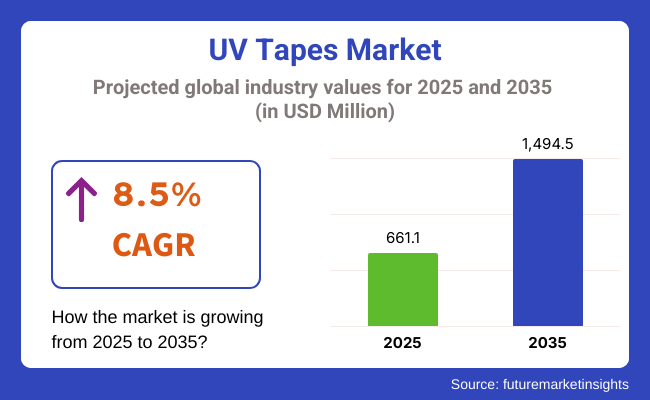

The global UV tapes market is projected to reach approximately USD 661.1 million in 2025, fueled by robust demand in semiconductor manufacturing, electronics assembly, and advanced panel displays. Market valuation is expected to expand further, touching USD 1,494.5 million by 2035, registering a CAGR of 8.5% during the forecast period, as detailed in recent corporate filings and technical disclosures by leading manufacturers.

Substantial growth is being driven by Asia-Pacific, led by Japan, South Korea, and China, where UV tapes are being rapidly adopted for wafer dicing and die-cutting operations in next-gen chip fabrication. In 2025, Shin-Etsu Chemical Co., Ltd., one of the foremost manufacturers of UV-curable dicing tapes, disclosed in its investor presentation a significant production scale-up. This step was taken to cater to the accelerating demand for precision adhesives in 5G IC components and silicon wafers.

Meanwhile, Teraoka Seisakusho Co., in its 2024 mid-year investor briefing, confirmed capacity augmentation at its Kanagawa facility, citing consistent orders from global electronics OEMs. The company emphasized that UV tape demand has outpaced previous forecasts, particularly in lead-frame and CSP (Chip Scale Package) processes.

UV tapes, designed to minimize adhesive residue post-UV exposure, are being increasingly mandated in cleanroom environments. In a 2025 technical release, Henkel AG confirmed that its LOCTITE UV tapes were certified under ISO 14644-1 Class 5 standards. These are used extensively in die attach processes, optical protection, and microfluidic device manufacturing.

In display technologies, UV tapes have become indispensable during OLED substrate lamination and module assembly. In a 2025 press release, Nitto Denko Corporation announced multi-year supply agreements with panel makers in Taiwan and South Korea. CEO Hideo Takasaki noted, “Our UV tape shipments doubled in Q1 2025 compared to Q1 2024, in direct response to OLED fab expansions across East Asia.”

Product advancements have improved tape elasticity, wavelength selectivity, and detachment responsiveness. Lintec Corporation, during its 2025 innovation showcase, unveiled a UV-sensitive variant engineered for faster debonding in fully automated packaging lines.

Challenges persist in adhesive uniformity and light stability across hybrid substrates. To address these, companies have intensified R&D and co-development initiatives with semiconductor fabs. The International Electronics Manufacturing Initiative’s 2025 symposium reported joint pilots aimed at aligning UV tape performance with the 2nm and sub-2nm silicon roadmap.

The market is segmented based on product type, application, and region. By product type, the market is divided into polyolefin (PO), polyethylene terephthalate (PET), polyvinyl chloride (PVC), and others. Based on application, it is categorized into wafer dicing, back-grinding, and others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia Pacific, and the Middle East and Africa.

The polyolefin (PO) segment is projected to be the fastest-growing product type in the UV tapes market, registering a CAGR of 9.2% between 2025 and 2035. This growth is driven by the increasing use of PO-based UV tapes in wafer dicing and back-grinding, where low residue, clean peelability, and excellent flexibility are essential.

Polyolefin tapes offer precise bonding during high-speed semiconductor processing and enable clean removal after UV exposure, supporting device reliability and manufacturing efficiency. Their compatibility with ultra-thin wafers and minimal adhesive transfer make them ideal for advanced packaging formats such as fan-out wafer-level packaging.

Polyethylene terephthalate (PET) continues to be preferred for its thermal resistance and high dimensional stability, especially in automated grinding operations. Polyvinyl chloride (PVC) maintains niche applications in areas demanding durability and tack, though its growth is restrained due to environmental regulations. The others segment, including hybrid films and customized polymers, is expanding in optical and display manufacturing.

| Product Type | CAGR (2025 to 2035) |

|---|---|

| Polyolefin (PO) | 9.2% |

The wafer dicing segment is projected to be the fastest-growing application in the UV tapes market, expected to grow at a CAGR of 8.9% between 2025 and 2035. This accelerated growth is fueled by rising demand for thinner wafers and compact chip architectures, particularly in mobile, wearable, and automotive electronics.

UV tapes are critical in wafer dicing due to their strong adhesion during cutting and clean removal post UV exposure, helping protect fragile substrates and improve yield. The push toward advanced chip packaging—such as 3D stacking and fan-out formats—further increases reliance on UV dicing tapes.

Back-grinding applications remain steady as fabs continue thinning wafers for enhanced thermal performance and integration. UV tapes ensure mechanical support and reduce stress during grinding, which is crucial for ultra-thin silicon. The others category includes specialized tape usage in optical protection, flexible electronics, and circuit shielding, gaining importance as flexible display and micro-device production scales globally.

| Application | CAGR (2025 to 2035) |

|---|---|

| Wafer Dicing | 8.9% |

North America is likely to continue being a robust market for UV tapes, driven by a well-developed electronics and semiconductor industry. The United States and Canada possess many high-tech producers that employ UV tapes in wafer dicing, chip protection, and microelectronic uses. Expansion of 5G infrastructure, growing use of IoT devices, and demand for sophisticated automotive electronics have also driven the growing market for high-performance UV tapes in the region.

In addition, tight controls on electronic waste and toxic materials are compelling manufacturers to formulate environmentally friendly UV tape solutions, which improve market competitiveness. The United States is also experiencing growth in local semiconductor manufacturing with efforts like the CHIPS and Science Act aimed at increasing local chip production. This will continue to drive demand for UV tapes in precision wafer processing and semiconductor packaging.

Europe has a significant market share in the overall UV tapes global market, primarily due to excellent demand from automobile and semiconductor applications. Germany, France, and the UK have been heavily investing in electronic components production, car innovations, and renewable energy equipment, all for which there are rising demands of sophisticated UV tapes.

The automotive industry in Germany is a significant consumer of UV tapes, as these materials play a crucial role in bonding lightweight materials, battery protection, and electronic circuit assembly for electric cars. Moreover, the emergence of smart manufacturing and Industry 4.0 in Europe has resulted in the implementation of automation in the manufacturing of semiconductors, further fueling the demand for UV-resistant adhesives.

Additionally, European Union rules for sustainable and low-VOC materials are encouraging producers to create bio-based and solvent-free UV tapes, solidifying Europe's stance on green electronic adhesives.

The Asia-Pacific region will lead the UV tapes market with the highest proportion of global output and consumption. Major semiconductor, display, and electronics players like China, Japan, South Korea, and Taiwan have driven demand for high-precision UV tapes.

China is the biggest semiconductor material consumer in the world and thus a prime market for UV tapes in wafer dicing, electronic encapsulation, and panel bonding applications. Japan and South Korea dominate display technology, such as OLED and flexible displays, where UV tapes provide defect-free processing of fragile components. Taiwan's leadership in semiconductor foundries and chip production also fuels the region's high-volume demand for UV tapes in precision electronics assembly.

India's booming electronics production sector is also contributing to the growth of the market, as production of mobile phones, consumer electronics, and auto parts continues to rise. Also propelling demand for superior adhesive solutions like UV tapes are growing investments in 5G infrastructure and smart cities.

Challenges

One of the major challenges confronting the UV tapes market is a high production cost of sophisticated UV adhesive formulations. R&D investments in specialized raw materials and developing UV-resistant and high-temperature-stable adhesives drive manufacturing costs higher.

Besides, variation in the raw material cost could affect manufacturers' profit margins. Large raw materials such as silicone adhesives and acrylic polymers are subject to supply chain susceptibility and price fluctuation, making it difficult for the continuity of price stability in the market.

A more important challenge is the growing requirement for green adhesive solutions. Regulatory bodies in the environment in Europe and North America are tightening the environmental laws and regulations that limit the use of solvent-based adhesives as well as those that are non-biodegradable, and they are compelling companies to develop ecologically friendly products

Opportunities

The UV tapes market holds many opportunities for market growth and technological innovation. The most favorable opportunity is seen in the advent of miniaturized electronics and flexible displays where UV tapes ensure fragile components firmly in place. Wearable technology, foldable smartphones, and high-resolution OLED displays are among the factors seen to drive next-generation UV adhesive demand.

The shift towards electric vehicles (EVs) and renewable energy solutions is also creating opportunities for UV tapes in battery manufacturing, solar panel encapsulation, and automotive electronics. With growing improvement in EV battery technology, the industry needs tough, heat-resistant, and UV-stable adhesives for both safety and durability.

Additionally, current R&D projects in bio-based UV tapes are creating new avenues for environmentally friendly adhesive solutions. Firms investing in biodegradable and solvent-free UV tapes will be best placed to establish competitiveness in markets with strict green regulations, including Europe and North America.

The growth of semiconductor manufacturing throughout Asia-Pacific, Europe, and North America also offers a massive growth prospect for UV tape producers. Governments' investments in local semiconductor manufacturing facilities are augmenting demand for high-precision adhesive solutions used in chip bonding, wafer dicing, and die-attach processes, creating a favorable market scenario for UV tapes between 2025 and 2035.

From 2020 to 2024, the UV tapes market saw great growth as demand increased in semiconductors, electronics, automotive, and healthcare sectors. High-performance adhesion-based, easy peel, precision cutting UV tapes became a crucial element in wafer dicing, chip packaging, and glass processing. The high-speed development of advanced electronic devices, component miniaturization, and high-precision manufacturing propelled the growth of the market.

The semiconductor industry played a major driver in UV tape uptake, most notably in wafer back-grinding, dicing, and thin wafer handling. A rise in ICs, MEMS, and advanced packaging of semiconductors pushed demand for UV-curable adhesive tapes to skyrocket.

The advancement in 5G communication, IoT devices, and high-performance computing also further energized the market, calling for low-stress, residue-free, and high-reliability UV tapes.

The display and electronics manufacturing industries also saw wide adoption of UV tape in organic light-emitting diode (OLED) displays, liquid crystal display (LCD) panels, and micro-LED production. Clean, non-contaminating, and precise adhesives required by the applications spurred research that led to the creation of proprietary UV tapes that have higher tensile strength and low-outgassing features.

In the automotive sector, UV tapes played a vital role in high-temperature assembly, electronic sensor encapsulation, and protective coatings. The increasing trend towards autonomous cars, electric vehicles (EVs), and advanced driver-assistance systems (ADAS) opened up new applications for UV tapes in lightweight materials, battery module assembly, and sensor protection.

Even as it recorded tremendous growth, the market was hit by issues such as volatility in raw material costs, supply chain disruptions, and environmental issues relating to solvent-based adhesives. Regulatory bodies like RoHS, REACH, and environmental agencies forced low-VOC and eco-friendly adhesive formulations to stricter standards, leading manufacturers to create recyclable, biodegradable, and solvent-free UV tapes.

The advent of precision automated manufacturing, AI-based adhesive formulation, and nanotechnology-based UV curing technologies enabled them to overcome such challenges, making the market robust and continuously growing. Between 2025 and 2035, the UV tapes market will witness transformative advancements driven by technological breakthroughs, environmental sustainability, and expanding industrial applications.

With industries heading towards miniaturization, high-precision bonding, and zero-defect manufacturing, the need for high-performance UV tapes offering high adhesion, ultra-low residue, and controlled release properties is sure to increase. The semiconductor and electronics industries will remain primary drivers of UV tape consumption, with increasing demand for thin wafer processing, advanced chip-scale packaging, and flexible hybrid electronics.

The rise of quantum computing, AI-driven chips, and neuromorphic processors will require UV tapes with higher heat resistance, anti-static properties, and precision thickness control. Additionally, wearable electronics, augmented reality (AR) devices, and flexible displays will propel the need for ultra-thin, stretchable, and optically transparent UV tapes.

The automotive industry will greatly increase its application of UV tapes, especially in bonding of lightweight composites, high-durability coating, and thermal management of EV batteries.

When electric cars and hydrogen fuel cell technology go mainstream, car manufacturers will count on UV tapes that have high dielectric strength, moisture resistance, and flame retardancy. Further, the use of smart surfaces, interactive touch panels, and integrated electronic circuits in the interior of vehicles will stimulate the demand for conductive and optically clear UV tapes.

Sustainability will be the prime focus, with manufacturers making a commitment to low-carbon, biodegradable, and recyclable UV tape products. Utilization of bio-based polymers, solvent-free adhesives, and UV-curable resins will reduce environmental impact and enable green manufacturing goals around the world. Companies will implement closed-loop recycling procedures, digital raw material tracing, and AI-powered waste management to enhance sustainability.

The growth of AI, robotics, and automation in UV tape production and use will transform production processes. UV curing systems with automation, intelligent adhesive dispensing machines, and real-time quality monitoring solutions will provide consistent adhesion performance, defect-free bonding, and material efficiency.

Further, the growth of photo-responsive adhesives, multi-functional coatings, and self-healing UV tapes will create new frontiers in medical implants, biocompatible adhesives, and smart wearable technology. The market for UV tapes will keep developing with a great focus on sustainability, technological advancements, and AI-based manufacturing.

With industries making the transition towards high-performance, sustainable, and next-generation UV tapes, companies have to adopt cutting-edge material science, circular economy principles, and precision engineering solutions to keep pace with the changing industrial dynamics.

The healthcare and medical industry will be the high-growth use segment for UV tapes in biomedical sensors, flexible diagnostic patches, and drug delivery systems. The demand for hypoallergenic, skin-friendly, and biocompatible adhesive tapes will propel innovation in UV-cross-linked hydrogels, antimicrobial coatings, and breathable adhesive materials.

The growing use of point-of-care diagnostics, telemedicine, and sophisticated wound care products will provide new avenues for UV tapes in medical-grade securement, transparent wound dressings, and controlled-release drug patches. As quantum computing, space electronics, and high-frequency 6G networks gain traction, manufacturers will develop UV tapes engineered for extreme environments, radiation resistance, and subatomic-scale precision bonding.

The integration of machine learning algorithms, predictive analytics, and AI-driven material discovery will accelerate the development of next-generation UV tapes with tunable adhesion, adaptive curing rates, and intelligent release control.

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments introduced low-VOC and solvent-free adhesive mandates. |

| Technological Advancements | Companies developed high-performance, residue-free, and precision-cutting UV tapes. |

| Industry Applications | UV tapes were widely used in semiconductor packaging, electronics, and display fabrication. |

| Environmental Sustainability | Companies explored solvent-free and energy-efficient UV tape curing processes. |

| Market Growth Drivers | Demand was fueled by 5G rollout, miniaturized electronics, and autonomous vehicle growth. |

| Production & Supply Chain Dynamics | Supply chains faced raw material shortages and geopolitical trade uncertainties. |

| End-User Trends | Consumers preferred high-precision, low-residue, and reliable UV tapes. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Policies will enforce biodegradable, recyclable, and carbon-neutral UV tape formulations. |

| Technological Advancements | Future innovations will focus on AI-driven formulation, self-healing adhesives, and photo-responsive bonding agents. |

| Industry Applications | The market will expand into biomedical devices, flexible hybrid electronics, and smart nanotechnology applications. |

| Environmental Sustainability | Industry-wide adoption of closed-loop recycling, bio-based adhesives, and zero-waste UV tape production. |

| Market Growth Drivers | Growth will be driven by quantum computing, AI-powered electronics, and energy-efficient high-frequency applications. |

| Production & Supply Chain Dynamics | Companies will invest in localized production, AI-powered logistics, and blockchain-enabled supply chain tracking. |

| End-User Trends | Future demand will emphasize sustainable, intelligent, and multi-functional UV tapes for next-gen applications. |

The USA UV tapes market is witnessing consistent growth with increasing demand from semiconductor, electronics, and optical industries. UV tapes find widespread usage in wafer dicing, back-grinding, and packaging of chips, an indication of the robust semiconductor manufacturing industry in the country. Increased demand for electronic component miniaturization, along with advances in 5G technology and IoT devices, is driving the market.

The USA government's investment in the production of semiconductors via the CHIPS and Science Act, including a USD 52 billion subsidy package, is expected to impact demand for UV tape significantly. In addition, the country's strong aerospace and defense industry, which relies on high-tech semiconductor and optical components, is also contributing to growth.

As the medical device and automotive industries require high-quality specifications, UV tapes are gaining acceptance in precision assembly, bonding, and microelectronic applications. Moreover, utilization of UV-curable adhesive technology is anticipated to increase as businesses look for residue-free, high-performance, and environmentally friendly alternatives.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

The UK UV tapes market is growing due to growing semiconductor, electronics, and medical device industries. The rise in demand for sophisticated materials and adhesives across the automotive, aerospace, and healthcare industries is driving demand for high-performance UV tapes.

The UK semiconductor sector, while smaller than the USA and East Asia's, is seeing significant government-funded investments to enable local chip production and R&D. The country's focus on next-generation packaging and photonics applications is driving the application of UV-curable bonding tapes in optoelectronics and display manufacturing.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.9% |

The UV tapes market in Europe is being driven by high growth, triggered by the rise of semiconductor fabrication facilities, growth in automotive manufacturing, and growth in demand for flexible electronics. Germany, France, and the Netherlands are among the leading countries for semiconductor R&D and innovation in automotive electronics, which drives the use of UV tapes in microelectronics.

The EU's Green Deal program is also driving manufacturers to use low-emission, solvent-free adhesives, boosting demand for environmentally friendly UV tapes in optical films, printed electronics, and future solar panels. Moreover, the growth of electric vehicles (EVs) is driving the application of UV tapes in battery packaging and sensor assembly.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 4.7% |

Japan is a world leader in semiconductor production, precision optics, and high-performance adhesives and is an important market for UV tapes. The growth of semiconductor market leaders like Tokyo Electron and Renesas Electronics, and the dominance of Japan in optical components, is largely driving demand for high-performance UV tapes used in wafer dicing, back-grinding, and microassembly applications.

The country's MEMS and nanotechnology capabilities are also driving demand for UV tapes with ultrahigh-precision adhesion control. In addition, Japan's drive towards high-efficiency and environment-friendly adhesives is driving research and development of low-residue, biodegradable UV tapes.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 4.9% |

The industry of UV tapes in South Korea is witnessing immense growth, which is driven by the growth of semiconductor manufacturing, flexible displays, and advanced microelectronics industries. With Samsung Electronics and SK Hynix, two of the largest semiconductor makers in the world, being its residence, South Korea plays a crucial role in the global output of memory chips and supplies nearly 60% of the DRAM in the world.

The requirement for UV tapes with excellent performance in wafer dicing, back-grinding, and chip packaging is directly proportional to the risky investment that the nation is placing in semiconductor fabrication plants. While the Korean government continues to make Korea a world leader in semiconductors, the requirement for high-precision residue-free UV tapes is bound to increase with unprecedented velocity.

Furthermore, the growing demand for AI and high-performance computing solutions is propelling demand for emerging packaging technologies, including 3D IC packaging and fan-out wafer-level packaging in which UV tapes are widely used.

The Korean display panel industry is another key driver of demand for UV tape, with market leaders like LG Display and Samsung Display controlling the world market for OLED, flexible, and foldable displays. The growing use of foldable smartphones, transparent OLEDs, and future-generation display panels has required the application of specialized UV tapes for optical film bonding, substrate protection, and sensitive component assembly.

South Korea's developments in Quantum Dot and MicroLED display technologies are likewise driving demand for precision UV tapes in encapsulation and film lamination applications. With the advancement of OLED production, demand is rising for low-residue UV tapes that have high adhesion but are easy to remove, especially in cleanroom conditions where contamination control is a major concern.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.1% |

The market for UV tapes is competitive, with major global players and regional producers driving industry growth. Firms concentrate on product durability, adhesive strength, and efficiency for use in semiconductor production, electronics, and other industrial applications. Demand for high-performance tapes for wafer dicing, back grinding, and other precision uses drives the market.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Sumitomo Bakelite Co., Ltd. | 6-10% |

| AI Technology, Inc. | 4-8% |

| Nitto Denko Corporation | 14-19% |

| Furukawa Electric Co., Ltd. | 11-16% |

| Mitsui Chemicals, Inc. | 9-13% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Sumitomo Bakelite Co., Ltd. | Manufactures UV tapes with superior adhesive properties, catering to the high-tech and automotive sectors. |

| AI Technology, Inc. | Focuses on innovative UV tape solutions for delicate electronics manufacturing, with an emphasis on high precision and environmental safety. |

| Nitto Denko Corporation | Develops high-performance UV tapes used in semiconductor applications, emphasizing advanced adhesion control and residue-free removal. |

| Furukawa Electric Co., Ltd. | Specializes in UV tapes for electronics and industrial applications, focusing on thermal stability and flexibility. |

| Mitsui Chemicals, Inc. | Produces advanced UV-curable adhesive tapes designed for precision cutting and semiconductor packaging. |

Key Company Insights

Sumitomo Bakelite Co., Ltd. (6-10%)

Sumitomo Bakelite manufactures UV tapes with excellent adhesive properties, targeting high-tech industries, including semiconductors, consumer electronics, and automotive manufacturing. The company continues to invest in developing high-precision adhesive solutions.

AI Technology, Inc. (4-8%)

AI Technology specializes in high-precision UV tape solutions for electronics and semiconductor applications. Its products emphasize clean removability, chemical resistance, and superior adhesion, making them highly reliable for industrial use.

Nitto Denko Corporation (14-19%)

As a leading manufacturer of UV tapes, Nitto Denko Corporation dominates the market with its innovative adhesive solutions. The company develops high-quality tapes for wafer dicing and back grinding applications, ensuring strong adhesion during processing and easy removal after UV exposure.

Furukawa Electric Co., Ltd. (11-16%)

Furukawa Electric supplies UV tapes optimized for semiconductor and industrial applications. The company emphasizes durability, flexibility, and heat resistance, making its products ideal for high-precision manufacturing.

Mitsui Chemicals, Inc. (9-13%)

Mitsui Chemicals offers advanced UV-curable adhesive tapes designed to enhance semiconductor packaging efficiency. The company’s focus on research and development enables it to deliver superior performance for delicate electronic applications.

Many other companies contribute significantly to the UV tapes market, driving innovation, cost optimization, and sustainability. These include:

The overall market size for UV Tapes Market was USD 661.1 Million in 2025.

The UV Tapes Market is expected to reach USD 1494.5 Million in 2035.

The demand for electronics adhesives is expected to increase as the electronics industry seeks reliable bonding solutions for miniaturized and high-performance devices. Their extensive use in circuit boards, semiconductor packaging, and consumer electronics is fueling market growth. Additionally, advancements in adhesive formulations and the rising demand for durable, heat-resistant, and eco-friendly materials are driving adoption.

The top 5 countries which drives the development of UV Tapes Market are USA, UK, Europe Union, Japan and South Korea.

Polyolefin (PO) to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Meters) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Meters) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 10: North America Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Meters) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: Latin America Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Meters) Forecast by Application, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 22: Western Europe Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 24: Western Europe Market Volume (Meters) Forecast by Application, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 30: Eastern Europe Market Volume (Meters) Forecast by Application, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Meters) Forecast by Application, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: East Asia Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 42: East Asia Market Volume (Meters) Forecast by Application, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Meters) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Meters) Forecast by Product Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by Application, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Meters) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Meters) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 9: Global Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Meters) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 27: North America Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Meters) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: Latin America Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Meters) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 67: Western Europe Market Volume (Meters) Analysis by Application, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by Application, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Meters) Analysis by Application, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by Application, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by Application, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Meters) Analysis by Application, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by Application, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by Application, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 117: East Asia Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 121: East Asia Market Volume (Meters) Analysis by Application, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Product Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by Application, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by Application, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Meters) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Meters) Analysis by Product Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by Application, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Meters) Analysis by Application, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by Application, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UV Cured Acrylic Foam Tapes Market Insights - Trends & Growth Forecast 2024 to 2034

Non-UV Dicing Tapes Market Trends - Growth & Forecast 2025 to 2035

UV Curable Resin and Formulated Products Market Size and Share Forecast Outlook 2025 to 2035

UV Stabilized Films Market Size and Share Forecast Outlook 2025 to 2035

UV Absorbers Market Size and Share Forecast Outlook 2025 to 2035

UV Cured Coatings Market Size and Share Forecast Outlook 2025 to 2035

UV-Protecting Polymers Market Size and Share Forecast Outlook 2025 to 2035

UV-C LED Market Size and Share Forecast Outlook 2025 to 2035

UV Adhesives Market Size and Share Forecast Outlook 2025 to 2035

UV and Light Sensitive Packaging Market Size and Share Forecast Outlook 2025 to 2035

UV-Blocking Transparent Film Market Size and Share Forecast Outlook 2025 to 2035

UV Curable Coatings Market Size and Share Forecast Outlook 2025 to 2035

UVI Stretch Films Market Size and Share Forecast Outlook 2025 to 2035

UV Protected Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

UVC Disinfection Product Market Report – Demand, Trends & Forecast 2025–2035

Uveal Melanoma Treatment Market – Growth & Forecast 2025 to 2035

UV LED Printers Market Growth - Trends & Forecast 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

UV LED Market by Technology, Application, and Region – Growth, Trends, and Forecast through 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA