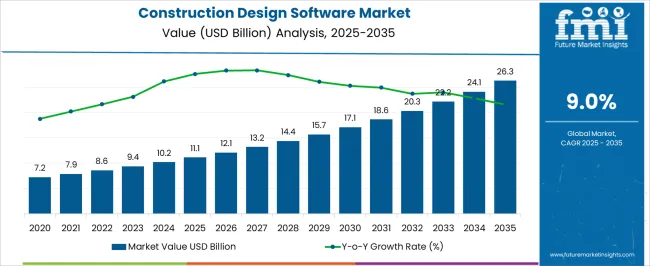

The construction design software category is projected to expand from USD 11.1 million in 2025 to USD 26.3 million in 2035 at a 9% CAGR, yielding an absolute dollar opportunity of USD 15.2 million. Growth is expected to be driven by expanded use of CAD and BIM workflows across architects, engineers, and contractors. Parametric modeling, clash detection, and quantity takeoff are being adopted to compress design cycles and curb errors. Cloud collaboration with version control and issue tracking is being prioritized to manage dispersed teams. Interoperability across IFC, DWG, RVT, BCF, and COBie is being prioritized, with APIs linking to common data environments, estimating, and field management. Owners are preferring governance under ISO 19650, audit trails, and immutable version history. Suppliers that deliver uptime, responsive support, training academies, and predictable pricing will win. The absolute dollar opportunity looks attainable as digital design standards spread across public works, industrial facilities, commercial buildings worldwide, and housing.

| Metric | Value |

|---|---|

| Construction Design Software Market Estimated Value in (2025 E) | USD 11.1 billion |

| Construction Design Software Market Forecast Value in (2035 F) | USD 26.3 billion |

| Forecast CAGR (2025 to 2035) | 9.0% |

The construction design software segment is estimated to account for 26% of the AEC software market, 18% of the CAD and drafting software market, 22% of the building information modeling software market, 17% of the structural and civil engineering design software market, and 15% of the construction technology software market. In aggregate, these proportions total 98% across the listed parent categories. This footprint is viewed as decisive because design suites guide scope definition, model coordination, and constructability reviews that determine downstream cost and schedule certainty. Value is realized when parametric modeling, clash detection, and quantity extraction streamline design to field handoffs and reduce rework.

Buyer preference tends to be shaped by interoperability, template libraries, multidisciplinary collaboration, and audit trails that meet documentation and compliance needs. The segment has been positioned as the reference layer for project data, with integrated workflows linking geospatial inputs, structural analysis, MEP routing, and detailing. Adoption has been reinforced by owners and EPC firms that require consistent drawing standards and model-based submittals across portfolios. Informed procurement focuses on license flexibility, cloud collaboration reliability, partner ecosystems, and implementation support that secures user adoption. In opinionated assessment, construction design software sets the practical benchmark for information quality in the built environment, creating measurable gains in coordination and tender accuracy. As libraries, rulesets, and automation expand, the segment is expected to deepen specification in public and private programs, preserving its strong weight across parent markets and elevating delivery confidence from schematic design through issue for construction.

The construction design software market is witnessing strong expansion, supported by the rising adoption of digital technologies to improve efficiency, collaboration, and accuracy across construction projects. Increasing complexity in architectural, engineering, and infrastructure development is encouraging the use of advanced design solutions that integrate 3D modeling, real-time collaboration, and data analytics.

The growing emphasis on reducing project delays and cost overruns is driving demand for platforms that offer seamless coordination between stakeholders, enhanced visualization, and predictive planning capabilities. Cloud integration and mobile accessibility are enabling greater flexibility and responsiveness in project execution, while regulatory requirements for sustainability and safety are influencing the adoption of software tools that improve compliance.

Rising investment in smart city infrastructure, coupled with increased demand for modular and prefabricated construction methods, is further accelerating market growth As the construction sector continues its digital transformation, the market is expected to experience sustained momentum, with vendors focusing on enhancing interoperability, scalability, and user experience to meet evolving industry needs.

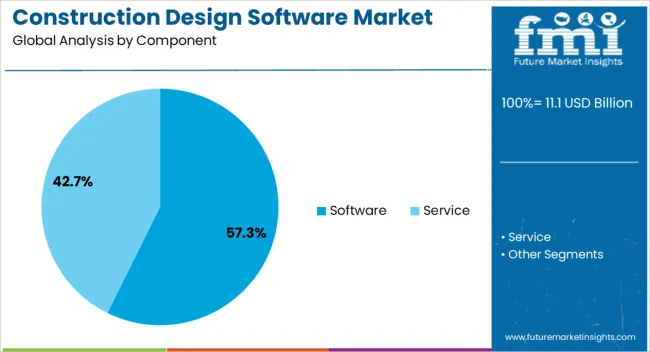

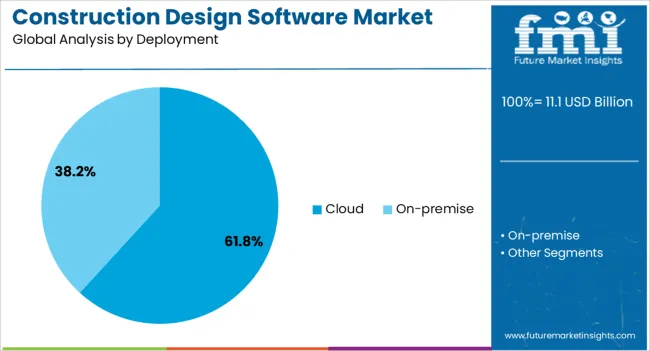

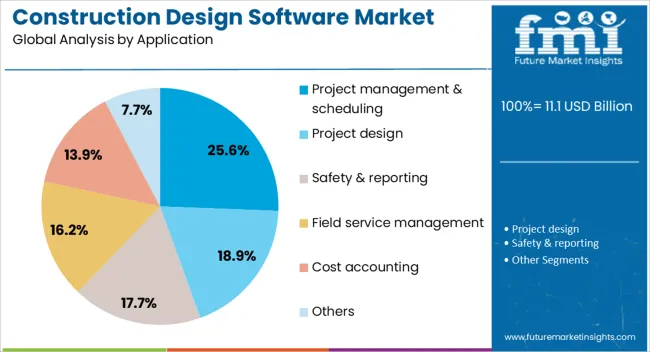

The construction design software market is segmented by component, deployment, application, end use, and geographic regions. By component, construction design software market is divided into Software and Service. In terms of deployment, construction design software market is classified into Cloud and On-premise. Based on application, construction design software market is segmented into Project management & scheduling, Project design, Safety & reporting, Field service management, Cost accounting, and Others. By end use, construction design software market is segmented into Architects & builders, Remodelers, Designers, and Others. Regionally, the construction design software industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The software component segment is projected to hold 57.3% of the construction design software market revenue share in 2025, making it the leading component category. This dominance is being driven by the increasing reliance on comprehensive digital platforms that integrate design, visualization, and analytical capabilities. Software solutions enable precise modeling, streamlined workflows, and real-time data sharing among project teams, reducing design errors and enhancing overall project outcomes.

The ability to customize functionalities based on project requirements is improving efficiency and scalability, making software an essential investment for construction firms of all sizes. Continuous advancements in artificial intelligence, building information modeling, and cloud-based collaboration tools are strengthening the appeal of dedicated software solutions.

The segment is further supported by growing demand for interoperability with other construction technologies, such as project management systems and cost estimation tools As organizations continue to prioritize digital adoption to enhance competitiveness and meet tighter project timelines, software is expected to remain the core revenue generator in the market.

The cloud deployment segment is anticipated to account for 61.8% of the construction design software market revenue share in 2025, establishing itself as the dominant deployment model. Its leadership is being reinforced by the need for flexible, scalable, and cost-effective solutions that support remote collaboration and real-time project updates. Cloud platforms enable seamless data access from multiple locations, ensuring that design modifications and project changes are immediately available to all stakeholders.

This approach reduces the dependency on on-premises infrastructure, lowering maintenance costs while improving accessibility for geographically distributed teams. The ability to integrate cloud-based design tools with other construction technologies, such as IoT-enabled monitoring systems and mobile project management applications, is further enhancing operational efficiency.

Strong data security protocols and compliance with industry regulations are making cloud solutions more attractive to large enterprises and small firms alike. As the industry continues to embrace digital transformation and remote working practices, cloud deployment is expected to retain its leading position in the market.

The project management and scheduling application segment is expected to hold 25.6% of the construction design software market revenue share in 2025, making it the leading application area. This dominance is being driven by the growing need to optimize timelines, resource allocation, and task coordination across increasingly complex construction projects. Software tools in this category provide real-time visibility into project progress, allowing stakeholders to identify bottlenecks and implement corrective measures promptly.

The integration of predictive analytics, automated scheduling, and scenario modeling capabilities is enabling more accurate planning and reducing the risk of delays and cost overruns. Adoption is further supported by the rising demand for collaborative platforms that consolidate project data, enabling synchronized decision-making between architects, engineers, and contractors.

Regulatory pressures to meet safety, quality, and sustainability benchmarks are also encouraging the use of advanced scheduling tools to ensure compliance. As project execution speed and efficiency become critical success factors, this application segment is expected to maintain its leadership in the market.

The construction design software market is projected to grow steadily as architects, engineers, and contractors prioritize coordinated models, faster approvals, and auditable design intent. Demand is reinforced by BIM authoring, clash detection, and multi-discipline collaboration that shorten design cycles and reduce rework. Opportunities are opening in cloud delivery, open APIs, and packaged workflows for verticals such as healthcare and infrastructure. Trends highlight model-based estimating, 4D scheduling links, and automated code checking. Challenges remain around training costs, license complexity, data standards, and integration with legacy CAD, document control, and on-prem archives across distributed teams.

Market demand has been reinforced by the shift to coordinated, model-centric delivery across architecture, structure, and MEP. Owners and public agencies are requesting BIM handover files, federated models, and transparent change histories that support procurement and facilities planning. Designers have relied on parametric modeling, clash detection, and rules-based drafting to reduce RFIs, compress review cycles, and raise drawing consistency. Cloud worksharing and model permissions are being used to align consultants, while reality capture inputs, such as point clouds, improve as-built accuracy. Energy code analyses, life safety layouts, and accessibility checks are being embedded into design reviews, which increases reliance on a single source of truth. The strongest pull comes from measurable rework reduction and cleaner submittals. When model coordination, sheet sets, and quantity takeoff live in the same platform, project teams move from reactive fixes to predictable, documented design control.

Opportunities are opening where platforms connect natively with estimating, scheduling, geospatial, and document control, so quantities, schedules, and transmittals flow without rekeying. Vendors are packaging discipline playbooks for hospitals, schools, data centers, and transit that include predefined families, detail libraries, and stamp-ready sheets. API ecosystems are enabling partners to add model checking, code compliance rules, and AR-based coordination, creating add-on revenue and deeper stickiness.

Mid-market firms are responding to tiered subscriptions, pooled licenses, and managed cloud hosting that reduce IT overhead. Training academies, template kits, and data migration services are shortening ramp time and boosting renewal rates. From our perspective, the richest upside comes when design software is sold with outcomes, not modules. Bundling onboarding, audit dashboards, and quarterly model health reviews raises sheet quality, improves clash resolution, and accelerates approvals, which in turn drives portfolio standardization across owner programs and repeat-bid contractors.

Trends point to connected design environments where authoring, coordination, and review live in a shared data backbone. 4D and 5D links are being adopted, so model objects carry schedule tasks and cost codes, allowing planners and estimators to work directly from design intent. Generative layout tools, parametric families, and automated detailing are reducing manual drafting while preserving standards. Model health analytics, issue heat maps, and element provenance are helping managers detect risk early. Interoperability via IFC, BCF, and open IDs is growing, enabling cross-platform collaboration with fewer exports. Reality capture from laser scans and photogrammetry is tied into fit-out and renovation, improving clash accuracy. In our opinion, the decisive trend is traceability. When every dimension, quantity, and change order links back to a timestamped element, closeout packages and digital handover become routine exports rather than rushed end-of-project compilations that invite disputes.

Challenges persist in change management as firms transition from file-based CAD to model-based delivery, which can expose skills gaps, template debt, and inconsistent families. Per-user pricing, storage tiers, and premium connectors create budgeting friction on multi-year programs with rotating teams. Integrations with legacy ERPs, DMS archives, and on-prem license servers are often complex, delaying go-live. Data standards vary across owners, causing rework in naming, classification, and level-of-detail, while mixed IFC implementations still generate translation issues. Hardware constraints on older laptops and remote connectivity limits in site offices hamper real-time coordination. Security reviews and data residency rules extend procurement cycles. Many setbacks can be mitigated through fixed-scope onboarding, template governance, offline-first sync, and transparent SKU packaging. Vendors that deliver repeatable implementation playbooks and measurable model health metrics will convert pilots to enterprise standards, while tool-only pitches risk shelfware.

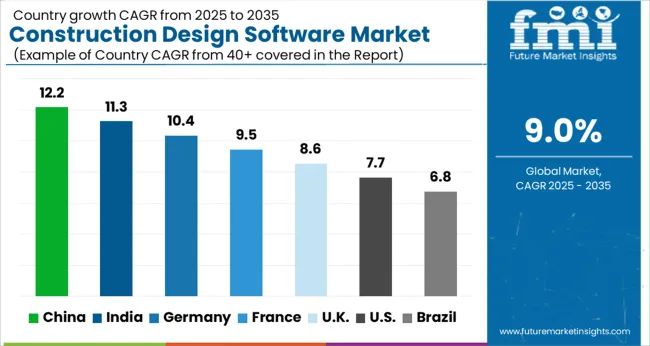

| Country | CAGR |

|---|---|

| China | 12.2% |

| India | 11.3% |

| Germany | 10.4% |

| France | 9.5% |

| UK | 8.6% |

| USA | 7.7% |

| Brazil | 6.8% |

The global construction design software market is projected to grow at 9% from 2025 to 2035. China leads at 12.2%, followed by India at 11.3% and Germany at 10.4%, with the United Kingdom at 8.6% and the United States at 7.7% trailing. Demand is being pulled by model-based workflows, clash coordination, code-checked documentation, and tighter links between design studios and site teams.

Cloud collaboration, CDE alignment, and discipline-specific libraries are being prioritized to compress design cycles and control RFIs. Parametric modeling, rule-based automation, and reality-capture inputs are being adopted to reduce rework. Asia is set to outpace on volume deployments and localized toolsets; Germany is expected to emphasize precision and audit-ready records; the UK is likely to expand through framework standards; the US is projected to progress via steady upgrades across large AEC networks. This report includes insights on 40+ countries; the top markets are shown here for reference.

The construction design software market in China is expected to expand at 12.2%. Uptake is being led by public works, transport hubs, industrial parks, and high-rise schemes where coordinated models and compliant drawing sets are required. Cloud tenancy within national regions is being specified, and Chinese-language templates for codes and acceptance criteria are being requested at bid. Domestic suites and international platforms are both being adopted, with API connectors used to link estimation, coordination, and field capture. Prefab-heavy programs favor detailed shop-drawing workflows and clash matrices to protect lead times.

Owner dashboards that monitor model health, issue resolution, and submittal status are being used to rank design teams. Momentum is set to continue as procurement favors standardized deliverables, role-based approvals, and documented audit trails across tier-1 cities and fast-growing provincial capitals.

The construction design software market in India is projected to grow at 11.3%. Activity is being driven by metro corridors, airports, data centers, campuses, and mixed-use clusters where model coordination and disciplined submittals reduce delays. Multilingual interfaces, mobile review tools, and geo-referenced markups are being preferred for dispersed teams. Public clients are issuing BEP requirements, level-of-information targets, and standardized naming, with acceptance tied to checkable model outputs. Cloud subscriptions with flexible seats are being adopted by EPC groups handling packages across states. University partnerships are expanding the trained-user pool, accelerating adoption in design studios and contractor design offices. It is expected that consistent gains will be recorded as tender documents enforce template libraries, audit trails, and clear approval paths that link models to payment milestones.

The construction design software market in Germany is forecast to increase at 10.4%. Demand is being anchored by industrial plants, hospitals, transport nodes, and precision-heavy commercial builds that require DIN-aligned outputs and traceable decisions. OpenBIM workflows with IFC exchanges are being favored to protect interoperability, while EU-region hosting and immutable logs satisfy audit needs. Parametric assemblies, discipline-specific content, and rule sets for model checks are being applied to curb rework. Acoustic, daylight, and code-driven performance studies are being linked to models to defend design choices. With emphasis on verifiable tolerances and certified documentation, Germany is positioned to sustain premium growth through rigorous acceptance protocols and well-governed CDEs that preserve records over long service lives.

The construction design software market in the UK is anticipated to rise at 8.6%. Refurb programs, education estates, healthcare builds, and build-to-rent schemes are requiring ISO 19650 alignment, model-based coordination, and structured approval chains. CDEs with common naming, revision control, and transmittals are being used to reduce dispute risk. Designers are mapping RIBA stages to model gateways and deliverable checklists, while clients request evidence packs that tie drawings, models, and site photos. Offsite-friendly detailing and clash matrices are being emphasized to protect manufacture slots. Steady growth will be maintained as framework procurement standardizes template packs by trade and as owners insist on dashboards that surface issue aging and readiness for handover.

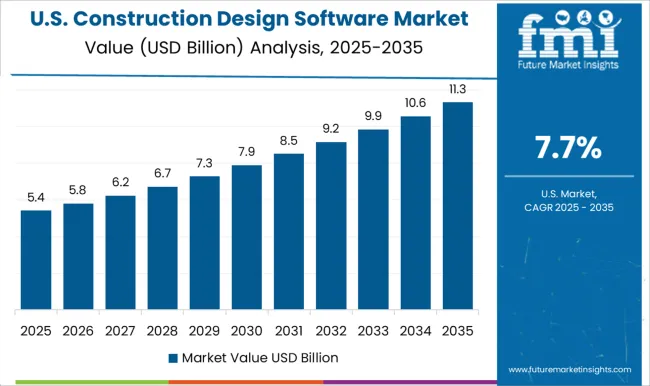

The construction design software market in the United States is projected to grow at 7.7%. Demand is being supported by healthcare, labs, logistics hubs, and corporate interiors where clash resolution, disciplined submittals, and defensible change records are essential. Large AEC networks are standardizing cloud hubs for model sharing, issue tracking, and automated audits. Interoperability across major suites, rule-based generative options, and reality-capture inputs are being adopted to compress schedules. Owners are requesting dashboards that connect model status to cost exposure and long-lead procurement. It is judged that migration from fragmented tools to integrated ecosystems will proceed steadily as GCs and design firms prioritize repeatable processes, cross-discipline accountability, and clean handovers to facilities teams.

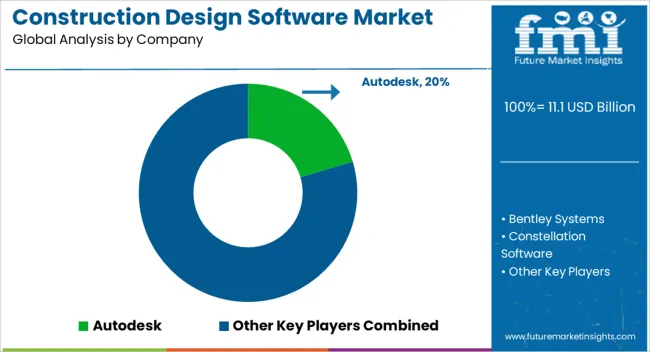

Competition in construction design software has been organized around BIM depth, open formats, and clear brochure storytelling. Autodesk positions suites that span concept to detailing, with brochures that present Revit, Civil 3D, and AutoCAD as a coordinated toolchain with model coordination and reality capture support. Bentley Systems frames MicroStation and discipline twins in literature that stresses precision modeling, federated data, and IFC interoperability.

Trimble promotes constructible workflows in brochures that link SketchUp and Tekla to layout and fabrication, turning design intent into shop ready outputs. Vectorworks highlights flexible modeling, integrated rendering, and landscape workflows with concise comparison tables. RIB Software SE centers brochures on 5D planning, cost linked models, and quantity fidelity. Oracle sets Aconex and design collaboration as a governed common data environment. SAP SE positions integration with enterprise records and approvals. Constellation Software groups niche authoring and coordination brands under steady release roadmaps. Microsoft appears as the platform layer in brochures that feature Azure based CDE partners, Power BI reporting, and Teams driven design reviews. Strategy has been executed through documentation that removes doubt for principals, BIM managers, and estimators.

| Item | Value |

|---|---|

| Quantitative Units | USD 11.1 Billion |

| Component | Software and Service |

| Deployment | Cloud and On-premise |

| Application | Project management & scheduling, Project design, Safety & reporting, Field service management, Cost accounting, and Others |

| End Use | Architects & builders, Remodelers, Designers, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Autodesk, Bentley Systems, Constellation Software, Microsoft, Oracle, Rib Software Se, Sage Group, SAP Se, Trimble, and Vectorworks |

| Additional Attributes | Dollar sales by deployment (cloud, on premise), Dollar sales by software type (CAD, BIM, generative design, simulation), Dollar sales by end user (architecture, engineering, construction, owners), Trends in collaborative BIM, parametric modeling, and digital twins, Role in clash detection, code compliance, quantity takeoff, Regional adoption across North America, Europe, Asia Pacific. |

The global construction design software market is estimated to be valued at USD 11.1 billion in 2025.

The market size for the construction design software market is projected to reach USD 26.3 billion by 2035.

The construction design software market is expected to grow at a 9.0% CAGR between 2025 and 2035.

The key product types in construction design software market are software and service.

In terms of deployment, cloud segment to command 61.8% share in the construction design software market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Construction Site Surveillance Robots Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Construction Wearable Technology Market Size and Share Forecast Outlook 2025 to 2035

Construction Repair Composites Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Construction Waste Market Size and Share Forecast Outlook 2025 to 2035

Construction Textile Market Size and Share Forecast Outlook 2025 to 2035

Construction Worker Safety Market Size and Share Forecast Outlook 2025 to 2035

Construction Valve Seat Insert Market Size and Share Forecast Outlook 2025 to 2035

Construction Telemetry Market Size and Share Forecast Outlook 2025 to 2035

Construction Trucks Market Size and Share Forecast Outlook 2025 to 2035

Construction Equipment Telematics Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Inverter Generator Market Size and Share Forecast Outlook 2025 to 2035

Construction Films Market Size and Share Forecast Outlook 2025 to 2035

Construction Flooring Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Construction Sealants Market Size and Share Forecast Outlook 2025 to 2035

Construction Bots Market Analysis Size and Share Forecast Outlook 2025 to 2035

Construction Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Construction Portable Generators Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA