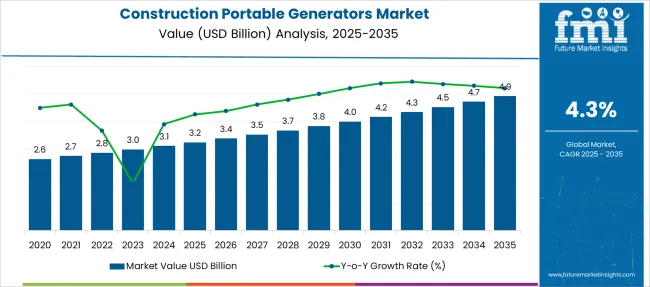

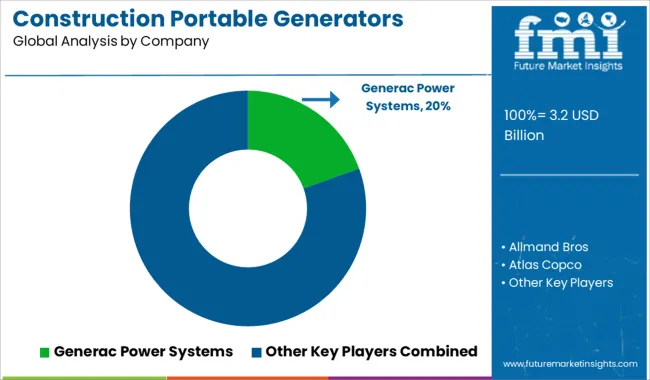

The Construction Portable Generators Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 4.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

| Metric | Value |

|---|---|

| Construction Portable Generators Market Estimated Value in (2025 E) | USD 3.2 billion |

| Construction Portable Generators Market Forecast Value in (2035 F) | USD 4.9 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The construction portable generators market is growing steadily due to increasing demand for reliable power sources at construction sites. Industry observations highlight the importance of portable generators in providing consistent electricity for tools and machinery in remote and temporary locations.

Infrastructure development activities and expansion of construction projects across residential and commercial sectors have accelerated market adoption. Technological improvements in generator design and fuel efficiency have enhanced usability and operational cost savings.

Regulatory frameworks focusing on emissions and safety have influenced product development toward cleaner and safer power solutions. As construction activities continue to rise globally, the need for dependable and portable power equipment remains critical. Market growth is expected to be driven by rising construction investments and increasing adoption of conventional portable generators powered by diesel engines. Single phase generators continue to dominate due to their suitability for small to medium scale construction needs.

The construction portable generators market is segmented by product, fuel & power rating, phase and geographic regions. The portable generators market is divided into Conventional portable and Inverter portable. In terms of fuel & power rating, the construction portable generators market is classified into Diesel, Gasoline, and Others. Based on the phase of the construction, the portable generators market is segmented into single-phase and three-phase. Regionally, the construction portable generators industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

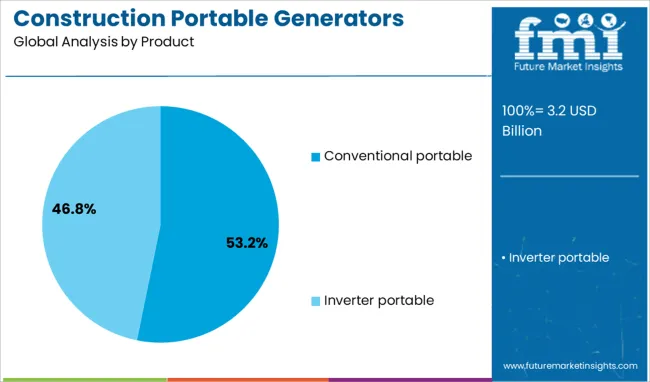

The conventional portable generator segment is projected to account for 53.2% of the market revenue in 2025, maintaining its leading position. This segment’s growth has been supported by its proven reliability and ease of use in various construction environments. Conventional portable generators are favored for their ruggedness and adaptability to different power demands on site.

Their widespread availability and compatibility with common construction equipment have further reinforced their dominance. Additionally, operators prefer conventional models for their simple maintenance and cost-effectiveness.

As construction projects demand flexible and mobile power solutions, the conventional portable segment is expected to sustain its market leadership.

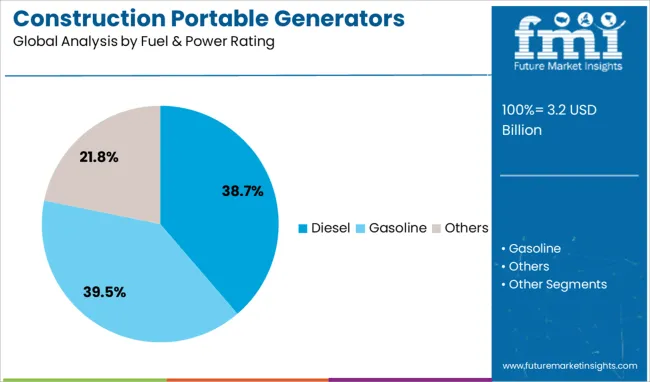

The diesel segment is expected to contribute 38.7% of the construction portable generators market revenue in 2025. Diesel generators have been preferred due to their fuel efficiency, durability, and ability to provide sustained power output under heavy loads. They are especially suited for long working hours in demanding construction settings.

The robustness of diesel engines offers better torque and power stability which is essential for operating heavy machinery. Regulatory emphasis on emissions is prompting manufacturers to innovate cleaner diesel technologies while maintaining performance.

The segment’s growth is supported by the global availability of diesel fuel and its cost advantages over alternative fuels in many regions.

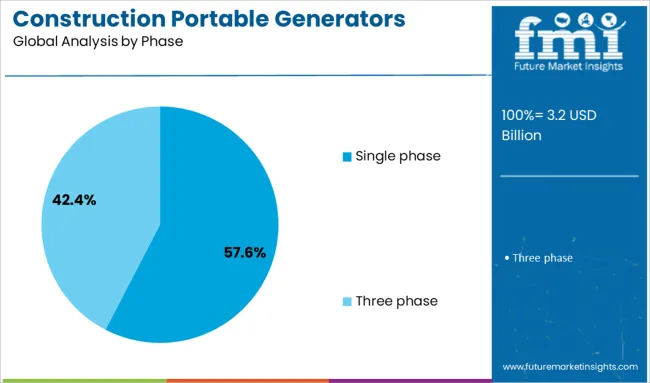

The single phase segment is projected to hold 57.6% of the market revenue in 2025, securing its position as the leading phase category. This preference stems from the segment’s suitability for smaller construction sites and light to medium electrical loads.

Single phase generators are widely used to power handheld tools and temporary lighting setups common on construction sites. Their simpler design and lower cost compared to three phase generators make them accessible to a broader range of users.

Additionally, single phase systems are easier to operate and maintain, which appeals to contractors and site managers. As demand grows for efficient and cost-effective power solutions in construction, the single phase segment is expected to maintain its dominant role.

The construction portable generators market is expanding globally as infrastructure projects and remote worksites require reliable onsite power. Lightweight and compact inverter generators are increasingly preferred for construction, renovation, and finishing tasks. Diesel remains common for heavy-duty use, while hybrid and cleaner fuel options are emerging. Demand is supported by rising need for temporary electrification, backup during outages, and grid-independent operations on job sites. Manufacturers are focusing on ease of transport, low noise, fuel efficiency, and digital control interfaces to serve professional users globally.

Portable generator manufacturers in the construction sector face a growing requirement to meet stringent emission standards. These regulations demand incorporation of advanced emission control systems, such as filters and catalytic converters, especially on diesel-powered units. Product variants must be tailored for differing local or regional regulations, which complicates design planning and production processes. Certification and field testing must align with jurisdictional mandates, requiring extra engineering effort. Smaller suppliers often lack internal validation facilities and outsource approvals, leading to longer deployment timelines. Adapting unit configurations to meet both power output and emission limits increases system cost and design complexity. Collectively, this makes compliance a major barrier when launching new genset models in multiple markets simultaneously, and complicates inventory and service planning for global suppliers.

Expansion of construction across sectors such as roads, railways, commercial buildings, and specialized facilities generates strong demand for portable generator sets. These units support critical construction activities in remote and grid-disconnected zones, including power for tools, lighting, equipment charging, and site trailers. Portable generators are also deployed during grid outages to maintain project continuity. Suppliers offering robust, weather-resistant models with modular designs and easy mobility are positioned to win long-term contracts. Rental models enable construction companies to scale generator use as project stages evolve. Collaborative relationships with construction firms, rental operators, and project managers help providers align genset features such as mobility, runtime, and torque output with field requirements. As urban development intensifies and uptime becomes critical, reliable portable power becomes indispensable, creating consistent demand across global infrastructure programs.

A prominent trend is the shift toward inverter-based portable generators and multi-fuel units tailored for construction sites. Inverter models offer stable voltage, low noise, and better fuel efficiency, making them ideal for sensitive equipment and low-impact environments. Multi-fuel configurations allow operators to switch between diesel, natural gas, or propane depending on availability and site constraints. These technologies support lower fuel consumption, quieter operation, and compliance with varying emission norms. Units combining solar or battery hybrid support are also emerging for intermittent loads or environmentally restrictive sites. Manufacturers providing built-in digital controls and remote monitoring further enhance usability and efficiency. Operators increasingly demand smart gensets that adapt to changing jobsite conditions. Suppliers integrating these advanced power solutions can differentiate themselves in projects that prioritize energy flexibility and operational adaptability.

Fuel cost fluctuations pose a significant constraint on total operating expense for construction generators. Variability in diesel, gas, or propane pricing makes budgeting for multi-month or long-term projects challenging. Construction firms must carefully monitor fuel markets to control operating costs, especially when carrying margins are thin. Higher fuel consumption increases total deployment cost and may prompt substitution toward storage battery systems or alternative fuel units. Some suppliers mitigate this risk by offering highly fuel-efficient models or advisory services on fuel management. Rental operators may provide fuel-inclusive service packages to stabilize pricing exposure. In regions where fuel access is limited or heavily taxed, cost unpredictability discourages adoption of larger capacity units. Until fuel pricing becomes more stable or alternative energy sources become viable at scale, volatility will continue to impact procurement decisions and system economics on construction job sites.

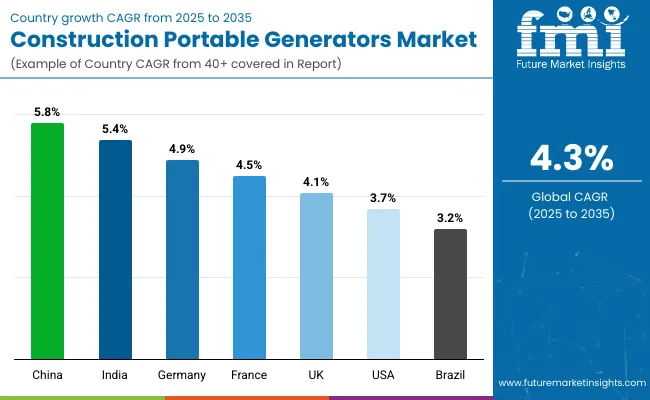

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

| USA | 3.7% |

| Brazil | 3.2% |

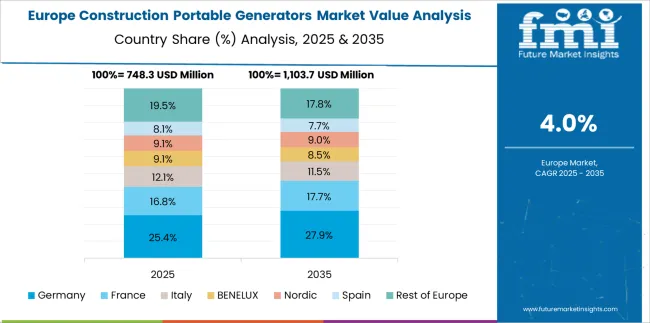

The global construction portable generators market is projected to grow at a CAGR of 4.3% through 2035, supported by rising demand for mobile power solutions across mid-scale and temporary construction sites. Among BRICS nations, China leads with 5.8% growth, driven by frequent deployment in decentralized building zones and rapid project turnovers. India follows at 5.4%, where use has been extended across tier-2 cities and semi-urban infrastructure works. In the OECD region, Germany reports 4.9% growth, backed by consistent use in renovation projects and compliance with noise control measures. The United Kingdom, at 4.1%, maintains demand for compact, fuel-efficient units across short-term civil and commercial works. The United States, at 3.7%, remains a steady market with preferences shaped by runtime expectations and safety certifications. Market growth has been shaped by decibel rating requirements, fuel tank regulations, and output standardization norms. This report includes insights on 40+ countries; the top five markets are shown here for reference.

A steady 5.8% CAGR has been observed in China’s construction portable generators market, led by widespread deployment across residential and commercial project sites. Construction crews have increasingly relied on lightweight and fuel-efficient units for off-grid applications. Compact generators designed with high mobility have supported operations in hilly and remote zones. Enhanced fuel tank capacity and improved noise insulation have become key selection criteria. Suppliers have responded by offering models equipped with digital control panels and overload protection systems. Growth has also been fueled by rising adoption in temporary construction setups such as mobile storage units and tool stations.

In India, the market has grown at a 5.4% CAGR, driven by infrastructure expansion across semi-urban and rural locations. Portable generators have been used extensively for powering handheld tools and temporary lighting at small-scale construction sites. Units featuring rugged frames and easy-start mechanisms have been favored by local contractors. Equipment rental firms have expanded their generator offerings to support varied project durations. Hybrid portable generators incorporating basic solar charging capability have seen pilot adoption in grid-deficient areas. Diesel-powered models continue to dominate, though demand for lower-emission petrol units is gradually building momentum.

Germany has posted a 4.9% CAGR, shaped by increased reliance on high-performance generators at renovation and short-cycle projects. Portable units with automatic voltage regulation and load balancing have become increasingly standard. Demand has concentrated around noise-compliant and emission-regulated models suited for use near residential areas. Product selection has emphasized features such as fuel economy, smart panel integration, and quick-refueling capability. Construction equipment suppliers have bundled generators with site lighting and mobile workstations to improve field efficiency. Limited downtime and maintenance needs have been critical to product selection in Germany’s precision-driven construction environment.

The United Kingdom market has registered a 4.1% CAGR, driven by consistent use of portable generators in smaller residential construction and maintenance works. Lightweight units with low-noise operation have been utilized in refurbishment projects and city-based developments. The rental segment has shown strong interest in models that offer intuitive control panels and transport-friendly casings. Application in modular building sites and prefabricated unit assembly zones has also grown. Stage V emission-compliant models are seeing wider availability due to enforcement of regulatory standards in urban construction zones.

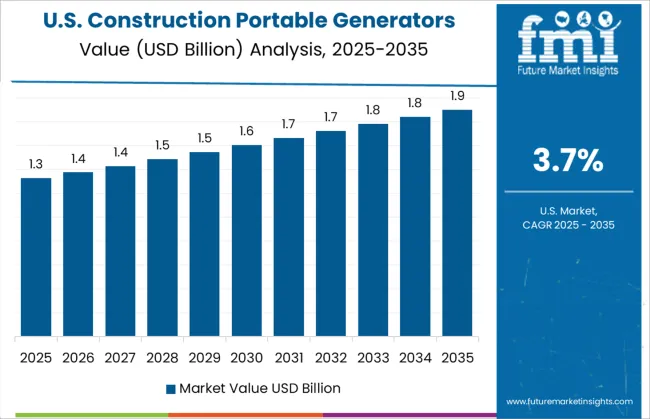

A 3.7% CAGR has been noted in the United States, where demand has been driven by small to mid-size construction operations. Portable units with high wattage output and dual-fuel compatibility have seen uptake among contractors working on remote builds and temporary sites. Generator trailers with integrated safety features have been offered to support OSHA-compliant setups. Fuel-efficient units capable of extended runtime have been preferred in areas where refueling access is limited. Solar-assisted portable models are emerging in niche use cases, though diesel and gasoline units remain dominant in terms of volume.

The construction portable generators market is supported by manufacturers offering rugged, mobile, and fuel-efficient power systems tailored to meet the fluctuating demands of job sites. Generac Power Systems is a dominant player, known for its versatile range of portable units that cater to both light and heavy-duty construction environments, with features like long runtime and advanced control panels.

Caterpillar and Cummins provide premium portable generators with industrial-grade durability, engineered for continuous operation under demanding field conditions. Atlas Copco, Wacker Neuson, and HIMOINSA specialize in compact, low-noise portable power units with strong fuel efficiency, widely used in urban construction and infrastructure projects where mobility and compliance with emission standards are critical.

Briggs & Stratton, Champion Power Equipment, and DuroMax Power Equipment offer competitively priced models popular among small to mid-scale contractors for quick deployment and ease of maintenance. Honda India Power Products, Yamaha Motor, and YANMAR HOLDINGS lead the segment for lightweight, gasoline-powered generators that are valued for their low maintenance needs and strong performance in remote or temporary applications. Deere & Company and DEWALT provide contractor-grade units integrated with enhanced safety features and optimized for tool compatibility on worksites.

Emerging and regionally focused players like Kirloskar Oil Engines, FIRMAN Power Equipment, GENMAC, Allmand Bros, Rehlko, and Westinghouse Electric Corporation are expanding market presence by offering reliable, portable solutions with varied fuel types and output capacities. These suppliers cater to diverse construction segments, from residential builds to public works, ensuring uninterrupted on-site power supply.

Generac Power Systems is expanding production by hiring 400 workers due to increased demand for portable and standby generators following hurricanes in 2024, with CEO Aaron Jagdfeld expecting continued sales growth driven by severe storms and power outages, as mentioned in Reuters, October 16, 2024.

At CES 2025, Jackery launched new solar products, including Solar Roof tiles with over 25% efficiency, the 5000 Plus solar generator, Explorer 3000 v2 portable generator, and a 600W DC-to-DC car charger, providing efficient renewable power solutions for homes and vehicles, as mentioned in The Verge, January 7, 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 Billion |

| Product | Conventional portable and Inverter portable |

| Fuel & Power Rating | Diesel, Gasoline, and Others |

| Phase | Single phase and Three phase |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Generac Power Systems, Allmand Bros, Atlas Copco, Briggs & Stratton, Caterpillar, Champion Power Equipment, Cummins, Deere & Company, DEWALT, DuroMax Power Equipment, FIRMAN Power Equipment, GENMAC, HIMOINSA, Honda India Power Products, Kirloskar Oil Engines, Rehlko, Wacker Neuson, Westinghouse Electric Corporation, Yamaha Motor, and YANMAR HOLDINGS |

| Additional Attributes | Dollar sales by construction portable generator type including conventional and inverter models such as diesel, gasoline, propane, and dual-fuel units, by power rating categories including below 2 kW, 2–10 kW, and above 10 kW, and by geographic region including North America, Europe, and Asia‑Pacific; demand driven by infrastructure development, off-grid jobsite needs, and emergency power restoration; innovation in low-emission engines, noise reduction, and telematics integration; costs influenced by fuel source, regulatory engine standards, and manufacturing volume. |

The global construction portable generators market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the construction portable generators market is projected to reach USD 4.9 billion by 2035.

The construction portable generators market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in construction portable generators market are conventional portable and inverter portable.

In terms of fuel & power rating, diesel segment to command 38.7% share in the construction portable generators market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA