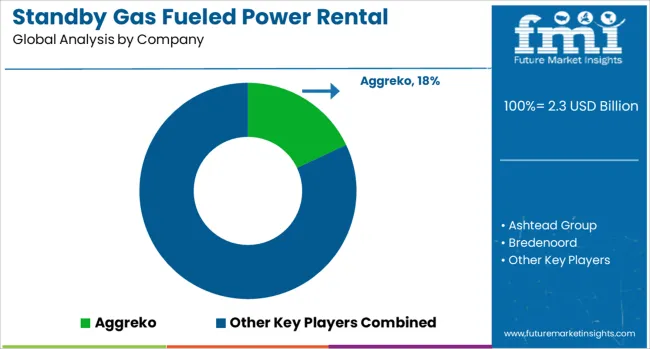

The standby gas fueled power rental market is estimated at 2.3 billion USD in 2025 and is forecast to reach 3.5 billion USD by 2035, reflecting a compound annual growth rate of 4.3%. Rolling CAGR analysis reveals steady year-on-year growth, with each successive year contributing incremental market value.

The multiplying factor over the ten-year period is approximately 1.52, indicating that the market size in 2035 will be 1.52 times the 2025 base. Growth is supported by rising demand for reliable backup power across industrial, commercial, and critical infrastructure sectors, driven by energy security concerns, grid instability, and cleaner fuel adoption. Technological improvements in equipment efficiency and operational flexibility further sustain adoption, highlighting consistent opportunities for providers and stakeholders.

| Metric | Value |

|---|---|

| Standby Gas Fueled Power Rental Market Estimated Value in (2025 E) | USD 2.3 billion |

| Standby Gas Fueled Power Rental Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 4.3% |

The standby gas fueled power rental market accounts for approximately 24%–26% of the broader standby power rental segment, reflecting its role as a cleaner alternative to diesel-based rentals. In the overall power generator rental market, it contributes about 20%–22%, driven by demand from oil & gas, construction, and utility applications. Its share in rental solutions across infrastructure development projects reaches roughly 16%–18%, especially in regions enforcing lower emissions.

Deployment in events, film production, and public gatherings represents nearly 12%–14% of the rental market. Within emergency and disaster relief settings, gas fueled standby systems account for around 8%–10%, offering quieter and more environmentally compliant backup power. The industry is experiencing rising adoption of gas-fueled rental units due to stricter environmental regulations and customer preference for low-emission alternatives. Engine advancements are improving fuel economy and reducing noise levels, making these units ideal for populated or sensitive locations. Integration of IoT-enabled monitoring and control systems enables remote diagnostics, fuel management, and predictive maintenance. Rental fleets are diversifying fuel-type offerings, allowing operators to switch between natural gas and propane as required. Demand is especially strong in urban infrastructure projects and utility grid modernization programs, where operational flexibility and emission compliance are paramount. These trends highlight a shift toward greener, smarter, and more adaptive power rental solutions.

The standby gas fueled power rental market is witnessing robust expansion, driven by increasing energy security concerns, the growing demand for reliable temporary power supply, and the need for cleaner alternatives to diesel-based gensets. As industries prioritize uninterrupted operations during outages or grid instability, rental models offer a flexible solution with minimal capital investment.

Stricter emission norms across key economies are promoting gas-fueled rental systems as a cleaner, scalable option compared to traditional diesel units. Additionally, the modularity and quick deployment of these systems are aligning with fast-paced infrastructure development, event management, and emergency response needs.

The integration of remote monitoring and smart load management capabilities further enhances system efficiency, supporting broader adoption across sectors such as utilities, construction, and oil & gas.

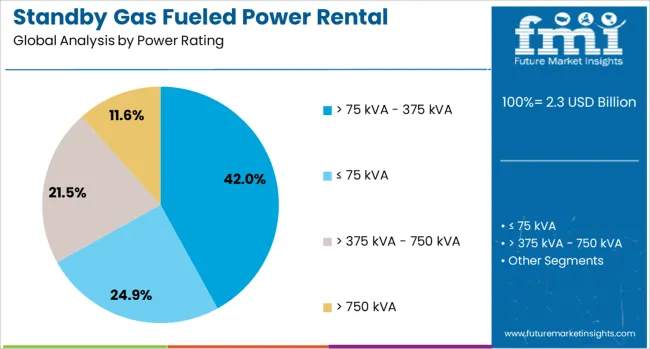

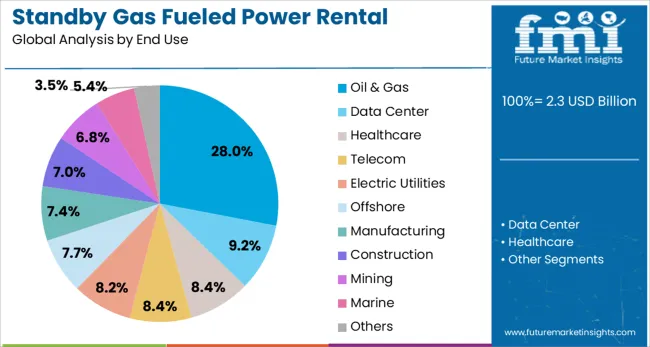

The standby gas fueled power rental market is segmented by power rating, end use, and geographic regions. By power rating of the standby gas fueled power rental market is divided into > 75 kVA - 375 kVA, ≤ 75 kVA, > 375 kVA - 750 kVA, and > 750 kVA. In terms of end use, the standby gas-fueled power rental market is classified into Oil & Gas, Data Center, Healthcare, Telecom, Electric Utilities, Offshore, Manufacturing, Construction, Mining, Marine, and Others. Regionally, the standby gas-fueled power rental industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The >75 kVA – 375 kVA segment is expected to lead the standby gas fueled power rental market with a 42.0% revenue share by 2025. This segment is favored due to its optimal balance between portability and power output, making it ideal for mid-size industrial applications, commercial establishments, and temporary utility support.

These units are versatile enough to be rapidly deployed across diverse operating conditions and offer reliable performance in grid-failure scenarios.

As demand grows for medium-capacity systems in sectors such as construction and emergency response, the segment’s scalability and lower emissions profile are supporting its dominance.

The oil & gas sector is projected to contribute 28.0% to the market by 2025, making it the leading end-use industry for standby gas fueled power rental solutions. Remote drilling operations, pipeline installations, and refineries often require mobile, high-reliability power systems in areas with limited grid access.

Gas-fueled rentals provide a cleaner, safer, and more efficient alternative to diesel, especially in environmentally sensitive zones.

Additionally, the cyclical nature of oil & gas projects aligns well with short- and medium-term rental models, allowing operators to optimize costs while maintaining compliance with tightening emission regulations.

Rising demand for standby gas fueled rental power systems has been driven by the growing need for backup generation in data centers, hospitals, telecom infrastructure, and industrial facilities. These systems provide reliable energy continuity during grid disruptions. Gas fueled units are preferred for their lower emissions relative to diesel alternatives and compatibility with cleaner fuels, such as L NG and biomethane blends. Fleet integration with digital monitoring platforms and rental providers has expanded deployment flexibility. Both short-notice and long term rental programs have been adopted across critical infrastructure sectors globally.

The standby gas fueled power rental sector has grown in response to critical infrastructure operators seeking reliable backup energy during outages. Hospitals, data centers, communication towers, and manufacturing facilities frequently engage rental services to ensure uninterrupted power. Gas engines—operating on natural gas or biogas—are utilized because of their fast startup capability and lower lifecycle emissions. Rental companies have deployed modular, containerized gensets that can be rapidly dispatched and integrated with facility control systems. Regular maintenance and flexible contract terms allow operators to scale capacity temporarily during peak demand or emergency situations. In regions with unreliable grid supply or high outage risk, gas-fueled systems have been selected over diesel for cleaner compliance and operational efficiency.

Environmental regulations and emissions standards have favored gas-fueled standby units in rental markets. Gas engines emit significantly fewer particulates and lower levels of NOx compared to diesel, enabling compliance with stricter air-quality mandates in urban and industrial zones. Regulations incentivizing low-carbon backup systems have led to rental preference for facilities aligning with ESG targets. In regions where diesel use is restricted, gas-fueled gensets are increasingly offered for temporary installation. Certification and permitting procedures for gas systems are often streamlined, facilitating faster deployment than fuel-oil units. Combined with rental operator expert handling and routine maintenance service, gas-fueled systems are viewed as cleaner, compliant, and readily deployable without enduring environmental approval delays.

Although operating costs for gas-fueled rental systems are typically lower than diesel, initial rental rates may be higher due to fuel supply connection requirements or rental company offset charges. Infrastructure readiness—such as access to pipeline gas or LNG delivery—can affect deployment speed, especially in remote or resource-constrained areas. Fuel supply logistics must be coordinated with facility operators or third-party providers, which may increase planning complexity. Installation overheads include safe connection to facility gas mains and testing for pressure stability. Leasing terms must account for regulatory compliance tasks, such as emissions monitoring and exhaust site planning. These constraints can delay deployment or make diesel rentals more favorable where gas access is not assured.

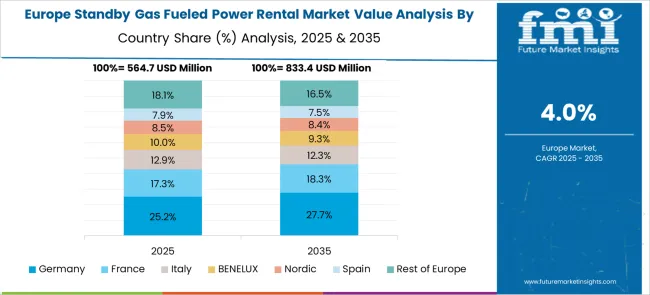

Rental demand for gas-fueled standby systems varies regionally. In urban markets of North America and Europe, strict emissions requirements and gas infrastructure maturity have resulted in higher penetration for natural gas rentals. The Asia-Pacific region is witnessing rapid expansion as gas grid networks are extended and data center clusters grow. Emerging markets in Latin America and Middle East are beginning to adopt gas-based rentals in industrial and infrastructure builds, though uptake is limited by fuel access and infrastructure gaps. Rental providers offering hybrid configurations—capable of switching between gas and dual-fuel modes—are differentiating service offerings. Partnerships between genset operators and gas utility firms have increased system readiness. As ESG priorities intensify, demand for clean backup rental power continues to rise across regulated and unregulated markets alike.

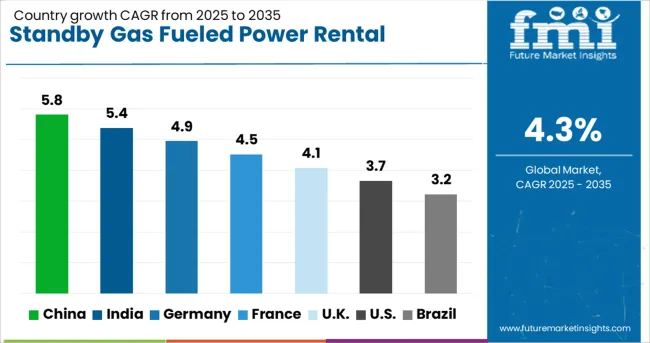

| Country | CAGR |

|---|---|

| China | 5.8% |

| India | 5.4% |

| Germany | 4.9% |

| France | 4.5% |

| UK | 4.1% |

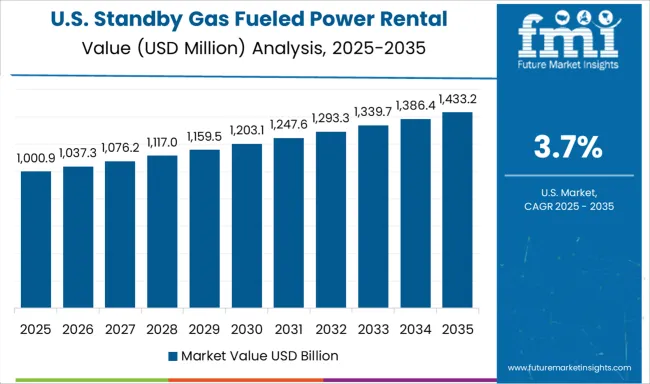

| USA | 3.7% |

| Brazil | 3.2% |

The global standby gas fueled power rental market is projected to grow at a CAGR of 4.3% between 2025 and 2035. China is set to lead with a growth rate of 5.8%, followed by India at 5.4% and Germany at 4.9%. The United Kingdom and the United States are expected to register 4.1% and 3.7% respectively. Growth across these countries is shaped by power reliability issues, data center expansion, and backup energy requirements during grid outages. Rental operators are scaling gas-powered genset fleets due to lower emission profiles compared to diesel alternatives. Temporary installations for events, industrial turnarounds, and critical infrastructure are supporting demand for gas-fired standby systems across urban and semi-urban deployment zones.

China is forecast to register a CAGR of 5.8% in the standby gas fueled power rental segment between 2025 and 2035. Expansion is supported by high energy consumption in tier-one cities and increased gas infrastructure availability. Rental companies have scaled fleets in Guangdong, Jiangsu, and Zhejiang provinces, where construction and IT facilities demand low-emission backup power. Gas gensets below 1 MW are preferred for urban usage due to their compliance with local air quality mandates. Government pilot programs promoting natural gas over diesel for mobile backup units have widened adoption in temporary hospital setups and telecom tower infrastructure.

India is projected to grow at a CAGR of 5.4% during the forecast period. Urban load shedding and voltage fluctuations are expanding the demand for standby gas generator rentals in telecom and commercial hubs. Companies in Mumbai, Delhi NCR, and Bengaluru are using 200 kVA to 800 kVA gas-powered units for hospitals, banking, and construction. Regulatory support for clean energy alternatives has increased the use of LPG and PNG-powered temporary gensets. Seasonal peak loads during summer and post-monsoon periods have also driven rental requirements. Distributed rental players are expanding containerized gas genset offerings for easier deployment across constrained sites.

Germany is expected to post a CAGR of 4.9% in this segment. Growth is driven by data center expansion, industrial decarbonization policies, and increased frequency of temporary energy demand during infrastructure retrofits. Natural gas-fueled rental gensets are used for temporary load balancing and grid stabilization support across Bavaria and North Rhine-Westphalia. Companies have transitioned from diesel to biogas-compatible mobile gensets to meet updated environmental rules. Containerized solutions ranging from 500 kVA to 1.5 MVA have seen adoption in emergency support roles. Event power management in metropolitan zones also continues to use gas rental power due to noise and particulate limits.

The United Kingdom is projected to grow at a CAGR of 4.1% from 2025 to 2035. Growth is supported by strong demand for rental power across emergency services, data infrastructure, and government facilities. Gas-based standby systems are favored over diesel due to noise compliance and indoor deployment flexibility. Temporary rental units are increasingly used in critical system retrofits and planned maintenance projects across the Midlands and Greater London regions. LNG-based systems are being deployed to support modular hospitals and greenfield event spaces. Rental providers have begun transitioning to dual-fuel-ready configurations for emissions flexibility.

The United States is expected to record a CAGR of 3.7% between 2025 and 2035. Demand growth is focused on backup gas genset rentals for disaster recovery, wildfire-prone grid areas, and aging infrastructure zones. Usage is expanding in states such as California, Texas, and Florida where mobile, cleaner power solutions are required. Natural gas-powered rentals are also being used in utilities for grid islanding and during line maintenance. Lower fuel costs and emission benefits versus diesel have prompted hospital and data facility operators to rent gas gensets during outage planning. EPA-compliant rental fleets are being scaled by major players.

Aggreko remains a dominant supplier in the standby gas fueled power rental market, offering modular and containerized units for emergency backup across utilities, healthcare, and industrial sectors. The company emphasizes rapid deployment and remote monitoring to ensure continuity during grid outages. Ashtead Group, through Sunbelt Rentals, provides natural gas generator rentals across North America and the UK, with scalable solutions for short-term and semi-permanent operations.

Bredenoord and Byrne Equipment Rental specialize in gas generator sets suited for construction, events, and oilfield operations, supported by regional fleets and 24/7 servicing. Caterpillar and Cummins deliver rental-ready gas gensets through dealer networks such as GMMCO and Sudhir Power, with units designed for seamless integration with customer load requirements. Generac Power Systems and HIMOINSA focus on compact, skid-mounted gas generators for rapid commissioning, particularly for small- to mid-scale applications.

Modern Hiring Service and Shenton Group supply tailored rental packages, emphasizing fuel efficiency and low-emission compliance for indoor and semi-enclosed environments. United Rentals and Herc Rentals offer gas-fueled generators through nationwide networks, targeting telecom, logistics, and municipal clients. Wagner Equipment supports gas generator rentals in the western USA, leveraging Caterpillar platforms with customized load balancing for mission-critical standby use.

Between 2023 and 2025, the standby gas fueled power rental market advanced through fleet modernization and cleaner technology integration. Rental providers expanded their inventories with low-NOx, noise-optimized gas generators equipped with IoT-based remote monitoring systems for real-time performance tracking. Hybrid rental solutions combining gas engines with battery storage gained momentum, offering enhanced fuel efficiency and reduced emissions. Demand increased from sectors such as data centers, construction, and healthcare, where temporary and emergency standby power remains critical for maintaining operational continuity during outages.

| Item | Value |

|---|---|

| Quantitative Units | USD 2.3 Billion |

| Power Rating | > 75 kVA - 375 kVA, ≤ 75 kVA, > 375 kVA - 750 kVA, and > 750 kVA |

| End Use | Oil & Gas, Data Center, Healthcare, Telecom, Electric Utilities, Offshore, Manufacturing, Construction, Mining, Marine, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Aggreko, Ashtead Group, Bredenoord, Byrne Equipment Rental, Caterpillar, Cummins, Generac Power Systems, GMMCO, Herc Rentals, HIMOINSA, Modern Hiring Service, Shenton Group, Sudhir Power, United Rentals, and Wagner Equipment |

The global standby gas fueled power rental market is estimated to be valued at USD 2.3 billion in 2025.

The market size for the standby gas fueled power rental market is projected to reach USD 3.5 billion by 2035.

The standby gas fueled power rental market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types in standby gas fueled power rental market are > 75 kva - 375 kva, ≤ 75 kva, > 375 kva - 750 kva and > 750 kva.

In terms of end use, oil & gas segment to command 28.0% share in the standby gas fueled power rental market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Gas Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Standby Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Prime Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Peak Shaving Diesel Fueled Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Gas Fueled Fire-Tube Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Power Equipment Market Size and Share Forecast Outlook 2025 to 2035

Power Generation Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Telecom Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Gas Liquid Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Power Plants Heavy Duty Gas Turbine Market Size and Share Forecast Outlook 2025 to 2035

Construction Power Rental Market Size and Share Forecast Outlook 2025 to 2035

Compact Power Equipment Rental Market Growth - Trends & Forecast 2025 to 2035

Diesel Fueled Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Gas Insulated Switchgear (GIS) Bushing Market Size and Share Forecast Outlook 2025 to 2035

Gas Discharge Tube (GDT) Arresters Market Size and Share Forecast Outlook 2025 to 2035

Power Grid Fault Prediction Service Market Size and Share Forecast Outlook 2025 to 2035

Gas & Dual-Fuel Injection Systems Market Size and Share Forecast Outlook 2025 to 2035

Power Plant Boiler Market Forecast Outlook 2025 to 2035

Power Ring Rolling Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA