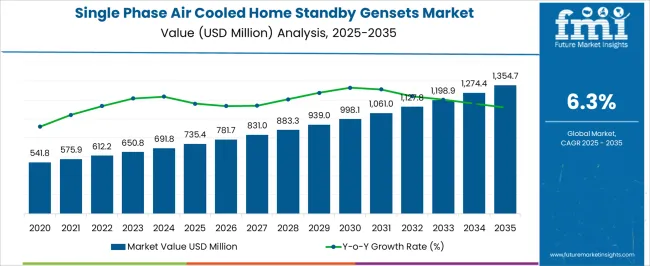

The single phase air cooled home standby gensets market, valued at USD 735.4 million in 2025 and projected to reach USD 1,354.7 million by 2035 at a CAGR of 6.3%, exhibits a technology-driven growth trajectory primarily centered on the air-cooled configuration. Air-cooled gensets dominate the market due to their simplicity, lower maintenance requirements, and cost-effective installation compared to liquid-cooled alternatives.

The incremental value addition from enhancements in air-cooling efficiency, noise reduction technologies, and automated load management systems contributes significantly to overall market growth. Year-on-year increases from USD 735.4 million in 2025 to USD 1,354.7 million in 2035 indicate that technological improvements, particularly in compact design and energy efficiency, have a cumulative effect on market expansion. The contribution analysis highlights that standard single-phase air-cooled units account for the largest share of total market value, driven by their suitability for residential applications with moderate power demands. Technological sub-segments, such as inverter-enabled gensets and smart control-enabled units, are emerging components that enhance operational efficiency and reliability. These advanced features are progressively incorporated into mid- to high-capacity models, providing differentiation and adding incremental market value.

The integration of smart sensors, automated safety cut-offs, and remote monitoring contributes to higher adoption rates, particularly in regions prioritizing uninterrupted power supply for households. The market growth is technology-led, with air-cooled configurations retaining dominant contribution while advanced units increasingly drive incremental value, reflecting a gradual evolution of the home standby gensets sector toward higher efficiency, reliability, and user convenience.

| Metric | Value |

|---|---|

| Single Phase Air Cooled Home Standby Gensets Market Estimated Value in (2025 E) | USD 735.4 million |

| Single Phase Air Cooled Home Standby Gensets Market Forecast Value in (2035 F) | USD 1354.7 million |

| Forecast CAGR (2025 to 2035) | 6.3% |

The single phase air cooled home standby gensets market represents a specialized segment within the global residential power backup and distributed energy solutions industry, emphasizing reliability, compact design, and uninterrupted power supply. Within the broader home generator market, it accounts for about 5.3%, driven by adoption in residential neighborhoods, small homes, and urban apartments.

In the standby and backup power systems segment, it holds nearly 4.8%, reflecting demand for efficient, easy-to-install, and low-maintenance units. Across the single phase power equipment and home electrical solutions market, the share is 4.2%, supporting seamless integration with household circuits and appliances. Within the distributed energy and emergency power category, it represents 3.8%, highlighting use during outages, grid failures, and adverse weather conditions. In the home automation and energy management sector, it secures 3.4%, emphasizing remote monitoring, operational safety, and energy efficiency. Recent developments in this market have focused on noise reduction, digital control, and fuel efficiency.

Innovations include inverter-integrated gensets, automatic start/stop features, and air-cooled systems for compactness and reduced maintenance. Key players are collaborating with home appliance manufacturers, electrical contractors, and smart home solution providers to enhance reliability, ease of installation, and user convenience. Adoption of IoT-enabled remote monitoring, predictive maintenance, and energy optimization features is gaining traction to improve operational performance. The hybrid solutions integrating solar storage, eco-friendly fuels, and modular designs are being deployed to meet growing residential energy resilience needs.

The market is experiencing steady growth driven by increasing demand for reliable backup power solutions in residential settings. This market is shaped by growing electricity infrastructure challenges, frequent power outages, and the rising adoption of home automation systems that require an uninterrupted power supply. The need for efficient, cost-effective, and compact standby generators has become paramount in regions with unstable grid power or in areas prone to natural disasters.

Technological advancements in genset design, including enhanced air cooling systems, have improved operational efficiency and reduced maintenance needs. Additionally, rising urbanization and increasing disposable income levels are enabling more homeowners to invest in standby power solutions.

The growing preference for environmentally friendly fuels and compliance with evolving emission regulations are also influencing product innovation. The market is expected to benefit from expanding residential construction activities and government incentives for energy security, positioning it for sustained growth over the next decade.

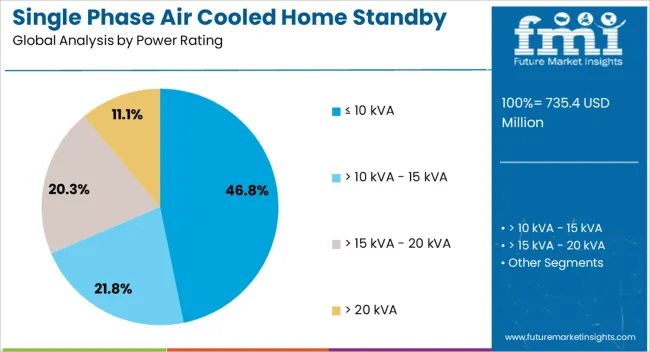

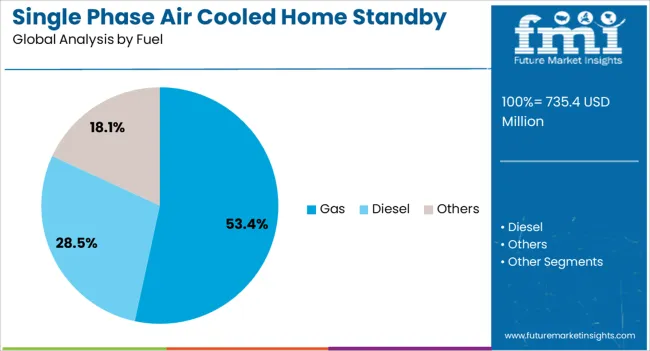

The single phase air cooled home standby gensets market is segmented by power rating, fuel, and geographic regions. By power rating, single phase air cooled home standby gensets market is divided into ≤ 10 kVA, > 10 kVA - 15 kVA, > 15 kVA - 20 kVA, and > 20 kVA. In terms of fuel, single phase air cooled home standby gensets market is classified into Gas, Diesel, and Others. Regionally, the single phase air cooled home standby gensets industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The segment of gensets with a power rating of 10 kilovolt-amperes or less is projected to hold 46.8% of the overall revenue share in 2025. This leading position is attributed to its suitability for typical home backup applications, where power demands are moderate and space constraints are significant. These gensets offer a balance of compact size, ease of installation, and sufficient power capacity to maintain essential household appliances during outages.

The segment’s growth is supported by rising demand in urban and suburban residences where energy reliability is critical. Furthermore, advancements in noise reduction and fuel efficiency in this power category have enhanced user acceptance.

The cost-effectiveness of smaller gensets combined with their adaptability to varying voltage requirements has made this segment highly attractive to end users As residential electrification continues to advance globally, this segment is expected to retain its dominance due to its alignment with typical home energy consumption patterns and affordability.

The gas-fueled gensets segment is estimated to account for 53.4% of the single-phase air-cooled home Standby Gensets market revenue in 2025. This leading share is driven by increasing environmental concerns and stringent emission norms that favor cleaner fuel sources. Gas-powered gensets produce lower emissions compared to diesel or petrol alternatives, making them preferable in residential areas with strict pollution control regulations.

Additionally, the availability and growing infrastructure for natural gas and liquefied petroleum gas in many regions have facilitated the adoption of gas-fueled generators. The operational advantages, including quieter performance and lower maintenance requirements, have also contributed to the segment’s growth.

Moreover, gas gensets are compatible with smart home systems and offer better fuel efficiency, aligning with the rising consumer focus on sustainable and cost-effective energy solutions. As governments worldwide continue to promote cleaner energy options, the gas fuel segment is expected to sustain its market leadership through ongoing innovation and increased user preference.

The market has witnessed significant expansion as homeowners increasingly demand reliable power backup solutions for uninterrupted electricity supply. These systems, characterized by compact design, air-cooled engines, and easy installation, are widely adopted in residential applications where power outages disrupt daily routines. Rising dependence on electrical appliances, digital home infrastructure, and work-from-home setups has further boosted demand. Manufacturers are offering noise-reducing enclosures, fuel efficiency optimization, and remote monitoring capabilities to enhance consumer appeal. Regulatory support for residential energy security, coupled with e-commerce and retail distribution expansion, has improved accessibility.

The adoption of single phase air cooled home standby gensets is driven by the need for reliable and continuous power supply in residential areas. Frequent power outages due to grid limitations, natural disasters, or maintenance activities have emphasized the importance of home backup solutions. Homeowners prioritize gensets that provide consistent voltage, rapid start-up, and stable operation for appliances such as refrigerators, heating systems, and digital equipment. Energy-efficient air cooled designs allow installation in limited spaces without requiring complex cooling infrastructure. Residential associations, developers, and home automation systems increasingly recommend or integrate these gensets to ensure seamless power continuity. This growing demand for household energy security continues to expand market penetration across urban and semi-urban regions.

Technological advancements in single phase air cooled home standby gensets have improved operational efficiency, safety, and user experience. Engine optimization, fuel-saving technologies, and low-emission designs reduce running costs and environmental impact. Integrated inverter systems and voltage regulation enhance appliance protection and stability. Noise-dampening enclosures, vibration reduction mechanisms, and remote monitoring capabilities improve user comfort and control. Smart connectivity allows users to track fuel levels, maintenance schedules, and performance metrics via mobile applications. These innovations ensure higher reliability, easier maintenance, and compliance with environmental and safety standards. Continuous R&D and incorporation of advanced technologies reinforce market competitiveness and attract residential consumers seeking dependable and user-friendly solutions.

The growth of single phase air cooled home standby gensets is supported by expanding distribution networks and accessibility through multiple sales channels. Manufacturers leverage retail chains, e-commerce platforms, and direct-to-consumer models to reach end users efficiently. Collaborations with electrical contractors, residential developers, and home improvement specialists enhance product visibility and installation support. Marketing strategies focusing on convenience, reliability, and fuel efficiency further influence purchasing decisions. Regional service centers and after-sales support networks increase customer confidence and reduce operational downtime. The combination of wide product availability, informative customer support, and promotional activities contributes significantly to market adoption and sustained residential demand.

Despite market growth, single phase air cooled home standby gensets face challenges related to fuel consumption, noise regulations, and compliance with environmental standards. Rising fuel prices can increase operational expenses for homeowners, while emission regulations necessitate advanced exhaust control systems. Noise restrictions in urban areas require manufacturers to implement soundproofing technologies, increasing production costs. The improper installation or maintenance can lead to safety hazards or reduced equipment lifespan. To overcome these challenges, industry players focus on fuel-efficient engines, low-noise enclosures, modular designs, and user-friendly maintenance solutions. Addressing cost, regulatory, and safety concerns remains essential for sustained market expansion and residential adoption.

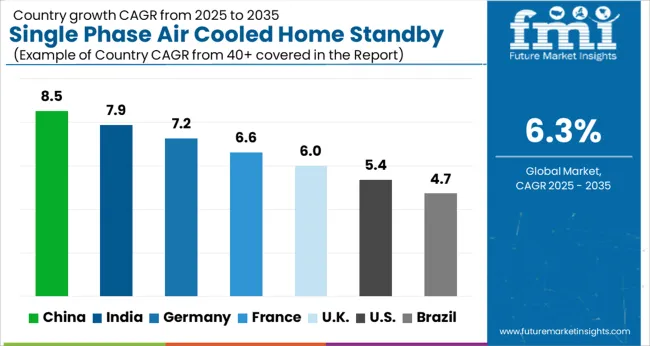

| Country | CAGR |

|---|---|

| China | 8.5% |

| India | 7.9% |

| Germany | 7.2% |

| France | 6.6% |

| UK | 6.0% |

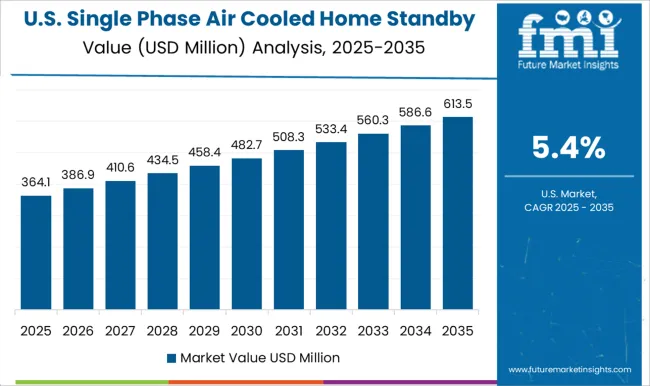

| USA | 5.4% |

| Brazil | 4.7% |

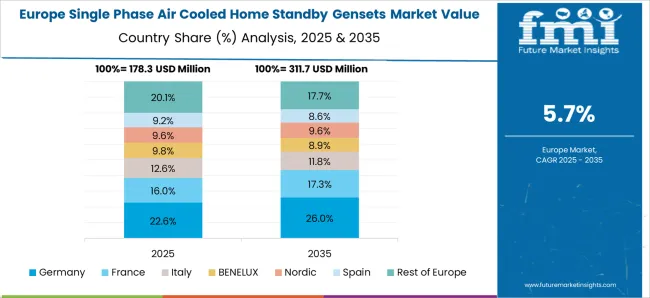

The market is projected to grow at a CAGR of 6.3% from 2025 to 2035, driven by rising demand for reliable residential power backup solutions. Germany achieved 7.2, reflecting steady adoption in residential and commercial segments, while India reached 7.9, fueled by urban electrification and increased household installations. China led with 8.5, supported by large-scale manufacturing and expanding domestic consumption. The United Kingdom recorded 6.0, influenced by modernization of residential power systems, and the United States reached 5.4, sustained by innovations in energy-efficient and compact genset designs.

The single phase air cooled home standby gensets market in China is projected to grow at a CAGR of 8.5%, driven by rising residential electricity demand, frequent power outages in remote areas, and adoption of home emergency power solutions. Adoption has been reinforced by increased consumer awareness, urban housing expansion, and availability of compact, low noise, and fuel efficient gensets. Domestic manufacturers focus on high reliability, easy installation, and service support for residential applications. Market growth is further supported by integration with smart home energy systems and government incentives for backup power solutions.

India is expected to record a CAGR of 7.9%, supported by demand for reliable residential backup power in urban and semi urban areas. Adoption has been reinforced by power supply inconsistencies, rising household electricity consumption, and availability of compact and low maintenance gensets. Domestic manufacturers focus on cost effective, fuel efficient, and durable home standby solutions. Market expansion is further driven by e commerce penetration, service support networks, and growing awareness of home energy security.

Germany is projected to grow at a CAGR of 7.2%, influenced by demand for home emergency power solutions, energy reliability, and residential safety. Adoption has been reinforced by technological improvements in genset noise reduction, fuel efficiency, and compact design. German manufacturers focus on durability, advanced cooling systems, and low emission compliance. Market growth is also supported by premium residential segments and integration with smart energy management systems.

The United Kingdom market is expected to grow at a CAGR of 6.0%, driven by adoption in residential and suburban areas requiring emergency backup power. Adoption has been reinforced by demand for low noise, compact, and fuel efficient gensets. Imported and domestic solutions are widely used, with emphasis on installation ease and compliance with local emission standards. The market outlook remains steady as residential users continue to prioritize reliable backup solutions for safety and convenience.

The United States market is projected to expand at a CAGR of 5.4%, supported by residential adoption in suburban and rural areas, energy security concerns, and frequent extreme weather events. Adoption has been reinforced by demand for fuel efficient, compact, and quiet gensets. Leading manufacturers focus on durability, service support, and integration with home power management solutions. Market growth remains moderate but steady as homeowners increasingly invest in reliable backup power solutions for safety and convenience.

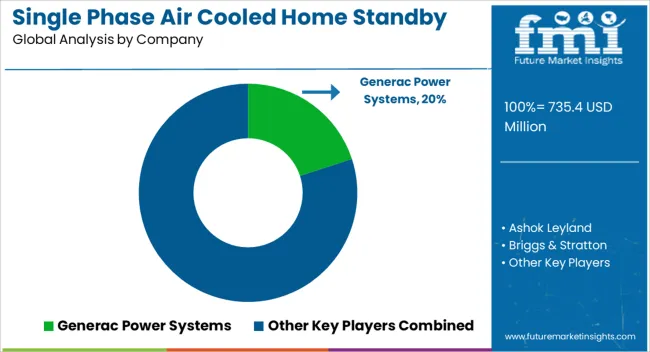

The market is dominated by a mix of global industrial power solution providers and regional players, competing primarily on reliability, efficiency, ease of installation, and after-sales service. Generac Power Systems, Cummins, Briggs & Stratton, and Eaton lead the market through robust product portfolios, extensive distribution networks, and strong brand reputation in both residential and small commercial applications. Regional and specialized manufacturers such as Ashok Leyland, HIMOINSA, Mahindra POWEROL, KUBOTA Corporation, Multiquip, PR Industrial, Rehlko, Winco, Yamaha Motor, Gillette Generators, and Honeywell International leverage localized manufacturing, cost-effective solutions, and targeted service offerings to address market demand in emerging economies.

These companies also focus on compact design, low-noise operation, and fuel efficiency to cater to urban residential users. Competition is further shaped by technological advancements in air-cooled systems, inverter integration, and smart monitoring capabilities. Manufacturers investing in product innovation, energy-efficient engines, and digital remote monitoring are better positioned to capture growing demand for uninterrupted home power solutions and to maintain a competitive edge in markets prioritizing reliability, convenience, and sustainability.

| Item | Value |

|---|---|

| Quantitative Units | USD 735.4 Million |

| Power Rating | ≤ 10 kVA, > 10 kVA - 15 kVA, > 15 kVA - 20 kVA, and > 20 kVA |

| Fuel | Gas, Diesel, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Generac Power Systems, Ashok Leyland, Briggs & Stratton, Cummins, Eaton, Gillette Generators, HIMOINSA, Honeywell International, KUBOTA Corporation, Mahindra POWEROL, Multiquip, PR Industrial, Rehlko, Winco, and Yamaha Motor |

| Additional Attributes | Dollar sales by generator type and capacity, demand dynamics across residential, small commercial, and emergency backup sectors, regional trends in home standby power adoption, innovation in fuel efficiency, noise reduction, and automatic transfer systems, environmental impact of emissions and fuel consumption, and emerging use cases in smart home energy management, off-grid backup, and renewable hybrid integration. |

The global single phase air cooled home standby gensets market is estimated to be valued at USD 735.4 million in 2025.

The market size for the single phase air cooled home standby gensets market is projected to reach USD 1,354.7 million by 2035.

The single phase air cooled home standby gensets market is expected to grow at a 6.3% CAGR between 2025 and 2035.

The key product types in single phase air cooled home standby gensets market are ≤ 10 kva, > 10 kva - 15 kva, > 15 kva - 20 kva and > 20 kva.

In terms of fuel, gas segment to command 53.4% share in the single phase air cooled home standby gensets market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air Cooled Single Phase Home Standby Gensets Market Size and Share Forecast Outlook 2025 to 2035

Single-channel Frequency Synthesizer Market Size and Share Forecast Outlook 2025 to 2035

Single-axis Drives Market Size and Share Forecast Outlook 2025 to 2035

Single Roller Cone Bits Market Size and Share Forecast Outlook 2025 to 2035

Single-use Bioreactors Market Size and Share Forecast Outlook 2025 to 2035

Single Board Computer Market Size and Share Forecast Outlook 2025 to 2035

Single-Serve Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Screw Extruder Market Size and Share Forecast Outlook 2025 to 2035

Single Core Armored Cable Market Size and Share Forecast Outlook 2025 to 2035

Single Axis Solar Tracker Market Size and Share Forecast Outlook 2025 to 2035

Single-Mode Optical Fiber Market Size and Share Forecast Outlook 2025 to 2035

Single-Coated Medical Tape Market Size and Share Forecast Outlook 2025 to 2035

Single Superphosphate (SSP) Market Size and Share Forecast Outlook 2025 to 2035

Single-Photon Emission Computed Tomography Market Size and Share Forecast Outlook 2025 to 2035

Single Dose Detergent Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Electron Transistor Market Size and Share Forecast Outlook 2025 to 2035

Single Colour Pad Printing Machines Market Size and Share Forecast Outlook 2025 to 2035

Single Portion Cosmetic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Single Use Pallet Market Size and Share Forecast Outlook 2025 to 2035

Single Serve Coffee Container Market Size, Share & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA