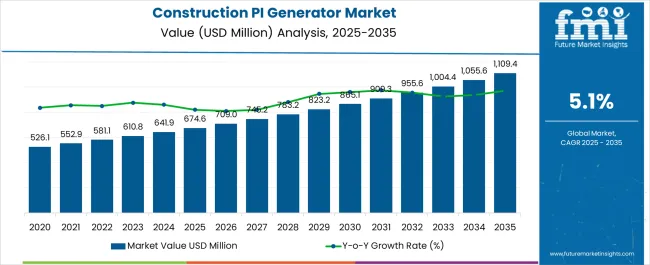

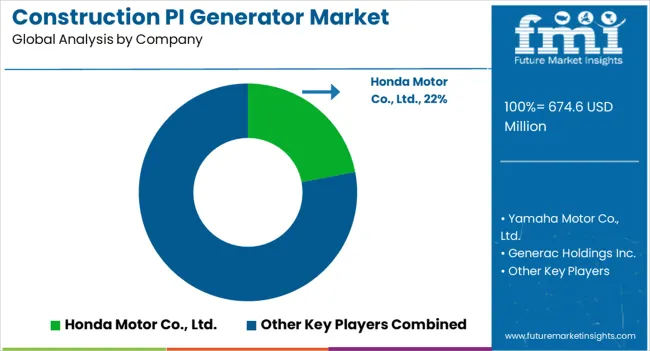

The Construction Portable Inverter Generator Market is estimated to be valued at USD 674.6 million in 2025 and is projected to reach USD 1109.4 million by 2035, registering a compound annual growth rate (CAGR) of 5.1% over the forecast period. A closer look at the rolling CAGR over shorter periods within this decade reveals consistent growth throughout. Between 2025 and 2030, the market expands from USD 674.6 million to about USD 823.2 million, reflecting a CAGR of 4.1%.

This phase is driven by steady demand from construction sites that require reliable, portable power sources for tools and equipment. The need to replace older, less efficient generators supports continued market growth during this period. From 2030 to 2035, the growth rate accelerates slightly as the market rises from USD 823.2 million to USD 1,109.4 million, yielding a CAGR close to 6.0%.

This increase is supported by rising construction activities and the adoption of more advanced portable inverter generators capable of meeting evolving site requirements. The combined effects of new construction projects and equipment replacements maintain strong demand.

Overall, the rolling CAGR analysis highlights a balanced growth trajectory with steady expansion throughout the decade. This consistent momentum indicates a mature but still expanding market, benefiting from ongoing demand in construction applications and equipment lifecycle renewals.

| Metric | Value |

|---|---|

| Construction Portable Inverter Generator Market Estimated Value in (2025 E) | USD 674.6 million |

| Construction Portable Inverter Generator Market Forecast Value in (2035 F) | USD 1109.4 million |

| Forecast CAGR (2025 to 2035) | 5.1% |

The Construction Portable Inverter Generator market is undergoing consistent expansion due to the rising need for flexible, low-noise, and fuel-efficient power solutions on job sites. Increasing demand for portable energy sources in construction projects, especially those in remote or urban zones with power constraints, has played a critical role in driving adoption. The shift toward sustainable operations and energy-efficient systems has been encouraging construction firms to deploy inverter generators that offer clean and stable power output.

Governmental pressure to reduce emissions, along with strict regulatory norms on job site noise levels, has further contributed to market momentum. Continuous innovation in compact design, smart monitoring, and multi-fuel adaptability has widened application scope across small to medium-scale construction activities.

As infrastructure development accelerates across emerging markets and advanced economies alike, the need for mobile and efficient power equipment is expected to sustain demand. The market is likely to grow steadily as construction contractors seek reliable power backup systems that align with safety, cost-effectiveness, and operational agility..

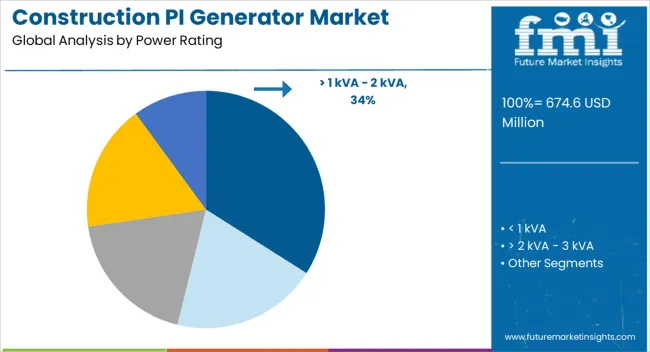

The construction portable inverter generator market is segmented by power rating, power source, and geographic regions. By power rating, the construction portable inverter generator market is divided into > 1 kVA - 2 kVA, < 1 kVA, > two kVA - 3 kVA, > three kVA - 4 kVA> 4 kVA.

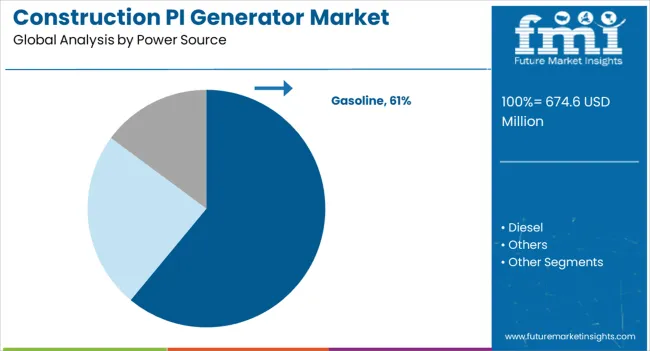

In terms of power source, the construction portable inverter generator market is classified into Gasoline, Diesel, and Others. Regionally, the construction portable inverter generator industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The 1 kVA to 2 kVA power rating segment is projected to account for 34% of the Construction Portable Inverter Generator market revenue share in 2025, marking it as the leading power capacity. The growth of this segment has been driven by the need for lightweight, compact, and easy-to-deploy power solutions in smaller construction projects. These generators are typically favored for their portability and are often used to power tools, lights, and charging equipment in off-grid or temporary job sites.

Their relatively low fuel consumption and operational efficiency have contributed to their increasing preference among contractors. The integration of inverter technology allows for cleaner power output that is compatible with sensitive tools and electronic devices.

Additionally, the ability to parallel-connect multiple units to scale power when needed without compromising efficiency has further reinforced their appeal. As construction projects become more modular and mobile, especially in urban redevelopment and interior refurbishment, the segment is expected to maintain its competitive edge in supporting on-site energy needs..

The gasoline power source segment is expected to dominate the Construction Portable Inverter Generator market with a 61% revenue share in 2025. This leadership has been driven by the widespread availability and affordability of gasoline, making it a preferred choice for contractors operating in diverse geographies. Gasoline-powered inverter generators are valued for their quick start capabilities, lower upfront cost, and reduced noise levels, aligning well with the evolving safety and environmental norms in the construction sector.

Their operational convenience, especially in small to mid-scale job sites, has enabled broad adoption across the industry. The segment has further benefited from advancements in engine technology and emissions control systems that allow for cleaner combustion and compliance with air quality regulations.

Moreover, gasoline-powered units typically feature user-friendly interfaces and maintenance procedures, which appeal to general contractors looking for reliable and accessible power equipment. As new product launches continue to enhance performance and durability, the segment is anticipated to retain its dominant role in powering construction operations..

The construction portable inverter generator market is expanding as construction sites demand reliable, efficient, and portable power solutions. These generators offer clean power with reduced noise and fuel consumption, making them ideal for on-site tools and equipment. While high upfront costs and maintenance needs pose challenges, advancements in inverter technology and battery integration are enhancing performance and convenience. Growing construction activities worldwide, coupled with increasing adoption of green power solutions, support steady market growth.

Construction sites require power sources that are both portable and capable of delivering consistent electricity to a variety of tools and equipment. Portable inverter generators meet these needs by providing stable and clean power, which protects sensitive electronics and machinery from damage. Their compact design and lightweight build allow easy transportation across large or remote construction zones. These generators also produce less noise and consume fuel more efficiently than traditional models, reducing operational costs and environmental impact. The growth of infrastructure projects and remote construction activities globally is fueling demand for these versatile power units. Contractors increasingly prioritize generators that combine portability with reliable performance to maintain productivity and safety on site.

Despite their advantages, construction portable inverter generators can be expensive compared to conventional generators, which limits their adoption among budget-conscious buyers. The advanced technology and components involved raise initial investment and repair costs. Additionally, regular maintenance is essential to ensure optimal performance, especially under demanding construction conditions where dust, debris, and rough handling are common. Maintenance downtime can disrupt construction schedules and increase operating expenses. To address these concerns, manufacturers are focusing on improving generator durability, simplifying maintenance procedures, and offering service support packages. Providing financing options and rental services also helps make these generators more accessible to small and mid-sized contractors. Overcoming cost and maintenance barriers is key to broader market penetration.

Advances in inverter technology are improving power quality, fuel efficiency, and user convenience in portable generators for construction. New models integrate features like automatic voltage regulation, noise reduction systems, and smart controls that allow remote monitoring and operation. Battery-powered and hybrid inverter generators are emerging, offering quieter operation and reduced emissions while supporting longer runtimes. These technological improvements enable safer operation of sensitive electronic tools and enhance energy efficiency, addressing growing environmental concerns at construction sites. Enhanced durability features protect units from harsh outdoor conditions. Companies investing in research and development of these innovations differentiate themselves in a competitive market and meet evolving contractor demands for reliable, eco-friendly power solutions.

The global increase in construction projects, especially in developing regions, drives demand for portable power generators that support flexible and efficient workflows. Governments encouraging infrastructure development and modernization are indirectly promoting the use of advanced power equipment. Regulatory emphasis on noise control and emissions reduction at construction sites encourages adoption of inverter generators that meet these environmental standards. Compliance with safety and quality certifications is becoming increasingly important for manufacturers to maintain market access. Contractors and rental companies are also adopting more sustainable power solutions to align with environmental policies and corporate social responsibility goals. As construction standards tighten worldwide, portable inverter generators designed to meet these requirements will see increased adoption.

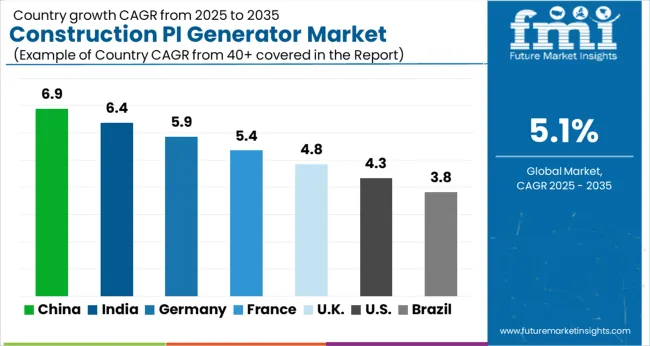

| Country | CAGR |

|---|---|

| China | 6.9% |

| India | 6.4% |

| Germany | 5.9% |

| France | 5.4% |

| UK | 4.8% |

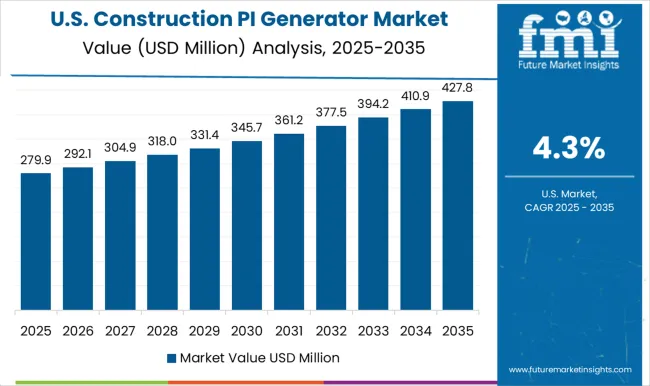

| USA | 4.3% |

| Brazil | 3.8% |

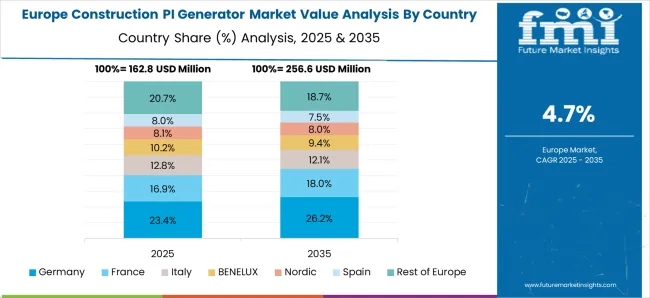

The global construction portable inverter generator market is expanding at a 5.1% CAGR, with notable growth across major regions. Among BRICS countries, China leads with 6.9% growth, driven by rapid infrastructure development and increased construction activities. India follows closely at 6.4%, supported by rising demand for reliable power solutions in both urban and rural construction sites. Within the OECD group, Germany reports 5.9% growth, reflecting high standards for efficiency and environmental compliance. The United Kingdom shows steady growth at 4.8%, fueled by adoption of portable and energy-efficient power solutions in construction. The United States, a mature market, grows at 4.3%, influenced by stringent regulatory requirements and a focus on product reliability. These countries collectively shape market trends through innovation in fuel efficiency, noise reduction, and portability. This report includes insights on 40+ countries; the top countries are shown here for reference.

China is witnessing a 6.9% CAGR in the construction portable inverter generator market, driven by rapid urbanization and large-scale infrastructure development projects. The booming construction industry demands reliable, efficient, and portable power solutions to support on-site equipment and tools. The shift towards cleaner and quieter inverter generators, compared to conventional models, aligns with government policies targeting emission reductions and noise pollution control. Chinese manufacturers are innovating to produce lightweight, fuel-efficient, and durable generators tailored for construction environments. Additionally, rising demand from small and medium construction firms is boosting sales. E-commerce platforms and direct-to-contractor sales channels are expanding accessibility across urban and semi-urban areas. Growing awareness about safety and equipment reliability further supports market growth, as construction sites prioritize uninterrupted power supply for critical operations.

India is experiencing a 6.4% CAGR in the construction portable inverter generator market, fueled by increasing construction activity and government initiatives such as smart city projects and affordable housing schemes. The need for reliable power supply at remote and off-grid construction sites drives demand for portable inverter generators. Manufacturers are focusing on producing cost-effective, fuel-efficient models that meet local environmental regulations. The rise of small-scale contractors and labor-intensive construction methods emphasizes the importance of lightweight and easy-to-transport generators. Growing industrialization and infrastructure upgrades in tier-2 and tier-3 cities also contribute to market expansion. Furthermore, partnerships between generator manufacturers and construction firms are helping improve product customization and after-sales service.

Germany is registering a 5.9% CAGR in the construction portable inverter generator market, supported by strict environmental regulations and a mature construction industry focused on sustainability. Construction companies are adopting inverter generators for their lower emissions, noise reduction, and fuel efficiency. The market favors compact, reliable, and technologically advanced models with digital controls and safety features. Germany’s emphasis on green building standards and energy-efficient construction practices aligns well with inverter generator adoption. Additionally, the repair and maintenance sector plays a role in extending generator lifecycles and reducing downtime. Rental services for portable inverter generators are popular among construction firms, especially for short-term or small-scale projects. The country’s focus on urban redevelopment and infrastructure modernization supports steady demand.

The United Kingdom is seeing a 4.8% CAGR in the construction portable inverter generator market, driven by infrastructure upgrades and rising demand for quieter power solutions in urban construction zones. UK construction firms increasingly prefer inverter generators for their portability, reduced noise, and efficient fuel consumption. Government initiatives promoting sustainable construction and reduced carbon footprints are influencing equipment choices. The market is seeing innovation in hybrid inverter generators that combine solar and fuel power for eco-friendly operation. Leasing and rental options are expanding, offering cost-effective access for smaller construction companies. Additionally, safety features such as automatic shutoff and overload protection are becoming standard to meet regulatory requirements and on-site safety standards.

The United States is posting a 4.3% CAGR in the construction portable inverter generator market, supported by ongoing infrastructure development and a growing number of construction projects in suburban and rural areas. Construction companies value inverter generators for their fuel efficiency, reduced emissions, and compact size, which enable easier transport and storage. The USA market is characterized by a broad range of portable inverter generators catering to both large contractors and small businesses. Technological advancements such as remote monitoring and smart control systems are improving generator management on job sites. Environmental regulations at federal and state levels encourage the adoption of cleaner generator models. Additionally, rental and leasing programs increase access for construction firms with varying project sizes and durations.

Yamaha Motor Corporation competes with a diversified line of lightweight, high-output inverter models engineered for portability and consistent voltage control, appealing to contractors needing stable power for sensitive tools and electronics. Generac has strengthened its presence by offering rugged inverter generators tailored for construction environments, emphasizing high power density, advanced load management, and user-friendly digital interfaces that support jobsite efficiency.

Briggs & Stratton combines decades of engine expertise with inverter technology to deliver versatile products that balance affordability with durable design, ensuring competitiveness in both small-scale contractor use and larger construction projects. Champion Power Equipment focuses on innovation through dual-fuel inverter generators that provide flexibility to operate on gasoline or propane, giving construction sites added resilience where fuel availability is inconsistent. DeWalt leverages its strong contractor brand recognition to market inverter generators designed for tool compatibility and heavy jobsite use, reinforcing its synergy with existing power tool ecosystems. Hyundai Power and WEN serve the market with cost-effective inverter generators, targeting contractors seeking functional and portable solutions without premium pricing.

Strategies in this market revolve around ruggedized design to withstand harsh construction conditions, integration of advanced inverter technology for clean power output, improved noise reduction for compliance with urban jobsite regulations, and the development of multi-fuel or eco-mode features to reduce operating costs.

| Item | Value |

|---|---|

| Quantitative Units | USD 674.6 Million |

| Power Rating | > 1 kVA - 2 kVA, < 1 kVA, > 2 kVA - 3 kVA, > 3 kVA - 4 kVA, and > 4 kVA |

| Power Source | Gasoline, Diesel, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honda Motor Co., Ltd., Yamaha Motor Co., Ltd., Generac Holdings Inc., Briggs & Stratton, Champion Power Equipment, and Kohler Co. |

| Additional Attributes | Dollar sales vary by power rating, including segments like 1 kVA, 1–2 kVA, and above; by fuel type, such as gasoline, diesel, and hybrid solutions; by region, led by Asia‑Pacific, North America, and Europe. Growth is driven by backup power demand on construction sites, quiet and efficient technology, and regulatory trends toward cleaner solutions. |

The global construction portable inverter generator market is estimated to be valued at USD 674.6 million in 2025.

The market size for the construction portable inverter generator market is projected to reach USD 1,109.4 million by 2035.

The construction portable inverter generator market is expected to grow at a 5.1% CAGR between 2025 and 2035.

The key product types in construction portable inverter generator market are > 1 kva - 2 kva, < 1 kva, > 2 kva - 3 kva, > 3 kva - 4 kva and > 4 kva.

In terms of power source, gasoline segment to command 61.0% share in the construction portable inverter generator market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Portable Inverter Generators Market Analysis by Power Rating, Power Source, Application, and Region through 2035

Construction Portable Generators Market Size and Share Forecast Outlook 2025 to 2035

Residential Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Portable Hydrogen Generator Market Size and Share Forecast Outlook 2025 to 2035

Portable Conventional Generator Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Portable Hydrogen Powered Generator Market Size and Share Forecast Outlook 2025 to 2035

Standby Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Gas Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Single Phase Portable Generators Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Diesel-Fired Construction Generator Sets Market Size and Share Forecast Outlook 2025 to 2035

Portable Audiometer Calibration System Market Size and Share Forecast Outlook 2025 to 2035

Generator Bushing Market Size and Share Forecast Outlook 2025 to 2035

Portable Crushers Market Size and Share Forecast Outlook 2025 to 2035

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Portable Filtration System Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA