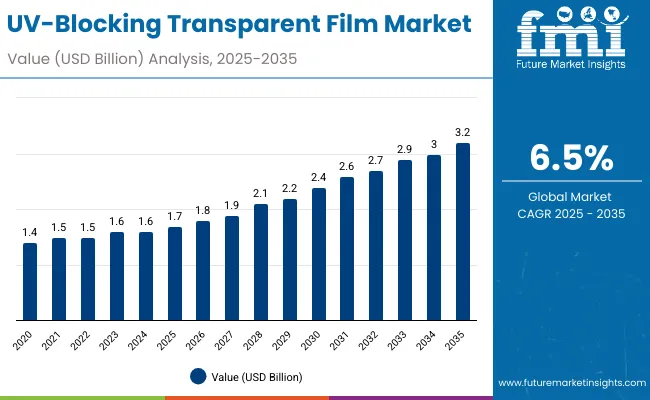

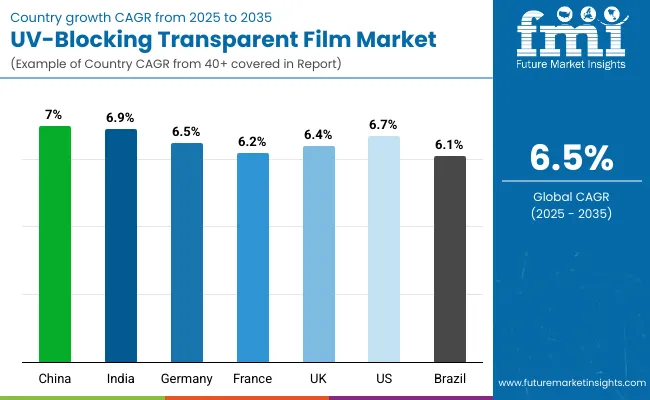

The UV-blocking transparent film market is expected to grow from USD 1.7 billion in 2025 to USD 3.2 billion by 2035, resulting in a total increase of USD 1.5 billion over the forecast decade. This represents an 88.2% total expansion, with the market advancing at a compound annual growth rate of 6.5%. Over ten years, the market grows by a 1.9 multiple.

| Metric | Value |

|---|---|

| UV-Blocking Transparent Film Market Estimated Value in (2025 E) | USD 1.7 billion |

| UV-Blocking Transparent Film Market Forecast Value in (2035 F) | USD 3.2 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

In the first half (2025-2030), the market progresses from USD 1.7 billion to USD 2.3 billion, contributing USD 0.6 billion, or 40.0% of total decade growth. This phase is shaped by rising use in food packaging and automotive applications, where protection against UV degradation is essential. Demand is further supported by consumer preference for longer shelf life and product safety.

In the second half (2030-2035), the market grows from USD 2.3 billion to USD 3.2 billion, adding USD 0.9 billion, or 60.0% of the total growth. This acceleration is supported by innovations in multilayer polymer films, bio-based UV stabilizers, and integration into electronics packaging. Expanding applications in construction and pharmaceuticals further drive growth, positioning UV-blocking films as a critical material in protective packaging solutions.

From 2020 to 2024, the UV-blocking transparent film market expanded from USD 1.3 billion to USD 1.6 billion, driven by demand in food packaging, electronics, and construction applications where UV degradation is a concern. Nearly 70% of revenues came from established packaging and film manufacturers supplying multi-layer protective films. Leaders such as Toray Industries, Eastman Chemical, and DuPont emphasized optical clarity, UV shielding, and mechanical durability. Differentiation was defined by film thickness control, recyclability, and resistance to yellowing, while smart indicator films remained secondary. Service-driven offerings such as performance audits contributed under 15% of revenues, as manufacturers primarily invested in direct procurement of advanced films.

By 2035, the UV-blocking transparent film market will reach USD 3.2 billion, growing at a CAGR of 6.50%, with eco-friendly, multi-functional films accounting for over 40% of total value. Competitive intensity will increase as solution providers introduce bio-based polymers, nanocomposite coatings, and IoT-enabled degradation tracking. Established players are shifting toward hybrid models combining advanced materials with cloud-linked monitoring tools. Emerging companies such as Uflex, SKC Films, and Cosmo Films are gaining share by offering recyclable UV-blocking laminates, smart performance layers, and flexible applications tailored to food safety, consumer electronics, and building insulation markets.

The growing demand for protective packaging that prevents UV-induced degradation of food, beverages, and pharmaceuticals is driving growth in the UV-blocking transparent film market. These films safeguard product quality, extend shelf life, and enhance visual appeal, making them vital in retail and healthcare packaging. Rising consumer preference for safe, preservative-free products further supports adoption.

Films engineered with advanced UV absorbers, multi-layer barriers, and high optical clarity are gaining popularity for balancing protection with product visibility. Their compatibility with automated packaging lines and lightweight structure reduces costs while improving efficiency. Sustainable, recyclable material options also align with environmental regulations and brand commitments to eco-friendly packaging solutions.

The market is segmented by material, coating, thickness, application, end-use industry, and region. Material segmentation includes polyethylene terephthalate (PET), polyvinyl chloride (PVC), polypropylene (PP), polycarbonate (PC), polymethyl methacrylate (PMMA), and others such as specialty polymers, providing strength and optical clarity. Coating types comprise UV absorber coated films, nano-composite films, multi-layer laminated films, anti-scratch and self-healing films, and low-emissivity UV films, enhancing durability and protective efficiency.

Thickness segmentation includes up to 50 microns, 51-100 microns, and above 100 microns, catering to varied packaging and industrial needs. Applications include food and beverage packaging, pharmaceutical and healthcare packaging, cosmetics and personal care packaging, automotive windows and interiors, building and construction uses such as glazing and facades, and consumer electronics displays. End-use industries include packaging, automotive, construction, electronics, and healthcare. Regionally, the market is segmented into North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa.

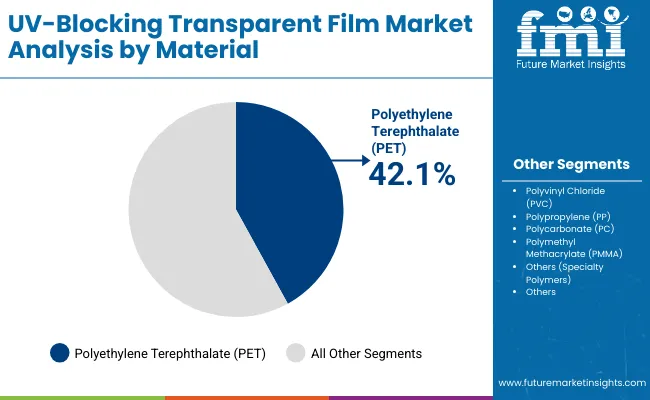

Polyethylene terephthalate (PET) films are projected to hold 42.1% of the market in 2025, driven by their excellent optical clarity, tensile strength, and recyclability. PET provides high UV resistance when coated or treated, making it ideal for packaging, electronics, and architectural uses. Its lightweight yet durable profile enhances cost-effectiveness across applications.

Growing demand for sustainable packaging and protective films reinforces PET’s adoption. Food and beverage brands rely on PET-based UV films to extend shelf life while maintaining product visibility. The material’s compatibility with advanced coatings further strengthens its position as the leading substrate in UV-blocking films.

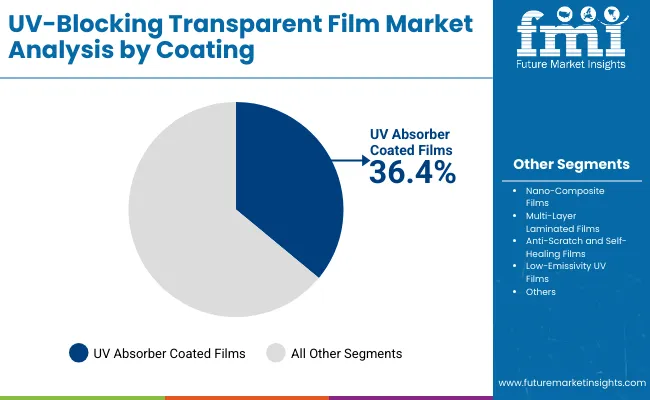

UV absorber coated films are forecast to account for 36.4% of the market in 2025, owing to their proven ability to filter harmful UV radiation. These films incorporate specialized additives or coatings that absorb and dissipate UV rays, preventing degradation of packaged products or surfaces.

Their use is expanding in packaging and automotive sectors, where protection against UV-driven discoloration and spoilage is critical. Easy integration into existing production processes keeps costs competitive. The segment benefits from growing demand for high-performance films in consumer and industrial applications alike.

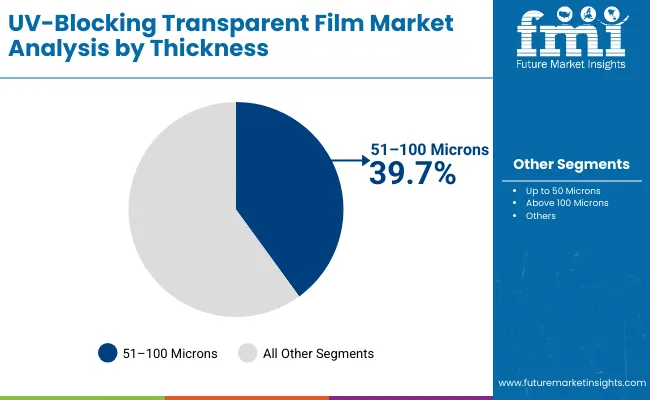

Films with 51-100 microns thickness are expected to hold 39.7% of the market in 2025, balancing durability with flexibility. This range ensures sufficient mechanical strength while maintaining transparency, making it suitable for packaging, glazing, and electronics applications.

Manufacturers favour this thickness for its adaptability in lamination, sealing, and coating processes. Its ability to combine strength with cost-efficiency ensures widespread use. As multi-layer designs gain traction, this thickness segment remains the standard for versatile UV-blocking film applications.

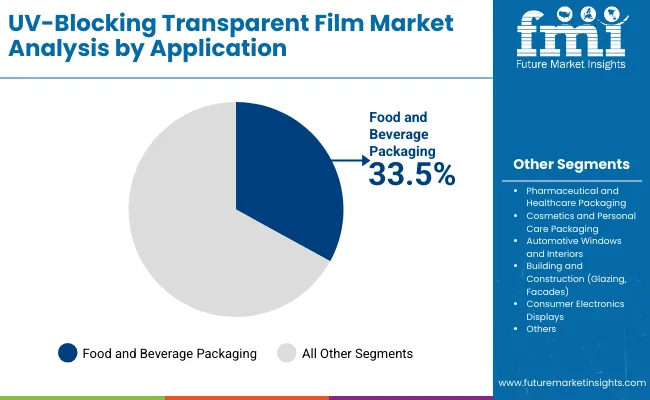

Food and beverage packaging is projected to represent 33.5% of demand in 2025, reflecting its reliance on UV protection to extend product shelf life. UV-blocking films help preserve taste, colour, and nutritional quality while ensuring clear visibility for branding and consumer appeal.

Adoption is supported by rising global consumption of packaged drinks, dairy, and nutraceuticals sensitive to UV exposure. The films are increasingly used in flexible pouches, bottles, and container wraps. With strong regulatory emphasis on food safety, this application remains the anchor of market demand.

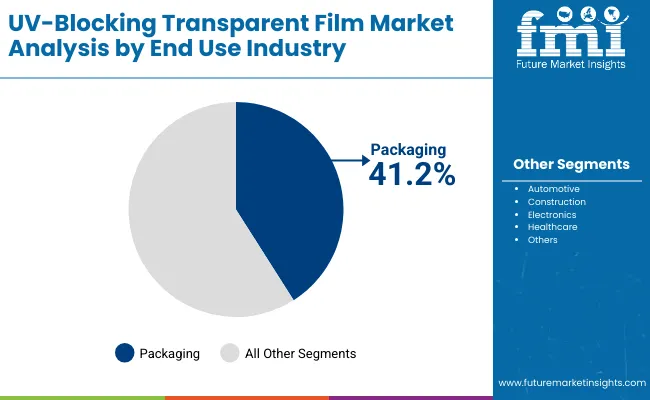

The packaging industry is expected to hold 41.2% of the market in 2025, as it encompasses food, beverages, cosmetics, and pharmaceuticals requiring UV protection. UV-blocking transparent films safeguard both shelf appeal and product integrity during storage and distribution.

The industry benefits from rising e-commerce and global exports, where packaging durability is critical. Continuous innovation in recyclable and biodegradable UV films also aligns with sustainability initiatives. Packaging remains the dominant end-use industry, anchoring growth across diverse applications.

The UV-blocking transparent film market is expanding as industries demand protective solutions that safeguard products from harmful ultraviolet radiation while maintaining visibility. Adoption is rising in food packaging, electronics, automotive, and construction. However, high production costs and recycling challenges restrain growth. Innovations in nanocoating, biodegradable films, and multi-layer laminates are creating new opportunities across diverse applications.

Product Protection, Shelf-life Extension, and Aesthetic Appeal Driving Adoption

UV-blocking films are increasingly used in food and beverage packaging to preserve freshness, prevent discoloration, and extend shelf life. Electronics and display manufacturers adopt these films to prevent UV-induced degradation in screens and devices. Automotive and construction sectors use UV films for window tinting and protective glazing, offering both functional and aesthetic benefits. Their ability to maintain transparency while blocking radiation makes them highly versatile across industries prioritizing product safety and consumer satisfaction.

High Manufacturing Costs, Recycling Issues, and Material Constraints Restraining Growth

The market faces challenges due to the high cost of producing advanced UV-blocking films, which often rely on specialty polymers, additives, or nanomaterials. Recycling is difficult because these films typically consist of multi-layer laminates, complicating material recovery. Limited barrier properties in some film types restrict their use in heavy-duty applications. Raw material price volatility further impacts affordability for manufacturers. These issues constrain adoption in cost-sensitive markets despite strong demand potential.

Nanocoating, Sustainable Polymers, and Multi-functional Trends Emerging

Key trends include the use of nanotechnology-based coatings that enhance UV protection while reducing film thickness and weight. Sustainable solutions, such as biodegradable and recyclable polymer films, are gaining traction as regulations on plastic waste tighten. Multi-functional films combining UV-blocking with moisture, oxygen, or thermal resistance are being developed to serve broader applications. Advances in printing compatibility and customization are enhancing branding opportunities. These innovations are positioning UV-blocking transparent films as high-performance, eco-conscious solutions across packaging, automotive, and construction industries.

The global UV-blocking transparent film market is expanding rapidly, driven by rising demand in construction, automotive, electronics, and packaging sectors. Asia-Pacific is at the forefront of growth, with China and India adopting these films widely to meet energy efficiency, safety, and product durability needs. Developed markets like the USA, Germany, and Japan are focusing on advanced nanotechnology films, recyclable materials, and regulatory compliance, making UV-blocking transparent films critical for sustainability and performance across diverse industrial applications worldwide.

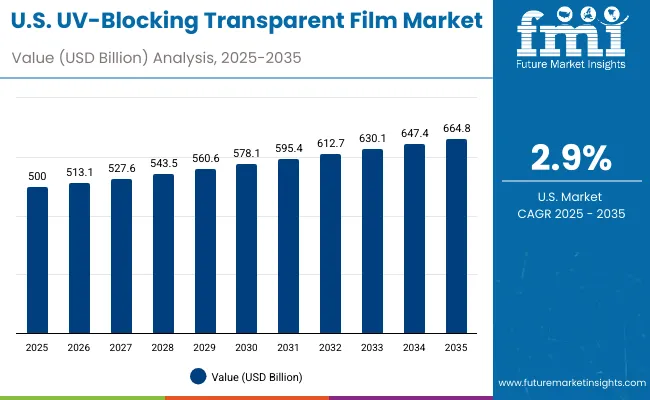

The USA market is projected to grow at a CAGR of 6.7% from 2025 to 2035, supported by rising demand in automotive glazing, construction glass, and electronics displays. Stringent energy-efficiency regulations are driving adoption in architectural films for commercial and residential buildings. Manufacturers are investing in nanocoating and multi-layer film designs that enhance UV protection while maintaining high clarity. Growth in electric vehicles and smart glass technologies is further fuelling demand for innovative UV-blocking films.

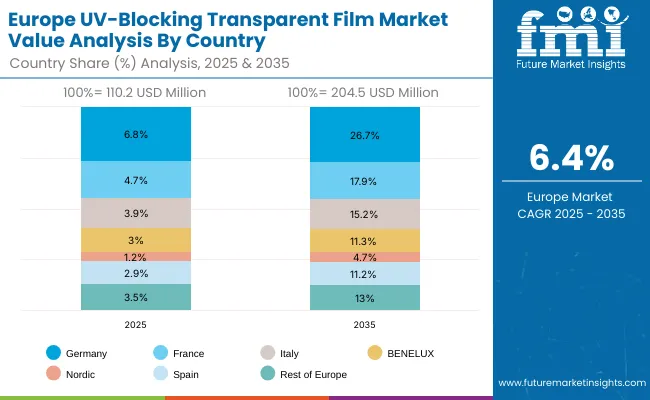

Germany’s market is expected to grow at a CAGR of 6.5%, supported by demand in automotive, renewable energy, and electronics. EU sustainability mandates are boosting the use of UV-protective films in solar panels and energy-efficient glass applications. German manufacturers are innovating with recyclable films and precision-engineered coatings to reduce environmental impact. Strong adoption is also seen in luxury vehicles and consumer electronics requiring advanced optical properties and consistent UV protection to preserve product quality and performance.

The UK market is forecast to grow at a CAGR of 6.4%, supported by adoption in construction, premium packaging, and healthcare. Rising demand for protective films in medical devices and food packaging is boosting growth. Local producers are emphasizing biodegradable, recyclable films to align with sustainability goals. The automotive sector is also adopting UV-blocking films for consumer safety, while rising architectural renovations across urban centers are creating new demand opportunities for energy-efficient solutions.

China’s market is projected to grow at a CAGR of 7.0%, driven by rapid expansion in construction, automotive, and electronics manufacturing. Domestic producers are scaling cost-effective UV-blocking films for high-volume demand in building glass and consumer products. Government incentives for energy-efficient materials are accelerating adoption. Export-focused firms are adopting high-quality films to meet global standards, particularly in solar energy applications and premium consumer electronics packaging.

India is forecast to grow at a CAGR of 6.9%, supported by growth in infrastructure, automotive, and healthcare packaging. Rising awareness of UV safety in consumer products and food packaging is boosting adoption. Affordable, eco-friendly films are gaining traction among SMEs. Expansion of pharmaceutical exports is also creating demand for UV-protective films to ensure product integrity. The government’s Smart Cities and Make in India initiatives are encouraging local production and technology adoption in the film sector.

Japan’s market is projected to grow at a CAGR of 6.3%, led by demand in automotive, electronics, and food packaging. Precision-engineered UV films are used in high-value electronics displays and automotive interiors. Manufacturers are focusing on compact, durable film solutions that enhance energy efficiency and consumer safety. Seasonal demand for UV-protection in personal care packaging also supports growth. Japanese OEMs are innovating with multilayer films to ensure clarity, flexibility, and long-lasting UV-blocking performance.

South Korea’s market is expected to grow at a CAGR of 6.5%, supported by strong demand in semiconductors, automotive, and premium packaging. Manufacturers are focusing on developing advanced multilayer films with high durability and clarity. Growth in cosmetics exports is driving adoption of UV-blocking packaging to maintain product quality. The country’s emphasis on smart manufacturing and export-oriented industries is reinforcing demand for UV-protective films across both industrial and consumer-focused applications.

Japan’s UV-blocking transparent film market, valued at USD 300 million in 2025, is led by polyethylene terephthalate (PET), which dominates with 42.2% share due to its durability, clarity, and cost-efficiency. Polyvinyl chloride (PVC) holds 14.5%, polypropylene (PP) accounts for 13.5%, polycarbonate (PC) stands at 12.8%, and polymethyl methacrylate (PMMA) has 10.4%. Specialty polymers represent 6.6%. PET’s leadership reflects its strong use in automotive, electronics, and construction, while PC and PP gain traction for high-performance needs. Growing adoption of specialty polymers also highlights Japan’s shift toward customized solutions for UV resistance, safety, and long-lasting protective applications.

South Korea’s UV-blocking transparent film market in 2025, worth USD 200 million, is dominated by UV absorber coated films, which capture 37.7% of share due to superior protection against ultraviolet degradation. Nano-composite films follow with 15.5%, multi-layer laminated films hold 14.7%, and anti-scratch/self-healing films represent 13.7%. Low-emissivity UV films account for 11.1%. The strength of UV absorber coated films reflects their cost-effectiveness and widespread usage in automotive, construction, and consumer electronics. Meanwhile, nano-composite and laminated options are advancing as performance-driven alternatives, while anti-scratch and low-emissivity solutions serve niche applications demanding durability, energy efficiency, and premium-grade UV resistance.

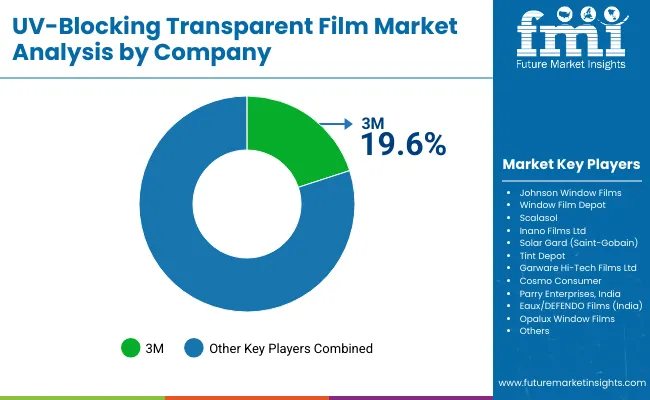

The UV-blocking transparent film market is moderately fragmented, with global chemical companies, window film specialists, and regional converters competing across automotive, construction, electronics, and consumer goods applications. Global leaders such as 3M, Johnson Window Films, and Solar Gard (Saint-Gobain) hold notable market share, driven by advanced multilayer coatings, high UV rejection rates, and compliance with international safety and performance standards. Their strategies increasingly emphasize durability, energy efficiency, and sustainable raw material integration.

Established mid-sized players including Window Film Depot, Scalasol, and Inano Films Ltd are supporting adoption of high-performance films featuring nano-ceramic layers, scratch resistance, and glare reduction. These companies are especially active in residential and commercial buildings, as well as automotive aftermarkets, offering tailored UV protection, thermal insulation, and customizable aesthetics to enhance comfort and energy savings.

Specialized regional providers such as Tint Depot, Garware Hi-Tech Films Ltd, Cosmo Consumer, Parry Enterprises India, Eaux/DEFENDO Films, and Opalux Window Films focus on niche markets with cost-effective yet durable UV-blocking solutions. Their strengths lie in localized production, rapid customization, and integration with decorative finishes, enabling broader adoption of UV-protection technology in developing markets and small-scale commercial projects.

Key Development

| Item | Value |

|---|---|

| Quantitative Units | USD 1. 7 Billion |

| By Material | Polyethylene Terephthalate (PET), Polyvinyl Chloride (PVC), Polypropylene (PP), Polycarbonate (PC), Polymethyl Methacrylate (PMMA), Others (Specialty Polymers) |

| By Coating | UV Absorber Coated Films, Nano-Composite Films, Multi-Layer Laminated Films, Anti-Scratch and Self-Healing Films, Low-Emissivity UV Films |

| By Thickness | Up to 50 Microns, 51-100 Microns, Above 100 Microns |

| By Application | Food and Beverage Packaging, Pharmaceutical and Healthcare Packaging, Cosmetics and Personal Care Packaging, Automotive Windows and Interiors, Building and Construction (Glazing, Facades), Consumer Electronics Displays |

| By End-Use Industry | Packaging, Automotive, Construction, Electronics, Healthcare |

| Key Companies Profiled | 3M, Johnson Window Films, Window Film Depot, Scalasol, Inano Films Ltd, Solar Gard (Saint-Gobain), Tint Depot, Garware Hi-Tech Films Ltd, Cosmo Consumer, Parry Enterprises (India), Eaux /DEFENDO Films (India), Opalux Window Films |

| Additional Attributes | Rising adoption of PET and PC-based UV-blocking films in packaging and construction, nano -composite coatings enhancing durability and UV resistance, growing demand in automotive for passenger safety and interior protection, increasing healthcare use for sterile packaging, and consumer electronics displays driving multi-layer and anti-scratch innovations for better performance and longevity. |

The global UV-blocking transparent film market is estimated to be valued at USD 1.7 billion in 2025.

The market size for the UV-blocking transparent film market is projected to reach USD 3.2 billion by 2035.

The UV-blocking transparent film market is expected to grow at a CAGR of 6.5% between 2025 and 2035.

The key materials in the UV-blocking transparent film market include polyethylene terephthalate (PET), polyvinyl chloride (PVC), polypropylene (PP), polycarbonate (PC), polymethyl methacrylate (PMMA), and specialty polymers.

The polyethylene terephthalate (PET) segment is expected to account for the highest share of 42.1% in the UV-blocking transparent film market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transparent Barrier Laminators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Transparent Paper Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Transparent Coating Market Size and Share Forecast Outlook 2025 to 2035

Transparent Plastics Market Size and Share Forecast Outlook 2025 to 2035

Transparent Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Transparent Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Transparent Display Market Size and Share Forecast Outlook 2025 to 2035

Transparent Digital Signage Market Analysis by Type, End Users and Region Through 2035

Transparent Conductive Films Market Size and Share Forecast Outlook 2025 to 2035

Multilayer Transparent Conductors Market Size and Share Forecast Outlook 2025 to 2035

Film Forming Starches Market Size and Share Forecast Outlook 2025 to 2035

Film Formers Market Size and Share Forecast Outlook 2025 to 2035

Film Capacitors Market Analysis & Forecast by Material, Application, End Use, and Region Through 2035

Film Tourism Industry Analysis by Type, by End User, by Tourist Type, by Booking Channel, and by Region - Forecast for 2025 to 2035

Filmic Tapes Market

PE Film Market Insights – Growth & Forecast 2024-2034

VCI Film Market Forecast and Outlook 2025 to 2035

TPE Films and Sheets Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

PSA Film Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA