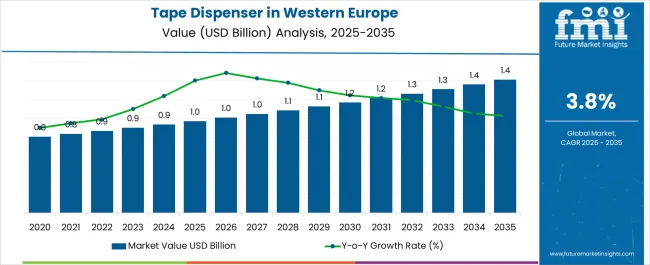

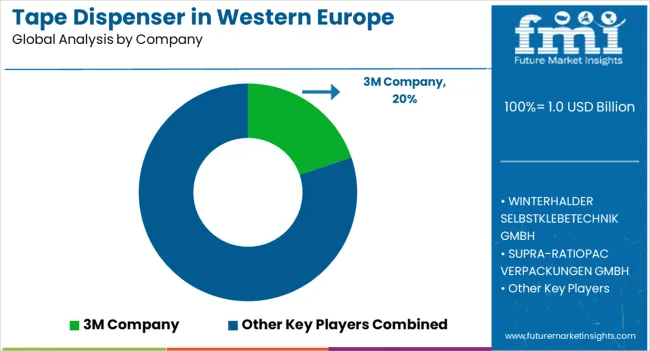

The Tape Dispenser Industry Analysis in Western Europe is estimated to be valued at USD 1.0 billion in 2025 and is projected to reach USD 1.4 billion by 2035, registering a compound annual growth rate (CAGR) of 3.8% over the forecast period.

| Metric | Value |

|---|---|

| Tape Dispenser Industry Analysis in Western Europe Estimated Value in (2025 E) | USD 1.0 billion |

| Tape Dispenser Industry Analysis in Western Europe Forecast Value in (2035 F) | USD 1.4 billion |

| Forecast CAGR (2025 to 2035) | 3.8% |

The tape dispenser market in Western Europe is experiencing sustained growth. Increasing demand from office environments, commercial establishments, and packaging applications is driving consistent adoption. Current dynamics are influenced by rising automation in material handling and the emphasis on workplace efficiency, while product ergonomics and cost-effectiveness are being prioritized by buyers.

Regulatory standards promoting safe and efficient office and packaging tools are shaping procurement decisions, while manufacturers are focusing on durable designs and innovation to differentiate in a competitive environment. The future outlook is supported by the expansion of commercial spaces, evolving retail supply chains, and digitized procurement practices that simplify access to advanced solutions.

Growth rationale is anchored on the essential role of tape dispensers in operational efficiency, the rising adoption of automated and user-friendly models, and the alignment of manufacturers with sustainability and cost-control trends This is expected to underpin steady revenue growth and expand product penetration across diverse end-user categories in Western Europe.

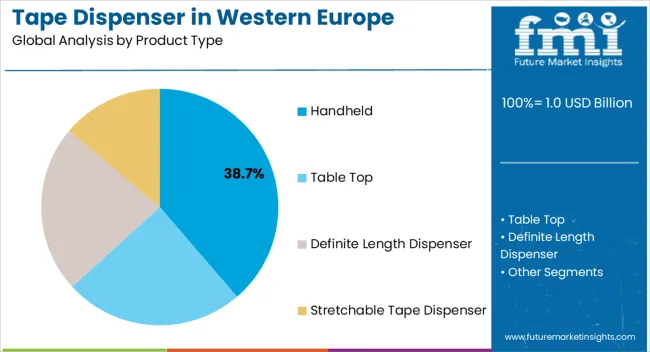

The handheld segment, accounting for 38.70% of the product type category, has maintained a strong position owing to its widespread use in offices, retail, and small-scale packaging operations. Its portability and low-cost profile have supported adoption across both commercial and individual users.

The segment has been reinforced by ergonomic designs that reduce strain and improve efficiency in manual operations. Distribution networks have ensured widespread availability across both offline and online channels, enhancing accessibility.

Despite the rising adoption of automated solutions, handheld dispensers remain a preferred choice where flexibility and cost considerations dominate Future growth is expected to be supported by incremental design improvements and continued demand from SMEs and retail operations, ensuring its stable contribution to the overall market.

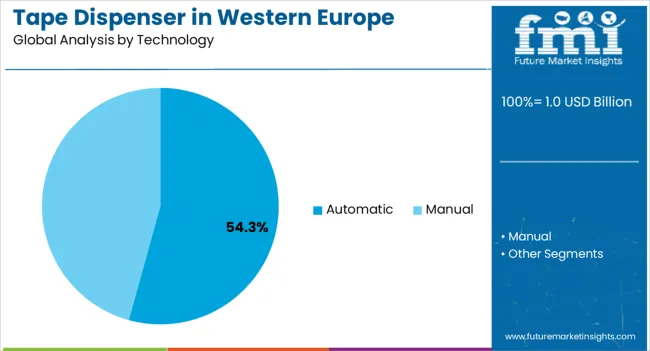

The automatic segment, holding 54.30% of the technology category, has emerged as the leading technology due to its ability to enhance speed, accuracy, and productivity in packaging and commercial applications. Demand has been supported by the growing need for automation in office and industrial workflows, where efficiency gains and labor savings are prioritized.

Continuous innovations in programmable features, safety enhancements, and multi-roll compatibility have improved the appeal of automatic dispensers. Their adoption has been strengthened by integration in logistics, warehousing, and e-commerce operations, aligning with broader automation trends in Western Europe.

Market growth is expected to be further supported by sustainability-focused designs that reduce waste, combined with expanding penetration into mid-sized enterprises seeking cost-effective productivity tools.

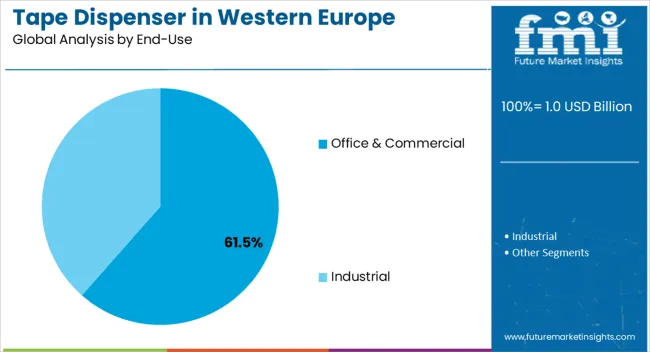

The office and commercial segment, representing 61.50% of the end-use category, has been driving the market due to the high frequency of tape dispenser usage in administrative, retail, and professional environments. Demand has been supported by the critical role of dispensers in packaging, documentation, and day-to-day office operations.

Procurement has been influenced by the need for durable, efficient, and cost-effective tools that streamline routine tasks. The dominance of this segment is further reinforced by structured purchasing through office supply distributors and bulk procurement by large institutions.

Growth potential is being enhanced by ongoing expansion in corporate spaces, rising retail activity, and adoption of sustainable operational practices This ensures the office and commercial segment remains a key contributor to the overall market performance in Western Europe.

The growth of tape dispense in Germany is attributed to the country's high-quality manufacturing sector and strict quality standards. The increasing adoption of automated tape dispensers in the automotive and aerospace industries also contributes to the industry growth in Germany. The tape dispenser in Germany is expected to grow with a CAGR of 4.70% from 2025 to 2035.

Germany has a robust industrial sector, including manufacturing and logistics. Tape dispensers are essential for packaging, sealing, and bundling goods in these industries, contributing to consistent demand. The growth of e-commerce in Germany has surged demand for efficient packaging solutions. Tape dispensers play a crucial role in securing shipping parcels, aligning with online retail's rise.

The automotive interior leather industry in United Kingdom is expected to grow with a CAGR of 3.80% during the forecast period. The demand for tape dispensers in the United Kingdom is driven by the country's strong economy and high demand for office and commercial supplies. Tape dispensers are widely used in the office and commercial sector for various applications, such as sealing envelopes, attaching documents, and packaging.

Significant increase in online retail in United Kingdom has driven the demand for efficient packaging solutions, including tape dispensers, to secure packages for shipping. Growing emphasis on sustainability in the United Kingdom. Tape dispensers made from eco-friendly materials or recyclable and biodegradable options are gaining traction in the country.

The table-top segment is expected to account for 56.50% of the industry share in 2025. Table-top tape dispensers are commonly used in office and commercial settings, as they are designed for high-volume use and can accommodate large rolls of tape.

They are also commonly used in the manufacturing industry, where they are used for sealing boxes and packaging materials. Table-top tape dispensers are preferred over hand-held tape dispensers in settings where tape dispensing is a constant activity.

| Attribute | Details |

|---|---|

| Product Type | Table Top |

| Value Share | 56.50% |

The office and commercial segment is estimated to dominate the tape dispenser industry by end users, with an industry share of 55.50% in 2025. This is due to the high demand for tape dispensers in office and commercial settings, which are used for various purposes, such as sealing envelopes, attaching documents, and packaging.

Tape dispensers are essential office supplies, and their demand is expected to increase with the growth of eCommerce and online shopping. Industrial tape dispensers are commonly used in manufacturing for packaging, assembly, and labeling applications.

| Attribute | Details |

|---|---|

| End-Use | Office and Commercial |

| Value Share | 55.50% |

The tape dispenser industry is highly competitive, with numerous manufacturers competing for market share. The industry is fragmented, with many small manufacturers and a few key players dominating the industry. Market players also focus on introducing sustainable materials to keep pace with changing industry preferences. Expansion strategies are expected to remain highly popular among leading players.

Product Portfolio

| Attribute | Details |

|---|---|

| Estimated Industry Size in 2025 | USD 1.0 billion |

| Projected Industry Size in 2035 | USD 1.4 billion |

| Anticipated CAGR between 2025 to 2035 | 3.8% CAGR |

| Historical Analysis of Demand for Deployment of Tape Dispensers in Western Europe | 2020 to 2025 |

| Demand Forecast for Deployment of Tape Dispenser in Western Europe | 2025 to 2035 |

| Report Coverage | Industry Size, Industry Trends, Analysis of key factors influencing Deployment of Tape Dispenser in Western Europe, Insights on Global Players and their Industry Strategy in Western Europe, Ecosystem Analysis of Local Providers in Western Europe. |

| Key Countries Analyzed While Studying Opportunities in the Deployment of Tape Dispenser in Western Europe | The United Kingdom, Germany, Italy, France, Spain, Rest of Western Europe |

| Key Companies Profiled | WINTERHALDER SELBSTKLEBETECHNIK GMBH; SUPRA-RATIOPAC VERPACKUNGEN GMBH; Tesa SE; 3M Company; Intertape Polymer Group Inc.; Fellow Brands; Shurtape Technologies LLC; Koziol USA; START International; Prisma Pressure Sensitive Products Ltd. |

The global tape dispenser industry analysis in Western Europe is estimated to be valued at USD 1.0 billion in 2025.

The market size for the tape dispenser industry analysis in Western Europe is projected to reach USD 1.4 billion by 2035.

The tape dispenser industry analysis in Western Europe is expected to grow at a 3.8% CAGR between 2025 and 2035.

The key product types in tape dispenser industry analysis in Western Europe are handheld, table top, definite length dispenser and stretchable tape dispenser.

In terms of technology, automatic segment to command 54.3% share in the tape dispenser industry analysis in Western Europe in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Tape Measure Market Size and Share Forecast Outlook 2025 to 2035

Tapes Market Insights – Growth & Demand 2025 to 2035

Tape & Label Adhesives Market

Tape Unwinder Market Trends & Growth Outlook 2024-2034

Tape Backing Materials Market Analysis by Material Type, Application, and Region through 2025 to 2035

Tape Banding Machine Market Overview - Demand & Growth Forecast 2025 to 2035

Tape Stretching Line Market Analysis – Growth & Trends 2025 to 2035

Tape Applicator Machines Market

Competitive Overview of Tape Backing Materials Companies

Tape Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Tape Dispenser Companies

Tape Dispenser Industry Analysis in Japan Size and Share Forecast Outlook 2025 to 2035

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

PVC Tapes Market Size and Share Forecast Outlook 2025 to 2035

ESD Tapes and Labels Market from 2025 to 2035

USA Tapes Market Analysis – Growth & Forecast 2024-2034

Leading Providers & Market Share in PVC Tapes Industry

Foam Tape Market Size and Share Forecast Outlook 2025 to 2035

Body Tape Market Size and Share Forecast Outlook 2025 to 2035

Seam Tapes Market Insights – Growth & Demand Forecast 2025-2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA