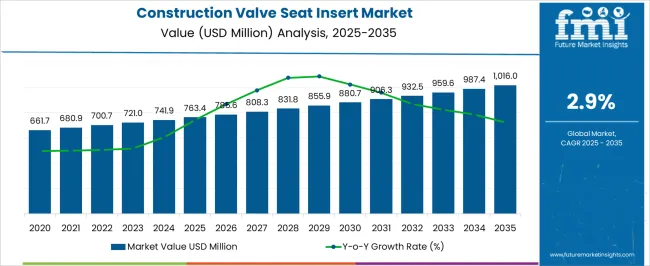

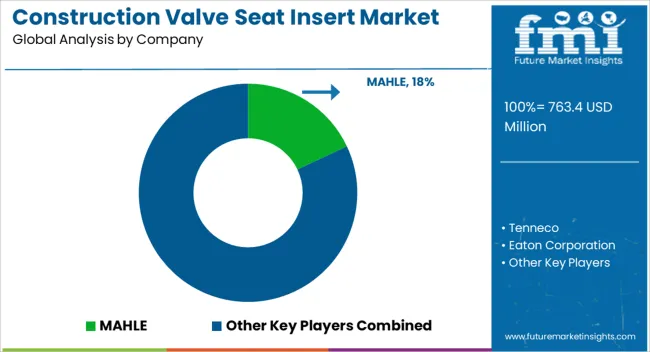

The construction valve seat insert market is estimated to be valued at USD 763.4 million in 2025 and is projected to reach USD 1016.0 million by 2035, registering a compound annual growth rate (CAGR) of 2.9% over the forecast period.

Between 2021 and 2025, the market is expected to demonstrate steady expansion, rising from USD 661.7 million in 2021 to USD 763.4 million in 2025. This growth reflects rising demand for durable and high-performance valve seat inserts in construction equipment engines, including excavators, loaders, and cranes, driven by the need for enhanced engine efficiency, longevity, and reduced maintenance frequency. During the 2021–2025 period, incremental increases are observed, with the market reaching USD 680.9 million in 2022, USD 700.7 million in 2023, USD 721.0 million in 2024, and USD 741.9 million prior to attaining USD 763.4 million in 2025. This period reflects consistent compound growth as manufacturers adopt advanced alloy compositions, precision machining, and surface treatment technologies to improve performance and reliability under harsh operational conditions.

From 2025 to 2035, the market continues its steady trajectory, reaching USD 1,016.0 million by 2035. Annual increases from USD 785.6 million in 2026 to USD 987.4 million in 2034 indicate sustained adoption of high-quality valve seat inserts across global construction equipment fleets. Growth is further supported by gradual replacement cycles, increasing mechanization in emerging economies, and enhanced focus on fuel-efficient engines, collectively driving the CAGR of 2.9% over the forecast period and reflecting long-term value accumulation.

| Metric | Value |

|---|---|

| Construction Valve Seat Insert Market Estimated Value in (2025 E) | USD 763.4 million |

| Construction Valve Seat Insert Market Forecast Value in (2035 F) | USD 1016.0 million |

| Forecast CAGR (2025 to 2035) | 2.9% |

The construction valve seat insert market is shaped by several parent markets that influence its growth and application across equipment and machinery industries. The construction equipment market holds the most dominant role, with valve seat inserts accounting for nearly 15-18% of this segment. Heavy-duty machinery such as excavators, bulldozers, and loaders rely on these inserts for engine durability and efficiency, making it a critical demand driver. The automotive and heavy vehicle components market contributes around 10-12%, as construction trucks and heavy-duty vehicles require valve seat inserts to enhance engine performance, reduce wear, and improve fuel efficiency. The industrial machinery market also plays an important role, with about 8-10% of the share.

Stationary engines, compressors, and turbines used in construction projects depend on valve seat inserts to maintain reliability under high pressure and temperature conditions. The metals and alloys market contributes approximately 7-9% to this sector. Since valve seat inserts are produced from high-strength alloys like steel, nickel, and cobalt, advancements in alloy development directly impact the performance and lifespan of inserts. Lastly, the aftermarket services and maintenance market accounts for about 6-8%, as regular replacement and servicing of valve seat inserts in construction equipment ensure operational efficiency and extended machinery lifespan.

The market is experiencing steady growth, supported by the expansion of infrastructure projects, increased investment in construction equipment, and the modernization of engine technologies. Demand has been sustained by the need for durable, high-performance components that can withstand extreme operating conditions and deliver long service life.

Advancements in metallurgy and precision engineering have enabled the production of valve seat inserts with superior wear resistance and thermal stability, meeting the rigorous demands of heavy-duty engines used in construction equipment. Environmental regulations and efficiency standards are also driving the adoption of advanced materials and manufacturing processes.

Additionally, the growing prevalence of large-scale construction activities across emerging markets is encouraging equipment manufacturers to prioritize quality and longevity in their components Strategic collaborations between OEMs and material suppliers are further enhancing product innovation, ensuring the market remains well positioned for consistent expansion in the coming years.

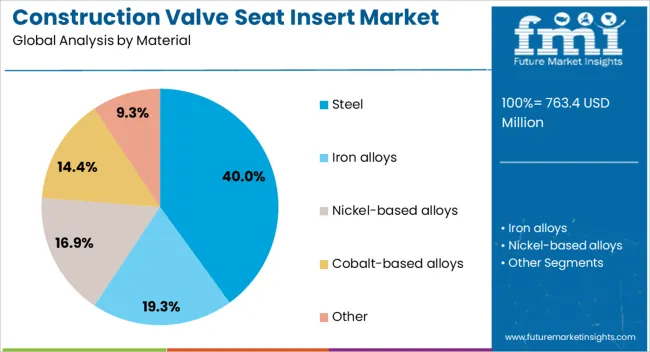

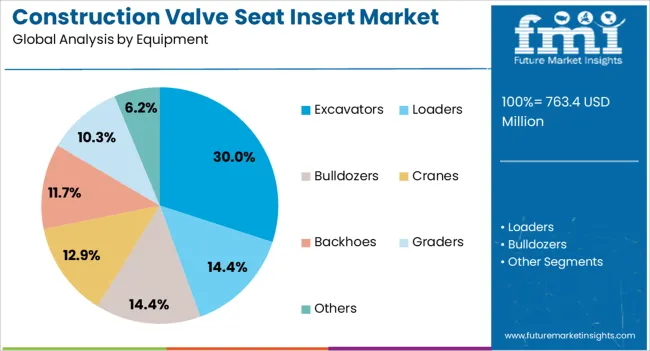

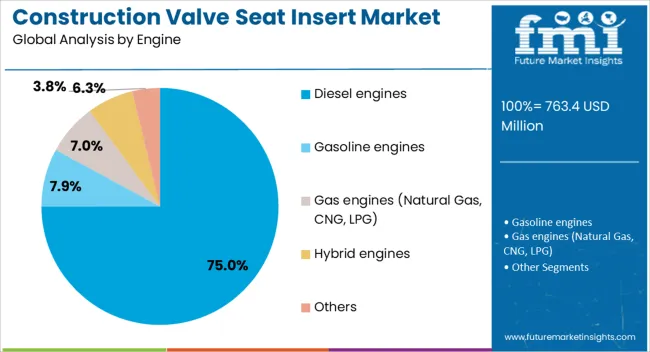

The construction valve seat insert market is segmented by material, equipment, engine, sales channel, and geographic regions. By material, construction valve seat insert market is divided into steel, iron alloys, nickel-based alloys, cobalt-based alloys, and other. In terms of equipment, construction valve seat insert market is classified into excavators, loaders, bulldozers, cranes, backhoes, graders, and others. Based on engine, construction valve seat insert market is segmented into diesel engines, gasoline engines, gas engines (Natural Gas, CNG, LPG), hybrid engines, and others. By sales channel, construction valve seat insert market is segmented into original equipment manufacturers (OEM) and aftermarket. Regionally, the construction valve seat insert industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The steel material segment is projected to hold 40% of the construction valve seat insert market revenue share in 2025, making it the leading material type. Its dominance has been supported by steel’s superior strength, wear resistance, and ability to maintain structural integrity under high temperatures and pressures. Steel valve seat inserts have been favored in construction equipment engines due to their durability in harsh working environments, where exposure to dust, debris, and heavy loads is common. The machinability and adaptability of steel also allow for precise manufacturing, ensuring a secure fit and optimal sealing performance in combustion chambers. Cost-effectiveness compared to certain high-alloy alternatives has further strengthened its adoption in both OEM and aftermarket applications Additionally, advancements in heat-treatment processes and alloy compositions have improved steel’s corrosion resistance and lifespan, making it a preferred choice for manufacturers seeking long-term reliability and reduced maintenance requirements.

The excavators segment is expected to account for 30% of the market revenue share in 2025, positioning it as the leading equipment category. This segment’s leadership has been driven by the extensive use of excavators in earthmoving, material handling, and infrastructure development projects. The heavy-duty engines used in excavators require high-quality valve seat inserts to ensure consistent performance, fuel efficiency, and reduced emissions. Steel and advanced alloy inserts have been adopted to enhance engine durability and extend service intervals, which is critical in minimizing downtime on high-value construction projects. Increasing global infrastructure spending and urbanization trends have fueled demand for excavators, thereby driving the consumption of valve seat inserts in this equipment class Furthermore, the integration of emission-compliant engine technologies in modern excavators has heightened the need for precision-engineered components, reinforcing the segment’s dominant position in the market.

The diesel engines segment is anticipated to hold 75% of the market revenue share in 2025, establishing it as the most significant engine category. The preference for diesel power in construction machinery has been supported by its high torque output, fuel efficiency, and capability to operate effectively under heavy loads for extended periods. Valve seat inserts used in diesel engines are required to endure extreme combustion pressures and temperatures, making material quality and engineering precision critical. Steel and alloy inserts have been optimized to provide superior wear resistance and maintain sealing integrity over prolonged operating cycles. The widespread use of diesel engines across excavators, loaders, and other heavy machinery ensures consistent demand for high-performance valve seat inserts Additionally, evolving emission standards are prompting manufacturers to adopt advanced manufacturing techniques and coatings to further enhance durability, efficiency, and environmental compliance, sustaining the diesel segment’s leadership in the market.

The construction valve seat insert market is driven by the demand for durability, efficiency, and long service life in heavy-duty machinery. Material advancements in alloys, ceramics, and composites are expanding their application across evolving equipment designs. High manufacturing costs and raw material volatility continue to challenge accessibility, especially in cost-sensitive regions. As construction activity rises worldwide, the integration of advanced valve seat inserts is becoming essential to meet efficiency and reliability needs. Regional collaborations and tailored solutions are expected to shape the market’s growth trajectory in the coming years.

The construction valve seat insert market is experiencing steady growth as durability and performance become essential factors in heavy-duty machinery. These inserts play a vital role in protecting valves used in engines, compressors, and industrial construction equipment against wear and corrosion. With construction projects increasingly dependent on reliable equipment that can withstand continuous operation in harsh environments, demand for high-performance valve seat inserts has accelerated. Manufacturers are investing in alloys, ceramics, and composite materials to extend service life and reduce downtime costs. The rising emphasis on efficiency and operational reliability has made valve seat inserts critical components across infrastructure development, mining, and large-scale construction applications. The demand is further supported by the expansion of machinery fleets in emerging regions, where construction activity continues to rise, creating stronger reliance on components that offer longer lifecycles and enhanced operational safety.

The construction valve seat insert market faces challenges from high manufacturing costs and uncertain raw material availability. Producing valve seat inserts requires specialized metallurgical processes, precise machining, and advanced heat treatment to ensure durability and thermal resistance. These processes elevate production expenses, which often discourages smaller construction firms from upgrading their machinery with high-quality inserts. Additionally, the reliance on specific alloys and ceramic composites exposes the industry to supply chain fluctuations and price volatility. Disruptions in sourcing critical inputs can delay production schedules and impact cost structures for both manufacturers and end users. Stringent quality standards imposed on construction equipment components also raise compliance costs, further intensifying barriers for new entrants. Together, these factors limit affordability in cost-sensitive regions, restricting the adoption of advanced valve seat inserts and pushing some buyers toward lower-grade alternatives that compromise long-term performance.

Material innovation is creating strong opportunities in the construction valve seat insert market. The integration of advanced alloys, ceramics, and composite blends is extending the application scope of valve seat inserts across various types of heavy-duty engines and compressors. High thermal stability and resistance to extreme operating conditions allow these components to function reliably in modern equipment. Research into lightweight yet durable compositions is also expanding the use of valve seat inserts in next-generation machinery that prioritizes fuel efficiency and lower emissions. Companies are focusing on delivering inserts with improved wear resistance, reduced friction, and extended service intervals, aligning with the construction industry’s growing need for cost-effective maintenance solutions. The ability to tailor valve seat inserts to specific equipment models enhances their role in optimizing machine performance. These material advancements are expected to unlock new applications, particularly as construction operations demand higher productivity and lower downtime.

The growing sophistication of construction equipment is shaping trends in the valve seat insert market. Manufacturers of heavy machinery are adopting advanced engine designs and fuel systems, requiring valve seat inserts with enhanced thermal and mechanical properties. As the push toward energy-efficient and environmentally responsible machinery intensifies, valve seat inserts are being developed to support compliance with evolving performance standards. The integration of digital monitoring systems in construction equipment is also highlighting the role of durable inserts in reducing maintenance frequency and enhancing engine stability. Regional equipment manufacturers are increasingly collaborating with valve insert producers to co-develop customized components, ensuring better compatibility and longer operational lifespans. With construction firms demanding reliable machines for large-scale projects, the role of valve seat inserts has become more pronounced, cementing their importance in the design and long-term operation of modern construction machinery.

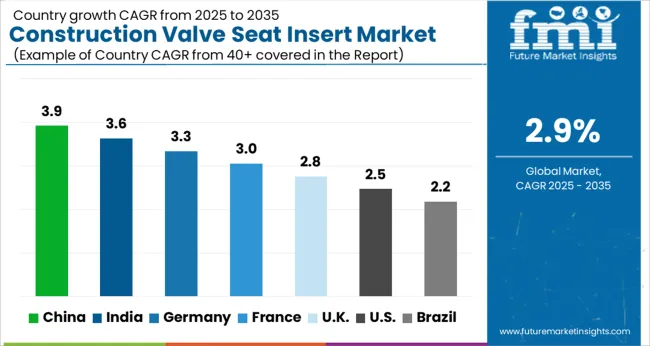

| Country | CAGR |

|---|---|

| China | 3.9% |

| India | 3.6% |

| Germany | 3.3% |

| France | 3.0% |

| UK | 2.8% |

| USA | 2.5% |

| Brazil | 2.2% |

The global construction valve seat insert market is projected to grow at a CAGR of 2.9% from 2025 to 2035. China leads with 3.9%, followed by India at 3.6% and France at 3.0%. The United Kingdom and the United States record more moderate growth at 2.8% and 2.5%, respectively. Market growth is shaped by infrastructure projects, construction machinery modernization, and the rising need for durable, performance-oriented components. International collaborations, manufacturing advancements, and OEM requirements are further supporting the market’s progression across leading regions. The analysis spans over 40+ countries, with the leading markets shown below.

China is expected to lead the construction valve seat insert market with a CAGR of 3.9% between 2025 and 2035. Demand is largely driven by the country’s strong infrastructure development and continuous investment in large-scale construction projects. The growth of industrial machinery and heavy equipment usage in construction activities supports the adoption of valve seat inserts, which are essential for maintaining durability and efficiency in engines. Domestic manufacturers are focusing on supplying cost-effective components, while international players target the market with advanced, precision-engineered inserts. The increasing focus on improving equipment lifespan and performance reliability in China’s construction industry is further strengthening market demand.

India is projected to expand at a CAGR of 3.6% from 2025 to 2035 in the construction valve seat insert market. Demand is rising due to the country’s ongoing infrastructure development programs, highway expansions, and growth in the real estate sector. Increasing usage of construction machinery, particularly heavy-duty engines, drives the adoption of valve seat inserts to enhance performance and longevity. Local manufacturers are strengthening their production capabilities, while global companies are entering into partnerships to tap into the growing demand. Equipment reliability and efficiency are key factors influencing purchase decisions in India’s market, as construction firms seek to minimize downtime and maintenance costs.

France is expected to grow at a CAGR of 3.0% in the construction valve seat insert market between 2025 and 2035. The market is driven by consistent demand from the construction sector, with valve seat inserts playing a vital role in improving the efficiency of machinery engines. Equipment modernization in France’s construction industry supports greater adoption of durable and high-performance inserts. The emphasis on advanced manufacturing techniques ensures quality and reliability, which is valued in both domestic and imported construction equipment. The country’s focus on reducing downtime in construction projects strengthens demand for precision-engineered valve seat inserts.

The United Kingdom is projected to record a CAGR of 2.8% in the construction valve seat insert market from 2025 to 2035. Demand is driven by ongoing construction activity across infrastructure, housing, and commercial projects. Equipment efficiency and cost-effectiveness remain important factors influencing adoption in the UK Manufacturers are focusing on supplying inserts that extend the service life of construction engines while maintaining operational efficiency. Imports play a notable role in the market, with international suppliers catering to growing needs. The shift towards advanced equipment and rising preference for performance-focused solutions are expected to sustain demand during the forecast period.

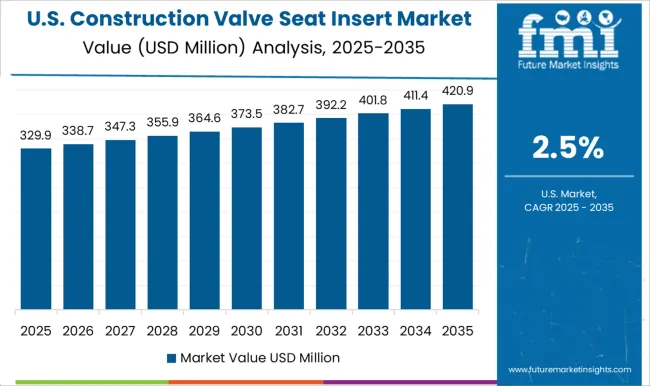

The United States is projected to expand at a CAGR of 2.5% in the construction valve seat insert market between 2025 and 2035. Growth is driven by steady investment in infrastructure renewal and residential construction projects. With the country’s reliance on heavy-duty equipment, the demand for durable and high-performance valve seat inserts is consistent. USA manufacturers emphasize advanced materials and precision engineering to ensure performance reliability and longer service intervals. The presence of established construction machinery producers also supports adoption, as OEM requirements drive innovation in valve seat insert design. The focus on efficiency and reducing operational downtime continues to shape demand trends in the market.

In the construction valve seat insert market, competition is driven by durability, precision machining, and material innovation. MAHLE holds a strong position with advanced inserts designed for heavy-duty diesel and construction engines, offering high wear resistance and compatibility with alternative fuels. Tenneco competes by integrating its Federal-Mogul expertise, providing inserts that balance performance with cost efficiency, targeting both OEMs and aftermarket channels. Eaton Corporation emphasizes engineered inserts tailored for severe-duty applications, highlighting its metallurgical know-how and ability to optimize heat transfer and sealing in demanding operating conditions. Mitsubishi Materials Corporation leverages its strength in metallurgy, supplying valve seat inserts crafted from heat-resistant alloys and powder metallurgy solutions that deliver extended life under thermal stress. BorgWarner competes with engineered solutions that integrate seamlessly with engine valve systems, ensuring combustion efficiency and emissions compliance.

Nippon Piston Ring positions itself through advanced powder metallurgy and proprietary coating technologies that enhance durability and minimize wear in heavy-duty construction engines. L.E. Jones specializes in customized valve seat inserts, focusing on precision, niche applications, and partnerships with OEMs seeking tailored designs for performance-critical engines. Strategic focus among these companies is on extending product life, meeting stricter emission standards, and aligning with the demand for engines capable of operating on varied fuel types. MAHLE and Tenneco strengthen their market presence with broad distribution and long-term OEM contracts. Eaton and BorgWarner emphasize engineered solutions designed to improve combustion efficiency and reduce downtime.

Mitsubishi Materials and Nippon Piston Ring continue to invest in alloy development and powder metallurgy expertise. L.E. Jones competes by offering flexibility, custom designs, and small-batch precision manufacturing. Product brochures underline these strengths: MAHLE presents inserts for high-load, high-temperature applications; Tenneco highlights performance inserts tested for durability; Eaton promotes valve seat inserts engineered for extreme conditions; Mitsubishi Materials details alloy-based and powder metal inserts; BorgWarner emphasizes systems integration; Nippon Piston Ring showcases coated inserts with extended wear life; and L.E. Jones illustrates custom designs for OEM partners.

| Item | Value |

|---|---|

| Quantitative Units | USD 763.4 million |

| Material | Steel, Iron alloys, Nickel-based alloys, Cobalt-based alloys, and Other |

| Equipment | Excavators, Loaders, Bulldozers, Cranes, Backhoes, Graders, and Others |

| Engine | Diesel engines, Gasoline engines, Gas engines (Natural Gas, CNG, LPG), Hybrid engines, and Others |

| Sales Channel | Original Equipment Manufacturers (OEM) and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | MAHLE, Tenneco, Eaton Corporation, Mitsubishi Materials Corporation, BorgWarner, Nippon Piston Ring, L.E. Jones, and Others |

| Additional Attributes | Dollar sales by product type (standard, premium, high-performance), material composition (cast iron, steel alloy, copper alloy), and application (excavators, loaders, cranes, heavy trucks). Demand is influenced by construction activity, engine efficiency requirements, and durability expectations. Regional trends indicate strong adoption in North America, Europe, and Asia-Pacific, supported by industrial expansion, machinery modernization, and OEM collaboration for enhanced engine performance. |

The global construction valve seat insert market is estimated to be valued at USD 763.4 million in 2025.

The market size for the construction valve seat insert market is projected to reach USD 1,016.0 million by 2035.

The construction valve seat insert market is expected to grow at a 2.9% CAGR between 2025 and 2035.

The key product types in construction valve seat insert market are steel, iron alloys, nickel-based alloys, cobalt-based alloys and other.

In terms of equipment, excavators segment to command 30.0% share in the construction valve seat insert market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Telematics Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA