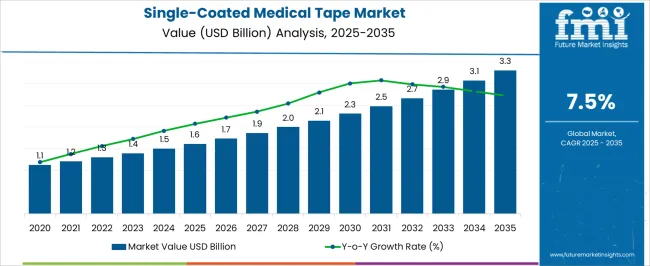

The Single-Coated Medical Tape Market is estimated to be valued at USD 1.6 billion in 2025 and is projected to reach USD 3.3 billion by 2035, registering a compound annual growth rate (CAGR) of 7.5% over the forecast period.

| Metric | Value |

|---|---|

| Single-Coated Medical Tape Market Estimated Value in (2025 E) | USD 1.6 billion |

| Single-Coated Medical Tape Market Forecast Value in (2035 F) | USD 3.3 billion |

| Forecast CAGR (2025 to 2035) | 7.5% |

The single-coated medical tape market is experiencing stable growth driven by the rising need for secure, skin-friendly, and performance-specific adhesives in medical settings. With advancements in patient monitoring systems and wearable medical devices, demand has increased for tapes offering optimal breathability, extended wear time, and minimal skin trauma. Medical device manufacturers are increasingly collaborating with tape suppliers to co-engineer solutions that ensure biocompatibility, flexibility, and adherence under dynamic physiological conditions.

Regulatory frameworks around medical safety, including ISO 10993 standards for biological evaluation, are influencing material selection and performance parameters. Moreover, the market is responding to sustainability pressures through low-VOC adhesives and recyclable carrier materials.

Hospitals and outpatient care centers are emphasizing infection control and ease of use, which has accelerated the demand for single-coated solutions in disposable devices and dressings. As care delivery models shift toward home and ambulatory settings, single-coated medical tapes are expected to see broader application scope and deeper integration into wearable and therapeutic systems.

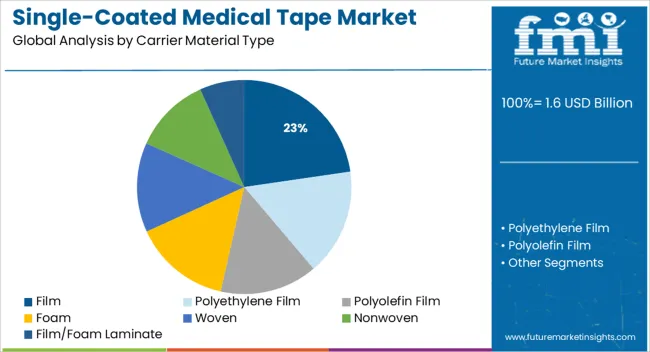

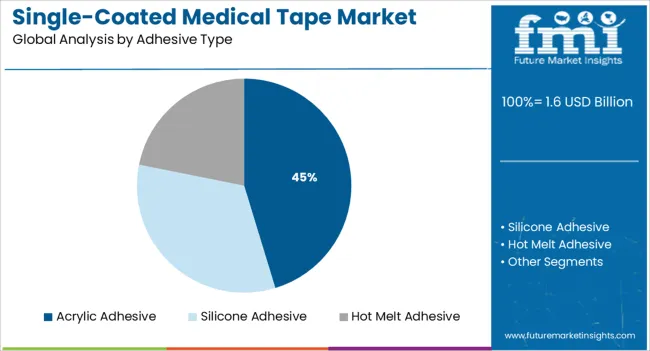

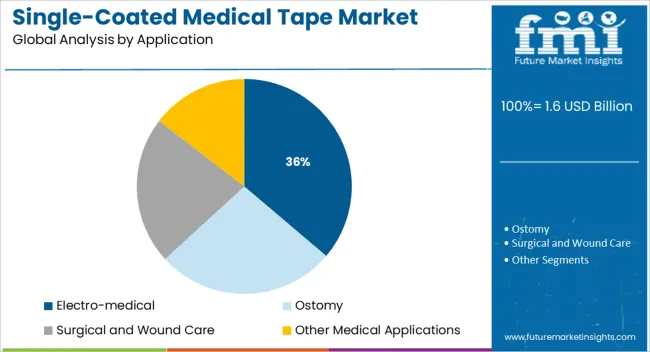

The market is segmented by Carrier Material Type, Adhesive Type, and Application and region. By Carrier Material Type, the market is divided into Film, Polyethylene Film, Polyolefin Film, Foam, Woven, Nonwoven, and Film/Foam Laminate. In terms of Adhesive Type, the market is classified into Acrylic Adhesive, Silicone Adhesive, and Hot Melt Adhesive. Based on Application, the market is segmented into Electro-medical, Ostomy, Surgical and Wound Care, and Other Medical Applications. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The film subsegment is projected to hold a 22.7% share of the single-coated medical tape market by 2025, making it the leading choice within the carrier material category. Its dominance is driven by the ability to provide a conformable yet durable backing that supports consistent adhesive application and skin contact.

Film carriers, including polyethylene and polyurethane types, have been preferred for their flexibility, water resistance, and ability to enable precision in cutting and conversion processes. These properties are essential in advanced medical tapes used in devices requiring extended wear and minimal skin disruption.

Manufacturers have also been incorporating micro-perforation and breathable film technologies to improve patient comfort without compromising adhesive strength. In clinical and home care settings, the visual transparency of films adds an additional advantage for wound observation and application precision, reinforcing their leadership in this segment.

Acrylic adhesive is anticipated to account for 45.3% of the market revenue in 2025 under the adhesive type segment, securing its position as the top-performing adhesive. This preference is due to acrylic’s well-established performance profile in terms of long-term wear, hypoallergenic properties, and moisture resistance.

The ability to maintain adhesion across a variety of skin types and under fluctuating temperature and humidity conditions has led to its widespread adoption in both therapeutic and diagnostic medical tapes. Acrylic adhesives also offer excellent sterilization compatibility, making them suitable for use in pre-packaged, sterile medical applications.

With ongoing developments in solvent-free and medical-grade acrylic formulations, manufacturers are able to meet increasing biocompatibility standards while enhancing process efficiency. These features have solidified acrylic adhesive as the adhesive system of choice in the single-coated medical tape space.

The electro-medical application segment is forecasted to contribute 36.2% of the overall market share in 2025, positioning it as the leading application area. This growth is being fueled by the proliferation of wearable monitoring systems, diagnostic patches, and electrotherapy devices that require reliable and skin-safe tape interfaces.

The integration of sensors and electrodes into patient care has necessitated high-performance tapes that can hold components in place without interfering with signal quality or causing skin irritation. Electro-medical tapes must deliver precise adhesion during extended wear while allowing for pain-free removal, especially in ambulatory and pediatric care.

As remote patient monitoring expands and telehealth gains prominence, medical tape manufacturers have been investing in advanced coatings and pressure-sensitive adhesives tailored for electro-medical compatibility. These innovations are enabling safer, more comfortable device-to-skin applications, ensuring continued dominance of this segment.

The global single-coated medical tape market is characterized by manufacturers supplying single-coated adhesive tapes for medical applications. Single-coated medical tapes are subject to advanced technological compositions and design implemented in the manufacturing process and material selection. Single-coated medical tapes offer a wide range of adhesive thickness, strengths, and backing materials to fulfill various end-use requirements.

Manufactures of single-coated medical tapes use different adhesive types such as acrylic adhesives, silicone adhesives, and hot melt adhesives. Single-coated medical tapes are designed for a range of applications such as a stick to medical device applications and good adhesion to skin applications.

Single-coated medical tapes offer breathability, repositionability and conformability options for patient comfort. The construction of single-coated medical tape includes a face stock, a pressure sensitive adhesive, and a liner. The selection of the adhesive for the manufacturing of single-coated medical tape depends on the end use applications.

Medical pressure sensitive tapes are widely used in the hospitals for secure medical and surgical dressings, to stick monitoring devices to the skin, life support equipment which requires care about and adhesive applied. Single coated medical tapes are used for a stick to skin application for wound care, electromedical applications, etc.

High growth accounted in the global pressure sensitive adhesive tape market is expected to propel the demand for the single-coated medical tape. Manufacturers of single-coated medical tape are identifying productive business opportunities offered by the material type segment of the global single-coated medical tape market.

The global market for single-coated medical tape is characterized by the supply of a variety of materials including plastic films & foam laminates, woven, nonwoven material, etc. Transparent single-coated medical tapes are highly preferred in end-use applications, especially for surgical and wound care applications.

However, the global single-coated medical tape caters to electromedical and ostomy that have specific niche applications. Research and innovation in terms of development conducted by single-coated medical tape manufacturers allowing way to innovation in the single-coated tape market. Overall the global market for single-coated medical tape is anticipated to witness a positive outlook over the forecast period.

Globally, the Single-coated medical tape market is divided into seven key regions - North America, Western Europe, Latin America, Eastern Europe, the Asia Pacific excluding Japan, Middle East & Africa, and Japan. The Asia Pacific excluding Japan, Middle East & Africa, and Japan.

North America and Europe regions are anticipated to have a well-established market for healthcare and pharmaceuticals and are expected to cumulatively account for maximum share in the global single-coated medical tape market during the forecast period. The Asia Pacific excluding Japan is expected to expand at an above average growth rate during the forecast period owing to the presence of a large number of small and local manufacturers in countries such as China and India.

Following are some of the key players operating in the single-coated medical tape market are 3M Company, Avery Dennison, Tekra Corporation, Berry Global Group, Inc., Scapa Group plc, Medco Coated Products, Shurtape Technologies, LLC, etc. Many more unorganized and local players are expected to contribute to the global single-coated medical tape market during the forecast period.

The research report presents a comprehensive assessment of the market and contains thoughtful insights, facts, historical data, and statistically supported and industry-validated market data. It also contains projections using a suitable set of assumptions and methodologies. The research report provides analysis and information according to market segments such as geographies, application, and industry.

The report is a compilation of first-hand information, qualitative and quantitative assessment by industry analysts, inputs from industry experts and industry participants across the value chain.

The report provides in-depth analysis of parent market trends, macro-economic indicators and governing factors along with market attractiveness as per segments. The report also maps the qualitative impact of various market factors on market segments and geographies.

The global single-coated medical tape market has been categorized on the basis of carrier material type, adhesive type, and application.

The global single-coated medical tape market is estimated to be valued at USD 1.6 billion in 2025.

The market size for the single-coated medical tape market is projected to reach USD 3.3 billion by 2035.

The single-coated medical tape market is expected to grow at a 7.5% CAGR between 2025 and 2035.

The key product types in single-coated medical tape market are film, polyethylene film, polyolefin film, foam, woven, nonwoven and film/foam laminate.

In terms of adhesive type, acrylic adhesive segment to command 45.3% share in the single-coated medical tape market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Medical Silicone Radiopaque Vascular Ties Market Size and Share Forecast Outlook 2025 to 2035

Medical Indoor Air Purifier Market Size and Share Forecast Outlook 2025 to 2035

Medical Eye Shield Film Market Size and Share Forecast Outlook 2025 to 2035

Medical Far Infrared Therapy Device Market Size and Share Forecast Outlook 2025 to 2035

Medical Latex Protective Suit Market Size and Share Forecast Outlook 2025 to 2035

Medical Activated Carbon Dressing Market Size and Share Forecast Outlook 2025 to 2035

Medical Coated Roll Stock Market Size and Share Forecast Outlook 2025 to 2035

Medical Billing Outsourcing Market Size and Share Forecast Outlook 2025 to 2035

Medical Pressure Mapping System Market Size and Share Forecast Outlook 2025 to 2035

Medical Chairs Market Size and Share Forecast Outlook 2025 to 2035

Medical Exoskeleton Market Forecast Outlook 2025 to 2035

Medical Display Market Forecast and Outlook 2025 to 2035

Medical Spa Market Size and Share Forecast Outlook 2025 to 2035

Medical Face Shield Market Forecast and Outlook 2025 to 2035

Medical Robot Market Size and Share Forecast Outlook 2025 to 2035

Medical Nutrition Market Forecast and Outlook 2025 to 2035

Medical Wax Market Size and Share Forecast Outlook 2025 to 2035

Medical Specialty Bag Market Size and Share Forecast Outlook 2025 to 2035

Medical Plastics Market Size and Share Forecast Outlook 2025 to 2035

Medical Device Tester Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA