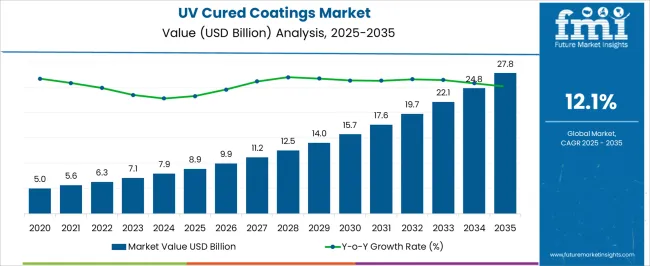

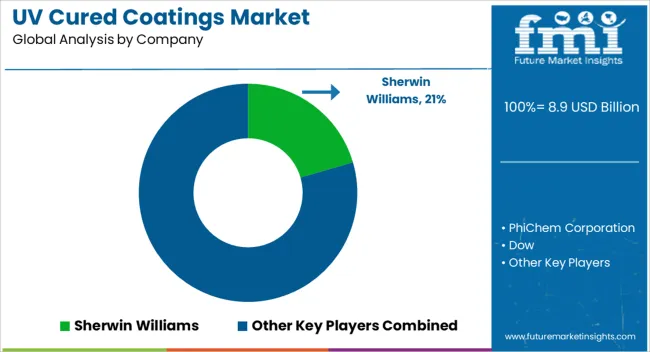

The UV Cured Coatings Market is estimated to be valued at USD 8.9 billion in 2025 and is projected to reach USD 27.8 billion by 2035, registering a compound annual growth rate (CAGR) of 12.1% over the forecast period.

| Metric | Value |

|---|---|

| UV Cured Coatings Market Estimated Value in (2025 E) | USD 8.9 billion |

| UV Cured Coatings Market Forecast Value in (2035 F) | USD 27.8 billion |

| Forecast CAGR (2025 to 2035) | 12.1% |

The UV Cured Coatings market is witnessing steady growth, driven by increasing demand for high-performance coatings across industrial, electronics, and automotive applications. The shift toward environmentally friendly and low-VOC coating solutions is accelerating adoption, as UV-curable formulations enable faster curing times, reduced energy consumption, and enhanced durability. Advancements in photoinitiator technology, resin chemistry, and UV lamp systems are improving performance characteristics, including adhesion, chemical resistance, and scratch resistance.

The growing need for precision coatings in electronics and high-value manufacturing sectors is supporting market expansion. In addition, regulatory pressures to reduce hazardous emissions and improve sustainability practices are encouraging manufacturers to adopt UV-curable technologies.

Continuous innovation in formulation and process optimization is enhancing versatility, allowing coatings to be applied across diverse substrates and applications As end-use industries increasingly prioritize operational efficiency, energy savings, and high-quality finishes, the UV Cured Coatings market is expected to sustain long-term growth, driven by technological advancements and rising adoption in specialized applications.

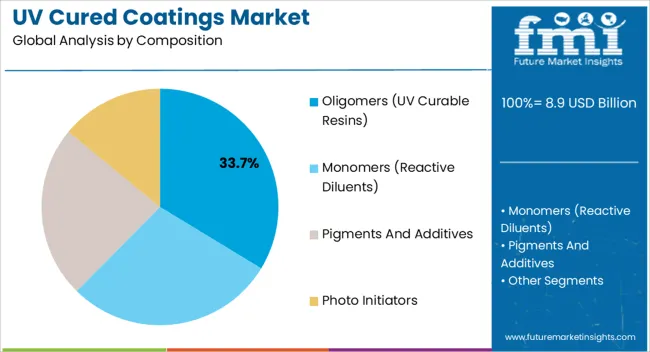

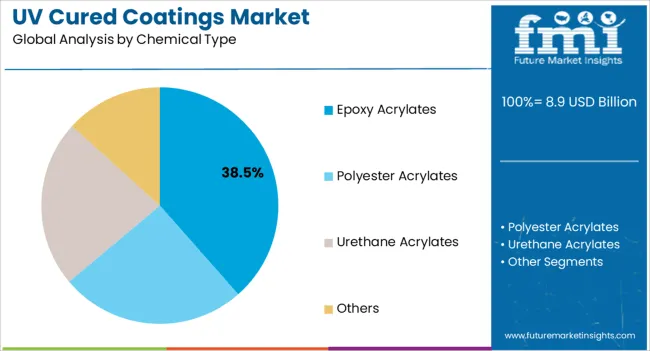

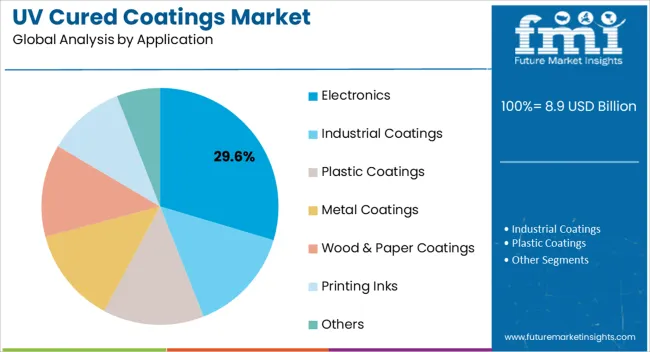

The uv cured coatings market is segmented by composition, chemical type, application, and geographic regions. By composition, uv cured coatings market is divided into Oligomers (UV Curable Resins), Monomers (Reactive Diluents), Pigments And Additives, and Photo Initiators. In terms of chemical type, uv cured coatings market is classified into Epoxy Acrylates, Polyester Acrylates, Urethane Acrylates, and Others. Based on application, uv cured coatings market is segmented into Electronics, Industrial Coatings, Plastic Coatings, Metal Coatings, Wood & Paper Coatings, Printing Inks, and Others. Regionally, the uv cured coatings industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The oligomers (UV curable resins) composition segment is projected to hold 33.7% of the UV Cured Coatings market revenue in 2025, establishing it as the leading composition type. Growth in this segment is being driven by the critical role oligomers play in defining the mechanical and chemical properties of the cured coating. Oligomers provide structural integrity, adhesion, and resistance to environmental stressors, which are essential for high-performance applications.

Continuous advancements in resin formulation and polymer chemistry are improving curing speed, surface finish, and durability, enhancing the overall performance of UV-cured coatings. The ability to tailor oligomer properties to specific industrial and electronics applications increases adoption, as manufacturers seek solutions that meet stringent performance and compliance standards.

Additionally, the compatibility of oligomers with various photoinitiators and additives allows for greater formulation flexibility As demand for fast-curing, durable, and environmentally compliant coatings rises across industries, the oligomers segment is expected to maintain its market leadership, supported by ongoing innovation and optimization in UV curable resin technologies.

The epoxy acrylates chemical type segment is expected to account for 38.5% of the market revenue in 2025, making it the leading chemical type. Growth is being driven by the superior adhesion, chemical resistance, and mechanical strength provided by epoxy acrylates, which are critical for high-performance coatings applications. These coatings are widely applied in industrial, electronics, and protective surfaces where durability, heat resistance, and chemical stability are essential.

Advancements in polymerization technology and formulation customization have enhanced the functionality and performance of epoxy acrylate-based coatings. The ability to combine fast curing with long-term durability allows manufacturers to achieve operational efficiency and reduce downtime in production processes.

Increasing demand for coatings in electronics manufacturing, where precise surface finish and protection against environmental stressors are required, further reinforces adoption As industries continue to prioritize sustainable, high-performance coatings solutions, the epoxy acrylates segment is expected to sustain its leading market position, driven by continuous technological improvements and alignment with regulatory compliance standards.

The electronics application segment is projected to hold 29.6% of the UV Cured Coatings market revenue in 2025, establishing it as the leading application area. Growth in this segment is being driven by the increasing demand for advanced coatings in electronic devices, printed circuit boards, and semiconductor components that require high precision, durability, and protection against moisture, dust, and chemical exposure. UV-curable coatings are preferred in electronics applications due to their fast curing times, low thermal impact, and ability to maintain surface integrity.

The integration of flexible, high-performance coatings enhances product reliability and extends device lifespan, which is critical for manufacturers. Advances in photopolymer technology and resin formulation have allowed coatings to meet stringent industry standards while supporting miniaturization and high-density electronic assemblies.

Regulatory requirements for low-VOC and environmentally compliant coatings are also boosting adoption in electronics manufacturing As demand for durable, fast-curing, and sustainable coatings rises in the electronics sector, this application segment is expected to continue driving market growth, supported by technological innovation and increasing product complexity.

According to the latest market survey conducted by Future Market Insights, the global UV Cured Coatings market is relishing a market valuation of US$ 6.3 Billion in 2025 and is all set to expand with a CAGR of 12.1% during the 2025 to 2035 period. The market is anticipated to top a valuation of US$ 19.7 Billion by the end of the forecast period.

| Attributes | Details |

|---|---|

| Market Size 2025 | US$ 6.3 Billion |

| Market Size 2035 | US$ 19.7 Billion |

| Value CAGR (2025 to 2035) | 12.1% |

| Collective Value Share: Top 3 Countries (2025E) | 35% to 40% |

UV curing, also known as ultraviolet curing, is a photochemical technique that uses intense ultraviolet light to immediately cure or dry inks, adhesives, or coatings. Compared to conventional curing and drying techniques like PVC coatings, UV coatings offers a number of advantages. UV curing coatings are widely utilized to enhance production efficiency and improve scratch and solvent resistance.

UV-cured coatings have higher productivity in less time, with less waste, no environmental pollutants, and no loss of coating thickness. Significant adoption of UV-cured coatings from various end-use industries such as automotive, telecommunications, glass and plastic decorations, and graphic arts is driving the growth of the global UV-cured coating market.

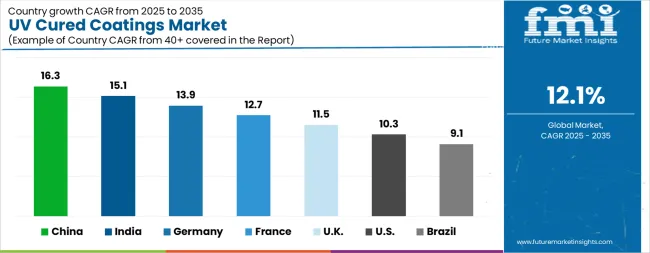

| Country | CAGR |

|---|---|

| China | 16.3% |

| India | 15.1% |

| Germany | 13.9% |

| France | 12.7% |

| UK | 11.5% |

| USA | 10.3% |

| Brazil | 9.1% |

The UV Cured Coatings Market is expected to register a CAGR of 12.1% during the forecast period, exhibiting varied country level momentum. China leads with the highest CAGR of 16.3%, followed by India at 15.1%. Developed markets such as Germany, France, and the UK continue to expand steadily, while the USA is likely to grow at consistent rates. Brazil posts the lowest CAGR at 9.1%, yet still underscores a broadly positive trajectory for the global UV Cured Coatings Market. In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 13.9%. The USA UV Cured Coatings Market is estimated to be valued at USD 3.2 billion in 2025 and is anticipated to reach a valuation of USD 8.6 billion by 2035. Sales are projected to rise at a CAGR of 10.3% over the forecast period between 2025 and 2035. While Japan and South Korea markets are estimated to be valued at USD 482.3 million and USD 276.9 million respectively in 2025.

| Item | Value |

|---|---|

| Quantitative Units | USD 8.9 Billion |

| Composition | Oligomers (UV Curable Resins), Monomers (Reactive Diluents), Pigments And Additives, and Photo Initiators |

| Chemical Type | Epoxy Acrylates, Polyester Acrylates, Urethane Acrylates, and Others |

| Application | Electronics, Industrial Coatings, Plastic Coatings, Metal Coatings, Wood & Paper Coatings, Printing Inks, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Sherwin Williams, PhiChem Corporation, Dow, Arshland Inc, BASF SE, Axalta Coatings Ltc, Akzonobel NV, and Dymax Corporation |

The global UV cured coatings market is estimated to be valued at USD 8.9 billion in 2025.

The market size for the UV cured coatings market is projected to reach USD 27.8 billion by 2035.

The UV cured coatings market is expected to grow at a 12.1% CAGR between 2025 and 2035.

The key product types in UV cured coatings market are oligomers (uv curable resins), monomers (reactive diluents), pigments and additives and photo initiators.

In terms of chemical type, epoxy acrylates segment to command 38.5% share in the UV cured coatings market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UV Coatings Market Growth & Forecast 2025 to 2035

UV Cured Acrylic Foam Tapes Market Insights - Trends & Growth Forecast 2024 to 2034

UV Curable Coatings Market Size and Share Forecast Outlook 2025 to 2035

UVC Upper Air Disinfection Unit Market Size and Share Forecast Outlook 2025 to 2035

UVC Surface Disinfection System Market Size and Share Forecast Outlook 2025 to 2035

Cured-in-Place Pipe (CIPP) Lining Services Market Size and Share Forecast Outlook 2025 to 2035

UV-C Sterilizing Conveyors Market Analysis - Size and Share Forecast Outlook 2025 to 2035

UV Curable Resin and Formulated Products Market Size and Share Forecast Outlook 2025 to 2035

UV Stabilized Films Market Size and Share Forecast Outlook 2025 to 2035

UV Absorbers Market Size and Share Forecast Outlook 2025 to 2035

UV-Protecting Polymers Market Size and Share Forecast Outlook 2025 to 2035

UV-C LED Market Size and Share Forecast Outlook 2025 to 2035

UV Adhesives Market Size and Share Forecast Outlook 2025 to 2035

UV and Light Sensitive Packaging Market Size and Share Forecast Outlook 2025 to 2035

UV-Blocking Transparent Film Market Size and Share Forecast Outlook 2025 to 2035

UVI Stretch Films Market Size and Share Forecast Outlook 2025 to 2035

UV Protected Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

UVC Disinfection Product Market Report – Demand, Trends & Forecast 2025–2035

Uveal Melanoma Treatment Market – Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA