The Construction Trucks Market is estimated to be valued at USD 54.0 billion in 2025 and is projected to reach USD 79.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.0% over the forecast period.

This steady trajectory highlights the essential role of construction trucks in infrastructure development, mining, and large-scale building projects. During the period from 2025 to 2030, growth will likely be moderate, with expanding road networks, urban infrastructure upgrades, and housing projects driving incremental demand, pushing the market above USD 65 billion.

From 2030 to 2035, expansion is expected to maintain pace as construction activity intensifies in emerging economies and demand for fuel-efficient, higher-capacity trucks strengthens. The incremental rise of USD 25.9 billion underscores the importance of fleet modernization, stricter emission standards, and integration of telematics in shaping purchasing preferences. Competitive intensity will increase, with manufacturers differentiating through advanced drivetrain technologies, payload optimization, and enhanced durability. Asia-Pacific and North America are anticipated to lead demand, supported by major infrastructure programs and replacement cycles.

| Metric | Value |

|---|---|

| Construction Trucks Market Estimated Value in (2025 E) | USD 54.0 billion |

| Construction Trucks Market Forecast Value in (2035 F) | USD 79.9 billion |

| Forecast CAGR (2025 to 2035) | 4.0% |

The construction trucks market is witnessing accelerated growth due to rising infrastructure development, urban expansion, and increased government investments in construction and transportation projects. High demand for efficient material handling and transportation solutions at job sites has driven the adoption of purpose built heavy vehicles across both developed and emerging economies.

Technological upgrades in powertrain systems, fuel efficiency, and vehicle durability have significantly enhanced fleet performance and reliability. Regulatory focus on emissions reduction and operational safety is further influencing the transition toward advanced truck configurations and alternate fuel options.

The overall market outlook remains strong as construction companies prioritize equipment productivity, long-haul capacity, and lifecycle cost optimization to meet growing project demands under tight schedules.

The construction trucks market is segmented by truck type, propulsion type, gross vehicle weight, and geographic region. By trucks, the construction trucks market is divided into Dump trucks, Tractor-trailer trucks, Cargo trucks, Specialized trucks, and Others. In terms of propulsion, the construction trucks market is classified into Diesel, Hybrid electric, and Others. Based on gross vehicle weight, the construction trucks market is segmented into those with a weight below 15 Tons and those with a weight above 40 Tons. Regionally, the construction trucks industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The dump trucks segment is expected to contribute 48.60% of the total market revenue by 2025 under the trucks category, making it the leading sub-segment. The increasing demand for earthmoving and bulk material transportation in mining, road construction, and civil engineering applications drives this.

Dump trucks offer high payload capacity, efficient unloading mechanisms, and rugged build quality, making them ideal for heavy duty operations. Their adaptability to challenging terrains and compatibility with automated fleet systems have enhanced their utility in both urban and remote construction zones.

As construction sites require versatile and high volume transport solutions, the dump trucks segment continues to maintain its dominant market share.

The construction truck market is driven by infrastructure projects, government spending, and technological upgrades. Despite competition from alternative vehicles, the need for efficient, robust trucks in large-scale projects continues to fuel growth.

The construction trucks market is primarily driven by the increasing demand for infrastructure development globally. Governments are investing heavily in roads, bridges, airports, and housing, creating a steady need for construction trucks. These vehicles are essential for transporting heavy materials such as cement, sand, and gravel, which are crucial for construction activities. As the number of large-scale projects grows, especially in emerging markets, the demand for construction trucks is expected to rise. These vehicles are integral to the efficiency and productivity of construction operations, contributing significantly to the completion of major infrastructure projects.

Government policies and increased infrastructure spending are key drivers for the construction trucks market. Many countries are launching ambitious infrastructure projects to boost economic growth, such as roads, public buildings, and energy plants. These projects require construction trucks to transport materials and move heavy equipment across construction sites. Governmental regulations encouraging infrastructure development, alongside funding for public works, are supporting the market. With governments focusing on upgrading infrastructure and reducing logistics costs, the construction truck market is expected to see consistent growth.

The growing focus on fuel efficiency and emissions reduction is shaping the construction truck market. Manufacturers are introducing advanced engine technologies, such as hybrid and electric-powered trucks, to meet stricter emission standards. These upgrades not only make construction trucks more environmentally friendly but also help companies reduce operational costs. The market is seeing greater adoption of trucks with higher fuel efficiency and lower carbon footprints, which are important in meeting regulations and operating cost concerns. The adoption of more energy-efficient models will likely continue to grow in the coming years.

The construction trucks market faces competition from alternative transportation and hauling solutions. While construction trucks remain essential in large-scale projects, companies are increasingly considering other vehicle types, such as autonomous and robotic machines, which can lower labor costs and improve site operations. Additionally, competition from second-hand vehicle markets and imports from low-cost regions is also intensifying. However, construction trucks remain a critical element of large construction operations due to their robustness, reliability, and efficiency in handling large volumes of materials.

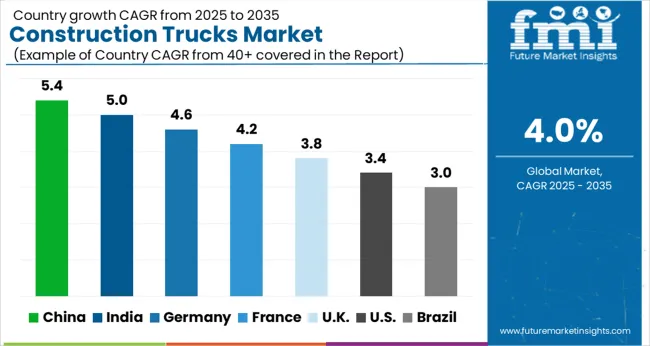

| Country | CAGR |

|---|---|

| China | 5.4% |

| India | 5.0% |

| Germany | 4.6% |

| France | 4.2% |

| UK. | 3.8% |

| USA | 3.4% |

| Brazil | 3.0% |

The construction trucks market is projected to grow globally at a CAGR of 4.0% between 2025 and 2035, driven by increasing infrastructure investments, demand for material transport solutions, and growth in construction activities. China leads with a CAGR of 5.4%, supported by extensive infrastructure development, ongoing urbanization, and robust demand in the construction, mining, and manufacturing sectors. India follows at 5.0%, fueled by rapid industrialization, rising demand for residential and commercial buildings, and government initiatives for infrastructure development. France records a CAGR of 4.2%, with growth fueled by government-backed construction projects, urban redevelopment, and the increasing adoption of energy-efficient vehicles. The UK posts 3.8%, supported by the need for construction trucks in public works and infrastructure upgrades, while the USA grows at 3.4%, driven by continuous demand from construction, mining, and infrastructure projects. The analysis spans over 40 countries, with these five serving as benchmarks for growth, fleet expansion, and construction project demand in the global construction truck industry.

The UK is projected to grow at a CAGR of 3.8% during 2025–2035, slightly below the global 4.0% baseline. During 2020–2024, the CAGR was about 2.7%, reflecting slower growth due to post-Brexit economic adjustments and high fuel costs. The acceleration in the upcoming years is expected to come from government-backed infrastructure initiatives, particularly in housing, public works, and transportation. The increasing focus on energy-efficient construction trucks, along with the integration of smart fleet technologies, will further boost the market. Urban renewal programs and rising housing demand will drive the need for construction trucks across various projects.

China is projected to register a CAGR of 5.4% during 2025–2035, above the global 4.0% baseline. Between 2020–2024, the market grew at a CAGR of 4.5%, driven by infrastructure investments, urbanization, and growing demand for construction and mining trucks. The acceleration in growth will come from continued government investments in large-scale infrastructure projects, particularly in transportation, housing, and public works. As the construction sector expands, the need for heavy-duty construction trucks will increase. Advancements in fuel-efficient and low-emission vehicles will boost the adoption of these trucks.

India is expected to grow at a CAGR of 5.0% during 2025–2035, surpassing the global rate of 4.0%. Between 2020–2024, the CAGR was 4.2%, driven by the growing construction sector, urban development, and government infrastructure projects. The market will see accelerated growth as the country advances with large-scale housing, transportation, and urbanization projects. The adoption of energy-efficient and autonomous construction trucks will play a significant role in market expansion. Local manufacturing, government incentives, and rising demand for construction materials will continue to drive the need for reliable and robust construction trucks.

France is projected to grow at a CAGR of 4.2% during 2025–2035, slightly above the global 4.0% baseline. During 2020–2024, the CAGR stood at 3.1%, with steady but slower growth due to economic uncertainties and project delays. The next phase will be driven by government-backed infrastructure projects and urban redevelopment programs. With a focus on environmental regulations and the shift toward low-emission construction trucks, demand for these vehicles is expected to rise. Government initiatives to modernize infrastructure and expand housing projects will further fuel the growth of the construction trucks market.

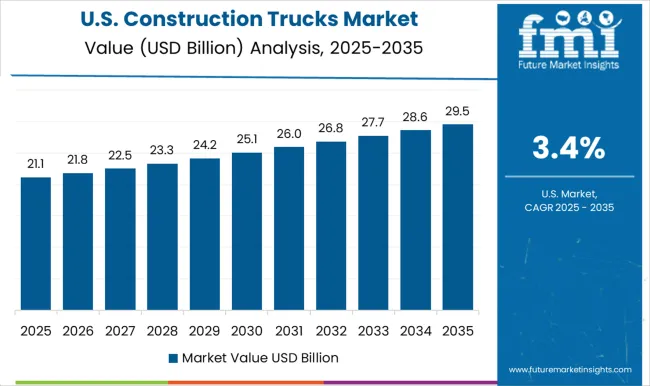

The USA is projected to grow at a CAGR of 3.4% during 2025–2035, slightly below the global 4.0% baseline. During 2020–2024, the CAGR was around 2.6%, impacted by supply chain disruptions and fluctuating demand in the construction sector. The upcoming period will benefit from increased government investments in infrastructure projects, particularly roads, bridges, and public buildings. As the demand for residential and commercial construction rises, the need for construction trucks will continue to grow. Advancements in fuel efficiency and environmental regulations will encourage the adoption of more energy-efficient trucks in the construction industry.

The construction trucks market features a mix of globally recognized manufacturers and specialized regional players, all competing on durability, performance, and technological advancements in construction vehicles. Caterpillar Inc. leads the market with a comprehensive range of heavy-duty construction trucks and equipment, known for their ruggedness, fuel efficiency, and strong aftermarket support. Komatsu Ltd. offers advanced construction vehicles that focus on productivity and low operating costs, with a strong emphasis on automation and digital solutions.

Hitachi Construction Machinery Co., Ltd. is a key player in the construction machinery industry, specializing in equipment that integrates innovative technologies to enhance efficiency and minimize environmental impact. Liebherr Group delivers high-performance construction vehicles that focus on versatility and reliability, meeting the demands of large-scale construction projects. Volvo Group stands out with its construction trucks that prioritize sustainability and cost-effective operations, while also incorporating smart fleet management solutions. Terex Corporation competes by offering a range of heavy-duty trucks and machinery designed for construction, infrastructure, and mining projects. XCMG Group and SANY Group are emerging players, particularly in the Asia-Pacific region, offering cost-effective yet high-performance construction trucks for a range of applications.

Doosan Corporation offers versatile and robust vehicles for both large and small construction operations. Ultimately, Hyundai Construction Equipment utilizes its global presence to offer durable, fuel-efficient construction vehicles, prioritizing quality and customer service. Strategic priorities for these players include integrating automation, enhancing fuel efficiency, and expanding regional presence in growing markets like Asia-Pacific and North America.

| Item | Value |

|---|---|

| Quantitative Units | USD 54.0 Billion |

| Trucks | Dump trucks, Tractor-trailer trucks, Cargo trucks, Specialized trucks, and Others |

| Propulsion | Diesel, Hybrid electric, and Others |

| Gross Vehicle Weight | Below 15 Tons and Above 40 Tons |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Caterpillar Inc., Komatsu Ltd., Hitachi Construction Machinery Co., Ltd., Liebherr Group, Volvo Group, Terex Corporation, XCMG Group, SANY Group, Doosan Corporation, and Hyundai Construction Equipment |

| Additional Attributes | Dollar sales projections and market share of key players, growth drivers such as infrastructure development, government initiatives, and demand from construction projects. |

The global construction trucks market is estimated to be valued at USD 54.0 billion in 2025.

The market size for the construction trucks market is projected to reach USD 79.9 billion by 2035.

The construction trucks market is expected to grow at a 4.0% CAGR between 2025 and 2035.

The key product types in construction trucks market are dump trucks, tractor-trailer trucks, cargo trucks, specialized trucks and others.

In terms of propulsion, diesel segment to command 56.9% share in the construction trucks market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electric Construction Dump Trucks Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Telematics Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA