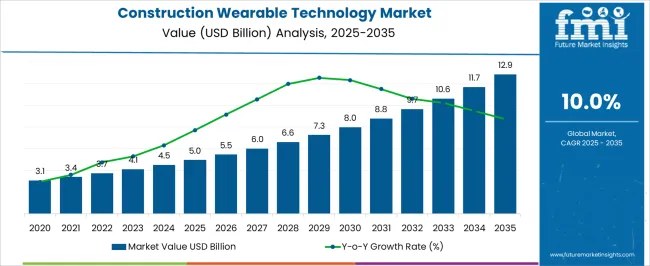

The construction wearable technology market is projected to grow from USD 5.0 billion in 2025 to USD 12.9 billion by 2035, reflecting a CAGR of 10.0%, demonstrating steady year-on-year growth. In 2025, the market reaches USD 5.0 billion, up from USD 4.5 billion in 2024, with annual increases gradually rising to USD 5.5 billion in 2026. Each year experiences consistent growth of approximately 8–10%, reflecting increasing adoption of wearable devices across construction sites for safety, workforce monitoring, and productivity management.

This predictable YoY growth allows manufacturers and service providers to align production and deployment schedules effectively. By 2035, the market is expected to reach USD 12.9 billion, representing an absolute increase of USD 7.9 billion from 2025, supported by the 10.0% CAGR. Year-on-year, values grow steadily from USD 6.6 billion in 2028 to USD 11.7 billion in 2034. These incremental annual gains highlight reliable market expansion, enabling stakeholders to anticipate demand, optimize supply chains, and scale operational capacity. The steady YoY increases provide a clear outlook for revenue planning, ensuring long-term engagement and strategic positioning within the construction wearable technology ecosystem over the decade.

| Metric | Value |

|---|---|

| Construction Wearable Technology Market Estimated Value in (2025 E) | USD 5.0 billion |

| Construction Wearable Technology Market Forecast Value in (2035 F) | USD 12.9 billion |

| Forecast CAGR (2025 to 2035) | 10.0% |

The construction wearable technology segment forms a critical part of the broader construction equipment and safety technology market. In 2025, wearable technology accounts for USD 5.0 billion, representing approximately 12–13% of the total parent market. By 2035, the segment is projected to reach USD 12.9 billion, maintaining a share of around 12–13%, highlighting its consistent relevance in construction operations. The stable percentage indicates that wearable solutions, including smart helmets, sensors, and monitoring devices, will continue to be an integral component of the construction technology ecosystem, supporting site safety, workforce monitoring, and operational efficiency.

Growing at a CAGR of 10.0% from 2025 to 2035, the construction wearable technology segment demonstrates significantly faster expansion than the overall parent market, reflecting increasing adoption rates and market penetration. Its steady contribution of 12–13% over the decade emphasizes predictable revenue opportunities for manufacturers, technology providers, and system integrators. The segment’s strategic importance within the construction equipment and safety market is underscored by its ability to deliver measurable operational benefits.

The construction wearable technology market is witnessing significant momentum due to the rising demand for real-time workforce monitoring, site safety, and productivity optimization. Employers are increasingly integrating wearables into workflows to reduce accident rates, ensure compliance with safety protocols, and gain analytics-driven insights into worker performance.

The availability of rugged, industry-specific devices and the growing interoperability of wearables with existing site management platforms have further enhanced adoption. Additionally, supportive regulatory mandates and investments in smart construction technologies are encouraging large-scale deployments across both developed and emerging markets.

The shift toward digitized construction ecosystems will continue to accelerate the uptake of wearable innovations in the years ahead.

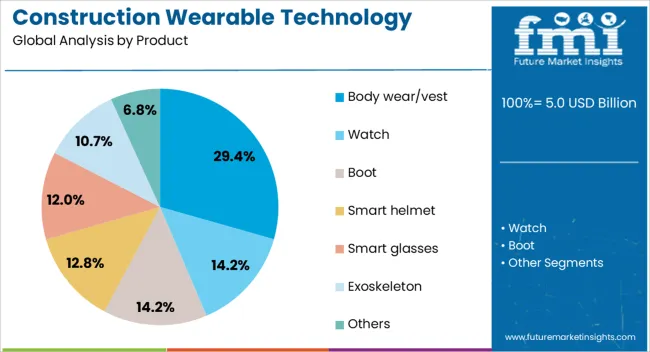

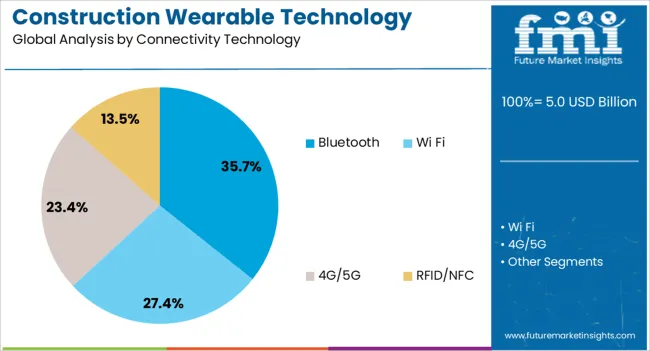

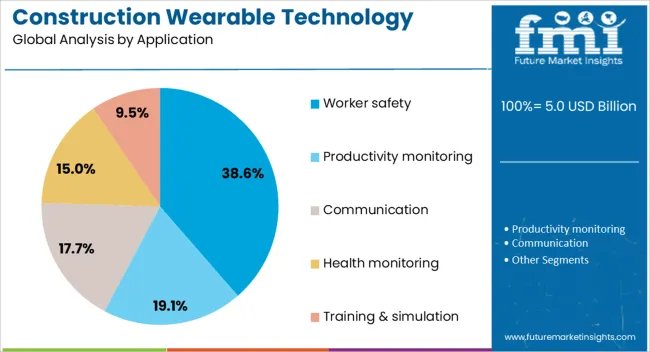

The construction wearable technology market is segmented by product, connectivity technology, application, end user, and geographic regions. By product, construction wearable technology market is divided into Body wear/vest, Watch, Boot, Smart helmet, Smart glasses, Exoskeleton, and Others. In terms of connectivity technology, construction wearable technology market is classified into Bluetooth, Wi Fi, 4G/5G, and RFID/NFC. Based on application, construction wearable technology market is segmented into Worker safety, Productivity monitoring, Communication, Health monitoring, and Training & simulation.

By end user, construction wearable technology market is segmented into Industrial, Residential, Commercial, Infrastructure, and Others. Regionally, the construction wearable technology industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The body wear/vest segment is expected to lead the product category with 29.40% share in 2025. This growth is driven by increasing demand for integrated safety solutions such as sensor-embedded vests that monitor vital signs, detect hazardous exposure, and provide real-time alerts.

These vests support ergonomics and worker comfort while housing advanced technologies like GPS, motion sensors, and thermal monitoring. With construction sites becoming increasingly digitized, body wear/vest solutions are seen as essential tools for risk mitigation and operational efficiency.

Their compatibility with enterprise platforms and data analytics systems further enhances their value proposition for large-scale contractors and infrastructure firms.

Bluetooth connectivity is projected to account for 35.70% of the market in 2025, making it the dominant technology in this space. Its widespread compatibility with mobile devices, low power consumption, and stable short-range communication make it ideal for on-site applications.

Bluetooth enables real-time data transmission from wearables to supervisors, enabling continuous health and safety monitoring. Furthermore, Bluetooth-based solutions are cost-effective, easy to integrate, and increasingly reliable in complex job site environments.

As construction operations prioritize seamless communication and worker tracking without relying on extensive infrastructure, Bluetooth continues to be the preferred choice.

Worker safety will remain the largest application area, representing 38.60% of the total market in 2025. The prominence of this segment is underpinned by the industry’s emphasis on reducing fatalities and injuries on site.

Wearables focused on safety provide critical functions such as fall detection, geofencing, fatigue monitoring, and environmental hazard alerts. Insurance firms and regulators are also incentivizing the adoption of such technologies to reduce claims and enforce standards.

As safety becomes a competitive differentiator and a regulatory requirement, the demand for wearable tech with robust safety features is expected to intensify across large and mid-scale construction firms globally.

The construction wearable technology market is expanding as companies adopt digital solutions to enhance safety, productivity, and operational efficiency on construction sites. Wearable devices such as smart helmets, vests, gloves, and augmented reality glasses enable real-time monitoring of worker health, location, and environmental conditions. Rising concerns about workplace safety, regulatory compliance, and the need for productivity optimization are driving adoption.

Integration with IoT platforms, cloud analytics, and AI-based monitoring allows construction managers to track performance, prevent accidents, and optimize resource allocation. Companies offering durable, easy-to-use, and data-enabled wearable solutions are well-positioned to capitalize on growth in large-scale construction, infrastructure development, and industrial projects worldwide.

The market faces challenges related to high device costs, adoption resistance, and data security concerns. Wearable technologies often require significant upfront investment, including hardware, software, and integration with site management systems. Construction workers may resist adoption due to comfort, usability, or privacy concerns. Capturing and transmitting sensitive health and location data raises cybersecurity and regulatory compliance issues, particularly in regions with strict labor or data protection laws. Ensuring device durability under harsh construction site conditions, including dust, vibration, and extreme temperatures, adds further complexity. Companies must provide cost-effective, reliable, and secure wearable solutions, along with training and support programs, to overcome these challenges and ensure successful deployment on construction sites.

The market is trending toward IoT integration, real-time monitoring, and augmented reality-enabled wearables. Smart helmets, vests, and glasses now provide live data on worker biometrics, fatigue, environmental hazards, and equipment usage. AR-enabled devices assist with on-site visualization, remote collaboration, and digital blueprints, reducing errors and enhancing decision-making. Wearables are increasingly integrated with site management software and predictive analytics platforms to improve resource allocation, safety compliance, and operational efficiency. Lightweight, ergonomic, and ruggedized designs are improving worker comfort and adoption rates. These trends highlight the focus on combining safety, productivity, and digital intelligence to create smarter, more connected construction sites.

The market offers opportunities in large-scale construction projects, safety regulation compliance, and workforce efficiency enhancement. Rapid urbanization, infrastructure expansion, and industrial facility construction are driving demand for wearable technologies to monitor worker health and prevent accidents. Regulatory authorities are increasingly mandating safety compliance, providing an incentive for companies to deploy wearable solutions. Wearables help track productivity, reduce downtime, and improve overall workforce management. Integration with training programs, preventive maintenance, and equipment monitoring creates additional value. Companies that provide scalable, durable, and analytics-enabled wearable solutions can benefit from the growing emphasis on construction safety, operational efficiency, and digital transformation in both emerging and developed markets.

Market growth is restrained by technical challenges, interoperability issues, and maintenance requirements. Wearable devices must withstand harsh construction environments, including exposure to dust, moisture, vibration, and extreme temperatures, which can reduce device lifespan. Interoperability with diverse site management platforms, IoT devices, and safety protocols can be challenging, slowing deployment. Regular maintenance, software updates, and battery management are required to ensure continuous operation. Additionally, concerns about worker privacy, data ownership, and resistance to technological change can limit adoption. Until ruggedized, standardized, and user-friendly wearable solutions become widely available, market penetration may remain limited to larger construction companies and technologically advanced projects.

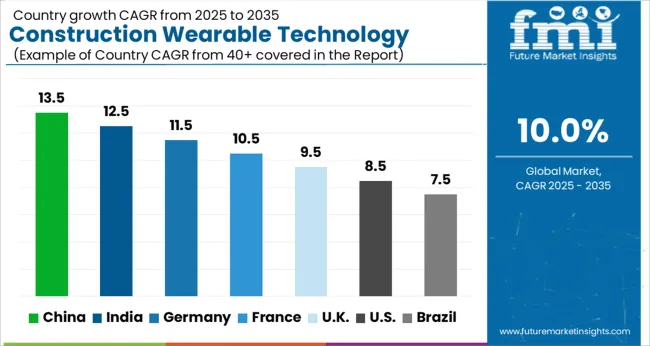

| Country | CAGR |

|---|---|

| China | 13.5% |

| India | 12.5% |

| Germany | 11.5% |

| France | 10.5% |

| UK | 9.5% |

| USA | 8.5% |

| Brazil | 7.5% |

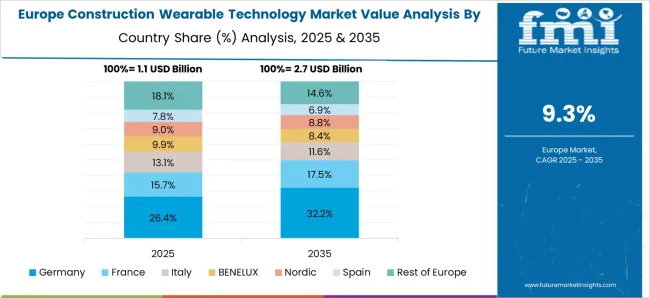

The global construction wearable technology market is projected to grow at a CAGR of 10.0% through 2035, supported by increasing demand across worker safety, site monitoring, and productivity tracking applications. Among BRICS nations, China has been recorded with 13.5% growth, driven by large-scale adoption of smart helmets, wearable sensors, and connected devices on construction sites, while India has been observed at 12.5%, supported by rising implementation in worker safety programs and real-time monitoring systems. In the OECD region, Germany has been measured at 11.5%, where production and deployment of wearable safety gear and site monitoring devices have been steadily maintained. The United Kingdom has been noted at 9.5%, reflecting consistent use in construction safety and operational tracking, while the USA has been recorded at 8.5%, with production and utilization across commercial and residential construction projects being steadily increased. This report includes insights on 40+ countries; the top five markets are shown here for reference.

China is emerging as a leader in construction wearable technology, growing at a CAGR of 13.5%, driven by large-scale infrastructure projects and increasing emphasis on worker safety. Manufacturers are introducing smart helmets, sensor-enabled vests, and wristbands capable of monitoring vital signs, environmental hazards, and worker location. Government initiatives promoting occupational safety, urban development, and smart city projects are accelerating adoption. Pilot deployments on mega construction sites have demonstrated benefits including accident reduction, improved labor productivity, and real-time site monitoring. Collaborations between domestic technology providers, construction companies, and research institutes are advancing device durability, connectivity, and integration with digital construction platforms. Rising adoption of automation and smart construction management continues to fuel China’s market.

Construction wearable technology market in India is expanding at a CAGR of 12.5%, supported by rapid urbanization, industrial growth, and strict labor safety initiatives. Manufacturers are supplying smart helmets, wearable sensors, and exoskeletons for real-time monitoring of worker health, fatigue, and environmental hazards. Government programs promoting construction modernization, occupational safety, and smart city development are encouraging adoption. Pilot implementations in residential, commercial, and infrastructure projects demonstrate operational benefits such as accident prevention, optimized workflow, and enhanced site supervision. Partnerships between domestic technology firms, construction companies, and international solution providers are improving integration, reliability, and sensor performance. India’s increasing focus on worker safety and digital construction management continues to drive growth in wearable adoption.

Construction wearable technology market in Germany is recording a CAGR of 11.5%, supported by stringent safety regulations, advanced construction practices, and industry digitization. Manufacturers are providing smart helmets, sensor-enabled vests, and wearable exoskeletons for worker monitoring, fatigue detection, and hazard alerts. Government initiatives promoting workplace safety, sustainable construction, and automation drive market adoption. Pilot projects in industrial, commercial, and infrastructure sites show benefits such as reduced accidents, increased productivity, and data-driven site management. Collaborations between technology providers, construction companies, and research institutes are enhancing sensor precision, device ergonomics, and connectivity. Germany’s commitment to safety, automation, and digital construction continues to propel wearable technology adoption.

The United Kingdom is experiencing a CAGR of 9.5% in construction wearable technology, fueled by rising safety standards, urban development projects, and digital construction adoption. Manufacturers are producing smart helmets, wearable sensors, and safety vests that track environmental hazards, worker location, and health indicators. Government programs promoting occupational safety, smart construction, and labor compliance are supporting market growth. Pilot deployments in commercial and infrastructure projects show benefits such as accident reduction, improved labor efficiency, and better site monitoring. Partnerships between domestic technology providers, construction firms, and research institutions enhance device reliability, connectivity, and software integration. Growing adoption of automation and digital construction management continues to support the UK market.

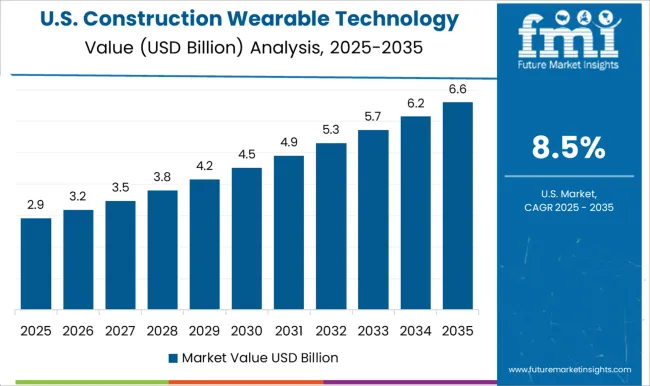

The United States construction wearable technology market is growing at a CAGR of 8.5%, supported by increasing safety regulations, labor efficiency programs, and the adoption of digital construction tools. Manufacturers are developing wearable devices such as helmets, vests, wristbands, and exoskeletons for real-time monitoring of worker health, fatigue, and environmental hazards. Government initiatives promoting occupational safety, construction modernization, and industrial digitization are encouraging adoption. Pilot projects in large commercial and infrastructure sites demonstrate operational benefits including reduced accidents, enhanced workflow, and real-time site analytics. Collaborations between technology providers, construction companies, and research institutes are improving sensor accuracy, device durability, and integration with construction management software. Focus on safety and workforce productivity continues to drive market growth in the USA

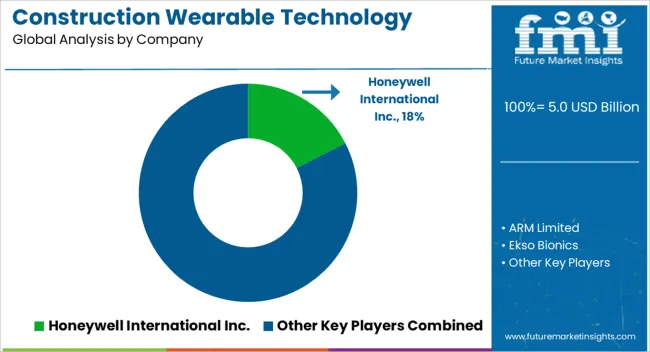

Wearable devices for construction environments are being adopted to improve worker safety, monitoring, and operational efficiency, with suppliers competing on sensor accuracy, ergonomics, and durability. Honeywell International Inc. is positioned as a leading provider, with brochures highlighting smart helmets, wearable gas detectors, and real-time location monitoring, along with technical specifications for battery life, environmental tolerance, and alert thresholds. ARM Limited supplies embedded processors and IoT modules, with literature detailing power consumption, connectivity options, and integration guidance for wearable devices. Ekso Bionics focuses on exoskeletons, with brochures emphasizing load-bearing capacity, joint articulation range, and safety certifications. Garmin and German Bionic Systems GmbH provide sensor-integrated wearable devices, with technical literature covering GPS tracking, motion sensors, and data transmission reliability. Kenzen emphasizes physiological monitoring for heat stress and fatigue, while Panasonic and RealWear Inc. deliver head-mounted displays and voice-controlled devices, with brochures presenting operating ranges, ruggedized casing specifications, and compatibility with communication systems. Siemens and Trimble Inc. offer connected wearable platforms for site management and workflow integration, with brochures detailing device interoperability, software interfaces, and real-time reporting. XREAL, Inc. provides AR-enabled wearables for visualization tasks, with literature highlighting display specifications, weight, and user comfort. Other regional suppliers compete by offering low-cost, modular, or specialized devices for niche construction applications. Adoption strategies are focused on accuracy, device robustness, and system interoperability.

| Item | Value |

|---|---|

| Quantitative Units | USD 5.0 Billion |

| Product | Body wear/vest, Watch, Boot, Smart helmet, Smart glasses, Exoskeleton, and Others |

| Connectivity Technology | Bluetooth, Wi Fi, 4G/5G, and RFID/NFC |

| Application | Worker safety, Productivity monitoring, Communication, Health monitoring, and Training & simulation |

| End User | Industrial, Residential, Commercial, Infrastructure, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Honeywell International Inc., ARM Limited, Ekso Bionics, Garmin, German Bionic Systems GmbH, Kenzen, Panasonic, RealWear Inc., Siemens, Trimble Inc., and XREAL, Inc. |

| Additional Attributes | Dollar sales vary by device type, including smart helmets, vests, gloves, and wearable sensors; by application, such as worker safety monitoring, productivity tracking, and fatigue management; by end-use industry, spanning residential, commercial, and infrastructure construction; by region, led by North America, Europe, and Asia-Pacific. Growth is driven by rising construction automation, focus on worker safety, and adoption of IoT and smart technologies. |

The global construction wearable technology market is estimated to be valued at USD 5.0 billion in 2025.

The market size for the construction wearable technology market is projected to reach USD 12.9 billion by 2035.

The construction wearable technology market is expected to grow at a 10.0% CAGR between 2025 and 2035.

The key product types in construction wearable technology market are body wear/vest, watch, boot, smart helmet, smart glasses, exoskeleton and others.

In terms of connectivity technology, bluetooth segment to command 35.7% share in the construction wearable technology market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Equipment Fleet Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Risk Assessment Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Design Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Accounting Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Management Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Punch List Software Market Size and Share Forecast Outlook 2025 to 2035

Construction ERP Software Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Software As A Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA