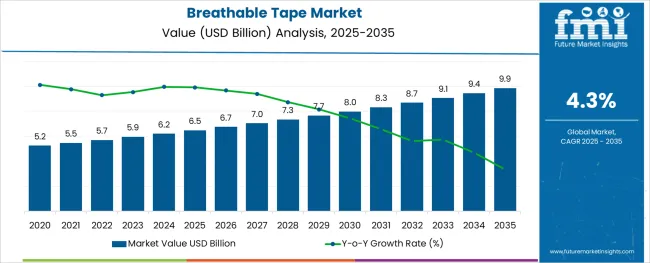

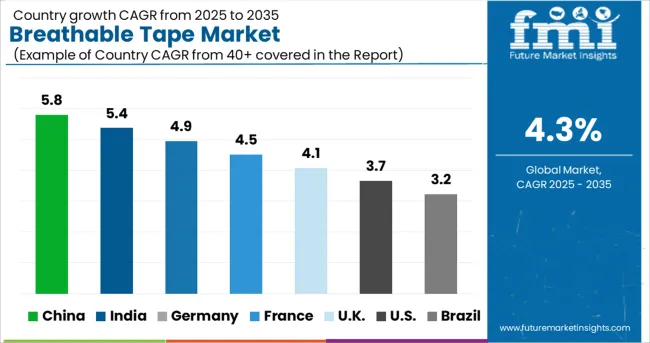

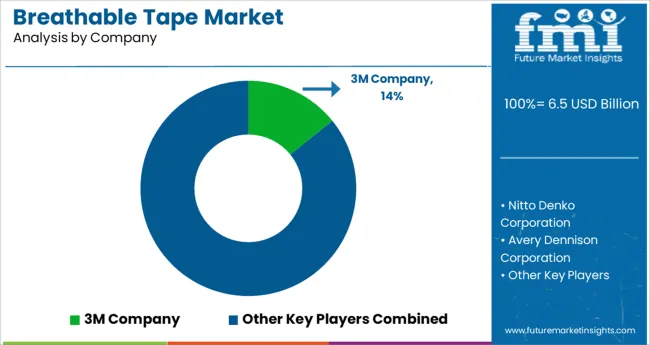

The Breathable Tape Market is estimated to be valued at USD 6.5 billion in 2025 and is projected to reach USD 9.9 billion by 2035, registering a compound annual growth rate (CAGR) of 4.3% over the forecast period.

The breathable tape market is experiencing stable expansion driven by growing demand for advanced wound care, post-surgical dressing support, and secure medical device fixation. As healthcare providers increasingly prioritize skin-friendly and hypoallergenic solutions, breathable tapes are being integrated into a broader range of clinical procedures and care protocols. Advancements in soft material engineering and moisture vapor transmission technologies are enabling products that maintain adhesion while minimizing skin irritation.

In addition, the global increase in surgical volumes and chronic disease prevalence is supporting steady demand across both acute care and outpatient settings. Manufacturers are responding with cost-effective, sterilizable, and latex-free options that cater to institutional quality standards.

Future opportunities lie in the development of sustainable and recyclable materials, product differentiation based on wear duration, and compatibility with telehealth-based wound care practices. The convergence of regulatory compliance, user comfort, and therapeutic performance is expected to keep the market on a steady growth trajectory.

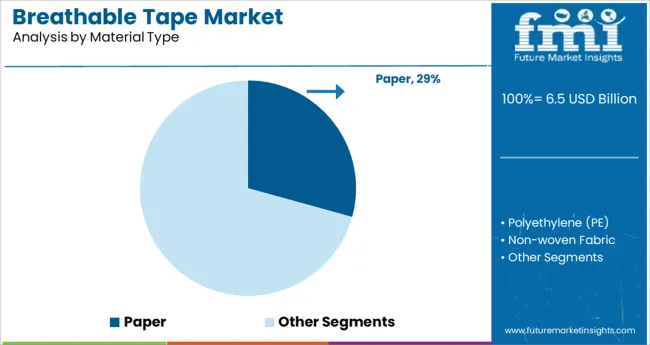

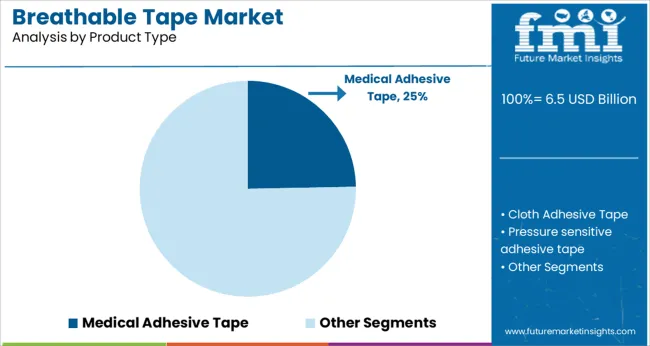

The market is segmented by Material Type, Product Type, and End User and region. By Material Type, the market is divided into Paper, Polyethylene (PE), Non-woven Fabric, and Others. In terms of Product Type, the market is classified into Medical Adhesive Tape, Cloth Adhesive Tape, Pressure sensitive adhesive tape, Waterproof tape, and Micro pore tape.

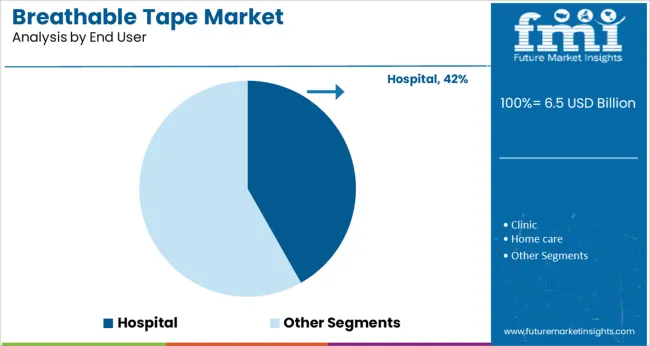

Based on End User, the market is segmented into Hospital, Clinic, Home care, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The paper material segment is projected to hold 29.3% of total revenue in 2025 under the material type category, making it the leading material. This leadership is being supported by paper’s lightweight composition, cost-effectiveness, and high breathability which are critical in maintaining skin integrity during prolonged usage.

Paper-based breathable tapes are widely adopted in clinical environments for securing gauze, IV tubing, and light dressings where minimal adhesive strength and ease of removal are required. The hypoallergenic nature of medical-grade paper further supports its use in sensitive patient populations such as pediatrics and geriatrics.

Additionally, paper tapes can be easily torn by hand and are often designed for single-use scenarios, reducing the risk of cross-contamination. These qualities, combined with their regulatory acceptance and widespread hospital usage, continue to reinforce the segment’s dominant position in the breathable tape market.

Medical adhesive tapes are anticipated to account for 24.7% of the total revenue in 2025 within the product type segment. This dominance has been attributed to their critical role in securing wound dressings, surgical drapes, and other medical devices in both inpatient and outpatient settings.

Enhanced demand for breathable adhesives that combine strong hold with patient comfort has pushed innovation in this segment, especially among manufacturers focusing on moisture permeability and skin-safe adhesives. The growing need for multi-day wear products in long-term care facilities and home healthcare has also fueled interest in breathable medical tapes.

With increasing emphasis on patient-centric care and infection control, hospitals and clinics are prioritizing medical-grade tapes that can adhere reliably while allowing the skin to breathe, thereby reducing risks of maceration and dermatitis. As a result, this segment is expected to continue leading in both clinical acceptance and procurement volumes.

The hospital end user segment is forecasted to represent 41.8% of total market revenue in 2025, establishing it as the leading consumer of breathable tape products. This leadership is being driven by consistent surgical activity, wound care protocols, and medical device securement needs across various departments including surgery, ICU, and general wards.

Institutional preference for breathable tapes that balance adhesion and comfort has made them a standard component of procedure kits and dressing sets. Hospitals are also adhering to evidence-based guidelines that favor moisture-permeable tapes for better patient outcomes, particularly in post-operative and chronic wound management.

Additionally, centralized purchasing models and long-term vendor partnerships have ensured consistent demand for high-quality, regulatory-compliant products. As hospitals continue to modernize their care delivery and infection prevention strategies, breathable tape usage is expected to rise further, making this end user segment a cornerstone of the market.

During the projection period, global demand for breathable tape is expected to expand at a good rate. During the predicted period, the sales of breathable tape are mostly influenced by hospitals and clinics. As it is used to cover wounds and injuries during surgery or first aid. Increased sales of breathable tape are predicted to be aided by an increase in the global accident ratio. Breathable tape is also employed in household applications, which allows breathable tape makers to capture a different market segment and presents an opportunity.

Increased adoption of breathable tape is influenced by the increased development of tape and diversity of tape for medical treatment or surgery. The global demand for breathable tape is likely to be driven by increasing clinical awareness, an increase in the number of injuries, and increased awareness of medical tape for skin injuries.

Over the projection period, rising healthcare spending in developed economies will create more opportunities for breathable tape makers. As a result, the demand for breathable tape is predicted to grow at a strong CAGR of 4.3% over the next several years.

North America dominates the breathable tape market share due to the presence of major key players surging awareness about minor injuries and rising prevalence of standardized healthcare facilities in this region.

Asia-Pacific region is the fastest growing region of breathable tape market during the forecast period of 2025 to 2035, with higher demand for breathable tape. Sales of breathable tape are growing due to the growing clinical awareness and upsurge in the demand of medical tape for injuries associated with skin.

Due to the presence of significant breathable tape manufacturers, sales of breathable tape, Europe is predicted to develop faster than the rest of the world throughout the projection period.

Some of the leading key players in the breathable tape market are 3M Company, Smith & Nephew Inc, Medline Industries Inc, Hartmann Inc, Dynarex Corp, Cardinal Health Inc, Nitto Medical Corp, Godson Tapes Pvt., Johnson & Johnson Consumer Inc, and Beiersdorf Inc, contributing to the substantial breathable tape market share.

| Report Attribute | Details |

|---|---|

| Growth rate | CAGR of 4.3% from 2025 to 2035 |

| Base year for estimation | 2024 |

| Historical data | 2020 to 2024 |

| Forecast period | 2025 to 2035 |

| Quantitative units | Revenue in million and CAGR from 2025 to 2035 |

| Report coverage | Revenue forecast, volume forecast, company ranking, competitive landscape, growth factors, and trends, Pricing Analysis |

| Segments covered | Material type, Product type, End user, Region |

| Regional scope | North America; Latin America; Europe; Middle East and Africa (MEA); East Asia; South Asia; Oceania |

| Country scope | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, Russia, Belgium, Poland, Czech Republic, China, India, Japan, Australia, Brazil, Argentina, Colombia, Saudi Arabia, UAE, Iran, South Africa |

| Key companies profiled | 3M Company; Smith & Nephew Inc; Medline Industries Inc; Hartmann Inc; Dynarex Corp; Cardinal Health Inc; Nitto Medical Corp; Godson Tapes Pvt.; Johnson & Johnson Consumer Inc; Beiersdorf Inc |

| Customization scope | Free report customization (equivalent to up to 8 analysts working days) with purchase. Addition or alteration to country, regional & segment scope. |

| Pricing and purchase options | Avail customized purchase options to meet your exact research needs. |

The global breathable tape market is estimated to be valued at USD 6.5 billion in 2025.

It is projected to reach USD 9.9 billion by 2035.

The market is expected to grow at a 4.3% CAGR between 2025 and 2035.

The key product types are paper, polyethylene (pe), non-woven fabric and others.

medical adhesive tape segment is expected to dominate with a 24.7% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Breathable Bag Perforators Market Forecast Outlook 2025 to 2035

Breathable Membrane Market Size and Share Forecast Outlook 2025 to 2035

Breathable Films Market Growth, Trends, Forecast 2025 to 2035

Breathable Lidding Film Packaging Market by Material Type from 2025 to 2035

Market Positioning & Share in the Breathable Films Industry

Competitive Overview of Breathable Lidding Film Packaging Companies

Waterproof Breathable Textiles WBT Size Market Size and Share Forecast Outlook 2025 to 2035

Tape Unwinder Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

Tape Dispenser Industry Analysis in Western Europe Size and Share Forecast Outlook 2025 to 2035

Tape Measure Market Size and Share Forecast Outlook 2025 to 2035

Tape Backing Materials Market Analysis by Material Type, Application, and Region through 2025 to 2035

Tape Stretching Line Market Analysis – Growth & Trends 2025 to 2035

Tapes Market Insights – Growth & Demand 2025 to 2035

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Competitive Overview of Tape Dispenser Companies

Competitive Overview of Tape Backing Materials Companies

Tape & Label Adhesives Market

Tape Applicator Machines Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA