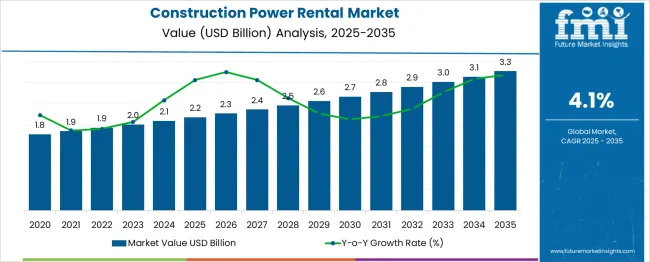

The Construction Power Rental Market is estimated to be valued at USD 2.2 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.1% over the forecast period. This reflects a 10-year growth multiplier of approximately 1.5x, which indicates a gradual but steady expansion within this segment. The market trajectory suggests that annual increments remain modest, starting at USD 0.1 billion per year in the initial phase, with slight acceleration toward the later years.

A midpoint evaluation in 2030 places the market at USD 2.7 billion, capturing 45% of total incremental gains within the first five years, while the remaining 55% occurs from 2030 to 2035. This distribution underscores a linear growth pattern with limited volatility, which is typical in infrastructure-driven service sectors. The CAGR across the entire period averages 4.2%, consistent with a capital-intensive industry influenced by rental demand cycles rather than sharp technological disruptions.

From a multiplier perspective, the market grows by 1.23x in the first half (2025–2030) and accelerates slightly to 1.22x in the second half (2030–2035). This progression suggests that revenue scaling remains reliant on larger infrastructure projects, hybrid energy solutions, and temporary power supply for electrification initiatives.

| Metric | Value |

|---|---|

| Construction Power Rental Market Estimated Value in (2025 E) | USD 2.2 billion |

| Construction Power Rental Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 4.1% |

The construction power rental market represents an important segment across multiple equipment and energy service domains. In the construction equipment rental market, its share is approximately 15–18%, as power solutions are critical for supporting operations at job sites alongside earthmoving and lifting equipment. Within the temporary power solutions market, it accounts for nearly 35–40%, driven by the reliance of construction projects on portable generators and backup systems. In the power equipment rental market, its contribution is around 25–28%, reflecting heavy usage during infrastructure and building activities.

The energy services market sees a smaller share of 3–4%, since this category includes permanent power supply and large-scale energy infrastructure services. For the industrial equipment rental market, construction power rental holds about 10–12%, given that power systems are essential in large-scale projects and heavy-duty industrial applications. Increasing infrastructure projects, urban development, and the need for reliable, mobile power during construction in remote or grid-inaccessible locations support growth.

Adoption of hybrid and fuel-efficient generators, along with digital monitoring for energy optimization, is enhancing operational efficiency. With fluctuating energy costs and growing emphasis on project flexibility, the construction power rental market is expected to strengthen its share within these parent markets, serving as a critical enabler for continuous site operations.

The construction power rental market is witnessing strong growth as increasing infrastructure development, urbanization, and stringent project timelines drive demand for reliable temporary power solutions. Rising investments in residential, commercial, and industrial construction are fueling the need for flexible power systems that minimize downtime and ensure operational continuity.

Cost optimization imperatives, better maintenance support, and access to modern, efficient equipment are propelling the shift toward rental over ownership. Future growth is expected to be supported by technological enhancements in generator efficiency, emissions compliance, and digital monitoring capabilities.

Growing emphasis on sustainability, coupled with the need to meet fluctuating power requirements without significant capital expenditure, is paving the way for long-term adoption across diverse construction environments.

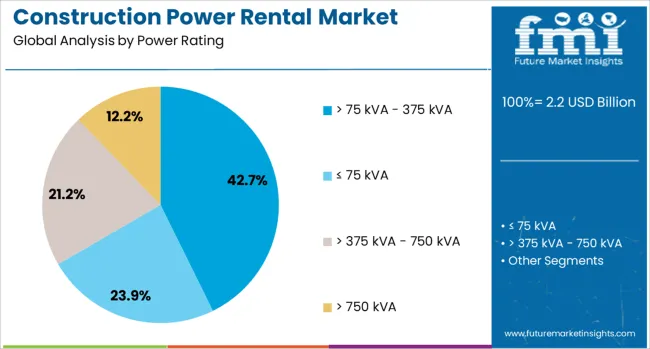

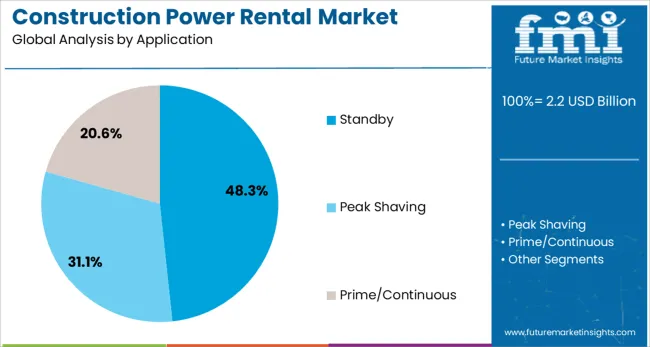

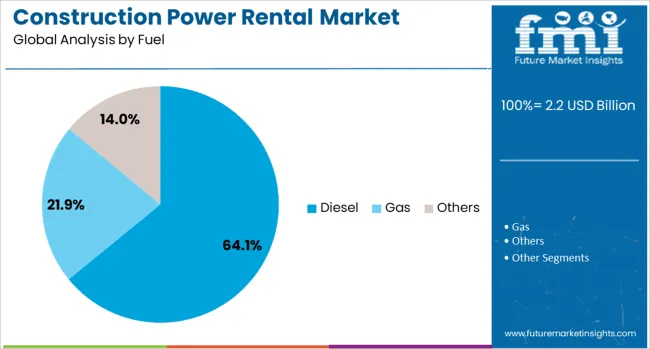

The construction power rental market is segmented by power rating, application, fuel, and geographic regions. By power rating, the construction power rental market is divided into > 75 kVA - 375 kVA, ≤ 75 kVA, > 375 kVA - 750 kVA, and > 750 kVA. In terms of application, the construction power rental market is classified into Standby, Peak Shaving, and Prime/Continuous. Based on fuel, the construction power rental market is segmented into Diesel, Gas, and Others. Regionally, the construction power rental industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by power rating, the 75 kVA 375 kVA category is projected to account for 42.70% of the total market revenue in 2025, establishing itself as the leading power rating segment. This leadership is attributed to the segment’s ability to address a broad spectrum of mid-scale construction needs efficiently.

Its popularity has been reinforced by its optimal balance of mobility, fuel efficiency, and capability to support multiple construction applications without oversizing. The versatility of this range allows contractors to manage varying site demands while keeping operational costs under control.

Enhanced availability of equipment in this power band and lower logistical complexities have further strengthened its position as the preferred choice for medium to large construction projects where reliability and adaptability are crucial.

Segmented by application, standby power is expected to hold 48.3% of the market revenue in 2025, making it the dominant application segment. This predominance is driven by the critical need to mitigate disruptions caused by grid instability and to maintain uninterrupted operations on construction sites.

Standby solutions have been increasingly favored for their ability to ensure compliance with contractual timelines by providing immediate backup during outages. Improvements in automatic transfer systems have supported their adoption, reduced response times, and increased awareness of the cost implications of downtime.

Contractors’ growing focus on risk mitigation and site productivity has elevated the importance of standby power, consolidating its leadership as an indispensable component of modern construction practices.

When segmented by fuel type, diesel powered equipment is forecast to capture 64.1% of the market revenue in 2025, retaining its position as the leading fuel segment. This dominance has been maintained by diesel’s high energy density, reliability under heavy loads, and widespread availability even in remote construction areas.

Contractors have continued to prefer diesel for its robustness in harsh environments and its ability to deliver consistent power output across variable site conditions. Improvements in engine efficiency and emission control technologies have also reinforced its relevance in the face of emerging environmental regulations.

The established infrastructure for diesel distribution and service support has ensured minimal operational disruptions, further anchoring its role as the preferred fuel choice within the construction power rental market.

The construction power rental market is influenced by factors such as increased infrastructure projects, strict equipment compliance, and the demand for reliable temporary energy solutions. Growth prospects have been strengthened by large-scale public infrastructure investments, while emerging opportunities lie in renewable-integrated rental solutions and hybrid systems for cost efficiency. Restraints such as high operating costs and dependency on fuel pricing continue to challenge growth, although market players are seen adopting energy-efficient systems. Recent developments indicate that digital monitoring and predictive maintenance are gaining attention as emerging trends in enhancing operational uptime and equipment lifecycle.

Growth in the construction power rental market is being driven by rising demand for temporary energy solutions in large infrastructure developments and remote site operations. Public and private sector projects launched in 2024, such as bridge and highway developments in India and smart city projects in the Middle East, have amplified equipment rentals. Power outages and grid instability in rapidly industrializing regions have encouraged the adoption of backup energy rental solutions. It is believed that the increased preference for flexible equipment leasing models is strengthening the demand for diesel and hybrid generators across medium- and large-scale construction projects globally.

Opportunities are expected to emerge with the growing shift toward hybrid generator solutions combining diesel and battery storage systems for construction sites. In 2025, several leading rental companies introduced offerings featuring fuel optimization and remote load management. Hybrid systems are being adopted to reduce operational costs and dependency on volatile fuel pricing, especially in regions with unstable grid supply. Opportunities are also increasing in rental equipment supporting renewable energy integration for off-grid construction projects, which are gaining prominence in emerging economies where infrastructure expansion requires flexible and energy-efficient temporary power solutions for sustained project timelines.

Recent trends indicate that the construction power rental market is experiencing rapid adoption of remote monitoring and telematics-enabled equipment. Companies in 2024 introduced advanced digital platforms offering real-time fuel tracking and predictive maintenance, ensuring maximum uptime and reducing downtime costs. Rental providers are leveraging data-driven services for enhanced asset utilization and contract optimization, which has become a preferred solution for large-scale contractors. These connected systems allow proactive service scheduling and efficiency analytics, helping rental companies differentiate through value-added services. It is considered a critical trend that enhances customer satisfaction and long-term rental partnerships globally.

One of the significant restraints in the construction power rental market is the rising operational expenditure linked to fuel consumption and maintenance. Fluctuations in global fuel prices, as witnessed in 2024 due to geopolitical tensions, have increased cost burdens for rental companies and contractors. Compliance with emission norms has further raised costs for upgrading equipment fleets. Short-term rental models face profitability concerns when projects extend beyond planned timelines. These cost pressures have prompted contractors to seek energy-efficient rental solutions. However, high initial investment for advanced rental systems continues to limit adoption among small and medium-scale construction firms globally.

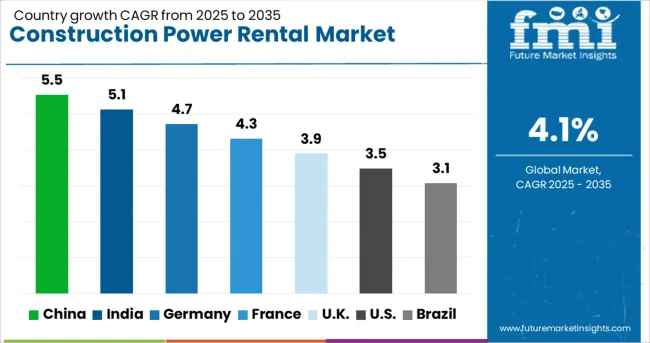

| Country | CAGR |

|---|---|

| China | 5.5% |

| India | 5.1% |

| Germany | 4.7% |

| France | 4.3% |

| UK | 3.9% |

| USA | 3.5% |

| Brazil | 3.1% |

The global construction power rental market is projected to grow at a CAGR of 4.1% from 2025 to 2035. China leads with 5.5%, followed by India at 5.1% and Germany at 4.7%. France records 4.3%, while the United Kingdom posts 3.9%. Growth is fueled by rising infrastructure investments, short-term energy needs in construction projects, and demand for reliable backup power solutions. China and India dominate adoption due to rapid urban expansion and large-scale infrastructure projects, while Germany focuses on hybrid rental systems. France and the UK emphasize low-emission generators and digital fleet monitoring for efficiency compliance.

The construction power rental market in China is forecast to grow at 5.5%, driven by large-scale urban infrastructure and transportation projects. Diesel generators dominate demand for long-duration power supply at construction sites. Rental companies invest in hybrid power systems integrating renewable energy for emission compliance. Expansion of digital platforms for fleet management improves operational transparency and efficiency.

The construction power rental market in India is projected to grow at 5.1%, supported by infrastructure development under government-led smart city and transport initiatives. Portable generators dominate usage in short-term projects and remote locations. Manufacturers focus on fuel-efficient systems to reduce costs for contractors. Growth in real estate and metro rail construction boosts adoption across tier-one and tier-two cities.

The construction power rental market in Germany is expected to grow at 4.7%, driven by modernization of road networks and energy-efficient building projects. Hybrid rental solutions dominate premium offerings for reducing emissions. Manufacturers integrate IoT sensors for real-time performance monitoring. Compliance with strict EU environmental norms accelerates transition toward low-noise and low-emission generators.

The construction power rental market in France is forecast to grow at 4.3%, supported by retrofitting of existing buildings and public infrastructure upgrades. Towable generators dominate use in urban renovation and event-driven projects. Manufacturers introduce digital energy tracking tools for optimizing consumption. Rental companies expand service offerings with energy consultancy solutions for efficiency-focused clients.

The construction power rental market in the UK is projected to grow at 3.9%, driven by investments in transportation networks and renewable energy projects. Compact generators dominate use in temporary site setups. Rental companies offer flexible leasing models to meet varying project durations. Demand for noise-compliant and low-carbon rental units accelerates adoption in urban construction environments.

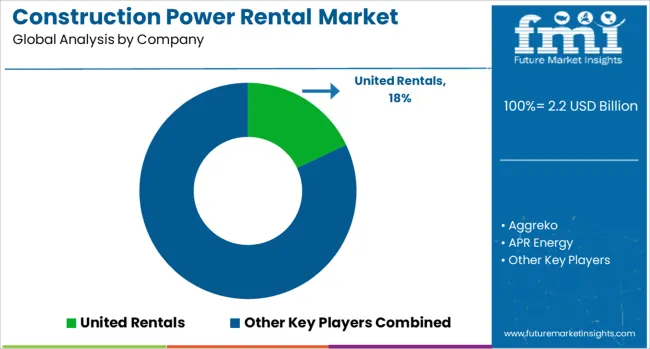

The construction power rental market is moderately consolidated, with United Rentals recognized as a leading player for its extensive fleet, strong service network, and ability to provide scalable power solutions across diverse construction projects. The company offers a wide range of diesel and gas generator rentals, load banks, and power distribution equipment, ensuring high availability and rapid deployment.

Key players include Aggreko, APR Energy, Atlas Copco, Bredenoord, Byrne Equipment Rental, Caterpillar, Cummins, Generac Power Systems, Herc Rentals, HIMOINSA, Paikane, Perennial Technologies, Powermak, Rehlko, Shenton Group, Sudhir Power, and Teksan. These companies specialize in providing temporary power systems for construction applications, focusing on reliability, fuel efficiency, and compliance with emission regulations.

Market growth is driven by the rapid expansion of construction activities in emerging economies, demand for uninterrupted power supply at remote project sites, and the increasing preference for rental solutions over equipment ownership to reduce capital costs.

Companies are investing in hybrid power solutions combining diesel generators with renewable sources, remote monitoring technologies, and smart load management systems to optimize operational efficiency. Regions such as Asia-Pacific and the Middle East are seeing significant growth due to large-scale infrastructure projects. North America and Europe continue to adopt power rental for both construction and emergency backup applications.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.2 Billion |

| Power Rating | > 75 kVA - 375 kVA, ≤ 75 kVA, > 375 kVA - 750 kVA, and > 750 kVA |

| Application | Standby, Peak Shaving, and Prime/Continuous |

| Fuel | Diesel, Gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | United Rentals, Aggreko, APR Energy, Atlas Copco, Bredenoord, Byrne Equipment Rental, Caterpillar, Cummins, Generac Power Systems, Herc Rentals, HIMOINSA, Paikane, Perennial Technologies, Powermak, Rehlko, Shenton Group, Sudhir Power, and Teksan |

| Additional Attributes | Dollar sales by service type (generator, transformer, load bank rental), dollar sales by fuel/equipment category (diesel, hybrid, solar; segmented by kVA ranges), regional demand trends (Asia-Pacific largest share, North America fast growth), competitive landscape, buyer preferences for scalable, low-emission and fuel-efficient rental power solutions, integration with temporary site electrification and construction project energy systems, innovations in modular configurations, IoT-enabled remote monitoring, predictive maintenance platforms, and renewable power integration for sustainable and cost-optimized rental operations. |

The global construction power rental market is estimated to be valued at USD 2.2 billion in 2025.

The market size for the construction power rental market is projected to reach USD 3.3 billion by 2035.

The construction power rental market is expected to grow at a 4.1% CAGR between 2025 and 2035.

The key product types in construction power rental market are > 75 kva - 375 kva, ≤ 75 kva, > 375 kva - 750 kva and > 750 kva.

In terms of application, standby segment to command 48.3% share in the construction power rental market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Construction Prime Power Generators Market Size and Share Forecast Outlook 2025 to 2035

Standby Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Telecom Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Compact Power Equipment Rental Market Growth - Trends & Forecast 2025 to 2035

Standby Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Prime Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Power Grid Fault Prediction Service Market Size and Share Forecast Outlook 2025 to 2035

Construction Material Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Industry Analysis in United Kingdom Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Power Supply Equipment for Data Center Market Size and Share Forecast Outlook 2025 to 2035

Power Electronics Market Size and Share Forecast Outlook 2025 to 2035

Construction Anchor Market Size and Share Forecast Outlook 2025 to 2035

Power Quality Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generator for Military Market Size and Share Forecast Outlook 2025 to 2035

Power Tools Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA