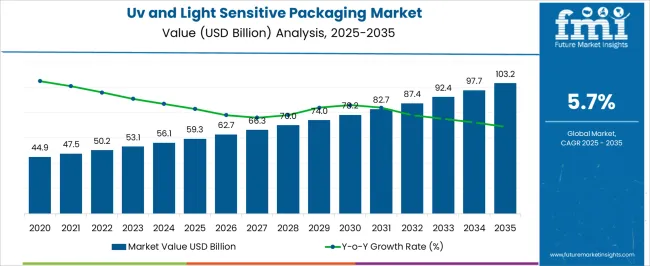

The UV and light sensitive packaging market, valued at USD 59.3 billion in 2025 and projected to reach USD 103.2 billion by 2035 at a CAGR of 5.7%, is positioned on a steady upward trajectory along the market maturity curve. Current adoption reflects an early growth stage where specialized applications in pharmaceuticals, cosmetics, and food sectors are driving penetration. The technology is still transitioning from niche to mainstream, as regulatory mandates for product safety and shelf-life extension encourage wider use.

Annual growth, averaging around 3 to 6 billion USD increments, illustrates consistent yet moderate adoption momentum. The adoption lifecycle indicates that innovators and early adopters are primarily concentrated among industries sensitive to light-induced degradation, particularly healthcare packaging. As the decade progresses, adoption is expected to expand into food and beverage and specialty chemicals, where protection against UV exposure ensures product integrity. This diffusion will shift the market toward the early majority stage by 2030, with enhanced cost efficiency and material innovation supporting broader acceptance.

The barriers, such as higher production costs, limited consumer awareness, and challenges in recyclability, still restrain full-scale penetration. By 2035, the industry will likely approach late growth phase maturity, with the adoption lifecycle indicating consolidation, regulatory standardization, and rising integration into circular packaging systems.

| Metric | Value |

|---|---|

| UV and Light Sensitive Packaging Market Estimated Value in (2025 E) | USD 59.3 billion |

| UV and Light Sensitive Packaging Market Forecast Value in (2035 F) | USD 103.2 billion |

| Forecast CAGR (2025 to 2035) | 5.7% |

The UV and light sensitive packaging market is assessed as an advanced niche within packaging technologies. It is estimated at 6.1% of the smart and intelligent packaging market, where photochromic and light barrier applications dominate. In the food and beverage packaging sector, a 2.8% share is evaluated, with dairy, beverages, and ready meals using UV blocking films to extend freshness.

Pharmaceutical and healthcare packaging adds a 3.4% share, ensuring drug formulations remain stable against photodegradation. Specialty chemical packaging contributes 2.2%, covering light reactive additives in polymer films. In active and protective packaging, a 4.6% share is observed, supported by the integration of UV absorbers and luminescent markers. Recent industry trends have been influenced by demand for product shelf life protection and visual engagement packaging. Breakthroughs include the development of UV shielding multilayer films, inks with light-triggered color change for tamper evidence, and biodegradable UV absorbers from bio-based compounds. Key players are pursuing collaborations with chemical companies to create food-safe light-blocking agents and digital authentication features.

Smart strategies include expansion of UV responsive labels for supply chain monitoring, deployment of nano coatings that filter specific light wavelengths, and the use of light sensitive polymers for premium branding. These advancements demonstrate how protective functionality is combined with interactive features, reshaping the role of packaging in safety and consumer engagement.

Rising awareness about the negative impact of light exposure on pharmaceuticals, cosmetics, and food products has prompted manufacturers to adopt advanced packaging solutions. Innovations in barrier materials, coatings, and intelligent packaging technologies have allowed companies to extend product stability and maintain aesthetic appeal.

Regulatory emphasis on safety and quality preservation is further accelerating adoption across developed and emerging markets. Manufacturers are also investing in recyclable and sustainable solutions to address environmental concerns without compromising protection standards.

The future outlook remains positive as technology advancements continue to enable enhanced performance, cost efficiency, and customisation for diverse applications. This market is expected to benefit from increasing industrial automation in packaging lines and expanding distribution networks that demand superior protective features for high-value products.

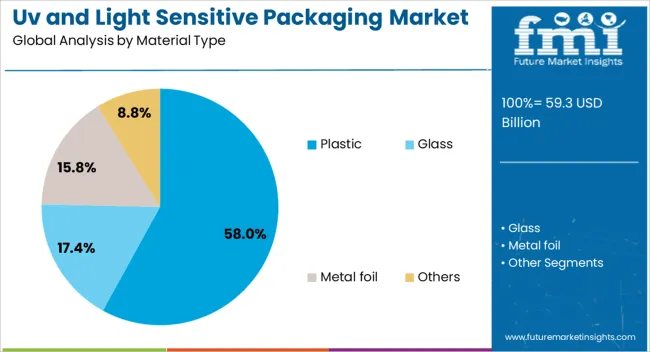

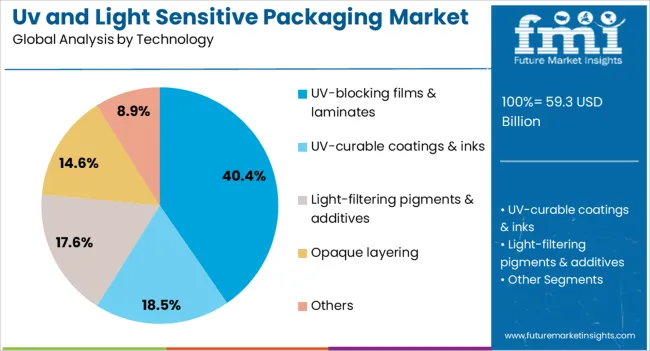

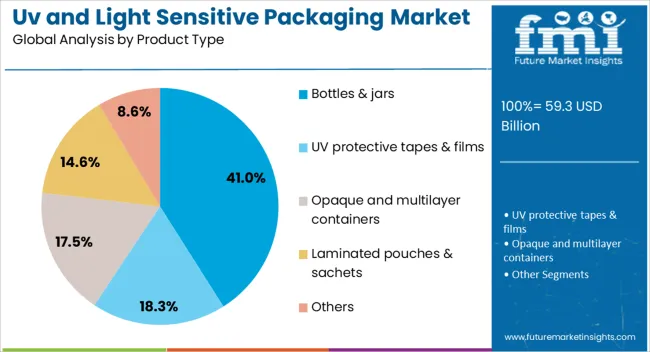

The UV and light-sensitive packaging market is segmented by material type, technology, product type, end-use industry, and geographic regions. By material type, UV and light sensitive packaging market is divided into Plastic, Glass, Metal foil, and Others. In terms of technology, UV and light sensitive packaging market is classified into UV-blocking films & laminates, UV-curable coatings & inks, Light-filtering pigments & additives, Opaque layering, and Others. Based on product type, UV and light sensitive packaging market is segmented into Bottles & jars, UV protective tapes & films, Opaque and multilayer containers, Laminated pouches & sachets, and Others.

By end use industry, UV and light sensitive packaging market is segmented into Food & beverage, Pharmaceuticals & healthcare, Cosmetics & personal care, Electronics, and Others. Regionally, the UV and light sensitive packaging industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic material type segment is anticipated to hold 58% of the UV and light-sensitive packaging market revenue share in 2025, making it the dominant material choice. Its growth has been supported by the versatility, lightweight nature, and cost efficiency of plastic in manufacturing high-barrier packaging. Plastic materials have been widely adopted for their ability to integrate UV-blocking additives and coatings during production, ensuring strong resistance to light-induced degradation.

Compatibility with diverse packaging formats and ease of molding into complex shapes have further contributed to its popularity. The ability to produce clear yet UV-protective designs has also supported demand in premium consumer goods.

Additionally, plastics offer scalability for mass production while maintaining consistent performance, which has made them a preferred choice for manufacturers looking to meet both performance and cost targets. Continuous advancements in recyclable and bio-based plastic materials are expected to strengthen the segment’s growth in the coming years.

The UV-blocking films and laminates technology segment is projected to account for 40.40% of the UV and light-sensitive packaging market revenue share in 2025, positioning it as the leading technology. This leadership is attributed to the superior protective properties and adaptability of UV-blocking films and laminates in safeguarding sensitive products. These materials are engineered to filter out harmful UV wavelengths while allowing necessary light transmission, enabling effective protection without compromising product visibility.

Their application across diverse packaging formats, including wraps, pouches, and container linings, has driven adoption in multiple industries. The technology’s ability to integrate with existing packaging lines without significant modifications has reduced implementation costs and encouraged widespread use.

Furthermore, ongoing innovation in multi-layer laminates has enhanced durability, barrier strength, and compatibility with sustainable materials, ensuring compliance with both performance and environmental standards.

The bottles and jars product type segment is expected to command 41% of the UV and Light Sensitive Packaging market revenue share in 2025, making it the leading product category. This segment’s dominance has been reinforced by its widespread use in packaging liquids, creams, and other sensitive formulations that require high protection against light exposure.

Bottles and jars offer structural rigidity, excellent sealing properties, and compatibility with a variety of closure systems, ensuring product integrity throughout storage and transport. The ability to incorporate UV-protective materials or coatings directly into the packaging structure has strengthened their role in premium and mass-market applications.

Their reusability and ease of branding have also contributed to their popularity among manufacturers aiming to enhance consumer engagement. The segment’s growth is further supported by demand from industries such as pharmaceuticals, cosmetics, and specialty food products, where product quality retention is a decisive factor in purchasing decisions.

UV and light sensitive packaging has been applied across food, beverage, pharmaceutical, and cosmetic sectors where product stability is compromised by light induced degradation. Formats include bottles, pouches, films, and cartons that incorporate pigments, coatings, or additives to block or filter harmful wavelengths. Active and intelligent packaging concepts have also been advanced, integrating photochromic inks and light indicators for tamper visibility and freshness cues. The market has been shaped by performance demands in shelf life protection, regulatory compliance, and brand differentiation strategies.

Light induced oxidation, nutrient loss, and color fading have been significant challenges in packaged dairy, juices, edible oils, and beer. UV barrier bottles, multilayer PET containers, and film laminates containing absorbers have been developed to extend freshness and prevent sensory deterioration. Brown and green tinted glass has been preferred in alcoholic beverages, while polymer packaging has adopted titanium dioxide and organic UV blockers for transparency retention. Shelf ready packs with integrated barrier properties have reduced reliance on secondary packaging. Growing demand for extended distribution in chilled and ambient supply chains has reinforced reliance on UV and light resistant formats. This dynamic has been further shaped by consumer expectations of taste consistency and premium appearance across competitive beverage and dairy categories.

Photodegradation has been a critical concern in the storage of antibiotics, vitamins, ophthalmic solutions, and biological drugs. Amber glass bottles and multilayer polymer vials have been adopted widely to protect light sensitive compounds. Regulatory authorities have required stability studies under defined light exposure conditions, driving adoption of packaging with proven UV resistance. Blister packs with pigmented films and UV protective coatings have been employed to secure tablets and capsules. Nutraceuticals containing carotenoids, omega oils, and herbal extracts have also utilized tinted PET jars and pouches. Manufacturers have invested in controlled barrier solutions that preserve efficacy throughout distribution. This demand has been reinforced by growing global movement of sensitive pharmaceuticals and strict compliance needs across multiple regulatory jurisdictions.

Material science advances have enabled packaging with high clarity combined with UV blocking by using nanoparticles, organic absorbers, and thin film coatings. Biopolymer based solutions have emerged with integrated light resistance, addressing demands for renewable material options. Smart packaging applications using photochromic inks and light responsive labels have introduced interactive elements for authentication and freshness monitoring. Coatings with selective wavelength filters have allowed premium products to retain visibility while blocking harmful radiation. Digital printing advancements have enabled brand messaging alongside UV blocking without compromising protective functions. These innovations have widened applications across cosmetics, premium beverages, and healthcare packaging where differentiation and safety are both critical.

Regulatory frameworks for food contact safety and pharmaceutical packaging have necessitated controlled use of UV stabilizers, pigments, and additives. Migration limits and toxicological assessments have been enforced, influencing material choice and formulation. Pressure to improve recyclability has led to demand for mono-material structures with integrated UV barriers, reducing challenges in recovery and sorting. Brands have also focused on lightweighting and reducing pigment load while retaining protection. Competition from alternative formats such as aluminum cans and opaque cartons has challenged polymer packaging, but visual merchandising benefits have kept interest in transparent UV protective options. Rising scrutiny of additives has driven the development of non-migratory coatings and inherently resistant polymer grades. These regulatory and sustainability factors continue to shape innovation priorities and strategic positioning within the UV and light-sensitive packaging market.

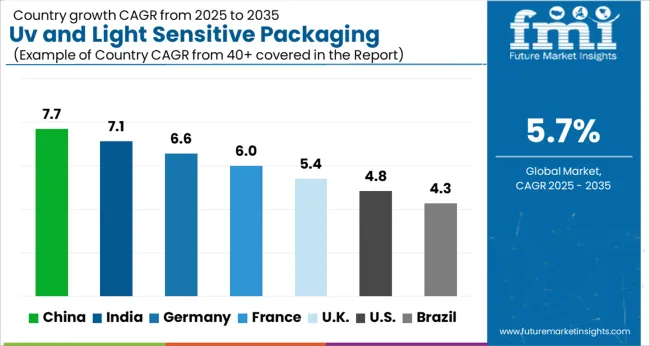

| Country | CAGR |

|---|---|

| China | 7.7% |

| India | 7.1% |

| Germany | 6.6% |

| France | 6.0% |

| UK | 5.4% |

| USA | 4.8% |

| Brazil | 4.3% |

China achieved the strongest expansion in the market with a forecast growth rate of 7.7%, supported by growing applications in pharmaceuticals, food safety, and specialty chemicals. India followed with 7.1%, where demand from the healthcare sector and rising packaged food consumption created consistent opportunities. Germany recorded 6.6%, driven by advancements in smart packaging technologies and emphasis on consumer safety standards.

The United Kingdom registered 5.4%, supported by active research in intelligent packaging materials and regulatory focus on product protection. The United States stood at 4.8%, where rising adoption in biologics and premium food products sustained the market outlook. Collectively, these countries highlight how safety, innovation, and functionality drive the global landscape of UV and light-sensitive packaging. This report includes insights on 40+ countries; the top markets are shown here for reference.

China is expanding at a CAGR of 7.7% in the market, supported by its strong pharmaceutical, food, and cosmetics industries. Growing awareness of product safety and extended shelf life is encouraging the use of protective packaging solutions that block harmful light exposure. Packaging firms in China are focusing on developing advanced coatings and barrier films that ensure the quality preservation of sensitive products. Rising investment in smart packaging technologies, along with regulatory emphasis on product safety, is further shaping market direction. With an increasing demand for premium packaged products and expanding e-commerce channels, China is expected to remain a key growth hub in the global UV and light-sensitive packaging landscape.

India is recording a CAGR of 7.1% in the market, largely influenced by its growing pharmaceutical and food processing sectors. Rising consumer demand for safe packaging in dairy, beverages, and healthcare products is driving innovation. Domestic packaging manufacturers are investing in materials with advanced UV protection to maintain quality during storage and transport. The shift toward sustainable packaging solutions is also impacting market strategies, as companies look to balance safety and eco-friendliness. With increasing demand from both urban and semi-urban areas, supported by retail expansion, India is becoming a significant market for protective packaging technologies.

Germany is progressing at a CAGR of 6.6% in the market, with strong demand from pharmaceuticals, cosmetics, and premium food segments. The country emphasizes high-quality, regulatory-compliant packaging that ensures safety and product integrity. German manufacturers are pioneering the development of multi-layer films and advanced coatings to enhance light protection. Sustainability remains central to packaging innovation, with companies adopting recyclable and bio-based materials. Rising exports of pharmaceutical and cosmetic products are also contributing to demand for advanced light-protective solutions. Germany continues to be a leader in Europe, setting benchmarks for packaging technology and compliance.

The United Kingdom is witnessing a CAGR of 5.4% in the market, supported by increased reliance on packaged pharmaceuticals, cosmetics, and premium foods. The rising influence of online retail and direct-to-consumer brands is boosting demand for secure and protective packaging. Packaging firms are focusing on innovation in lightweight UV-resistant materials that balance safety with sustainability. Collaboration between packaging companies and healthcare firms is strengthening the market, particularly in specialized product categories. With strong consumer demand for authenticity and safety in packaging, the UK market is expected to maintain steady growth.

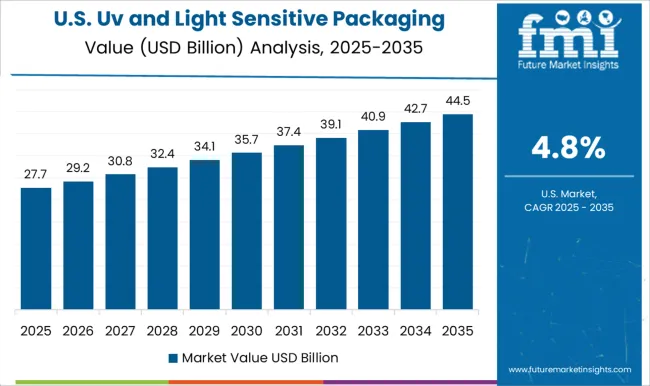

The United States is expanding at a CAGR of 4.8% in the market, driven by strong demand from pharmaceuticals, nutraceuticals, and beverage industries. Packaging producers are introducing advanced UV protective coatings and films to extend product shelf life. Sustainability remains a pressing factor, with companies seeking recyclable and renewable materials without compromising protective functions.

The presence of leading packaging technology firms is also fueling innovation, particularly in food safety applications. With consumer expectations around product integrity rising and regulatory standards becoming stricter, the US market is expected to experience steady development in the coming years.

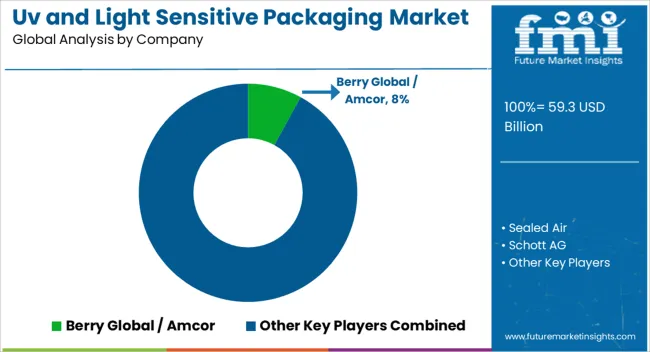

The market is driven by strong participation from global leaders in packaging, glass manufacturing, and advanced materials, each contributing through specialized expertise. Berry Global and Amcor are among the most influential players, offering extensive portfolios of flexible and rigid packaging with advanced UV barrier technologies that safeguard sensitive products, particularly in pharmaceuticals and personal care.

Sealed Air adds value with its protective packaging films engineered with coatings that extend product stability by minimizing UV penetration. Schott AG has established a firm position through its high-performance glass packaging solutions, widely adopted in the pharmaceutical and biotech sectors. Nitto Denko Corporation contributes with adhesive and protective film innovations that enhance durability and safety in light-sensitive packaging.

Gerresheimer AG leverages its strength in pharmaceutical glass and plastics to provide UV-resistant containers tailored for healthcare needs. Owens-Illinois Inc. and Bormioli Pharma are also integral players, supplying specialized glass packaging that maintains product integrity under UV exposure. Together, these companies influence the evolution of packaging technologies by combining material science expertise with application-specific designs to meet the rising demand for safe, reliable, and high-performance solutions across global markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 59.3 Billion |

| Material Type | Plastic, Glass, Metal foil, and Others |

| Technology | UV-blocking films & laminates, UV-curable coatings & inks, Light-filtering pigments & additives, Opaque layering, and Others |

| Product Type | Bottles & jars, UV protective tapes & films, Opaque and multilayer containers, Laminated pouches & sachets, and Others |

| End Use Industry | Food & beverage, Pharmaceuticals & healthcare, Cosmetics & personal care, Electronics, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Berry Global / Amcor, Sealed Air, Schott AG, Nitto Denko Corporation, Gerresheimer AG, Owens-Illinois Inc., and Bormioli Pharma |

| Additional Attributes | Dollar sales by packaging type and application, demand dynamics across food, beverage, and pharmaceutical sectors, regional trends in smart packaging adoption, innovation in UV protection, light filtration, and material performance, environmental impact of packaging waste and recycling, and emerging use cases in product safety, shelf-life extension, and premium packaging solutions. |

The global UV and light sensitive packaging market is estimated to be valued at USD 59.3 billion in 2025.

The market size for the UV and light sensitive packaging market is projected to reach USD 103.2 billion by 2035.

The UV and light sensitive packaging market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types in UV and light sensitive packaging market are plastic, polyethylene terephthalate (PET), polypropylene (PP), polyvinyl chloride (PVC), others, glass, amber glass, flint glass with coatings, metal foil and others.

In terms of technology, uv-blocking films & laminates segment to command 40.4% share in the UV and light sensitive packaging market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

UV Stabilized Films Market Size and Share Forecast Outlook 2025 to 2035

UV Absorbers Market Size and Share Forecast Outlook 2025 to 2035

UV Cured Coatings Market Size and Share Forecast Outlook 2025 to 2035

UV-Protecting Polymers Market Size and Share Forecast Outlook 2025 to 2035

UV-C LED Market Size and Share Forecast Outlook 2025 to 2035

UV Adhesives Market Size and Share Forecast Outlook 2025 to 2035

UV-Blocking Transparent Film Market Size and Share Forecast Outlook 2025 to 2035

UV Curable Coatings Market Size and Share Forecast Outlook 2025 to 2035

UVI Stretch Films Market Size and Share Forecast Outlook 2025 to 2035

UV Protected Tarpaulin Sheets Market Size and Share Forecast Outlook 2025 to 2035

UV Tapes Market Growth - Trends & Forecast 2025 to 2035

UVC Disinfection Product Market Report – Demand, Trends & Forecast 2025–2035

Uveal Melanoma Treatment Market – Growth & Forecast 2025 to 2035

UV LED Printers Market Growth - Trends & Forecast 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

UV LED Market by Technology, Application, and Region – Growth, Trends, and Forecast through 2025 to 2035

UV Coatings Market Growth & Forecast 2025 to 2035

Market Share Insights of UV Stabilized Films Providers

UV Cured Acrylic Foam Tapes Market Insights - Trends & Growth Forecast 2024 to 2034

UV Conveyor Systems Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA