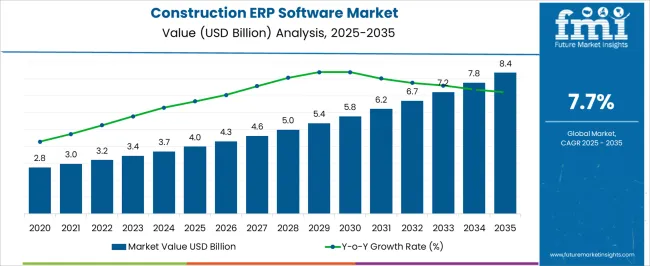

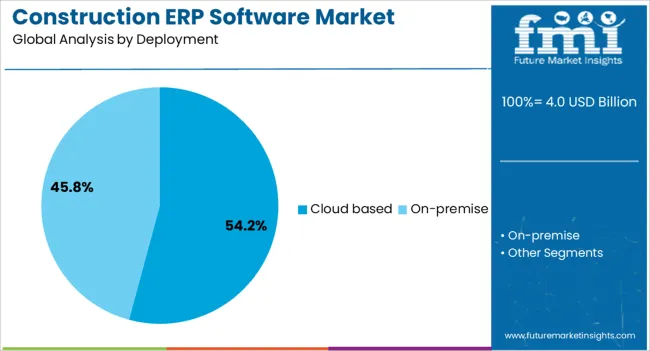

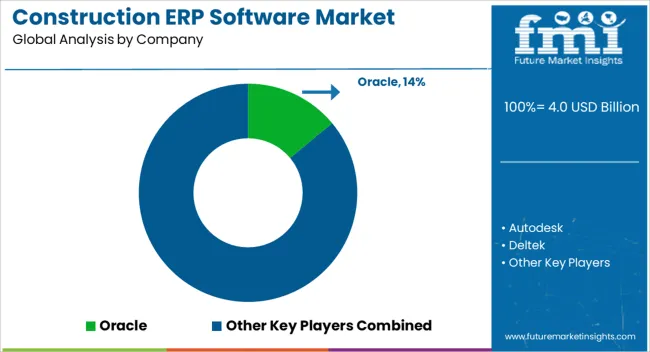

The construction ERP software market, valued at USD 4.0 billion in 2025 and projected to reach USD 8.4 billion by 2035 at a CAGR of 7.7%, illustrates a clear pattern of contribution by underlying technologies that collectively drive market expansion. The growth trajectory indicates that cloud-based ERP solutions are likely to dominate, given their scalability, remote accessibility, and ability to integrate project management, procurement, and financial modules.

On-premises ERP systems continue to contribute, particularly in regions or firms with legacy infrastructure, though their relative share is gradually decreasing as migration toward cloud solutions accelerates. Advanced modules such as AI-powered project analytics, IoT-enabled site monitoring, and mobile-integrated dashboards are increasingly influencing the value contribution across the technology stack. Early years of the forecast period show incremental adoption of these technologies, reflected in the moderate growth from USD 4.0 billion in 2025 to approximately USD 5.4 billion by 2030. Mid-decade adoption is driven by integrated analytics and mobile capabilities, enhancing decision-making efficiency and resource optimization.

By the latter part of the forecast, these advanced technological components significantly contribute to the overall market value, driving revenues beyond USD 8.0 billion by 2035. The contribution analysis highlights that cloud-based platforms, augmented by AI, IoT, and mobile integration, are central to market growth, while traditional ERP modules maintain supportive roles, resulting in a diversified technology-driven expansion.

| Metric | Value |

|---|---|

| Construction ERP Software Market Estimated Value in (2025 E) | USD 4.0 billion |

| Construction ERP Software Market Forecast Value in (2035 F) | USD 8.4 billion |

| Forecast CAGR (2025 to 2035) | 7.7% |

The construction ERP software market represents a specialized part of enterprise resource planning solutions, highlighting its critical role in streamlining project management and operational efficiency. Within the broader construction technology and digital solutions industry, it accounts for nearly 4.7%, driven by increasing adoption in infrastructure and commercial projects. In the global ERP software segment, it secures around 3.9%, emphasizing the need for tailored solutions that address construction-specific workflows. Across the project lifecycle management and scheduling software space, its share stands at 5.2%, reflecting growing reliance on integrated platforms. Within the building information modeling and construction IT tools market, it represents 4.1%, linking ERP solutions with design and planning integration. In the broader industrial digital transformation ecosystem, it holds about 3.5%, showing its contribution to process optimization and real-time data management. Recent developments in this market have highlighted significant advancements in cloud deployment, modular design, and AI integration. Cloud-based ERP platforms are increasingly being adopted for flexibility, remote accessibility, and lower upfront costs.

Vendors are investing in modular ERP systems that allow construction firms to implement customized modules for accounting, procurement, project costing, and compliance. AI-driven predictive analytics tools are being embedded to forecast delays, cost overruns, and resource allocation needs. Mobile-enabled ERP platforms are also gaining traction, enabling on-site project managers and workers to update progress in real-time. Partnerships between ERP providers and construction technology firms are expanding interoperability, especially with BIM and IoT-enabled asset tracking. These developments demonstrate how digital innovation, customization, and data intelligence are reshaping the market.

The market is witnessing robust growth driven by the increasing need for integrated solutions that streamline project management, procurement, financials, and resource planning within construction firms. Digital transformation initiatives across the construction industry are accelerating the adoption of ERP systems that enhance operational efficiency and decision-making.

Growing complexity in construction projects, coupled with rising demand for real-time data access and collaboration, is fueling the shift toward cloud-enabled and scalable software platforms. Additionally, the push for regulatory compliance, cost control, and risk mitigation is encouraging construction companies to invest in ERP solutions that provide end-to-end visibility and automation.

As infrastructure development and urbanization intensify globally, the market outlook remains strong, with continuous innovation expected in deployment models and industry-specific customization.

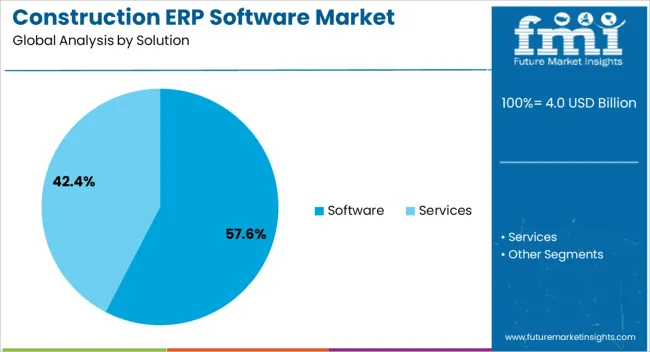

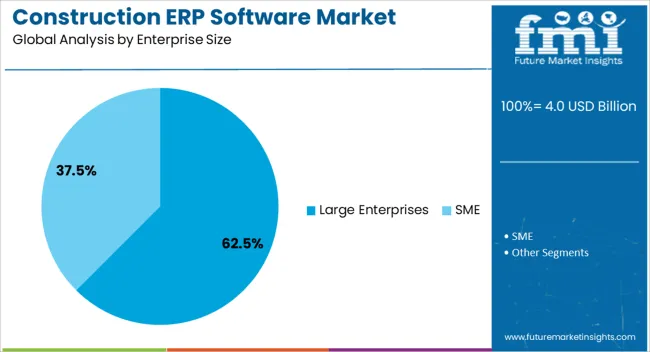

The construction ERP software market is segmented by solution, deployment, enterprise size, end use, and geographic regions. By solution, the construction ERP software market is divided into Software and Services. In terms of deployment, the construction ERP software market is classified into cloud-based and on-premises. Based on enterprise size, the construction ERP software market is segmented into Large Enterprises and SME.

By end use, the construction ERP software market is segmented into Commercial Construction, Residential Construction, Infrastructure & Civil Engineering, and Industrial Construction. Regionally, the construction ERP software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software solution segment is projected to hold 57.6% of the construction ERP software market revenue share in 2025, establishing it as the leading segment. This prominence is attributed to the preference for comprehensive, modular software packages that offer wide-ranging functionalities, including project planning, accounting, and supply chain management.

The segment’s growth has been driven by the flexibility and scalability of software solutions, which can be tailored to diverse construction workflows and integrated with third-party applications. Moreover, software solutions enable frequent updates and enhancements without major disruptions to business operations.

This adaptability has made them the preferred choice among construction firms seeking to leverage technology for improved productivity and competitive advantage.

The cloud-based deployment segment is expected to capture 54.2% of the market revenue in 2025, positioning it as the dominant deployment model. The growth of this segment is being driven by the increasing demand for remote accessibility, cost-effective infrastructure, and simplified IT management.

Cloud-based ERP solutions facilitate real-time collaboration among project teams across geographically dispersed sites, enhancing transparency and communication. Furthermore, the pay-as-you-go pricing models and reduced need for on-premises hardware investments have lowered barriers to adoption.

The scalability and automatic updates provided by cloud platforms allow construction companies to rapidly adjust to project demands and technological advancements, supporting continued expansion of this deployment segment.

The large enterprises segment is anticipated to hold 62.5% of the market revenue in 2025, making it the largest end-use category. This leadership is driven by the complex and large-scale nature of projects managed by these organizations, which require robust ERP systems to coordinate multiple stakeholders, schedules, and compliance requirements.

Large enterprises benefit from comprehensive ERP platforms that support extensive customization, integration with legacy systems, and advanced analytics capabilities. The ability to centralize data and automate processes at scale improves operational efficiency and risk management, which are critical for sustaining profitability in highly competitive markets.

Investments in digital transformation initiatives by large construction firms continue to underpin the growth of this segment.

The market has become increasingly important for streamlining business processes in the construction industry. With the complexity of projects expanding, ERP solutions provide integrated tools for managing finances, procurement, human resources, equipment, and project schedules in a unified system.

The adoption of digital platforms has been driven by the need for real time visibility, cost control, and improved collaboration among stakeholders. Growing use of cloud-based and mobile accessible ERP systems has accelerated market adoption. These platforms are increasingly tailored for construction firms, offering modules for contract management, compliance tracking, and project documentation.

Construction projects often involve multiple contractors, suppliers, and stakeholders, which creates operational challenges. The need for centralized data and seamless coordination has driven ERP software adoption. Real-time project tracking and budget monitoring have improved efficiency and reduced risks of delays and cost overruns. Integration of procurement, payroll, and accounting functions within ERP systems has enabled construction firms to manage complex workflows on a single platform. As the scale of infrastructure projects continues to rise globally, the adoption of ERP solutions is expected to grow further, ensuring greater control and operational transparency.

The increasing shift toward cloud-based ERP solutions has transformed the market landscape. Cloud deployment enables construction companies to access systems from multiple locations, ensuring flexibility and scalability. Mobile-enabled ERP platforms have become essential for field workers, allowing instant data entry, document sharing, and real-time communication with project managers. This has improved decision-making and reduced administrative delays. Furthermore, cloud ERP solutions provide cost advantages by reducing upfront investments in hardware and maintenance. With construction firms operating across distributed sites, cloud and mobile ERP adoption has been recognized as a critical enabler of efficiency and productivity.

Construction ERP software has gained prominence due to its ability to assist firms in meeting compliance requirements and managing operational risks. Many regions have strict regulations on safety, labor management, and environmental reporting, which can be integrated within ERP systems for automated tracking. ERP tools provide detailed audit trails and documentation that enhance transparency and accountability. Risk management modules have supported firms in identifying potential delays, supply chain bottlenecks, or budget overruns in advance. As governments and regulatory authorities increase scrutiny of construction practices, ERP systems are being positioned as essential tools to meet evolving standards.

Despite its advantages, ERP software adoption in the construction industry faces challenges related to high implementation costs, complexity, and resistance to change. Small and medium-sized construction firms often struggle with the significant investment required for ERP deployment.

Customization of ERP systems to suit unique project needs adds further complexity and cost. Moreover, workforce training and adaptation to digital platforms have slowed adoption in certain markets. Integration with legacy systems can also create operational hurdles. These challenges have prompted software providers to focus on modular, scalable, and user-friendly ERP solutions tailored for construction firms of different sizes.

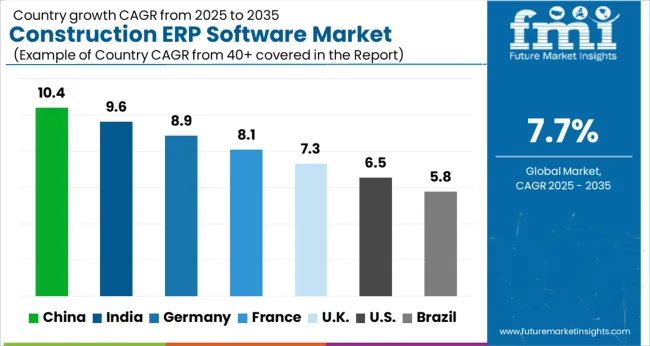

| Country | CAGR |

|---|---|

| China | 10.4% |

| India | 9.6% |

| Germany | 8.9% |

| France | 8.1% |

| UK | 7.3% |

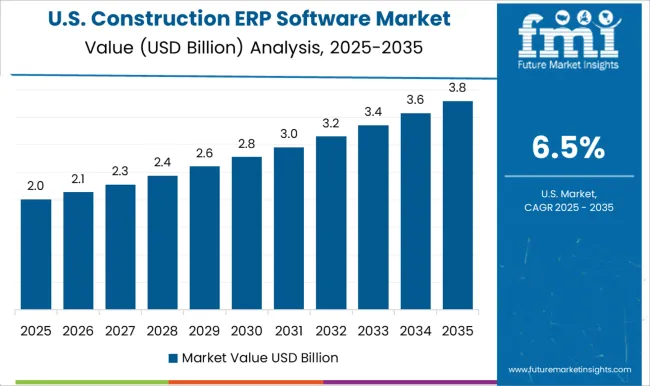

| USA | 6.5% |

| Brazil | 5.8% |

The market is anticipated to grow at a forecast CAGR of 7.7% during 2025 to 2035, reflecting increasing digitalization in construction operations. India at 9.6% and Germany at 8.9% are witnessing steady adoption of integrated project management solutions to enhance efficiency and reduce operational delays. China leads with 10.4, driven by large-scale urban infrastructure and industrial projects. The UK at 7.3 and the USA at 6.5 are maintaining moderate growth, influenced by investments in smart construction technologies and cloud-based platforms. Together, these countries illustrate a spectrum of implementation strategies, technological integration, and scaling practices shaping global market dynamics. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is projected to expand at a CAGR of 10.4%, driven by the digitization of large scale construction projects, urban infrastructure development, and demand for integrated project management systems. Adoption has been reinforced by contractors seeking enhanced workflow automation, cost tracking, and real time monitoring of resources. Domestic software providers focus on cloud based ERP platforms, mobile accessibility, and integration with BIM and project planning tools. Both commercial and government infrastructure projects contribute to robust demand. The market is expected to maintain strong growth as construction companies continue to invest in digital transformation and efficiency optimization across China.

India is expected to record a CAGR of 9.6%, supported by growing construction activities, real estate development, and government infrastructure projects. Adoption has been reinforced by contractors seeking to manage costs, labor, materials, and project timelines through centralized software solutions. Domestic and international ERP providers have introduced scalable solutions for large and mid sized construction firms. Integration with mobile and cloud platforms has enhanced operational efficiency and reporting capabilities. The market is anticipated to continue expanding as digital project management becomes increasingly vital for competitive construction operations in India.

Germany is projected to grow at a CAGR of 8.9% in the construction ERP software market, driven by demand for automation in project management, resource planning, and cost optimization. Adoption has been reinforced by contractors, real estate developers, and municipal projects requiring precise tracking of materials, labor, and timelines. German software providers focus on integration with BIM, real time reporting, and advanced analytics to improve decision making. Export demand for high quality ERP solutions has also contributed to market growth. Germany continues to emphasize process efficiency and project cost management in commercial and infrastructure projects.

The United Kingdom market is expected to grow at a CAGR of 7.3%, influenced by adoption of digital construction management tools, regulatory compliance, and commercial project expansion. Contractors are deploying ERP software to monitor project timelines, budgets, and labor allocation efficiently. Domestic and imported software solutions offer cloud based platforms, mobile access, and integration with financial management and procurement systems. The market is forecasted to expand steadily as demand for operational efficiency, reporting transparency, and cost control becomes critical across U K construction projects.

The United States market is projected to expand at a CAGR of 6.5%, driven by adoption in commercial construction, residential development, and government infrastructure projects. Contractors are deploying ERP software for centralized project management, real time reporting, and cost control. Leading providers such as Procore, Oracle Construction, and Viewpoint offer cloud based and mobile enabled solutions with integration to BIM and accounting systems. Demand is reinforced by large scale projects requiring workflow automation, labor management, and material tracking. Market growth is expected to continue as construction firms increasingly adopt digital solutions for efficiency, scalability, and project transparency.

The market is characterized by the presence of global technology leaders alongside specialized industry-focused providers. Oracle and SAP dominate with comprehensive enterprise solutions that integrate project management, financials, and supply chain functionalities, appealing to large construction firms and multinational contractors. Microsoft and Autodesk leverage their extensive software ecosystems, providing scalable ERP platforms that seamlessly interface with design, collaboration, and cloud-based tools. Specialized players such as Procore Technologies and Viewpoint focus exclusively on construction workflows, offering project-centric platforms that enhance real-time collaboration, resource allocation, and on-site reporting.

Deltek and Sage Group deliver mid-market solutions tailored to small and medium-sized enterprises, emphasizing ease of deployment, cost efficiency, and localized compliance. Competitive strategies across the sector are centered on cloud adoption, AI-driven analytics, mobility solutions, and integration with Building Information Modeling (BIM) systems, which help firms optimize operational efficiency and project profitability. Regional expansion, strategic partnerships, and subscription-based models further intensify market competition, compelling providers to innovate and enhance platform capabilities continually.

| Item | Value |

|---|---|

| Quantitative Units | USD 4.0 Billion |

| Solution | Software and Services |

| Deployment | Cloud based and On-premise |

| Enterprise Size | Large Enterprises and SME |

| End Use | Commercial Construction, Residential Construction, Infrastructure & Civil Engineering, and Industrial Construction |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Oracle, Autodesk, Deltek, Microsoft, Procore Technologies, Sage Group, SAP, and Viewpoint |

| Additional Attributes | Dollar sales by software type and deployment model, demand dynamics across residential, commercial, and infrastructure construction sectors, regional trends in digital adoption, innovation in project management, cost control, and real-time analytics, environmental impact of reduced paper usage and workflow optimization, and emerging use cases in integrated supply chain management, predictive maintenance, and smart construction projects. |

The global construction ERP software market is estimated to be valued at USD 4.0 billion in 2025.

The market size for the construction ERP software market is projected to reach USD 8.4 billion by 2035.

The construction ERP software market is expected to grow at a 7.7% CAGR between 2025 and 2035.

The key product types in construction ERP software market are software and services.

In terms of deployment, cloud based segment to command 54.2% share in the construction ERP software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Telematics Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Construction Films Market Size and Share Forecast Outlook 2025 to 2035

Construction Flooring Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Construction Sealants Market Size and Share Forecast Outlook 2025 to 2035

Construction Bots Market Analysis Size and Share Forecast Outlook 2025 to 2035

Construction Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Generators Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA