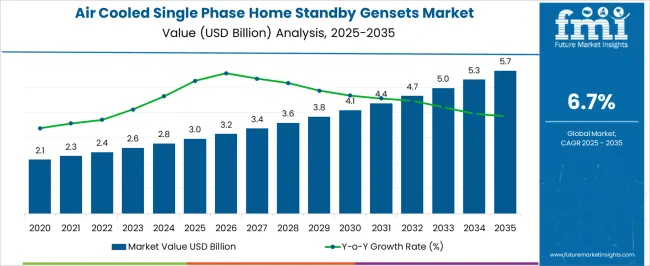

The Air Cooled Single Phase Home Standby Gensets Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 5.7 billion by 2035, registering a compound annual growth rate (CAGR) of 6.7% over the forecast period. The YoY trend in the chart shows a steady climb from USD 2.1 billion in 2020, with growth momentum accelerating through 2025–2027, where the curve peaks in terms of expansion rate. This mid-period surge is driven by rising adoption in residential backup power, especially in regions prone to grid instability and weather-related outages.

After 2028, the YoY growth rate begins to taper, though absolute market value continues increasing consistently. The moderation indicates a shift from early adoption to a more mature, replacement-driven phase where homeowners upgrade older units to newer, more efficient models. By 2030–2035, growth steadies between USD 4.1 and 5.7 billion, showing resilience but highlighting that saturation begins to take shape.

| Metric | Value |

|---|---|

| Air Cooled Single Phase Home Standby Gensets Market Estimated Value in (2025 E) | USD 3.0 billion |

| Air Cooled Single Phase Home Standby Gensets Market Forecast Value in (2035 F) | USD 5.7 billion |

| Forecast CAGR (2025 to 2035) | 6.7% |

The air cooled single phase home standby gensets market is expanding steadily, driven by the growing demand for reliable backup power solutions in residential settings. Frequent power outages and unstable grid supply in many regions have heightened the need for home standby generators that ensure continuous electricity availability.

The preference for air cooled systems has been influenced by their simpler design, ease of installation, and lower maintenance compared to liquid-cooled alternatives. Advances in generator efficiency and noise reduction have made these gensets more appealing for home use.

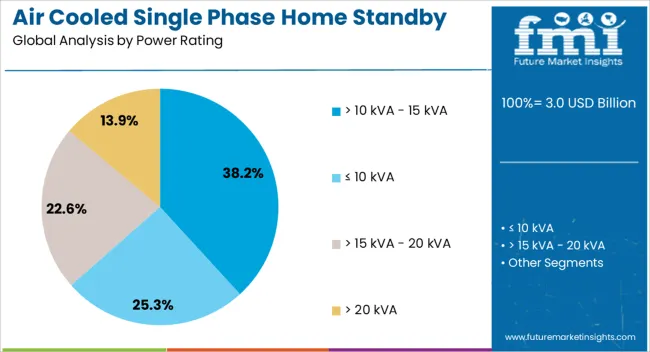

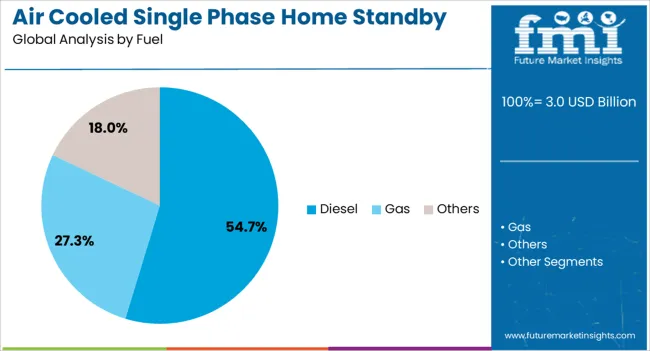

Increasing urbanization and rising disposable incomes have also contributed to wider adoption, as homeowners prioritize uninterrupted power for essential appliances. Future growth is expected to be propelled by advancements in fuel efficiency and emissions control, as well as growing awareness of generator safety features. Segmental growth is expected to be led by the power rating of greater than 10 kVA up to 15 kVA, and diesel as the preferred fuel type due to its availability and cost-effectiveness.

The air cooled single phase home standby gensets market is segmented by power rating, fuel, and geographic regions. By power rating, the air cooled single phase home standby gensets market is divided into > 10 kVA - 15 kVA, ≤ 10 kVA, > 15 kVA - 20 kVA, and > 20 kVA. In terms of fuel, the air-cooled single-phase home standby gensets market is classified into Diesel, Gas, and Others. Regionally, the air cooled single phase home standby gensets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The power rating segment of greater than 10 kVA up to 15 kVA is projected to account for 38.2% of the market revenue in 2025, positioning it as the leading category. This rating range offers a balance of sufficient power output for most household needs while maintaining compact size and manageable fuel consumption.

Homeowners have favored this power range for its ability to support critical appliances such as refrigerators, lighting, and HVAC systems during outages. Manufacturers have optimized gensets within this range to provide reliable performance without excessive noise or emissions.

Additionally, this segment suits mid-sized homes and smaller residential complexes, contributing to its widespread acceptance. As demand for effective backup power continues to rise, the > 10 kVA - 15 kVA segment is expected to retain its market dominance.

The diesel fuel segment is projected to hold 54.7% of the market revenue in 2025, establishing it as the preferred fuel type for air cooled single phase home standby gensets. Diesel has been favored for its high energy density, cost efficiency, and wide availability.

Homeowners and installers value diesel gensets for their robust performance and longer operational life under standby conditions. Diesel engines are also known for better fuel economy compared to gasoline, making them more economical for extended backup use.

Environmental regulations and improvements in emission control technologies have enhanced the acceptability of diesel-powered gensets in residential areas. Furthermore, the storage stability of diesel fuel supports emergency preparedness, ensuring gensets are ready for use when needed. With these advantages, the diesel segment is expected to maintain a strong position in the market.

Air cooled single phase home standby gensets are seeing steady adoption due to rising power outage concerns, cost-effectiveness, and suitability for residential needs. Evolving consumer preferences, product enhancements, and distribution growth are driving this segment forward.

Adoption of air cooled single phase home standby gensets is gaining pace in regions frequently experiencing grid instability and seasonal weather disruptions. Homeowners prefer these units for their ability to power essential household systems such as lighting, refrigeration, and communication equipment. Their compact footprint makes them suitable for properties with limited space, while installation simplicity reduces setup time. Price competitiveness against liquid cooled systems and inverter models further supports their appeal. Demand is particularly strong in areas where extreme weather events cause extended outages, leading to a greater willingness to invest in reliable backup solutions. This trend is expected to continue as consumers prioritize uninterrupted household operations.

Recent advancements in air cooled single phase home standby gensets have improved their performance, making them more appealing to homeowners. Noise reduction designs and improved airflow systems allow these units to operate with less disturbance, making them acceptable for suburban neighborhoods. Integrated load management technology optimizes fuel use while ensuring priority supply to critical appliances. Fuel versatility, such as models capable of running on natural gas or LPG, enhances adaptability in various regions. Manufacturers are also introducing corrosion-resistant materials and weatherproof enclosures, extending unit longevity in harsh climates. These upgrades are influencing homeowners who previously hesitated due to concerns about operational impact and durability.

Expanded distribution channels are helping manufacturers tap into previously underserved residential markets. Partnerships with home improvement retailers, electrical contractors, and online platforms have increased product visibility and accessibility. Financing options and bundled installation packages are encouraging purchases from cost-conscious homeowners. Dealer training programs are improving aftersales service quality, leading to higher customer satisfaction and repeat purchases. The rise in e-commerce for large equipment has also allowed customers to compare features, read reviews, and place orders directly, shortening the buying process. This broader reach is creating opportunities for manufacturers to expand brand loyalty while maintaining competitive pricing strategies across regions.

Competition in the air cooled single phase home standby gensets sector is encouraging innovation and differentiation. Established brands are focusing on product customization, such as variable power output options, to meet diverse household energy needs. Marketing strategies emphasize reliability, operational savings, and ease of maintenance. Smaller manufacturers are positioning themselves with niche offerings, including ultra-compact models and extended warranty packages. Collaborations with fuel suppliers and local service providers ensure prompt support and fuel availability during emergencies. Competitive pricing, combined with ongoing promotional campaigns, is increasing market penetration. This competitive environment benefits end users through better features, improved service, and greater product variety.

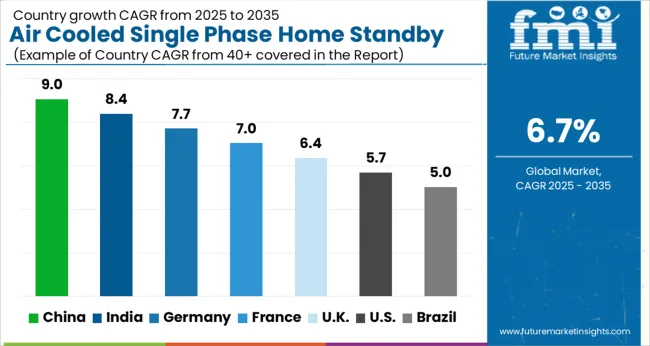

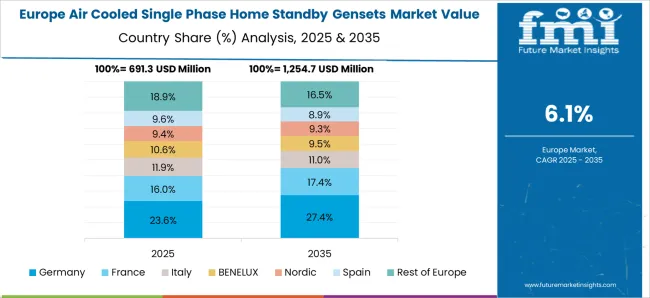

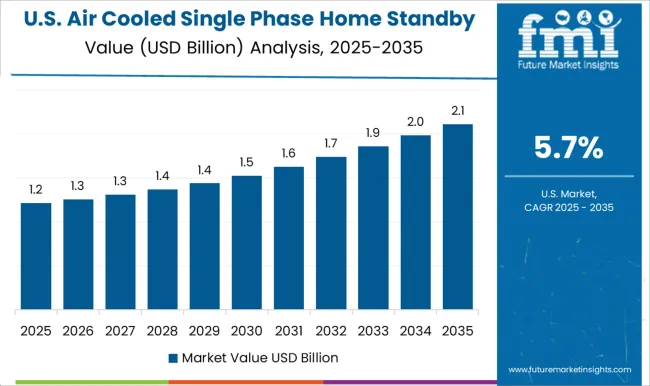

The air cooled single phase home standby gensets market is projected to expand globally at a CAGR of 6.7% from 2025 to 2035, supported by increasing power outage concerns, competitive pricing, and advancements in residential generator technology. China leads with a CAGR of 9.0%, driven by rising residential construction, greater grid instability in certain regions, and government incentives for cleaner fuel-based standby power. India follows at 8.4%, supported by expanding rural electrification, frequent outages in high-demand zones, and growth in suburban housing. France posts 7.0%, benefitting from modernization in housing infrastructure and uptake in regions with seasonal storm disruptions. The United Kingdom achieves 6.4%, aided by demand in countryside estates and growing rental market adoption, while the United States records 5.7%, reflecting steady demand in storm-prone states and replacement cycles for aging diesel units. The analysis covers more than 40 countries, with these six markets representing benchmarks for production capacity planning, channel expansion, and long-term investment strategies in the global air cooled single phase home standby gensets industry.

China is forecast to post a CAGR of 9.0% during 2025–2035, compared to about 6.8% between 2020–2024, showing a notable uplift in market pace. Earlier growth was shaped by steady adoption in regions with seasonal outages and selective installation in high-value residential properties. The stronger momentum ahead is linked to broader availability of natural gas connections, rising suburban housing developments, and competitive pricing from domestic brands. Demand will also benefit from homeowners prioritizing uninterrupted power for work-from-home setups and increased appliance usage. Manufacturers are expected to leverage e-commerce platforms and dealer expansion to improve reach in both tier-one and tier-two cities.

India is projected to grow at a CAGR of 8.4% between 2025–2035, up from nearly 6.2% in 2020–2024, indicating a stronger future trajectory. The earlier phase was marked by selective adoption in premium housing and gated communities. The sharper rise in the next decade will stem from continued rural electrification, housing expansion in tier-two and tier-three cities, and longer seasonal outages during peak demand. Localized assembly, dealer network expansion, and LPG-compatible models will help manufacturers meet varied regional needs. Rental operators serving residential clusters are also emerging as a growth driver in markets with unpredictable grid reliability.

France is expected to register a CAGR of 7.0% during 2025–2035, compared with 5.4% between 2020–2024, showing a clear upward shift. The earlier growth pattern was influenced by limited residential backup installations, largely in rural or storm-affected zones. The next decade will benefit from upgraded housing regulations, growing installation in holiday homes, and heightened consumer awareness about uninterrupted appliance usage. Seasonal storm disruptions and increased reliance on home heating and cooling systems are also supporting the need for standby gensets. Manufacturers are tailoring quieter, compact models to appeal to urban fringe homeowners seeking cost-effective, low-maintenance backup options.

The United Kingdom is anticipated to grow at a CAGR of 6.4% during 2025–2035, compared with roughly 4.9% in 2020–2024, showing a measurable improvement in growth momentum. The earlier phase saw demand mainly from countryside estates and select urban fringe properties. The upcoming decade’s rise is linked to heightened clean air compliance, increased installations in coastal regions prone to grid instability, and greater adoption through the rental market. Manufacturers are targeting fleet partnerships with rental providers and developing low-noise, weather-resistant models to meet UK climate conditions. Expansion into rural Scotland and Northern Ireland offers additional volume potential.

The United States is forecast to post a CAGR of 5.7% for 2025–2035, compared with about 4.3% in 2020–2024, highlighting a modest but steady improvement. Early growth was supported by demand in hurricane-prone states and areas with aging grid infrastructure. The upcoming decade’s stronger trajectory will be driven by replacement cycles, expansion in solar-plus-backup generator installations, and an increase in standby units for new housing in high-risk weather zones. Manufacturers are integrating smart load management and remote monitoring to appeal to tech-savvy homeowners. Dealer financing programs are also boosting adoption in mid-income residential markets.

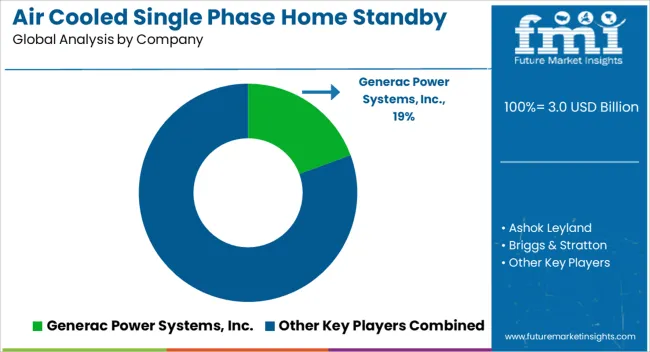

The air cooled single phase home standby gensets market features a competitive mix of global manufacturers, regional specialists, and niche-focused brands targeting residential backup power needs. Generac Power Systems, Inc. maintains leadership through a wide range of capacity options, integrated smart controls, and strong dealer networks. Ashok Leyland leverages its engine expertise to produce reliable, cost-efficient gensets for emerging markets.

Briggs & Stratton offers compact, user-friendly models with improved noise suppression for suburban applications. Caterpillar focuses on premium-grade units with advanced monitoring and fuel efficiency. Champion Power Equipment delivers value-driven products with quick-start technology. Cummins Inc. emphasizes durability and remote diagnostics for higher-end residential customers. Eaton integrates gensets into whole-home electrical solutions, enhancing compatibility and safety. HIMOINSA specializes in versatile models with weatherproofing for varied climates. Kirloskar and Mahindra POWEROL cater to cost-sensitive markets through localized manufacturing and service availability. Kohler Co. targets premium homeowners with high-performance, low-noise units. PINNACLE GENERATORS and PR INDUSTRIAL srl focus on tailored solutions for regional demands. Prakash offers budget-friendly units with basic standby capabilities. Sichuan XinYici Power Machinery Co., Ltd. brings competitive pricing and scalable production to support export markets. Strategic priorities include enhancing fuel adaptability, expanding e-commerce sales channels, strengthening aftersales networks, and integrating load management features to capture rising demand in outage-prone residential sectors.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.0 Billion |

| Power Rating | > 10 kVA - 15 kVA, ≤ 10 kVA, > 15 kVA - 20 kVA, and > 20 kVA |

| Fuel | Diesel, Gas, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Generac Power Systems, Inc., Ashok Leyland, Briggs & Stratton, Caterpillar, Champion Power Equipment, Cummins Inc., Eaton, HIMOINSA, Kirloskar, Kohler Co., Mahindra POWEROL, PINNACLE GENERATORS, PR INDUSTRIAL srl, Prakash, and Sichuan XinYici Power Machinery Co., Ltd. |

| Additional Attributes | Dollar sales, share, regional demand trends, competitor positioning, fuel type preferences, pricing benchmarks, regulatory impacts, distribution strategies, and emerging residential adoption patterns. |

The global air cooled single phase home standby gensets market is estimated to be valued at USD 3.0 billion in 2025.

The market size for the air cooled single phase home standby gensets market is projected to reach USD 5.7 billion by 2035.

The air cooled single phase home standby gensets market is expected to grow at a 6.7% CAGR between 2025 and 2035.

The key product types in air cooled single phase home standby gensets market are > 10 kva - 15 kva, ≤ 10 kva, > 15 kva - 20 kva and > 20 kva.

In terms of fuel, diesel segment to command 54.7% share in the air cooled single phase home standby gensets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Single Phase Air Cooled Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Airless Sprayer Accessories Market Size and Share Forecast Outlook 2025 to 2035

Air Purge Valve Market Size and Share Forecast Outlook 2025 to 2035

Air Flow Sensors Market Size and Share Forecast Outlook 2025 to 2035

Air Separation Plant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cooling Turbines Market Size and Share Forecast Outlook 2025 to 2035

Air Conditioning Compressor Market Size and Share Forecast Outlook 2025 to 2035

Air Measuring Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Smoke Detection and Fire Extinguishing System Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Hose Fittings Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Cabin Interior Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Galley Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Interior Lighting Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Battery Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Floor Panels Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Fuel Systems Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Seat Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Ground Support Equipment Market Size and Share Forecast Outlook 2025 to 2035

Aircraft Maintenance, Repair and Overhaul Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA