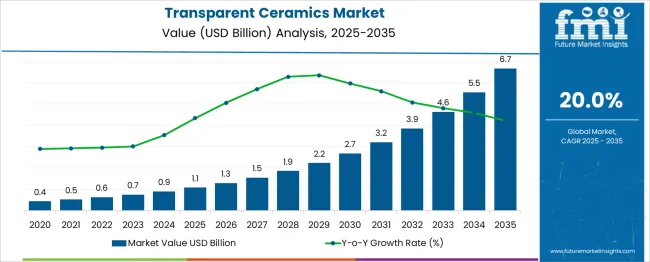

The Transparent Ceramics Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 6.7 billion by 2035, registering a compound annual growth rate (CAGR) of 20.0% over the forecast period. The transparent ceramics market is projected to create an absolute dollar opportunity of USD 5.6 billion over the forecast period. This strong growth is supported by a CAGR of 20%, driven by the increasing demand for transparent ceramics in defense, optics, electronics, and energy-efficient applications. In the first five-year phase (2025-2030), the market is expected to grow from USD 1.1 billion to USD 2.7 billion, adding USD 1.6 billion, which accounts for 28.6% of the total incremental growth, as industries increasingly adopt transparent ceramics for high-performance applications.

The second phase (2030-2035) contributes USD 4 billion, representing 71.4% of the incremental growth, driven by advancements in manufacturing techniques, cost reduction, and expanded applications in emerging sectors such as wearable technology, automotive, and solar panels. Annual increments will rise from USD 0.3 billion in the early years to USD 1 billion by 2035, reflecting accelerating growth as demand for these high-performance materials intensifies. Manufacturers focusing on innovation, scalability, and versatile applications will capture the largest share of this USD 5.6 billion opportunity.

| Metric | Value |

|---|---|

| Transparent Ceramics Market Estimated Value in (2025 E) | USD 1.1 billion |

| Transparent Ceramics Market Forecast Value in (2035 F) | USD 6.7 billion |

| Forecast CAGR (2025 to 2035) | 20.0% |

The transparent ceramics market is experiencing consistent growth, driven by increasing demand for lightweight, high-strength optical materials in defense, aerospace, and optoelectronic applications. The shift toward advanced ceramics with improved thermal resistance, hardness, and transparency has led to their integration into high-energy lasers, sensors, infrared optics, and protective armor.

A strong push from defense procurement programs and optical system manufacturers has reinforced the demand for transparent ceramics capable of withstanding extreme environments without compromising visibility or performance. Advancements in fabrication technologies, such as spark plasma sintering and hot isostatic pressing, are enabling better control over microstructure and transparency levels, expanding their applicability across critical sectors.

As emerging technologies such as LiDAR, laser communication, and photonic devices evolve, transparent ceramics are expected to play a vital role due to their unique optical-mechanical synergy. Strategic collaborations among material science companies and OEMs, combined with rising R&D investments, are likely to shape the future growth of this market across both mature and emerging economies.

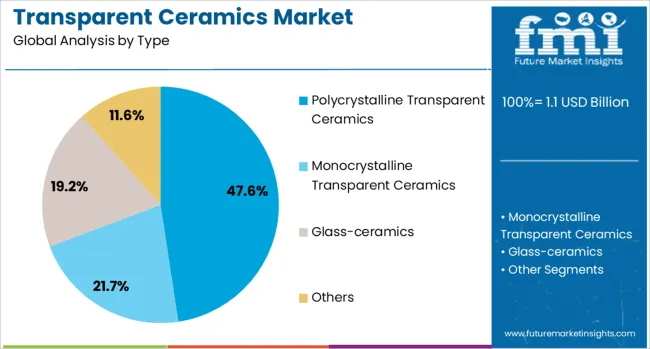

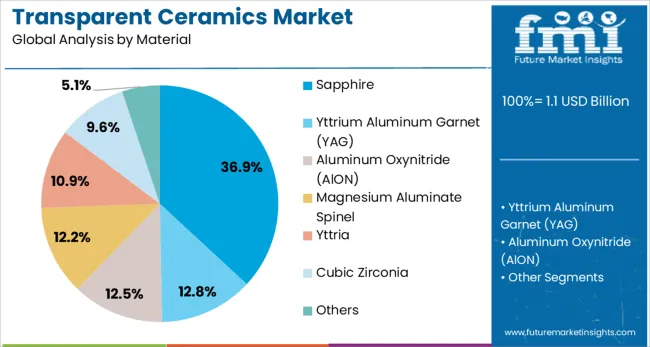

The transparent ceramics market is segmented by type, material, application, structure, and geographic regions. By type, the transparent ceramics market is divided into Polycrystalline Transparent Ceramics, Monocrystalline Transparent Ceramics, Glass-ceramics, and others. In terms of material, the transparent ceramics market is classified into Sapphire, Yttrium Aluminum Garnet (YAG), Aluminum Oxynitride (AlON), Magnesium Aluminate Spinel, Yttria, Cubic Zirconia, and Others.

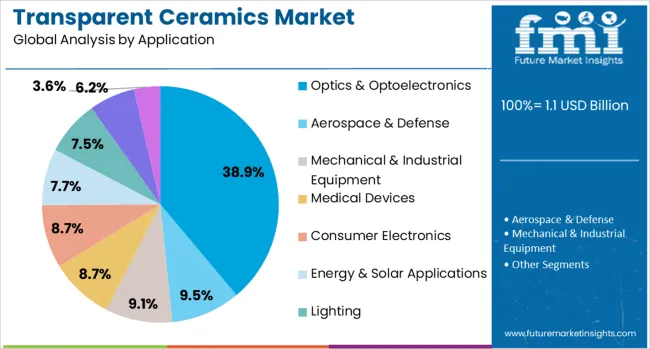

Based on application, the transparent ceramics market is segmented into Optics & Optoelectronics, Aerospace & Defense, Mechanical & Industrial Equipment, Medical Devices, Consumer Electronics, Energy & Solar Applications, Lighting, Sensors & Instrumentation, and Others.

By structure, the transparent ceramics market is segmented into crystalline and non-crystalline. Regionally, the transparent ceramics industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Polycrystalline transparent ceramics are projected to account for 47.6% of the transparent ceramics market revenue share in 2025, positioning this type as the leading category. Their dominance is supported by superior mechanical strength, high thermal stability, and better optical performance compared to traditional glass or single-crystal alternatives.

These ceramics have been increasingly utilized in demanding applications such as high-power laser windows, infrared domes, and protective armor systems due to their ability to maintain transparency while resisting mechanical stress and thermal shock. Continuous advancements in sintering techniques and powder processing have contributed to improved uniformity and transmittance across a broad spectrum, enhancing their integration in advanced optical assemblies.

The capability to scale production while maintaining cost-effectiveness has further strengthened their commercial viability across defense and industrial sectors. As the requirement for robust, transparent materials intensifies in both civil and military technologies, the polycrystalline category is expected to remain a key growth driver within the transparent ceramics landscape.

Sapphire is expected to contribute 36.9% of the total revenue share in the transparent ceramics market by 2025, reflecting its strong positioning among material types. The segment's growth has been supported by sapphire's high hardness, excellent optical clarity, and resistance to chemical and thermal damage, making it suitable for critical optical and sensor applications. It has been widely adopted in high-durability environments, including military sensor windows, aerospace instrumentation, and semiconductor inspection systems.

Technological enhancements in crystal growth methods such as Kyropoulos and edge-defined film-fed growth have enabled the production of larger and purer sapphire substrates, thereby improving availability for high-specification uses. Sapphire’s compatibility with UV, visible, and IR wavelengths enhances its utility in multi-spectral optical systems.

The material’s resilience and long operational lifespan are influencing procurement choices across defense and industrial markets, where durability and performance are essential. With demand for ruggedized optical components increasing globally, sapphire is expected to continue as a leading material for selection.

The optics and optoelectronics application segment is projected to hold 38.9% of the transparent ceramics market revenue share in 2025, making it the most significant application area. The segment’s leadership is driven by the growing integration of transparent ceramics into optical systems requiring high transmission, durability, and environmental resistance. Demand for components used in imaging, sensing, illumination, and laser-based communication systems has been increasing.

Transparent ceramics have been increasingly utilized in photonics and optical networks due to their minimal absorption losses and stability under high-energy radiation. Precision requirements in lenses, photodetectors, and optical isolators have aligned with the unique properties of ceramic materials, such as high refractive index and customizable transmittance.

Additionally, advancements in high-speed optical data transfer and sensor miniaturization are fostering the need for materials that ensure accuracy without compromising structural resilience. As optoelectronic technologies evolve across healthcare, defense, and telecommunications, transparent ceramics are playing a central role in delivering performance-enhancing optical solutions.

The transparent ceramics market is driven by the increasing demand for advanced materials in optics, electronics, and defense sectors. Opportunities are expanding in optics and electronics applications, while emerging trends in defense and security are reshaping the market. However, challenges such as high production costs and manufacturing complexity may hinder growth. By 2025, addressing these obstacles through more efficient production processes will be critical for sustaining market expansion.

The transparent ceramics market is growing due to the increasing demand for advanced materials in industries such as optics, electronics, and defense. Transparent ceramics offer unique properties such as high hardness, transparency, and resistance to high temperatures, making them ideal for applications in laser systems, bulletproof windows, and electronic components. By 2025, the market will continue benefiting from the growing need for these high-performance materials in cutting-edge technologies, including defense systems and optical applications.

Opportunities in the transparent ceramics market are growing, particularly in the optics and electronics sectors. The demand for transparent ceramics in optical lenses, windows, and sensors is rising due to their superior mechanical and optical properties. In electronics, the materials are increasingly used for LED technology, power devices, and energy-efficient components. By 2025, these expanding applications in high-tech industries will contribute significantly to the market's growth as more sectors seek high-quality, durable, and efficient materials.

Emerging trends in the transparent ceramics market include the increasing use of these materials in defense and security applications. Transparent ceramics are increasingly used in armored windows, laser systems, and sensors for military vehicles, drones, and aircraft due to their exceptional strength and transparency. These materials offer enhanced protection while maintaining clarity, making them a crucial part of modern defense technologies. By 2025, the demand for transparent ceramics in defense applications will continue to shape the market, particularly in high-security sectors.

Despite the market’s growth, challenges related to high production costs and complex manufacturing processes persist in the transparent ceramics market. The production of high-quality transparent ceramics requires specialized equipment and advanced materials, which increase overall manufacturing expenses. Additionally, the complexity of the manufacturing process, particularly in terms of precision and quality control, can limit scalability. By 2025, overcoming these challenges through more efficient production techniques will be essential for ensuring continued market growth.

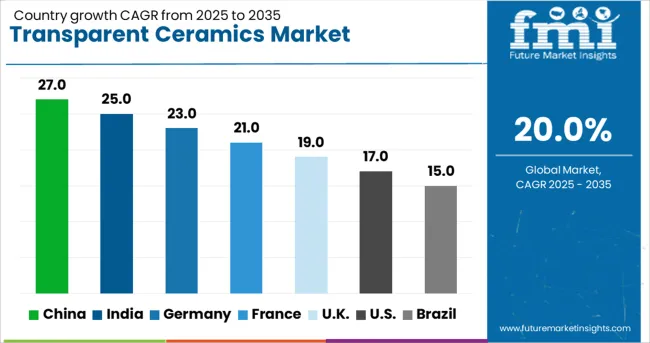

| Country | CAGR |

|---|---|

| China | 27.0% |

| India | 25.0% |

| Germany | 23.0% |

| France | 21.0% |

| UK | 19.0% |

| USA | 17.0% |

| Brazil | 15.0% |

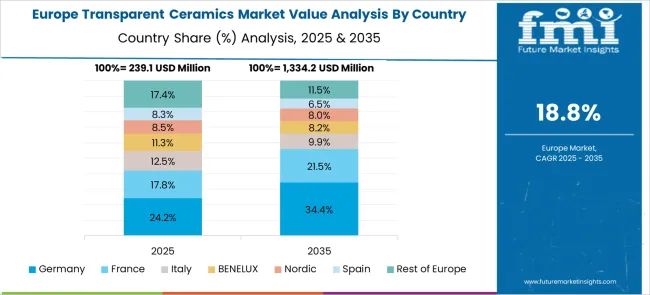

The global transparent ceramics market is projected to grow at a 20% CAGR from 2025 to 2035. China leads with a growth rate of 27.0%, followed by India at 25.0%, and Germany at 23.0%. The United Kingdom records a growth rate of 19.0%, while the United States shows the slowest growth at 17.0%. These differences in growth rates are driven by factors such as increasing demand for transparent ceramics in high-tech applications like optical lenses, military armor, and display technologies. Emerging markets like China and India are witnessing higher growth due to rapid industrialization, technological advancements, and increasing adoption of transparent ceramics in advanced manufacturing and defense sectors, while more mature markets like the USA and the UK experience steady growth driven by established industries and cutting-edge innovations in material science. This report includes insights on 40+ countries; the top markets are shown here for reference.

The transparent ceramics market in China is growing at an impressive pace, with a projected CAGR of 27.0%. China’s rapidly expanding manufacturing sector, coupled with advancements in optics, defense, and electronic industries, is significantly driving the demand for transparent ceramics. The country’s growing focus on high-performance materials for optical lenses, LED displays, and military applications, as well as investments in R&D for new ceramic materials, further accelerates market growth. Additionally, China’s rapid industrialization and increasing demand for advanced defense and technology solutions make it a key player in the transparent ceramics market.

The transparent ceramics market in India is projected to grow at a CAGR of 25.0%. India’s growing demand for advanced materials in optical, electronic, and defense applications is fueling the adoption of transparent ceramics. As the country’s industrial and manufacturing sectors expand, the need for high-performance, durable, and versatile materials like transparent ceramics is increasing. Additionally, the rise in defense and aerospace applications, along with the demand for optical lenses and display technologies, further supports market growth. The country’s push towards innovation and technological advancements is expected to drive the continued growth of the transparent ceramics market.

The transparent ceramics market in Germany is projected to grow at a CAGR of 23.0%. Germany’s well-established manufacturing sector, particularly in optics, automotive, and defense industries, continues to drive the demand for transparent ceramics. The country’s focus on high-quality, durable, and precision-engineered materials for military armor, optical lenses, and specialized displays supports market growth. Additionally, Germany’s ongoing investments in advanced material science and the increasing demand for transparent ceramics in industrial applications such as sensors and lighting further contribute to the market’s growth.

The transparent ceramics market in the United Kingdom is projected to grow at a CAGR of 19.0%. The UK’s growing emphasis on advanced materials for optical, military, and display technologies is driving the adoption of transparent ceramics. The rise in demand for high-performance materials in industries such as aerospace, defense, and electronics further supports market growth. Additionally, the UK’s focus on technological innovation, particularly in the areas of nanotechnology and materials science, is accelerating the development and integration of transparent ceramics into cutting-edge applications.

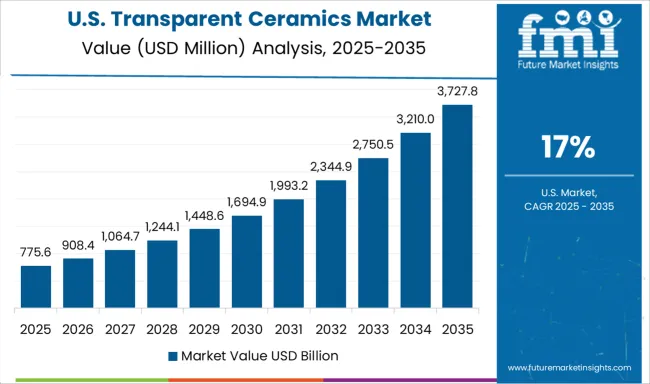

The transparent ceramics market in the United States is expected to grow at a CAGR of 17.0%. The USA continues to be a key market for transparent ceramics, driven by strong demand from defense, aerospace, and electronics industries. The increasing need for high-performance, durable materials for optical lenses, display technologies, and military armor contributes to steady market growth. Additionally, the USA focus on technological advancements, including the development of next-generation materials and devices, ensures continued adoption of transparent ceramics in high-tech applications, although growth is slower compared to emerging markets.

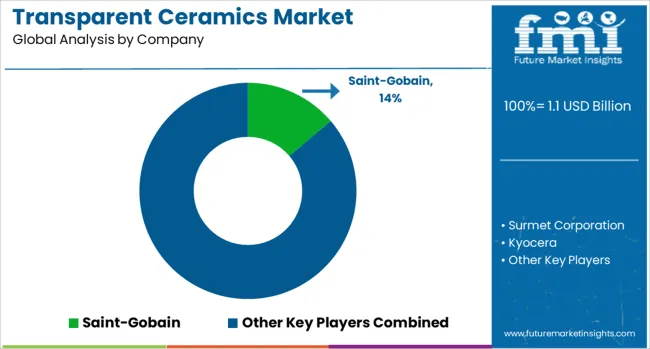

The transparent ceramics market is dominated by Saint-Gobain, which leads with its advanced transparent ceramic materials used in a variety of applications, including optics, defense, and telecommunications. Saint-Gobain’s dominance is supported by its extensive expertise in material science, global presence, and commitment to developing high-performance transparent ceramics that offer excellent strength, optical clarity, and thermal resistance.

Key players such as Surmet Corporation, Kyocera, and Coorstek Corporation maintain significant market shares by offering specialized transparent ceramics for demanding applications like laser technology, armor protection, and aerospace components. These companies focus on providing high-quality, durable, and cost-effective solutions for diverse industrial and commercial sectors.

Emerging players like CeramTech GmbH, CeraNova Corporation, and Rubicon Technology, Inc. are expanding their market presence by offering innovative transparent ceramics tailored for niche applications, including medical devices, LED technology, and high-performance windows. Their strategies include improving manufacturing processes, enhancing material properties, and focusing on eco-friendly production methods.

Market growth is driven by the increasing demand for transparent ceramics in high-tech industries, rising investments in defense and optical technologies, and growing applications in energy-efficient building materials. Innovations in new ceramic compositions, advanced fabrication techniques, and integration with smart technologies are expected to shape competitive dynamics and drive further growth in the global transparent ceramics market.

| Item | Value |

|---|---|

| Quantitative Units | USD 1.1 Billion |

| Type | Polycrystalline Transparent Ceramics, Monocrystalline Transparent Ceramics, Glass-ceramics, and Others |

| Material | Sapphire, Yttrium Aluminum Garnet (YAG), Aluminum Oxynitride (AlON), Magnesium Aluminate Spinel, Yttria, Cubic Zirconia, and Others |

| Application | Optics & Optoelectronics, Aerospace & Defense, Mechanical & Industrial Equipment, Medical Devices, Consumer Electronics, Energy & Solar Applications, Lighting, Sensors & Instrumentation, and Others |

| Structure | Crystalline and Non-crystalline |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Saint-Gobain, Surmet Corporation, Kyocera, Coorstek Corporation, CeramTech GmbH, Konoshima Chemicals Co. Ltd, CeraNova Corporation, Rubicon Technology, Inc., Crystalwise Technology Inc., Hansol Technics Co. Ltd., Almatis GmbH, Schott AG, II-VI Optical Systems, and Superior Technical Ceramics Corporation |

| Additional Attributes | Dollar sales by ceramic type and application, demand dynamics across optics, defense, and electronics sectors, regional trends in transparent ceramics adoption, innovation in laser technologies and high-strength materials, impact of regulatory standards on manufacturing processes, and emerging use cases in advanced optical components and next-generation displays. |

The global transparent ceramics market is estimated to be valued at USD 1.1 billion in 2025.

The market size for the transparent ceramics market is projected to reach USD 6.7 billion by 2035.

The transparent ceramics market is expected to grow at a 20.0% CAGR between 2025 and 2035.

The key product types in transparent ceramics market are polycrystalline transparent ceramics, monocrystalline transparent ceramics, glass-ceramics and others.

In terms of material, sapphire segment to command 36.9% share in the transparent ceramics market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA