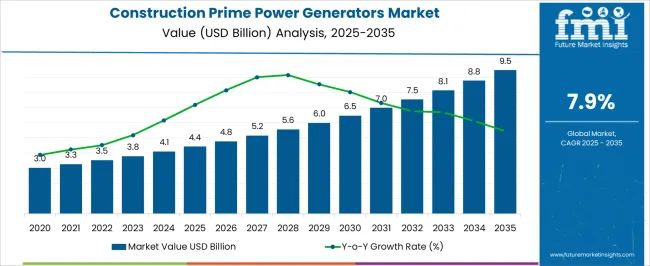

The construction prime power generators market reaches USD 4.4 billion in 2025 and is anticipated to expand to USD 9.5 billion by 2035, with a CAGR of 7.9%. In the first half-decade from 2021 to 2025, the market rises from USD 3.3 billion to USD 4.4 billion, with intermediate increments through USD 3.5 billion, 3.8 billion, and 4.1 billion. This period is characterized by increased adoption in infrastructure projects, commercial construction, and mining operations, where a reliable power supply is essential.

Growth is driven by higher unit deployments alongside moderate price increases as manufacturers enhance efficiency and meet emission and safety regulations. Between 2026 and 2030, values strengthen from USD 4.4 billion to USD 6.5 billion, passing through USD 4.8 billion, 5.2 billion, 5.6 billion, and 6.0 billion. Expansion in this phase is fueled by the replacement of older units, deployment in remote construction sites, and rising demand for hybrid and low-emission models. Investments in portable and high-capacity generator designs further contribute to growth, while emerging regions add substantial adoption volumes. By 2035, the market will reach USD 9.5 billion, with intermediate increments through USD 7.0 billion, 7.5 billion, 8.1 billion, and 8.8 billion, emphasizing the strong influence of infrastructure development and regulatory compliance on half-decade weighted growth patterns.

| Metric | Value |

|---|---|

| Construction Prime Power Generators Market Estimated Value in (2025 E) | USD 4.4 billion |

| Construction Prime Power Generators Market Forecast Value in (2035 F) | USD 9.5 billion |

| Forecast CAGR (2025 to 2035) | 7.9% |

The construction prime power generators market draws demand from five parent markets that together shape product design, rating choices, service models, and channel strategy. The power generation equipment market contributes about 25-30%, encompassing diesel and gas gensets, alternators, digital controls, and cooling assemblies specified for continuous duty on jobsites. The construction equipment market adds roughly 18-22%, since earthmoving, concreting, lifting, tunneling, and temporary camp utilities rely on prime rated sets as the primary supply where grid access is limited or unstable. The temporary and rental power market provides approximately 12-15%, driven by fleet deployments that require rapid mobilization, paralleling, containerized packaging, sound attenuation, and telemetry for utilization tracking and remote diagnostics.

The industrial machinery and equipment market accounts for 8-10%, covering crushers, batching plants, drilling rigs, welding lines, and balance of plant during build phases that need steady frequency and voltage under variable step loads. The electrical equipment and switchgear market supplies another 6-8%, integrating ATS, low and medium-voltage switchgear, protection relays, distribution panels, synchronization gear, and power quality meters that enable safe islanded operation and seamless load sharing.

The market is experiencing sustained growth driven by rising infrastructure development, increasing investment in commercial and residential construction, and the growing need for an uninterrupted power supply in off-grid and remote locations. These generators are being deployed extensively to ensure operational continuity during construction activities, where grid access is limited or unreliable.

Advancements in engine efficiency, emissions compliance, and noise reduction have enhanced the performance of prime power generators, making them more suitable for modern construction needs. Regulatory support for energy reliability in critical projects has further encouraged adoption, especially in regions undergoing rapid urbanization and industrialization.

Market momentum is also being supported by rental service providers who cater to temporary power requirements, allowing construction firms to avoid large capital expenditures. As demand for energy security and operational efficiency increases, prime power generators are expected to remain an indispensable asset for construction projects worldwide, with ongoing technological improvements reinforcing long-term market growth.

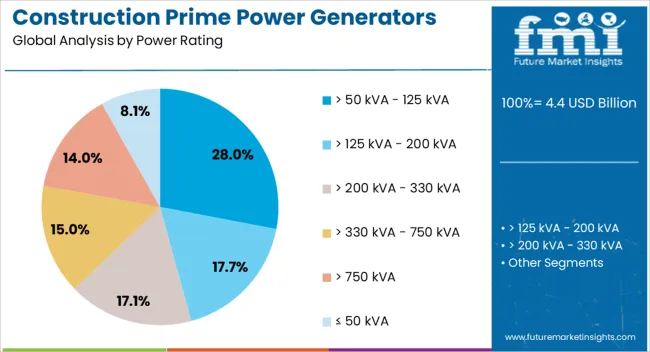

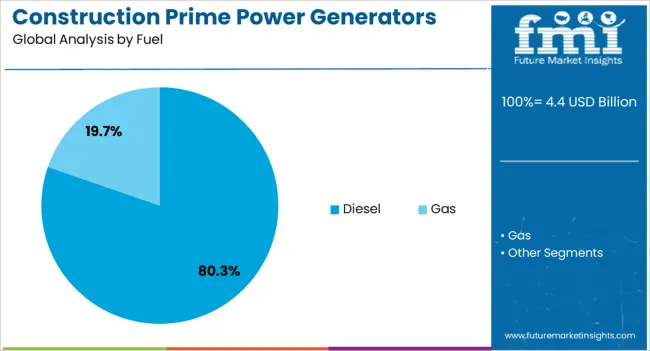

The construction prime power generators market is segmented by power rating, fuel, and geographic regions. By power rating, construction prime power generators market is divided into > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, > 750 kVA, and ≤ 50 kVA. In terms of fuel, construction prime power generators market is classified into Diesel and Gas. Regionally, the construction prime power generators industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The > 50 kVA - 125 kVA power rating segment is projected to account for 28% of the Construction Prime Power Generators market revenue share in 2025, making it a leading capacity category. This dominance has been supported by its suitability for a wide range of medium-scale construction operations that require a consistent and efficient power supply. Units in this power range provide an optimal balance between fuel efficiency and operational capacity, enabling cost-effective performance for contractors.

Their portability and ease of installation have facilitated deployment in diverse site conditions without significant infrastructure support. The ability to handle multiple equipment loads simultaneously has reinforced their position in high-demand construction environments.

Furthermore, compliance with emission standards and integration with automated control systems have enhanced operational reliability, making them a preferred choice for construction firms. As construction activities expand in both developed and emerging markets, this power rating is expected to maintain strong adoption levels due to its operational versatility.

The diesel fuel segment is expected to hold 80.30% of the Construction Prime Power Generators market revenue share in 2025, establishing it as the leading fuel type. Its dominance has been attributed to the high energy density and efficiency of diesel engines, which deliver reliable performance in demanding construction site conditions. Diesel generators are favored for their durability, longer operational lifespan, and ability to operate at varying load capacities without compromising efficiency.

The widespread availability of diesel fuel, even in remote project locations, has further reinforced its preference among contractors. Advancements in engine technology have reduced emissions and improved fuel economy, ensuring compliance with environmental regulations while maintaining output performance.

Additionally, the lower total cost of ownership and reduced maintenance frequency compared to alternative fuel types have contributed to sustained adoption. The proven dependability of diesel-powered units in critical construction applications ensures that this segment will continue to dominate in the foreseeable future.

Demand for construction prime power generators remains firm as contractors treat continuous electricity as a core productivity lever, not a backup. Cost pressure, complex compliance, fuel volatility, and skills gaps persist, making lifecycle economics and supplier reliability decisive. Clear upside exists in hybridized systems with battery buffering, gas units where fuel access permits, and bundled rental models that shift capex to opex. Telematics, faster packaging, regional parts support, and refurbishment programs define current best practice. Vendors that guarantee uptime, simplify mobilization, and prove predictable operating costs will capture outsized share.

Prime power generator sets are being specified as essential plant on construction sites where grid connections are unavailable, unreliable, or delayed by permitting. Continuous electricity for cranes, concrete batching, dewatering pumps, tower lights, welding sets, site offices, and security systems is being treated as mission critical. Contractors prefer modular, containerized units with quick-connect distribution boards, automatic transfer switches, and load-sharing controllers so that capacity can be scaled with project phases. Rental fleets are being booked early in tender cycles as EPC firms de-risk schedules. Fuel management, noise attenuation, and spill containment are now baseline requirements rather than differentiators. Remote and linear projects such as highways, pipelines, transmission corridors, and mining construction rely on long-running sets that tolerate dust, heat, and variable loads. In this context, prime power is viewed not as a contingency but as a core enabler of predictable productivity and uptime.

High upfront capital for multi-megawatt packages, volatile prices for engines and alternators, and elevated transport costs are constraining purchasing decisions. Compliance with acoustic limits, local emissions rules, and site safety standards increases specification complexity and elongates approval timelines. Fuel price swings undermine budgeting, while poor load factor profiles raise the total cost of ownership through wet-stacking, glazing, and maintenance events. Skilled operator availability remains uneven, so misuse and deferred service shorten engine life and raise warranty disputes. Insurance, theft risk, and vandalism push buyers toward more expensive canopies and telemetry. Tendering dynamics compress margins as contractors request turnkey bundles that include commissioning, fuel logistics, and 24x7 service level agreements. Lead times for control electronics and exhaust aftertreatment can delay mobilization. These factors make lifecycle modeling and supplier financial stability decisive, and they slow adoption in cost-sensitive projects even when technical justification is strong.

Hybrid prime power architectures are opening clear opportunities. Battery buffering with fast power electronics smooths load steps, enables smaller engine sizing, and cuts idle hours, which lowers service frequency and fuel use. Gas-fueled sets gain interest where pipeline or CNG access exists, improving operating economics and acoustic profiles on dense jobsites. Drop-in liquid fuels and advanced lubricants allow fleets to harmonize maintenance across mixed engines. Digital service programs that bundle remote diagnostics, predictive parts kits, and technician dispatch windows are valued by EPC schedulers who prize uptime guarantees over unit price. Rental and leasing models continue to expand, letting contractors convert capex to opex and right-size fleets by project stage. Standardized skid footprints, quick-fit cabling, and plug-and-play distribution gear accelerate site energization. Suppliers that package financing, telemetry, training, and fuel logistics with hardware are positioned to take disproportionate share during large infrastructure waves.

Telematics is moving from optional to default. Fleet managers expect geofencing, remote start-stop, event logs, and real-time parameters for temperature, oil pressure, vibration, and kWh output, integrated into project dashboards. Data is being used to optimize load sharing, rotate sets to equalize hours, and trigger condition-based maintenance. Emissions regulations are tightening, driving higher usage of aftertreatment, cleaner fuels, and gas engines where practical. Packaging innovations emphasize faster cranage, smaller footprints, and improved airflow for hot environments. Regionalization is accelerating as manufacturers add local assembly and parts depots to reduce lead times and mitigate logistics risk.

Consolidation in rental markets continues, with national players standardizing control platforms and spares to simplify multi-site deployment. Refurbishment programs for mid-life units are gaining traction, giving buyers predictable performance at a lower entry cost. The market rewards suppliers that deliver speed, transparency, and guaranteed uptime.

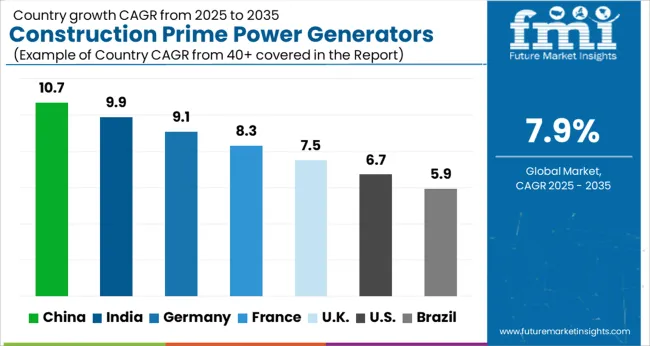

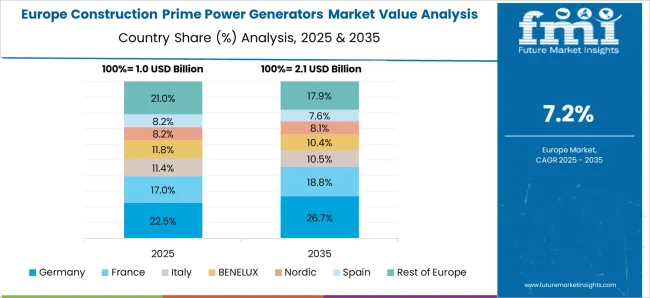

| Country | CAGR |

|---|---|

| China | 10.7% |

| India | 9.9% |

| Germany | 9.1% |

| France | 8.3% |

| UK | 7.5% |

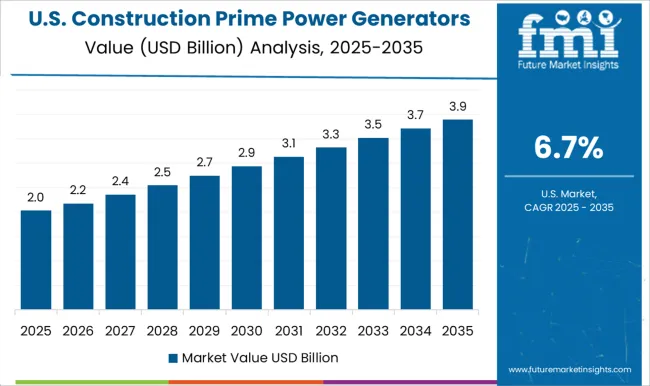

| USA | 6.7% |

| Brazil | 5.9% |

The global panel vans market is projected to grow at a CAGR of 5.7% from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 8.1%, followed by India at 7.5%, and France at 6.3%, while the United Kingdom records 5.7% and the United States posts 5.1%. These rates translate to a growth premium of +35% for China, +26% for India, and +5% for France versus the baseline, while the United States and the United Kingdom show slower growth. Divergence reflects local catalysts: the expanding e-commerce and logistics sectors in China and India, while more mature markets like the United States and the United Kingdom experience slower growth due to established infrastructure and market maturity. The analysis includes over 40+ countries, with the leading markets detailed below.

The construction prime power generators market in China is projected to grow at a CAGR of 10.7% from 2025 to 2035, driven by rapid infrastructure expansion, large-scale construction projects, and urbanization in tier-1 and tier-2 cities. High-capacity diesel and gas generator sets are in strong demand for industrial construction sites, mining operations, and temporary power requirements in remote locations. Portable and containerized units are preferred for flexibility and ease of deployment. Local manufacturers are scaling production to meet increasing orders while integrating digital monitoring systems for fuel efficiency, load management, and maintenance alerts. Off-grid and emergency power solutions are further driving adoption, particularly in regions lacking stable grid infrastructure.

The construction prime power generators market in India is expected to expand at a CAGR of 9.9%, fueled by highway development, metro rail construction, and mining projects requiring reliable onsite power. Diesel and natural gas generators dominate due to durability and load capacity, while hybrid solutions gain interest for energy efficiency. Project timelines are driving demand for rapid-deployment units with pre-installed control systems. Industrial parks and temporary infrastructure developments also require scalable power solutions. Local manufacturing hubs in Gujarat, Maharashtra, and Tamil Nadu facilitate shorter lead times. Utilities and construction EPCs increasingly prefer modular, containerized generators to reduce downtime and simplify logistics.

Demand for construction prime power generators in Germany is projected to grow at a CAGR of 9.1%, supported by large civil engineering projects, renewable construction initiatives, and industrial modernization. Mobile diesel, natural gas, and hybrid generators are widely adopted for site flexibility and emission compliance. High demand exists for units with smart load management, fuel monitoring, and remote diagnostics. Temporary power for urban construction sites, industrial retrofits, and critical infrastructure are primary drivers. Local manufacturers leverage advanced testing facilities and standard certifications to meet stringent quality and performance requirements. Modular deployment and containerized solutions are increasingly preferred to reduce installation time and ensure operational reliability.

The UK market is expected to grow at a CAGR of 7.5%, led by commercial and residential infrastructure projects, rail electrification, and utility maintenance requirements. Diesel and gas-powered units dominate, with increasing adoption of hybrid and low-noise models for urban construction. Temporary and modular solutions with remote control and telemetry systems are in high demand. Project developers prioritize reliability, quick deployment, and compliance with emission and noise standards. Leasing of prime power generators is gaining traction among small and medium construction companies to optimize capital expenditure. Emergency backup and off-grid construction applications further drive market expansion.

The USA market is projected to grow at a CAGR of 6.7%, supported by large-scale highway projects, urban redevelopment, and energy sector construction. Diesel, gas, and hybrid generators are preferred for industrial construction, data centers, and temporary sites. Modular, containerized, and portable units with advanced load control, remote monitoring, and predictive maintenance capabilities are increasingly adopted. Construction companies seek compliance with NFPA and EPA standards while minimizing downtime. Emergency power needs for large projects and off-grid sites further boost adoption. The market also benefits from regional manufacturing clusters that reduce lead times and improve service support.

The construction prime power generators market has been characterized by intense competition driven by technological upgrades, capacity expansions, and strategic alliances. Key global players such as Caterpillar, Cummins, Kohler, Generac, and Atlas Copco have maintained strong positions through wide product portfolios and global distribution networks. These companies have focused on launching generator sets with improved fuel efficiency and advanced control systems to capture market share across construction sites with high power demands.

Regional manufacturers, including Kirloskar Electric, Mahindra Powerol, and Greaves Cotton, have gained traction in price-sensitive markets by offering cost-competitive prime power units tailored for local construction conditions. Competitive intensity has been further shaped by rental service providers who procure bulk units from OEMs and offer flexible deployment models, creating indirect rivalry for direct sales channels.

Market consolidation trends have been observed as larger companies acquire smaller firms to enhance their regional footprint and service capabilities. Brand reputation, after-sales support, and adherence to emission regulations have emerged as decisive factors influencing competitive positioning in this sector.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.4 Billion |

| Power Rating | > 50 kVA - 125 kVA, > 125 kVA - 200 kVA, > 200 kVA - 330 kVA, > 330 kVA - 750 kVA, > 750 kVA, and ≤ 50 kVA |

| Fuel | Diesel and Gas |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar Inc., Cummins Inc., Generac Power Systems, Mitsubishi Heavy Industries, MTU Onsite Energy (Rolls-Royce), Kohler / SDMO, Atlas Copco, FG Wilson, Perkins, and Other regional/local manufacturers |

| Additional Attributes | Dollar sales by generator type (diesel, gas, hybrid), power capacity (low, medium, high), and application (commercial construction, industrial, infrastructure projects). Demand dynamics are driven by rising infrastructure investments, temporary power requirements, and strict emission regulations. Regional trends indicate strong growth in North America, Europe, and Asia-Pacific, fueled by large-scale construction projects and rental fleet expansion. |

The global construction prime power generators market is estimated to be valued at USD 4.4 billion in 2025.

The market size for the construction prime power generators market is projected to reach USD 9.5 billion by 2035.

The construction prime power generators market is expected to grow at a 7.9% CAGR between 2025 and 2035.

The key product types in construction prime power generators market are > 50 kva - 125 kva, > 125 kva - 200 kva, > 200 kva - 330 kva, > 330 kva - 750 kva, > 750 kva and ≤ 50 kva.

In terms of fuel, diesel segment to command 80.3% share in the construction prime power generators market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA