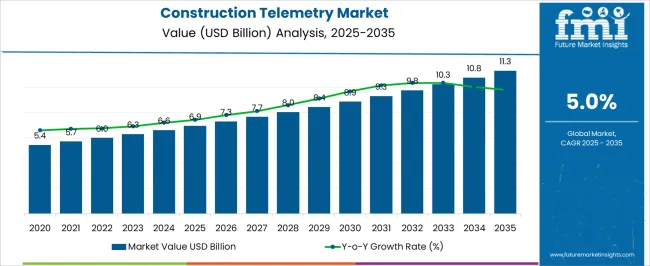

The Construction Telemetry Market is estimated to be valued at USD 6.9 billion in 2025 and is projected to reach USD 11.3 billion by 2035, registering a compound annual growth rate (CAGR) of 5.0% over the forecast period. Between 2025 and 2030, the market is expected to rise from USD 6.9 billion to USD 8.9 billion, driven by increasing demand for real-time data monitoring and improved project management in construction operations. Year-on-year analysis shows steady growth, with values reaching USD 7.3 billion in 2026 and USD 7.7 billion in 2027, supported by the adoption of advanced sensors and data analytics for equipment tracking and performance optimization. By 2028, the market is forecasted to reach USD 8.0 billion, advancing to USD 8.4 billion in 2029 and USD 8.9 billion by 2030.

Innovations in IoT integration, automation, and the rising need for enhanced safety, efficiency, and cost control in construction projects will further fuel growth. These dynamics position construction telemetry as a critical tool in improving operational efficiency, reducing downtime, and enhancing the overall management of construction sites across the globe.

| Metric | Value |

|---|---|

| Construction Telemetry Market Estimated Value in (2025 E) | USD 6.9 billion |

| Construction Telemetry Market Forecast Value in (2035 F) | USD 11.3 billion |

| Forecast CAGR (2025 to 2035) | 5.0% |

The construction telemetry market is expanding due to the rising need for real-time data and automation in construction site management. Industry discussions highlight the importance of monitoring equipment, materials, and personnel to improve project efficiency and safety.

Increasing adoption of smart construction technologies and digital workflows has accelerated the demand for telemetry solutions that provide accurate, timely information. Government infrastructure projects and private sector investments have further driven the integration of advanced monitoring systems.

Improvements in sensor technology, connectivity, and data analytics have enhanced the capability of telemetry systems to support decision-making on construction sites. The market outlook remains positive as construction firms seek to reduce costs, optimize asset utilization, and meet tighter project deadlines. Segment growth is expected to be led by hardware components, GPS-based technologies, and fleet management applications, which collectively enhance operational control and visibility.

The construction telemetry market is segmented by component, technology, application, end user, and geographic regions. By component, the construction telemetry market is divided into Hardware, Software, and Service. In terms of technology, the construction telemetry market is classified into GPS, Cellular, Satellite, RFID, and Others. Based on the application, the construction telemetry market is segmented into Fleet management, Safety & security, Remote operations & monitoring, Fuel management, Maintenance & repair, and Others.

The end users of the construction telemetry market are segmented into Infrastructure and heavy construction, Residential construction, Commercial construction, and Industrial construction. Regionally, the construction telemetry industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

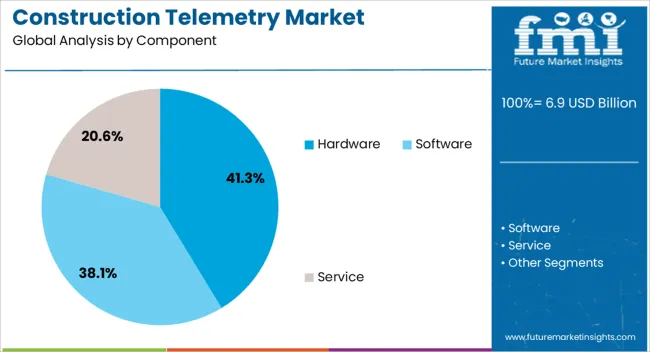

The hardware segment is projected to contribute 41.3% of the construction telemetry market revenue in 2025, maintaining its lead among components. This growth reflects the critical role of physical devices such as sensors, transmitters, and gateways in capturing and transmitting construction data.

Durable and reliable hardware is essential for withstanding harsh environmental conditions on job sites. As construction projects grow in complexity and scale, demand for robust hardware that ensures continuous data collection has increased.

Advances in miniaturization and energy efficiency have also improved the deployment flexibility of telemetry hardware. The need for seamless integration with software platforms has further propelled hardware sales. Consequently, the hardware segment is poised to retain its dominant position in the market.

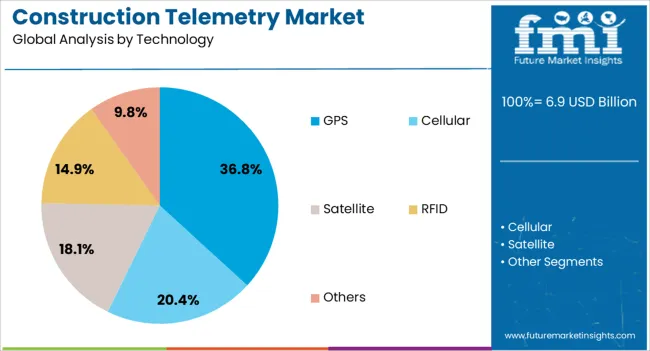

The GPS technology segment is expected to account for 36.8% of the market revenue in 2025, holding a leading position among telemetry technologies. GPS enables precise tracking of equipment, vehicles, and personnel, facilitating improved site management and asset utilization.

Construction managers rely on GPS data to monitor fleet movements, optimize logistics, and ensure safety compliance. The increasing deployment of GPS-enabled devices combined with real-time data analytics has enhanced operational efficiency.

Furthermore, GPS integration with other technologies such as IoT sensors and mobile applications has expanded its utility. As the construction industry moves towards digital transformation, GPS technology remains a cornerstone for location-based telemetry solutions.

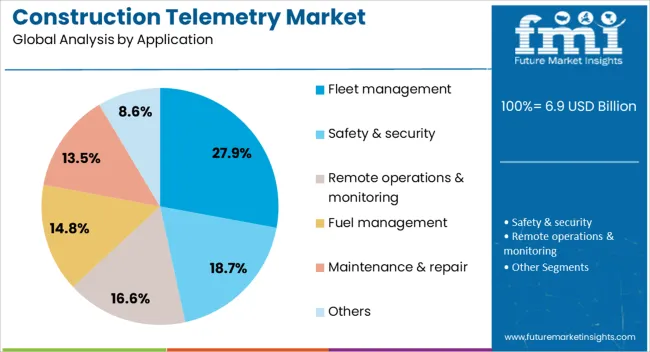

The fleet management application segment is projected to represent 27.9% of the construction telemetry market revenue in 2025, leading the market in use cases. Managing construction vehicle fleets effectively is crucial for reducing downtime, improving fuel efficiency, and minimizing operational costs.

Telemetry systems provide real-time insights into vehicle location, usage patterns, and maintenance needs, enabling proactive management. Increased construction activities and large-scale projects have amplified the complexity of fleet operations, driving adoption of telemetry for better control.

The emphasis on safety and regulatory compliance has further supported fleet management solutions. As fleet sizes grow and technology adoption expands, this segment is expected to maintain its lead in the construction telemetry market.

The construction telemetry market is driven by the increasing need for real-time data and monitoring solutions in construction projects. Opportunities in infrastructure expansion and the adoption of IoT and automation are shaping the market. However, challenges such as high implementation costs and data security risks may limit growth. By 2025, overcoming these obstacles through cost-effective, secure solutions will be crucial for sustaining the market's growth and ensuring its widespread adoption in the construction industry.

The construction telemetry market is expanding due to the increasing demand for real-time data and monitoring solutions in construction projects. Telemetry systems allow contractors and project managers to monitor machinery, material usage, and worker performance remotely, ensuring greater operational efficiency. The need for more precise management in large-scale projects, along with the focus on reducing downtime, is driving market growth. By 2025, demand for these systems will continue to grow as construction projects become more complex and data-driven.

Opportunities in the construction telemetry market are increasing with the expansion of construction and infrastructure projects. The rise in infrastructure development, particularly in emerging markets, has led to the adoption of telemetry solutions to optimize construction operations. These systems help ensure timely project completion by offering insights into machine health, fuel efficiency, and worker productivity. By 2025, the market will continue to benefit from this trend as more construction companies adopt real-time data systems for enhanced decision-making.

Emerging trends in the construction telemetry market highlight the growing integration of IoT and automation technologies. The use of sensors, connected devices, and real-time data analytics is enhancing the efficiency and accuracy of construction operations. IoT-enabled telemetry systems are enabling construction sites to operate more efficiently through predictive maintenance and automatic adjustments to equipment performance. By 2025, these trends are expected to reshape the market, pushing the construction industry toward greater automation and data-driven project management.

Despite growth, challenges such as high implementation costs and data security concerns persist in the construction telemetry market. The initial cost of setting up telemetry systems, including the infrastructure and technology required, can be significant. Furthermore, as more construction sites adopt connected devices, the risk of data breaches and unauthorized access increases, raising concerns among stakeholders. By 2025, addressing these barriers through affordable solutions and robust cybersecurity measures will be essential for the broader adoption of telemetry systems.

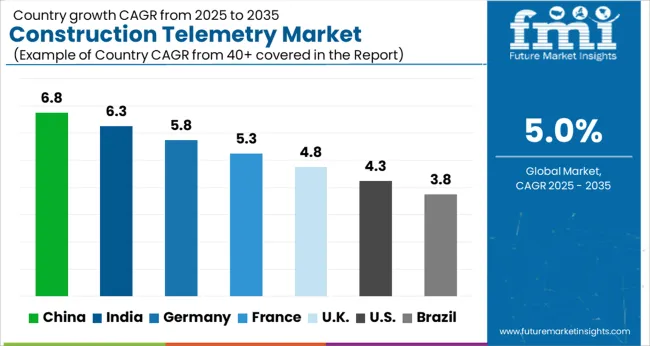

The global construction telemetry market is projected to grow at a 5% CAGR from 2025 to 2035. China leads with a growth rate of 6.8%, followed by India at 6.3%, and Germany at 5.8%. The United Kingdom records a growth rate of 4.8%, while the United States shows the slowest growth at 4.3%. These varying growth rates are driven by factors such as increasing demand for real-time data monitoring in construction projects, rising investments in smart construction technologies, and the need for enhanced efficiency and safety in construction sites. Emerging markets like China and India are seeing higher growth due to rapid urbanization, infrastructure development, and the adoption of advanced construction technologies, while more mature markets like the USA and the UK experience steady growth driven by technological innovations and regulatory standards. This report includes insights on 40+ countries; the top markets are shown here for reference.

The construction telemetry market in China is growing rapidly, with a projected CAGR of 6.8%. China’s expanding construction sector, driven by large-scale urbanization and infrastructure development projects, is significantly contributing to the demand for telemetry solutions that provide real-time data on construction site performance. The adoption of advanced technologies for monitoring equipment, safety, and project progress is accelerating, as the country pushes for smarter, more efficient construction operations. Additionally, government support for sustainable infrastructure development and smart city initiatives further boosts the market for construction telemetry.

The construction telemetry market in India is projected to grow at a CAGR of 6.3%. India’s rapidly growing construction industry, along with increasing investments in infrastructure development, is driving the demand for telemetry systems. The country’s focus on enhancing construction site safety, improving efficiency, and reducing project delays is significantly boosting the adoption of real-time monitoring solutions. Additionally, the growing emphasis on smart cities and sustainable construction practices is accelerating the demand for telemetry solutions that enable better resource management and data-driven decision-making in construction projects.

The construction telemetry market in Germany is projected to grow at a CAGR of 5.8%. Germany’s well-established construction industry, combined with its strong focus on technology integration and operational efficiency, continues to drive demand for telemetry solutions in construction projects. The country’s emphasis on smart construction, energy-efficient buildings, and safety regulations fuels the need for advanced real-time monitoring systems. Additionally, the increasing adoption of digital construction technologies, coupled with Germany’s focus on sustainability and reducing construction time, further accelerates the demand for construction telemetry solutions.

The construction telemetry market in the United Kingdom is projected to grow at a CAGR of 4.8%. The UK’s focus on modernizing infrastructure and adopting smart construction practices is contributing to steady demand for telemetry solutions. Real-time monitoring of construction sites, equipment performance, and project progress is becoming a key part of the construction process, helping to reduce costs and improve safety. The UK’s increasing emphasis on sustainability, reducing carbon emissions, and enhancing the quality of construction materials further drives the demand for advanced telemetry systems in both large-scale and smaller projects.

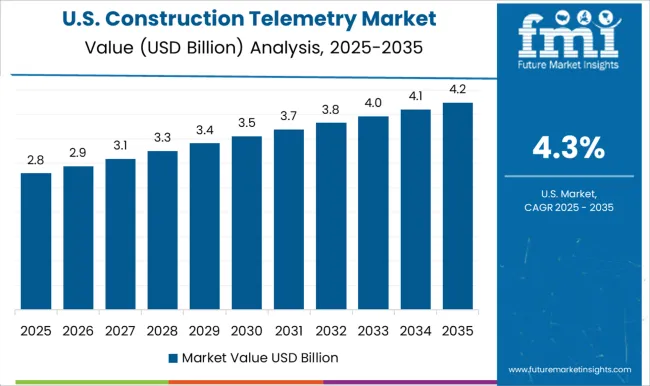

The construction telemetry market in the United States is expected to grow at a CAGR of 4.3%. The USA market is driven by the increasing adoption of smart construction technologies and the need for real-time data to improve project efficiency and safety. As the construction industry continues to modernize, there is a growing demand for telemetry systems that allow for remote monitoring of equipment, materials, and workers. Additionally, regulatory requirements for construction site safety, coupled with the demand for more sustainable building practices, contribute to steady demand for construction telemetry systems, despite slower growth compared to emerging markets.

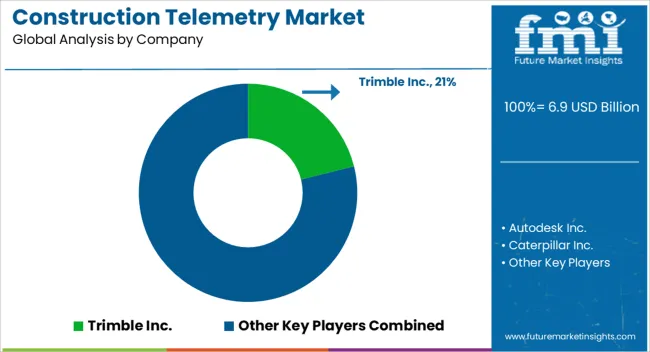

The construction telemetry market is dominated by Trimble Inc., which leads with its advanced telemetry solutions designed for monitoring, controlling, and managing construction equipment and operations. Trimble’s dominance is supported by its comprehensive range of construction management tools, strong integration with GPS and real-time data analytics, and its global presence in the construction, mining, and agriculture sectors. Key players such as Autodesk Inc., Caterpillar Inc., and Hilti Corporation maintain significant market shares by offering integrated solutions that provide accurate data collection, fleet management, and remote monitoring for construction projects, ensuring better operational efficiency and productivity. Emerging players like Komatsu Ltd., Procore Technologies Inc., and Leica Geosystems AG are expanding their market presence by providing specialized telemetry solutions for specific construction needs, such as heavy machinery tracking, project management, and real-time asset management.

Their strategies include enhancing software interfaces, offering cloud-based solutions, and improving sensor technologies for more precise monitoring. Market growth is driven by the increasing demand for smart construction equipment, the rise of IoT technology, and the need for real-time data to optimize construction workflows. Innovations in machine learning, AI-driven predictive analytics, and automation are expected to continue shaping competitive dynamics and drive further growth in the global construction telemetry market.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.9 Billion |

| Component | Hardware, Software, and Service |

| Technology | GPS, Cellular, Satellite, RFID, and Others |

| Application | Fleet management, Safety & security, Remote operations & monitoring, Fuel management, Maintenance & repair, and Others |

| End User | Infrastructure and heavy construction, Residential construction, Commercial construction, and Industrial construction |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Trimble Inc., Autodesk Inc., Caterpillar Inc., Hilti Corporation, Komatsu Ltd., Leica Geosystems AG, Procore Technologies Inc., Skycatch Inc., Topcon Corporation, and Verizon Connect LLC |

| Additional Attributes | Dollar sales by telemetry system type and application, demand dynamics across construction, mining, and infrastructure sectors, regional trends in construction telemetry adoption, innovation in real-time monitoring and data analytics technologies, impact of regulatory standards on safety and efficiency, and emerging use cases in smart construction and automated project management. |

The global construction telemetry market is estimated to be valued at USD 6.9 billion in 2025.

The market size for the construction telemetry market is projected to reach USD 11.3 billion by 2035.

The construction telemetry market is expected to grow at a 5.0% CAGR between 2025 and 2035.

The key product types in construction telemetry market are hardware, _sensors, _gps devices, _telematics control units, _microcontrollers & processors, _others, software, _data analysis platforms, _dashboards, _predictive maintenance software, _safety & compliance monitoring software, _others, service, _installation & integration, _maintenance & support and _consulting.

In terms of technology, gps segment to command 36.8% share in the construction telemetry market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Telematics Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA