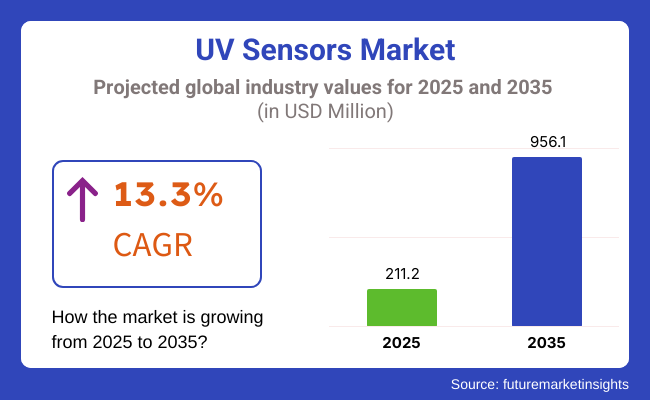

The UV sensors market is expected to experience significant growth, is likely to have a market share of USD 211.2 million in 2025, while it is expected to reach USD 956.1 million by the year 2035 with a CAGR of 13.3%. The expanding usage of UV sensing devices in the healthcare sector, consumer electronics, and environmental monitoring is the key factor for this industry growth.

The acceleration of growth is due to the incorporation in wearables and consumer devices that track UV exposure and protect from skin diseases. Furthermore, the depletion of the ozone layer and the increase in skin cancer cases have been the reasons for the development of the UV index monitoring system used in the weather forecasting and personal health management sector. The addition in IoT-enabled gadgets is another reason for the fast-growing industry.

The industry shows great promise, but it is affected by some hindrances like the high costs of production and the low precision under extreme environmental conditions. The difficulty of allowing to detect different wavelengths also serves a challenge, as it restricts the technical options for wider usage. Further, the absence of common regulations in some regions results in the variations of the goods and their functioning.

The most crucial opportunity is in the area of the expansion in air and water quality monitoring where governments and industries are enhancing their funding of pollution control initiatives. The growing application of sensors in industrial automation, robotics, and food safety presents an attractive opportunity for industry participants.

Besides, the amalgamation of AI and cloud-based analytics has been powerfully increasing the general collection of real data and making the predictive analysis more precise, therefore, they are introduced in diverse fields.

The most important industry trends are the use in cars to monitor UV exposure inside the vehicles and the increasing application of UV-C sensors in sterilization technologies, particularly related to health issues worldwide. Along with this, the development in semiconductor technology invariably gives rise to the coming of miniaturized and more energy-efficient which are both highly sensitive and accurate.

Seeing as industries shift towards smart sensing solutions, UV sensors are emerging as a vital component in the future progression in environmental control, health care, and industrial safety applications.

Tremendous growth has been attained in this industry owing to its application in consumer electronics, industrial safety, healthcare, and environmental monitoring. UV sensors are used in consumer electronics, from personal health management and wearable technology to smartphones that provide an indication of exposure to the UV spectrum. The uses are growing in applications for medical and disinfection including sterilization qualification within hospital and air purifier industry.

Another important catalyst for the growth is environmental monitoring that incorporates their use within weather stations (such as automatic meteorological stations or meteorological data acquisition systems) and pollution control systems to monitor high levels of harmful UV radiation.

However, as the technology of IoT and smart sensors finally becomes cheaper, efficient, and small, even basic options may become fairly inexpensive. Compliance with the regulations is paramount, particularly in healthcare and industrial sectors, where precise and reliable sensors are in high demand. The growth rate of the industry is likely to maintain as industries focus on safety and sustainability.

During 2020 to 2024, the industry experienced rapid growth as a result of growing awareness of monitoring UV radiation, the rise in skin cancer, and the development of wearable health devices. Use of UVA, UVB, and UVC sensors increased in consumer electronics, healthcare, and industrial uses. Companies like Vishay, Silicon Labs, and ams-OSRAM introduced miniaturized, high-accuracy for smartphones, wearables, and environmental monitoring systems.

Governments became more stringent in occupational UV exposure regulations, generating strong demand in agriculture, construction, and automotive applications. Sensor calibration problems, low sensitivity under low-light conditions, and high production cost, however, slowed mass deployment.

Despite them, embedded UV sensors in IoT air quality monitoring systems became popular. Between 2025 to 2035, the industry will transform with artificial intelligence-driven UV exposure monitoring, flexible printed sensors, and quantum dot-based sensing technologies. Next-generation technology will focus on real-time UV risk examination, internal UV-sensing smart wearables, and ultra-high-sensitivity biosensors for medical diagnostics.

5G and edge computing will collaboratively enable real-time UV monitoring of outdoor laborers, sport players, and vulnerable groups. The advancements of self-powering UV sensors utilizing Nano generators will make them less power-hungry and thus best suited for use in industrial protection and wearables. UV sensors will be fully autonomous, AI-optimized sensing devices by 2035, enhancing health protection, environmental safety, and industrial automation.

Comparative Market Shift Analysis from 2020 to 2024 vs. 2025 to 2035

| 2020 to 2024 | 2025 to 2035 |

|---|---|

| Growing concern with UV exposure risk and regulatory pressure. | Growth in wearables, medical, and industrial applications. |

| Smart UV sensing based on AI and smart textiles. | Embedment in autonomous UV hazard detection for safety applications. |

| UVA, UVB, and UVC sensors for personal and environmental monitoring. | Smartphones and IoT -enabled air quality integration. |

| Nanogenerator - and quantum dot-powered UV sensors. | AI-based biosensors for skin diagnosis and healthcare. |

| High cost of production and calibration sensitivity in low illumination conditions. | Narrow precision in tracking real-time UV exposure. |

| Requirements for ultra-highly sensitive self-sustained UV sensors. | Integration complexities with flexible and smart textile devices. |

| Transition from discreet towards integrated IoT. | Greater usage with health monitoring and industrial safety applications. |

| Autonomous UV monitoring system for predictive insight. | Smart fabrics and AI-facilitated detection in field applications. |

| Applied to consumer electronics, medical devices, and industrial UV monitoring. | Increased need for compliance with regulations in occupational safety. |

| Integrated into wearables, sports equipment, and industrial safety systems. | AI-controlled UV monitoring transforming environmental and health protection. |

The industry is experiencing steady growth due to growing applications in environmental monitoring, healthcare, consumer electronics, and industrial safety. However, there are various threats like technological limitations, high production cost, regulatory problems, and industry competition that can hamper its growth and application.

Technological limitations and calibration problems remain significant threats. UV sensors need to provide high accuracy and stability but are prone to error caused by external factors like temperature change, humidity, and sensor aging. Sensor hardness needs to be enhanced, methods for calibration enhanced, and AI-based error correction systems integrated for reliability of performance.

High manufacturing expenses and material constraints pose financial threats. UV sensors must be designed using specialized semiconductors such as gallium nitride (GaN) or silicon carbide (SiC), driving production expenses higher. Miniaturization and integration with IoT devices also drive development expenses higher.

Extensive competition in the industry and technology advancements at high speed also pose challenges. Established companies and new players compete with each other for industry dominance. Moreover, future developments in wearable sensors, nanotechnology, and other detection approaches may divert demand from traditional options. In order to minimize this threat, companies should allocate funds to R&D, focus on product differentiation, and develop strategic alliances in order to maintain their industry position.

Despite such issues, the industry is promising in terms of growth, given that demand is being fueled by the increasing need for UV exposure awareness, environmental monitoring, and industrial safety. Such companies would be well-positioned to compete if they manage to get across the technology hurdles, reduce costs, and meet rules and regulations.

UV phototubes account for 40.3% of the industry in 2025 and light sensors 34.6% - high figures that underline the prominence in these industries.

UV sensors are particularly well suited for ultraviolet detection due to their high sensitivity and accuracy, which have a lot of non-experimental applications like industrial flame detection and sterilization systems. These sensors find other applications, including environmental monitoring, particularly the detection of ozone depletion and ultraviolet levels.

Major players operating in the industry, such as Hamamatsu Photonics and Thorlabs, are dominating this segment by designing innovative UV phototubes for high-accuracy applications. UV phototube demand will remain strong based on healthcare, industrial safety, and environmental awareness.

Conversely, light sensors (35.6% of market share) are rapidly becoming popular across automotive and consumer electronics and IoT applications. Such sensors, once added to the increasing number of wearables and smartwatches, help consumers measure their level of exposure to UV rays for both sun protection and health.

Silicon Labs and Vishay Inter technology, for instance, sell small, energy-efficient ultraviolet light sensors designed for smart home devices, self-driving cars, and automated lighting systems. The growth of the UV segment is primarily driven by the rising presence of UV light sensors in automotive safety and consumer electronics.

UV phototubes and light sensors are undergoing considerable improvements, with industrial applications boosting demand for UV phototubes and light sensors experiencing growth through the consumer and automotive sectors. Owing to the increasing awareness of UV exposure and automation, the Industry is anticipated to record steady growth.

The industry in 2025 is divided into end users, with the medical & healthcare sector holding 25.3% and the pharmaceutical industry following with 21.7%.

The medical & healthcare industry is expected to grow at the fastest growth rate due to the rising deployment in various sterilization methods and disinfection systems as well as wearable health monitoring systems. Hospitals and diagnostic centers use disinfection systems to mitigate hospital-acquired infections (HAIs).

Additionally, UV sensors embedded in smart wearables from companies like Apple, Fitbit, and Garmin allow consumers to monitor their UV exposure, supporting skin and eye health. These are some of the reasons why UV sensors are increasingly being used in medicine.

The pharmaceutical industry, with a 21.7% market share, also uses UV sensors in quality control, drug development, and UV sterilization processes. UV sensors are essential for accurate light exposure during the pharmaceutical synthesis process, improving drug stability and safety. Merck KGaA and Pfizer are some of the companies realizing stringent standards using UV sensor technology in manufacturing and R&D. In addition, UV Sensors also play a role in the sterilization of pharmaceutical packaging to avoid contamination.

Technological innovations and regulatory requirements will help maintain demand in both sectors. Due to the continuous investments in UV-based safety and quality control measures employed by healthcare facilities and pharmaceutical companies, the industry is projected to witness steady growth in the fourth.

| Countries | CAGR (2025 to 2035) |

|---|---|

| USA | 7.2% |

| UK | 6.8% |

| France | 6.5% |

| Germany | 7% |

| Italy | 6.3% |

| South Korea | 7.5% |

| Japan | 7.1% |

| China | 8.2% |

| Australia | 6.7% |

| New Zealand | 6.4% |

The USA industry will be the industry leader at a growth rate of 7.2% during 2025 to 2035. The leadership is due to huge investments in research and development processes, growing adoption of smart devices, and imposition of strict regulations on monitoring of UV radiation in industrial and healthcare sectors. The growth is further fueled by increasing demand in environmental monitoring and water filtration applications. With a large number of important players, the USA industry is anticipated to witness long-term growth.

The UK industry will grow at 6.8% CAGR through the forecast period. Increasing applications in consumer electronics and healthcare fuel this. It has been at the forefront of manufacturing sophisticated sensor technologies, especially environmental monitoring. Environmental control via air and water policies by the government continues to be a major driver of industry expansion. In addition, the availability of major producers and rising demand for wearable UV sensing devices are promoting industry growth.

France's industry is anticipated to register a CAGR of 6.5% during the forecast period of 2025 to 2035. The sensors are increasingly being adopted in applications within automotive, aerospace, and smart cities segments. The country's strong industrial infrastructure and government regulation of work safety are driving the adoption of the sensors. In addition, public health awareness regarding the harmful impacts of UV radiation is driving the adoption of personal UV monitoring devices.

Germany is likely to see a CAGR of 7% in the Industry during the forecast period. The robust automotive and industrial sectors in the country are key consumers for curing materials and quality inspection. Pursuits for environmental sustainability in Germany, along with government subsidies for intelligent infrastructure, are stimulating the industry. The presence of global sensor companies as headquarters locations also supports the growth of the industry.

The Italian industry is expected to expand at a 6.3% CAGR. Increasing applications in solar parks and industries are primarily driving Italian demand. Greater interest from the government of Italy towards renewable power generation and preserving the environment is causing the installation in solar parks. The country's fashion and cosmetics industry is also integrating UV sensor technology into fashion goods and beauty care products.

South Korea is expected to achieve a CAGR of 7.5% in the industry during the forecast period. The developments in consumer electronics and semiconductor manufacturing in the country fuel the growth. South Korea is also at the forefront of wearable technology, with smartwatches and fitness trackers incorporating the sensors. Moreover, the increasing uses in robotics and industrial automation are fueling industry growth.

Japan's industry is anticipated to expand at a rate of 7.1% between 2025 and 2035. Japan's focus on precision technology and automation is driving demand in the electronics and automotive sectors. Japan's aging population is also driving the use in medical devices to protect against harmful radiation. Additionally, studies on UV-based sterilization methods are driving industry growth in the medical field.

China will experience the highest growth rate among the countries under study, at a CAGR of 8.2%. Urbanization and industrialization in the nation are generating massive demand for water and air quality monitoring. Government green protection policies and smart city development policies are also driving the industry. China's robust consumer electronics industry, especially smartphones and wearables, is another significant growth driver.

The Australian industry is expected to register a CAGR of 6.7%. The country has experienced severe exposure to UV radiation, prompting high usage of personal UV monitoring equipment. Governmental emphasis on renewable energy and environmental monitoring is further driving the demand for solar energy system sensors. The Australian healthcare industry is also embracing UV sensor technology to help avoid skin cancer and identify it at an early age.

New Zealand is expected to observe a CAGR of 6.4% in the industry over the forecast period. New Zealand has high rates of skin cancer, and significant measures have been taken by the country towards stopping ozone layer depletion, driving the adoption. The agricultural sector of New Zealand also employs UV sensors to analyze the exposure of crops and optimize the growth environment. Further, the growing trend for smart home systems is seeing UV-based IoT products evolve.

The industry is growing rapidly with rising concern about the impact of UV radiation and increasing demand for monitoring solutions across industries. Growth is driven by sensor technology advancements, increasing use of sensors in consumer electronic products and regulatory needs for UV monitoring in health care, environmental, and industrial uses. Increasing use of smart devices, smart UV monitoring systems on IoT, and semiconductor technology advancements drive industry growth.

The industry leader is STMicroelectronics, which is known for high-tech UV sensor solutions for consumer and industrial electronic markets. It is a leader in UV sensor integration with a focus on high-performance and low-power solutions for wearable electronics, healthcare, and smart home automation.

Broadcom Inc. holds a robust industry share with diversified high-performance and reliability UV sensors. Broadcom sensors have widespread applications in a wide range of industries, such as telecommunication, automobile and industrial automation, where accuracy and reliability are under extreme stress.

Apogee Instruments, Inc. is a producer of precise UV sensors employed in environmental monitoring, agricultural studies, and scientific applications. It is a specialist in high-precision used in weather stations, greenhouse monitoring, and climate research.

Davis Instruments is a specialist in UV sensor solutions employed in weather observation, environmental monitoring and data acquisition systems. Its solutions are extensively applied in public health monitoring, industrial safety, and meteorology to support compliance with ecological standards.

Panasonic Corporation employs the technological capability of its electronic components in making UV sensors according to the competitive demands of the automotive and consumer electronics sectors. Panasonic UV sensors are used in car safety devices, air condition monitoring, and wearable health care products. Its competitors are making R&D, partnerships and acquisitions as industry competition expands to cover more industry territories and provide advanced UV sensor technology.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| STMicroelectronics | 17.1% |

| Apogee Instruments, Inc. | 17.2% |

| Broadcom Inc. | 17.3% |

| Davis Instruments | 17.4% |

| Panasonic Corporation | 17.5% |

| Other Companies (combined) | 13.5% |

| Company Name | Key Offerings/Activities |

|---|---|

| STMicroelectronics | Advanced sensors for electronics and industrial applications. |

| Apogee Instruments, Inc. | Precision sensors for research and agricultural monitoring. |

| Broadcom Inc. | High-performance sensors for telecom and automation sectors. |

| Davis Instruments | S ensors for environmental data collection and analysis. |

| Panasonic Corporation | S ensors for automotive and consumer electronics industries. |

Key Company Insights

STMicroelectronics (17.1%)

STMicroelectronics leads the industry with advanced technologies tailored for consumer electronics and industrial uses.

Apogee Instruments, Inc. (17.2%)

Apogee Instruments, Inc. specializes in precision UV sensors designed for agricultural research and environmental monitoring.

Broadcom Inc. (17.3%)

Broadcom Inc. maintains a strong industry presence through a diverse portfolio of high-performance UV sensors widely adopted in telecommunications and industrial automation sectors.

Davis Instruments (17.4%)

Davis Instruments provides UV sensor solutions for environmental monitoring, weather tracking, and data collection applications.

Panasonic Corporation (17.5%)

Panasonic Corporation offers UV sensors designed for automotive and consumer electronics industries.

Other Key Players (13.5% Combined)

By type, the industry is segmented into UV phototubes, light sensors, and UV spectrum sensors.

By end user, the industry is segmented into pharmaceutical, automotive, medical & healthcare, consumer electronics, chemical, food & beverages, and others.

By region, the industry spans North America, Latin America, Western Europe, Eastern Europe, South Asia and Pacific, East Asia, and the Middle East & Africa (MEA).

The industry is expected to reach USD 211.2 million in 2025.

The industry is projected to grow to USD 956.1 million by 2035.

China is expected to experience significant growth, with a CAGR of 8.2% during the forecast period.

The UV phototubes segment is one of the most popular categories in the industry.

Leading companies include STMicroelectronics, Apogee Instruments, Inc., Broadcom Inc., Davis Instruments, Panasonic Corporation, LAPIS Semiconductor Co., Ltd., Solar Light Company, Inc., Silicon Laboratories, Vernier Software & Technology LLC, and Shade.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by End User, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End User, 2018 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Type, 2018 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End User, 2018 to 2033

Table 31: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: South Asia and Pacific Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 34: South Asia and Pacific Market Volume (Units) Forecast by Type, 2018 to 2033

Table 35: South Asia and Pacific Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 36: South Asia and Pacific Market Volume (Units) Forecast by End User, 2018 to 2033

Table 37: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 39: East Asia Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 40: East Asia Market Volume (Units) Forecast by Type, 2018 to 2033

Table 41: East Asia Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 42: East Asia Market Volume (Units) Forecast by End User, 2018 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Type, 2018 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Type, 2018 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End User, 2018 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End User, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End User, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 13: Global Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End User, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End User, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 31: North America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End User, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End User, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End User, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End User, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End User, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End User, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: South Asia and Pacific Market Value (US$ Million) by Type, 2023 to 2033

Figure 92: South Asia and Pacific Market Value (US$ Million) by End User, 2023 to 2033

Figure 93: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 96: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: South Asia and Pacific Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 99: South Asia and Pacific Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 100: South Asia and Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: South Asia and Pacific Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 103: South Asia and Pacific Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 104: South Asia and Pacific Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 105: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 106: South Asia and Pacific Market Attractiveness by Type, 2023 to 2033

Figure 107: South Asia and Pacific Market Attractiveness by End User, 2023 to 2033

Figure 108: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 109: East Asia Market Value (US$ Million) by Type, 2023 to 2033

Figure 110: East Asia Market Value (US$ Million) by End User, 2023 to 2033

Figure 111: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 113: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 114: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: East Asia Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 117: East Asia Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 118: East Asia Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 119: East Asia Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 120: East Asia Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 121: East Asia Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 122: East Asia Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 123: East Asia Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 124: East Asia Market Attractiveness by Type, 2023 to 2033

Figure 125: East Asia Market Attractiveness by End User, 2023 to 2033

Figure 126: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End User, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Type, 2018 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Type, 2018 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End User, 2018 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End User, 2018 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End User, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End User, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End User, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UV-C Sterilizing Conveyors Market Analysis - Size and Share Forecast Outlook 2025 to 2035

UV Curable Resin and Formulated Products Market Size and Share Forecast Outlook 2025 to 2035

UV Stabilized Films Market Size and Share Forecast Outlook 2025 to 2035

UV Absorbers Market Size and Share Forecast Outlook 2025 to 2035

UV Cured Coatings Market Size and Share Forecast Outlook 2025 to 2035

UV-Protecting Polymers Market Size and Share Forecast Outlook 2025 to 2035

UV-C LED Market Size and Share Forecast Outlook 2025 to 2035

UV Adhesives Market Size and Share Forecast Outlook 2025 to 2035

UV and Light Sensitive Packaging Market Size and Share Forecast Outlook 2025 to 2035

UV-Blocking Transparent Film Market Size and Share Forecast Outlook 2025 to 2035

UV Curable Coatings Market Size and Share Forecast Outlook 2025 to 2035

UVI Stretch Films Market Size and Share Forecast Outlook 2025 to 2035

UV Protected Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

UVC Disinfection Product Market Report – Demand, Trends & Forecast 2025–2035

Uveal Melanoma Treatment Market – Growth & Forecast 2025 to 2035

UV LED Printers Market Growth - Trends & Forecast 2025 to 2035

UV LED Market by Technology, Application, and Region – Growth, Trends, and Forecast through 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

Market Share Insights of UV Stabilized Films Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA