and AI-powered analytics solutions for predictive maintenance which can reduce equipment failures and improve the repair scheduling process.

Integration of Smart Maintenance Technologies

Increase in use of IoT & AI for construction equipment maintenance are major factors over the favourable market growth. Integrating smart sensors, telematics, and advanced data analytics enable monitoring machinery health in real-time, allowing predictive and proactive maintenance strategies to be employed.

Automated maintenance scheduling, remote diagnostics, and digital twin technology are revolutionizing the field, reducing costs and improving efficiency. Real-time data analytics tools such as cloud-based fleet management systems and repair solutions powered by machine learning will give some companies a competitive edge in the evolving market.

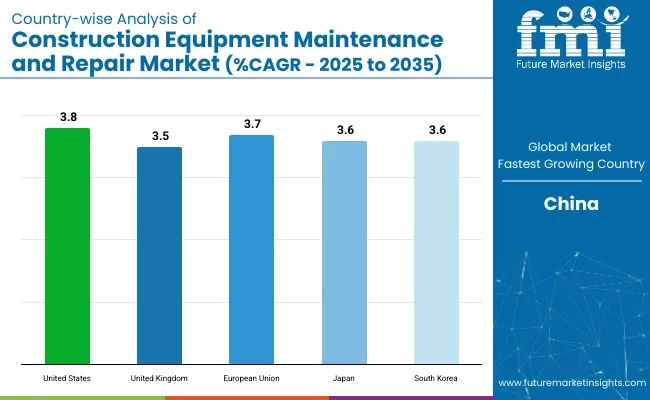

The United States accounts for the significant share in the construction equipment maintenance and repair market owing to the large-scale infrastructure projects, growing investment in smart construction technologies, and presence of major construction equipment manufacturers in the country. Predictive maintenance solutions utilizing IoT and AI-driven diagnostics are also rewriting the script, allowing for improved efficiency and reduced asset downtime.

This, along with an increased demand for rental construction equipment, has led to a spurring need for regular servicing and repair, further fuelling the market. Moreover, other factors such as stringent safety regulations and emissions control measures are enhancing the demand for maintenance services to ensure compliance with environmental standards.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 3.8% |

Growing government initiatives and plans for developing infrastructure projects such as smart cities in the country is likely to boost the United Kingdom construction equipment maintenance and repair market. With an increasing attention on sustainability, companies are upcycling and upgrading old machinery to meet green building standards.

Both have fuelled demand for scheduled maintenance and repair services, which has grown with the rise in leasing of equipment. Digital tethering with machines like bulldozers and loaders is allowing for real-time diagnostics and preventative maintenance minimizing surprises and expensive downtime.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 3.5% |

The European Union construction equipment maintenance and repair market is growing steadily, thanks to stringent environmental policies, rising urbanization and investment in large-scale infrastructure projects. The market is dominated by Germany, France, and Italy, which are pioneers in telematics-based maintenance solutions and automated diagnostics.

The increasing adoption of electric and hybrid construction equipment is also expected to create specialized repair and maintenance services. In addition, the emergence of robust aftermarket service providers and the alliances with Original Equipment Manufacturers (OEMs) are boosting the market landscape of Europe.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 3.7% |

In Japan, the construction equipment maintenance and repair industry is significant due to the ageing infrastructure of the country, in addition to growing mechanization and automation in construction. There is a growing demand for more sophisticated up keep, such as robotics-enabled inspections and AI-based failure prediction.

Further, the increasing emphasis on the development of earthquake resistant infrastructure and rapid urban redevelopment projects are enhancing the demand for improved machinery. Moreover, the presence of top construction equipment manufacturers and incorporation of smart diagnostics has supportive factor for the growth of the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.6% |

The South Korea construction equipment maintenance and repair market is also growing owing to the increasing investments in smart infrastructure and urban development projects. The fast-paced industrial growth and technological evolution have also fuelled the use of AI-based predictive maintenance systems.

Furthermore, the transition to building with eco-friendly equipment is guiding service providers to create solutions for extensive repair and maintenance services for electric and hybrid machinery. Increasing safety and emissions standards and government regulations also continue to drive demand to perform regular equipment inspections and maintenance services.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.6% |

The report is an in-depth analysis of the global construction equipment maintenance and repair market, monitoring the market for key trends, and the changing dynamics of the market. As the global construction industry continues to increase, companies are placing greater emphasis on preventive maintenance, condition-based monitoring and servicing for quick repairs to improve equipment longevity and reduce downtime.

Predictive maintenance technologies, IoT-based monitoring systems, and AI-powered diagnostics are transforming the market with affordable solutions that minimize the risk of unanticipated breakdowns. In addition, the rising investment in renting construction equipment has driven the market for specialized maintenance services to improve operational efficiency.

The overall market size for the construction equipment maintenance and repair market was USD 24.1 billion in 2025.

The construction equipment maintenance and repair market is expected to reach USD 35.9 billion in 2035.

The construction equipment maintenance and repair market is expected to grow at a CAGR of 4.1% during the forecast period.

The demand for the construction equipment maintenance and repair market will be driven by the increasing adoption of heavy machinery in infrastructure projects, rising equipment rental services, growing focus on predictive maintenance technologies, and the expansion of the construction industry in emerging markets.

The top five countries driving the development of the construction equipment maintenance and repair market are the USA, China, Germany, Japan, and India.

Table 1: Global Market Value (USD Million) Forecast by Region, 2020 to 2035

Table 2: Global Market Value (USD Million) Forecast by Component, 2020 to 2035

Table 3: Global Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 4: Global Market Value (USD Million) Forecast by Vehicle, 2020 to 2035

Table 5: Global Market Value (USD Million) Forecast by Service Provider, 2020 to 2035

Table 6: Global Market Value (USD Million) Forecast by Service Type, 2020 to 2035

Table 7: North America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 8: North America Market Value (USD Million) Forecast by Component, 2020 to 2035

Table 9: North America Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 10: North America Market Value (USD Million) Forecast by Vehicle, 2020 to 2035

Table 11: North America Market Value (USD Million) Forecast by Service Provider, 2020 to 2035

Table 12: North America Market Value (USD Million) Forecast by Service Type, 2020 to 2035

Table 13: Latin America Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 14: Latin America Market Value (USD Million) Forecast by Component, 2020 to 2035

Table 15: Latin America Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 16: Latin America Market Value (USD Million) Forecast by Vehicle, 2020 to 2035

Table 17: Latin America Market Value (USD Million) Forecast by Service Provider, 2020 to 2035

Table 18: Latin America Market Value (USD Million) Forecast by Service Type, 2020 to 2035

Table 19: Western Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 20: Western Europe Market Value (USD Million) Forecast by Component, 2020 to 2035

Table 21: Western Europe Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 22: Western Europe Market Value (USD Million) Forecast by Vehicle, 2020 to 2035

Table 23: Western Europe Market Value (USD Million) Forecast by Service Provider, 2020 to 2035

Table 24: Western Europe Market Value (USD Million) Forecast by Service Type, 2020 to 2035

Table 25: Eastern Europe Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 26: Eastern Europe Market Value (USD Million) Forecast by Component, 2020 to 2035

Table 27: Eastern Europe Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 28: Eastern Europe Market Value (USD Million) Forecast by Vehicle, 2020 to 2035

Table 29: Eastern Europe Market Value (USD Million) Forecast by Service Provider, 2020 to 2035

Table 30: Eastern Europe Market Value (USD Million) Forecast by Service Type, 2020 to 2035

Table 31: South Asia and Pacific Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 32: South Asia and Pacific Market Value (USD Million) Forecast by Component, 2020 to 2035

Table 33: South Asia and Pacific Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 34: South Asia and Pacific Market Value (USD Million) Forecast by Vehicle, 2020 to 2035

Table 35: South Asia and Pacific Market Value (USD Million) Forecast by Service Provider, 2020 to 2035

Table 36: South Asia and Pacific Market Value (USD Million) Forecast by Service Type, 2020 to 2035

Table 37: East Asia Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 38: East Asia Market Value (USD Million) Forecast by Component, 2020 to 2035

Table 39: East Asia Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 40: East Asia Market Value (USD Million) Forecast by Vehicle, 2020 to 2035

Table 41: East Asia Market Value (USD Million) Forecast by Service Provider, 2020 to 2035

Table 42: East Asia Market Value (USD Million) Forecast by Service Type, 2020 to 2035

Table 43: Middle East and Africa Market Value (USD Million) Forecast by Country, 2020 to 2035

Table 44: Middle East and Africa Market Value (USD Million) Forecast by Component, 2020 to 2035

Table 45: Middle East and Africa Market Value (USD Million) Forecast by Sales Channel, 2020 to 2035

Table 46: Middle East and Africa Market Value (USD Million) Forecast by Vehicle, 2020 to 2035

Table 47: Middle East and Africa Market Value (USD Million) Forecast by Service Provider, 2020 to 2035

Table 48: Middle East and Africa Market Value (USD Million) Forecast by Service Type, 2020 to 2035

Figure 1: Global Market Value (USD Million) by Component, 2025 to 2035

Figure 2: Global Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 3: Global Market Value (USD Million) by Vehicle, 2025 to 2035

Figure 4: Global Market Value (USD Million) by Service Provider, 2025 to 2035

Figure 5: Global Market Value (USD Million) by Service Type, 2025 to 2035

Figure 6: Global Market Value (USD Million) by Region, 2025 to 2035

Figure 7: Global Market Value (USD Million) Analysis by Region, 2020 to 2035

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2025 to 2035

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2025 to 2035

Figure 10: Global Market Value (USD Million) Analysis by Component, 2020 to 2035

Figure 11: Global Market Value Share (%) and BPS Analysis by Component, 2025 to 2035

Figure 12: Global Market Y-o-Y Growth (%) Projections by Component, 2025 to 2035

Figure 13: Global Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 14: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 15: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 16: Global Market Value (USD Million) Analysis by Vehicle, 2020 to 2035

Figure 17: Global Market Value Share (%) and BPS Analysis by Vehicle, 2025 to 2035

Figure 18: Global Market Y-o-Y Growth (%) Projections by Vehicle, 2025 to 2035

Figure 19: Global Market Value (USD Million) Analysis by Service Provider, 2020 to 2035

Figure 20: Global Market Value Share (%) and BPS Analysis by Service Provider, 2025 to 2035

Figure 21: Global Market Y-o-Y Growth (%) Projections by Service Provider, 2025 to 2035

Figure 22: Global Market Value (USD Million) Analysis by Service Type, 2020 to 2035

Figure 23: Global Market Value Share (%) and BPS Analysis by Service Type, 2025 to 2035

Figure 24: Global Market Y-o-Y Growth (%) Projections by Service Type, 2025 to 2035

Figure 25: Global Market Attractiveness by Component, 2025 to 2035

Figure 26: Global Market Attractiveness by Sales Channel, 2025 to 2035

Figure 27: Global Market Attractiveness by Vehicle, 2025 to 2035

Figure 28: Global Market Attractiveness by Service Provider, 2025 to 2035

Figure 29: Global Market Attractiveness by Service Type, 2025 to 2035

Figure 30: Global Market Attractiveness by Region, 2025 to 2035

Figure 31: North America Market Value (USD Million) by Component, 2025 to 2035

Figure 32: North America Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 33: North America Market Value (USD Million) by Vehicle, 2025 to 2035

Figure 34: North America Market Value (USD Million) by Service Provider, 2025 to 2035

Figure 35: North America Market Value (USD Million) by Service Type, 2025 to 2035

Figure 36: North America Market Value (USD Million) by Country, 2025 to 2035

Figure 37: North America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 40: North America Market Value (USD Million) Analysis by Component, 2020 to 2035

Figure 41: North America Market Value Share (%) and BPS Analysis by Component, 2025 to 2035

Figure 42: North America Market Y-o-Y Growth (%) Projections by Component, 2025 to 2035

Figure 43: North America Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 44: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 45: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 46: North America Market Value (USD Million) Analysis by Vehicle, 2020 to 2035

Figure 47: North America Market Value Share (%) and BPS Analysis by Vehicle, 2025 to 2035

Figure 48: North America Market Y-o-Y Growth (%) Projections by Vehicle, 2025 to 2035

Figure 49: North America Market Value (USD Million) Analysis by Service Provider, 2020 to 2035

Figure 50: North America Market Value Share (%) and BPS Analysis by Service Provider, 2025 to 2035

Figure 51: North America Market Y-o-Y Growth (%) Projections by Service Provider, 2025 to 2035

Figure 52: North America Market Value (USD Million) Analysis by Service Type, 2020 to 2035

Figure 53: North America Market Value Share (%) and BPS Analysis by Service Type, 2025 to 2035

Figure 54: North America Market Y-o-Y Growth (%) Projections by Service Type, 2025 to 2035

Figure 55: North America Market Attractiveness by Component, 2025 to 2035

Figure 56: North America Market Attractiveness by Sales Channel, 2025 to 2035

Figure 57: North America Market Attractiveness by Vehicle, 2025 to 2035

Figure 58: North America Market Attractiveness by Service Provider, 2025 to 2035

Figure 59: North America Market Attractiveness by Service Type, 2025 to 2035

Figure 60: North America Market Attractiveness by Country, 2025 to 2035

Figure 61: Latin America Market Value (USD Million) by Component, 2025 to 2035

Figure 62: Latin America Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 63: Latin America Market Value (USD Million) by Vehicle, 2025 to 2035

Figure 64: Latin America Market Value (USD Million) by Service Provider, 2025 to 2035

Figure 65: Latin America Market Value (USD Million) by Service Type, 2025 to 2035

Figure 66: Latin America Market Value (USD Million) by Country, 2025 to 2035

Figure 67: Latin America Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 70: Latin America Market Value (USD Million) Analysis by Component, 2020 to 2035

Figure 71: Latin America Market Value Share (%) and BPS Analysis by Component, 2025 to 2035

Figure 72: Latin America Market Y-o-Y Growth (%) Projections by Component, 2025 to 2035

Figure 73: Latin America Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 74: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 75: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 76: Latin America Market Value (USD Million) Analysis by Vehicle, 2020 to 2035

Figure 77: Latin America Market Value Share (%) and BPS Analysis by Vehicle, 2025 to 2035

Figure 78: Latin America Market Y-o-Y Growth (%) Projections by Vehicle, 2025 to 2035

Figure 79: Latin America Market Value (USD Million) Analysis by Service Provider, 2020 to 2035

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Service Provider, 2025 to 2035

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Service Provider, 2025 to 2035

Figure 82: Latin America Market Value (USD Million) Analysis by Service Type, 2020 to 2035

Figure 83: Latin America Market Value Share (%) and BPS Analysis by Service Type, 2025 to 2035

Figure 84: Latin America Market Y-o-Y Growth (%) Projections by Service Type, 2025 to 2035

Figure 85: Latin America Market Attractiveness by Component, 2025 to 2035

Figure 86: Latin America Market Attractiveness by Sales Channel, 2025 to 2035

Figure 87: Latin America Market Attractiveness by Vehicle, 2025 to 2035

Figure 88: Latin America Market Attractiveness by Service Provider, 2025 to 2035

Figure 89: Latin America Market Attractiveness by Service Type, 2025 to 2035

Figure 90: Latin America Market Attractiveness by Country, 2025 to 2035

Figure 91: Western Europe Market Value (USD Million) by Component, 2025 to 2035

Figure 92: Western Europe Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 93: Western Europe Market Value (USD Million) by Vehicle, 2025 to 2035

Figure 94: Western Europe Market Value (USD Million) by Service Provider, 2025 to 2035

Figure 95: Western Europe Market Value (USD Million) by Service Type, 2025 to 2035

Figure 96: Western Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 97: Western Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 100: Western Europe Market Value (USD Million) Analysis by Component, 2020 to 2035

Figure 101: Western Europe Market Value Share (%) and BPS Analysis by Component, 2025 to 2035

Figure 102: Western Europe Market Y-o-Y Growth (%) Projections by Component, 2025 to 2035

Figure 103: Western Europe Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 104: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 105: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 106: Western Europe Market Value (USD Million) Analysis by Vehicle, 2020 to 2035

Figure 107: Western Europe Market Value Share (%) and BPS Analysis by Vehicle, 2025 to 2035

Figure 108: Western Europe Market Y-o-Y Growth (%) Projections by Vehicle, 2025 to 2035

Figure 109: Western Europe Market Value (USD Million) Analysis by Service Provider, 2020 to 2035

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Service Provider, 2025 to 2035

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Service Provider, 2025 to 2035

Figure 112: Western Europe Market Value (USD Million) Analysis by Service Type, 2020 to 2035

Figure 113: Western Europe Market Value Share (%) and BPS Analysis by Service Type, 2025 to 2035

Figure 114: Western Europe Market Y-o-Y Growth (%) Projections by Service Type, 2025 to 2035

Figure 115: Western Europe Market Attractiveness by Component, 2025 to 2035

Figure 116: Western Europe Market Attractiveness by Sales Channel, 2025 to 2035

Figure 117: Western Europe Market Attractiveness by Vehicle, 2025 to 2035

Figure 118: Western Europe Market Attractiveness by Service Provider, 2025 to 2035

Figure 119: Western Europe Market Attractiveness by Service Type, 2025 to 2035

Figure 120: Western Europe Market Attractiveness by Country, 2025 to 2035

Figure 121: Eastern Europe Market Value (USD Million) by Component, 2025 to 2035

Figure 122: Eastern Europe Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 123: Eastern Europe Market Value (USD Million) by Vehicle, 2025 to 2035

Figure 124: Eastern Europe Market Value (USD Million) by Service Provider, 2025 to 2035

Figure 125: Eastern Europe Market Value (USD Million) by Service Type, 2025 to 2035

Figure 126: Eastern Europe Market Value (USD Million) by Country, 2025 to 2035

Figure 127: Eastern Europe Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 130: Eastern Europe Market Value (USD Million) Analysis by Component, 2020 to 2035

Figure 131: Eastern Europe Market Value Share (%) and BPS Analysis by Component, 2025 to 2035

Figure 132: Eastern Europe Market Y-o-Y Growth (%) Projections by Component, 2025 to 2035

Figure 133: Eastern Europe Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 134: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 135: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 136: Eastern Europe Market Value (USD Million) Analysis by Vehicle, 2020 to 2035

Figure 137: Eastern Europe Market Value Share (%) and BPS Analysis by Vehicle, 2025 to 2035

Figure 138: Eastern Europe Market Y-o-Y Growth (%) Projections by Vehicle, 2025 to 2035

Figure 139: Eastern Europe Market Value (USD Million) Analysis by Service Provider, 2020 to 2035

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Service Provider, 2025 to 2035

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Service Provider, 2025 to 2035

Figure 142: Eastern Europe Market Value (USD Million) Analysis by Service Type, 2020 to 2035

Figure 143: Eastern Europe Market Value Share (%) and BPS Analysis by Service Type, 2025 to 2035

Figure 144: Eastern Europe Market Y-o-Y Growth (%) Projections by Service Type, 2025 to 2035

Figure 145: Eastern Europe Market Attractiveness by Component, 2025 to 2035

Figure 146: Eastern Europe Market Attractiveness by Sales Channel, 2025 to 2035

Figure 147: Eastern Europe Market Attractiveness by Vehicle, 2025 to 2035

Figure 148: Eastern Europe Market Attractiveness by Service Provider, 2025 to 2035

Figure 149: Eastern Europe Market Attractiveness by Service Type, 2025 to 2035

Figure 150: Eastern Europe Market Attractiveness by Country, 2025 to 2035

Figure 151: South Asia and Pacific Market Value (USD Million) by Component, 2025 to 2035

Figure 152: South Asia and Pacific Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 153: South Asia and Pacific Market Value (USD Million) by Vehicle, 2025 to 2035

Figure 154: South Asia and Pacific Market Value (USD Million) by Service Provider, 2025 to 2035

Figure 155: South Asia and Pacific Market Value (USD Million) by Service Type, 2025 to 2035

Figure 156: South Asia and Pacific Market Value (USD Million) by Country, 2025 to 2035

Figure 157: South Asia and Pacific Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 160: South Asia and Pacific Market Value (USD Million) Analysis by Component, 2020 to 2035

Figure 161: South Asia and Pacific Market Value Share (%) and BPS Analysis by Component, 2025 to 2035

Figure 162: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Component, 2025 to 2035

Figure 163: South Asia and Pacific Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 164: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 165: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 166: South Asia and Pacific Market Value (USD Million) Analysis by Vehicle, 2020 to 2035

Figure 167: South Asia and Pacific Market Value Share (%) and BPS Analysis by Vehicle, 2025 to 2035

Figure 168: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Vehicle, 2025 to 2035

Figure 169: South Asia and Pacific Market Value (USD Million) Analysis by Service Provider, 2020 to 2035

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service Provider, 2025 to 2035

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service Provider, 2025 to 2035

Figure 172: South Asia and Pacific Market Value (USD Million) Analysis by Service Type, 2020 to 2035

Figure 173: South Asia and Pacific Market Value Share (%) and BPS Analysis by Service Type, 2025 to 2035

Figure 174: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Service Type, 2025 to 2035

Figure 175: South Asia and Pacific Market Attractiveness by Component, 2025 to 2035

Figure 176: South Asia and Pacific Market Attractiveness by Sales Channel, 2025 to 2035

Figure 177: South Asia and Pacific Market Attractiveness by Vehicle, 2025 to 2035

Figure 178: South Asia and Pacific Market Attractiveness by Service Provider, 2025 to 2035

Figure 179: South Asia and Pacific Market Attractiveness by Service Type, 2025 to 2035

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2025 to 2035

Figure 181: East Asia Market Value (USD Million) by Component, 2025 to 2035

Figure 182: East Asia Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 183: East Asia Market Value (USD Million) by Vehicle, 2025 to 2035

Figure 184: East Asia Market Value (USD Million) by Service Provider, 2025 to 2035

Figure 185: East Asia Market Value (USD Million) by Service Type, 2025 to 2035

Figure 186: East Asia Market Value (USD Million) by Country, 2025 to 2035

Figure 187: East Asia Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 190: East Asia Market Value (USD Million) Analysis by Component, 2020 to 2035

Figure 191: East Asia Market Value Share (%) and BPS Analysis by Component, 2025 to 2035

Figure 192: East Asia Market Y-o-Y Growth (%) Projections by Component, 2025 to 2035

Figure 193: East Asia Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 194: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 195: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 196: East Asia Market Value (USD Million) Analysis by Vehicle, 2020 to 2035

Figure 197: East Asia Market Value Share (%) and BPS Analysis by Vehicle, 2025 to 2035

Figure 198: East Asia Market Y-o-Y Growth (%) Projections by Vehicle, 2025 to 2035

Figure 199: East Asia Market Value (USD Million) Analysis by Service Provider, 2020 to 2035

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Service Provider, 2025 to 2035

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Service Provider, 2025 to 2035

Figure 202: East Asia Market Value (USD Million) Analysis by Service Type, 2020 to 2035

Figure 203: East Asia Market Value Share (%) and BPS Analysis by Service Type, 2025 to 2035

Figure 204: East Asia Market Y-o-Y Growth (%) Projections by Service Type, 2025 to 2035

Figure 205: East Asia Market Attractiveness by Component, 2025 to 2035

Figure 206: East Asia Market Attractiveness by Sales Channel, 2025 to 2035

Figure 207: East Asia Market Attractiveness by Vehicle, 2025 to 2035

Figure 208: East Asia Market Attractiveness by Service Provider, 2025 to 2035

Figure 209: East Asia Market Attractiveness by Service Type, 2025 to 2035

Figure 210: East Asia Market Attractiveness by Country, 2025 to 2035

Figure 211: Middle East and Africa Market Value (USD Million) by Component, 2025 to 2035

Figure 212: Middle East and Africa Market Value (USD Million) by Sales Channel, 2025 to 2035

Figure 213: Middle East and Africa Market Value (USD Million) by Vehicle, 2025 to 2035

Figure 214: Middle East and Africa Market Value (USD Million) by Service Provider, 2025 to 2035

Figure 215: Middle East and Africa Market Value (USD Million) by Service Type, 2025 to 2035

Figure 216: Middle East and Africa Market Value (USD Million) by Country, 2025 to 2035

Figure 217: Middle East and Africa Market Value (USD Million) Analysis by Country, 2020 to 2035

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2025 to 2035

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2025 to 2035

Figure 220: Middle East and Africa Market Value (USD Million) Analysis by Component, 2020 to 2035

Figure 221: Middle East and Africa Market Value Share (%) and BPS Analysis by Component, 2025 to 2035

Figure 222: Middle East and Africa Market Y-o-Y Growth (%) Projections by Component, 2025 to 2035

Figure 223: Middle East and Africa Market Value (USD Million) Analysis by Sales Channel, 2020 to 2035

Figure 224: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2025 to 2035

Figure 225: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2025 to 2035

Figure 226: Middle East and Africa Market Value (USD Million) Analysis by Vehicle, 2020 to 2035

Figure 227: Middle East and Africa Market Value Share (%) and BPS Analysis by Vehicle, 2025 to 2035

Figure 228: Middle East and Africa Market Y-o-Y Growth (%) Projections by Vehicle, 2025 to 2035

Figure 229: Middle East and Africa Market Value (USD Million) Analysis by Service Provider, 2020 to 2035

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Service Provider, 2025 to 2035

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service Provider, 2025 to 2035

Figure 232: Middle East and Africa Market Value (USD Million) Analysis by Service Type, 2020 to 2035

Figure 233: Middle East and Africa Market Value Share (%) and BPS Analysis by Service Type, 2025 to 2035

Figure 234: Middle East and Africa Market Y-o-Y Growth (%) Projections by Service Type, 2025 to 2035

Figure 235: Middle East and Africa Market Attractiveness by Component, 2025 to 2035

Figure 236: Middle East and Africa Market Attractiveness by Sales Channel, 2025 to 2035

Figure 237: Middle East and Africa Market Attractiveness by Vehicle, 2025 to 2035

Figure 238: Middle East and Africa Market Attractiveness by Service Provider, 2025 to 2035

Figure 239: Middle East and Africa Market Attractiveness by Service Type, 2025 to 2035

Figure 240: Middle East and Africa Market Attractiveness by Country, 2025 to 2035

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom - Size, Share, and Forecast 2025 to 2035

Construction Films Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA