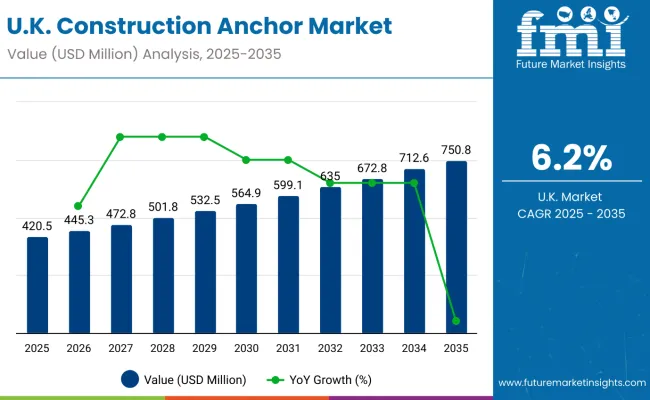

The UK construction anchor industry is projected to grow from USD 420.5 million in 2025 to USD 750.8 million by 2035, representing a CAGR of 6.2%. This expansion is driven by increased infrastructure spending, urban housing development, and a shift toward advanced anchoring solutions suited to contemporary construction demands.

Recent advancements have centered on smart anchor systems. Rawlplug introduced an AI-powered installation tracking system in 2024, tailored for sleeve anchors in large projects across the UK and France. The system enables real-time quality assurance and improves regulatory compliance on site. This innovation highlights a critical industry trend toward embedded sensor technology that enhances safety, documentation, and workflow transparency.

Product innovation has also been notable. Trutek Fasteners Polska, which opened a UK warehouse in 2024, launched concrete screw bolts designed for reusability and adjustment post-installation-without loss in load-bearing capacity. These anchors can be removed and reinstalled even in cracked concrete. A cordless gas-powered nailing tool, set for launch in 2025, was also unveiled. Such innovations underscore a broader effort to meet demands for faster, more flexible, and durable installations.

A key market milestone was the launch of the Follow‑Me Track‑iT weatherproof anchor at PLASA Show in September 2024. Though intended for AV and stage use, its success in outdoor and harsh environments shows the potential for high‑performance anchoring technologies in construction. This product demonstrates the sector’s capacity for crossover innovation and rigorous environmental standards.

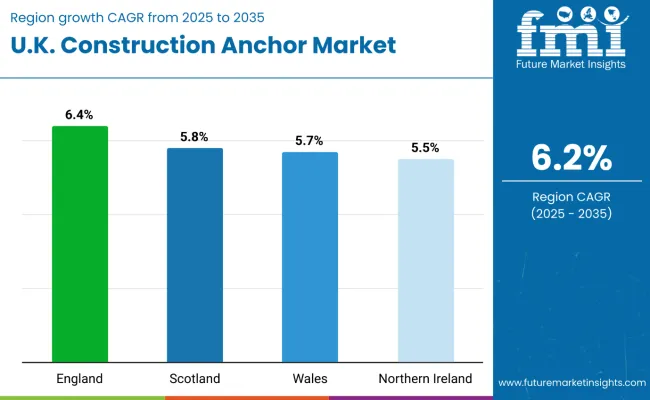

The UK’s industry structure reflects varied regional growth. England leads with infrastructure investments in rail, highways, and residential projects. Scotland trends toward sustainable construction methods that influence anchor selection. Wales sees steady demand driven by public spending on housing and highways, while Northern Ireland is impacted by urban development and government-backed construction programs.

As technology becomes more integrated-with anchoring systems featuring sensors, AI, and modular adjustability-the UK is emerging as a hub for anchor innovation. Trends include smart anchors, reusable fastening systems, and AI-driven installation tools, aligning with demand for more efficient, safe, and adaptive construction methodologies. These developments are set to underpin the UK market’s robust growth through 2035.

The UK construction anchors market is growing steadily, supported by ongoing infrastructure development, residential construction, and increasing focus on sustainable building practices. The market relies on a balance of domestic manufacturing and international trade to meet the demand for various types of anchoring solutions.

The construction anchors market in the UK is governed by stringent regulations and standards to ensure safety, quality, and performance in construction projects. These regulations cover product testing, installation guidelines, and environmental compliance, helping maintain structural integrity and worker safety.

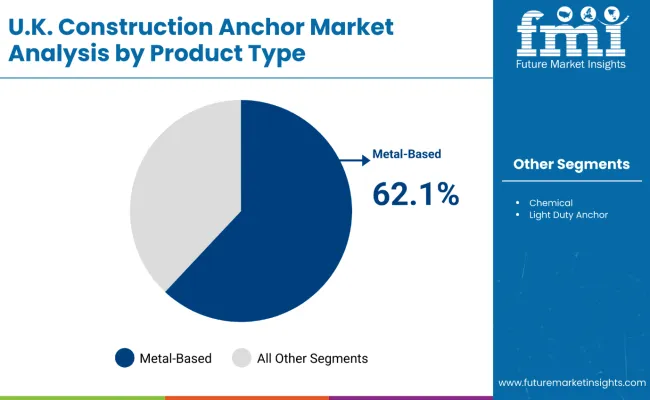

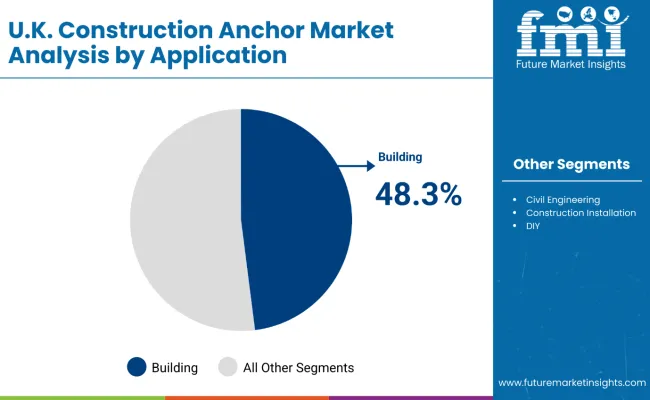

The construction anchor market in the UK is expanding due to robust demand in both commercial and residential projects. In 2025, metal-based anchors, including wedge and concrete screws, are projected to hold a market share of 62.1%. Building construction remains the leading application segment with a market share of 48.3%, supported by rising infrastructure investments.

Metal construction anchors are projected to capture approximately 62.1% of the UK market by 2025. Their superior tensile strength, resistance to load stress, and durability in adverse environmental conditions make them preferred in heavy-duty applications. Subtypes such as wedge anchors, undercut anchors, and concrete screws are widely adopted across large-scale commercial and infrastructure projects. These anchors are favored for their reliability in reinforced concrete, especially in structural applications like bridges, tunnels, and high-rise buildings.

Top suppliers like Hilti, fischer UK, ITW Construction Products, and Rawlplug have strengthened market presence through R&D in corrosion-resistant coatings, high-strength alloys, and tool-less installation innovations. For instance, fischer’s FBN II bolt anchor line is extensively used in steel structures due to its load-bearing precision. As regulations on construction safety tighten, contractors are shifting toward ETA-certified products, boosting the segment’s credibility.

The building construction segment is expected to command a 48.3% share of the UK construction anchor market by 2025. This dominance stems from rising demand for anchor systems in both residential and commercial building projects, especially in structural reinforcement, wall installation, façade fixing, and HVAC system mounting. Anchors are indispensable in ensuring the structural integrity of multi-storey buildings, hospitals, and educational facilities.

Players such as Hilti, DEWALT (Stanley Black & Decker), fischer UK, and Rawlplug supply advanced anchors tailored for different substrates, including concrete, masonry, and hollow brickwork. DEWALT’s range of mechanical drop-in anchors is extensively used in suspended ceiling installations and elevator support systems. Furthermore, the UK's shift toward net-zero buildings and retrofit upgrades for energy efficiency contributes to rising anchor consumption.

Future Market Insights (FMI) conducted a comprehensive survey with key stakeholders in the UK construction anchor industry, including manufacturers, suppliers, contractors, and regulatory bodies. The survey aimed to analyze current industry trends, technological advancements, and regulatory impacts shaping the industry.

A significant portion of respondents emphasized the growing demand for high-performance and corrosion-resistant anchors, particularly in large-scale infrastructure and commercial projects. Stakeholders noted that the rising adoption of sustainable and eco-friendly construction practices is driving innovation in anchoring solutions. Industry experts highlighted that government regulations promoting safety standards and sustainability have led to increased investment in advanced materials and testing procedures.

The push for high-load-capacity anchors in the construction of high-rise buildings, bridges, and tunnels is accelerating demand for premium anchoring solutions. Survey participants also pointed out that automation and digitalization in construction processes are transforming anchor manufacturing and installation techniques.

Contractors and suppliers surveyed by FMI expressed concerns about fluctuating raw material prices, which impact production costs and pricing strategies. However, they acknowledged that investments in R&D and product innovation could mitigate cost challenges while ensuring compliance with evolving building codes.

Additionally, manufacturers emphasized the importance of expanding distribution networks and forming strategic partnerships to strengthen their industry presence. FMI’s survey concluded that the UK construction anchor industry is poised for steady growth between 2025 and 2035.

Experts predict a significant shift toward modular construction, requiring adaptable anchoring solutions. Industry players believe that innovation, compliance with stringent safety standards, and the integration of digital technologies will be crucial for maintaining competitiveness in this evolving landscape.

| Regulation | Impact on Industry |

|---|---|

| UKCA (UK Conformity Assessed) Marking | Replaced the CE marking post-Brexit, requiring construction anchor manufacturers to comply with new certification and testing procedures. |

| BS 8539:2012 Code of Practice | Establishes best practices for selecting, installing, and testing anchors in construction, ensuring enhanced safety and performance. |

| Construction Products Regulation (CPR) | Mandates that all construction anchors meet fire and structural safety requirements, influencing material selection and manufacturing processes. |

| Health and Safety at Work Act 1974 | Requires employers to ensure safe anchoring practices on construction sites, impacting training and compliance costs. |

| UK Green Building Regulations | Encourages the use of environmentally friendly materials, driving innovation in sustainable anchoring solutions. |

| Building Safety Act 2022 | Strengthens accountability in construction projects, increasing the demand for high-quality, certified anchoring systems in high-risk buildings. |

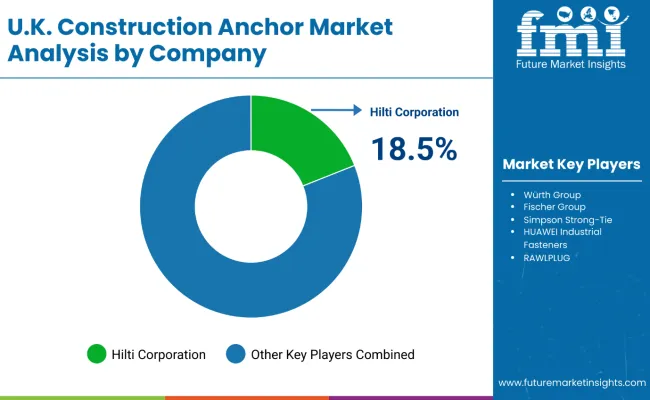

| Company | Market Share (%) |

|---|---|

| Hilti Corporation | 18.5% |

| Würth Group | 15.2% |

| Fischer Group | 12.8% |

| ITW (Illinois Tool Works) | 10.3% |

| EJOT Holding GmbH & Co. KG | 8.7% |

| Simpson Strong-Tie | 7.9% |

| HUAWEI Industrial Fasteners | 6.5% |

| RAWLPLUG | 5.2% |

| Sika AG | 4.8% |

| Others | 10.1% |

The UK construction anchor sector is one of the subsectors of construction materials and infrastructure development, being directly affected by macroeconomic factors such as the level of infrastructure investment, real estate development and regulatory frameworks.

To be steady growing throughout 2025 to 2035 owing to the urbanization scale-up, government funding in public infrastructure and demand towards sustainable construction practices. Government programs in the UK to build infrastructures such as housing, transport networks, and commercial spaces would reel a significant demand for construction anchors.

As a result of the National Infrastructure Strategy and the drive to achieve net-zero carbon buildings, there will be an upsurge in demand for high-performance, sustainable anchorage solutions. Also, ongoing private sector investments in commercial and industrial construction will drive further industry expansion.

Raw material prices, such as steel and adhesives, will have an effect on the cost to manufacturing. But technical developments like corrosion-resistant and high-load-capacity anchors will counter cost pressure. The growth in prefabrication and modular building methods, too, will offer opportunities for newly developed anchoring systems.

Economic factors such as inflation and interest rate fluctuations take place, but the UK construction anchor industry is still expected to remain strong with steady growth predicated on innovation, regulatory compliance, and increased activity within the construction sector.

The UK construction anchor industry is set to grow steadily between 2025 and 2035, fueled by a growing volume of infrastructure projects, improvements in sustainable construction practices, and a higher usage of high-performance anchoring solutions. The right opportunity is found in government-backed infrastructure modernization for transportation networks, bridges, and high-rise buildings.

Increased focus on green building initiatives will enable manufacturers to meet the needs for energy-efficient, corrosion resistant, and eco-friendly anchors. At the same time, the increasing popularity of prefabricated and modular construction will drive the demand for specialized fasteners, providing an opportunity for innovation.

Manufacturers should focus on innovation, carrying out R&D to produce cost-effective, high-strength, and lightweight anchoring solutions for emerging construction technologies, thereby restoring their growth potential.

Building relationships with contractors, distributors, and online retailers will increase reach and accessibility. They are also advised to take advantage of the digitalization of consumer behavior by utilizing e-commerce sales channels and providing virtual product demonstrations to respond to customer needs for convenience procurement to increase sales.

Regulatory compliance will become even more important, as emerging standards for safety and the environment will continue to create a requirement for certified, high-performance anchors. Manufacturers would have to proactively align with UK and EU construction regulations for their products to be accepted and in business for the long term.

Offering stronger options for seismic-resistant anchoring solutions could also give construction companies some added competitive edge-especially in high-risk construction zones. Focusing on innovation, sustainability, and strategic partnerships, the industry can emerge with additional revenue streams and sustained growth throughout the forecast period.

Large-scale infrastructure development projects, growing urbanization, and rising requirements for high-rise structures will propel the England construction anchor industry forward. As the demand for anchoring solutions rises, so does the city investments, especially on commercial and residential properties in London, Manchester, and Birmingham.

The continued UK government focus on smart cities and green infrastructure is also driving industry growth. Suitable for Internal use the advancements in anchor technology, such as lightweight, high-strength materials, and corrosion-resistant coatings, are enhancing performance and durability, making anchors a key element in contemporary construction.

Additionally, the increasing use of prefabricated and modular construction techniques is fueling industry demand. With the enhanced sectoral demands as England continues to reign as the largest industry in terms of production capacities and supply chains across the UK, the companies are implementing strategies to increase productivity rates to meet the demand.

According to the experts at FMI, the England construction anchor industry is set to witness a growth of nearly 6.4% during the 2025 to 2035 period.

The construction anchor industry in Scotland is steadily growing, with investments in infrastructure, renewable energy projects, and urban redevelopment backed by the government. With a rising number of commercial and residential construction jobs in cities like Glasgow and Edinburgh, there’s a growing need for quality anchoring solutions.

The increasing construction of offshore wind farms and hydroelectric projects is also a higher factor towards the industry growth as the building of such projects requires specialized anchors to retain their structural standing.

Scotland’s drive towards sustainable and energy-efficient construction has technology that fits very well with anchoring innovation. But the growth of the industry is constrained by its smaller size and lower levels of private-sector investment than is found in England. These challenges aside, the construction sector continues to be an important element of Scotland’s economy, and high demand for construction anchors driving the ongoing infrastructure modernization means this trend should continue.

The growth rate during the period 2025 to 2035 here will be approximately higher than 5.8% as further states FMI.

The Wales construction anchor industry is witnessing a steady growth on account of the public sector investments in the housing, infrastructure and industrial sectors. Commercial and residential construction in urban centers, such as Cardiff and Swansea, is rising, while the requirement of advanced anchoring systems is propelled by major infrastructure projects like rail network upgrades and highway improvements.

Furthermore, the Welsh government's emphasis on sustainable and energy-efficient building techniques further bolsters the promotion of innovative anchoring solutions. But the population size helps, as does the position in England and Scotland having money for us, as there are much fewer private sector deals.

Supply chain issues and varying material prices are also potential growth headwinds. However, with the ongoing modernization of its infrastructure and expansion of its construction sector, the need for high-performance anchors will likely grow in Wales.

FMI believes that the construction anchor industry in Wales will register over 5.7% CAGR during 2025 to 2035.

The Northern Ireland construction anchor industry is growing at a steady but relatively slow pace, albeit with substantial government infrastructure and urban development investments depicted. With commercial and residential construction on the rise in areas such as Belfast and Derry, this surging demand for long-lasting anchor systems is a welcome trend for the anchoring industry.

Industry expansion is also being driven by modernization of transportation networks such as roads, bridges, and public transit. But there are some limitations for the industry, for instance, reduced levels of private sector investment and the risk of an economic downturn that could turn construction activity lower.

Finally, demand for advanced anchoring solutions is being driven by stricter building regulations and an increasing focus on sustainability. Northern Ireland may have the smallest industry within the UK, but the drive for infrastructure development continues to guarantee demand in construction anchors.

According to FMI, the industry for Northern Ireland construction anchors is likely to progress at a growth rate of almost 5.5% during the period 2025 to 2035.

The UK construction anchor market is moderately consolidated, dominated by a few key players who hold significant market share. Companies like Breedon Group, Keller Group, and Forterra lead the industry through strategic acquisitions, product innovation, and expanded portfolios.

While these major players drive market trends, there are also numerous smaller regional suppliers and niche manufacturers contributing to a somewhat fragmented landscape at the lower end.

The market shows a blend of consolidation among top firms alongside fragmentation in smaller segments, allowing for competitive dynamics and opportunities for growth through mergers, acquisitions, and technological advancements.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 420.5 Million |

| Projected Market Size (2035) | USD 750.8 Million |

| CAGR (2025 to 2035) | 6.20% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and thousand units for volume |

| Products Analyzed (Segment 1) | Metal (Wedge Anchor, Undercut Anchor, Concrete Screws, Drop-in Anchor, Sleeve and Nail Anchor, Cast-in Anchor), Chemical (Injectable Adhesive Anchor, Capsule Adhesive Anchor), Light Duty Anchor (Nylon Plugs, Drywall Plugs, Drywall Screws, Insulation Anchor, Metal Screws) |

| Applications Analyzed (Segment 2) | Building Construction, Civil Engineering, Construction Installation, DIY |

| Sales Channels Analyzed (Segment 3) | Direct Sales, Distributor Sales, Retail Sales, Home Centers, Online Sales |

| Countries Covered | England, Scotland, Wales, Northern Ireland |

| Key Players influencing the UK Construction Anchor Market | Stanley Black & Decker, Inc., Hilti Corporation, Simpson Strong-Tie Company, Inc., EJOT Holding GmbH & Co. KG, Ancon Limited, Misumi Corporation, Platipus Anchor Ltd, 2K Polymer Systems, Itw Construction Products, Anchor Systems (International) Ltd, Others |

| Additional Attributes | Market size in dollar sales and CAGR, share by anchor type (mechanical, chemical), application trends (commercial, residential, infrastructure), regional dollar sales within UK, competitive dollar sales, material trends, regulatory standards, demand drivers. |

The growth is driven by increasing infrastructure projects, urbanization, and advancements in anchor technology, ensuring better durability and performance in construction.

Metal anchors like wedge and undercut anchors, along with chemical options such as injectable and capsule adhesive anchors, are widely used across various applications.

England leads due to large-scale projects, while Scotland, Wales, and Northern Ireland are seeing steady growth driven by infrastructure development and commercial construction.

Online sales are expanding due to convenience and accessibility, while retail and distributor channels remain strong for bulk purchases and professional construction needs.

The shift toward eco-friendly and energy-efficient buildings is increasing demand for durable, corrosion-resistant, and high-performance anchors in sustainable construction projects.

Table 01: Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Metal Product Type

Table 02: Value (US$ million) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Metal Product Type

Table 03: Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Chemical Product Type

Table 04: Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Light Duty Anchor Product Type

Table 05: Value (US$ million) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 06: Value in (US$ million) Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Sales Channel

Table 07: Volume (Th. Units) Historical Data 2018 – 2022 and Forecast 2023 to 2033 By Country

Table 08: Value (US$ million) Historical Data 2018 – 2022 and Forecast 2023 to 2033 By Country

Table 09: England Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Metal Product Type

Table 10: England Value (US$ Th) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Metal Product Type

Table 11: England Value (US$ Th) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Chemical Product Type

Table 12: England Value (US$ Th) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Light Duty Anchor Product Type

Table 13: England Value (US$ Th) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 14: England Value in (US$ Th) Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Sales Channel

Table 15: Scotland Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Metal Product Type

Table 16: Scotland Value (US$ Th) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Metal Product Type

Table 17: Scotland Value (US$ Th) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Chemical Product Type

Table 18: Scotland Value (US$ Th) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Light Duty Anchor Product Type

Table 19: Scotland Value (US$ Th) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 20: Scotland Value in (US$ Th) Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Sales Channel

Table 21: Wales Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Metal Product Type

Table 22: Wales Value (US$ Th) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Metal Product Type

Table 23: Wales Value (US$ Th) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Chemical Product Type

Table 24: Wales Value (US$ Th) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Light Duty Anchor Product Type

Table 25: Wales Value (US$ Th) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 26: Wales Value in (US$ Th) Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Sales Channel

Table 27: Northern Ireland Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Metal Product Type

Table 28: Northern Ireland Value (US$ Th) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Metal Product Type

Table 29: Northern Ireland Value (US$ Th) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Chemical Product Type

Table 30: Northern Ireland Value (US$ Th) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 Light Duty Anchor Product Type

Table 31: Northern Ireland Value (US$ Th) and Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Application

Table 32: Northern Ireland Value in (US$ Th) Volume (Th. Units) Historical Data 2018 to 2022 and Forecast 2023 to 2033 By Sales Channel

Figure 01: Historical Volume (000’ Units), 2018 to 2022

Figure 02: Volume (000’ Units) Forecast, 2023 to 2033

Figure 03: Historical Business Size (US$ million) (2018 to 2022)

Figure 04:Value (US$ million) Forecast, 2023 – 2033

Figure 05: Absolute $ Opportunity, 2018 to 2023 and 2033

Figure 06: Business Share and BPS Analysis Product Type – 2023 to 2033

Figure 07: Business Y-o-Y Growth Projections Product Type, 2022 to 2033

Figure 08: Business Attractiveness Product Type, 2023 to 2033

Figure 09: Business Share and BPS Analysis Metal Product Type – 2023 to 2033

Figure 10: Business Y-o-Y Growth Projections Metal Product Type, 2022 to 2033

Figure 11: Business Attractiveness Metal Product Type, 2023 to 2033

Figure 12: Business Share and BPS Analysis Chemical Product Type – 2023 to 2033

Figure 13: Business Y-o-Y Growth Projections Chemical Product Type, 2022 to 2033

Figure 14: Business Attractiveness Chemical Product Type, 2023 to 2033

Figure 15: Business Share and BPS Analysis Light Duty Product Type – 2023 to 2033

Figure 16: Business Y-o-Y Growth Projections Light Duty Anchor Product Type, 2022 to 2033

Figure 17: Business Attractiveness Light Duty Anchor Product Type, 2023 to 2033

Figure 18: Incremental $ Opportunity Product Type, 2023 to 2033

Figure 19: Business Share and BPS Analysis By Application – 2023 to 2033

Figure 20: Business Y-o-Y Growth Projections By Application, 2022 to 2033

Figure 21: Business Attractiveness By Application, 2023 to 2033

Figure 22: Incremental $ Opportunity By Application, 2023 to 2033

Figure 23: Business Share and BPS Analysis By Sales Channel – 2023 to 2033

Figure 24: Business Y-o-Y Growth Projections By Sales Channel, 2022 to 2033

Figure 25: Business Attractiveness By Sales Channel, 2023 to 2033

Figure 26: Incremental $ Opportunity Sales channel, 2023 to 2033

Figure 27: Business Share and BPS Analysis By Country – 2023 to 2033

Figure 28: Business Y-o-Y Growth Projections By Country, 2022 to 2033

Figure 29: Business Attractiveness By Country, 2023 to 2033

Figure 30: Incremental $ Opportunity By Country, 2023 to 2033

Figure 31: England Business Share and BPS Analysis Product Type – 2023 to 2033

Figure 32: England Business Y-o-Y Growth Projections Product Type, 2022 to 2033

Figure 33: England Business Attractiveness Product Type, 2023 to 2033

Figure 34: England Business Share and BPS Analysis Metal Product Type – 2023 to 2033

Figure 35: England Business Y-o-Y Growth Projections Metal Product Type, 2022 to 2033

Figure 36: England Business Attractiveness Metal Product Type, 2023 to 2033

Figure 37: England Business Share and BPS Analysis Chemical Product Type – 2023 to 2033

Figure 38: England Business Y-o-Y Growth Projections Chemical Product Type, 2022 to 2033

Figure 39: England Business Attractiveness Chemical Product Type, 2023 to 2033

Figure 40: England Business Share and BPS Analysis Light Duty Product Type – 2023 to 2033

Figure 41: England Business Y-o-Y Growth Projections Light Duty Anchor Product Type, 2022 to 2033

Figure 42: England Business Attractiveness Light Duty Anchor Product Type, 2023 to 2033

Figure 43: England Business Share and BPS Analysis By Application – 2023 to 2033

Figure 44: England Business Y-o-Y Growth Projections By Application, 2022 to 2033

Figure 45: England Business Attractiveness By Application, 2023 to 2033

Figure 46: England Business Share and BPS Analysis By Sales Channel – 2023 to 2033

Figure 47: England Business Y-o-Y Growth Projections By Sales Channel, 2022 to 2033

Figure 48: England Business Attractiveness By Sales Channel, 2023 to 2033

Figure 49: Scotland Business Share and BPS Analysis Product Type – 2023 to 2033

Figure 50: Scotland Business Y-o-Y Growth Projections Product Type, 2022 to 2033

Figure 51: Scotland Business Attractiveness Product Type, 2023 to 2033

Figure 52: Scotland Business Share and BPS Analysis Metal Product Type – 2023 to 2033

Figure 53: Scotland Business Y-o-Y Growth Projections Metal Product Type, 2022 to 2033

Figure 54: Scotland Business Attractiveness Metal Product Type, 2023 to 2033

Figure 55: Scotland Business Share and BPS Analysis Chemical Product Type – 2023 to 2033

Figure 56: Scotland Business Y-o-Y Growth Projections Chemical Product Type, 2022 to 2033

Figure 57: Scotland Business Attractiveness Chemical Product Type, 2023 to 2033

Figure 58: Scotland Business Share and BPS Analysis Light Duty Product Type – 2023 to 2033

Figure 59: Scotland Business Y-o-Y Growth Projections Light Duty Anchor Product Type, 2022 to 2033

Figure 60: Scotland Business Attractiveness Light Duty Anchor Product Type, 2023 to 2033

Figure 61: Scotland Business Share and BPS Analysis By Application – 2023 to 2033

Figure 62: Scotland Business Y-o-Y Growth Projections By Application, 2022 to 2033

Figure 63: Scotland Business Attractiveness By Application, 2023 to 2033

Figure 64: Scotland Business Share and BPS Analysis By Sales Channel – 2023 to 2033

Figure 65: Scotland Business Y-o-Y Growth Projections By Sales Channel, 2022 to 2033

Figure 66: Scotland Business Attractiveness By Sales Channel, 2023 to 2033

Figure 67: Wales Business Share and BPS Analysis Product Type – 2023 to 2033

Figure 68: Wales Business Y-o-Y Growth Projections Product Type, 2022 to 2033

Figure 69: Wales Business Attractiveness Product Type, 2023 to 2033

Figure 70: Wales Business Share and BPS Analysis Metal Product Type – 2023 to 2033

Figure 71: Wales Business Y-o-Y Growth Projections Metal Product Type, 2022 to 2033

Figure 72: Wales Business Attractiveness Metal Product Type, 2023 to 2033

Figure 73: Wales Business Share and BPS Analysis Chemical Product Type – 2023 to 2033

Figure 74: Wales Business Y-o-Y Growth Projections Chemical Product Type, 2022 to 2033

Figure 75: Wales Business Attractiveness Chemical Product Type, 2023 to 2033

Figure 76: Wales Business Share and BPS Analysis Light Duty Product Type – 2023 to 2033

Figure 77: Wales Business Y-o-Y Growth Projections Light Duty Anchor Product Type, 2022 to 2033

Figure 78: Wales Business Attractiveness Light Duty Anchor Product Type, 2023 to 2033

Figure 79: Wales Business Share and BPS Analysis By Application – 2023 to 2033

Figure 80: Wales Business Y-o-Y Growth Projections By Application, 2022 to 2033

Figure 81: Wales Business Attractiveness By Application, 2023 to 2033

Figure 82: Wales Business Share and BPS Analysis By Sales Channel – 2023 to 2033

Figure 83: Wales Business Y-o-Y Growth Projections By Sales Channel, 2022 to 2033

Figure 84: Wales Business Attractiveness By Sales Channel, 2023 to 2033

Figure 85: Northern Ireland Business Share and BPS Analysis Product Type – 2023 to 2033

Figure 86: Northern Ireland Business Y-o-Y Growth Projections Product Type, 2022 to 2033

Figure 87: Northern Ireland Business Attractiveness Product Type, 2023 to 2033

Figure 88: Northern Ireland Business Share and BPS Analysis Metal Product Type – 2023 to 2033

Figure 89: Northern Ireland Business Y-o-Y Growth Projections Metal Product Type, 2022 to 2033

Figure 90: Northern Ireland Business Attractiveness Metal Product Type, 2023 to 2033

Figure 91: Northern Ireland Business Share and BPS Analysis Chemical Product Type – 2023 to 2033

Figure 92: Northern Ireland Business Y-o-Y Growth Projections Chemical Product Type, 2022 to 2033

Figure 93: Northern Ireland Business Attractiveness Chemical Product Type, 2023 to 2033

Figure 94: Northern Ireland Business Share and BPS Analysis Light Duty Product Type – 2023 to 2033

Figure 95: Northern Ireland Business Y-o-Y Growth Projections Light Duty Anchor Product Type, 2022 to 2033

Figure 96: Northern Ireland Business Attractiveness Light Duty Anchor Product Type, 2023 to 2033

Figure 97: Northern Ireland Business Share and BPS Analysis By Application – 2023 to 2033

Figure 98: Northern Ireland Business Y-o-Y Growth Projections By Application, 2022 to 2033

Figure 99: Northern Ireland Business Attractiveness By Application, 2023 to 2033

Figure 100: Northern Ireland Business Share and BPS Analysis By Sales Channel – 2023 to 2033

Figure 101: Northern Ireland Business Y-o-Y Growth Projections By Sales Channel, 2022 to 2033

Figure 102: Northern Ireland Business Attractiveness By Sales Channel, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Telematics Market Size and Share Forecast Outlook 2025 to 2035

Construction Films Market Size and Share Forecast Outlook 2025 to 2035

Construction Sealants Market Size and Share Forecast Outlook 2025 to 2035

Construction Bots Market Analysis Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA