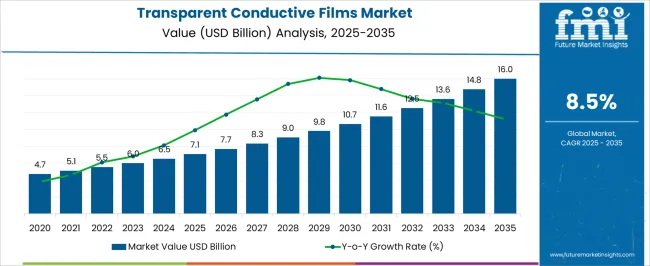

The transparent conductive films market is estimated to be valued at USD 7.1 billion in 2025 and is projected to reach USD 16.0 billion by 2035, registering a compound annual growth rate (CAGR) of 8.5% over the forecast period.

The global transparent conductive films market is projected to grow from 7.1 USD billion in 2025 to 16.0 USD billion by 2035, registering a CAGR of 8.5%. Analysis of half-decade weighted growth reveals distinct contributions from the first and second halves of the forecast period, highlighting how adoption accelerates in later years relative to initial stages. During the early half-decade, from 2025 to 2029, incremental growth is observed as the market rises from 7.1 USD billion to approximately 8.3 USD billion, driven primarily by moderate adoption in touch panels, flexible displays, and consumer electronics. This period carries a weighted contribution of roughly 35–40% to total decade growth, reflecting cautious investments, ongoing R&D, and gradual integration of novel materials such as silver nanowires, conductive polymers, and metal mesh solutions.

In the latter half-decade, from 2030 to 2035, accelerated adoption is recorded as the market expands from 9.0 USD billion to 16.0 USD billion, contributing over 60% of total decade growth. This surge is supported by increased penetration in automotive displays, OLED lighting, smart windows, and emerging IoT devices requiring transparent conductive layers. Factors such as enhanced manufacturing efficiency, declining production costs, and rising preference for high-performance, flexible, and durable films further amplify late-stage growth.

| Metric | Value |

|---|---|

| Transparent Conductive Films Market Estimated Value in (2025 E) | USD 7.1 billion |

| Transparent Conductive Films Market Forecast Value in (2035 F) | USD 16.0 billion |

| Forecast CAGR (2025 to 2035) | 8.5% |

The transparent conductive films (TCF) market is strongly shaped by five interconnected parent markets, each contributing uniquely to overall demand and growth. The consumer electronics market holds the largest share at approximately 40%, driven by the widespread use of TCFs in smartphones, tablets, laptops, and wearables, where touch sensitivity and display performance are paramount. The display technologies market contributes around 25%, as TCFs are essential in the manufacturing of LCDs, OLEDs, and flexible displays, enabling high-resolution and energy-efficient screens. The solar energy market accounts for about 15%, with TCFs utilized in photovoltaic cells and building-integrated solar panels, enhancing energy conversion efficiency.

The automotive industry holds a 10% share, driven by the integration of TCFs in touch-enabled control panels, heads-up displays, and advanced driver-assistance systems (ADAS), improving user interaction and safety features. Finally, the aerospace and defense sector represents 10%, where TCFs are employed in avionics displays, cockpit interfaces, and transparent antennas, ensuring reliability and performance in critical applications. Collectively, the consumer electronics, display technologies, and solar energy sectors account for 80% of overall demand, highlighting that advancements in personal devices, visual technologies, and renewable energy solutions remain the primary growth drivers, while automotive and aerospace applications provide complementary opportunities for market expansion globally.

The transparent conductive films market is experiencing steady growth, driven by rising demand for high-performance display and touch technologies in consumer electronics, automotive, and industrial applications. Growth is being supported by increasing adoption of devices such as smartphones, tablets, touchscreens, and wearable electronics, where high conductivity, transparency, and mechanical flexibility are critical.

Advancements in material processing and coating techniques have improved film performance, enabling thinner, more durable, and cost-effective solutions. The market is further influenced by the expansion of flexible and transparent displays, solar panels, and other optoelectronic devices that rely on conductive coatings to improve energy efficiency and device responsiveness.

Investments in research and development are accelerating the introduction of next-generation materials that offer improved electrical and optical properties while maintaining environmental compliance As consumer demand for more energy-efficient, lightweight, and high-resolution electronic devices grows globally, transparent conductive films are increasingly being integrated across a wide range of applications, positioning the market for sustained growth in the coming years.

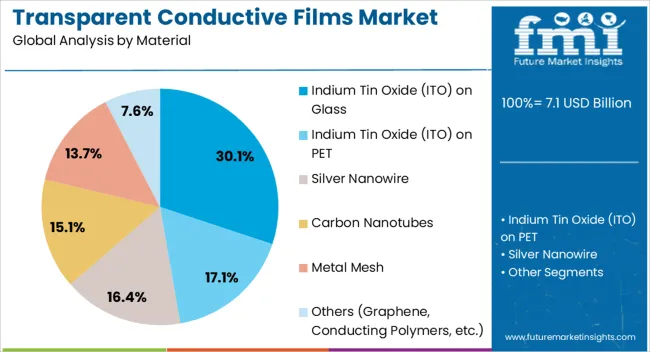

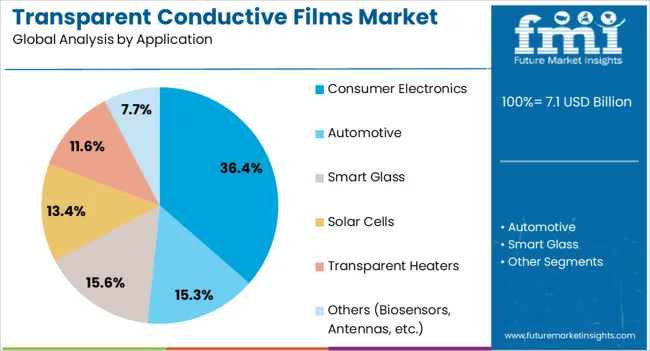

The transparent conductive films market is segmented by material, application, and geographic regions. By material, transparent conductive films market is divided into indium tin oxide (ITO) on glass, indium tin oxide (ITO) on pet, silver nanowire, carbon nanotubes, metal mesh, and others (graphene, conducting polymers, etc.). In terms of application, transparent conductive films market is classified into consumer electronics, automotive, smart glass, solar cells, transparent heaters, and others (biosensors, antennas, etc.). Regionally, the transparent conductive films industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The Indium Tin Oxide on glass segment is projected to hold 30.1% of the transparent conductive films market revenue share in 2025, making it the leading material type. This leadership is being driven by the material’s high transparency, excellent conductivity, and stable performance under a wide range of operating conditions. Its compatibility with established glass substrates allows for ease of integration into displays, touchscreens, and other optoelectronic devices without compromising device durability.

The segment benefits from a long history of adoption in consumer electronics, where consistent electrical and optical properties are critical for high-quality performance. Technological improvements in sputtering and coating processes have enhanced the uniformity, adhesion, and conductivity of Indium Tin Oxide films, reducing production costs and material waste.

Continued demand for high-resolution touch displays and large-format panels, combined with the need for reliable and scalable manufacturing methods, reinforces the segment’s dominance The material’s proven track record, regulatory compliance, and broad compatibility with current and next-generation display technologies are supporting its continued growth in the global market.

The consumer electronics segment is expected to account for 36.4% of the transparent conductive films market revenue share in 2025, establishing it as the leading application area. Its dominance is being driven by increasing penetration of smartphones, tablets, wearable devices, and interactive displays worldwide. High-performance films enable responsive touchscreens, improved display clarity, and energy efficiency, which are critical factors influencing consumer purchasing decisions.

Manufacturers are prioritizing integration of transparent conductive films to meet rising expectations for thinner, lighter, and more durable devices. The segment is also being fueled by the growing popularity of large-format displays, foldable devices, and smart home appliances, where conductive films ensure uniform performance and flexibility.

Advances in material technology, such as enhanced conductivity and mechanical strength, allow for extended device lifespans and improved user experience Rising consumer demand for innovative electronic products, coupled with the ongoing expansion of electronics manufacturing in emerging regions, is reinforcing the segment’s leading position and supporting sustained market growth in the coming decade.

The transparent conductive films market is expanding due to strong demand from touchscreens, displays, solar, and automotive applications. Regulatory compliance with RoHS, chemical safety, and environmental guidelines drives adoption and global acceptance. Technological advancements in materials, coatings, and manufacturing processes enhance transparency, conductivity, flexibility, and durability, enabling innovative applications in electronics, photovoltaics, and automotive sectors. Growth is supported by rising consumer electronics penetration, solar installations, and smart automotive solutions. Manufacturers are focusing on high-performance, scalable, and eco-friendly films to meet evolving market needs

The transparent conductive films market is expanding due to rising adoption in touchscreens, displays, and electronic devices. Smartphones, tablets, laptops, and interactive kiosks increasingly rely on TCFs for high conductivity, optical clarity, and durability. Flexible and lightweight designs are gaining traction in foldable displays and wearable devices. Consumer preference for responsive and high-quality touch interfaces drives demand for reliable films. Manufacturers are focusing on enhancing transparency, conductivity, and flexibility to meet evolving device specifications. The growing electronics and consumer devices market is fueling consistent demand, positioning TCFs as critical components in modern display technologies.

Regulatory frameworks and environmental guidelines significantly influence the TCF market. Restrictions on hazardous substances (RoHS), chemical safety standards, and recycling mandates require manufacturers to adopt safe and eco-friendly materials. Compliance with international quality and safety certifications ensures product reliability and global market acceptance. Government incentives for energy-efficient and green electronics further support adoption of indium tin oxide (ITO)-free alternatives and environmentally friendly conductive films. Adhering to regulatory standards reduces operational risks, enhances brand credibility, and facilitates entry into highly regulated regions, particularly in consumer electronics, automotive, and solar energy applications.

Technological innovations in materials and coating processes are shaping TCF market growth. Developments in ITO, silver nanowires, graphene, and conductive polymers improve transparency, electrical conductivity, and mechanical flexibility. Roll-to-roll coating, sputtering, and printing technologies allow scalable and cost-effective production. Hybrid and flexible films enable integration into foldable, curved, and wearable devices. Research focuses on enhancing durability, scratch resistance, and uniformity while reducing material usage and production costs. These advancements allow TCFs to meet the increasing demand for lightweight, high-performance, and versatile components in electronics, solar cells, and automotive applications.

The TCF market is supported by expanding applications in solar energy and automotive sectors. Transparent conductive films are critical in photovoltaic modules, smart windows, heads-up displays, and instrument panels. Rising solar installations and demand for energy-efficient buildings encourage adoption of high-performance TCFs. Automotive manufacturers integrate films in touchscreens, sensors, and display panels, driven by smart car and electric vehicle trends. Industrial and architectural applications, including transparent heaters and flexible electronics, further support growth. Collaboration between TCF manufacturers and device or system integrators is increasing to develop customized solutions for specialized end-use applications.

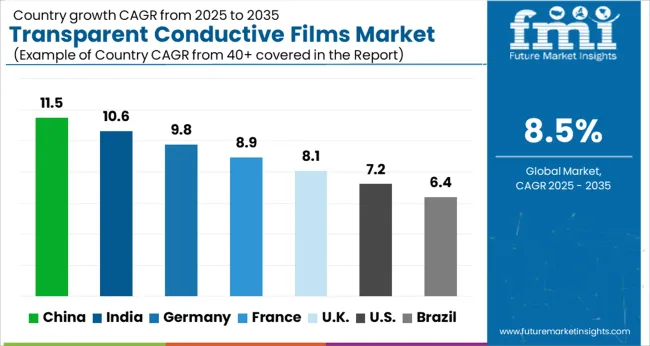

| Country | CAGR |

|---|---|

| China | 11.5% |

| India | 10.6% |

| Germany | 9.8% |

| France | 8.9% |

| UK | 8.1% |

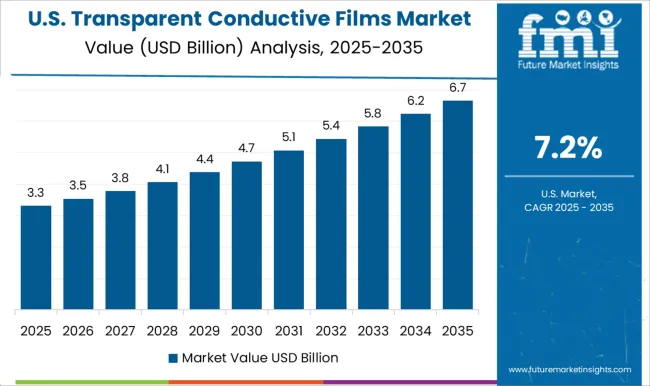

| USA | 7.2% |

| Brazil | 6.4% |

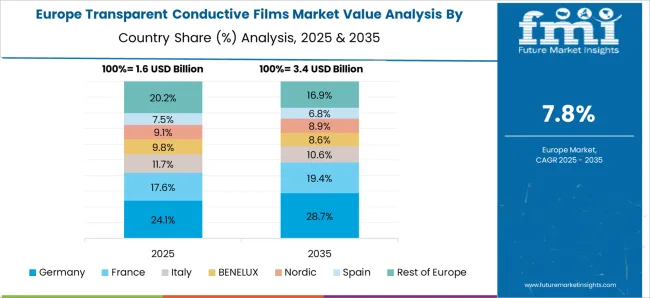

The global transparent conductive films market is projected to grow at a CAGR of 8.5% from 2025 to 2035. China leads expansion at 11.5%, followed by India at 10.6%, Germany at 9.8%, the UK at 8.1%, and the USA at 7.2%. Growth is driven by rising demand in touchscreens, displays, solar panels, and flexible electronics, along with increasing adoption of energy-efficient and lightweight conductive materials. China and India dominate production and consumption due to large-scale electronics manufacturing and expanding renewable energy applications, while Germany, the UK, and the USA focus on advanced film formulations, high-transparency solutions, and integration into cutting-edge devices. The analysis includes over 40 countries, with the leading markets detailed below.

The transparent conductive films market in China is projected to grow at a CAGR of 11.5% from 2025 to 2035, driven by increasing adoption in touchscreens, displays, photovoltaics, and flexible electronics. Rising smartphone, tablet, and consumer electronics production, alongside growth in solar panel installations, is fueling demand for high-performance TCFs. Manufacturers are investing in advanced deposition techniques, indium tin oxide (ITO) alternatives, and flexible film technologies to enhance conductivity, transparency, and mechanical durability. Collaborations with global technology providers support R&D for innovative materials such as silver nanowires, graphene, and conductive polymers. Expansion in automotive electronics, interactive displays, and wearable devices further contributes to market growth, while government support for renewable energy applications boosts adoption of TCF-based photovoltaic modules.

The TCF market in India is expected to grow at a CAGR of 10.6% from 2025 to 2035, supported by rising demand in consumer electronics, solar energy, and automotive electronics. Adoption is boosted by increasing smartphone penetration, rising solar energy installations, and growth in industrial displays and touch panels. Domestic manufacturers are expanding production capacity, investing in high-performance alternatives to ITO, and developing flexible, durable, and low-resistance films. Collaborations with international technology providers enable knowledge transfer, innovation in nanomaterials, and adherence to global quality standards. Demand from emerging applications, including smart wearables, interactive signage, and energy-efficient photovoltaics, is further accelerating adoption, making India a high-growth market in the Asia-Pacific region.

Germany’s TCF market is projected to grow at a CAGR of 9.8% from 2025 to 2035, driven by demand in automotive electronics, industrial touch panels, photovoltaics, and consumer devices. Manufacturers are investing in alternatives to traditional ITO films, including silver nanowires, carbon-based materials, and conductive polymers, to improve transparency, flexibility, and conductivity. Adoption is fueled by growth in electric vehicles, renewable energy installations, and smart industrial automation. Collaborations with European and global suppliers facilitate R&D, innovation in film deposition techniques, and compliance with EU environmental and quality regulations. Increasing demand for flexible electronics, wearable devices, and interactive display solutions further strengthens the market, positioning Germany as a leading adopter in Europe.

The UK TCF market is expected to grow at a CAGR of 8.1% from 2025 to 2035, influenced by adoption in consumer electronics, solar energy, and interactive display panels. Manufacturers are focusing on high-performance, flexible, and transparent conductive materials to meet rising demand for touchscreens, wearable devices, and energy-efficient photovoltaics. Partnerships with global technology providers enable knowledge transfer, access to advanced deposition methods, and development of ITO alternatives like silver nanowires and conductive polymers. Industrial automation, smart retail displays, and renewable energy applications are creating steady growth opportunities. Government initiatives supporting clean energy, smart infrastructure, and electronics manufacturing further encourage adoption of TCF solutions in commercial and industrial segments.

The USA TCF market is projected to grow at a CAGR of 7.2% from 2025 to 2035, driven by demand in consumer electronics, automotive touchscreens, solar panels, and flexible electronics. Manufacturers are investing in high-performance films with superior conductivity, transparency, and mechanical durability. Growth is fueled by increasing production of smartphones, tablets, wearable devices, and electric vehicles. Adoption of ITO alternatives such as silver nanowires, graphene, and conductive polymers is increasing to meet performance and sustainability standards. Collaborations with global suppliers facilitate advanced R&D, innovative deposition techniques, and compliance with stringent quality and environmental regulations. Expanding industrial displays, interactive signage, and solar energy installations further accelerate market expansion across multiple sectors.

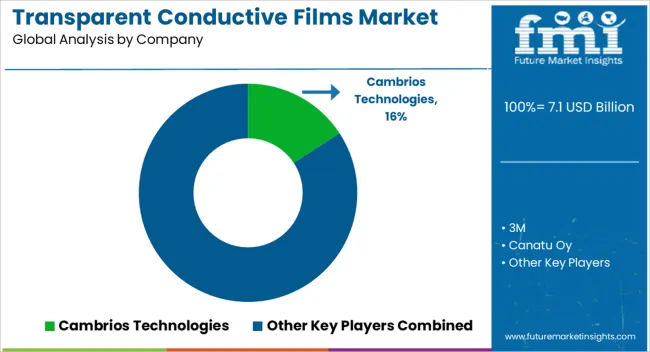

Competition in the transparent conductive films (TCF) market is defined by conductivity, optical transparency, and flexibility for touchscreens, displays, and solar applications. Cambrios Technologies leads with high-performance silver nanowire and hybrid TCF solutions offering excellent conductivity, optical clarity, and compatibility with flexible substrates. 3M competes with conductive coatings and films for industrial, consumer electronics, and photovoltaic applications, emphasizing durability, adhesion, and large-scale production capabilities. Canatu Oy differentiates through carbon-based TCFs, including carbon nanotube films, optimized for foldable devices, wearable electronics, and low-power displays.

DuPont focuses on conductive polymers and ink formulations that balance transparency, conductivity, and environmental resistance. Eastman Kodak provides TCF solutions for displays and solar panels, emphasizing high-quality deposition techniques and long-term stability. Other major players such as Nitto Denko, Rolith, Toyobo, Dontech, C3Nano, TDK, and Pike & Company compete through specialty films, flexible substrates, and tailored conductivity/optical properties for diverse end uses. Strategies center on improving surface uniformity, enhancing flexibility, and reducing sheet resistance while maintaining high transparency. Product development focuses on touchscreens, OLEDs, LCDs, photovoltaic modules, and emerging flexible electronic applications.

Partnerships with device manufacturers, display suppliers, and solar module producers support faster adoption and integration of TCF solutions. Product brochure content is detailed and technical. TCF offerings include silver nanowire, carbon nanotube, conductive polymer, and hybrid films. Specifications highlight sheet resistance, optical transmittance, surface roughness, flexibility, and thermal stability. Guidelines for applications in touch panels, flexible displays, solar cells, and transparent heaters are provided. Coating methods, lamination instructions, packaging formats, and storage conditions are described. Performance attributes such as durability, adhesion, conductivity retention under bending, and environmental resistance are highlighted, reflecting a market focused on high performance, reliability, and application versatility across electronics and renewable energy sectors.

| Items | Values |

|---|---|

| Quantitative Units | USD 7.1 billion |

| Material | Indium Tin Oxide (ITO) on Glass, Indium Tin Oxide (ITO) on PET, Silver Nanowire, Carbon Nanotubes, Metal Mesh, and Others (Graphene, Conducting Polymers, etc.) |

| Application | Consumer Electronics, Automotive, Smart Glass, Solar Cells, Transparent Heaters, and Others (Biosensors, Antennas, etc.) |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cambrios Technologies, 3M, Canatu Oy, DuPont, Eastman Kodak, Nitto Denko, Rolith, Toyobo, Dontech, C3Nano, TDK, and Pike & Company. |

| Additional Attributes | Dollar sales by material type (ITO, silver nanowire, conductive polymers) and application (displays, touchscreens, photovoltaics), share by region and end-use segment, growth trends, optical and electrical performance, emerging deposition technologies, and competitive positioning. |

The global transparent conductive films market is estimated to be valued at USD 7.1 billion in 2025.

The market size for the transparent conductive films market is projected to reach USD 16.0 billion by 2035.

The transparent conductive films market is expected to grow at a 8.5% CAGR between 2025 and 2035.

The key product types in transparent conductive films market are indium tin oxide (ito) on glass, indium tin oxide (ito) on pet, silver nanowire, carbon nanotubes, metal mesh and others (graphene, conducting polymers, etc.).

In terms of application, consumer electronics segment to command 36.4% share in the transparent conductive films market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Transparent Barrier Laminators Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Transparent Paper Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Transparent Coating Market Size and Share Forecast Outlook 2025 to 2035

Transparent Plastics Market Size and Share Forecast Outlook 2025 to 2035

Transparent Plastic Packaging Market Size and Share Forecast Outlook 2025 to 2035

Transparent Ceramics Market Size and Share Forecast Outlook 2025 to 2035

Transparent Display Market Size and Share Forecast Outlook 2025 to 2035

Transparent Digital Signage Market Analysis by Type, End Users and Region Through 2035

Multilayer Transparent Conductors Market Size and Share Forecast Outlook 2025 to 2035

UV-Blocking Transparent Film Market Size and Share Forecast Outlook 2025 to 2035

Conductive Adhesive Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymer Coating Market Size and Share Forecast Outlook 2025 to 2035

Conductive Inks Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymer Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Conductive Silicone Market Size and Share Forecast Outlook 2025 to 2035

Conductive Polymers Market Size and Share Forecast Outlook 2025 to 2035

Conductive Fluted Sheets Market Size and Share Forecast Outlook 2025 to 2035

Conductive Cardboard Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Conductive Bags Market from 2025 to 2035

Understanding Market Share Trends in Conductive Inks

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA