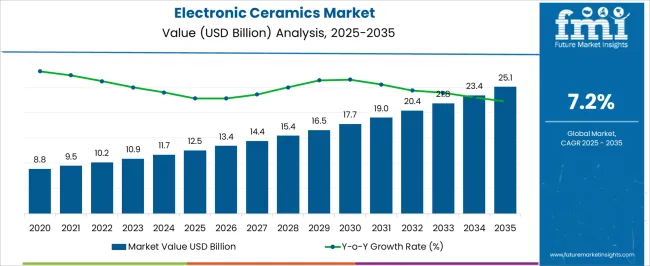

The electronic ceramics market is projected to grow from USD 12.5 billion in 2025 to USD 25.1 billion by 2035, reflecting a strong CAGR of 7.2%. The half-decade weighted growth analysis reveals significant growth drivers throughout the forecast period. From 2025 to 2029, the market grows from USD 8.8 billion to USD 12.5 billion, representing steady demand driven by the increasing use of electronic ceramics in industries such as automotive, telecommunications, and consumer electronics. These ceramics are used in a wide range of applications, including capacitors, insulators, and sensors, contributing to a steady growth trajectory. Between 2029 and 2031, the market experiences a slight acceleration, rising from USD 13.4 billion to USD 14.4 billion. This growth is attributed to technological advancements in electronic ceramics, as manufacturers adopt more sophisticated materials to meet the increasing demand for high-performance components in advanced electronic devices, electric vehicles, and renewable energy technologies. From 2031 to 2035, the market sees a more pronounced growth, reaching USD 25.1 billion by 2035. The acceleration is fueled by growing demand for electronic ceramics in emerging technologies such as 5G networks, semiconductors, and electric vehicles, as well as the expanding adoption of smart devices and electronics globally. The half-decade weighted growth analysis shows that the market will experience robust growth with an increasing share of advanced applications in the latter part of the forecast period.

| Metric | Value |

|---|---|

| Electronic Ceramics Market Estimated Value in (2025 E) | USD 12.5 billion |

| Electronic Ceramics Market Forecast Value in (2035 F) | USD 25.1 billion |

| Forecast CAGR (2025 to 2035) | 7.2% |

The electronic ceramics market is experiencing steady growth, driven by rising demand for miniaturized, energy-efficient components across electronics, automotive, and telecommunications industries. Technological advancements in multilayer ceramics, electrostrictive behavior, and dielectric stability have expanded the functional range of ceramic materials.

Ongoing R&D investments and the integration of ceramic components in emerging applications such as EV power systems, 5G modules, and smart home infrastructure are fueling market expansion. Supply chain localization and increased support for domestic electronic manufacturing are further accelerating ceramic adoption.

Enhanced mechanical, thermal, and electrical performance, combined with the ability to operate in high-temperature and high-voltage environments, positions electronic ceramics as critical enablers in next-generation devices. Looking forward, sustainability trends and lifecycle durability requirements are expected to reinforce demand for reliable, recyclable ceramic-based components in consumer and industrial sectors.

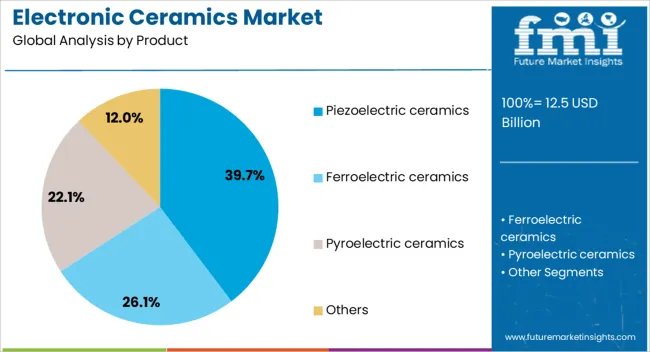

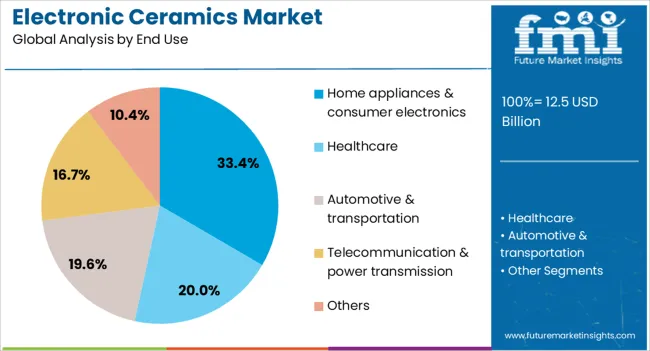

The electronic ceramics market is segmented by product, end use, and geographic regions. By product, market is divided into Piezoelectric ceramics, Ferroelectric ceramics, Pyroelectric ceramics, and Others. In terms of end use, market is classified into Home appliances & consumer electronics, Healthcare, Automotive & transportation, Telecommunication & power transmission, and Others. Regionally, the industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Piezoelectric ceramics are expected to account for 39.70% of the total market revenue in 2025, making them the leading product category. This dominance is being driven by the material's superior electromechanical coupling properties, which enable precise actuation and sensing across a wide frequency spectrum.

The expanding use of piezoelectric ceramics in transducers, ultrasound equipment, acoustic sensors, and MEMS devices has contributed to its broad market presence. Their ability to convert mechanical energy into electrical signals and vice versa has been particularly valuable in consumer electronics, automotive parking sensors, and medical diagnostics.

The ongoing demand for compact, high-efficiency components has further reinforced adoption, especially as device architectures grow more integrated and multifunctional. Additionally, continued improvements in material composition and manufacturing precision are enhancing the reliability and responsiveness of piezoelectric ceramics in mission-critical applications.

Home appliances and consumer electronics are projected to hold 33.40% of the total electronic ceramics market share in 2025, making them the leading end-use industry. This segment's growth is being supported by the increasing use of ceramic-based components in products such as smartphones, washing machines, air conditioners, and microwave ovens.

Ceramic materials are favored for their heat resistance, dielectric strength, and long operational life, enabling safe, efficient operation in compact and high-performance devices. The rise of smart appliances and IoT-enabled consumer electronics has accelerated the demand for sensors, filters, and capacitors that rely on electronic ceramics for stable signal processing and electromagnetic interference shielding.

Growing consumer expectations for energy-efficient and durable appliances, combined with manufacturers' focus on miniaturization, continue to drive the widespread integration of ceramic components in this sector.

The electronic ceramics market is expanding as the demand for advanced electronic components and devices increases across various industries, including automotive, telecommunications, consumer electronics, and energy. Electronic ceramics, known for their electrical, magnetic, and optical properties, are used in components such as capacitors, resistors, piezoelectric devices, and semiconductors. As the adoption of electronic devices continues to grow and industries demand more efficient and durable electronic components, the market for electronic ceramics is set for continued growth. Innovations in material science, such as the development of high-performance ceramics, are also contributing to the market's expansion.

Despite the market's growth, the electronic ceramics market faces challenges related to high production costs and raw material availability. Manufacturing electronic ceramics requires specialized processes, advanced technology, and high-quality raw materials, which can be expensive. The cost of production, particularly for high-performance ceramics, may limit adoption, especially in price-sensitive industries or emerging markets. The availability of specific raw materials used in the production of electronic ceramics, such as rare earth metals, can be uncertain, leading to supply chain challenges and fluctuations in material costs. These factors may increase the overall cost of end products and limit the growth potential in certain sectors.

The electronic ceramics market presents significant opportunities, particularly with technological advancements and the expansion of applications across various industries. New developments in material properties and manufacturing techniques are driving the creation of more efficient and durable electronic ceramics that can meet the growing demands of modern technologies. The rise of emerging technologies such as IoT, renewable energy systems, and next-generation semiconductors is creating new applications for electronic ceramics, particularly in sensors, capacitors, and resistors. As industries continue to integrate electronic ceramics into advanced electronic systems, the market is expected to expand, offering ample opportunities for innovation and growth.

A key trend in the electronic ceramics market is the increasing integration of electronic ceramics in the energy and automotive sectors. In the energy sector, electronic ceramics are increasingly used in renewable energy systems, such as solar panels and energy storage devices, due to their insulating and piezoelectric properties. In the automotive industry, electronic ceramics are used in components for electric vehicles, power electronics, and sensors, where their high temperature and corrosion resistance are crucial. As the push for electric mobility and clean energy solutions intensifies, the adoption of electronic ceramics in these industries is expected to grow. This trend is driving innovation and contributing to the overall growth of the electronic ceramics market.

high-performance ceramics, are also contributing to the market's expansion

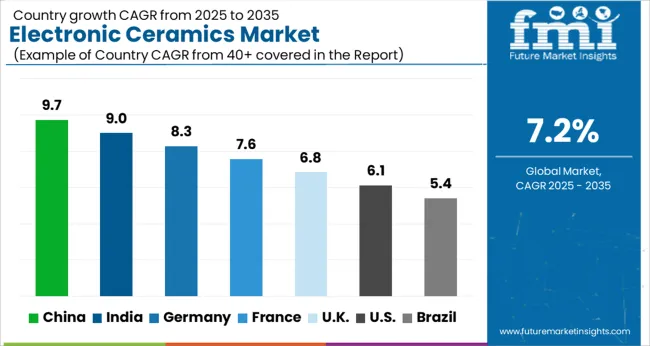

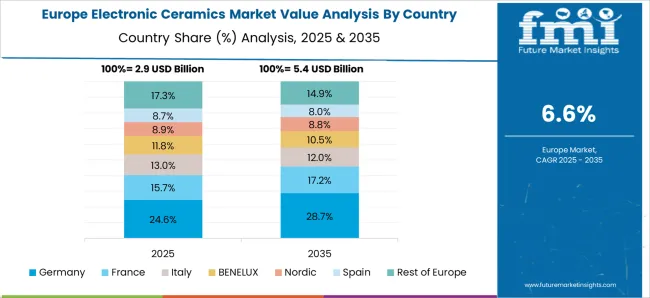

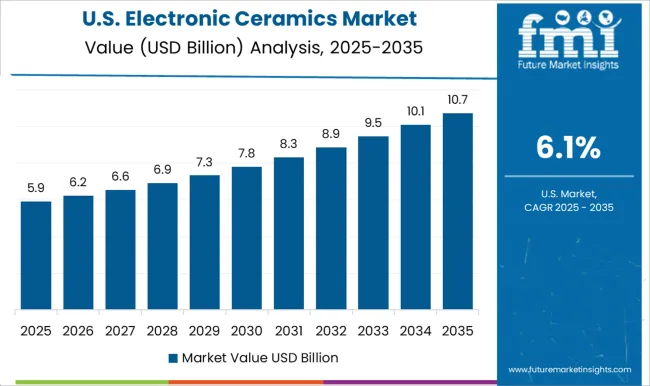

The global electronic ceramics market is projected to grow at a global CAGR of 7.2% from 2025 to 2035. China leads the market with a growth rate of 9.7%, followed by India at 9.0%. Germany records a growth rate of 8.3%, while the UK shows 6.8% and the USA follows at 6.1%. The market is primarily driven by increasing demand for electronic ceramics in industries such as electronics, automotive, telecommunications, and renewable energy. China and India are leading the growth, supported by rapid industrialization, infrastructure development, and technological advancements. Developed markets like Germany, the UK, and the USA are witnessing steady growth, fueled by innovation in electronic ceramics and their applications in high-tech industries. The analysis spans over 40+ countries, with the leading markets shown below.

Electronic Ceramics Market Growth in China

The electronic ceramics market in China is growing at a 9.7% CAGR, driven by the country’s rapidly expanding electronics, automotive, and telecommunications sectors. With China’s focus on technological innovation, there is increasing demand for electronic ceramics used in semiconductors, capacitors, and piezoelectric devices. The growing consumer electronics market, as well as China’s substantial investments in smart city infrastructure and 5G technology, are also contributing to the demand for electronic ceramics. Additionally, China’s large manufacturing base, coupled with government support for innovation and development in high-tech industries, is accelerating market growth.

The electronic ceramics market in India is projected to grow at a 9.0% CAGR, supported by the country’s increasing industrialization and growing demand for electronic devices. With India’s rapid adoption of digital technologies, there is rising demand for electronic ceramics used in semiconductors, capacitors, and other high-performance electronic components. The government’s push to develop manufacturing capabilities in the electronics and telecommunications sectors is also driving the market. As India focuses on becoming a global hub for electronics manufacturing, the demand for advanced materials like electronic ceramics is expected to rise. Additionally, the country’s growing automotive and renewable energy sectors further contribute to market growth.

The electronic ceramics market in Germany is expected to grow at an 8.3% CAGR, driven by the demand for advanced materials in the automotive, telecommunications, and renewable energy industries. As one of the leading European countries in industrial innovation, Germany’s focus on enhancing the performance and efficiency of electronic devices and systems is boosting the use of electronic ceramics. Germany’s commitment to green energy solutions, particularly in wind and solar power generation, is further increasing demand for ceramic materials in renewable energy applications. The country’s strong research and development capabilities are also contributing to the growth of the electronic ceramics market.

The UK’s electronic ceramics market is projected to grow at a 6.8% CAGR, supported by rising demand for high-performance materials in electronics, automotive, and energy sectors. With the UK’s growing focus on digital technologies, including 5G infrastructure and smart city projects, the demand for advanced ceramic materials is increasing. The UK’s renewable energy initiatives, including offshore wind energy projects, are contributing to the adoption of electronic ceramics in energy generation and storage applications. The need for efficient, durable components in the automotive sector, particularly for electric vehicles, is also driving the market growth in the UK

The USA electronic ceramics market is expected to grow at a 6.1% CAGR, driven by the increasing demand for advanced materials in electronics, automotive, and telecommunications. As the USA continues to lead in technological innovations, particularly in semiconductor and telecommunications industries, the need for high-quality electronic ceramics is rising. The demand for ceramics in electric vehicles, renewable energy applications, and 5G infrastructure is further contributing to market growth. With a strong focus on research and development, the USA is expected to continue advancing electronic ceramics technology to meet the growing needs of high-tech industries.

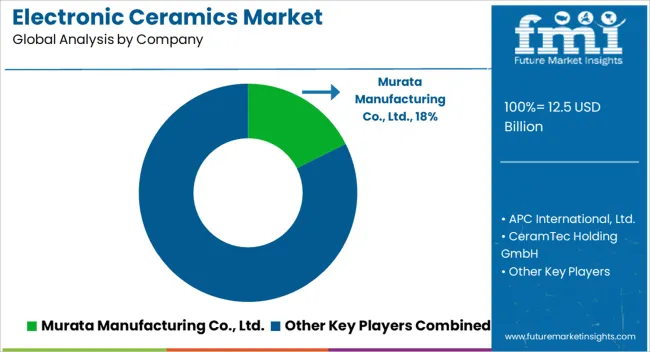

The electronic ceramics market is driven by key players offering advanced ceramic materials used in various electronic applications such as capacitors, semiconductors, sensors, and other electronic components. Murata Manufacturing Co., Ltd. is a global leader in the market, providing high-performance electronic ceramic components, particularly for capacitors and inductors, focusing on miniaturization and high-frequency performance for the telecommunications and consumer electronics sectors. APC International, Ltd. specializes in piezoelectric ceramics, offering products used in sensors, actuators, and transducers for applications in industries such as automotive, healthcare, and industrial automation. CeramTec Holding GmbH is a significant player, offering a broad portfolio of ceramic materials for electronic components, including capacitors, insulators, and piezoelectric devices, with a strong focus on high precision and performance.

Central Electronics Limited manufactures a variety of electronic ceramics used in telecommunications, defense, and industrial applications, focusing on high-performance materials and cost-effective solutions. Kyocera Corporation provides a range of advanced ceramics used in semiconductors, capacitors, and insulators, with a focus on reliability, durability, and environmental sustainability. Maruwa Co., Ltd. is known for manufacturing electronic ceramics, particularly used in high-frequency applications such as capacitors, resistors, and inductors for the automotive, telecommunications, and consumer electronics markets. Morgan Advanced Materials offers specialized electronic ceramics used in components such as sensors and insulators, emphasizing high performance, durability, and material innovation. PI Ceramics focuses on piezoelectric ceramics, providing solutions for sensors, actuators, and transducers for applications in industrial, medical, and automotive sectors. Sensor Technology Ltd. specializes in the development of sensors and piezoelectric materials, used in various industries for measurement and control applications. Sparkler Ceramics Pvt. Ltd. offers a range of ceramic products for electronic applications, focusing on performance, quality, and innovation in the manufacture of electronic ceramics for industries like energy, automotive, and telecommunications.

| Item | Value |

|---|---|

| Quantitative Units | USD Billion |

| Product | Piezoelectric ceramics, Ferroelectric ceramics, Pyroelectric ceramics, and Others |

| End Use | Home appliances & consumer electronics, Healthcare, Automotive & transportation, Telecommunication & power transmission, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Murata Manufacturing Co., Ltd., APC International, Ltd., CeramTec Holding GmbH, Central Electronics Limited, Kyocera Corporation, Maruwa Co., Ltd., Morgan Advanced Materials, PI Ceramics, Sensor Technology Ltd., and Sparkler Ceramics Pvt. Ltd. |

| Additional Attributes | Dollar sales by product type (piezoelectric ceramics, capacitors, insulators, resistors) and end-use segments (consumer electronics, telecommunications, automotive, industrial automation, healthcare). Demand dynamics are driven by the increasing adoption of advanced electronic ceramics in high-performance applications, the growing demand for miniaturized electronic components, and innovations in electronic device functionalities. Regional trends show strong growth in North America, Europe, and Asia-Pacific, with technological advancements and the rising demand for consumer electronics and industrial applications contributing to market expansion. |

The global electronic ceramics market is estimated to be valued at USD 12.5 billion in 2025.

The market size for the electronic ceramics market is projected to reach USD 25.1 billion by 2035.

The electronic ceramics market is expected to grow at a 7.2% CAGR between 2025 and 2035.

The key product types in electronic ceramics market are piezoelectric ceramics, ferroelectric ceramics, pyroelectric ceramics and others.

In terms of end use, home appliances & consumer electronics segment to command 33.4% share in the electronic ceramics market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Electronic Sealants Market Size and Share Forecast Outlook 2025 to 2035

Electronic Nasal Spray Devices Market Size and Share Forecast Outlook 2025 to 2035

Electronic Expansion Valves Market Size and Share Forecast Outlook 2025 to 2035

Electronics Adhesives Market Size and Share Forecast Outlook 2025 to 2035

Electronic Tactile Tester Market Size and Share Forecast Outlook 2025 to 2035

Electronic Trial Master File (eTMF) System Market Size and Share Forecast Outlook 2025 to 2035

Electronic Wipes Market Size and Share Forecast Outlook 2025 to 2035

Electronic Grade Trisilylamine Market Size and Share Forecast Outlook 2025 to 2035

Electronically Scanned Arrays System Market Size and Share Forecast Outlook 2025 to 2035

Electronics Retailing Market Size and Share Forecast Outlook 2025 to 2035

Electronic Dictionary Market Size and Share Forecast Outlook 2025 to 2035

Electronic Shelf Label Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electronics Films Market Size and Share Forecast Outlook 2025 to 2035

Electronic Payment System For Transportation Market Size and Share Forecast Outlook 2025 to 2035

Electronic Skin Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Electronic Equipment Repair Service Market Analysis - Size, Share, and Forecast 2025 to 2035

Electronic Logging Device Market Size and Share Forecast Outlook 2025 to 2035

Electronic Skin Patch Market Size and Share Forecast Outlook 2025 to 2035

Electronic Musical Instruments Market Size and Share Forecast Outlook 2025 to 2035

Electronic Flight Bag Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA