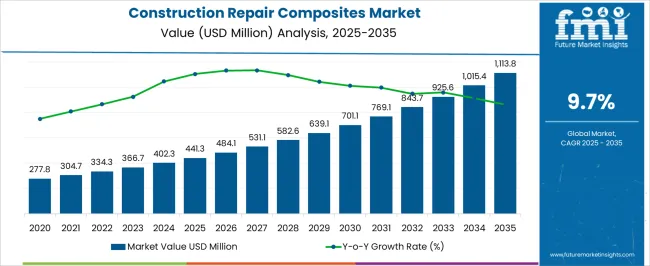

The construction repair composites market is estimated to be valued at USD 441.3 million in 2025 and is projected to reach USD 1,113.8 million by 2035, registering a compound annual growth rate (CAGR) of 9.7% over the forecast period.

This growth represents an absolute dollar opportunity of USD 672.5 million over the decade. Annual growth shows a consistent upward trajectory, starting from USD 441.3 million in 2025, reaching USD 531.1 million in 2028, USD 701.1 million in 2031, and progressing to USD 1,015.4 million by 2034. The steady increase highlights strong potential for manufacturers and suppliers to expand production, enhance distribution, and cater to growing construction repair needs globally.

The absolute dollar opportunity emphasizes the expanding value within the construction repair composites market over the next ten years. Incremental growth from USD 441.3 million in 2025 to USD 1,113.8 million in 2035 underscores a cumulative increase of USD 672.5 million. Key years such as USD 582.6 million in 2029 and USD 843.7 million in 2033 indicate periods of accelerated adoption. This growth trajectory allows stakeholders to strategically plan capacity expansion, optimize supply chains, and enhance product offerings, ensuring they capture a meaningful portion of the expanding market throughout the 2025–2035 period.

| Metric | Value |

|---|---|

| Construction Repair Composites Market Estimated Value in (2025 E) | USD 441.3 million |

| Construction Repair Composites Market Forecast Value in (2035 F) | USD 1,113.8 million |

| Forecast CAGR (2025 to 2035) | 9.7% |

The construction repair composites market is a segment of the broader global construction materials market, which includes concrete, steel reinforcements, coatings, adhesives, and polymer-based solutions. In 2025, construction repair composites are estimated to account for approximately 5% of the total construction materials market, reflecting their growing role in structural maintenance, repair, and retrofitting applications. With the parent market projected to grow from around USD 8.8 billion in 2025 to USD 21.5 billion in 2035, the construction repair composites segment’s growth from USD 441.3 million in 2025 to USD 1,113.8 million in 2035 at a CAGR of 9.7% represents roughly 10% of the total incremental growth in the parent market.

Within the parent market, concrete and cement-based materials hold about 50% of total value, steel reinforcements account for 20%, and coatings and adhesives contribute roughly 15%. The construction repair composites segment, with its CAGR of 9.7%, demonstrates faster growth compared to several traditional material categories, highlighting its rising adoption in building repair and industrial applications. The absolute increase of USD 672.5 million over the decade represents nearly 10% of the total parent market expansion. This trend provides manufacturers and suppliers opportunities to scale production, diversify product lines, and capture a larger share of the growing construction materials market.

The construction repair composites market is experiencing strong growth, supported by the rising need for durable, high-performance materials that extend the service life of existing infrastructure. Increasing urbanization, aging structural assets, and the need for cost-efficient rehabilitation solutions are driving the adoption of advanced composite materials in repair applications. The lightweight nature, corrosion resistance, and superior mechanical strength of these composites are enabling their use in bridges, buildings, marine structures, and industrial facilities.

Growing environmental regulations and sustainability goals are encouraging the use of materials with longer life cycles and reduced maintenance requirements. Technological advancements in manufacturing processes and resin chemistry are improving the performance characteristics of these composites, allowing them to withstand extreme environmental conditions and high mechanical stress.

The ability to customize products for specific load-bearing, chemical resistance, and thermal performance needs is further broadening their appeal As global infrastructure investment increases and repair over replacement becomes a preferred approach, the market is expected to witness sustained demand over the coming decade.

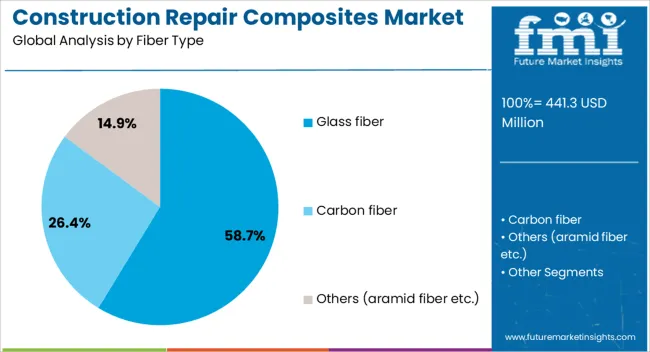

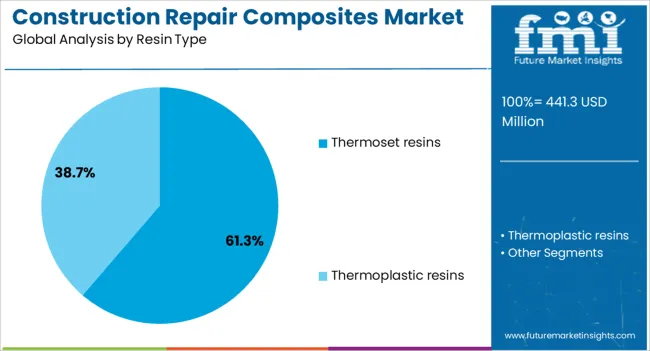

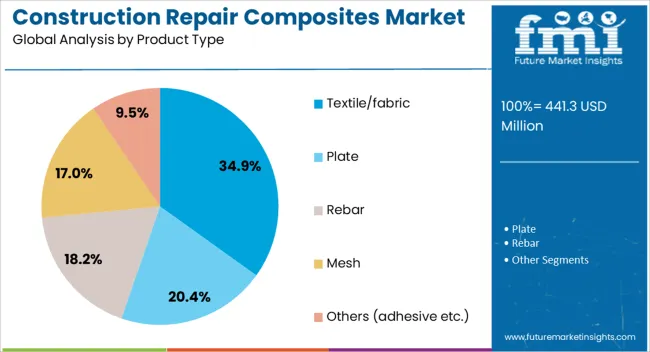

The construction repair composites market is segmented by fiber type, resin type, product type, application, distribution channel, and geographic regions. By fiber type, construction repair composites market is divided into glass fiber, carbon fiber, and others (aramid fiber etc.). In terms of resin type, construction repair composites market is classified into thermoset resins and thermoplastic resins. Based on product type, construction repair composites market is segmented into textile/fabric, plate, rebar, mesh, and others (adhesive etc.). By application, construction repair composites market is segmented into infrastructure, residential buildings, commercial buildings, and industrial facilities. By distribution channel, construction repair composites market is segmented into direct sales and indirect sales. Regionally, the construction repair composites industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The glass fiber segment is projected to account for 58.7% of the construction repair composites market revenue share in 2025, positioning it as the leading fiber type. This dominance is being driven by the favorable balance it offers between cost, strength, and ease of handling, making it widely suitable for both structural and non-structural repair applications. Glass fiber’s high tensile strength, resistance to environmental degradation, and compatibility with various resin systems are contributing to its widespread adoption in reinforcing concrete, steel, and masonry structures.

It is being increasingly used in situations where corrosion resistance is critical, particularly in marine and industrial environments. Manufacturing advancements have enabled the production of glass fibers with improved surface treatments, enhancing bonding with resins and extending service life.

Its relatively low cost compared to alternative fibers such as carbon fiber is further strengthening its position in cost-sensitive repair projects The versatility of glass fiber in meeting diverse mechanical and design requirements is expected to sustain its leadership in the market.

The thermoset resins segment is anticipated to hold 61.3% of the construction repair composites market revenue share in 2025, making it the dominant resin type. Its leadership is supported by the excellent chemical resistance, thermal stability, and mechanical strength that thermoset resins provide when cured. These resins form irreversible cross-linked structures that deliver long-term performance under harsh environmental and load conditions.

The segment benefits from widespread use in applications requiring high structural integrity, including bridge strengthening, pipeline rehabilitation, and building retrofitting. Their compatibility with a wide range of fibers, including glass and carbon, enables the production of repair composites tailored for specific performance criteria. Thermoset resins also offer superior resistance to moisture, UV radiation, and corrosive agents, which is critical for outdoor and industrial applications.

Continuous innovation in resin formulations is improving curing efficiency and adhesion properties, making them more adaptable to field installation requirements Their proven reliability and durability are ensuring continued preference among engineers and contractors for large-scale infrastructure repair projects.

The textile or fabric segment is expected to represent 34.9% of the construction repair composites market revenue share in 2025, establishing itself as the leading product type. This dominance is being driven by the flexibility, ease of application, and adaptability that textile or fabric forms provide in various repair scenarios. These products can be wrapped, layered, or shaped to conform to complex geometries, enabling effective reinforcement of irregular structures.

Their lightweight nature reduces the need for heavy lifting equipment, accelerating installation and reducing labor costs. Textile or fabric composites impregnated with high-performance resins create a strong, durable bond with existing substrates, improving structural performance and extending service life.

The ability to apply them in confined spaces and challenging environments is increasing their adoption across building repair, bridge strengthening, and seismic retrofitting projects As demand grows for solutions that combine strength with minimal disruption to operations, textile or fabric composites are expected to maintain their leadership position in the product type segment of the market.

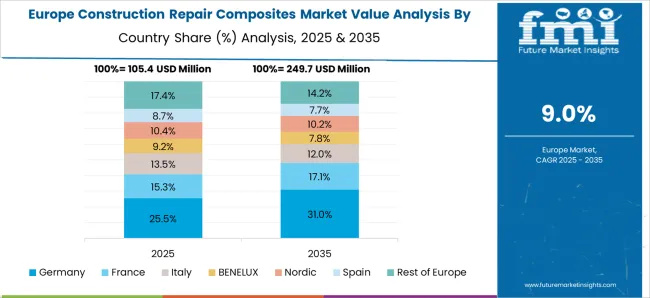

The construction repair composites market is growing due to increasing demand for durable, high-performance repair materials in infrastructure, residential, and commercial projects. North America and Europe lead adoption with advanced fiber-reinforced polymers, carbon composites, and engineered repair solutions. Asia-Pacific shows rapid growth fueled by urbanization, infrastructure expansion, and aging construction stock. Manufacturers differentiate through material strength, corrosion resistance, and ease of application. Regional differences in project scale, environmental conditions, and regulatory standards strongly influence product adoption, performance requirements, and global competitiveness.

The rise in aging infrastructure and rapid urban development is a key driver for construction repair composites. North America and Europe prioritize structural retrofitting using high-performance fiber-reinforced polymers and carbon composites for bridges, highways, and commercial buildings to extend service life and reduce maintenance costs. Asia-Pacific markets adopt composites for large-scale infrastructure expansion, including airports, metro networks, and industrial facilities, often prioritizing cost-effectiveness alongside durability. Differences in environmental stressors, load requirements, and construction timelines influence material selection, application methods, and performance expectations. Leading suppliers offer engineered composites with high tensile strength, corrosion resistance, and long-term durability, while regional players provide economical, locally sourced solutions. Infrastructure and urbanization contrasts directly shape adoption, project reliability, and competitiveness globally.

Innovation in composite materials drives market adoption by providing lightweight, high-strength, and corrosion-resistant repair solutions. North America and Europe focus on advanced epoxy resins, carbon fiber composites, and polymer-modified mortars for structural reinforcement and seismic retrofitting. Asia-Pacific markets increasingly adopt polymer and fiber-reinforced composites that balance performance with cost-efficiency for large infrastructure projects. Differences in construction standards, environmental conditions, and project complexity influence material formulation, curing times, and application techniques. Leading suppliers invest in R&D to enhance bond strength, chemical resistance, and application versatility, while regional manufacturers focus on scalable, cost-effective products. Material innovation contrasts shape adoption, operational longevity, and competitiveness across the global construction repair composites market.

Regulatory frameworks and safety standards significantly affect construction repair composite adoption. North America and Europe enforce strict building codes, seismic standards, and environmental compliance, requiring certified, high-performance repair materials. Asia-Pacific markets vary; developed countries adhere to international norms, while emerging regions adopt locally defined standards that prioritize cost and availability. Differences in regulatory rigor, certification processes, and compliance expectations influence material development, testing protocols, and market entry. Leading suppliers provide fully certified composites with detailed performance documentation, while regional manufacturers deliver locally compliant solutions. Safety and regulatory contrasts shape adoption, credibility, and competitive positioning in the global construction repair composites market.

The use of construction repair composites is expanding beyond infrastructure to industrial and residential applications. North America and Europe focus on retrofitting industrial plants, high-rise residential buildings, and heritage structures requiring specialized composite solutions. Asia-Pacific markets adopt composites for large-scale residential projects, commercial complexes, and industrial warehouses where durability and speed of application are critical. Differences in project scale, construction techniques, and environmental exposure influence product selection, structural requirements, and application methods. Leading suppliers offer customizable composite systems optimized for strength, corrosion resistance, and ease of installation, while regional players provide adaptable, cost-effective solutions. Application expansion contrasts drive adoption, product diversification, and competitiveness globally.

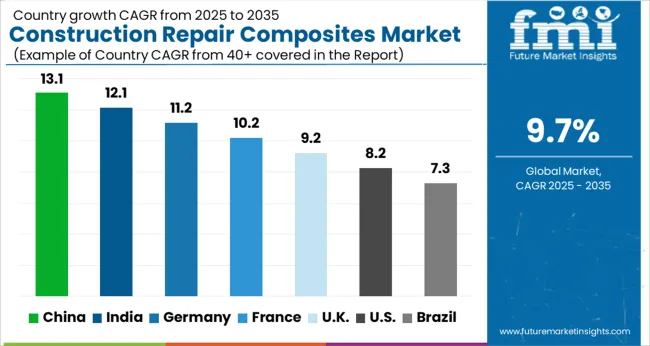

| Country | CAGR |

|---|---|

| China | 13.1% |

| India | 12.1% |

| Germany | 11.2% |

| France | 10.2% |

| UK | 9.2% |

| USA | 8.2% |

| Brazil | 7.3% |

The global construction repair composites market is projected to grow at a 9.7% CAGR through 2035, driven by demand in infrastructure rehabilitation, building maintenance, and industrial renovations. Among BRICS nations, China led with 13.1% growth as large-scale production and deployment were executed in urban and industrial projects, while India at 12.1% expanded manufacturing and application to meet rising regional repair and reinforcement needs. In the OECD region, Germany at 11.2% maintained steady utilization under strict construction quality and safety standards, while the United Kingdom at 9.2% advanced moderate-scale application across commercial and civil infrastructure. The USA, growing at 8.2%, supported consistent deployment in building and industrial repair initiatives while adhering to federal and state-level regulatory and safety frameworks. This report includes insights on 40+ countries; the top countries are shown here for reference.

The construction repair composites market in China is projected to grow at a CAGR of 13.1%, driven by increasing infrastructure development, industrial renovation projects, and urban redevelopment initiatives. Adoption is being encouraged for composites that provide high strength, durability, and corrosion resistance. Manufacturers are being urged to supply advanced, cost effective, and high performance solutions. Distribution through construction companies, contractors, and material suppliers is being strengthened. Research into composite material formulations, enhanced bonding properties, and sustainable repair techniques is being conducted. Expansion of residential and commercial construction, government infrastructure programs, and demand for long lasting repairs are considered key drivers of the construction repair composites market in China.

In India, the construction repair composites market is forecasted to grow at a CAGR of 12.1%, fueled by rising infrastructure upgrades, urban development, and industrial maintenance projects. Adoption is being promoted for composites that ensure durability, strength, and resistance to environmental stress. Local manufacturers are being encouraged to provide affordable, high quality, and efficient solutions. Distribution through construction contractors, industrial suppliers, and material distributors is being expanded. Awareness campaigns and demonstration projects are being conducted to promote adoption of advanced repair materials. Expanding urbanization, infrastructure investments, and industrial maintenance programs are recognized as primary factors propelling the construction repair composites market in India.

Germany is witnessing steady growth in the construction repair composites market at a CAGR of 11.2%, supported by adoption in industrial maintenance, commercial renovation, and civil infrastructure repair projects. Adoption is being encouraged for composites that provide longevity, structural strength, and environmental resistance. Manufacturers are being urged to deliver advanced, reliable, and sustainable solutions. Distribution through construction material suppliers, contractors, and industrial service providers is being strengthened. Research into composite durability, environmental resistance, and bonding enhancement is being pursued. Expansion of infrastructure refurbishment, industrial maintenance, and high quality construction standards are considered essential drivers of the construction repair composites market in Germany.

The construction repair composites market in the United Kingdom is projected to grow at a CAGR of 9.2%, driven by demand from industrial refurbishments, residential renovations, and commercial construction repairs. Adoption is being promoted for composites that provide strength, reliability, and longevity. Manufacturers are being encouraged to supply advanced, cost effective, and environmentally friendly solutions. Distribution through contractors, construction suppliers, and industrial service providers is being optimized. Pilot projects and awareness programs are being conducted to promote high performance composites. Government infrastructure programs, commercial construction upgrades, and industrial maintenance initiatives are recognized as major factors driving the construction repair composites market in the United Kingdom.

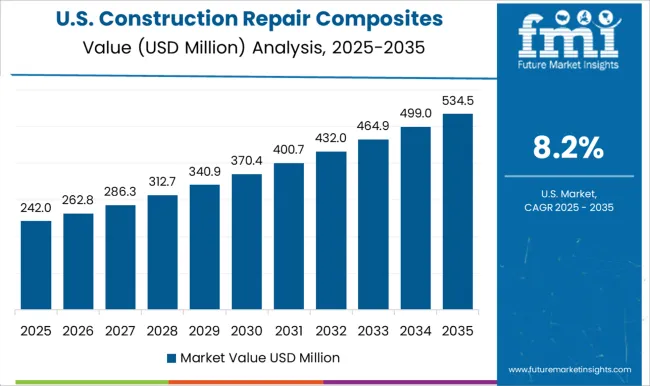

The construction repair composites market in the United States is projected to grow at a CAGR of 8.2%, influenced by adoption in commercial, industrial, and civil infrastructure repair projects. Adoption is being encouraged for composites that provide durability, strength, and environmental resistance. Manufacturers are being urged to supply cost effective, advanced, and reliable solutions. Distribution through contractors, construction suppliers, and industrial service providers is being maintained. Research into material performance, bonding strength, and sustainability is being conducted. Expansion of infrastructure rehabilitation, industrial maintenance programs, and commercial building upgrades are considered key drivers of the construction repair composites market in the United States.

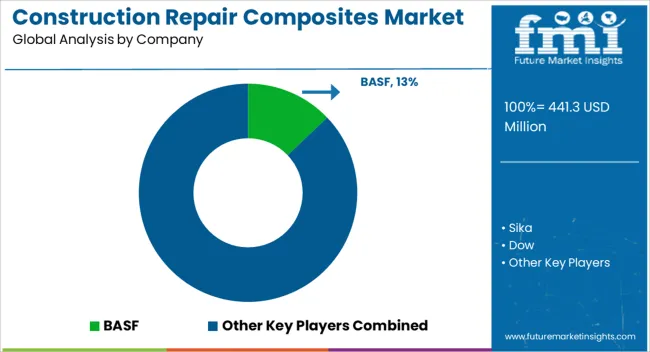

The construction repair composites market is led by a group of prominent global suppliers providing advanced materials for structural reinforcement, repair, and retrofitting applications. BASF is a key player, offering high-performance resins, adhesives, and fiber-reinforced composites that enhance durability and strength in building repair projects. Sika and Dow are also major contributors, delivering innovative polymer-based solutions and cementitious composites that address structural challenges and improve repair efficiency. Saint-Gobain and Henkel provide specialized repair composites, adhesives, and bonding systems, ensuring reliability and long-term performance in diverse construction environments.

Other notable suppliers include Owens Corning, Mapei, and Fosroc, who supply fiber-reinforced polymers, epoxy systems, and high-quality repair mortars widely used in both commercial and residential construction projects. Companies like Master Builders Solutions, Chomarat, and Simpson Strong-Tie contribute with tailored solutions for structural strengthening, corrosion protection, and load-bearing reinforcement. Rockwool and Creative Composites further add value by offering composite materials that combine thermal insulation with structural reinforcement, meeting modern construction standards and sustainability requirements.

Additionally, firms such as Sireg Geotech and Dextra enhance the market with advanced geotechnical composites and carbon fiber reinforcement systems that are crucial for large-scale infrastructure repair. Collectively, these suppliers drive innovation in the construction repair composites market by providing durable, cost-effective, and high-performance materials. Their continuous research and development efforts enable construction professionals to extend the service life of existing structures, improve safety, and meet stringent environmental regulations, ensuring that the market remains dynamic and responsive to global construction demands.

| Item | Value |

|---|---|

| Quantitative Units | USD 441.3 million |

| Fiber Type | Glass fiber, Carbon fiber, and Others (aramid fiber etc.) |

| Resin Type | Thermoset resins and Thermoplastic resins |

| Product Type | Textile/fabric, Plate, Rebar, Mesh, and Others (adhesive etc.) |

| Application | Infrastructure, Residential buildings, Commercial buildings, and Industrial facilities |

| Distribution Channel | Direct sales and Indirect sales |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF, Sika, Dow, Saint-Gobain, Henkel, Owens Corning, Mapei, Fosroc, Master Builders Solutions, Chomarat, Simpson Strong-Tie, Rockwool, Creative Composites, Sireg Geotech, and Dextra |

| Additional Attributes | Dollar sales vary by composite type, including fiber-reinforced polymers, carbon fiber composites, and glass fiber composites; by application, such as structural repair, crack filling, seismic retrofitting, and surface restoration; by end-use, spanning commercial buildings, bridges, industrial facilities, and residential structures; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by aging infrastructure, demand for durable repairs, and lightweight, high-strength materials. |

The global construction repair composites market is estimated to be valued at USD 441.3 million in 2025.

The market size for the construction repair composites market is projected to reach USD 1,113.8 million by 2035.

The construction repair composites market is expected to grow at a 9.7% CAGR between 2025 and 2035.

The key product types in construction repair composites market are glass fiber, carbon fiber and others (aramid fiber etc.).

In terms of resin type, thermoset resins segment to command 61.3% share in the construction repair composites market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA